Summary

Table of Content

Non-Alcoholic Beer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Non-Alcoholic Beer Market Size

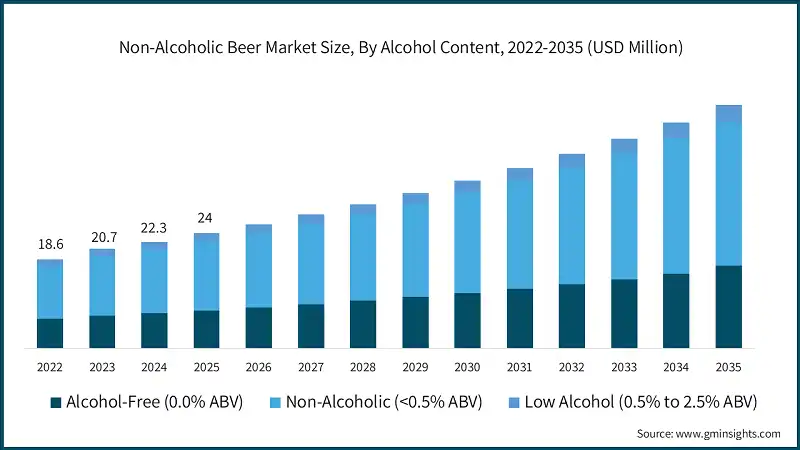

The global non-alcoholic beer market size was valued at USD 24 billion in 2025. The market is expected to grow from USD 25.9 billion in 2026 to USD 50.8 billion in 2035, at a CAGR of 7.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Non-alcoholic beer, which includes alcohol-free (0% ABV), non-alcoholic (<0.5% ABV), and low-alcohol (0.5% to 2.5% ABV) variants, has emerged as a significant segment within the global beverage industry. These products cater to health-conscious consumers, designated drivers, and individuals seeking the taste of beer without alcohol's effects. The market encompasses diverse beer styles including lagers, IPAs, wheat beers, stouts, and specialty brews, offering consumers authentic beer experiences with minimal to zero alcohol content.

- Currently, North America and Europe collectively dominate the non-alcoholic beer market, accounting for substantial volume and value shares driven by mature consumer awareness, established distribution networks, and strong health and wellness trends. The Asia-Pacific region is experiencing the fastest growth, fueled by rising disposable incomes, urbanization, changing lifestyle preferences, and increasing adoption of Western drinking cultures combined with traditional moderation values in countries like China, India, and Southeast Asian nations.

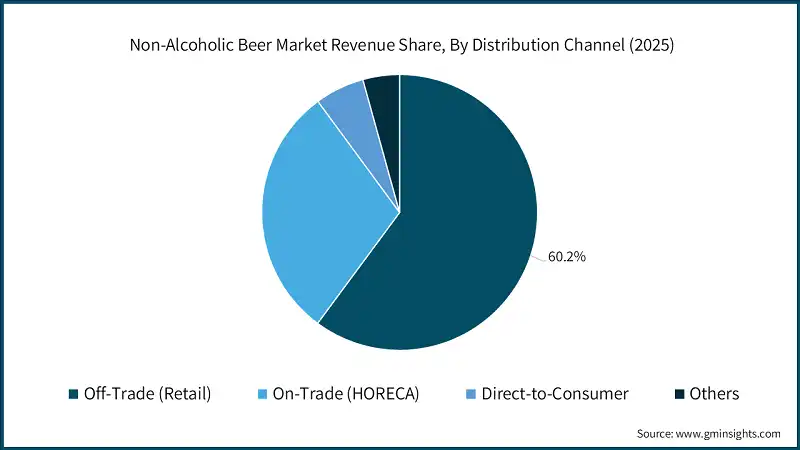

- Non-alcoholic lagers represent the largest segment by beer style, accounting for over 53% of the market, followed by non-alcoholic IPAs and wheat beers, reflecting consumer preference for familiar, approachable beer styles. The off-trade (retail) distribution channel dominates with approximately 60% market share, driven by supermarkets, hypermarkets, convenience stores, and e-commerce platforms, while on-trade (HORECA) and direct-to-consumer channels show promising growth as breweries and brands establish direct relationships with consumers.

- The convergence of health consciousness, premiumization trends, and brewing innovation creates a dynamic environment for the global non-alcoholic beer market. As major breweries invest heavily in advanced brewing technologies—including arrested fermentation, vacuum distillation, and reverse osmosis—to improve taste profiles and authenticity, the market continues to shed its historical stigma. The interconnected growth of craft brewing culture, athletic lifestyle movements, and mindful drinking trends underscores the importance of non-alcoholic beer in meeting evolving consumer preferences, thereby ensuring sustained global demand across demographics and occasions.

