Summary

Table of Content

Metal Cord Grips Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Metal Cord Grips Market Size

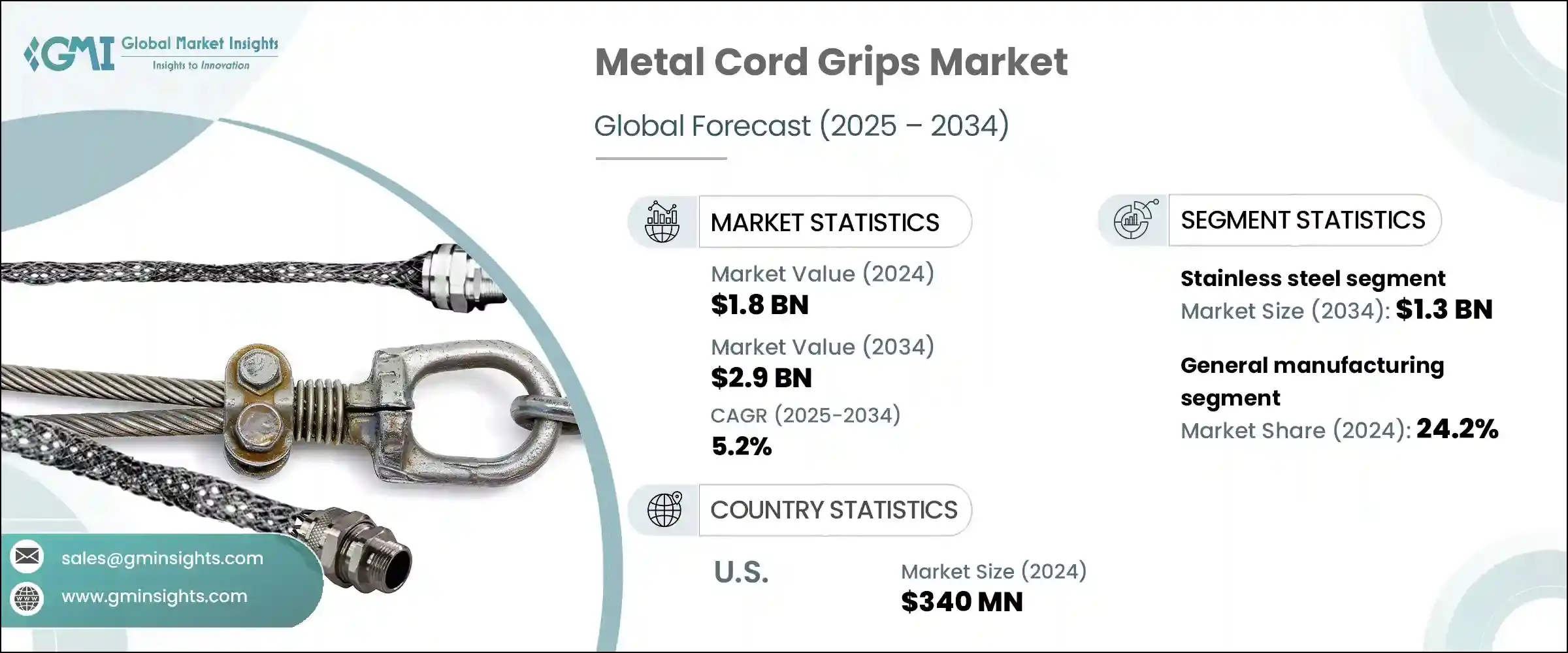

Metal Cord Grips Market was valued at USD 1.68 billion in 2023 and is anticipated to register a CAGR of 5.2% from 2024 to 2032. Global expenditures in infrastructure projects, such as transportation, utilities, and urban development, are driving the demand for metal cord grips to support large electrical and communication networks. The expansion of telecommunications infrastructure, notably the introduction of 5G networks, has created a demand for secure & efficient cable management solutions such as metal cord grips. Continuous advances in metal cord grip designs, such as enhanced sealing mechanisms and ease of installation, are making these devices more user-friendly and dependable, thereby boosting market expansion.

To get key market trends

With tighter regulations and standards for electrical installations and equipment, there is an increasing emphasis on ensuring safety and compliance. Cable glands that meet or exceed these standards, such as IP ratings, are in higher demand. The spread of industrial automation and the Internet of Things (IoT) is increasing the demand for cable glands that can safely and reliably manage cables in complex & interconnected systems. This includes electromagnetic compatibility (EMC) shielded seals to prevent interference in sensitive electronic environments.

