Summary

Table of Content

Milk Protein Hydrolysate Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Milk Protein Hydrolysate Market Size

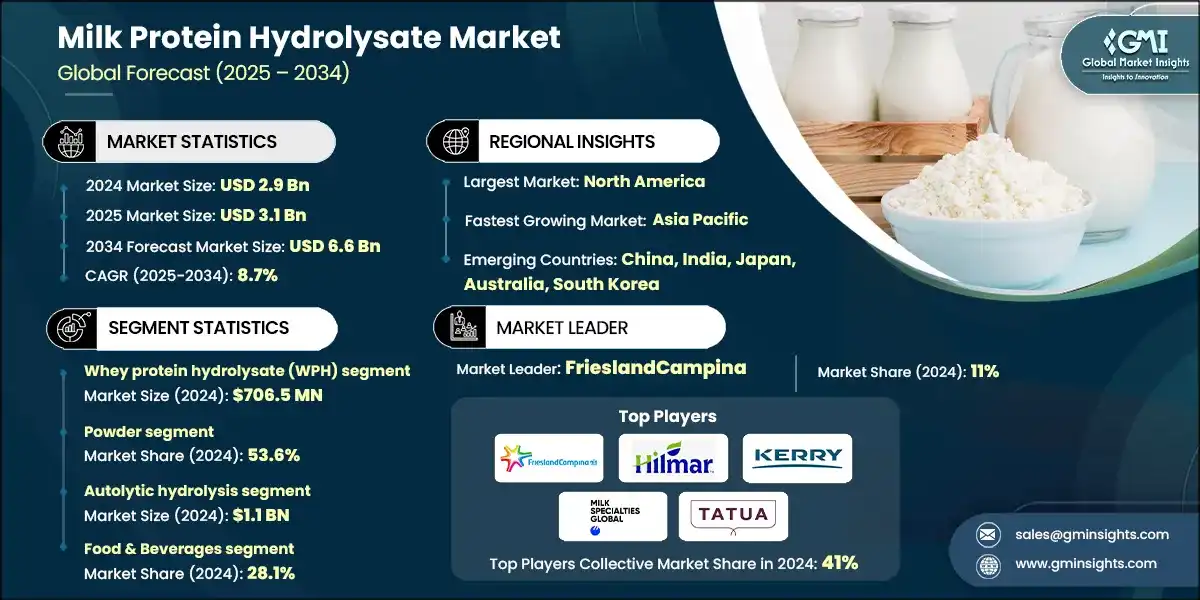

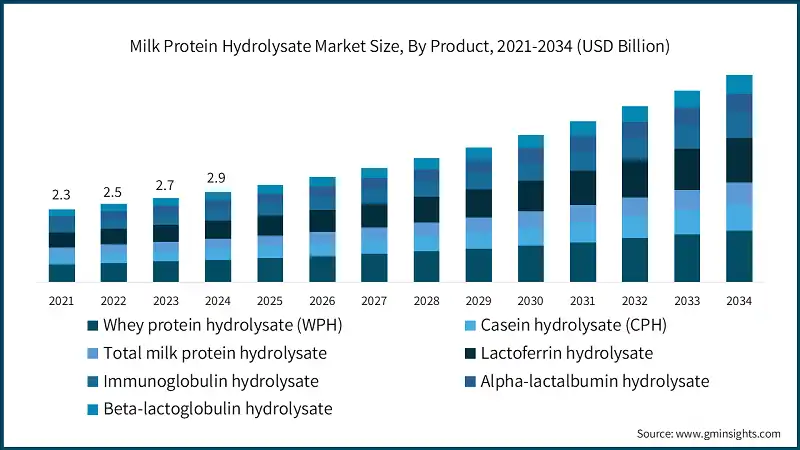

The global milk protein hydrolysate market size was valued at USD 2.9 billion in 2024. The market is expected to grow from USD 3.1 billion in 2025 to USD 6.6 billion in 2034, at a CAGR of 8.7% according to the latest report published by Global Market Insights Inc.

To get key market trends

- Milk protein hydrolysate consists of milk proteins that get degraded to smaller peptides and amino acids due to enzymatic hydrolysis. This process renders the proteins more digestible and less allergenic; hence, MPH finds special significance in specialized nutrition. Increased awareness regarding the benefits related to digestibility and hypoallergenic properties of the products is becoming prevalent among consumers and health conscious, leading to a growing market segment for MPH.

