Summary

Table of Content

Menstrual Pain Relief Patches Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Menstrual Pain Relief Patches Market Size

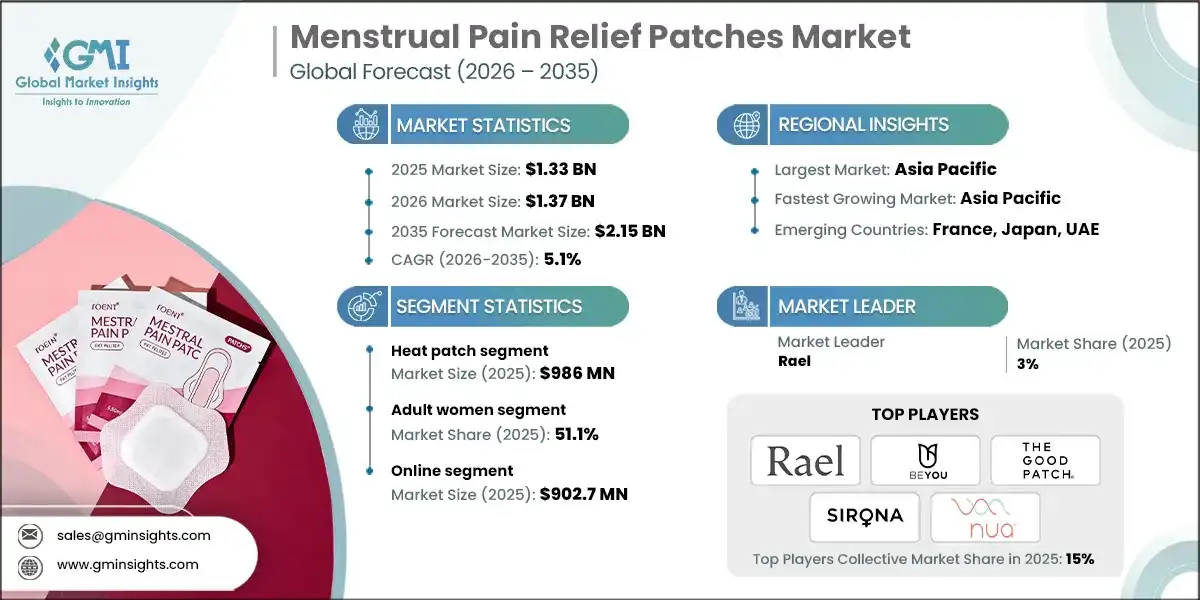

The global menstrual pain relief patches market was estimated at USD 1.33 billion in 2025. The market is expected to grow from USD 1.37 billion in 2026 to USD 2.15 billion in 2035, at a CAGR of 5.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

The growth of women focused pain management products is based around an acceptance and understanding that menstrual health is a crucial component of holistic wellness and health. Women are now more openly conversing about their cycles and how they impact them, leading to a reduction in shame and supporting the search for women’s specific needs through targeted solutions. Because most of the time women have activities that require them to be present whether they have their period, convenient and immediate access to comfort products is becoming increasingly appealing.

This shift in product preferences aligns with a large influx of products in the personal care category focused on providing a better environment, focus, flexibility, and emotional support for women to thrive in their menstrual cycles. More women are seeking effective and discreet methods of relieving their discomfort without medication, and there has been significant demand for these products due to changes in lifestyle as well as increases in the number of women participating in higher education, working outside of the home, and participating in physical activity. In today’s world where women expect a greater level of care and support during their menstrual cycles, the market for women-oriented pain management products continues to expand through normalized conversations surrounding the subject.

More women today are looking to use fewer pharmaceutical medications and reduce potential side effects from it by using herbal disposable patches for relief of menstrual pain. Because many women have preferences for clean ingredients made from plants, as well as other benefits, such as being able to have a less invasive approach to the use of herbal products, herbal disposable patches that have been created with the infusion of various natural plant and herb extracts that provide properties that soothe or warm can meet these preferences. The fact that women can apply and wear herbal disposable patches for menstrual pain relief while they are busy working, traveling, and performing their daily routines makes them even more appealing to consumers.

Multiple factors are contributing to this trend toward the use of herbal patches for menstrual pain relief among women. First and foremost, as more women seek to incorporate a holistic approach to wellness into their lifestyles, more women are becoming selective about the products they choose to use for menstrual pain relief based on how "natural" they perceive the product to be and if it is made from sustainable sources. Additionally, many women are becoming more conscious of environmental issues and are looking for products that have an eco-friendly design, which is contributing to the growing popularity of herbal disposable patches as a category that blends comfort, familiarity, and convenience. This has also created a stronger preference for women to purchase herbal disposable patches that have been developed specifically to provide effective and gentle relief for menstrual pain.

Menstrual Pain Relief Patches Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.33 Billion |

| Market Size in 2026 | USD 1.37 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.1% |

| Market Size in 2035 | USD 2.15 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rise in women pain relief product | Increase demand for all categories, encourage innovative approaches, and increase willingness of consumers to use nondrug approaches to menstrual pain. |

| Increase herbal disposable pain patches | Increase the number of health-conscious consumers using natural and clean label ingredients, which expands organic and premium as segments. |

| Growing adoption of period patches among millennials | Increase the overall growth of the market by increasing the numbers of repeat purchases, the number of customers using the internet to buy, and the visibility of products through social media. |

| Pitfalls & Challenges | Impact |

| Limited awareness among women | Slow the penetration of products into new markets (particularly in developing countries) and the potential effectiveness of product launches, education of consumers and brand-building efforts for new products. |

| Skin sensitivity, irritation & material constraints | Reduce the ongoing use of products by users and require the continued research and evaluation of hypoallergenic materials, which can raise production costs. |

| Opportunities: | Impact |

| Growing demand for natural & herbal pain relief patches | This creates opportunities for product differentiation and premium pricing, which ultimately leads to companies investing in plant-based formulations and sustainable materials. |

| Partnerships with healthcare providers & gynecologists | It builds credibility through clinical testing, thus building higher trust among consumers and increasing the adoption of these products via medical recommendations and women’s health programs. |

| Market Leaders (2025) | |

| Market Leaders |

3% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | France, Japan, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Menstrual Pain Relief Patches Market Trends

