Summary

Table of Content

Neurostimulation Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Neurostimulation Devices Market Size

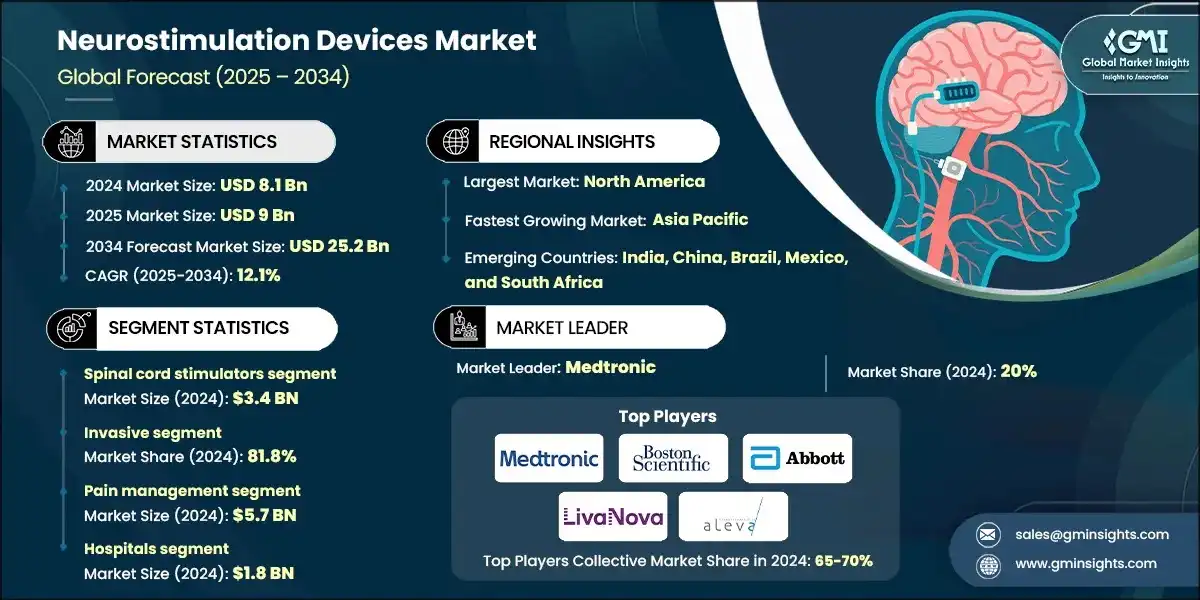

The global neurostimulation devices market size was estimated at USD 8.1 billion in 2024. The market is expected to grow from USD 9 billion in 2025 to USD 25.2 billion in 2034, growing at a CAGR of 12.1%, according to the latest report published by Global Market Insights Inc.

To get key market trends

The growth of the market is largely influenced by the increasing demand for minimally invasive surgery in developed countries, increasing prevalence of neurological disorders, technological advancements in neurostimulation devices, and increasing number of elderly patients with neurological disorders.

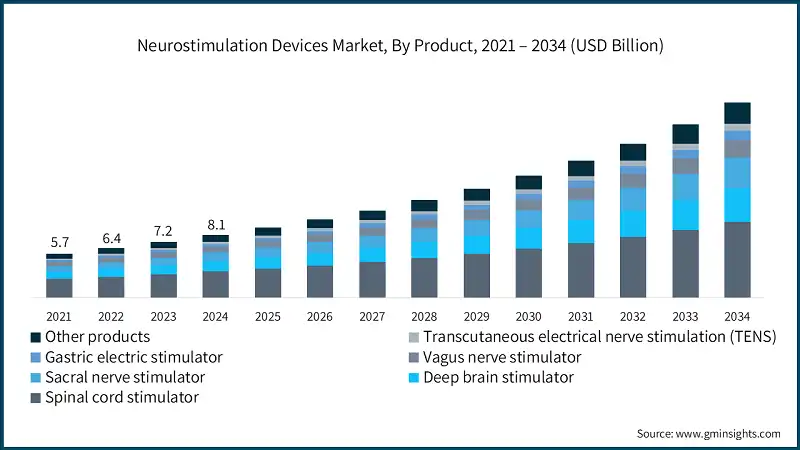

The market increased from USD 5.7 billion in 2021 to USD 7.2 billion in 2023. This growth was driven by the increasing prevalence of neurological disorders and expanding healthcare infrastructure globally. For instance, according to a major study published in The Lancet Neurology, over 3 billion people, more than 1 in 3 globally, were living with a neurological disorder in 2021, making these conditions the leading cause of illness and disability worldwide.