- The growth of the market is mainly induced by the increasing requirement for infant formulas designed for babies with allergies or intolerance to cow's milk proteins. MPH is largely utilized in hypoallergenic infant nutrition products, helping those infants that cannot tolerate regular milk proteins.

- Moreover, interest in the sports nutrition segment is increasing, as athletes require fast-absorbing sources of protein that can help them with muscle recovery and performance. Another application of MPH is in clinical nutrition, wherein the protein is given in a digestible form to patients under medical or therapeutic diets.

- The technological advancements in enzymatic hydrolysis and membrane filtration have enhanced the quality, consistency, and functionality of milk protein hydrolysates. By controlling the protein breakdown very precisely, the producer can also optimize digestibility, flavour, and nutritional value, making the hydrolysates appropriate for all nutrition segments, from infant to clinical.

- Further, improvements in purification allow for better taste and alignment with the growing consumer preference for natural, minimally processed, and clean-label products. These technological innovations are the ultimate growth drivers in adopting milk protein hydrolysates across different functional food markets in the future. For instance, the use of MPH in hypoallergenic infant formulas is regulated by the U.S. Food and Drug Administration (FDA).

Milk Protein Hydrolysate Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.9 Billion |

| Market Size in 2025 | USD 3.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.7% |

| Market Size in 2034 | USD 6.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Shift to hypoallergenic nutrition | More consumers, especially parents and healthcare providers, seek hypoallergenic formulas and foods due to rising awareness of milk protein allergies. This shift is pushing manufacturers to increase milk protein hydrolysate offerings, fuelling market expansion. |

| Demand for clean-label products | People prefer natural, minimally processed ingredients with clear labelling. Enzymatic hydrolysis technology supports this trend by enabling the production of milk protein hydrolysates without harsh chemicals, encouraging wider consumer acceptance. |

| Integration into functional foods | Milk protein hydrolysates are increasingly added to functional beverages and snacks targeting health-conscious and athletic consumers. This diversification beyond infant nutrition is opening new revenue streams and broadening market reach. |

| Expansion of infant and clinical nutrition needs | Increasing birth rates and rising cases of food allergies are boosting demand for specialized infant formulas and clinical nutrition products. Milk protein hydrolysates offer reduced allergenicity and better digestibility, making them ideal for these needs. This trend is a key factor driving market growth. |

| Pitfalls & Challenges | Impact |

| Flavor and palatability issues | Hydrolysates sometimes have a bitter taste, posing challenges for product formulation. Overcoming taste barriers is crucial for expanding usage in mainstream food and beverage products. |

| Intense market competition | The MPH market faces competition from plant-based and non-hydrolysed protein products, which are often marketed as more natural or sustainable. This forces MPH producers to innovate constantly to maintain market share. |

| Opportunities: | Impact |

| Rising demand in sports nutrition | Increasing awareness about muscle recovery and protein quality among athletes is driving demand for fast-absorbing milk protein hydrolysates. This opens a lucrative market segment for tailored supplements and functional foods. |

| Growth in personalized nutrition | Consumers seek nutrition customized to their health needs, there is potential for MPH products designed for digestive health, allergies, and metabolic conditions, creating niche but high-value markets. |

| Rising interest in gut health and immunity | Consumers’ growing awareness of gut health and immunity is increasing demand for easily digestible and bioactive proteins like MPH, which support digestive comfort and immune function, especially among older adults and vulnerable groups. |

| Market Leaders (2024) | |

| Market Leaders |

11% market share |

| Top Players |

Collective Market Share is 41% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Japan, Australia, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Milk Protein Hydrolysate Market Trends

- The milk protein hydrolysate industry is witnessing growth due to increased awareness of food allergies, digestive health, and specialized nutrition. This is most evident in infant and clinical nutrition, where demand is rising for hypoallergenic and easily digestible protein sources.

- Market is taking a shift into hypoallergenic nutrition owing to rising awareness about milk protein allergies and intolerances all over the globe. It is now considerably favoured by consumers and health-care practitioners as hydrolysates of milk proteins can lower the probabilities of allergy in infants and sensitive adults. These factors have resulted in the innovation of products and an increase in the application of hydrolysed proteins in specialized dietary formulations, thus incrementing the growth of the market.

