Summary

Table of Content

Nicotine Pouches Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Nicotine Pouches Market Size

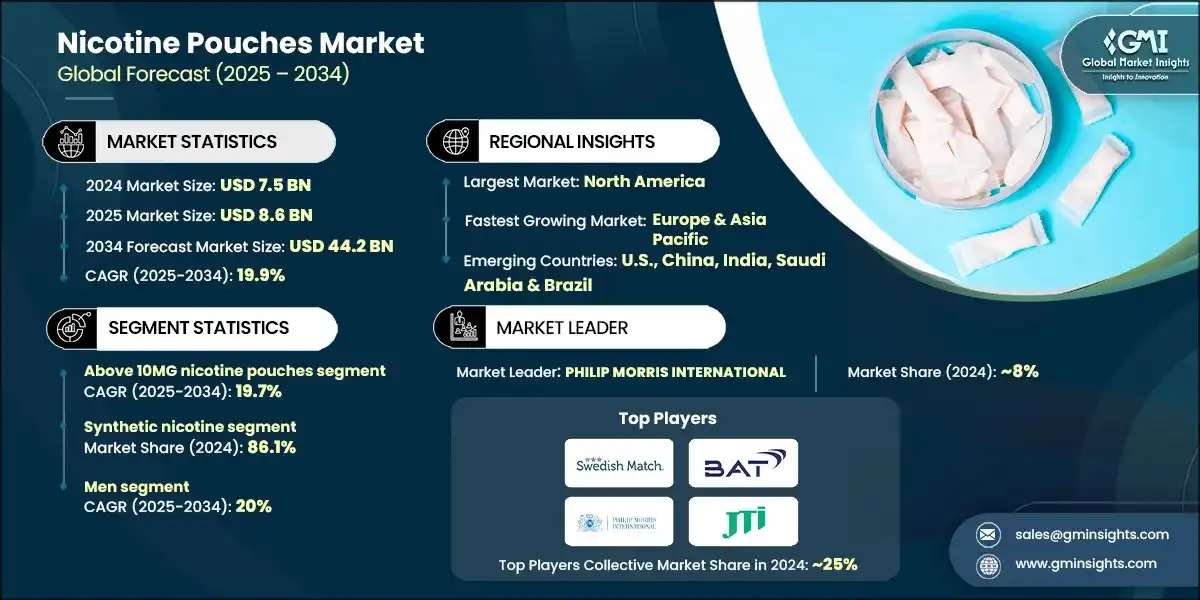

The global nicotine pouches market was estimated at USD 7.5 billion in 2024. The market is expected to grow from USD 8.6 billion in 2025 to USD 44.2 billion in 2034, at a CAGR of 19.9% according to latest report published by Global Market Insights Inc.

To get key market trends

- Nicotine pouches are on the rise because people are quitting smoking cigarettes. Smoking cigarettes has been a big problem in America, but nicotine pouches have allowed adult users to satisfy their craving for nicotine without the dangers of smoking. Nicotine pouches are easy to hide from employers and other people. The CDC has estimated that over 80% of American adults support the establishment of smoke-free zones in their workplaces, which helps explain the increasing demand for alternatives to smoking. This shift represents an opportunity for harm reduction for individuals who would like to stop using tobacco products or who view these products as less harmful than smoking cigarettes or chewing tobacco.

- One major factor fueling the growth of the global nicotine pouch industry is the increase in consumers being aware of their health. The emergence of long-term effects associated with smoking, such as lung cancer and heart disease, has contributed significantly to the greater acceptance of safer alternatives to traditional tobacco products. With an active role from the government in the form of anti-smoking campaigns and tightening of regulations, many smokers have switched over to nicotine pouches either as a means of quitting smoking or as one of several healthier lifestyles possible. According to the World Health Organization (WHO), tobacco kills approximately 8 million people each year and this death rate has led to the establishment of very strict governmental regulation on the sale of tobacco products. By providing an alternative to combustible tobacco products that are considered cleaner or less hazardous, nicotine pouches are beginning to be used by many smokers and even newer users as part of their overall lifestyle change that involves health and wellness.