This growing burden is accelerating demand for advanced neurostimulation technologies that offer both invasive and non-invasive, targeted therapeutic solutions. As neurological disorders continue to rise, the neurostimulation devices market is poised for continued growth, driven by the urgent need for effective, scalable, and patient-friendly treatment options.

The rising global elderly population is significantly contributing to the growth of the neurostimulation devices market. Older adults are more prone to neurological disorders such as Parkinson’s disease, Alzheimer’s, chronic pain, and stroke-related complications. According to the World Health Organization, by 2030, 1 in 6 people globally will be aged 60 years or older, with the number rising from 1 billion in 2020 to 1.4 billion in 2030. By 2050, this figure is expected to double to 2.1 billion, and the population aged 80+ years will triple, reaching 426 million. Therefore, with the increasing aging demographic, the demand for neurostimulation therapies is also growing, stimulating market growth.

Neurostimulation devices are medical technologies designed to deliver targeted electrical impulses to specific areas of the nervous system. These devices help manage and treat various neurological conditions such as chronic pain, Parkinson’s disease, epilepsy, and depression. They are often minimally invasive and can be implanted or used externally, offering patients improved symptom control and enhanced quality of life.

Neurostimulation Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.1 Billion |

| Market Size in 2025 | USD 9 Billion |

| Forecast Period 2025 to 2034 CAGR | 12.1% |

| Market Size in 2034 | USD 25.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for minimally invasive surgery in developed countries | Boosts adoption of neurostimulation devices as safer, less invasive alternatives for managing chronic neurological conditions. |

| Increasing prevalence of neurological disorders | Drives the need for effective long-term treatment solutions, accelerating the deployment of neurostimulation technologies. |

| Technological advancements in neurostimulation devices | Enhances device precision, patient comfort, and treatment outcomes, encouraging wider clinical use. |

| Increasing number of elderly patients with neurological disorders | Expands the patient base requiring neurostimulation therapies, especially for age-related conditions like Parkinson’s and Alzheimer’s. |

| Investments by companies and organizations across the globe | Fuels innovation, product development, and global accessibility of neurostimulation therapies. |

| Pitfalls & Challenges | Impact |

| Complications associated with neurostimulation devices | May lead to patient reluctance and increased regulatory scrutiny, slowing adoption and clinical acceptance. |

| Lack of skilled healthcare practitioners | Limits the effective deployment and management of neurostimulation therapies, especially in emerging healthcare systems. |

| Opportunities: | Impact |

| Integration with digital health and AI | Enables personalized therapy, remote monitoring, and data-driven adjustments, enhancing treatment precision and improving patient outcomes. |

| Market Leaders (2024 ) | |

| Market Leaders |

Market Share 20% |

| Top Players |

Collective market share in 2024 is Market Share 65-70% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, Mexico, and South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Neurostimulation Devices Market Trends

- Rapid technological innovation is reshaping the neurostimulation devices industry. These advancements, particularly in wireless power systems, biocompatible materials, and closed-loop feedback mechanisms, are making neurostimulation therapies more accessible, less invasive, and better tailored to individual patient needs. As a result, clinical adoption is accelerating, and the market is expanding.

- Additionally, the development of self-powered, closed-loop neurostimulation systems. These cutting-edge devices leverage biomaterials and bioelectronics to deliver personalized therapy by continuously monitoring neural activity and adjusting stimulation in real time.

- Moreover, the integration of wireless power transfer technologies supported by both implantable and wearable accessories eliminates the need for bulky batteries or frequent surgical replacements. This helps to enhance patient comfort and also significantly improves long-term usability.

- Additionally, the use of flexible, low-cost, and biocompatible electrodes crafted from materials such as silicone polymer and nanoclay is making neurostimulation devices more scalable and affordable. These electrodes provide reliable neural sensing while ensuring patient safety and comfort, making them ideal for long-term use in both clinical and home environments.

- For instance, Abbott Laboratories’ Proclaim DRG Neurostimulation System is a cutting-edge therapy designed to treat chronic pain conditions, particularly Complex Regional Pain Syndrome (CRPS) types I and II. This system stands out for its recharge-free design and BurstDR stimulation technology, which mimics natural neural firing patterns to deliver superior pain relief with minimal side effects.