Metal Cord Grips Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 1.68 Billion |

| Forecast Period 2024 - 2032 CAGR | 5.2% |

| Market Size in 2032 | USD 2.64 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Furthermore, the metal cord grips market is facing intense competition, not only from established players but also from new entrants and alternative products. As of 2023, the top five companies in this sector collectively held only 35% of the market share, indicating a fragmented landscape with numerous small and medium-sized enterprises (SME) vying for market share. This competition has led to price wars, with average prices of standard metal cord grips dropping by 7% between 2020 and 2023. Adding to this pressure is the growing popularity of alternative materials like high-performance plastics and composites. These materials offer benefits such as lighter weight, corrosion resistance, and in some cases, lower costs. In 2023, plastic cable glands captured 18% of the overall cable management market, up from 13% in 2020, directly impacting the metal cord grips segment.

Metal Cord Grips Market Trends

The metal cord grip market, while established, is experiencing a surge in technological advancements driven by the need for enhanced functionality, safety, and efficiency. The market has undergone significant technological advancements, driven by the increasing demand for secure and reliable cable management solutions in various industries. Metal cord grips, also known as cable glands, are essential components used to provide strain relief, sealing, and grounding for cables entering electrical equipment. These grips are predominantly made from robust materials such as stainless steel, brass, and aluminum, which offer high durability, corrosion resistance, and mechanical strength. The market has seen substantial growth due to the expanding applications in sectors like automation, manufacturing, energy, and telecommunications.

Metal Cord Grips Market Analysis

Learn more about the key segments shaping this market

Based on material, the stainless-steel segment was crossed USD 760.5 million in 2023 and is expected to reach USD 1.16 billion by 2032. Stainless steel provides excellent durability and longevity, providing a reliable cable management solution that can withstand harsh operating conditions and long-term use without damage. As the industry seeks long-term maintenance-free solutions, stainless steel cable holders are the recommended choice for critical installations. Stainless steel meets strict safety, hygiene, and environmental protection standards, making it the preferred material choice in regulated industries. Wire grippers used in the food & beverage, pharmaceutical, and petrochemical industries must meet strict compliance requirements, driving the demand for stainless steel versions.

Learn more about the key segments shaping this market

Based on end use, the general manufacturing segment witnessed a significant growth of 5.7% through 2032 and is likely to exceed USD 673.3 million by 2032. With the rise of Industry 4.0 and smart manufacturing initiatives, there is a growing demand for advanced cable management solutions that can integrate with automated systems and data-driven processes. The adoption of automation and robotics in manufacturing processes is driving the need for flexible & reliable cable management solutions. Metal cord grips play a critical role in securing and protecting cables in robotic arms, automated machinery, and production lines, ensuring uninterrupted operation and minimizing downtime.

Looking for region specific data?

Asia Pacific region captured about 36% share of the metal cord grips market in 2023 and is projected to hit USD 1.03 billion by 2032. The Asia Pacific region is experiencing rapid industrialization and infrastructure development, particularly in countries including China, India, and Southeast Asian nations. This growth fuels the demand for metal cord grips in various sectors, including manufacturing, construction, and utilities, where secure cable management is essential. The Asia Pacific region is a hub for the electronics and electrical industries, with a large number of manufacturing facilities producing consumer electronics, automotive components and industrial machinery. Metal cable holders are important components in these industries to manage cables in equipment and control panels, which drive the regional demand.

Large-scale infrastructure projects, both domestic and international, are planned in China, which would give further impetus to companies and thus accelerate the China metal cord grips growth. The increase in the demand for energy resources and technological development is expected to boost the cable sleeve market in China. Emerson Electric Co. is a technology company providing design services, industrial automation, and process control. It offers hardware and software solutions for infrastructure, heating and power companies. Emerson serves the industrial, commercial, and consumer markets. The company's products & services find applications in climate technologies, grid power, process control, and industrial automation. Emerson Electric operates in Asia Pacific, the Middle East & Africa, the Americas, and Europe.

Europe region holds a market share of 30.7% of the overall market and is expected to reach USD 845.4 million by 2032. Government initiatives, such as Horizon 2020 and Europe 2020, and manufacturing activities are increasing the demand for cable connectors in Europe. Thus, the increase in business in industrial and manufacturing industries has increased the demand for cable glands in the European region, which has boosted the metal cord grips market growth in the region over the forecast years. Increased penetration of Industry 4.0 and ICT along with increased R&D activities are driving market growth in the region. The establishment of new companies led to the adoption of green technology in Europe.

The establishment of new companies led to the adoption of green technology in Europe. In addition, companies invest heavily in the market; therefore, the adoption of green technologies in Europe and the growth of the residential sector in the region are also factors supporting the market growth.

The UK market is expected to grow in the coming years with the development of technology. Furthermore, growing demand from food processing, marine, and other industries has increased the demand for cable glands, contributing to the UK metal cord grips market growth over the forecast years.