- The wide variety of flavored products and different levels of nicotine have been major contributors to the growth of the market for nicotine pouches. Through numerous flavoring options, such as mint, fruit, coffee, and exotic blends, manufacturers have provided a greater number of taste preferences and enhanced the overall experience of the consumer. The flexibility of nicotine concentration gives consumers the ability to choose products that meet their tolerance levels or help them to reduce their consumption at a steady rate. In addition, the flexibility of nicotine concentration helps to foster brand loyalty among customers and creates reasons for consumers to continually purchase the same product. Consumers will continue to have strong demand for nicotine pouches throughout the projected time of growth.

Nicotine Pouches Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 7.5 billion |

| Market Size in 2025 | USD 8.6 billion |

| Forecast Period 2025 - 2034 CAGR | 19.9% |

| Market Size in 2034 | USD 44.2 billion |

| Key Market Trends | |

| Drivers | Impact |

| Smoke-free alternatives to traditional tobacco products gain traction. | Encourages rapid adoption among smokers seeking harm-reduction options, boosting overall market penetration. |

| Heightened health awareness | Drives consumers away from combustible tobacco toward cleaner, perceived safer nicotine solutions, accelerating category growth. |

| Diverse flavors and varying strengths | Enhances user experience and personalization, increasing repeat purchases and expanding the consumer base. |

| Pitfalls & Challenges | Impact |

| Uncertainty in regulations | Creates compliance risks and market entry barriers, slowing expansion in certain regions. |

| Concerns over youth adoption & public health | Triggers stricter controls and negative publicity, potentially limiting marketing freedom and growth. |

| Opportunities: | Impact |

| Customization of flavors & strengths. | Offers differentiation and consumer loyalty, enabling brands to capture niche segments and premium positioning. |

| Emerging next-generation formats | Opens avenues for innovation and diversification, attracting health-conscious and tech-savvy consumers. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of ~8% |

| Top Players |

Collective market share in 2024 is ~25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Europe & Asia Pacific |

| Emerging Country | U.S., China, India, Saudi Arabia & Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Nicotine Pouches Market Trends

- The nicotine pouch market continues to see some of the biggest trends, among them innovation and diversification. Leading brands have begun adding many new flavors, textures, formats of pouches, etc., to keep up with the evolving tastes of shoppers, including bold and exotic flavor profiles based on tropical fruits, exotic spices, and dessert-type options to appeal to broader audiences. Additionally, extended-release technology has made these products longer-lasting when consumed, and the quality of materials used in making these pouches has improved dramatically, allowing for maximum user comfort and moisture control.

- Furthermore, many brands are currently looking into hybrid product development that combines nicotine with such functional ingredients as caffeine, adaptogens, or botanicals that appeal to consumers who place a higher premium on wellness. The innovation and diversification strategies of companies not only enhance their customers’ overall user experience but also provide businesses with a point of differentiation in an increasingly competitive and saturated market.

- The introduction of synthetic nicotine is emerging as a major topic in industry and has already begun to play a central role in product innovation. Because synthetic nicotine has no connection to tobacco, it provides companies with a way to comply with specific requirements in many areas of the world. It also provides an alternative for those who are health-conscious and want to choose a cleaner, safer product than traditional tobacco products. Manufacturers can create unique flavors that may not otherwise be allowed, due to the absence of restrictions related to tobacco-based products. For example, companies can create flavor combinations that would not be considered "normal" or "traditional," opening the door to experimenting with flavors that are generally less conventional than the traditional tobacco-based flavors.

- With the anticipated development of regulatory frameworks surrounding synthetic nicotine, as well as the anticipated continued reduction in production costs for synthetic nicotine, synthetic nicotine represents an important component for the development of future generations of nicotine-based products. The emergence of synthetic nicotine will enable companies to establish themselves as the leaders in providing companies and consumers with the tools necessary to continue to look for methods of reducing their harmfulness toward one another.