- By eliminating the need for frequent charging and offering a more natural stimulation experience, it significantly enhances patient comfort and compliance. Its ease of use and long-term reliability have made it a preferred choice in pain management clinics, thereby driving wider clinical adoption and contributing to the growth of the neurostimulation market.

- The merging of bioelectronics, wireless technologies, and advanced materials is enhancing the functionality of neurostimulation devices and redefining the patient experience, stimulating market growth.

Neurostimulation Devices Market Analysis

Learn more about the key segments shaping this market

The neurostimulation devices market was valued at USD 5.7 billion in 2021. The market size reached USD 7.2 billion in 2023, from USD 6.4 billion in 2022.

Based on the product, the market is segmented into spinal cord stimulator, deep brain stimulator, sacral nerve stimulator, vagus nerve stimulator, gastric electric stimulator, transcutaneous electrical nerve stimulation (TENS), and other products. Spinal cord stimulators dominate the neurostimulation devices market, valued at USD 3.4 billion in 2024.

- Spinal cord stimulators (SCS) are implantable devices that deliver mild electrical pulses to the spinal cord to block pain signals from reaching the brain. They are typically used in patients with chronic pain who haven’t responded to other treatments. Deep brain stimulation is a surgical treatment that involves implanting electrodes in specific areas of the brain to deliver electrical impulses, helping regulate abnormal brain activity.

- SCS is commonly used to treat conditions like failed back surgery syndrome (FBSS), complex regional pain syndrome (CRPS), and neuropathic pain. It offers a drug-free alternative, reducing reliance on opioids and improving quality of life.

- For instance, according to NIH, in 2025, globally 250,000 to 500,000 people suffer spinal cord injuries (SCIs) annually, with around 17,000 new cases in the U.S. alone. Many of these individuals experience chronic pain, making spinal cord stimulators (SCS) a vital solution. By blocking pain signals to the brain, SCS offers effective, non-opioid relief. Its growing adoption is driving innovation and significantly contributing to the expansion of the neurostimulation devices market.

- Recent innovations like closed-loop systems, wireless control, and recharge-free implants have made SCS more effective and user-friendly. These features enhance therapy precision and patient comfort.

- As demand for non-invasive pain management grows, SCS adoption is expected to rise globally.

Based on type, the neurostimulation devices market is segmented into invasive and non-invasive. The invasive segment dominated by type segment with a market share of 81.8% in 2024.

- Invasive neurostimulation devices, including SCS, deep brain stimulators (DBS), and vagus nerve stimulators (VNS), dominate the market due to their effectiveness in managing chronic and refractory conditions such as Parkinson's disease, epilepsy, and chronic pain.

- Additionally, invasive neurostimulation devices are recognized as the gold standard for managing neurological and pain-related disorders, supported by strong clinical evidence and established safety profiles.

- SCS, in particular, is extensively used, driven by its widespread application in treating chronic pain. The proven clinical efficacy and established safety profiles of these devices further reinforce the strong revenue growth in the invasive segment.

Based on application, the neurostimulation devices market is segmented into pain management, urinary and faecal incontinence, Parkinson’s disease, epilepsy, essential tremor, gastroparesis, depression, dystonia, and other applications. The pain management segment dominated the application segment, valued at USD 5.7 billion in 2024.

- Pain management is one of the primary applications of neurostimulation devices, aimed at reducing chronic and neuropathic pain through targeted electrical stimulation. It offers a non-pharmacological alternative to traditional pain therapies.

- Neurostimulation is especially effective for conditions like failed back surgery syndrome (FBSS), complex regional pain syndrome (CRPS), and sciatica, helping patients regain mobility and improve quality of life.

- For instance, in 2023, according to the CDC, 24.3% of adults in the U.S. reported experiencing chronic pain, while 8.5% suffered from high-impact chronic pain that frequently limited their daily life or work activities. This growing prevalence highlights the urgent need for effective pain management solutions.

- With rising global cases of chronic pain and increasing awareness of opioid risks, demand for neurostimulation-based pain therapies is growing rapidly. These devices offer long-term, customizable relief.

Learn more about the key segments shaping this market

Based on end use, the neurostimulation devices market is segmented into hospitals, ambulatory surgery centers, specialty clinics, and other end users. The hospitals segment dominated by end use segment valuing at USD 1.8 billion in 2024.

