Summary

Table of Content

Monosodium Glutamate (MSG) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Monosodium Glutamate Market Size

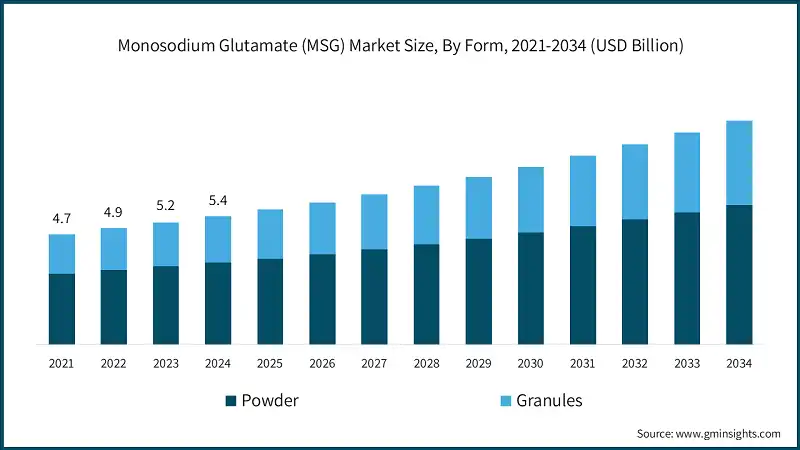

The global monosodium glutamate (MSG) market size was valued at USD 5.4 billion in 2024. The market is expected to grow from USD 5.7 billion in 2025 to USD 9.5 billion in 2034, at a CAGR of 5.7%, according to the latest report published by Global Market Insights Inc.

To get key market trends

- Monosodium glutamate is a salt and is commonly known as MSG. It's one of the popular food flavour enhancers popular for a taste called umami. Processed or packaged foods like instant noodles, soup, seasonings, and frozen meals typically have this ingredient. Most commonly, Asians use it in their cuisines, but recently, it has quietly become an ingredient in the general production of food worldwide as it enhances without dominating other ingredients.

- Urban lifestyles are growing, leading to increased demand for establishment and convenience foods, and these will all eventually lead to the growth of the market for MSG. As consumers always look further into meal options that are faster to prepare, MSG is used by manufacturers with mass-produced items to maintain a strong flavour in these products. In addition, with the international spread of cuisine around the world today, there is acceptability of ingredient because food education improves and the myth surrounding its health risks has been broken.

- The greatest expansion is being witnessed in food processing, especially in instant noodles, snacks, and seasoning mixes. These segments thrive on consistency with bold flavours that appeal across regions, and MSG fulfils the demand efficiently and effectively. The food service industry (fast food, takeout) is another very large user and depends on consistent flavour and low-cost ingredients.

- Technological advancement like Microbial fermentation, with the help of Corynebacterium glutamicum, that helps in producing glutamic acid from natural sugars (such as molasses or tapioca starch) and further neutralized to form MSG. Biotechnology innovations have made this process considerably more efficient, with increased yield, purity, and now sustainability and cost savings. Development in downstream process like membrane filtration and crystallization, helps in lowering waste and energy usage, making it possible for producers to manufacture excellent quality MSG suited to clean-label and health-conscious food products.

- According to the United States Food and Drug Administration (FDA), monosodium glutamate (MSG) is classified as "generally recognized as safe" (GRAS), meaning it can be used freely in food products within certain limits. Likewise, the European Food Safety Authority (EFSA) approved MSG as a safe food additive and establishes acceptable daily intake levels. This ensure that quality standards of MSG are maintained and provide guidance for manufacturers on proper usage while relieving consumer concerns through transparency and safety assessment.

Monosodium Glutamate (MSG) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 5.4 Billion |

| Market Size in 2025 | USD 5.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.7% |

| Market Size in 2034 | USD 9.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for convenient foods | Consumers fast-paced lifestyles continue to drive the demand for ready-to-eat and convenience foods, which often require strong flavour enhancers like MSG. This trend boosts MSG use as manufacturers seek to maintain authentic, savory taste in processed meals without added sodium or complex ingredients. |

| Shift toward clean-label products | There is growing consumer interest in natural and transparent ingredients, pushing producers to adopt fermentation-based MSG made from plant sources rather than synthetic chemicals. This shift supports the perception of MSG as a clean-label ingredient, increasing its acceptance in health-conscious markets. |

