Summary

Table of Content

Military Drones Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Military Drones Market Size

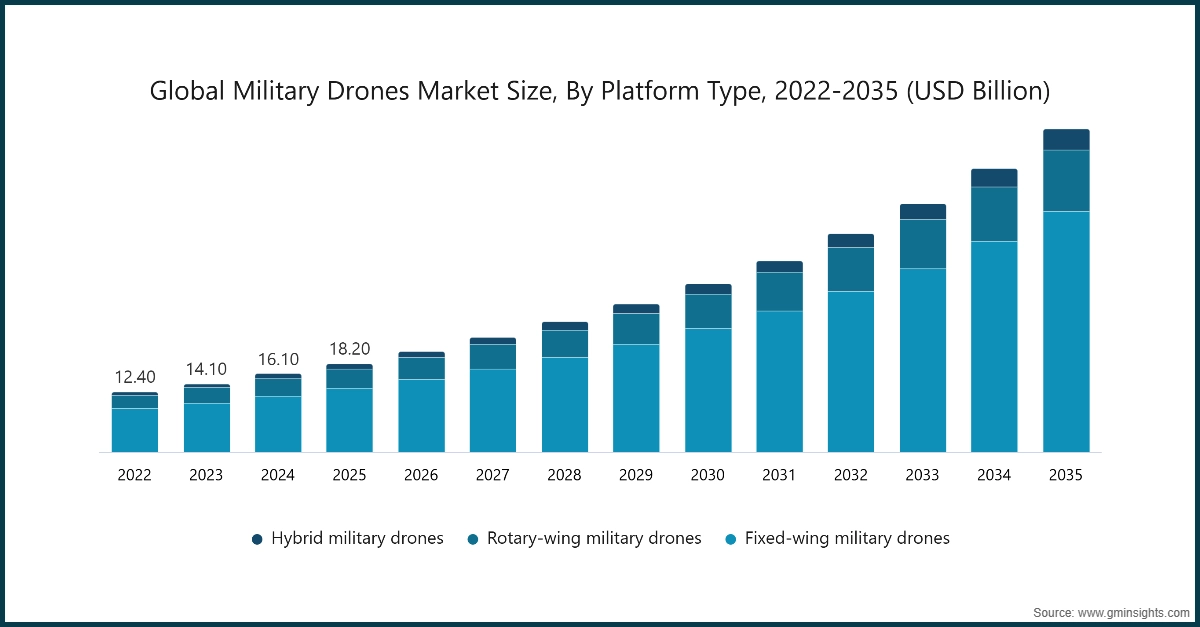

The global military drones market was valued at USD 18.2 billion in 2025. The market is expected to grow from USD 20.7 billion in 2026 to USD 39.4 billion in 2031 and USD 66.5 billion in 2035, at a CAGR of 13.8% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

Several factors contribute to the growth of the military drones market, such as the increase in defense & homeland security spending, the continual shift towards unmanned and autonomous warfare, growing need for border security and maritime surveillance, and expansion of electronic warfare and payload capabilities.

A considerable rise in global defense modernization programs and geopolitical tensions is expected to strengthen the demand for military drones industry. For instance, in August 2023, the Department of Defense in the U.S. remains to focus on unmanned aerial systems under Replicator initiatives, which in turn, promotes the deployment of UAVs specific for ISR and combat applications. Similarly, NATO members are often increasing investments in HALE and MALE drones to improve persistent interoperability and surveillance, while countries in the Asia-Pacific and Middle East region are gradually intensifying indigenous and imported UAV fleets to address maritime surveillance, border security, and asymmetric warfare requirements. Such strategic steps are likely to promote the growth of market.

