Summary

Table of Content

Mouth Freshener Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Mouth Freshener Market Size

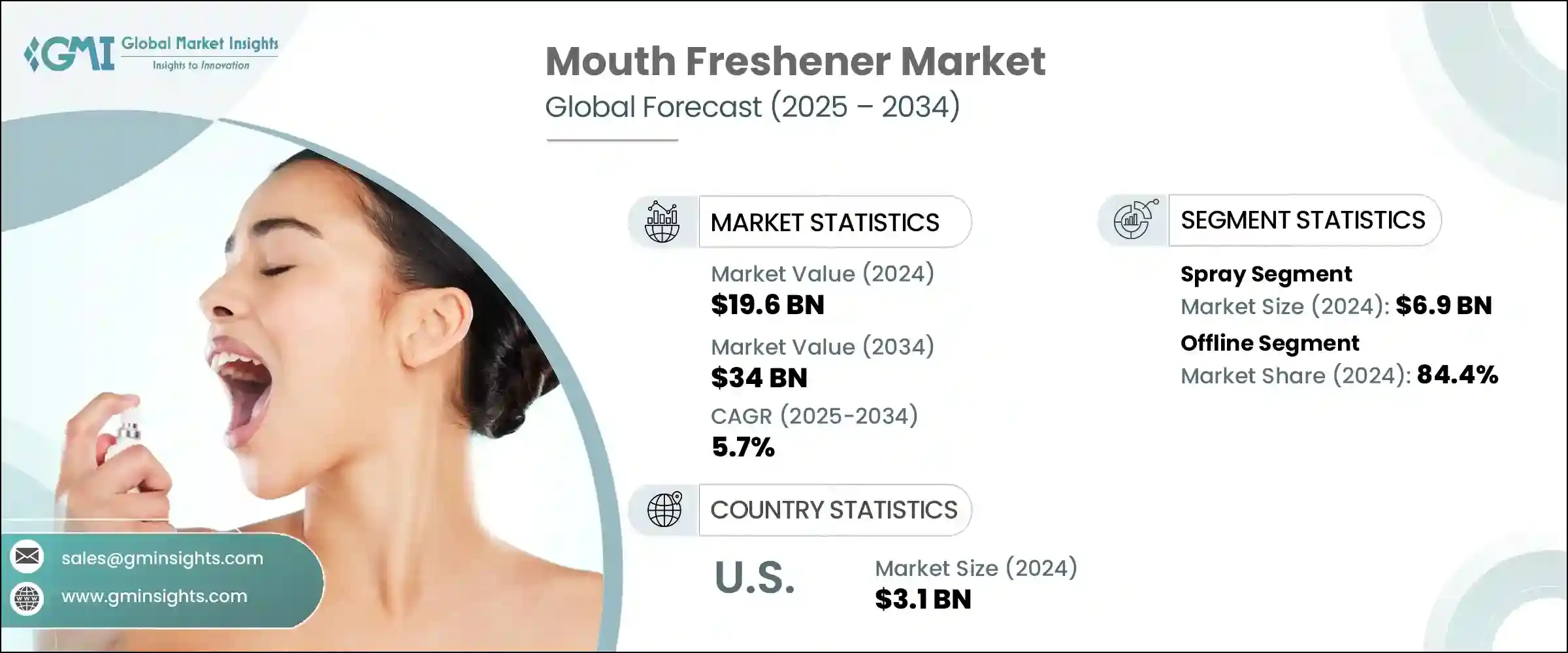

The global mouth freshener market size was valued at USD 19.6 billion in 2024 and is projected to grow at a CAGR of 5.7% between 2025 and 2034.

To get key market trends

The increasing awareness regarding oral care and the need to maintain a pleasant breath is propelling market growth. With the improvement in standards of living, there has been an escalated shift towards fresheners for FDI- Freshening of the mouth. This trend is vividly striking urban regions which have social interaction as a core part of their life.

Mouth Freshener Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 19.6 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.7% |

| Market Size in 2034 | USD 34 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Furthermore, the availability of newer types of mouth fresheners has risen. Products like mints, sprays, chewing gums, and even some herbal mixtures are available which meets the needs of different consumers. Along with this, the inclusion of natural and organic elements in the fresheners captures the attention of the customers who pay attention to wellness.