- Companies in the nicotine pouch industry are making sustainability an important priority. Increasingly, consumers want companies to follow environmentally friendly practices, and many companies now provide eco-friendly options to better serve their customers. Companies have expanded their range of eco-friendly alternatives to include recyclable materials used in the packaging of nicotine pouches, biodegradable nicotine pouch products, and reusable aluminum cans. The increase in sustainability options is heavily influenced by environmental regulations and expectations placed on the companies by consumers.

- Companies are investing resources to ensure they source their raw materials from sustainably harvested sources, as well as reducing the carbon footprint associated with production and distribution. By being responsible and embedding sustainability into every operational facet of their company, companies in the nicotine pouches segment can create a positive reputation for their brand, establish rapport with environmentally conscious consumers, and remain competitive for years to come. The growing focus companies place on sustainability will play a crucial role in shaping the future of the nicotine pouches segment.

Nicotine Pouches Market Analysis

Learn more about the key segments shaping this market

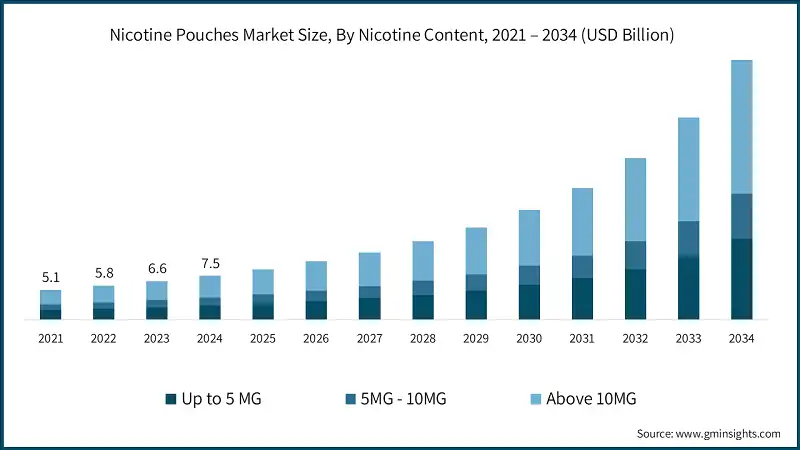

Based on nicotine content, the nicotine pouches market is categorized into up to 5 MG, 5MG - 10MG and above 10MG. The above 10MG nicotine pouches accounted for revenue of around USD 2.4 billion in 2024 and is anticipated to grow at a CAGR of 19.7% from 2025 to 2034.

- These high-strength pouches cater to consumers who want a more intense nicotine hit without the harmful effects of combustion, making them an attractive option for those transitioning from cigarettes or other smokeless tobacco forms.

- Additionally, the convenience and discreet nature of pouches align with smoke-free regulations and social norms, further boosting adoption. The segment also benefits from flavor innovation and extended-release technology, which enhance user experience and satisfaction.

Based on category of nicotine pouches market consists of tobacco-free and synthetic nicotine. The synthetic nicotine emerged as leader and held 86.1% of the total market share in 2024 and is anticipated to grow at a CAGR of 20.1% from 2025 to 2034.

- Synthetic nicotine offers a tobacco-free formulation, which appeals strongly to health-conscious consumers and those seeking harm-reduction alternatives without the stigma or regulatory complexities associated with tobacco-derived products. This positioning aligns with global trends toward cleaner, “next generation” nicotine solutions, especially in regions enforcing strict tobacco regulations.

- Additionally, synthetic nicotine provides greater purity and consistency, enabling manufacturers to deliver precise doses and improved product quality, which enhances consumer trust and satisfaction. Regulatory clarity in major markets, such as the U.S. FDA’s acceptance of synthetic nicotine under PMTA pathways, has further accelerated adoption by legitimizing these products and opening doors for innovation.