| Technological advances in fermentation | Improved microbial fermentation techniques have enhanced production efficiency, purity, and sustainability of MSG. These innovations reduce environmental impact and production costs, enabling wider adoption of MSG in diverse food products while meeting regulatory and consumer expectations. |

| Globalization of culinary tastes | As global food culture spreads, more consumers are exposed to cuisines where MSG is traditionally used, like Asian and Mediterranean dishes. This expanding palate encourages food companies and restaurants worldwide to include MSG in their recipes to deliver authentic flavours, fueling market growth. |

| Pitfalls & Challenges | Impact |

| Competition from natural flavour enhancers | Natural ingredients like yeast extracts, mushroom extracts, and seaweed-based umami enhancers are gaining popularity as “clean-label” substitutes. This creates competition for MSG, especially among consumers seeking all-natural products, which can slow its adoption in certain segments. |

| Rising demand for low-sodium alternatives | With increasing health awareness, many consumers and manufacturers aim to reduce sodium intake. Although MSG contains less sodium than table salt, some perceive it as contributing to overall sodium levels, leading to hesitance and pushing the market to innovate with lower-sodium or alternative flavour enhancers. |

| Opportunities: | Impact |

| Sustainability-driven competitive edge | Companies investing in sustainable production methods for MSG can capitalize on rising regulatory pressures and consumer demand for eco-friendly products, positioning themselves as leaders in responsible manufacturing. |

| Leveraging emerging sector opportunities | MSGs role is expanding beyond food into pharmaceuticals and pet foods, where flavour masking and enhancement are valuable. Exploring these adjacent sectors offers untapped revenue streams and diversification possibilities for producers. |

| Customized flavour solutions for regional preferences | Manufacturers can tailor MSG formulations to suit local taste preferences, enabling better market penetration and stronger brand loyalty in diverse geographic markets. |

| Market Leaders (2024) | |

| Market Leaders |

18% |

| Top Players |

Collective market share in 2024 is 47% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | MEA |

| Emerging Country | Saudi Arabia, South Africa, UAE |

| Future Outlook |

|

What are the growth opportunities in this market?

Monosodium Glutamate Market Trends

- The key factor which continues to fuel the expansion of monosodium glutamate (MSG) industry is increasing consumer preference for convenience and more flavourful foods. In fact, there has been an increase in the demand for ready-to-eat and processed foods due to the increasing busy lifestyles of people around the globe.

- MSG itself is an essential ingredient in flavour enhancement without depending heavily on salt or other additives. This causes food manufacturers to apply MSG in the formulation of appetizers, soups, and seasoning blends. For example, most popular instant noodles contain MSG but maintain the umami flavour, which meets consumers' taste and convenience needs. Such changing consumption patterns in the present day will result directly in further expansions of the MSG market.

- Developing technologies in fermentation with microbial strains such as Corynebacterium glutamicum are revolutionizing the MSG production process-increasing its yield and decreasing its environmental impact. Membrane filtration and ultrafiltration technologies improved purification processes allowing for the greatest consistency and purity in the products.

- Closed-loop bioreactor systems recycle water and nutrients, thereby minimizing waste and energy consumption. There is an increasing trend among companies to implement automated fermentation monitoring supported by IoT sensors to control operating conditions in real time. These technologies benefit the consumer by providing clean-label ingredients details and hence achieve the environmental regulations, which is steadily leading the market.

- Some manufacturers are exploring the prospects of using blockchain technology for greater traceability in sourcing the ingredients while controlling both regulatory demands and consumer expectations for ingredient sourcing. Manufacturers have adopted 'smart' factory pilots with the use of sensors and AI analytics in the optimization of production processes. These developments tend to legitimize MSG production, rendering it more agile and responsive toward further market outreach.

Monosodium Glutamate Market Analysis

Learn more about the key segments shaping this market

The monosodium glutamate market by form is segmented into powder and granules. Powder holds the largest market value of USD 3.4 billion in 2024 and is projected to grow at a CAGR of 5.4% till 2034.

- The powder market of MSG is leading in terms of market share accounting for about 63.8% in 2024. Monosodium glutamate powder form is found to grow extensively primarily because it is versatile and able to penetrate a larger cross section of food applications. Once mixed, powdered MSG blends very well with seasoning mixes, soups, snacks, and processed foods, thereby favouring most manufacturers that need an even flavour accentuation.