- The trend of clean-label nutrition and transparency has demanded new expectations from the packaging beyond protection. Smart packaging technologies-the digital codes and tamper-evident features-are giving assurance to the consumers about the authenticity, ingredient origin, and allergen control. Traceability is further enhanced by these features so that companies can comply with stricter labelling regulations, especially in regulated markets. By marrying physical protection and information transparency, packaging has become an instrument that builds brand credibility and spurs product acceptance from health-conscious consumers.

- Milk protein hydrolysates are increasing their application in functional foods, catering consumer demand for an added health benefit in a source of nutrition. They produce bioactive peptides that promote health in digestion or enhance immunity, making them ideal ingredients in fortified beverages, snacks, and meal replacements. Such integration into more common foods essentially extends the market beyond clinical and infant nutrition, aiding in steady uptake and diversification.

- Regulatory developments are also affecting the setting of standards in the milk protein hydrolysate industry. In the U.S. and Europe, regulatory authorities introduced stricter requirements on nutritional labelling, allergen declaration, and packaging materials safety, with specific mentions for infant and medical nutrition. Manufacturers are upgrading their packaging to satisfy functional and compliance requirements and to do so with food-grade, recyclable materials coupled with secure sealing technologies. This not only ensures regulatory conformity but also works toward strengthening consumer safety and environmental responsibility, which will continue to support growth in the market.

Milk Protein Hydrolysate Market Analysis

Learn more about the key segments shaping this market

The milk protein hydrolysate market by product is segmented into whey protein hydrolysate (WPH), casein hydrolysate (CPH), total milk protein hydrolysate, lactoferrin hydrolysate, immunoglobulin hydrolysate, alpha-lactalbumin hydrolysate, beta-lactoglobulin hydrolysate. Whey protein hydrolysate (WPH) holds the largest market size USD 706.5 million and is projected to grow at a CAGR of 8.9% in 2024.

- The Whey Protein Hydrolysate (WPH) market is leading in terms of market share accounting for about 24.5% in 2024. The reason for this growing market demand is the increasing need for such easily digestible and rapidly assimilable proteins primarily used by athletes, fitness freaks, and people with specific dietary needs.

- WPH has a high rate of bioavailability and has low allergenic potential, which makes it a widely used ingredient in clinical nutrition, baby formulas, and sports supplements. Its superior functional properties include rapid muscle recovery, lower allergenic response, which brought its application to the field of health and wellness applications.

- Lactoferrin hydrolysate is one of the key segments having market share of 20.4% in 2024, and the growth is due to its immune-boosting and antimicrobial properties. After COVID-19 the growing awareness concerning immune well-being has shifted people's mindset, toward consumption of bioactive proteins, including lactoferrin, through dietary supplements and functional foods sources.

- Clinical studies highlighting lactoferrin in supporting gut health, fighting infections, and increasing its dispersion in high-value nutraceuticals formed part of the strong scientific backing and growing consumer health awareness factors propelling these segments forward.

Learn more about the key segments shaping this market

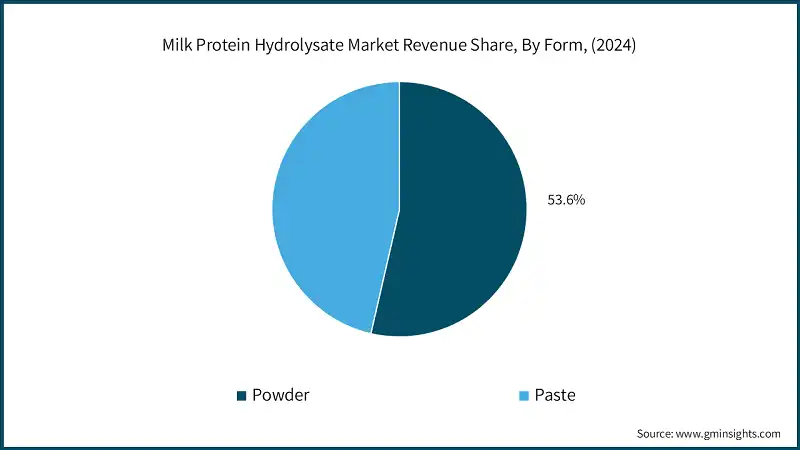

Based on form, the market is segmented into powder and paste. Powder holds highest of the market share of 53.6% in 2024.