- Hospitals represent a key segment for complex and invasive neurostimulation procedures, including SCS, deep brain stimulation, and vagus nerve stimulation, as these require advanced surgical infrastructure and post-operative care.

- Additionally, hospitals serve as primary centers for neurological diagnosis and treatment, often receiving referrals from general practitioners and smaller clinics. This drives the volume of procedures performed and increases the adoption of neurostimulation devices in this segment.

- Moreover, invasive neurostimulation devices require follow-up programming, device calibration, and close monitoring for potential complications, which are more effectively managed in hospital settings.

Looking for region specific data?

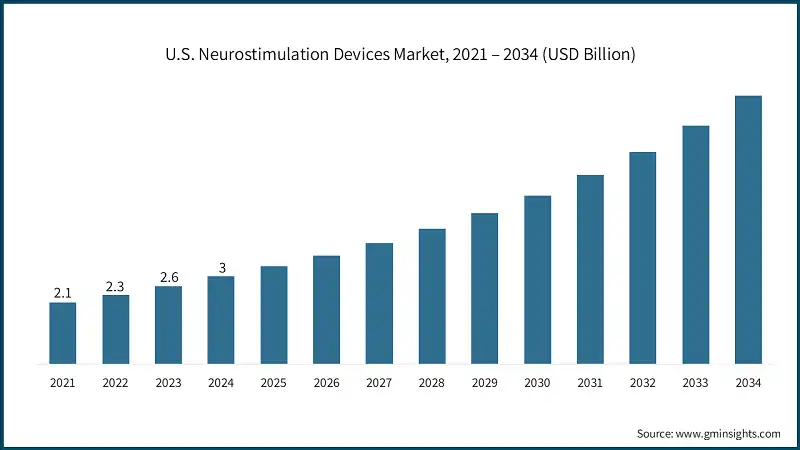

The North America neurostimulation devices market dominated the market with a market share of 41.2% in 2024. The market was valued at USD 2.4 billion in 2021 and increased to USD 3 billion in 2023. Growth in neurological disorders and the aging population can be attributed to increasing revenue growth in the market.

The U.S. neurostimulation devices market was valued at USD 2.1 billion and USD 2.3 billion in 2021 and 2022, respectively. The market size reached USD 3 billion in 2024, growing from USD 2.6 billion in 2023.

- This growth is largely attributed to the rising prevalence of neurological conditions such as epilepsy, essential tremor, and Parkinson’s disease across the country.

- For instance, as per the Parkinson's Foundation, nearly 90,000 new Parkinson’s cases are diagnosed in the U.S. every year, many of which benefit from neurostimulation therapies. This rising demand is expanding clinical adoption and innovation.

- As the burden of neurological conditions grows, neurostimulation offers targeted, long-term solutions, stimulating market growth.

The Europe neurostimulation devices market accounted for USD 2.4 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The rising prevalence of neurological diseases in the region, coupled with the increasing adoption of minimally invasive technologies, is anticipated to stimulate the growth of the market.

- Additionally, Europe benefits from the strong presence of leading neurotechnology companies actively investing in research and development. Their focus on creating innovative, patient-friendly solutions is stimulating market growth.

Germany's neurostimulation devices market is anticipated to witness considerable growth over the analysis period.

- The rising prevalence of neurological diseases such as epilepsy, essential tremor, and Parkinson’s disease in the country is significantly influencing the growth of the market.

- For instance, as per the University Hospital Erlangen in Germany, approximately 0.5% to 1% of the population experiences spontaneous and recurring seizures characteristic of epilepsy annually. In contrast, a significantly larger portion, around 5% to 7%, suffer at least one isolated epileptic seizure at some point in their lives without necessarily developing chronic epilepsy.

- Thus, as neurological disorders in the country increase, so does the need for neurostimulation devices.

The Asia Pacific neurostimulation devices market is anticipated to grow at a CAGR of 13.1% during the analysis timeframe.

- The market in the Asia Pacific region is witnessing growth, driven by various factors. The increasing prevalence of neurological disorders, such as epilepsy, Parkinson’s disease, and chronic pain conditions, is fuelling demand for advanced neurostimulation solutions.

- Additionally, technological advancements in neurostimulation devices, including improvements in precision, miniaturization, and wireless capabilities, are enhancing treatment outcomes and expanding clinical applications.