Between 2022 and 2024, the market witnessed considerable growth, increasing from USD 12.5 billion in 2022 to USD 16.1 billion in 2024. Surging investments in intelligence, surveillance, and reconnaissance (ISR) and border security capabilities are gradually stimulating the need for unmanned aerial systems across major defense economies. Meanwhile, the large-scale UAV acquisition program across the U.S. and Europe are translating into firm order backlogs and persistent production demand. Strategic investments in collaborative combat aircraft, long-endurance surveillance drones, and interoperable MALE platforms exhibit a fundamental shift toward unmanned force architectures. For instance, in November 2025, Rift secured a fund of about USD 5.2 million to develop real-time aerial intelligence, with an aim to adopt operational network from a remote command center and scale its autonomous drone infrastructure in France. Henceforth, this factor is likely to strengthen the growth for market.

Military Drones Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 18.2 Billion |

| Market Size in 2026 | USD 20.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 13.8% |

| Market Size in 2035 | USD 66.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Escalating global defense expenditure | Drives 26% growth due to rising adoption of unmanned aerial platforms for combat missions, surveillance, and force modernization programs across major defense economies. |

| Geopolitical tensions & regional conflicts | Contributes 20% growth owing to border security challenges and ongoing conflicts accelerating demand for loitering, tactical, and combat drones to facilitate real-time situational awareness and precision strike operations. |

| Technological advancement in autonomous systems | Fuels 18% growth, supported by rapid progress in AI-driven navigation, sensor fusion, swarm intelligence, and assured communications, which improve mission endurance and operational efficiency of military UAVs. |

| Growing requirements for ISR capability | Account for 21% growth by rising focus of armed forces to deploy high-altitude and long-endurance drones to allow continuous monitoring, battlefield intelligence, and target acquisition with reduced human risk. |

| Pitfalls & Challenges | Impact |

| Increasing cybersecurity vulnerabilities in electronic warfare | Restrains 21% growth as the integration of advanced data links, autonomous control systems, and satellite communications exposes military drones to cyber intrusions, electronic jamming, and signal spoofing. |

| Regulatory restrictions and export control frameworks | Constrain ~17% of market growth, as strict international arms regulations and licensing requirements may limit cross-border sales, restrict technology transfer, and delay program execution, particularly for HALE and MALE platforms. |

| Opportunities: | Impact |

| Advancements in autonomous flight control, AI, and secure communications | Account for 17% growth as improvements in AI-enabled navigation, encrypted data, and sensor fusion links improve mission endurance and real-time decision-making for military drones |

| Increasing adoption of unmanned and remotely operated combat and ISR platforms | Contributes 15% growth driven by rising dependence on autonomous and remotely piloted drones for ISR and precision strike missions, allowing armed forces to conduct operations while reducing personnel exposure and enhancing operational tractability. |

| Market Leaders (2025) | |

| Market Leader |

7% market share |

| Top Players |

Collective market share in 2025 is ~31% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia-Pacific |

| Emerging countries | China, India, Vietnam, Turkey, and Ukraine |

| Future outlook |

|

What are the growth opportunities in this market?

Military Drones Market Trends

- The integration of machine learning and AI algorithms is transforming the landscape and capability of military drone, enabling real-time threat assessment, autonomous target identification, and adaptive mission planning. For instance, the U.S. Department of Defense funded USD 1.8 billion in fiscal year 2025, especially for autonomous unmanned systems development, representing a growth of about 24% from the 2024. AI-powered drones are demonstrating improved decision-making capabilities in complex battlefield environments, reducing human operator workload while enhancing mission success rates. Thus, the growing developments of AI-driven military drones are likely to positively influence market growth during the forecast period.

- Furthermore, the ongoing regional conflicts and counterterrorism operations have emphasized the effectiveness of drones for loitering munitions, precision strikes, and persistent surveillance. This creates a robust demand for both fixed-wing and rotating wing military drones, especially in combat missions applications and battlefield communication relay. This factor plays a pivotal role in expanding the growth outlook of military drones market across the world.

- Managed swarm operations are increasingly evolving the next generation of modern military capabilities. Globally, defense forces are continually investing in swarm-driven unmanned systems, which promotes confidence in large-scale, networked drone deployments. Swarm technology allows numerous UAVs to function in harmonized developments for missions, such as determined surveillance, coordinated combat operations, and electronic warfare with typical swarm sizes operating under shared command-and-control architectures. Henceforth, this factor is likely to strengthen the demand for market.