- It has a very fine texture that quickly dissolves and is evenly distributed, making it particularly relevant in mass food production and commercial-ready products. For example, many popular instant noodle and snack brands utilize powdered MSG to achieve a base umami flavour that will appeal to consumers around the globe.

- The granule segment of the MSG market is growing steadily mainly due to its suitability for applications requiring controlled flavour release and easy handling in industrial food processing applications. Granular MSG is the type used primarily in the large-scale manufacture of sauces, ready meals, and seasoning blends used by foodservice providers, where precise dosing is important.

- Granulates have coarser textures, thus allowing for slower dissolution, which can improve flavour profiles in certain culinary applications. Some frozen food producers prefer granular MSG to better preserve flavour integrity during cooking and reheating. This functional advantage lends vigour to the segment, especially in markets that are rapidly advancing in the field of industrial food production.

Learn more about the key segments shaping this market

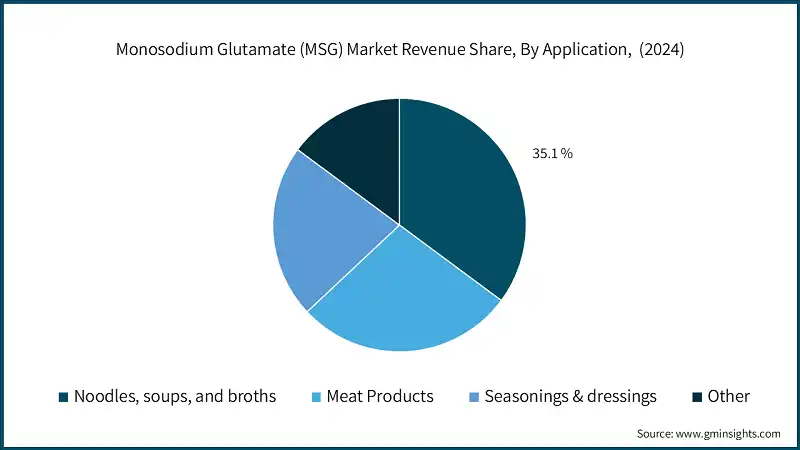

Based on application, the monosodium glutamate market is segmented into noodles, soups, and broths, meat products, seasonings & dressings and other. Noodles, soups, and broths holds highest of the market share of 35.1% in 2024.

- The MSG market has been dominated by noodle, soup, and broths accounts for USD 1.7 billion in 2024, due to its constant presence in the processed and packaged food industry. The consumer inclination towards ready and tasty meal options mostly found in urban cities with fast-paced living adds additional support to this segment. The iconic savoury taste of these products simply cannot be achieved without MSG, making it a key ingredient. The market for cheap and fast food is always expanding, and manufacturers are bent on innovating and expanding products in this segment. As such, steady demand maintains its place in the leading position in the industry.

- The meat products and seasonings & dressings segments follow a steady growth path owing to their enhancement flavor profiles. MSG is used to balance taste in processed meats and to enhance the attractiveness of sauces and condiments. These categories benefit from packaged food consumption trends and changing consumer preferences toward richer taste and lower additives. The flavor enhancement role of the other two segments does not equal the volume of that of the leading segment but is rather one of the catalysts for the growth of the entire market.

Based on distribution channel, the market is segmented into B2B and B2C. B2B accounts for USD 4 billion in 2024.

- The MSG B2B accounts highest market share due to its significance in supplying bulk food manufacturers, processors, and foodservice companies. The channel entails bulk purchasing and long-term contracts leading to a more dedicated supply in sectors, such as packaged foods, ready meals, and institutional catering. The B2B distribution alloy guarantees continuous demand since these companies will seek MSG in large quantities to maintain the flavour between the different products they offer. In addition, packaged and convenience foods drive the growth of this sector globally, making it the largest slice of the market.

- For the B2C segment, steady growth is expected from the heightened consumer awareness and an increasing trend in home cooking, but still far smaller compared to the respective markets discovered as this segment typically has relatively fewer purchases and retail channels that are often fragmented. Packaging and ready-to-use MSG products for retail target household consumers who wish to enhance flavour in their daily cooking procedures. However, the large-scale and volume requirements place B2B as more of a driving factor in the growth of the market, which has been underpinned by continuous demand from industries and by growing food production worldwide.