Socio-cultural reasons facilitate the increasing demand for mouth fresheners. In Asia, using mouth fresheners, specifically, is a practice that has been going on for a long time. Many of these traditions have been globalized, and these products are now being accepted in new markets as part of daily oral care. Moreover, the adoption of Western habits that focus on personal grooming and self-presentation, especially in professional and social contexts, has further propelled the use of mouth fresheners and made it part of daily personal care routines.

There is an increasing demand for convenient oral care products. Due to the hectic lifestyles and being constantly on-the-go, consumers are paying more attention to products that enhance breath and provide quick refreshment. ‘Mouth fresheners’ have emerged as a popular choice giving instant freshness at the touch of a button, whether a spritz or a spray. This gives vibrant promise to the market for mouth fresheners, spurred on by the increasing need for effective and convenient dental care solutions to meet the demands in today’s hectic lives.

A challenging barrier for manufacturers of oral care products, namely mouth fresheners and beyond, is having to navigate rules and regulations across geographical regions. Each area has its set of rules with regards to the ingredients, labelling, and even the health claims that can be made. These strict guidelines are often at cross-purposes with other industry frameworks, making growth difficult. To illustrate, there is a ban on the sale of chewing gum in Singapore, unless it is sold by a licensed pharmacist or prescribed by a doctor.

Mouth Freshener Market Trends

- The manufacturers of mouth fresheners are taking into consideration the offer novel flavours and creative designs that sell the product, that is, in line with the consumers changing needs. They are catering to a new paradigm that targets the apathetic potential customers by providing new combinations of herbs, spices and fruits to give new taste that cuts across the diverse palate.

- Furthermore, the demands of new products for oral care also consisting of the area of mouth hygiene is increasing because of movement of people to cities and increasing urban centres. Designs such as sprays, strips, and pocket size packs are coming into vogue to the ease of use and efficiency, which satisfies the needs of customers who want something more than just cleanliness in their mouth care products. For instance, Van Melle has a mouth freshener spray called Spray mint which is easy to carry and deliver over 175 sprays per pack. This is a zero alcohol, zero calorie, zero sugar mouth spray.

Trump Administration Tariffs

- The tariffs during the Trump administration, particularly the ones pertaining to imports from China, resulted in heightened costs for materials such as menthol, sweeteners, and even the packaging used for mouth fresheners. This placed mouth freshener manufacturers in a tough situation where they either had to absorb the burden or pass the cost on to the consumers. This impacted on profit margins and pricing strategies for many manufacturers.

- Many mouth freshener brands use an international supply chain to source the flavoring and packaging materials. The impact of the tariffs highly disrupted these networks and their ability to access primary materials, causing delays, forcing some manufacturers to switch to alternative suppliers or reengineer some product formulas which could lead to shifts in product quality, and in turn, shifts in consumer sentiment.

- U.S. based companies producing mouth fresheners modified their sourcing strategies to explore more domestic or non-tariffed regions in response to the tariffs. Even though this switch reduced dependency on some of the most vulnerable imports, it lead to an increase in operational expenses and alteration in the procurement and production processes that required significant time.

Mouth Freshener Market Analysis

Learn more about the key segments shaping this market

Based on product type, the mouth freshener market is classified into gums, spray, strips, capsule and others. The spray segment dominated the market, accounting for USD 6.9 billion in 2024 and is expected to grow at a CAGR of 6.9% during the forecast period of 2025-2034.

- Mouth freshener sprays have changed oral health due to their convenience and simplicity.

- These sprays are compact and portable, fitting easily into backpacks or pockets to ensure that fresh breath is always available. They deliver significant breath enhancement with a single spritz, making them a popular choice among consumers looking for simple oral hygiene treatments that can be easily integrated into their regular routines.

Learn more about the key segments shaping this market

Based on distribution channel, the mouth freshener market is classified as online and offline. The offline distribution channel dominated the market share of 84.4% of the market share in 2024 and is expected to reach USD 28.4 billion over the forecast period of 2025-2034.

- Offline channels continue to play an important role in the distribution of mouth fresheners as they allow consumers to interact with items in person.

- Supermarkets, hypermarkets, and convenience stores provide accessible locations where customers can physically investigate, touch, and sample many mouth freshener alternatives. Furthermore, the widespread availability of mouth fresheners in various offline channels allows for increased sales volumes while catering to diverse consumer tastes and assuring convenience through direct interaction and fast accessibility.

Looking for region specific data?