Non-Alcoholic Beer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 24 Billion |

| Market Size in 2026 | USD 25.9 Billion |

| Forecast Period 2026-2035 CAGR | 7.8% |

| Market Size in 2035 | USD 50.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising health consciousness & wellness trends | Driving increased adoption of non-alcoholic alternatives globally, particularly among millennials and Gen Z consumers |

| Growing sober-curious & mindful drinking movements | Expanding the consumer base beyond traditional abstainers to include social drinkers seeking moderation |

| Technological advancements in brewing processes | Enabling production of better-tasting non-alcoholic beers that closely mimic traditional beer flavor profiles worldwide |

| Pitfalls & Challenges | Impact |

| Taste perception gaps compared to alcoholic beer | Continue to challenge market penetration despite improvements, potentially limiting repeat purchases |

| Higher production costs & pricing premiums | Create affordability barriers in price-sensitive markets and limit mass-market adoption globally |

| Opportunities: | Impact |

| Expansion of craft non-alcoholic beer segment | Offers opportunities for premium positioning and differentiation in the global market |

| Emerging markets in Asia-Pacific & Latin America | Present significant growth potential as awareness increases and distribution networks expand internationally |

| Market Leaders (2025) | |

| Market Leaders |

~12.8% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Emerging Country | China, India, Vietnam |

| Future Outlook |

|

What are the growth opportunities in this market?

Non-Alcoholic Beer Market Trends

- Advanced brewing technology innovations including membrane filtration, vacuum distillation, and arrested fermentation techniques are revolutionizing non-alcoholic beer production, enabling brewers to preserve authentic beer flavors, aromas, and mouthfeel while removing alcohol. These technological improvements address historical taste deficiencies, significantly enhancing product quality and consumer acceptance, thereby driving market growth as products increasingly rival their alcoholic counterparts in sensory experience.

- The premiumization trend is reshaping the non-alcoholic beer landscape as consumers demonstrate willingness to pay premium prices for craft-quality, artisanal non-alcoholic beers featuring specialty ingredients, unique flavor profiles, and sophisticated branding. This shift encourages established craft breweries and new entrants to invest in high-quality non-alcoholic offerings, expanding beyond basic lagers to include IPAs, stouts, sour beers, and experimental styles, ultimately elevating the category's prestige and market value.

- Strategic partnerships between non-alcoholic beer brands and wellness, fitness, and lifestyle sectors are creating powerful marketing synergies and expanding distribution channels. Collaborations with athletic organizations, fitness centers, wellness retreats, and health-focused retailers position non-alcoholic beer as a functional beverage aligned with active, healthy lifestyles, effectively reaching target demographics and normalizing consumption occasions beyond traditional drinking settings.

- Sustainability initiatives and eco-conscious packaging innovations are becoming critical differentiators in the non-alcoholic beer market, with leading brands adopting renewable energy in brewing, water conservation technologies, recyclable aluminum cans, and carbon-neutral production processes. These environmental commitments resonate strongly with younger, environmentally aware consumers who prioritize brands demonstrating genuine sustainability credentials, creating competitive advantages and strengthening brand loyalty in increasingly conscious markets.

- Direct-to-consumer (DTC) channels and subscription models are emerging as significant growth drivers, enabling non-alcoholic beer brands to build direct relationships with consumers, gather valuable consumption data, and create community-driven brand experiences. Digital platforms facilitate personalized recommendations, exclusive releases, and curated variety packs, while subscription services ensure consistent revenue streams and customer retention, particularly important for smaller craft producers seeking to compete with major beverage conglomerates' distribution advantages.

Non-Alcoholic Beer Market Analysis

Learn more about the key segments shaping this market

Based on alcohol content, the non-alcoholic beer market is segmented into alcohol-free (0.0% ABV), non-alcoholic (<0.5% ABV), and low alcohol (0.5% to 2.5% ABV). Non-alcoholic (<0.5% ABV) dominated the market with an approximate market share of 60% in 2025 and is expected to grow with a CAGR of 7.6% till 2035.

- Non-alcoholic (<0.5% ABV) dominates due to its optimal balance between authentic beer taste and minimal alcohol content, making it legally compliant with non-alcoholic labeling standards in most jurisdictions while delivering a drinking experience closest to traditional beer. This segment benefits from established brewing processes that preserve flavor complexity, mouthfeel, and aroma profiles better than completely alcohol-free alternatives.

- The trace alcohol content (below 0.5%) allows brewers to maintain natural fermentation characteristics and hop expression, driving high consumer acceptance across demographics. Non-alcoholic beer's versatility for various occasions—from social gatherings to post-workout refreshment—combined with regulatory recognition as a non-alcoholic beverage in major markets, solidifies its leading position in the industry.

- Alcohol-free (0.0% ABV) products represent the fastest-growing segment with a CAGR of 8.1% from 2026 to 2035, catering to consumers with zero-tolerance policies, religious restrictions, pregnancy, medical conditions, or strict wellness commitments. This segment appeals to the most health-conscious consumers and those in recovery programs seeking complete alcohol avoidance. Advanced brewing technologies including vacuum distillation and reverse osmosis enable production of genuinely alcohol-free beers with improving taste profiles, though challenges in replicating full beer complexity remain. Growing consumer awareness and premium positioning of 0.0% ABV products drive their expanding market presence.