- The powder category currently accounts for the largest share of the market, with a percentage of 53.6% clearly showing a preference among consumers and manufacturers, both present and future. The longer shelf life, ease of storage and transportation, and greater stability of the powder compared to paste are the main reasons for this increase. Protein hydrolysates in powder form are the most versatile and suitable for various applications-from infant formulas and sports nutrition to clinical and functional foods.

- Paste form, constituting 46.4% of the market share in 2024, is generally applied for more specialized or ready-to-use functionalities where it is comparatively slower growing, due to shorter shelf life, and heavier logistics.

Based on technology, the market is segmented into acid hydrolysis, enzymatic hydrolysis, microbial fermentation, autolytic hydrolysis, ultrasonic hydrolysis. Autolytic hydrolysis accounts for USD 1.1 billion in 2024.

- Autolytic hydrolysis holds for 38.5% market share in 2024. Natural and inexpensive process is preferred in industry reason for this domination. The feature that distinguishes the method is that it produces high-quality protein hydrolysates free from harsh chemicals.

- Acid hydrolysis accounts for 22.5% market share in 2024 because of the property of being effective in bulk production while having drawbacks such as nutrient degradation. Raw materials microbial fermentation at 18.9% of market share in 2024, caters demand for bioactive peptides or functional ingredients produced sustainably.

- Ultrasonic Hydrolysis obtains the 12.1% of market share in 2024, showing the growing interest in this breakthrough technology that increases extraction efficiency and reduces processing time. Enzymatic Hydrolysis currently has the least share of the market, which potentially has been a result of cost and technical complexity.

Based on end use, the market is segmented into food & beverages, animal feed, pharmaceutical, cosmetics & personal care and others. Retail distribution leads the highest market share in 2024.

- The Food & Beverages segment is the most prominent and the fastest growing in terms of development and accounts for 28.1% in 2024. Growth is due to rising consumer demand for high-protein, functional, and easily digestible food, especially in sports and clinical nutrition. milk protein hydrolysates are a favored ingredient in the preparation of protein bars, ready-to-drink shakes, and nutritional supplements due to their properties such as quick absorption and low allergenicity. Leading food companies are adding hydrolysates to performance-boosting beverages and foods in response to health and fitness trends.

- The pharmaceutical segment, accounting for 26.33%, is also growing quite rapidly, as one of the therapeutic benefits associated with hydrolysed proteins is their role in managing metabolic disorders and malnutrition in infants. Hydrolysates are increasingly being considered in medical nutrition formulations because they produce bioactive peptides and hence improved digestibility, and as a result are helpful especially in hospitals and elder care-nursing homes.

- For example, hypoallergenic infant formulas, as well as amino acid-based therapeutic drinks, are examples of products within this trend. Both these segments are harnessing the advancements in enzymatic hydrolysis and the increased awareness about tailored nutrition solutions.

Looking for region specific data?

The U.S. milk protein hydrolysate market accounted for USD 870.3 million in 2024.

- The U.S. has established a stronghold in the North American milk protein hydrolysate market due to a raised awareness regarding food allergies and digestive health-safety of newborns and elderly individuals. The healthcare expenditure trend, coupled with a solid dairy industry, further propels the market.

- The various government programs, especially those set by the FDA about regulations on hypoallergenic infant formulas, make sure that the products being bought are safe and at the same time boost the confidence of the consumer in buying these products. Furthermore, U.S. agricultural initiatives motivate innovative incentives into the food technology development that support the launching of new products made with milk protein hydrolysates.

- Growth in North America is due to strong collaborations between dairy producers, health care providers, and regulatory bodies ensure safe and efficient formulas. Moreover, supply chain transparency improvement and sustainable sourcing practices are making strides in the region, coinciding with the increasing emphasis on environmental responsibility within the region.

- Sustainability has become a prime concern in the North American milk protein hydrolysate market. Manufacturers are becoming increasingly aware of sustainable packaging materials and production regimes to minimize environmental impacts, thus responding to rising regulatory pressure and consumer demand for sustainable products. The strict safety laws and allergen-labeling guidelines enforced by the FDA further ensure the reliability of products. Meanwhile, research efforts are also looking into improving the efficiency of enzymatic hydrolysis techniques so that less energy and waste are produced during manufacturing without compromising the quality of the product.