The U.S. mouth freshener market was valued at 3.1 billion in 2024 and is anticipated to drive significant growth in the industry over the forecast period.

- The rising concern among consumers regarding oral hygiene and oral breath has led to an increase in demand for mouth fresheners. Moreover, the manufacturers come up with innovative tastes, designs, flavors, and compositions that fit within the wide ranges and preferences. This includes the use of natural ingredients and sugarless options along with the use of basic eco-friendly containers that are making the market more appealing.

The UK market is projected to witness significant growth in the forecast period.

- Effective oral hygiene practices including dental visits and maintenance of dental aids extend to mouth fresheners as well, which have gained considerable attention from UK governmental bodies and health institutions.

China dominated the Asia Pacific mouth freshener market with 23% of market share in 2024 due to increase in awareness regarding oral health and hygiene among consumers.

- As Chinese consumers place a high importance on health and wellness, mouth fresheners have become crucial parts of their daily habits, showcasing a larger shift towards proactive self-care and preventative dental measures.

Mouth Freshener Market Share

- In 2024, the market players, such as Perfetti Van Melle, Ferrero Ferndale Confectionery Pty ltd, Mondelez International and Hager Worldwide, collectively held around 10%-15% market share.

- Van Perfetti Melle focuses on breath-freshening technologies and sugar-free options on mint and mentos marvels while also breath minting these global brands with innovative flavors. To meet local tastes, the company also has limited-edition and region-specific flavor additions. It also appeals to health and eco-conscious consumers by using sustainable packaging and portion-controlled formats as well as more environmentally preference-friendly materials. Through strong marketing and distribution networks, the company also maintains its market leader status across various markets.

- The mouth freshener competition for Ferrero is through its mini refreshing mints contained in one of the most recognized packages in Tic Tac brand. The company drives innovation through new seasonal offerings and multi-sensory experiences like cooling effects. By partnering with popular culture and enhancing product visibility through digital marketing, Ferrero also targets younger audiences. Eco-friendly policy is another focus with reasoned us warranty aimed at defended spending, that Ferrero supports.

Mouth Freshener Market Companies

Major players operating in the mouth freshener industry are:

- Dabur Binaca

- Ferndale Confectionery Pty Ltd

- Ferrero

- Hager Worldwide

- HARIBO GmbH & Co. KG

- Johnson & Johnson

- Kraft Foods Inc.

- Leaf Holland BV

- Lotte

- Mars Incorporated

- Mondelez International

- Perfetti Van Melle

- The Hershey Company

- The Kraft Heinz Company

- Wrigley Jr. Company

Mouth Freshener Industry News

- In 2024, HARIBO, one of the leading global suppliers of gummies, unveiled the expansion of its product offerings by including HARIBO Football Mix gummies which come in flavors like pineapple, strawberry, raspberry, lemon, orange, and apple. As for the new limited-edition mix, it offers an extraordinarily triple soft “fluffy” dual-layer texture in each gummy which improves every delicious bite.

- In July 2021, Ferndale Confectionery, a prominent participant in the global mouth freshener market, recently inaugurated a new factory in Ballarat.

- In February 2020, Colgate announced the launch of their CBD product line, which includes mouthwash, toothpaste, and dental floss.

The mouth freshener market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Gums

- Spray

- Strips

- Capsule

- Others

Market, By Category

- Flavored

- Non-flavored

Market, By Ingredient

- Sugar-free

- Conventional

Market, By Price Range

- Low

- Medium

- High

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

What is the size of spray segment in the mouth freshener industry?

The spray segment generated over USD 6.9 billion in 2024.

How much is the U.S. mouth freshener market worth in 2024?

The U.S. market of mouth freshener was worth over USD 3.1 billion in 2024.

Who are the key players in mouth freshener industry?

Some of the major players in the industry include Dabur Binaca, Ferndale Confectionery Pty Ltd, Ferrero, Hager Worldwide, HARIBO GmbH & Co. KG, Johnson & Johnson, Kraft Foods Inc., Leaf Holland BV, Lotte, Mars Incorporated, Mondelēz International, Perfetti Van Melle, The Hershey Company, The Kraft Heinz Company, and Wrigley Jr. Company.

How big is the mouth freshener market?

The market size of mouth freshener was valued at USD 19.6 billion in 2024 and is expected to reach around USD 34 billion by 2034, growing at 5.7% CAGR through 2034.

Mouth Freshener Market Scope

Related Reports