- Low alcohol (0.5% to 2.5% ABV) occupies a niche segment serving consumers seeking significant alcohol reduction rather than complete elimination, offering a middle ground between non-alcoholic and full-strength beers. This category appeals to moderate drinkers looking to reduce overall alcohol consumption while maintaining traditional beer characteristics. Low-alcohol beers are easier to produce with conventional brewing methods requiring less intensive dealcoholization, resulting in more authentic flavor profiles. However, regulatory ambiguity in some markets and positioning challenges between non-alcoholic and regular beer categories limit broader adoption compared to the dominant non-alcoholic segment.

Based on beer style, the non-alcoholic beer market is segmented into non-alcoholic lager, non-alcoholic IPA, non-alcoholic wheat beer, non-alcoholic stout & porter, non-alcoholic light beer, non-alcoholic golden & blonde ale, non-alcoholic copper & amber ale, non-alcoholic sour beer, non-alcoholic gose and others. Non-alcoholic lager dominated the market with an approximate market share of 54.5% in 2025 and is expected to grow with a CAGR of 7.6% up to 2035.

- Non-alcoholic lager dominates due to its universal appeal, familiar taste profile, and position as the most consumed beer style globally in both alcoholic and non-alcoholic formats. Lagers' clean, crisp, and refreshing characteristics translate well to non-alcoholic production, making them accessible entry points for consumers new to the category. The style's mild flavor profile, lower bitterness, and smooth finish appeal to broad demographics across age groups and cultural preferences.

- Major breweries leverage their established lager brands to introduce non-alcoholic variants, benefiting from existing brand equity and consumer trust. The technical ease of producing non-alcoholic lagers compared to more complex styles, combined with cost-effectiveness and scalability, reinforces their market leadership across retail and on-premise channels.

- Non-alcoholic IPA represents a rapidly growing premium segment catering to craft beer enthusiasts and hop-forward beer lovers seeking non-alcoholic alternatives without compromising on bold flavors and aromatic complexity. This segment benefits from the craft beer movement's influence and appeals to younger, adventurous consumers willing to pay premium prices for distinctive taste experiences. Advanced brewing techniques preserve hop aromas and bitterness profiles, though replicating the full mouthfeel and alcohol-derived warmth remains challenging. The IPA segment's growth reflects the broader premiumization trend and craft breweries' innovation leadership in non-alcoholic beer development.

- Non-alcoholic wheat beer serves consumers seeking lighter, fruit-forward, and naturally cloudy beer styles with characteristic banana and clove notes from traditional wheat beer fermentation. This segment appeals particularly in European markets where wheat beer traditions run deep, and in warmer climates where refreshing, sessionable beers are preferred. Wheat beers' naturally softer flavor profiles adapt well to dealcoholization processes, maintaining drinkability and authentic characteristics better than some other styles.

- Non-alcoholic stout & porter represents the fastest-growing segment with a CAGR of 9.6% from 2026 to 2035, driven by coffee culture crossover appeal and consumers seeking rich, full-bodied alternatives to traditional beers. These dark beer styles leverage roasted malt complexity, chocolate and coffee notes, and creamy textures that partially compensate for alcohol's absent body and warmth. The segment benefits from positioning as sophisticated, dessert-like beverages suitable for evening consumption and food pairing, attracting consumers who might not typically choose lighter non-alcoholic options.

Based on flavor profile, the non-alcoholic beer market is segmented into citrus, hoppy, malt-forward, pine & resinous, coffee & roasted, fruit-forward, honey, bread & grain, and others. Hoppy dominated the market with an approximate market share of 22.8% in 2025 and is expected to grow with a CAGR of 7.4% through 2035.

- Hoppy flavor profiles dominate due to their strong association with craft beer culture and the growing consumer preference for bold, aromatic, and complex taste experiences in non-alcoholic beers. Hop-forward profiles deliver distinctive bitterness, floral, herbal, and tropical fruit notes that create satisfying sensory experiences even without alcohol's palate effects. Advanced dry-hopping techniques and hop extract technologies enable brewers to preserve volatile hop aromatics during dealcoholization processes, maintaining the intensity that hop enthusiasts expect. The segment benefits from the craft IPA revolution's influence and appeals to discerning consumers seeking authentic beer experiences. Hoppy non-alcoholic beers effectively mask any off-flavors from dealcoholization while providing the assertive taste profiles that differentiate premium offerings from mass-market alternatives.

- Citrus flavor profiles represent the fastest-growing segment with a CAGR of 8.2% from 2026 to 2035, driven by their refreshing, approachable characteristics and broad consumer appeal across demographics. Citrus notes—including lemon, lime, grapefruit, and orange—align with health and wellness associations, creating perceptions of natural, vitamin-rich beverages suitable for active lifestyles. This segment benefits from the popularity of citrus-infused beverages across categories and appeals particularly to consumers transitioning from hard seltzers, flavored sparkling waters, and citrus sodas. Citrus profiles complement lighter beer styles and provide natural sweetness that balances any residual bitterness, making them ideal gateway products for non-traditional beer consumers.