Military Drones Market Analysis The global military drones industry was valued at USD 12.5 billion and USD 14.1 billion in 2022 and 2023, respectively. The market size reached USD 18.2 billion in 2025, growing from USD 16.1 billion in 2024. Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Based on the platform type, the global military drones market is divided into fixed-wing military drones, rotary-wing military drones, and hybrid military drones. The fixed wing military drones segment accounted for 72.1% of the market in 2025.

- Fixed-wing military drones continue to have a huge impact on this trend due to their superior endurance capabilities, extended operational ranges features, higher cruise speeds, and greater payload capacities compared to alternative platform types, which further stimulates the adoption of fixed-wing drones in military application. Furthermore, the rising procurement of medium-altitude long-endurance (MALE) platforms for maritime surveillance and expeditionary operations is likely to strengthen the growth of fixed-wing market.

- The hybrid military drones segment was valued at USD 4.4 billion in 2025 and is anticipated to grow at a CAGR of 14.8% over the forecast years. The hybrid connector segment has gained momentum due to the increasing operational need for runway-independent deployments, along with the growing UAV integration in naval and shipborne surveillance.

- Manufacturers need to focus their efforts on developing hybrid military drones with strong VTOL–fixed-wing transition control that enable real-time data transmission and modular payload integration across multi mission military operations.

Based on mode of operation, the military drones market is classified into remotely piloted, semi-autonomous, and fully autonomous. The remotely piloted segment dominated the market in 2025 with a market share of 64.5%.

- The remotely piloted segment growth is driven by the continual need for communications links between ground control stations and airborne systems, with pilots and sensor operators making real-time decisions regarding flight path, sensor employment, and weapons engagement.

- Manufacturers should focus on developing high-reliability command-and-control architectures, which support mission continuity and operator trust in contested environments to meet evolving requirements in defense applications.

- The fully autonomous segment is expected to witness growth at a CAGR of 15.8% during the forecast period. The growing adoption of swarm and collaborative combat concepts to enable coordinated multi-drone operations supports the demand for fully autonomous military drones.

- As such, manufacturers must make it a priority to create robust onboard autonomy that supports military safety in communication-denied environments.