Looking for region specific data?

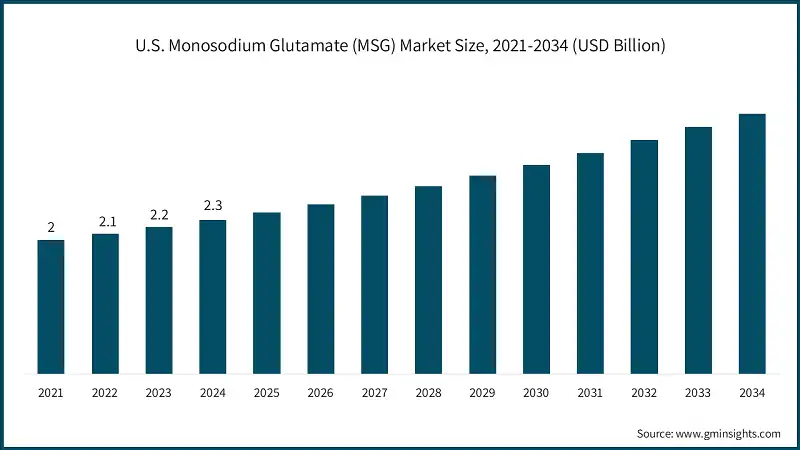

The U.S. monosodium glutamate market accounted for USD 2.3 billion in 2024.

- The progressive growth of the United States MSG market is expected to grow due to the increased demand for processed foods and convenience foods until 2034. Various governmental efforts like the FDA’s strict food safety regulations and the USDA’s promotion of natural ingredients in processed foods toward food safety and transparency further encourage cleaner and more natural methods of production among manufacturers. MSG favours the consumers, who have given the rising interest in multicultural and health-oriented products, aided by active lifestyles driving demand for ready-to-eat meals. These factors ensure that the market has strong and sustainable growth.

- In North America as a whole, including Canada, the flourishing foodservice sector and rapid urbanization further complement the consumption of flavourful convenience foods. MSG category is supported by the regulatory frameworks emphasizing ingredient safety and sustainability. Together, these trends sustain ongoing regional market growth throughout the upcoming years.

The monosodium glutamate (MSG) market in Germany is expected to experience significant and promising growth from 2025 to 2034.

- The MSG market in Europe is anticipated to grow at a steady rate until 2034, due to region's regulatory framework and an increasing demand for healthier, tastier foods. The EU's Farm to Fork Strategy and the Green Deal together help push the food industry toward sustainable practices, including the use of naturally sourced food additives such as MSG.

- A growth in consumers' demand for clean-label and plant-based products further aids in the acceptance of MSG as a sodium-reducing flavour enhancer. A range of EU-wide food safety agreements enforced by EFSA ensure the trust in the quality and transparency of the ingredient-use. These combined causes signify a healthy panorama to expand the market across the member states.

- Germany is now becoming an innovative hub supporting the European MSG market due to increasing health consciousness and demand for low-sodium alternatives in food. The German government assist sustainable food innovations under programs such as the salt-reduction and flavour-enhancement technologies promoted by the Federal Ministry of Food and Agriculture (BMEL). Manufacturers are generally adopting fermentation-based MSG production technique due to consumer preference shifting toward clean-label products. Public campaigns promoting healthy eating and food-label transparency also favour consumer acceptance. Together, these national provisions are projected to sustain growth in Germany's MSG market for the next ten years.

The monosodium glutamate (MSG) market in China is expected to experience significant and promising growth from 2025 to 2034.

- In the Asia Pacific region, growth of MSG market will expand due to factors such as fast urbanization, preference for umami-rich dishes in people's diet, and the fast-growing processed food industry. The governments of the region are giving emphasis on modernizing food safety, and countries like India and other Southeast Asian nations have been transforming their food standards on the contemporary international model.

- Japan and South Korea offer innovation grants and public-private R&D initiatives in favour of trends toward clean label and natural flavour enhancers. Fermentation-based MSG is being popular as it synchronizes with health and sustainability goals. Collectively these developments are delivering systematic adoption and improvements in production in the MSG space across the region over time.