- Malt-forward flavor profiles serve consumers seeking traditional, authentic beer characteristics with emphasis on caramel, toasted bread, biscuit, and grainy notes derived from specialty malts. This segment appeals to classic beer drinkers who prioritize malt sweetness and body over hop bitterness, particularly in European markets where malt-driven beer traditions dominate. Malt-forward profiles help compensate for alcohol's absent body and warmth, providing fuller mouthfeel and satisfying richness that enhance perceived quality and drinkability.

Based on packaging type, the non-alcoholic beer market is segmented into standard cans (12 oz / 355 ml), tall cans (19.2 oz / 568 ml), glass bottles, kegs & draft, and others. Standard cans (12 oz / 355 ml) dominated the market with an approximate market share of 45.4% in 2025 and is expected to grow with a CAGR of 7.7% till 2035.

- Standard cans (12 oz / 355 ml) dominate due to their optimal combination of portability, convenience, recyclability, and consumer familiarity as the universal beer packaging format. Aluminum cans provide superior protection against light and oxygen exposure, preserving non-alcoholic beer's delicate flavor profiles and extending shelf life compared to other packaging options. The format's single-serve sizing aligns perfectly with moderation-focused consumption occasions and enables precise portion control for health-conscious consumers.

- Cans' lightweight nature reduces transportation costs and carbon footprint, supporting sustainability initiatives increasingly important to target demographics. The packaging's compatibility with outdoor activities, sporting events, and on-the-go consumption—key occasions for non-alcoholic beer—reinforces market leadership. Additionally, cans' printable surfaces enable eye-catching designs that help non-alcoholic brands stand out on crowded retail shelves.

- Glass bottles maintain significant market presence with 26% share in 2025, appealing to premium-positioned brands and consumers who associate glass with quality, tradition, and authentic beer experiences. Glass packaging conveys sophistication and craftsmanship, making it preferred for restaurant and bar settings where presentation influences purchase decisions. The format benefits from established recycling infrastructure and perception as an environmentally responsible choice, though heavier weight increases transportation emissions. Glass bottles' transparency allows consumers to see product clarity and color, important visual cues for quality assessment, particularly for specialty and craft non-alcoholic beers targeting discerning consumers.

- Tall cans (19.2 oz / 568 ml) serve consumers seeking larger single-serve portions or extended drinking occasions without opening multiple containers. This format appeals particularly to home consumption and sharing occasions, offering better value perception and reduced packaging waste per volume compared to standard cans. The segment benefits from the craft beer industry's adoption of tall can formats and their association with premium, artisanal products. Tall cans' larger surface area provides expanded branding opportunities and shelf presence that helps emerging non-alcoholic brands compete with established players.

- Kegs & draft represent important on-premise channels, enabling restaurants, bars, and taprooms to serve non-alcoholic beer fresh from tap systems, delivering optimal carbonation, temperature, and presentation. This format reduces per-serving packaging waste and costs while providing authentic beer hall experiences that normalize non-alcoholic consumption in social drinking environments. The segment's growth reflects increasing on-premise availability as establishments recognize non-alcoholic beer's profit potential and role in inclusive hospitality.

Based on material, the non-alcoholic beer market is segmented into malted grains, hops, yeasts, and enzymes. Malted grains dominated the market with an approximate market share of 70.6% in 2025 and is expected to grow with a CAGR of 7.8% up to 2035.

- Malted grains dominate as the foundational ingredient in non-alcoholic beer production, providing essential fermentable sugars, flavor compounds, color, body, and mouthfeel that define beer's character. Barley malt remains the primary grain, supplemented by wheat, rye, oats, and specialty malts that contribute diverse flavor profiles ranging from biscuity and bread-like to caramel, chocolate, and roasted notes.

- The malting process—controlled germination and kilning—develops enzymes that convert starches to sugars during mashing, creating the wort base for fermentation. In non-alcoholic production, malted grains' contribution becomes even more critical as they must compensate for alcohol's absent body, warmth, and flavor complexity. Specialty malts add color depth and roasted characteristics particularly important in darker non-alcoholic styles. The segment's dominance reflects malted grains' irreplaceable role in authentic beer production and their cost-effectiveness as bulk ingredients, with brewers typically using 85-95% malted grains in grain bills.

- Hops represent a significant ingredient segment with 27% market sharein 2025, providing bitterness, aroma, flavor complexity, and natural preservation properties essential to beer's identity. In non-alcoholic beer, hops play an amplified role in masking potential off-flavors from dealcoholization processes while delivering the aromatic intensity and flavor profiles consumers expect. Modern hop varieties offer diverse characteristics—from citrus, tropical fruit, and pine to floral, herbal, and earthy notes—enabling brewers to create distinctive products across styles.

- Advanced hopping techniques including late-addition hopping, dry-hopping, and hop extracts preserve volatile aromatic compounds that might otherwise be lost during alcohol removal. The craft beer revolution's emphasis on hop-forward styles drives premium non-alcoholic IPA development, increasing hop usage rates and costs. Hop selection and application timing critically influence final product quality, making this ingredient segment vital for differentiation and consumer acceptance.