The market in the Germany is expected to experience significant and promising growth from 2025 to 2034.

- Germany and France are the main countries contributing to the European milk protein hydrolysate market driven by increased demand for allergen-free nutrition and concerns about the aging population. Regulation of hydrolysed proteins for infant and medical nutrition is actively updated in Europe by regulatory bodies, including EFSA, thus fostering innovation in products.

- The government support for sustainability in dairy farming is also in line with consumer interest in ethically sourced and clean-label ingredients. Initiatives directed toward the public health regarding infant allergy prevention may further stimulate demand in this region.

- The market growth in Europe is anticipated to stay stable until 2034, given that manufacturers are already adopting technologies in enzymatic hydrolysis and integrating smart packaging for safer products and traceability. The innovative developments in specialized nutrition are facilitated through increased collaboration between various research institutions and industry players.

The milk protein hydrolysate market in China is expected to experience significant and promising growth from 2025 to 2034.

- Asia pacific is witnessing a phenomenal amount of growth in the milk protein hydrolysate market primarily due to increased consumer awareness with respect to health and nutrition especially at urban centers. The subsequent conclusion of such growing awareness is the increased demand for hypoallergenic digestible proteins in functional foods as well as clinical nutrition products.

- Countries in Southeast Asia have started implementing better regulatory frameworks to ensure product safety and instill consumer confidence. At the same time, investment is being made by key manufacturers in enzymatic hydrolysis and filtration technologies to improve the quality of products in line with various needs of dietary preferences, taking the region forward steadily until 2034.

- The emergent markets of Asia-Pacific today are China and India. These two giants are fast growing due to their disposable income levels, population of infants, and degree of urbanization since they drive demand for premium-quality nutrition products.

- For instance, Government initiatives such as India's National Nutrition Mission and China's Healthy China 2030 plan that indirectly boost the adoption of milk protein hydrolysate, both countries are making efforts in infant health improvement and malnutrition reduction. The increasing development of healthcare infrastructure and heightened awareness of food allergies contribute to the advancement of clinical and infant nutrition sectors

UAE market is expected to experience significant and promising growth from 2025 to 2034.

- In the MEA region, the milk protein hydrolysate market is developing steadily, primarily due to the growing awareness of food allergies and digestive health, especially among infants and the older demographic. This reflects the priorities of the governments across the region towards improvement in healthcare and nutrition, thus extending their regulatory frameworks in line with the international food safety standards.

- Urbanization and enhancements in healthcare infrastructure have further promoted the use of specialized nutrition products. The manufacturing technologies have improved, and so has the supply chain, providing the products more access and better quality, thereby adding to the growing market of the region till 2034.

- The UAE being one key market in the MEA would have considerably strong governmental support for healthcare including nutrition initiatives such as maternal and child health programs. The adoption of stringent international regulatory standards in the country could further promote consumer trust in hypoallergenic milk protein hydrolysates.

Brazil is expected to experience significant and promising growth from 2025 to 2034.

- The Latin American market for milk protein hydrolysate consistently grows, due to increasing health awareness coupled with improved demand for specialty nutrition products. These specialty nutrition products are mainly targeted to parents of infants as well as those with allergies.

- Governments around the region are trying to improve their food safety regulations to international standards. This is also aiding in developing consumer confidence in trying these products. As economies advance and urban areas become more populated, so are changes in eating habits toward functional and hypoallergenic food. This offers wide opportunities for market development and innovations.

- Brazil is the largest and most developed market in the region, often the first to innovate and improve quality in the milk protein hydrolysate sector. Long-term investments are being made by the country’s dairy industry in advanced processes of enzymatic hydrolysis and environmentally friendly farming practices to meet increasing demands for clean-label and hypoallergenic nutrition. Brazil’s healthcare policies toward better infant and clinical nutrition are also providing a great impetus to the milk protein hydrolysates market. These initiatives make Brazil a key player in the Latin American market.

Milk Protein Hydrolysate Market Share

- Milk Protein Hydrolysate industry is moderately consolidated with players like ConAgra Foods, Inc., Del Monte Foods Company, Dole Food Company, Inc., Pacific Coast Producers, Seneca Foods Corporation holding 41% market share.