Learn more about the key segments shaping this market

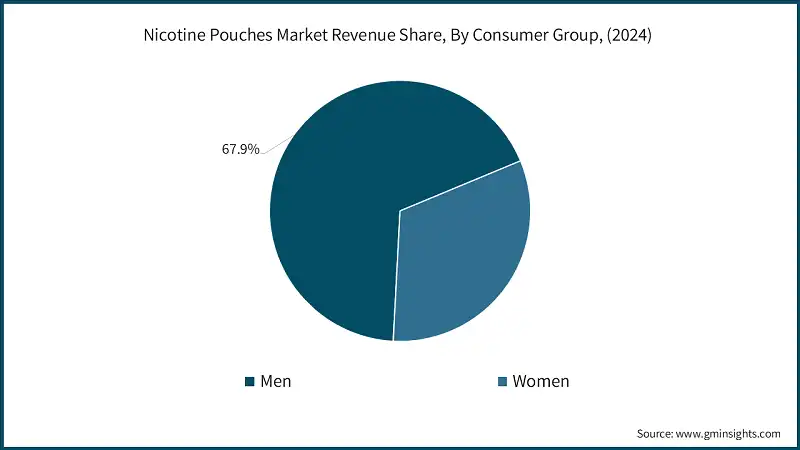

Based on consumer group of nicotine pouches market consists of men and women. The men consumers emerged as leader and held 67.9% of the total market share in 2024 and is anticipated to grow at a CAGR of 20% from 2025 to 2034.

- Men have exhibited higher smoking prevalence compared to women, making them a primary target for harm-reduction alternatives like nicotine pouches. This segment is particularly drawn to pouches because they offer a discreet, smoke-free experience that fits well with workplace and social environments where smoking is restricted.

- Additionally, men tend to prefer stronger nicotine strengths and bold flavors, which aligns with the product innovations in the market, such as high-nicotine variants and mint or tobacco-like flavors. Marketing strategies by leading brands often focus on masculine branding and active lifestyle imagery, further reinforcing appeal among male consumers.

Looking for region specific data?

North America Nicotine Pouches Market

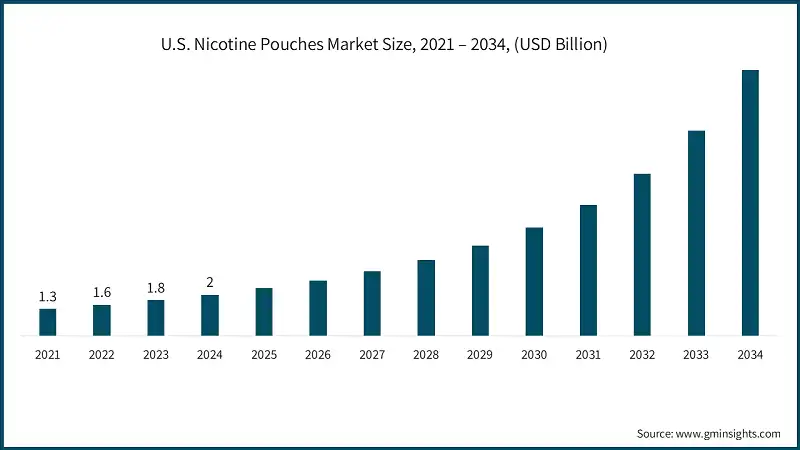

The U.S. dominates an overall North America market and valued at USD 2 billion in 2024 and is estimated to grow at a CAGR of 21.1% from 2025 to 2034.

- The U.S. has witnessed a significant decline in cigarette smoking rates, driven by heightened health awareness and stringent anti-smoking regulations, creating a large pool of consumers seeking harm-reduction alternatives. Nicotine pouches perfectly fit this demand as they offer a smoke-free, discreet, and convenient solution that complies with public smoking bans and workplace restrictions.

- Additionally, the U.S. market benefits from aggressive product innovation and marketing by major players such as Swedish Match (ZYN), Altria (On!), and BAT (VELO), which have established strong brand recognition and extensive distribution networks across convenience stores, gas stations, and online platforms. The popularity of flavored pouches and higher nicotine strengths among American consumers further accelerates adoption, especially among younger adults aged 18–35.

Europe Nicotine Pouches Market

In the European nicotine pouches industry, Germany is expected to experience significant and promising growth from 2025 to 2034.

- The country has seen a steady decline in traditional cigarette consumption due to strict anti-smoking laws, public health campaigns, and rising awareness of tobacco-related risks, creating strong demand for harm-reduction alternatives. Nicotine pouches, being smoke-free and discreet, align perfectly with Germany’s stringent indoor smoking restrictions and health-conscious lifestyle trends.

- Additionally, the growing popularity of flavored and high-strength pouches among younger demographics and former smokers is fueling adoption. Germany’s well-developed retail infrastructure and rapid expansion of e-commerce platforms make these products widely accessible, while increasing acceptance of tobacco-free and synthetic nicotine options further accelerates market penetration.

Asia Pacific Nicotine Pouches Market

In the Asia Pacific market, the China held 28% market share in 2024 and is anticipated to grow at a CAGR of 18.8% from 2025 to 2034.

- With China being the world’s largest cigarette market, the shift toward harm-reduction alternatives is gaining momentum as consumers seek smoke-free options that comply with strict indoor smoking bans and urban lifestyle norms. Nicotine pouches offer a discreet, odorless, and convenient solution, which resonates well with younger demographics and professionals in metropolitan areas.

- Additionally, the rise of e-commerce platforms and digital payment systems in China makes these products easily accessible, while aggressive marketing by global and local brands is expanding awareness. The growing preference for tobacco-free and flavored pouches, combined with innovation in high-nicotine variants, further accelerates adoption.

Middle East and Africa Nicotine Pouches Market

In the Middle East and Africa nicotine pouches industry, Saudi Arabia held 24.2% market share in 2024 promising growth from 2025 to 2034.

- The country has a high prevalence of tobacco use but increasing health awareness and government initiatives to curb smoking are pushing consumers toward harm-reduction alternatives. Nicotine pouches, being smoke-free and discreet, align well with cultural norms and strict public smoking restrictions, making them an attractive option for users seeking convenience without social stigma.

- Additionally, the growing popularity of flavored and tobacco-free pouches among younger demographics and expatriates is fueling demand. Saudi Arabia’s strong retail infrastructure, combined with rapid digitalization and e-commerce penetration, ensures easy product availability. Global brands are actively entering the market through partnerships and localized marketing strategies, leveraging the region’s preference for premium, innovative products.

Nicotine Pouches Market Share

- In 2024, the prominent manufacturers in market are Swedish Match – ZYN, British American Tobacco (BAT) – Lyft, Philip Morris International, Swedish Match - On! Japan Tobacco International (JTI) - Nordic Spirit collectively held the market share of ~25%.

- ZYN maintains its dominant market position through strict regulatory compliance, robust brand loyalty initiatives, and scalable production capabilities. The brand prioritizes harm reduction by deploying advanced age-verification systems to ensure responsible marketing. Its innovation strategy includes expanding flavor portfolios, offering a variety of nicotine strengths, and enhancing pouch comfort and moisture control. Swedish Match capitalizes on its manufacturing expertise to deliver consistent quality and reliability, solidifying its leadership in the market.

- BAT sustains its competitive edge by continuously refining its product portfolio and implementing science-backed harm-reduction strategies. The company emphasizes a wide range of flavors, high-strength options, and improved pouch textures to elevate the user experience. Through investments in loyalty programs and e-commerce platforms, BAT enhances digital engagement and ensures strong consumer retention. Its innovation framework combines research-driven product development with targeted marketing campaigns tailored to adult consumers, reinforcing its market presence.

Nicotine Pouches Market Companies

Major players operating in the nicotine pouches industry include:

- Moxy

- Black Buffalo

- Lyft

- White Fox

- Nordic Spirit

- Dryft

- Killa

- ZERO

- Rogue

- VELO

- On!

- ZYN

- UPROAR

PMI strengthens its position in the smoke-free category by scaling production and leveraging regulatory approvals. The company invests in advanced manufacturing technologies and enforces stringent quality standards to ensure product consistency. Its innovative efforts focus on expanding its nicotine pouch portfolio, introducing appealing new flavors, and optimizing packaging for enhanced convenience. PMI also prioritizes responsible marketing practices and utilizes advanced digital tools for age verification, ensuring compliance and consumer trust.

