Summary

Table of Content

Non Halogenated Flame Retardants Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Non Halogenated Flame Retardants Market Size

Non Halogenated Flame Retardants Market size was more than $1 billion in 2015 and will grow over 8% from 2016 to 2024. Increasing demand of polymer from automobile and construction industry in BRICS nations coupled with rising concerns over toxicity will drive the market in future.

To get key market trends

Polymer is touted to substitute steel in automotive manufacturing process to reduce weight and advance efficiency which may positively influence the non-halogenated flame retardants market share. Polymers are highly inflammable and catch fire due to overheating, electric failure or lighters. Demand supply mismatch for key raw materials including aluminum hydroxide, nitrogen hydroxide and phosphorous may act as a restraint for the market. High demand for aluminum and phosphorous hydroxide from manufacturing industries may hamper the business outlook.

Non Halogenated Flame Retardants Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 1 Billion (USD) |

| Forecast Period 2016 - 2024 CAGR | 8% |

| Market Size in 2024 | 3.4 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Non Halogenated Flame Retardants Market Analysis

Aluminum hydroxide was valued over USD 300 million by 2015. It is widely used fillet in rubber, FRPs and polymers. It is an excellent smoke suppressant and is extremely affordable.

Phosphorus based non halogenated flame retardants will grow at over 8%. Organic phosphorous compounds will evolve due to their superior smoke suppressant properties. Chlorine and bromine-based fire suppressants are toxic in nature. Environmental regulation against usage of chlorine and bromine-based fire suppressants will growth.

Global non halogenated flame retardants market from polyolefins applications exceeded 300 kilo tons in 2015. These products require retardant material like PE, LLDPE, LDPE, PP, EVA & MDPE. Polyolefins are widely used in wires in construction, transportation and electrical industries.

Epoxy resin applications will register growth over 7% during the forecast period. Epoxy resins are used in paint coatings, adhesives and electronic equipment. Smoke suppressant additives are used to improve its fire-resistant properties.

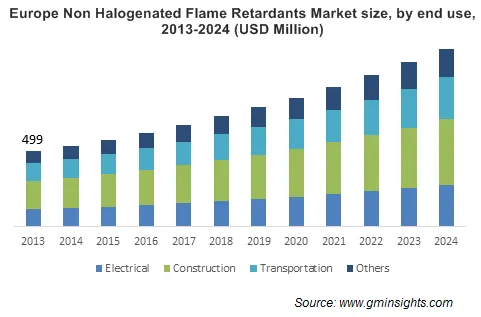

Non halogenated flame retardants market from construction sector is expected to exceed USD 1 billion by 2024. Demand for fire safety material in construction sector will drive growth. Building materials, wires, switchboards and cables in the construction business use polymers.

Learn more about the key segments shaping this market

Global non halogenated flame retardants market would experience a significant growth subject to increasing adoption of polymers among automotive industry. Growing adoption of polymers for electronic functions in automotive sector will complement this development. Performance matrix of products are durability, protection, insulation and lower heat and smoke emission are pertinent to the adoption of product.

Use of polymer reduces weight of automobiles by 10% resulting in fuel saving. Additionally, lighter vehicles help to reduce fuel emission levels. Propylene, ABS and other high-performance polymers are used for automotive manufacturing.

Asia Pacific will witness gains over 8% owing to the large-scale spending in India and China. Presence of manufacturing facilities coupled with fire safety concerns will boost product demand. Large scale automotive production in Latin America will drive the non-halogenated flame retardants market growth.

Rise in average income from developing economies in India and China may favor the packaging and construction industry. In 2015, over 40% of Asia Pacific construction spending was in China which translates to more than USD 1 trillion in revenue. Industry analysis suggests that the global spending on construction exceeded USD 9,000 billion in 2015.

Non Halogenated Flame Retardants Market Share

Global non halogenated flame retardants industry share is concentrated with top 4 companies catering to over 30% of the demand.

- Nabaltec

- Albermarle

- Israel Chemicals

- BASF

are key players. Other companies in the business include

- Clariant

- Chemtura

- DSM

- Italmatch Chemicals

- Thor Group

- Huber

- FRX Polymers

- DuPont

Industry Background

Non halogenated flame retardants market is broadly categorized into metal hydroxides and phosphorus based. There are toxicity concerns surrounding the products belonging to these categories. Companies are forced to reduce the levels of toxic additives as per government regulation. Alternately, retardants that are eco-friendly will experience an increase in demand. They are applied in rubber, textiles and plastics industries out of which the plastic industry is a major end-user.

Non halogenated flame retardants market report includes in-depth coverage of the industry with estimates & forecast in terms of volume (kilo tons) and revenue in USD Million from 2013 to 2024, for the following segments:

By Product

- Aluminum Hydroxide

- Phosphorous based flame retardants

By Application

- Polyolefins

- Epoxy resins

- Unsaturated polyester

- Polyvinyl Chloride

- Engineering thermoplastics

- Rubber

- Styrenics

By End Use

- Construction

- Electrical

- Transportation

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Poland

- Asia Pacific

- China

- India

- Japan

- Malaysia

- Thailand

- Indonesia

- Australia

- South Korea

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Latin America

- Brazil

- Brazil

Frequently Asked Question(FAQ) :

How is the global non-halogenated flame retardants market expected to perform through 2024?

The non-halogenated flame retardants market valued over USD 1 billion in 2015 and is projected to grow over 8% through 2024.

What will drive the growth in the construction sector?

The non-halogenated flame retardants market size from the construction sector is expected to surpass exceed USD 1 billion by 2024 due to rising demand of fire safety material in the construction sector.

What factors will influence the market growth in the Asia Pacific region?

The Asia Pacific region is expected to witness over 8% gains due to the major spending in India and China. The existence of manufacturing facilities and fire safety concerns will support the market growth.

Why will phosphorus as a product foster the growth of global non-halogenated flame retardants market?

The non-halogenated flame retardants market share from phosphorous will depict 8% through 2024. Due to their superior smoke suppressant properties, phosphorous compounds are projected to fare well through the forecast period.

Non Halogenated Flame Retardants Market Scope

Related Reports