- Yeasts constitute a smaller but essential ingredient segment, responsible for fermenting wort sugars into alcohol and carbon dioxide while producing flavor compounds including esters and phenols that contribute fruity, spicy, and complex notes. In non-alcoholic production, yeast selection and fermentation management become more nuanced as brewers must either arrest fermentation early or use specialized yeast strains that produce minimal alcohol. Some producers employ non-fermenting yeast for flavor development without alcohol generation. The segment's growth reflects increasing sophistication in yeast strain selection and fermentation control technologies that improve flavor complexity in non-alcoholic beers.

Learn more about the key segments shaping this market

Based on distribution channel, the non-alcoholic beer market is segmented into off-trade (retail), on-trade (HORECA), direct-to-consumer, and others. Off-trade (retail) dominated the market with an approximate market share of 60.2% in 2025 and is expected to grow with a CAGR of 7.9% up to 2035.

- Off-trade (retail) dominates due to the convenience, accessibility, and cost advantages of purchasing non-alcoholic beer through supermarkets, hypermarkets, convenience stores, specialty beverage retailers, and e-commerce platforms. This channel benefits from consumers' established shopping routines, promotional opportunities, and the ability to compare products and prices across brands. Retail environments enable impulse purchases through strategic shelf placement and attractive packaging displays, while loyalty programs and bulk-buying options provide value incentives.

- The COVID-19 pandemic accelerated off-trade growth as consumers shifted toward at-home consumption, a behavioral change that persists as hybrid work arrangements and home entertaining remain prevalent. E-commerce within off-trade shows particularly strong growth, offering subscription services, curated variety packs, and direct delivery that overcome limited retail shelf space constraints. Major retailers increasingly dedicate expanded shelf space to non-alcoholic beer as category growth justifies the allocation, improving visibility and consumer awareness.

- On-trade (HORECA) represents a substantial channel with 29.8% market share in 2025, encompassing hotels, restaurants, cafes, bars, pubs, and entertainment venues where non-alcoholic beer serves critical roles in inclusive hospitality and responsible service. This channel provides social validation and normalization of non-alcoholic consumption, reducing stigma as establishments position these products alongside alcoholic offerings rather than as inferior alternatives.

- On-premise consumption enables trial experiences where bartenders and servers can recommend products, educate consumers, and facilitate discovery of premium options consumers might not select independently in retail settings. The channel benefits from higher per-serving margins and the experiential value consumers place on dining and social occasions. Draft service enhances perceived quality and authenticity, while creative cocktail applications using non-alcoholic beer as mixers expand consumption occasions and appeal.

- Direct-to-consumer (DTC) represents an emerging channel enabling brands to build direct relationships with consumers, gather valuable consumption data, and create community-driven experiences through branded websites, subscription services, and social media engagement. This channel particularly benefits craft breweries and emerging brands lacking extensive retail distribution, allowing them to reach nationwide audiences without traditional distribution infrastructure.

- DTC enables personalized marketing, exclusive product releases, and curated variety packs that encourage trial across product ranges. Subscription models provide predictable revenue streams and customer retention, while direct feedback loops inform product development. The channel's lower growth rate reflects logistical challenges including shipping costs, age verification requirements, and state-by-state alcohol beverage regulations that sometimes restrict direct shipment even for non-alcoholic products.

Looking for region specific data?

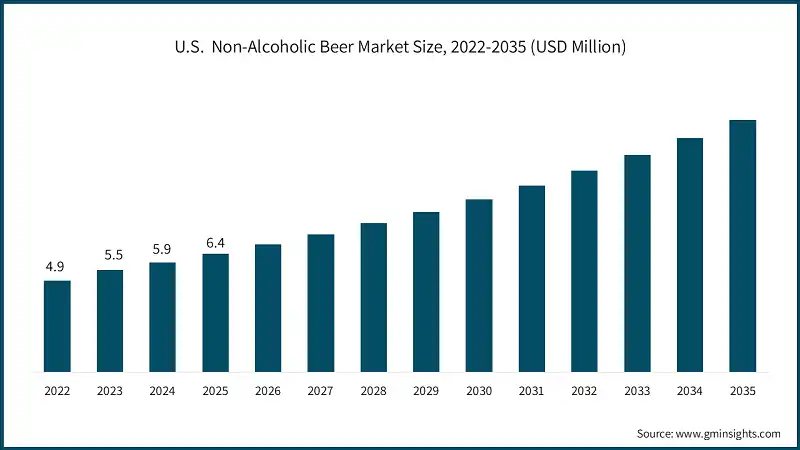

The U.S. non-alcoholic beer market accounted for USD 6.4 billion in 2025.

- The strong momentum for non-alcoholic beer in North America comes primarily from the United States, wherein consistent demand is driven by well-established health and wellness movements, the sober-curious trend gaining mainstream acceptance, and extensive craft brewing culture embracing innovation. Constant emphasis on mindful drinking among millennials and Gen Z consumers, sophisticated marketing campaigns positioning non-alcoholic beer as lifestyle products rather than alcohol substitutes, and robust adoption of premium craft non-alcoholic offerings across diverse consumption occasions consistently elevate the country's market position.