On! Nicotine Pouches appeals to value-driven consumers by offering premium nicotine pouches at competitive prices. The brand differentiates itself with an extensive range of flavors and nicotine strengths, catering to diverse consumer preferences. Swedish Match leverages its established production capabilities to ensure cost efficiency and scalability. On!'s innovative strategy emphasizes maintaining high product quality while delivering affordability and user-friendly packaging formats, meeting the needs of its target audience.

Nicotine Pouches Industry News

- In April 2025, ALP Supply Co. LLC partnered with Nicokick and Northerner as its designated online distributors for ALP nicotine pouches. This collaboration aims to enhance the accessibility of ALP's premium, tobacco-free nicotine products to a larger adult demographic across the United States.

- In January 2025, the U.S. Food and Drug Administration (FDA) approved the marketing of 20 ZYN nicotine pouch products through the premarket tobacco product application (PMTA) process. This milestone marks the first FDA authorization for any nicotine pouch. After an in-depth scientific review, the FDA concluded that ZYN pouches, available in 3 mg and 6 mg nicotine strengths and flavors such as citrus, cool mint, menthol, and coffee, pose lower health risks compared to cigarettes and most smokeless tobacco products.

- In April 2025, Emplicure introduced its innovative KLAR nicotine pouches in the UK market. Unlike traditional cellulose-based pouches, KLAR incorporates a bioceramic powder to deliver controlled nicotine and flavor release. Available in mint and citrus flavors with strengths of 3mg, 6mg, and 9mg, the product is sold in 700 retail stores across the UK and online at Haypp.com, with plans for further international expansion.

- In February 2025, Nic Pouches launched a UK-based online platform offering more than 300 premium nicotine pouch products. The store provides adult consumers with access to a wide variety of brands, including ZYN, Velo, Killa, and Pablo, available in different flavors and strengths.

The nicotine pouches market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Flavour Type

- Flavoured

- Mint

- Fruit

- Herbal

- Others (wintergreen, coffee, sweeteners, etc)

- Non-Flavoured

Market, By Type

- Moist pouches

- Dry pouches

Market, By Nicotine Content

- Up to 5 MG

- 5MG - 10MG

- Above 10MG

Market, By Format

- Mini

- Slim

- Regular

- Maxi

Market, By Category

- Tobacco-free

- Synthetic nicotine

Market, By Price

- Low

- Medium

- High

Market, By Consumer Group

- Men

- Women

Market, By Distribution Channel

- Online

- E-Commerce

- Company website

- Offline

- Specialty vape shops

- Other retail stores

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the nicotine pouches market?

Key players include Moxy, Black Buffalo, Lyft, White Fox, Nordic Spirit, Dryft, Killa, ZYN, Velo, and ZERO.

What are the upcoming trends in the nicotine pouches industry?

Key trends include the introduction of bold and exotic flavors, extended-release technology, hybrid products combining nicotine with functional ingredients, and improved material quality for enhanced user comfort.

Which consumer group leads the nicotine pouches market?

Male consumers led the market with a 67.9% share in 2024 and are expected to grow at a CAGR of 20% from 2025 to 2034.

Which region dominates the nicotine pouches market?

The U.S. dominates the North American market, valued at USD 2 billion in 2024, and is estimated to grow at a CAGR of 21.1% from 2025 to 2034.

What was the market share of synthetic nicotine in 2024?

Synthetic nicotine held 86.1% of the total market share in 2024 and is projected to grow at a CAGR of 20.1% from 2025 to 2034.

What is the projected size of the nicotine pouches market in 2025?

The market is expected to reach USD 8.6 billion in 2025.

How much revenue did the above 10MG nicotine content segment generate?

The above 10MG nicotine content segment generated USD 2.4 billion in 2024 and is anticipated to grow at a CAGR of 19.7% from 2025 to 2034.

What is the projected value of the nicotine pouches market by 2034?

The market is expected to reach USD 44.2 billion by 2034, fueled by advancements in product development, hybrid offerings, and growing adoption among health-conscious consumers.

What is the market size of the nicotine pouches market in 2024?

The market size was USD 7.5 billion in 2024, with a CAGR of 19.9% expected through 2034, driven by innovation, diversification, and increasing consumer demand for tobacco-free alternatives.

Nicotine Pouches Market Scope

Related Reports