Summary

Table of Content

Network Function Virtualization (NFV) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Network Function Virtualization Market Size

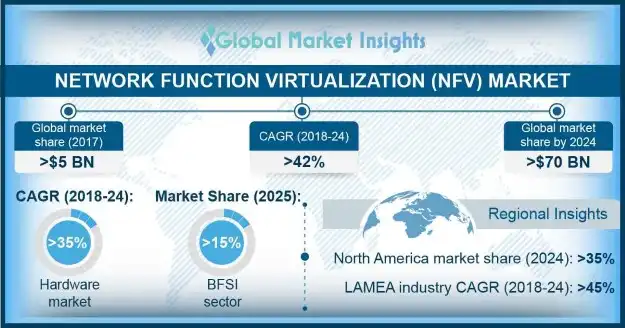

NFV Market size exceeded USD 5 billion in 2017, growing at a CAGR of over 42% from 2018 to 2024.

To get key market trends

To get key market trends

The NFV market is expected to witness a sharp growth as network virtualization technologies enable enterprises to eliminate the costs associated with the procurement and maintenance of hardware equipment. The technologies help to deliver network services in a more scalable way compared to the traditional networking approach. The enterprises are rapidly embracing network virtualization solutions as they promote faster server provisioning and quick deployment of network services. The SME are projected to witness a heavy usage of virtualization solutions as they enable consolidation of server & applications and improve disaster recovery. By deploying these solutions, they can also handle multiple workloads with maximum uptime and improved performance.

Network Function Virtualization Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2017 |

| Market Size in 2017 | 5 Billion (USD) |

| Forecast Period 2018 - 2024 CAGR | 42% |

| Market Size in 2024 | 70 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Rapid investments for the commercialization of 5G networks will also drive the demand for NFV solutions. The implementation of virtualization technology will help to enhance 5G network’s functional and architectural viability including increased agility and reduced capital expenditure.

Network Function Virtualization Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

The hardware network function virtualization (NFV) market is expected to witness a growth rate of over 35% from 2017 to 2024 due to the heavy usage of hardware equipment such as switches, storage devices, and servers. To support the diverse networking demands of enterprises, they need high-performance virtual switches and routers, which play a key role in IT architecture and enable robust & flexible NFV infrastructure. The training & consulting service segment will exhibit a growth rate of above 50% as these services assist customers in analyzing gaps and assessing operational & infrastructural readiness. The increasing inclination toward virtualized networks will fuel the need for training & consulting service providers, helping enterprises in effective planning for NFV-based deployments.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

The BFSI sector will hold a market share of above 15% by 2025 as banking and financial institutions are rapidly transforming their traditional IT infrastructure to more robust and flexible network infrastructure. These institutions are highly dependent on IT networks to deliver services including online banking, mobile banking, and core banking services. This increases the demand for network virtualization and cloud computing platforms to improve network performance, scalability, and deliver faster network services. The investment in cloud-based virtualization solutions will enable BFSI institutions to scale up the network with minimal effort, while retaining the control of every asset.

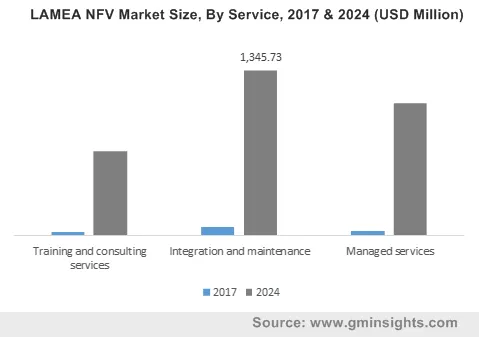

The LAMEA NFV market is estimated to witness a growth rate of over 45% due to the growing popularity of technologies such as cloud computing and network virtualization. The rising number of data centers in countries including Mexico, Brazil, and GCC increased the uptake of server virtualization solutions to run heavy workloads and applications in the cloud. The rising investments for the development of 5G infrastructure will also fuel market growth. In this region, countries including Mexico, Saudi Arabia, Dubai, and Kuwait are exploring 5G technology and undertaking live trials of 5G on speed, equipment, and latency. Therefore, telecom operators in the region are preparing to switch to virtualization technologies and SDN-based solutions for flexible and scalable network management.

Network Function Virtualization Market Share

Companies operating in the NFV market are adopting product development strategy to meet the needs of various customers and to target untapped markets. For instance, in May 2017, AT&T added new network connectivity options and new security applications to its AT&T FlexWare NFV solution. With this release, the solution got enabled with connectivity options including Ethernet, VPN, and dedicated internet as well as broadband. These options helped AT&T FlexWare to integrate virtually with any network. In July 2016, AT&T and Amdocs collaborated to provide open software solutions to accelerate NFV. Under this partnership, Amdocs became a system integrator for companies using AT&T’s open source ECOMP platform to enable software-centric network capabilities.

Some of the key players operating in the network function virtualization (NFV) market are

- Huawei

- Broadcom

- Ericsson

- Juniper

- AT&T

- Nokia

- F5 Networks

- HP

- Citrix

- Riverbed

- 6Wind

- VMware

- Verizon

- Pluribus

- Arista

- Amdocs

- NFWare

- Cisco

- IBM

Industry Background

As new networking technologies are gaining traction, enterprises struggle to remain agile. The siloed network architecture is not capable to meet new networking demands such as low latency, high scalability, and security. Enterprises are embracing network virtualization technologies, which integrate hardware & software network resources, minimizing operational costs. The network virtualization technology is expected to gain more acceptance with the proliferation of cloud computing and Network as a Service (NaaS) business model.

Frequently Asked Question(FAQ) :

What factors will augment the demand for training and consulting services?

Training & consulting services help enterprises in analyzing gaps, evaluating operational and infrastructure readiness and plan effective NFV-based deployment strategies.

Which region is expected to record a significant growth in the market?

Latin America, Middle East and Africa (LAMEA) NFV industry will see rapid growth owing to an increasing number of data centers in Brazil, Mexico and GCC nations to run cloud-based applications.

How will the adoption of 5G networks drive the network function virtualization market trends?

Implementing NFV technology can help to improve the architectural and functional viability of a 5G network, including lower capital expenditure and higher agility.

How much size did the global NFV market register in 2017?

The market size of NFV exceeded USD 5 billion in 2017.

How much will the NFV industry share grow during the forecast timeline?

The industry share of NFV is growing at a CAGR of over 42% to 2024.

Why will SMEs witness a fast adoption of NFV technologies?

Network function virtualization (NFV) technologies provide SMEs with faster deployment of scalable network services, allow server and applications to be consolidated and enable faster disaster recovery.

Network Function Virtualization Market Scope

Related Reports