Summary

Table of Content

Nicotine Replacement Therapy Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Nicotine Replacement Therapy Market Size

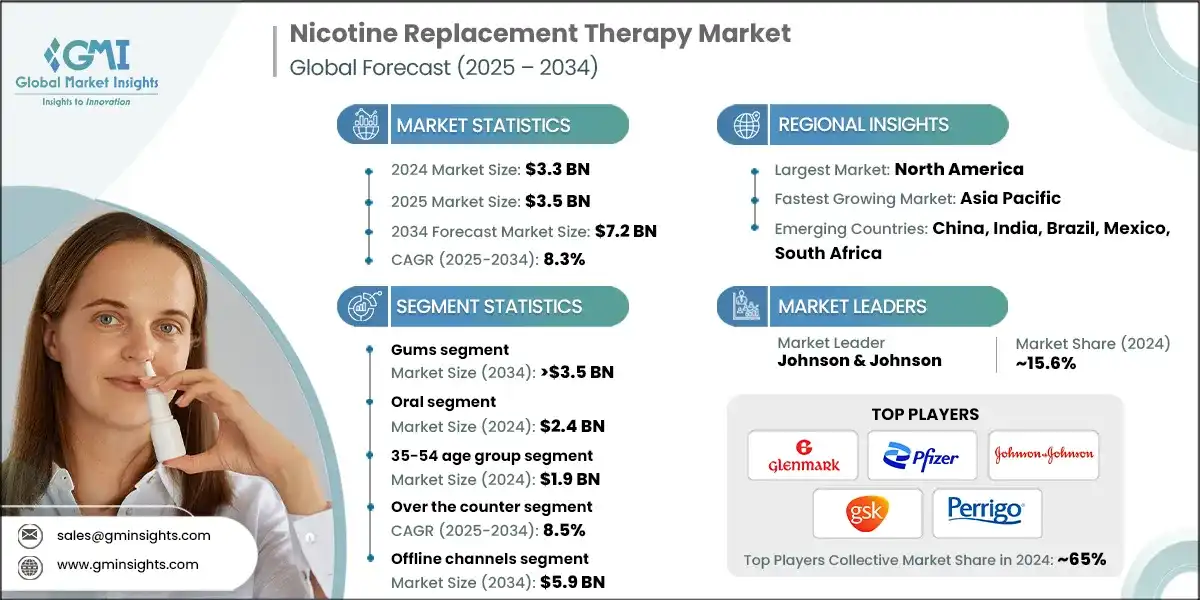

The global nicotine replacement therapy market was valued at USD 3.3 billion in 2024. The market is expected to grow from USD 3.5 billion in 2025 to USD 7.2 billion in 2034, at a CAGR of 8.3% during the forecast period, according to the latest report published by Global Market Insights Inc. This growth is attributed to the rising prevalence of smoking, growing government regulations and tobacco control initiatives and technological advancements in NRT products.

To get key market trends

In addition, mobile apps, telemedicine, and AI-driven tools support real-time tracking of cravings and withdrawal symptoms. These platforms improve adherence and allow remote customization of treatment plans. Moreover, digital health integration is especially impactful in rural areas and is a growing trend in NRT adoption, that further contributes to market growth.

Nicotine replacement therapy (NRT) is designed for individuals who wish to quit smoking. Abruptly discontinuing smoking can trigger withdrawal symptoms and intense cravings, making the quitting process challenging. Major players in the industry are Pfizer, Johnson & Johnson, GlaxoSmithKline, Perrigo Company and others. These players dominated the market by adopting various strategies such as product expansion and establishing global distribution networks.