- China continues to dominate the global MSG market, driven by its deep-rooted culinary use of umami flavors and the scale of its processed food industry. Also, under the National Food Safety Plan, as well as the Healthy China 2030 initiative, the Chinese government is pressuring manufacturers to increase ingredient transparency and minimize excessive salt in packaged foods. This, indirectly, is facilitating the use of MSG as a low sodium flavor enhancer.

- Furthermore, policies that inspire green manufacturing as well as sustainable agricultural sourcing also encourage the shift into natural fermentation methods of MSG production. Thus, these regulations and health-oriented measures work to strengthen trust among consumers and, subsequently, support long-term growth in the market.

UAE monosodium glutamate market is expected to experience significant and promising growth from 2025 to 2034.

- Market across the Middle East and Asia related to MSG is expected to grow steadily over the next decade until 2034 given the proliferation of urbanization, increased consumption of processed foods, and the rising demand for cost-effective flavour enhancers. Various governments like Saudi Arabia, South Africa, and Nigeria would concentrate on strengthening food safety frameworks in the countries, focusing on the international level through regulatory bodies such as the Saudi Food and Drug Authority (SFDA) and South African Bureau of Standards (SABS). In such cases, guidelines encourage the adoption of safe and high-quality food additives such as MSG.

- The UAE market of MSG is anticipated to witness enormous and promising growth during 2025-2034 and rapid growth of its food manufacturing and processing sectors. Such promises in developing the country have been supported by government-led programs, such as the National Food Security Strategy 2051 and the ''Make it in the Emirates'' initiative, all with the main purpose of improving food production domestically, including flavouring agents such as MSG. The Emirates Authority for Standardization and Metrology (ESMA) pushes strict food safety and quality controls, thus improving consumer trust and responsible ingredient usage.

Brazil is expected to experience significant and promising growth from 2025 to 2034.

- The MSG market in Latin America is overall increasing due to the changing lifestyles of the people, where convenience foods and fast-food gain prominence. Everything nowadays must be delicious, but people are also becoming more health-conscious, so MSG's abilities to make a delicious-tasting dish with less salt will be important. All governments throughout the region are acting upon improving their food safety rules which additionally encourage better quality and transparency that would help augment MSG consumption. All these factors combined have resulted in a growing demand for MSG in the food market throughout Latin America.

- The MSG business in Brazil is growing because people are consuming more processed and ready-to-eat foods, especially in urban areas. Consumers want tasteful food that does not cost much, and while MSG helps enhance taste. Other things the government wants are to ensure the safety and labeling of food products that will help build trust towards MSG. In turn, modernization of Brazil's food industry has facilitated production and widespread use of MSG, further contributing to the steady growth of the market.

Monosodium Glutamate Market Share

- Monosodium Glutamate (MSG) industry are moderately consolidated with players like Ajinomoto Co., Inc., Fufeng Group, Foodchem International, Meihua Holdings Group Co., Ltd, and Vedan International (Holdings) Limited. holding 47% market share.

- The competitors that dominate the MSG market invest in long-term research and development to maintain their dominance. The improvement of fermentation processes for better yield, purification, and cost-effectiveness is the focus of these companies.

- By innovating energy-efficient production methods, they minimize operational costs and carbon footprint, thereby contributing towards global sustainability objectives. Besides, maintaining the edge in regulatory compliance guarantees that their products meet evolving food safety and quality standard requirements across different regions, further cementing their market position.

- Apart from flavor enhancement, multifunctional advantages of MSG have also penetrated the vast spectrum of consumer requirements for better, healthier diets. The industry is undergoing change towards combining sodium reduction in food with customizations. This proposition is essential for health-conscious consumers interested in taste and is vital for market growth.

- Digitization in supply chains like ingredient traceability and AI-based demand forecasting helps major players improve efficiency and reduce wastes while being able to respond faster to market shifts.

Monosodium Glutamate Market Companies

Major players operating in the monosodium glutamate (MSG) industry are:

- Ajinomoto Co., Inc.