- The presence of pioneering non-alcoholic breweries including Athletic Brewing Company, Bravus Brewing, and Partake Brewing with dedicated production facilities, combined with major breweries like Heineken, Anheuser-Busch InBev, and Molson Coors launching non-alcoholic variants of flagship brands through established distribution networks, ensures sustained demand. Growing partnerships with fitness brands, wellness influencers, and sports organizations, along with increasing availability in gyms, yoga studios, and health-focused retail channels, further reinforce market leadership as consumers seek better-for-you beverage alternatives meeting taste expectations without compromising social experiences.

The non-alcoholic beer market in Germany is estimated to experience significant and promising growth from 2025 to 2035.

- Non-alcoholic beer growth in Europe is an integral component of the market due to strong brewing heritage, mature consumer acceptance, and well-established traditions of alcohol-free beer consumption dating back decades.

- In Germany, consumers and hospitality establishments are embracing premium non-alcoholic beers that meet rigorous Reinheitsgebot (German Beer Purity Law) standards and deliver authentic taste profiles, which improve social drinking experiences and operational flexibility while meeting stricter requirements for responsible alcohol service and designated driver programs, driving advancement of specialty-grade non-alcoholic wheat beers, lagers, and craft styles into mainstream consumption occasions, sports facilities, workplace cafeterias, and family-friendly dining establishments across urban and rural markets.

- Germany's leadership in brewing technology and innovation, combined with cultural acceptance of "alkoholfrei" beer as a legitimate beverage choice rather than compromise, positions the market for sustained expansion as younger generations prioritize health consciousness alongside traditional beer appreciation.

The non-alcoholic beer market in China is estimated to experience significant and promising growth from 2026 to 2035.

- Asia Pacific is the fastest-growing region in the market and includes China, India, Japan, South Korea, and Southeast Asian nations. China remains the most essential growth driver of the Asia-Pacific beer market, which is increasingly driven by rapid urbanization, rising disposable incomes, growing health awareness among middle-class consumers, and increasing adoption of Western drinking cultures balanced with traditional moderation values.

- The country is experiencing both increased imports of premium international non-alcoholic brands and domestic production capacity development through local breweries and partnerships with global beverage companies, thus becoming a significant consumer in the global arena. The regional momentum is further fueled by strong demand from younger urban professionals, expanding modern retail infrastructure including e-commerce platforms, government initiatives promoting responsible drinking and reducing alcohol-related social issues, and growing fitness culture emphasizing healthy lifestyle choices, with rising quality expectations and increasing emphasis on authentic taste profiles accelerating market expansion across tier-1, tier-2, and emerging tier-3 cities.

South Africa market is estimated to experience significant and promising growth from 2026 to 2035.

- The non-alcoholic beer market keeps steadily growing in the Middle East and Africa catered by cultural and religious preferences for alcohol-free beverages, rising expatriate populations familiar with beer culture, and expanding hospitality sectors serving diverse international clientele. The development of luxury hotels, international restaurant chains, entertainment districts, and tourism infrastructure are the drivers for such high-quality non-alcoholic beer requirements in countries like Saudi Arabia and the UAE in the Middle East.

- In Africa, countries such as South Africa are experiencing increased adoption among health-conscious consumers, growing middle class with evolving beverage preferences, and expanding modern retail channels all requiring authentic-tasting, premium non-alcoholic beer options for social occasions, dining experiences, and everyday refreshment that align with both traditional values and contemporary lifestyles.

Brazil is estimated to experience significant and promising growth from 2026 to 2035.

- Brazil is contributing to the non-alcoholic beer market in Latin America owing to its increasing emphasis on health and wellness trends, growing awareness of alcohol-related health concerns, and expanding middle-class consumer base seeking premium beverage alternatives. With the growth in Brazil's craft beer culture, gaining momentum for authentic taste experiences, and thus demand for non-alcoholic lagers, IPAs, and wheat beers is steady, particularly among younger urban consumers in São Paulo, Rio de Janeiro, and other major metropolitan areas.

- Industries are maintaining the trend with increasing regional adoption of non-alcoholic beer for consumption at sporting events, beach culture, social gatherings, and everyday occasions where refreshment without intoxication is desired, supported by growing distribution through supermarkets, convenience stores, bars, and restaurants across diverse socioeconomic segments.

Non-Alcoholic Beer Market Share

Non-alcoholic beer markets are moderately consolidated with players like Athletic Brewing Company, Heineken N.V., Anheuser-Busch InBev, Carlsberg Group, and Molson Coors holding approximately 47.2% market share collectively in 2025.

- Non-alcoholic beer manufacturers are constantly involved in research and development to improve brewing technologies, develop advanced dealcoholization methods, and enhance authentic taste replication. Innovations in arrested fermentation techniques, vacuum distillation processes, reverse osmosis systems, and membrane filtration technologies help companies meet evolving consumer expectations and remain relevant in high-growth segments such as craft non-alcoholic IPAs, premium alcohol-free lagers, functional wellness beverages, and specialty beer styles catering to health-conscious demographics.