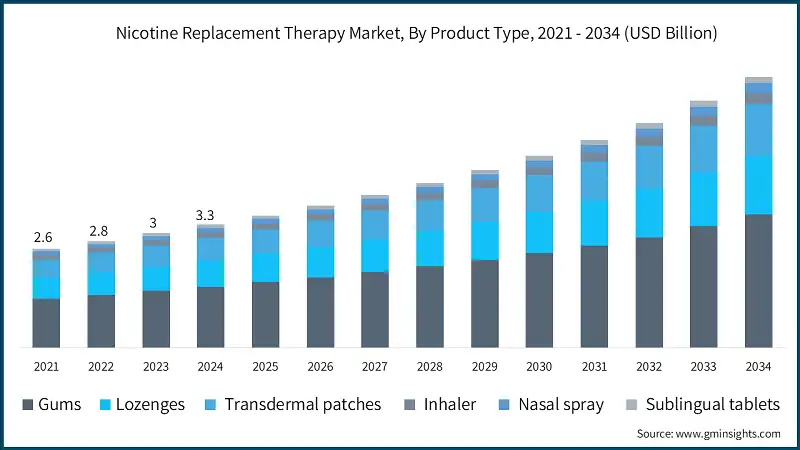

Nicotine replacement therapy market has witnessed steady growth, growing from USD 2.6 billion in 2021 to USD 3 billion in 2023. The growth of the market is driven by increasing consumer demand for natural and personalized products.

Consumers are increasingly prioritizing preventive health over reactive treatment, viewing smoking cessation as a proactive step toward long-term wellness. This evolving mindset is driving demand for NRT products, which are now being integrated into broader lifestyle changes that include fitness, nutrition, and mental well-being.

Urban environments, often associated with elevated stress levels, contribute to higher smoking rates. As public awareness of smoking-related health risks grows, urban populations are turning to NRT solutions to manage withdrawal symptoms and reduce nicotine dependence in a structured and supportive way.

For instance, as per the report published by World Health Organization, in June 2025, it has been reported that the tobacco epidemic is one of the biggest public health threats the world has ever faced, responsible for over 7?million deaths annually as well as disability and long-term suffering from tobacco-related diseases. Around 80% of the 1.3 billion tobacco users worldwide live in low- and middle-income countries, where the burden of tobacco-related illness and death is heaviest.

The nicotine replacement therapy (NRT) market is gaining momentum through increased investment in healthcare infrastructure across developing regions, particularly in Asia-Pacific and Latin America. This expansion supports broader access to cessation tools and strengthens market potential.

Nicotine Replacement Therapy Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.3 Billion |

| Market Size in 2025 | USD 3.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.3% |

| Market Size in 2034 | USD 7.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing cases of cancer globally | Rising global cancer cases are boosting demand for NRT as smoking cessation becomes a key preventive strategy. |

| Increasing smoking cessation initiatives | Growing cessation programs globally are driving demand for NRT products through education, subsidies, and healthcare integration. |

| Rising health awareness and education | Awareness boosts NRT demand by educating smokers about the health risks of tobacco and the benefits of quitting. |

| Expansion of over the counter (OTC) access of NRT products | Wider OTC access boosts NRT adoption by improving convenience, affordability, and self-managed smoking cessation efforts. |

| Pitfalls & Challenges | Impact |

| Associated side-effects of NRT | The adverse reactions may discourage users from continuing treatment or trying NRT altogether, especially without proper guidance. |

| Stringent regulation and restrictions | Strict regulatory controls on NRT formulations, marketing, and distribution may limit innovation, accessibility, and market expansion. |

| Opportunities: | Impact |

| Integration with digital health platforms | Digital health integration enhances NRT adherence, personalization, and reach, driving market growth through tech-savvy consumer engagement. |

| Growing global aging population | Aging populations seek safer cessation methods, boosting NRT demand due to rising health risks and chronic conditions. |

| Market Leaders (2024) | |

| Market Leaders |

~15.6% market share. |

| Top Players |

Top Players Collective Market Share ~65% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Nicotine Replacement Therapy Market Trends

- The market experiencing dynamic transformation driven by the fact that governments and health organizations are intensifying anti-smoking efforts through taxation, public bans, and awareness campaigns. WHO reports over 1.3 billion tobacco users, with tobacco causing 8 million deaths annually.

- These efforts are pushing smokers toward cessation tools like NRT. In addition, countries are integrating NRT into national health programs, making it more accessible and affordable, especially in low- and middle-income regions where 80% of smokers reside.

- Moreover, innovations like RespiRx, a Bluetooth-enabled, breath-activated nicotine inhaler, represent the next generation of NRT. These devices offer real-time dosing feedback, track usage, and integrate with mobile apps for personalized support.

- Other advancements include fast-dissolving oral films, synthetic nicotine, and AI-powered cessation apps, all aimed at improving bioavailability, user experience, and adherence.

- Further, regulatory bodies such as U.S. FDA and EMA are approving more NRT formats for over the counter drugs use, including nicotine pouches and sprays. Countries like India have added NRT to their National List of Essential Medicines, enabling insurance coverage. In the U.S., the Affordable Care Act mandates coverage of cessation treatments, significantly improving access and affordability.