Learn more about the key segments shaping this market

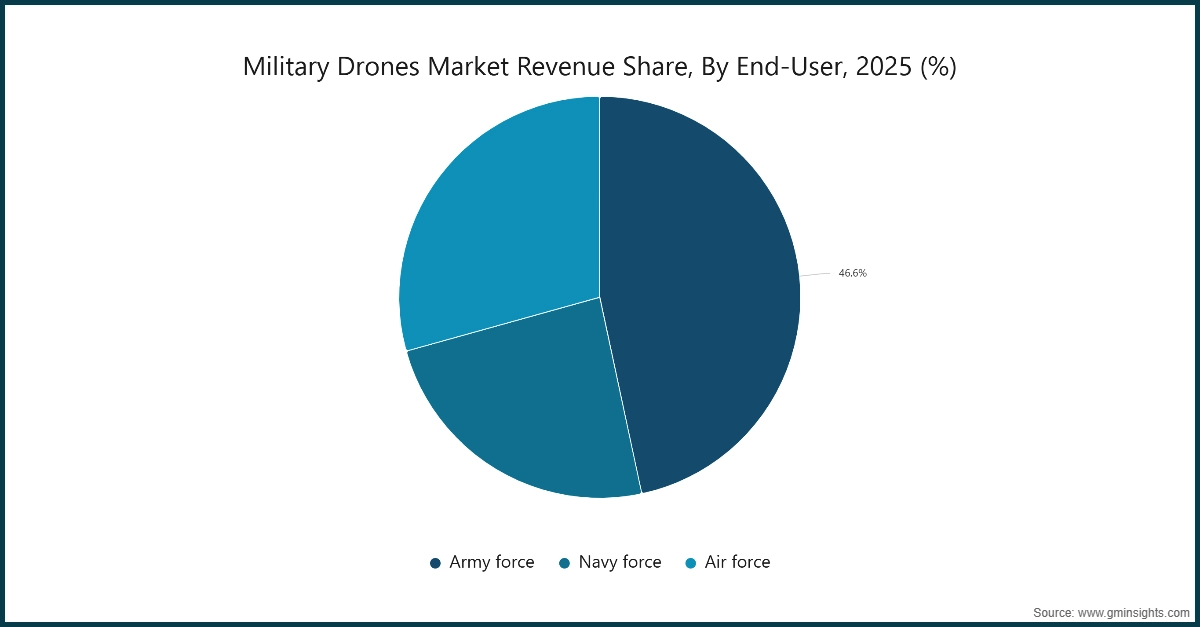

Based on end-user, the military drones market is classified into army force, navy force, and air force. The army force segment dominated the market in 2025 with a market share of 46.6%.

- The army force segment is driven by surging demand for tactical ISR and battlefield awareness to manage complex land warfare environments, along with the shift toward precision, low-cost, and swiftly deployable strike capabilities.

- Manufacturers should focus on developing rugged, lightweight, and rapidly deployable military drones that can operate in harsh land environment and tackle strike mission with reduced logistical footprint.

- The army force segment is expected to witness growth at a CAGR of 14.6% during the forecast period, owing to air forces are prioritizing military drones, especially MALE and HALE drones, for intelligence gathering and situational awareness.

- As such, manufacturers must create high-payload, and interoperable unmanned aerial platforms that support modern-day requirement of air force in securing long-range communications and seamless integration.

North America Military Drones Market

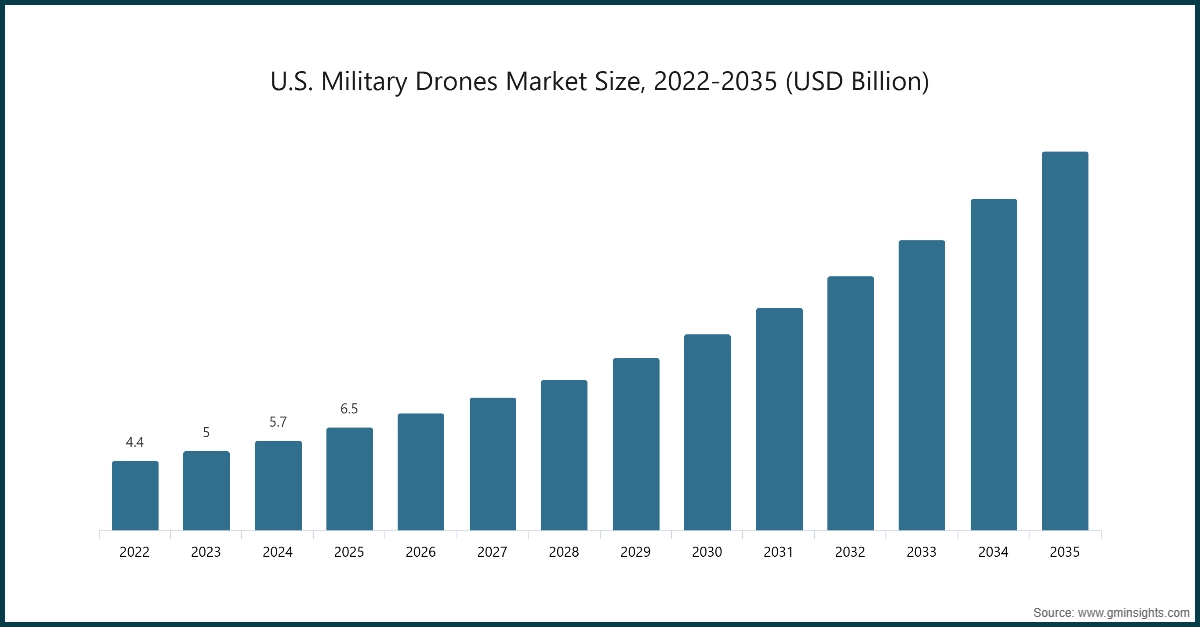

North America dominated the global military drones industry with a share of 38.9% in 2025.