The North America region holds a market share of 23.6% of the overall market and is expected to reach USD 532.3 million by 2032. The adoption of industrial automation technologies in the manufacturing, automotive, and aerospace industries in North America is increasing the demand for wire ropes. These components are an integral part of securing cables in automated machines, control panels, robotic systems, and production lines, ensuring safe and efficient operation.

The growing focus on renewable energy sources, such as solar, wind, and hydropower, in North America is driving the demand for metal rope handles. These components are crucial for securing cables for renewable energy installations, including solar power plants, wind turbines and hydroelectric plants, supporting the transition to clean energy. Despite oil price volatility, the oil & gas industry remains an important market for wire rod holders in North America. These components are essential for securing cables in oil rigs, refineries, pipelines, and offshore platforms, ensuring reliable electrical connections in harsh and hazardous environments.

Metal Cord Grips Market Share

The global metal cord grips industry is fragmented, with the presence of prominent players such as Hubbell Wiring, Device-Kellems, Thomas & Betts (ABB), Eaton, Lapp Group, Leviton, Mencom Corporation, Sealcon, Roxtec International AB, Panduit, R. Stahl, and Remke Industries. Manufacturers are adopting strategic steps, such as mergers, acquisitions, partnerships, and collaboration, to meet the growing consumer demand and consolidate their position in the market.

Metal Cord Grips Market Companies

Major key players operating in the metal cord grips industry include:

- Alpha Wire

- Amphenol Industrial

- Anamet Electrical

- Cooper Crouse-Hinds (Eaton)

- Eaton

- Heyco (Nexans)

- Hubbell Wiring Device-Kellems

- Lapp Group

- Leviton

- Mencom Corporation

- Panduit

- R. Stahl

- Remke Industries

- Sealcon

- Thomas & Betts (ABB)

Metal Cord Grips Industry News

- In February 2024, Mencom Corporation, a leading global manufacturer of industrial electrical connectors, successfully completed the acquisition of ELIM spol. s r.o., a leading producer of wiring harnesses located in Volary, Czech Republic. This strategic acquisition marks a significant milestone for Mencom, solidifying its footprint in Europe and enhancing its ability to locally manufacture and distribute high-quality products to a broader customer base.

- In January 2023, Panduit acquired DongWon EN-Tec Co., Ltd’s subsea cable and pipe protection product portfolio and related technologies. The product portfolio includes URAPROTECT, a polyurethane submarine cable and pipe protector solution, bend stiffeners and restrictors, and J-Tube seals for wind turbine applications. This transaction allows Panduit to offer its Asia Pacific customers a wider breadth of capabilities and a growing portfolio of complementary high-quality industrial products used for protecting power cable and fiber optic subsea cable installations against hazardous conditions.

- In April 2020, Leviton Manufacturing recalled about 98,000 electrical connectors owing to mislabeled terminal markings. The 50-amp, non-NEMA electrical connectors, plugs, receptacles and inlets pose a shock hazard. Leviton also received four reports of mismarked devices. One consumer received an electrical shock, and three others reported minor property damage.

This metal cord grips market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand units) from 2021 to 2032, for the following segments:

Market, By Material Type

- Brass

- Stainless Steel

- Aluminium

- Others

Market, By Size

- Upto 1 inch

- 1-2 inch

- 3 inch

Market, By Shape

- 45 degree elbow

- 90 degree elbow

- Straight

Market, By Cord Holding Type

- Bushing

- Screw down clamp

Market, By End Use

- General Manufacturing

- Construction

- Oil & Gas

- Energy & Power

- Transportation

- Cleanroom Environments

- Utilities

- Others

Market, by Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

Mention the key players involved in metal cord grips industry?

Alpha Wire, Amphenol Industrial, Anamet Electrical, Cooper Crouse-Hinds (Eaton), Eaton, Heyco (Nexans), Hubbell Wiring Device-Kellems, Lapp Group, Leviton, Mencom Corporation, Panduit, R. Stahl, Remke Industries, Sealcon, and Thomas & Betts (ABB)

How big is the Asia Pacific metal cord grips industry?

Asia Pacific region dominated 36% share of the metal cord grips market in 2023 and is expected to reach USD 1.03 billion by 2032, attributed to the rapid industrialization and infrastructure development.

What is the size of metal cord grips market?

The market size of metal cord grips was reached USD 1.68 billion in 2023 and is anticipated to register 5.2% CAGR between 2024 and 2032, due to the increasing manufacturing industries.

Why is the demand for stainless-steel metal cord grips growing?

The stainless-steel segment in the metal cord grips market generated a revenue of USD 760.5 million in 2023 and is expected to reach USD 1.16 billion by 2032, owing to the excellent durability and longevity for providing a reliable cable management.

Metal Cord Grips Market Scope

Related Reports