- Additionally, NRT products have evolved from basic patches and gums to controlled-release lozenges, nicotine-infused films, and plant-based alternatives. These innovations aim to mimic the sensory experience of smoking while minimizing health risks.

- In addition, combination therapies (e.g., patch + gum) are also gaining traction for their higher efficacy in managing cravings and withdrawal symptoms, that further contributes the growth of the market.

- Increasing adoption of localized production and sustainable packaging to mitigate supply chain disruptions and reduce costs, manufacturers are investing in regional production hubs and diversifying raw material sourcing.

- Lastly, recent product approvals and launches such as Kenvue’s nicotine gum and patch became the first WHO-prequalified NRT products highlight innovation and supply-chain dependencies, that further contributes to market growth.

Nicotine Replacement Therapy Market Analysis

Learn more about the key segments shaping this market

In 2021, the global nicotine replacement therapy market was valued at USD 2.6 billion. The following year, it saw a slight increase to USD 2.8 billion, and by 2023, the market further climbed to USD 3 billion.

Based on product type, the global nicotine replacement therapy market is divided into gums, lozenges, transdermal patches, inhaler, nasal spray and sublingual tablets. The gums segment accounted for 49.6% of the market in 2024. The segment is expected to exceed USD 3.5 billion by 2034, growing at a CAGR of 8.2% during the forecast period.

- Nicotine gum offers a medically validated, accessible method to manage withdrawal symptoms, making it a preferred choice among health-conscious consumers. This awareness has led to a surge in demand for effective cessation aids like nicotine gum. As smoking is increasingly viewed as a chronic addiction rather than a lifestyle choice, long-term NRT solutions are gaining traction.

- Medical professionals increasingly recommend nicotine gum as part of structured cessation plans. Its rapid action and faster absorption make it effective for managing withdrawal symptoms.

- The growing recognition of NRT by healthcare systems, especially in North America and Asia-Pacific, has led to more prescriptions and endorsements. This medical backing enhances consumer trust and drives adoption, particularly among heavy smokers seeking clinically supported solutions.

- Further, transdermal patches segment is expected to grow with the fastest CAGR of 8.7% during the analysis period. Nicotine patches offer a steady, controlled release of nicotine, helping users manage withdrawal symptoms without the harmful chemicals in cigarettes.

- With over 1.3 billion tobacco users globally, the demand for effective cessation tools is surging. The ease of use of transdermal patches and long-lasting effect make them especially appealing to heavy smokers seeking a structured quitting method.

Based on the route of administration, the nicotine replacement therapy market is segmented into oral, transdermal and nasal. The oral segment dominated the market in 2024 with a revenue of USD 2.4 billion.

- Oral nicotine replacement therapy (NRT) products such as lozenges, gums, and dissolvable films provide a discreet and portable solution for managing nicotine cravings.

- These formulations can be used without attracting attention, making them particularly suitable for workplaces, public transportation, and social settings. Their convenience promotes better user compliance and satisfaction, especially among younger and urban populations who prefer non-invasive, on-demand options.

- In addition, the rise of e-commerce has made oral NRT products more accessible. Online platforms offer convenience, privacy, and competitive pricing, encouraging more consumers to try these therapies.

- This trend is especially strong in regions with limited physical access to pharmacies or where stigma around smoking cessation persists thereby contributing to market growth.

- The market for transdermal route of administration is expected to expand more rapidly owing to the advantages offered by transdermal patches such as consistent and controlled release of nicotine over 16-24 hours, helping users manage withdrawal symptoms without frequent dosing.

- This steady delivery reduces the intensity of cravings and mood swings, making it easier for smokers to quit. The simplicity of once-daily application also improves adherence, especially among users who prefer low-maintenance solutions transdermal drug delivery systems.

Based on mode, the nicotine replacement therapy market is classified into over the counter and prescription. Over the counter segment dominated the market in 2024 and is growing with a CAGR of 8.5% during the forecast period.

- Over the counter NRT products like gums, patches, and lozenges are widely available in pharmacies, supermarkets, and online platforms. This accessibility allows consumers to begin cessation efforts without needing a prescription or clinical consultation.

