Summary

Table of Content

Muconic Acid Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Muconic Acid Market Size

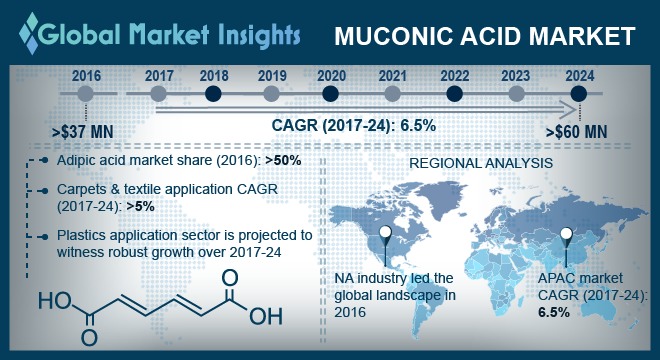

Muconic Acid Market size was more than USD 37 million in 2016 and will witness 6.5% CAGR during the projected timespan.

To get key market trends

Plastic industry is an important end-user. The plastics industry is likely to grow at a CAGR close to 7% during the forecast timeframe. Asia Pacific, led by China, accounted for more than 40% of global plastics production in 2015. Rising popularity of packaged goods, especially food & beverage, will augment plastic packaging demand in the coming years. This will, in turn, fuel muconic acid market size in the production of plastic material (PET, bio-plastics, etc.). In recent times, technological advancements and upgradations have been made in development of biotechnology processes for muconic acid production.Increasing lubricants demand and steadily growing textile industry will play a significant role in fueling muconic acid market size over the forecast timespan. Textile industry is a prime end-user, thus recent technological developments in textile industry will positively influence product demand in the coming years. The global textile market was approximately worth USD 1.7 trillion in 2015, which constitutes close to 2% of world’s GDP. The textile market is poised to grow at over 4% in the coming years. Asia Pacific and Latin America are regions with huge growth potential for textile industry and thus for muconic acid market size growth. In addition, automobile industry is a major user of lubricants and the sturdy rise in demand for passenger vehicles will fuel lubricants demand, which will subsequently propel muconic acid market growth over the forecast timeframe, as the product is used as an additive in lubricants.

The only major challenge for muconic acid market in future will be the increasing government initiatives and environmental regulations regarding ban of plastic material in packaging. This will directly affect product demand in the next few years. However, continuous R&D efforts by market players to produce muconic acid through biotechnological methods through renewable sugar sources and various others, will positively influence product demand during the forecast timespan.

Muconic Acid Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 37 Million (USD) |

| Forecast Period 2017 - 2024 CAGR | 6.5% |

| Market Size in 2024 | 60 Million (USD) |

What are the growth opportunities in this market?

Muconic Acid Market Analysis

Adipic acid held major chunk of overall muconic acid market in 2016 and accounted for more than 50% of the total industry share in the same year. Adipic acid is precursor to nylon synthesis. Nylon is extensively used in textile industry. Rising disposable income of consumers and amplified spending power in specially Asia Pacific countries including India, China, Thailand, Japan, Malaysia, etc. will propel textile industry growth in this region. This implies positive growth for product demand in the forecast timeframe.

Carpets & textile led the global muconic acid market in 2016 in terms of volume and value. It is likely to attain a CAGR of more than 5% during the forecast period. The product is majorly used for producing adipic acid, which is widely used in synthesizing nylon. Nylon is an important fabric of textile industry. It is used in production of garments, linen and carpets. Asia Pacific is the leading region in terms of textile production and exports, according to World Trade Organization. Thus, carpet & textile industry has bright growth opportunities in this region, which indicates equivalent growth avenues for muconic acid market in the coming years.

Plastics is another important application segment that has huge market opportunities over the next few years. Plastics are widely used in many end-user industries for packaging, as these are cost-competitive and have pressure resistance and high strength. The product is used in manufacturing bioplastics, PET and other polymers, which are prime components of plastic bottles, boxes, pouches and cans. Growing packaging industry shall be driving plastics demand, which will eventually fuel product demand over the forecast timeframe. Moreover, rising popularity of bio-based production processes for muconic acid shall be a key factor promoting product demand in the forecast duration.

In 2016, North America led the global muconic acid market size, in terms volume and value. Continuously growing automobile industry with rapid technological changes in textile industry will complement business growth. Growing concern among consumers about usage of bio-based products, shall be a major factor influencing the popularity of bio-based muconic acid among manufacturers. Europe shall witness moderate growth rate for muconic acid market owing to mature textile and plastics industry.

Asia Pacific muconic acid market is likely to experience tremendous growth over the forecast timespan due to continuously increasing product demand from textile and automobile industries. China muconic acid market is a major industrial hub and shall be primarily responsible for future surged product demand in this region. Furthermore, huge market for plastic packaging options is a positive outlook for the product in this region.

Muconic Acid Market Share

Global muconic acid market is moderately competitive with major players accounting more than 50% of the market share in 2016. Key players operating in the business are:

- Myriant Corporation

- Sigma-Aldrich Corporation

- Toronto Research Chemicals

- Alfa Aesar

- Dynacare

- Thermo Fisher Scientific

- Amyris

- TCI.

The industry players have multinational presence with a wide base of distribution network and years of experience in muconic acid market.

Companies operating in this market have various kinds of business structures. Some focus on providing product to research and academic institutions for use in practical studies while some are focusing on improving product properties for long-term sustainability. For instance, Myriant corporation is using flexible technology platform to develop bio-based products that can be used conveniently in variety of applications.

Industry Background

Muconic acid is naturally occurring dicarboxylic acid. It is widely used as a chemical intermediate for the production of caprolactam, adipic acid, which are precursor to fibers, textiles and plastics. Adipic acid is a prime ingredient in manufacturing Nylon- 6, 6, which is extensively used in textile industry. The product is also used to manufacture food additives, pharmaceuticals and agrochemicals. Companies are investing in technologies are to increase the product usage in unexplored industries.

Frequently Asked Question(FAQ) :

How much size did the global Muconic Acid Market register in 2016?

Muconic Acid Market

What will be the worth of the Muconic Acid industry by the end of 2024?

Muconic Acid Market will witness 6.5% CAGR during the projected timespan.

Muconic Acid Market Scope

Related Reports