- In the North American market, growing defense budget, increasing indigenous manufacturing capability to develop advanced military equipment, and rising deployments of drones for border surveillance and maritime patrol are driving the growth of the market.

- In addition, the market growth is further due to technological innovation in defense sector for improving combat operations, along with the presence of major vendors of military drones.

Looking for region specific data?

The U.S. military drones market was valued at USD 4.4 billion and USD 5.0 billion in 2022 and 2023, respectively. The market size reached USD 6.5 billion in 2025, growing from USD 5.7 billion in 2024.

- The growth of the market in the U.S. is being driven by increasing use of MALE and HALE drones, along with growing integration of drones into manned–unmanned teaming and multi-domain operations.

- Companies addressing U.S. market demand must emphasize on secure SATCOM integration, high-endurance platforms, and interoperability with C4ISR architectures to align with evolving needs of armed forces.

Europe Military Drones Market

Europe market accounted for USD 4.2 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The European market is expected to grow due to the emerging collaborative development initiatives for ISR capabilities, and increased defense spending following heightened security concerns from Russian military actions.

- In addition, the growing initiatives to promote indigenous UAV development throughout Europe drive this market.

Germany dominates the Europe military drones industry, showcasing robust growth potential.

- Germany's market is likely to driven by the increased defense budgets and replacement of aging military systems with modern capabilities.

- Companies should focus on developing interoperable, NATO-compliant platforms, and long-endurance ISR capabilities that enable substantial defense infrastructure, thereby driving the market growth.

Asia Pacific Military Drones Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 14.7% during the analysis timeframe.

- The Asia Pacific market continues to see rapid growth from an expanding geopolitical tension, along with the border security challenges in the region.

- Further, the market is driven by the rising demand for tactical drones and loitering munitions, supported by indigenous manufacturing initiatives.

China military drones industry is estimated to grow with a significant CAGR of 15.7% in the Asia-Pacific.

- China's market influenced by a range of factors, including the rising defense budget, large-scale domestic UAV production, and the increased investments in swarm technology by regulatory bodies.

- Companies operating in the Chinese market prioritize the scalable production, cost-efficient platforms, and advanced autonomous capabilities.

Latin American Military Drones Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil's market is being driven by growing requirements for border surveillance and maritime monitoring, along with rising investments in indigenous defense manufacturing.

- Manufacturers must emphasize cost-effective, adaptable UAV platforms with better ISR capabilities competent for extensive monitoring and long-duration patrol missions.

Middle East and Africa Military Drones Market

Saudi Arabia military drones' market to experience substantial growth in the Middle East and Africa in 2025.

- In the Middle East & Africa Region, ongoing force modernization programs and increased focus on border surveillance and airspace security facilitates the greater adoption of military drones is driving Saudi Arabia market growth.

- Companies targeting the region should emphasize on offering cost-effective and rapidly deployable military drone solutions that are potent enough to operate across harsh climatic conditions and diverse terrains, while aligning with confined procurement and industrial participation requirements.

Military Drones Market Share

Big players such as Northrop Grumman Corporation, Israel Aerospace Industries (IAI), General Atomics Aeronautical Systems, Thales Group, and Lockheed Martin control more than half of the military drones industry, accounting for over 31% of total market share in 2025. These key contributors are innovating in the areas of long endurance ISR platforms and UAVs, spanning across air force, navy and armed forces. Leveraging advanced avionics, system-level integration capabilities, and resilient unmanned solutions, leading vendors are well positioned to provide reliable, high?speed solutions to be capable of operating in high-threat environments. The constant focus on improving scalability and multi-domain integration stimulates their dominance across land, air, and maritime defense applications.

Several small niche players entering the military drones space. These companies support increased competition and ultimately drive technological advancements to provide specialized industry specific solutions to the emerging needs of the modular UAV systems, addressing specialized performance and environmental requirements.