- Countries like China, India, and Japan are rapidly adopting these innovations, supported by growing healthcare infrastructure and a rising focus on minimally invasive surgical procedures, especially in more developed areas. The expansion of hospitals and diagnostic centers, coupled with government initiatives aimed at improving neurological care and access to cutting-edge therapies, is further accelerating market growth across the region.

China's neurostimulation devices market is predicted to grow significantly over the forecast period.

- The country is experiencing an aging population. Individuals in these age groups are at a higher risk of developing neurological disorders such as Parkinson’s disease, Alzheimer’s disease, epilepsy, and chronic pain syndromes.

- For instance, as per the estimates from the World Health Organization in 2019, approximately 254 million people of the age group 65 and above were residing in the country. This number is projected to rise significantly, with 402 million people expected to be over the age of 60 by 2040.

- This demographic trend is expected to drive substantial growth in the market, as healthcare systems increasingly adopt these technologies to improve patient outcomes.

Brazil is experiencing significant growth in the Latin America neurostimulation devices market due to the increasing number of neurological disorders across the region.

- Brazil is witnessing a notable demographic shift marked by a steady increase in its elderly population.

- For instance, as per the Brazilian Institute of Geography and Statistics (IBGE), individuals aged 65 and above in Brazil reached approximately 22.2 million in 2022, accounting for 10.9% of the total population. This represents a 57.4% increase compared to 2010, when the elderly population stood at 14.1 million, or 7.4% of the population. This sharp rise highlights the growing need for medical interventions tailored to age-related conditions.

- As aging individuals are more susceptible to neurological disorders such as Parkinson’s disease, Alzheimer’s, chronic pain, and epilepsy, the demand for neurostimulation devices is expected to surge.

Saudi Arabia neurostimulation devices market is poised to witness substantial growth in the Middle East and Africa market during the forecast period.

- Saudi Arabia is experiencing a significant rise in neurological conditions such as Parkinson’s disease, epilepsy, chronic pain syndromes, and depression.

- As these disorders become more widespread, the need for advanced therapeutic solutions like neurostimulation devices is growing rapidly. These devices offer targeted, minimally invasive treatment options that help manage symptoms effectively, reduce reliance on long-term medication, and improve patients' quality of life.

- The increasing burden of neurological diseases is expected to be a key driver of growth in Saudi Arabia’s market.

Neurostimulation Devices Market Share

- The top five companies, Medtronic, Boston Scientific, Abbott Laboratories, LivaNova, and Aleva Neurotherapeutics, collectively hold approximately 65-70% of the neurostimulation devices industry. These companies maintain their leadership through a combination of diverse product portfolios, strategic partnerships, regulatory approvals, and continuous innovation in device design, AI integration, and minimally invasive technologies.

- Companies in the neurostimulation space are adopting value-based pricing strategies to increase accessibility, especially in emerging regions where affordability influences adoption. Leading manufacturers are addressing unmet clinical needs by introducing next generation neurostimulation systems with features like adaptive stimulation, remote programming, and MRI compatibility. For example, developers are focusing on wireless and rechargeable implants with enhanced safety protocols to reduce surgical risks and improve patient comfort. These innovations are particularly vital in managing chronic neurological conditions, where long-term, personalized therapy is essential for improving quality of life.

- Emerging players in the neurostimulation devices space typically enter the industry by focusing on niche applications, innovative technologies, or cost-effective solutions. They often leverage AI integration, miniaturization, or wireless capabilities to differentiate their products. Collaborations with research institutions, clinical trials for novel indications, and targeting underserved markets or regions also help them gain traction and compete with established companies.

Neurostimulation Devices Market Companies

Some of the eminent market participants operating in the neurostimulation devices industry include:

- Abbott Laboratories

- Aleva Neurotherapeutics

- BioControl Medical

- Boston Scientific

- ElectroCore

- Endostim

- Helbling Holding

- Innovative Health Solutions

- Laborie

- LivaNova

- Medtronic

- MicroTransponder

- Neuronetics

- Parasym

- RS Medical

- Synapse Biomedical

- tVNS Technologies (Cerbomed)

- LivaNova

LivaNova is a global medical technology company specializing in neuromodulation therapies, particularly for epilepsy and treatment-resistant depression. Its Vagus Nerve Stimulation (VNS) systems are widely used in clinical settings, offering long-term, non-pharmacological solutions. LivaNova continues to invest in digital health integration and clinical research to enhance therapeutic outcomes and expand its reach in neurological care.