- The convenience of self-administered therapy appeals to individuals seeking privacy or immediate relief from cravings. As retail and e-commerce channels expand, OTC availability continues to drive market penetration, especially in regions with limited healthcare infrastructure, thereby contributing to market growth.

- Further, OTC NRT products are generally more affordable than prescription-based therapies, making them attractive to cost-sensitive consumers. Many governments subsidize OTC NRTs or include them in public health programs, further reducing financial barriers.

- The prescription segment growing with a CAGR of 6.7% during the analysis period. The market growth for prescription segment is driven by the fact that prescription NRT products are covered under public health insurance schemes or employer-sponsored plans.

- For example, the U.S. Affordable Care Act mandates coverage of smoking cessation treatments, including prescription NRT, without co-payments. This financial support reduces barriers to access and drives demand, especially among low-income and high-risk populations.

Based on age group, the nicotine replacement therapy market is bifurcated into 18-34, 35-54 and 55+ age group. The 35-54 age group segment was anticipated to be worth of USD 1.9 billion in 2024 and is expected to grow at 8.6% CAGR during the forecast period.

- Individuals aged 34-54 are increasingly aware of the long-term health risks associated with smoking, such as cardiovascular disease, cancer, and respiratory disorders. This age group often begins to experience early symptoms or receives medical advice prompting lifestyle changes.

- As a result, they are more motivated to quit smoking and seek effective cessation aids like NRT products. Their health-conscious behavior and willingness to invest in preventive care make them a key demographic for NRT adoption.

- In addition, many people in the 34-54 age group have been smoking for over a decade, leading to stronger nicotine dependence. This makes quitting more challenging and increases the need for structured cessation support.

- NRT products, especially prescription-based therapies and combination treatments, are well-suited to address the intense withdrawal symptoms experienced by long-term smokers. Their higher dependency levels drive demand for clinically proven and sustained-release NRT solutions.

- Lastly, the 34-54 age group is digitally literate and actively engages with mobile health apps, wearables, and online support communities. NRT products integrated with digital platforms such as smart patches or app-guided regimens appeal to this tech-savvy segment.

- These tools enhance adherence, track progress, and provide behavioral support, making quitting more manageable and increasing the success rate.

Learn more about the key segments shaping this market

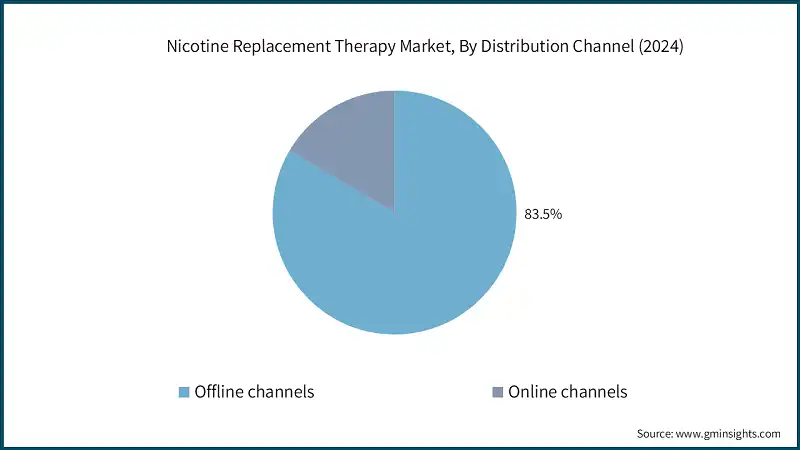

Based on distribution channel, nicotine replacement therapy market is classified into offline channels and online channels. The offline channels segment dominated the market in 2024 and is expected to reach USD 5.9 billion by 2034. The offline distribution channels are further sub-segmented into hospital pharmacies, retail pharmacies and other offline distribution channels.

- Offline channels such as pharmacies, supermarkets, and convenience stores offer immediate access to NRT products without the need for digital literacy or internet connectivity. This is especially important in rural and semi-urban areas where online infrastructure may be limited.

- Retail pharmacies offer professional guidance from pharmacists, which is especially valuable for first-time users of nicotine replacement therapy (NRT) products. Personalized recommendations, dosage instructions, and behavioral support help improve treatment adherence and success rates, thereby contributing to market growth.

- Many consumers prefer purchasing health-related products from physical stores due to their trust in established retail brands and the opportunity to inspect products before buying. This habitual buying behavior, particularly among older demographics, supports the continued growth of offline retail channels.

Looking for region specific data?

North America Nicotine Replacement Therapy Market

The North America market dominated the market with a market share of 48.3% in 2024.

- North America has a well-informed population that is highly aware of the health risks associated with smoking, including cancer, cardiovascular disease, and respiratory conditions. Public health campaigns, educational initiatives, and media coverage have significantly influenced consumer behavior.

- This awareness drives demand for safer cessation methods like NRT, especially among middle-aged and older adults seeking long-term health improvements. The region’s high disease burden makes it a major contributor to global market growth.

- Moreover, governments in North America enforce strict tobacco control measures, including advertising bans, high tobacco taxes, and public smoking restrictions.

- In addition, North America benefits from a robust healthcare system that integrates NRT into primary care and hospital-based cessation programs. Physicians frequently prescribe NRT products as part of structured quit plans, and insurance coverage makes these therapies more accessible. This clinical endorsement enhances consumer trust and drives sustained adoption.

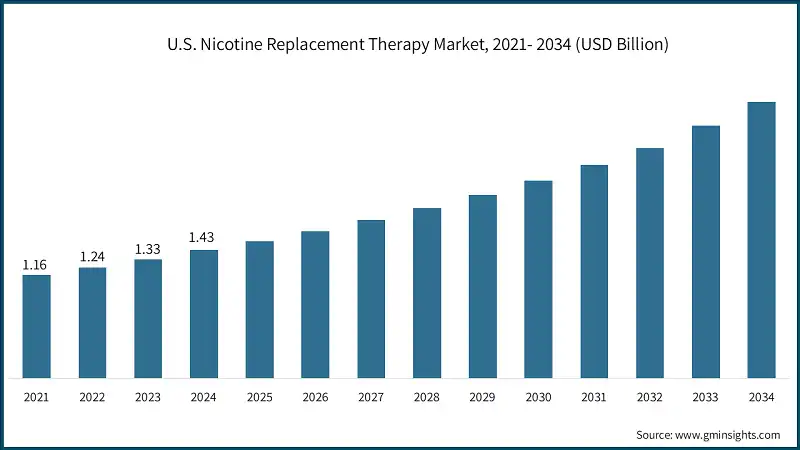

The U.S. nicotine replacement therapy market was valued at USD 1.16 billion and USD 1.24 billion in 2021 and 2022, respectively. The market size reached USD 1.43 billion in 2024, growing from USD 1.33 billion in 2023.

- The U.S. government actively promotes smoking cessation through initiatives such as the CDC’s Tips From Former Smokers campaign and the Affordable Care Act, which mandates insurance coverage for NRT products without co-payments. These efforts significantly enhance accessibility and encourage usage among smokers seeking to quit.

- The U.S. market is experiencing rapid growth in digital health solutions that complement NRT products. Apps like Nicotex Begin offer personalized 12-week cessation programs aligned with WHO protocols, integrating NRT usage with behavioral tracking and motivational support to improve outcomes.

- With approximately 480,000 smoking-related deaths annually and 14% of U.S. adults still smoking, the demand for effective cessation tools remains high. NRT products are increasingly utilized in clinical settings to manage withdrawal symptoms and reduce relapse rates, reinforcing their role in comprehensive cessation strategies.

- The burden of chronic diseases like lung cancer and heart disease continues to drive healthcare providers to recommend NRT as a preventive measure.

Europe Nicotine Replacement Therapy Market

Europe market accounted for USD 704.5 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- European countries have robust public health systems that actively promote smoking cessation. Campaigns led by organizations like the NHS (UK), Santé publique France, and the HSE (Ireland) educate citizens on the risks of smoking and the benefits of quitting. These efforts increase awareness and drive adoption of NRT products, particularly among middle-aged adults and those with chronic health conditions.

- Europe has a well-established network of retail and hospital pharmacies that serve as key distribution channels for NRT products.

- Pharmacists play a vital role in guiding consumers on product selection and usage. Offline availability, combined with growing e-commerce platforms, ensures broad access to NRT across urban and rural regions.

Germany dominates the European nicotine replacement therapy market, showcasing strong growth potential.

- German consumers are increasingly prioritizing mental and physical well-being, leading to a surge in demand for smoking cessation aids. The broader wellness movement has made quitting smoking a lifestyle choice, not just a medical necessity.

- NRT products, especially lozenges and patches, are seen as tools for self-improvement, aligning with the growing emphasis on preventive healthcare and personal responsibility.

Asia Pacific Nicotine Replacement Therapy Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 9% during the analysis timeframe.

- Countries like China and India account for nearly 40% of the global smoking population. This massive base of tobacco users creates a strong demand for cessation solutions. As awareness of smoking-related diseases rises, more individuals are turning to NRT products such as gums, patches, and lozenges. The scale of the problem makes Asia Pacific a critical region for NRT market expansion.

- Moreover, the growth of retail pharmacies and online platforms across Asia Pacific has made NRT products more accessible. Consumers can now purchase cessation aids conveniently, with options for home delivery and digital support. This expansion is particularly impactful in countries with limited healthcare infrastructure, enabling broader reach and market penetration.

China nicotine replacement therapy market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- China has one of the largest smoking populations globally, with over 300 million smokers. This contributes significantly to the country’s burden of smoking-related diseases such as lung cancer and cardiovascular disorders.

- The Chinese government has intensified efforts to reduce tobacco consumption through public health campaigns, smoking bans in public places, and increased tobacco taxes.

- These initiatives are supported by healthcare institutions and NGOs, which promote NRT as part of structured cessation programs. The regulatory push and public education efforts are creating a favorable environment for NRT adoption.

Latin American Nicotine Replacement Therapy Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil is witnessing increased awareness of smoking-related health risks, including cancer and cardiovascular diseases. Public health campaigns and educational initiatives are encouraging smokers to seek safer alternatives. As a result, NRT products like gums, patches, and lozenges are gaining popularity among health-conscious consumers who are motivated to quit smoking.

- Brazil’s expanding middle class is increasingly focused on wellness and preventive healthcare. This demographic is more likely to invest in smoking cessation products and participate in structured quit programs. Their purchasing power supports demand for both OTC and prescription NRT formats, especially those offering convenience and personalization.

Middle East and Africa Nicotine Replacement Therapy Market

Saudi Arabia market to experience substantial growth in the Middle East and Africa nicotine replacement therapy market in 2024.

- Saudi Arabia has included NRT products on its essential drugs list, meaning they are fully subsidized by the government. This significantly reduces the financial barrier for consumers seeking to quit smoking.

- The availability of free or low-cost NRT options such as patches, gums, and lozenges encourages widespread adoption, especially among middle- and low-income groups. This policy reflects the country’s commitment to reducing tobacco-related health burdens.

- Lastly, Saudi Arabia has over 4.3 million smokers, with 26.3% of men being current smokers a figure projected to rise. This growing health concern is prompting both individuals and public health institutions to seek effective cessation solutions. NRT products are increasingly viewed as a safer and medically endorsed alternative to tobacco, driving demand among adult male populations.

Nicotine Replacement Therapy Market Share

The Nicotine Replacement Therapy (NRT) market is characterized by a blend of established global leaders and emerging innovators, creating a dynamic and moderately consolidated competitive landscape. Leading companies such as Johnson & Johnson, GlaxoSmithKline, Pfizer, Perrigo Company, and Glenmark hold a significant share of the market, estimated at around 65%. Their dominance is sustained through strategic investments in research and development, geographic expansion, regulatory compliance, and the creation of patient-centric therapies that address evolving cessation needs.

To reinforce their market positions, these firms are adopting multi-pronged strategies including acquisitions, strategic partnerships, and competitive pricing models. These approaches aim to improve access to advanced NRT products, enhance affordability, and address unmet needs among populations struggling with nicotine dependence, particularly in regions with high smoking prevalence.

In parallel, emerging players are contributing to market growth through technological innovation, such as novel delivery mechanisms, flavored and fast-acting formulations, and digital health integration. Their presence is especially notable in Asia-Pacific and Latin America, where rising awareness of smoking-related health risks and expanding healthcare infrastructure are driving increased adoption of NRT solutions.

Overall, the market is experiencing intensified competition and greater diversity, as both established and emerging companies evolve their offerings to meet global demand for safer, more effective, and accessible smoking cessation therapies.

Nicotine Replacement Therapy Market Companies

Prominent players operating in the nicotine replacement therapy industry are as mentioned below:

- Cipla

- Dr. Reddy’s Laboratories

- Fertin Pharma

- Glenmark

- GlaxoSmithKline

- Johnson & Johnson

- Niconovum

- Pfizer

- Rubicon Research

- Rusan Pharma

- Sparsh Pharma

- Perrigo Company

- Pierre Fabre Group

- Johnson & Johnson

Johnson & Johnson leads the nicotine replacement therapy market with a share of 15.6% in 2024. Johnson & Johnson leads the NRT segment with its popular Nicorette brand, offering a wide range of over-the-counter solutions and leveraging its global healthcare presence to support smoking cessation efforts.

Pfizer plays a major role in NRT with its prescription-based smoking cessation aid Chantix, backed by strong clinical research and a commitment to reducing tobacco dependence globally.

GlaxoSmithKline is a prominent NRT provider, offering products like NicoDerm CQ and Nicorette, and investing in behavioral support tools to enhance quit success rates through integrated therapy approaches.

Nicotine Replacement Therapy Industry News

- In June 2025, Achieve Life Sciences, Inc., a late-stage specialty pharmaceutical company focused on the global development and commercialization of cytisinicline as a treatment of nicotine dependence for smoking cessation, announced it has named Omnicom as its strategic innovation partner and agency of record to lead initiatives in support of Achieve’s planning for U.S. commercial launch.

- In May 2025, Cipla health introduces Nicotex begin, a first-of-its-kind app for smoking cessation. With its intuitive design and user interface, it ensures an engaging and stress-free experience for the users. Some other key features include Nicotine Replacement Therapy (NRT) integration with gums, patches, and lozenges to ease nicotine cravings, along with expert-led weekly counselling sessions, with additional sessions available as needed.

- In June 2024, Ayrton Saunders Limited (Ayrtons), announced the approval by the UK Medicines and Healthcare products Regulatory Agency (MHRA) of the world's first and only clinically approved, patented nicotine inhaler system able to deliver nicotine directly via the lungs to help smokers replace, cut down and ultimately quit smoking. The company is working to extend this landmark approval to additional markets in the EU and beyond and will explore discussions regarding regulatory and commercial pathways in the US and Japan.

The nicotine replacement therapy market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product Type

- Gums

- Lozenges

- Transdermal patches

- Inhaler

- Nasal spray

- Sublingual tablets

Market, By Route of Administration

- Oral

- Transdermal

- Nasal

Market, By Mode

- Over the counter (OTC)

- Prescription

Market, By Age Group

- 18-34

- 35-54

- 55+

Market, By Distribution Channel

- Offline channels

- Hospital pharmacies

- Retail pharmacies

- Other offline distribution channels

- Online channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the nicotine replacement therapy industry?

Key trends include AI-driven cessation apps, Bluetooth-enabled inhalers, fast-dissolving oral films, plant-based alternatives, and expansion of OTC access across emerging markets.

Who are the key players in the nicotine replacement therapy market?

Key players include Johnson & Johnson, Pfizer, GlaxoSmithKline, Perrigo Company, Glenmark, Cipla, Dr. Reddy’s Laboratories, Fertin Pharma, Rubicon Research, Rusan Pharma, Sparsh Pharma, Pierre Fabre Group, and Niconovum.

What was the valuation of the oral route of administration segment?

The oral segment dominated the market in 2024 with a revenue of USD 2.4 billion, supported by the popularity of gums, lozenges, and dissolvable films.

Which region leads the nicotine replacement therapy market?

North America led the market with 48.3% share in 2024, driven by strong tobacco control policies, public health campaigns, and high adoption of OTC NRT products.

How much revenue did the gums segment generate?

The gums segment accounted for 49.6% of the market in 2024 and is expected to exceed USD 3.5 billion by 2034, driven by consumer preference for accessible and effective smoking cessation aids.

What is the market size of the nicotine replacement therapy in 2024?

The market size was USD 3.3 billion in 2024, with a CAGR of 8.3% expected through 2034 driven by rising smoking cessation initiatives, health awareness, and wider OTC access.

What is the projected size of the nicotine replacement therapy industry in 2025?

The nicotine replacement therapy market is expected to reach USD 3.5 billion in 2025.

What is the projected value of the nicotine replacement therapy market by 2034?

The market is expected to reach USD 7.2 billion by 2034, supported by digital health integration, personalized therapies, and innovative product formats.

Nicotine Replacement Therapy Market Scope

Related Reports