Military Drones Market Companies

Prominent players operating in the military drones industry are as mentioned below:

- AeroVironment Inc.

- Airbus

- BAE Systems Inc.

- Baykar Tech

- Boeing

- Dassault Aviation

- Elbit Systems

- General Atomics Aeronautical Systems

- Israel Aerospace Industries (IAI)

- Leonardo S.p.A.

- Lockheed Martin

- Northrop Grumman Corporation

- Teledyne FLIR LLC

- Textron Inc.

- Thales Group

Northrop Grumman continues leadership in high-altitude, long-endurance and autonomous unmanned systems, combining secure satellite communications, advanced ISR sensors, and multi-domain command-and-control architectures improved for contested and denied environments.

Israel Aerospace Industries (IAI)

IAI provide a wide-ranging portfolio of tactical UAVs and MALE, notable by modular payload architectures, combat-proven airframes, and swift deployment capability, serving applications across maritime patrol, border surveillance, and multi-mission military operations.

General Atomics leads in armed UAV platforms and long-endurance, combining comprehensive flight endurance, precision strike integration, and high payload capacity to facilitate target acquisition, persistent ISR, and network-centric warfare missions.

Thales differentiate through systems-integration and sensor-centric expertise, embedding advanced radar, electronic warfare, electro-optical/infrared, and secure communications solutions into military drones to improve interoperability, situational awareness, and mission resilience.

Lockheed Martin directs on next-generation collaborative and unmanned combat aircraft solutions, leveraging strengths in stealth, autonomy, and AI-driven mission systems to provision future air combat, advanced ISR operation, and manned-unmanned teaming.

Military Drones Industry News

- In November 2025, Indian-based Larsen & Toubro (L&T) and U.S. aerospace giant General Atomics signed a strategic partnership to jointly produce advanced drones in India. The collaboration aligns closely with the Ministry of Defense’s proposed a procurement program for 87 Medium Altitude Long Endurance (MALE) drones for the Indian armed forces. This strategic step is likely to reshape unmanned aerial vehicle (UAVs) ecosystem in India.

- In February 2025, AeroVironment (AV) launched its new JUMP 20-X, a next-generation, modular Group 3 UAS intended to meet the dynamic needs of modern warfare. This development set a new standard for autonomous maritime operations, which delivers unrivaled versatility, effectiveness, and precision in contested and complex environments.

- In January 2023, Baykar secured a defense contract of USD 370 million from Kuwait, strengthening its increasing footprint in the global drone industry. This agreement underscores escalating demand from Middle Eastern defense forces for cost-effective and combat-proven UAVs, thereby improving Baykar’s competitiveness against recognized Western and Israeli UAV suppliers.

The military drones market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Platform Type

- Fixed-wing military drones

- Rotary-wing military drones

- Single rotor

- Multi rotor

- Hybrid military drones

Market, By Weight Class

- Small UAVs (<25 kg)

- Tactical UAVs (25-600 kg)

- Medium-Altitude Long-Endurance (MALE) (600-5,670 kg)

- High-Altitude Long-Endurance (HALE) (>5,670 kg)

Market, By Propulsion Type

- Electric

- Battery

- Solar

Market, By Mode of Operation

- Remotely Piloted

- Semi-Autonomous

- Fully Autonomous

Market, By Operational Range

- Visual Line of Sight (VLOS) (<5 km)

- Extended Visual Line of Sight (EVLOS) (5-25 km)

- Beyond Line of Sight (BLOS) (>25 km)

Market, By Take-Off

- Runway Launch & Recovery

- Catapult Launch & Net Recovery

- Vertical Take-off & Landing (VTOL)

- Hand Launched

- Others

Market, By Application

- Intelligence, Surveillance & Reconnaissance (ISR)

- Combat & Strike Missions

- Battlefield Communication Relay

- Electronic Warfare & Signal Intelligence

- Logistics & Resupply Missions

- Target Acquisition & Damage Assessment

Market, By End-User

- Army force

- Navy force

- Air force

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE