Home > Semiconductors & Electronics > Telecom and Networking > Telecom Software > Network Telemetry Market

Network Telemetry Market Analysis

- Report ID: GMI4508

- Published Date: May 2020

- Report Format: PDF

Network Telemetry Market Analysis

The network telemetry industry is witnessing rapid growth in the wake of evolving technologies such as Software Defined Networking (SDN) and Network Function Virtualization (NFV). Network telemetry provides an accurate and real-time analysis of data transmission parameters for these new technologies.

In addition, the growing stress on networking infrastructure due to work from home policies amidst the COVID-19 outbreak has also boosted the market growth. For instance, in March 2020, Cloudflare reported an additional stress of over 25% on global fixed and wireless networks after the imposition of global quarantine policies.

In the UK, the solutions segment dominated over 75% market share in 2019 owing to growing popularity of real-time network data analysis tools. In addition, network analytics is also gaining traction across the country as enterprises are increasingly adopting telemetry solutions to streamline the performance of their networks and facilitate timely detection of network anomalies.

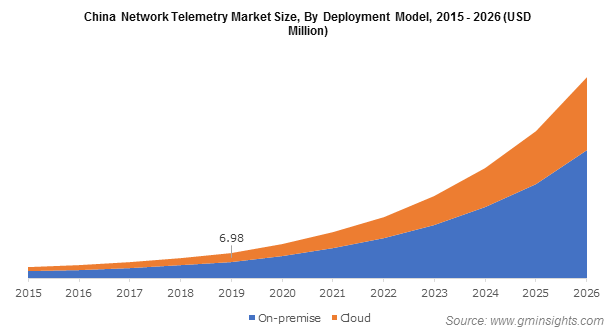

In China, the on-premise segment held a significant market share of around 65% in 2019 due to shifting preference of Chinese telecom providers toward on-premise hosting of network telemetry tools. On-premise solutions offer greater control over enterprise data and better resiliency compared to cloud-based tools. Moreover, on-premise network telemetry tools trace the health of each on-premise network device, providing real-time, granular level information.

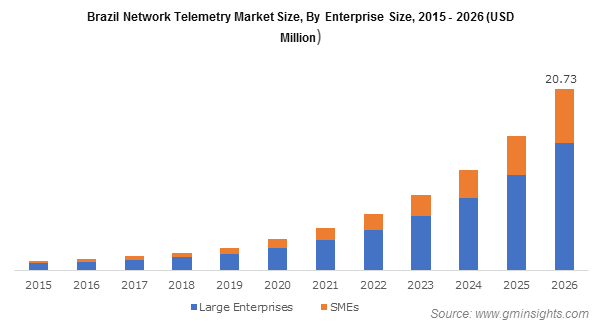

The large enterprises segment accounted for over 70% share of the Brazil network telemetry market in 2019 on account of increasing importance of network performance monitoring and real-time fault resolution amongst large enterprises. Telemetry tools enable large enterprises in efficiently analyzing useful information accessed from network devices and optimizing the performance of large-scale networks. In addition, the increasing usage of telemetry solutions by large enterprises to reduce incidents of network attacks has created new market opportunities.

In Canada, the CSP application segment held around 45% market share in 2019, which is attributed to rising usage of network telemetry tools by CSPs to predict and analyze performance issues proactively. The dynamic fluctuation in network traffic patterns accompanied by exponential rise in data rates has also pressurized enterprises operating in the Canadian cloud computing landscape to adopt telemetry solutions for removing performance bottlenecks.

CSPs in Canada have also faced unprecedented network stress due to remote working trends during the coronavirus situation. For instance, Distributel reported over 50% increase in network loads during the month of March 2020. Efficient telemetry tools for monitoring cloud network performance are assisting the Canadian CSPs to address congestion between networks, fueling the market growth in the region.

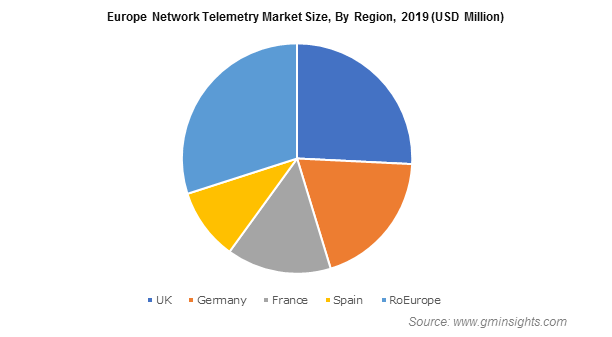

Europe network telemetry market held a significant revenue share of around 25% in 2019 due to increasing uptake of telemetry solutions for cloud network analysis and security management. The growing penetration of telemetry tools in the UK and Germany to support data center virtualization has further accentuated the market growth. In addition, European cloud computing SME are rapidly adopting telemetry tools for efficient network management and reduction of cybersecurity policy violation, influencing the market size expansion.