- The leading brands dominating the milk protein hydrolysate market invest significantly in R&D to come up with sustainable, high-performing packaging materials. They innovate eco-friendly fabrics, biodegradable composites, even strong textiles that comply with the gradual growth of environmental regulations and industry standards. Continuous advancements driven by commitment to sustainability are made in packaging technology, assures the quality of products while creating a minimized environmental impact.

- Packaging solutions that are moisture resistant, recyclable, and extremely durable are mostly used by all packaging manufacturers for food, retail, and agricultural usage. Market leaders further expand their presence into regions where green packaging is a priority by forming strategic alliances with other brands, manufacturers, and sustainability organizations. Such collaborations are crucial for accelerating the uptake of sustainable packaging to meet consumers demands.

- Aggressive expansion strategies across key markets in Asia-Pacific, North America, and Europe go along with such innovations to put the milk protein hydrolysate market in the forefront of big sustainability happenings worldwide. Through these avenues, companies are setting new trends with eco-friendly packaging solutions to drive growth and shape future infrastructure globally in the milk protein hydrolysate industry.

Milk Protein Hydrolysate Market Companies

Major players operating in the milk protein hydrolysate industry are:

- Arla Foods Ingredients Group

- AMCO Proteins

- A. Costantino & C.

- Armor Proteines

- Agropur Cooperative

- FrieslandCampina

- Glanbia Nutritionals

- Hilmar Ingredients

- Havero Hoogwegt

- Kerry Ingredients

- Lactalis Group

- Milk Specialties Global

- Tatua Co-operative Dairy Company

FrieslandCampina is the world's largest dairy ingredients company, focusing on high-quality milk protein hydrolysates mainly for infant nutrition, sports, and medical foods. These hydrolysates enjoy high popularity among sensitive consumer segments for their digestibility and hypoallergenic property. The company invests a high share of its revenue into R&D for the development of customized protein solutions for health and performance support. Their products serve global brands and specialized nutrition markets.

Hilmar Ingredients is at the forefront of dairy protein innovation with a selection of milk protein hydrolysates aimed at sports nutrition, infant formulas, and medical food. Recognized for stable supply and consistent quality, the hydrolysates from Hilmar provide enhanced rates of adsorption and reduced allergenicity. In response to the growing demand for functional and specialty nutrition products, the company provides customized protein blends and technical support to product developers.

Kerry Ingredients provide food and beverage solutions and deals in specialized milk protein hydrolysates as infant nutrition and performance foods. These hydrolysates are known to enhance protein digestibility and allergenic potential reduction, thus being excellent for sensitive consumers. Kerry brings in cutting-edge enzymatic technologies and flavor knowledge to develop the right hydrolysate that meets clean label expectations while maintaining fantastic taste profiles. It builds its innovations around various health-driven marketplaces worldwide.

Milk Specialties Global is dedicated to creating high-quality hydrolysates from milk proteins for nutritional and therapeutic applications. Their products are found in infant formula - clinical nutrition and sports formulation - because the inherent bioactive properties of protein hydrolysates and their better digestibility. Innovation and customer cooperation are hallmarks of the company, which offers tailor-made hydrolysates to improve protein functionality and consumer acceptability. Their solutions attempt to redefine the expanding functional protein market.

Tatua Co-operative Dairy Company a New Zealand-based business, produces premium milk protein hydrolysates with a strong focus on clean-label and functional applications. Their hydrolysates widely form a crucial component in infant formula and clinical nutrition products, appreciated for enhanced bioavailability and allergen management attributes. While establishing its excellence in enzymatic hydrolysis, Tatua has been able to develop custom proteins for improving taste and solubility in the end products. The cooperative is proud of being a sustainable farmer with quality control.

Milk Protein Hydrolysate Industry News

- On May 27, 2025, Arla Foods Ingredients appointed Alchemy Agencies to oversee the distribution of its premium performance nutrition ingredients throughout Australia, New Zealand, and the Pacific Islands. Under the agreement, the focus is on key products such as Lacprodan whey protein isolate and MicelPure micellar casein isolate. The cooperation works in tandem with Arla's growth strategy for the Asia-Pacific region and builds upon Alchemy's expertise in the specialty food and beverage markets.