- Advanced quality control capabilities using gas chromatography for alcohol content verification, sensory evaluation panels for taste consistency, shelf-life stability testing, and carbonation level monitoring systems, along with ISO 22000 food safety management, HACCP certifications, and compliance with FDA, EU, and regional beverage regulations, enable producers to consistently deliver products that exceed stringent taste benchmarks and meet industry standards including alcohol content labeling accuracy (0% ABV vs. <0.5% ABV), ingredient transparency requirements, and various quality and safety regulations across multiple international markets.

- By establishing collaborations with fitness brands, wellness influencers, sports organizations, and lifestyle retailers, companies are increasing the strength of their market presence. These collaborations facilitate co-development of customized non-alcoholic beer offerings for specific occasions such as post-workout recovery beverages, social gathering alternatives, designated driver programs, or mindful drinking experiences, and sharing best practices which lead to improved consumer education initiatives and category normalization.

- Strategic partnerships with athletic organizations, music festivals, entertainment venues, and health-focused retail chains enable manufacturers to anticipate consumer trends and develop next-generation products aligned with lifestyle preferences, including functional ingredients like electrolytes or adaptogens, sustainable packaging innovations using recyclable aluminum or plant-based materials, and specialized product formats such as variety packs, single-serve options, and subscription services that enhance consumer engagement and brand loyalty while expanding distribution reach beyond traditional beer channels into gyms, yoga studios, wellness centers, and direct-to-consumer platforms.

Non-Alcoholic Beer Market Companies

Major players operating in the non-alcoholic beer industry are:

- Athletic Brewing Company

- Heineken N.V.

- Anheuser-Busch InBev

- Carlsberg Group

- Molson Coors

- Clausthaler / Radeberger Group

- BrewDog

- Partake Brewing

- Bravus Brewing Company

- Nirvana Brewery

- Big Drop Brewing Co.

- Erdinger Alkoholfrei

- WellBeing Brewing

- Grüvi

- Surreal Brewing Company

- Hairless Dog Brewing

- Mikkeller

- Infinite Session

- Rightside Brewing

Athletic Brewing Company Athletic Brewing Company, founded in 2017 and headquartered in Milford, Connecticut, is America's largest dedicated non-alcoholic brewer. The company operates two state-of-the-art brewing facilities in Milford, CT and San Diego, CA, producing an extensive portfolio of craft non-alcoholic beers (<0.5% ABV) across multiple styles including IPAs, lagers, stouts, and seasonal offerings. Athletic Brewing pioneered a proprietary brewing process that preserves authentic beer flavor without alcohol, positioning products for active lifestyles and health-conscious consumers. The company employs a direct-to-consumer business model featuring e-commerce, subscription services, and expanding retail distribution, with products available in major chains including Whole Foods.

Heineken N.V., the world's second-largest brewer with presence in over 190 countries, has established itself as the global leader in non-alcoholic beer through its Heineken 0.0 brand, available in more than 100 countries. Launched in 2017 as part of the company's EverGreen strategic initiative, Heineken 0 achieved strong volume growth and has captured significant share of the global low/no-alcohol beer market. The company invests heavily in advanced dealcoholization technologies including vacuum distillation to preserve authentic taste and aroma, while allocating significant marketing resources through high-profile partnerships with Formula 1 and sporting events. Heineken's strategy includes extending 0 options across its entire portfolio, innovating in flavored and craft variants, and expanding draught availability across Europe.

Anheuser-Busch InBev, the world's largest brewer with over 500 brands globally, has aggressively expanded its non-alcoholic portfolio by leveraging flagship brands including Budweiser Zero, Corona Cero, Stella Artois 0.0, and Michelob ULTRA Zero across international markets. The company positions non-alcoholic beer as a healthy, nutritious adult refreshment alternative, emphasizing natural ingredients and functional benefits such as vitamin D fortification in Corona Cero, which was designated the official beer of the 2024 Paris Olympics. AB InBev has invested in dealcoholization facilities utilizing vacuum distillation technology and operates numerous no-alcohol beer brands globally. The company's strategy focuses on mainstream brand extensions rather than dedicated non-alcoholic labels, targeting significant production volume from low/no-alcohol beverages.

Carlsberg Group, Europe's leading brewer with operations across 82 breweries, has made alcohol-free brews a strategic priority under its "Accelerate SAIL" strategy, achieving strong volume growth with particularly strong performance across Western Europe and Central & Eastern Europe. The company offers alcohol-free variants across flagship brands including Carlsberg 0.0%, Carlsberg Nordic, Tuborg, and regional brands. Carlsberg's acquisition of Britvic plc in January 2025 strategically expanded its soft drinks exposure, positioning the company as Europe's largest PepsiCo bottler and creating cross-selling opportunities for non-alcoholic portfolios. The company has launched numerous new alcohol-free products, increased marketing investments, and integrates non-alcoholic expansion with sustainability commitments, leveraging brewing heritage to deliver authentic taste profiles.