- Arshine Food Additives

- Foodchem International

- Fufeng Group

- Great American Spice Company

- Linghua Group

- Meihua Holdings Group Co., Ltd

- Ningxia Eppen Biotech Co., Ltd

- Prinova

- Vedan International (Holdings) Limited

Ajinomoto Co., Inc. is the pioneer and global manufacture of MSG on an industrial scale and has been producing it for more than a century. Widely recognized for its flagship "Ajinomoto" brand, MSG is produced by advanced fermentation processes using natural ingredients like sugarcane and tapioca. Its strong focus on R&D and clean-label solutions support its reputation for high-quality, food-grade flavor enhancers. Thus, Ajinomoto has global manufacturing operations to ensure supply across Asia, North America, and Europe.

Foodchem International, it is a world distributor of food additives, including high-purity MSG for industrial and culinary applications, is established out of China, exporting to over 120 countries with adherence to strict quality assurance and global food safety standards. MSG products from Foodchem are targeted for different markets in the food industry, including instant noodles, snacks, and condiments. Logistics flexibility and packaging also support an effective distribution worldwide.

Fufeng Group is one of the biggest producers of monosodium glutamate (MSG) in China with a wide range of amino acid products for the food industry. It is known for MSG production by biological means, with larger production capacity and efficiency in exports. Combined with raw material sourcing, Fufeng has built a strong competitive edge by its cost-based MSG production capacity in the global supply chain. The brand is widely used in bulk food manufacturing, as well as in retail markets.

Vedan International is a key player in Asia, which is known for fermentation-based production stemming back from decades of biochemical expertise. The company produces MSG under various brand lines, supplies to numerous food processors and restaurant chains throughout Southeast Asia and Taiwan, and offers foods with an MSG component. Vedan has also been focusing on environmental sustainability as part of waste and resource management improvements in terms of efficiency. The MSG products of Vedan are held highly concerning their purity and consistent performance.

Meihua Holdings is a leading producer of MSG in China with highly advanced bio fermentation and food-grade amino acids capabilities. The company traders under MSG in both domestic and foreign markets paying special attention to serving large-scale food manufacturers. With the introduction of advanced production equipment and processes with eco-friendly practices, Meihua has established itself as a trustworthy, cost-competitive supplier. Vertical integration practiced by the company helps in quality control from the sourcing of raw materials to the finished product.

Monosodium Glutamate Industry News

- August 2023: Mei Ah Foodstuffs International has teamed up with a food delivery platform to introduce ready-to-eat meals featuring Ajinomoto MSG.

- September 2023: Kerry Ingredients has tested an innovative flavouring technology that blends MSG with natural extracts.

The monosodium glutamate (MSG) market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of kilo tons from 2021-2034 for the following segments:

Market, By Form

- Powder

- Granules

Market, By Application

- Noodles, soups, and broths

- Meat products

- Seasonings & dressings

- Others

Market, By Distribution Channel

- B2B

- B2C

- Supermarkets and hypermarkets

- Convenience stores

- Specialty stores

- Online retail

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the monosodium glutamate (MSG) market?

Key trends include advanced fermentation, IoT-enabled monitoring, blockchain-based traceability, and smart factory systems for optimized production.

Who are the key players in the monosodium glutamate (MSG) industry?

Key players include Ajinomoto Co., Inc., Arshine Food Additives, Foodchem International, Fufeng Group, Linghua Group, Meihua Holdings Group Co., Ltd, Prinova, and Vedan International Limited.

What was the valuation of the noodles, soups, and broths segment in 2024?

The noodles, soups, and broths segment accounted for USD 1.7 billion in 2024, holding the largest market share of 35.1%, owing to its consistent presence in the processed and packaged food industry.

Which region leads the monosodium glutamate (MSG) sector?

The United States leads the market, accounting for USD 2.3 billion in 2024. The market growth is led by increasing demand for processed and convenience foods.

What is the expected size of the MSG market in 2025?

The market size is projected to reach USD 5.7 billion in 2025.

How much revenue did the powdered MSG segment generate in 2024?

The powdered MSG segment generated approximately USD 3.4 billion in 2024, dominating the market due to its widespread use in processed foods.

What was the market size of the monosodium glutamate in 2024?

The market size was valued at USD 5.4 billion in 2024, with a CAGR of 5.7% expected through 2034. Increasing demand for processed and convenience foods is driving market growth.

What is the projected value of the monosodium glutamate market by 2034?

The MSG market is poised to reach USD 9.5 billion by 2034, driven by advancements in fermentation technologies and growing consumer preference for umami flavor in food products.

Monosodium Glutamate (MSG) Market Scope

Related Reports