Aleva Neurotherapeutics is a Swiss-based company focused on next-generation deep brain stimulation (DBS) technologies. Known for its proprietary directSTIM electrode system, Aleva aims to improve precision and reduce side effects in DBS procedures. The company emphasizes innovation in electrode design and stimulation control, positioning itself as a disruptive player in advanced neuromodulation therapies.

ElectroCore develops non-invasive vagus nerve stimulation (nVNS) devices for treating migraines, cluster headaches, and other conditions. Its flagship products, gammaCore and Truvaga, are FDA-cleared and used in both clinical and consumer settings. With the acquisition of NeuroMetrix and its Quell platform, ElectroCore has broadened its reach in chronic pain management. The company’s focus on bioelectronic medicine and direct-to-consumer strategies positions it as an innovative force in the neurostimulation devices market.

Neurostimulation Devices Industry News

- In September 2022, Aleva Neurotherapeutics received CE approval for MRI labeling of its directSTIM Deep Brain Stimulation (DBS) System, enabling use in full-body 1.5 Tesla MRI environments. Designed to treat Parkinson’s disease, the system features a fully directional lead that delivers targeted electrical stimulation to improve symptom control and reduce side effects. This milestone allows patients to benefit from advanced DBS therapy while safely undergoing MRI scans, enhancing both clinical flexibility and long-term care outcomes.

- In May 2025, ElectroCore completed its acquisition of NeuroMetrix, gaining access to the Quell Fibromyalgia Solution. This strategic move strengthened ElectroCore’s position in non-invasive bioelectronic therapies and expanded its reach, particularly within the VA Hospital System. The merger significantly enhanced the company’s presence in chronic pain and wellness solutions, allowing it to offer a broader portfolio of neuromodulation treatments and capitalize on growing demand for non-pharmaceutical approaches to pain management.

The neurostimulation devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Product

- Spinal cord stimulator

- Deep brain stimulator

- Sacral nerve stimulator

- Vagus nerve stimulator

- Gastric electric stimulator

- Transcutaneous electrical nerve stimulation (tens)

- Other products

Market, By Type

- Invasive

- Non-invasive

Market, By Application

- Pain management

- Urinary and fecal incontinence

- Parkinson's disease

- Epilepsy

- Essential tremor

- Gastroparesis

- Depression

- Dystonia

- Other applications

Market, By End Use

- Hospitals

- Ambulatory surgery centers

- Specialty clinics

- Other end users

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the invasive segment in 2024?

The invasive segment accounted for 81.8% of the market share in 2024, led by the widespread use of devices like spinal cord stimulators and deep brain stimulators.

Which region leads the neurostimulation devices sector?

The U.S. leads the market, with a valuation of USD 3 billion in 2024, propelled by the rising prevalence of neurological conditions such as epilepsy, essential tremor, and Parkinson’s disease.

Who are the key players in the neurostimulation devices industry?

Key players include Abbott Laboratories, Aleva Neurotherapeutics, BioControl Medical, Boston Scientific, ElectroCore, Endostim, Helbling Holding, Laborie, LivaNova, Medtronic, MicroTransponder, and Neuronetics.

What are the upcoming trends in the neurostimulation devices market?

Key trends include wireless power, closed-loop systems, biocompatible materials, self-powered neurostimulation, and flexible electrodes improving device performance and patient comfort.

How much revenue did the spinal cord stimulators segment generate in 2024?

The spinal cord stimulators segment generated approximately USD 3.4 billion in 2024, due to its effectiveness in managing chronic pain.

What is the expected size of the neurostimulation devices market in 2025?

The market size is projected to reach USD 9 billion in 2025.

What is the market size of the neurostimulation devices in 2024?

The market size was USD 8.1 billion in 2024, with a CAGR of 12.1% expected through 2034. Increasing demand for minimally invasive surgeries and a growing elderly population with neurological disorders are driving market growth.

What is the projected value of the neurostimulation devices market by 2034?

The market is poised to reach USD 25.2 billion by 2034, driven by technological innovations, rising prevalence of neurological conditions, and the adoption of advanced neurostimulation therapies.

Neurostimulation Devices Market Scope

Related Reports