Clausthaler, produced by Binding-Brauerei Brewery and part of Germany's Radeberger Gruppe KG, holds the distinction of being the world's first non-alcoholic beer, launched in 1979. The brand utilizes a patented brewing process that prevents alcohol formation by producing minimal fermentable maltose in the wort and employing specially cultured bottom-fermenting yeast, conforming to Germany's Reinheitsgebot (Beer Purity Law of 1516). Clausthaler is distributed in over 50 countries globally, positioning itself as a premium non-alcoholic beer emphasizing master brewer expertise, selected ingredients, and multiple international taste awards. Radeberger Group expanded its non-alcoholic portfolio by launching Radeberger Alkoholfrei using gentle thermal dealcoholization and regional aroma hops, reflecting strategic adaptation to market trends while maintaining authentic German brewing heritage.

Non-Alcoholic Beer Industry News

- In January 2025, Carlsberg Group completed its acquisition of Britvic plc for EUR 3.3 billion (approx. USD 4.2 billion), marking one of the beverage industry's most significant strategic moves to expand beyond traditional alcoholic beverages. The acquisition strategically doubled Carlsberg's soft drinks exposure from 16% to 30% of total volumes, positioning the company as Europe's largest PepsiCo bottler.

- In 2024, Athletic Brewing Company inaugurated its second state-of-the-art brewing facility in San Diego, California, adding 200,000 barrels of annual production capacity and effectively doubling the company's manufacturing capabilities to meet surging demand for craft non-alcoholic beer. The 150,000-square-foot facility features advanced brewing technology specifically designed for non-alcoholic beer production, including proprietary dealcoholization systems, automated quality control, and sustainable operations utilizing solar energy and water reclamation systems.

The non-alcoholic beer market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of Million Liters from 2022 to 2035 for the following segments:

Market, By Alcohol Content

- Alcohol-free (0% ABV)

- Non-alcoholic (<0.5% ABV)

- Low alcohol (0.5% to 2.5% ABV)

Market, By Beer Style

- Non-alcoholic lager

- Non-alcoholic IPA

- Non-alcoholic wheat beer

- Non-alcoholic stout & porter

- Non-alcoholic light beer

- Non-alcoholic golden & blonde ale

- Non-alcoholic copper & amber ale

- Non-alcoholic sour beer

- Non-alcoholic gose

- Others

Market, By Flavor Profile

- Citrus

- Hoppy

- Malt-forward

- Pine & resinous

- Coffee & roasted

- Fruit-forward

- Honey

- Bread & grain

- Others

Market, By Packaging Type

- Standard cans (12 oz / 355 ml)

- Tall cans (19.2 oz / 568 ml)

- Glass bottles

- Kegs & draft

- Others

Market, By Material

- Malted grains

- Hops

- Yeasts

- Enzymes

Market, By Distribution Channel

- Off-trade (retail)

- Supermarkets & hypermarkets

- Convenience stores

- Specialty beverage stores

- Online retail / e-commerce

- Other

- On-trade (HORECA)

- Direct-to-consumer

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the non-alcoholic beer industry?

Key players include Athletic Brewing Company, Heineken N.V., Anheuser-Busch InBev, Carlsberg Group, Molson Coors, Clausthaler / Radeberger Group, BrewDog, Partake Brewing, Bravus Brewing Company, Nirvana Brewery, Big Drop Brewing Co., and Erdinger Alkoholfrei.

What are the upcoming trends in the non-alcoholic beer market?

Key trends include advanced brewing technologies, product premiumization, partnerships with wellness and fitness sectors, sustainability initiatives, and growing DTC and subscription-based models.

What was the market share of non-alcoholic lagers in 2025?

Non-alcoholic lagers held a market share of approximately 54.5% in 2025 and is set to expand at a CAGR of 7.6% up to 2035.

What was the market share of hoppy variants in 2025?

Hoppy variants accounted for an approximate market share of 22.8% in 2025 and is anticipated to observe around 7.4% CAGR till 2035.

What was the valuation of the U.S. non-alcoholic beer sector?

The U.S. market was valued at USD 6.4 billion in 2025. Growth is driven by health and wellness trends, the sober-curious movement, and the innovative craft brewing culture.

What is the expected size of the non-alcoholic beer industry in 2026?

The market size is projected to reach USD 25.9 billion in 2026.

What was the market share of non-alcoholic (<0.5% ABV) variants in 2025?

Non-alcoholic (<0.5% ABV) variants dominated the market with an approximate share of 60% in 2025 and is expected to grow at a CAGR of 7.6% through 2035.

What is the projected value of the non-alcoholic beer market by 2035?

The market is poised to reach USD 50.8 billion by 2035, fueled by premiumization, sustainability initiatives, and expanding distribution channels.

What was the market size of the non-alcoholic beer in 2025?

The market was valued at USD 24 billion in 2025, with a CAGR of 7.8% expected through 2035. The markets growth is driven by health-conscious consumers, the sober-curious trend, and innovations in brewing technologies.

Non-Alcoholic Beer Market Scope

Related Reports