- On November 5, 2024, Arla Foods Ingredients has introduced Lacprodan DI-3092, a new whey protein hydrolysate which is meant for peptide-based medical nutrition. This ingredient contains 10g of highly quality protein in a volume of 100ml; exceeding the market standard and boasts a significantly improved taste with minimal bitterness for patient compliance. It solves the most significant challenges in medical nutrition by providing high protein content, the best taste, and quality. Presented as prototypes of ready-to-drink and ready-to-mix powders, it is suitable for patients with nutrient absorption problems and possible gastrointestinal complications.

- In March 2023, Arla Foods Ingredients' Peptigen IF-3080, a milk protein hydrolysate designed for infant formula, received official approval from the European Union. In February 2022, the EU introduced new regulations mandating a safety and suitability assessment for all protein hydrolysates used in formula products, post which the European Food Safety Agency (EFSA) opined that IF-3080 was safe & suitable for use in EU infant formulas and follow-on formulas.

- In December 2022, Kerry unveiled a novel tool, known as KerryNutri Guide, that has the capability to evaluate a broad spectrum of food and beverage items in accordance with various front-of-pack nutrition labeling systems, directing users toward achieving a more favorable rating.

The milk protein hydrolysate market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of kilo tons from 2021–2034 for the following segments:

Market, By Product

- Whey protein hydrolysate (WPH)

- Casein hydrolysate (CPH)

- Total milk protein hydrolysate

- Lactoferrin hydrolysate

- Immunoglobulin hydrolysate

- Alpha-lactalbumin hydrolysate

- Beta-lactoglobulin hydrolysate

Market, By Form

- Powder

- Paste

Market, By Technology

- Acid hydrolysis

- Enzymatic hydrolysis

- Microbial fermentation

- Autolytic hydrolysis

- Ultrasonic hydrolysis

Market, By End Use

- Food & beverages

- Protein supplement

- Infant nutrition

- Sports nutrition

- Bakery & food ingredients

- Beverages

- Others

- Animal feed

- Poultry

- Broilers

- Layers

- Swine

- Cattle

- Aquaculture

- Salmon

- Trouts

- Shrimps

- Others

- Equine

- Pet

- Poultry

- Pharmaceutical

- Pharmaceutical formulations

- Clinical nutrition

- Others

- Cosmetics & Personal Care

- Skincare

- Haircare

- Others

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the milk protein hydrolysate industry?

Key players include Arla Foods Ingredients Group, AMCO Proteins, A. Costantino & C., Armor Proteines, Agropur Cooperative, FrieslandCampina, Glanbia Nutritionals, Hilmar Ingredients, Lactalis Group, and Milk Specialties Global.

What are the upcoming trends in the milk protein hydrolysate market?

Trends include hydrolysates in functional foods, smart clean-label packaging, stricter labeling rules, and recyclable food-grade materials.

Which region leads the milk protein hydrolysate sector?

The U.S. leads the North American market, accounting for USD 870.3 million in 2024. Factors such as heightened awareness of food allergies, digestive health, and a robust dairy industry contribute to its leadership.

What is the growth outlook for the autolytic hydrolysis segment?

The autolytic hydrolysis segment held a market share of 38.5% in 2024, valued at USD 1.1 billion. Its natural and cost-effective process is expected to sustain its dominance during the forecast period.

What is the market size of the milk protein hydrolysate in 2024?

The market size was USD 2.9 billion in 2024, with a CAGR of 8.7% expected through 2034. Increasing awareness of digestibility and hypoallergenic benefits is driving market growth.

What is the projected value of the milk protein hydrolysate market by 2034?

The market is poised to reach USD 6.6 billion by 2034, driven by rising demand for specialized nutrition, functional foods, and clean-label products.

What is the expected size of the milk protein hydrolysate market in 2025?

The market size is projected to reach USD 3.1 billion in 2025.

How much revenue did the whey protein hydrolysate segment generate in 2024?

The whey protein hydrolysate segment generated approximately USD 706.5 million in 2024, dominating the market with a CAGR of 8.9% projected through 2034.

What was the market share of the powder form in 2024?

The powder form accounted for 53.6% of the market share in 2024, led by its longer shelf life, ease of storage, and versatility in applications such as infant formulas, sports nutrition, and functional foods.

Milk Protein Hydrolysate Market Scope

Related Reports