The market for menstrual pain relief patches has steadily evolved over time due to consumer demand for non-invasive and convenient options for period discomfort. Many brands now focus on comfort, portability, and natural formulations; consumers are increasingly interested in these types of products show consideration to lifestyle needs, value a company's commitment to sustainability, and provide personalized care. Menstrual health awareness has increased, and stigma has decreased, resulting in a growing number of consumers that want modern, effective, and discreet ways to relieve period pain.

- There is a growing consumer preference towards patches that contain natural ingredients with a growing emphasis on chemical-free wellness products to be clean. This is part of an overall trend in health-conscious behavior, where health-conscious users want to relieve pain/aches effectively while not having to resort to using pharmaceuticals. For these reasons, brands are incorporating calming herbs and essential oils, as well as biodegradable materials into their patches. This combination will appeal to consumers who are interested in being environmentally friendly and have sensitive skin.

- Today women are busy to focus on self-care; therefore, they want something convenient that they can put on while on-the-go. The compact nature of wearable patches has made them very popular among women who need discreet pain relief under their clothing and do not need any additional device to provide that relief, allowing them to continue working, traveling, and exercising without interruption or discomfort while using our product. The portability and simplicity of our patches have become major decision-making factors in the purchase of these products.

- Due to worries over adverse consequences associated with long-term use of OTC (oral pain medication), there is an increasing number of consumers that choose to treat themselves without taking oral medications. The application of heat and topical mechanisms on patch products provide a more concentrated, medication-free solution as a part of the trend toward developing non-invasive ways to improve health and well-being. Therefore, patches may be perceived as a gentler way to achieve pain relief without requiring much effort on the part of users.

- Manufacturers of patches are developing and marketing patches that are designed to accommodate a variety of pain levels, skin types, effectiveness durations, and levels of physical activity. Some manufacturers concentrate on providing heat for a prolonged period while others use natural ingredients or flexible adhesives in their production. This type of product differentiation means that patches can provide a variety of user-customized alternatives.

Menstrual Pain Relief Patches Market Analysis

Learn more about the key segments shaping this market

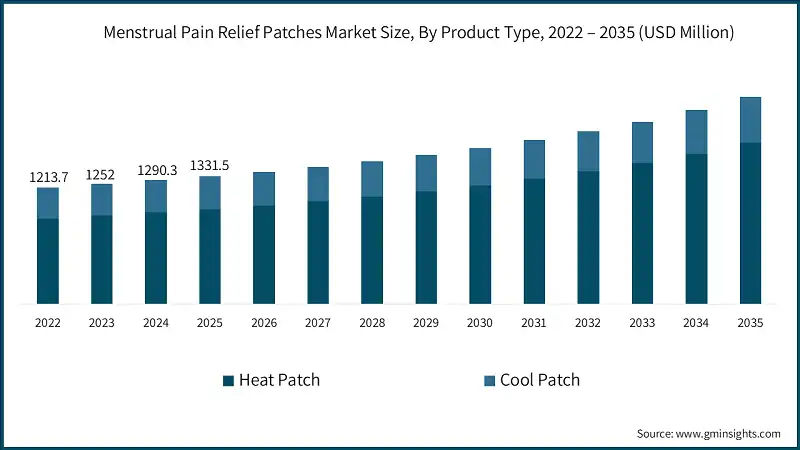

Based on product type, the market is divided into heat patch and cool patch. In 2025, heat patch held the major market share, generating a revenue of USD 986 million.

- Menstrual heat pain relief patches are now one of the most common product types in this category. The main benefit is that they are a simple and non-medicated method of relieving menstrual cramps. Heat-based menstrual pain relief patches provide continuous heating in the abdominal region and back, allowing for muscle relaxation and providing comfort to the affected area. This type of heat patch is especially appealing to consumers who prefer natural methods of pain relief. Therefore, many women choose heat patch products over any other way to manage their monthly discomfort during their period.

- This segment of products has been greatly influenced by design features, such as using soft and flexible materials, as well as using skin safe adhesive products which allow users to wear them with total discretion while moving around under their outer garments. Also, manufacturers of these products continue to create comfort solutions and improve their product's design characteristics, such as creating thinner designs, fabric options that promote breathability during use, and longer heating periods. In addition to these new design features, as consumers are increasingly looking for more convenient ways to wear heat patches all day long with the greatest level of convenience, heat patch manufacturers are increasingly focusing on design features that are ultra lightweight, conform to a user's natural body shape and provide consistent thermal temperature control.

- The heat patch segment is benefiting from consumerism and the emphasis on mobility, wellness, and self-care. New product offerings are being developed using environmentally friendly materials, fragrance-free varieties, and re-useable/heating elements to be congruent with changing consumer values. As the product category of heat patches combines effectiveness, comfort, and simplicity into one product category, they will continue to grow as a base part of product offerings, particularly among consumers who desire a less intrusive, more accessible method of alleviating menstrual discomfort.

Learn more about the key segments shaping this market

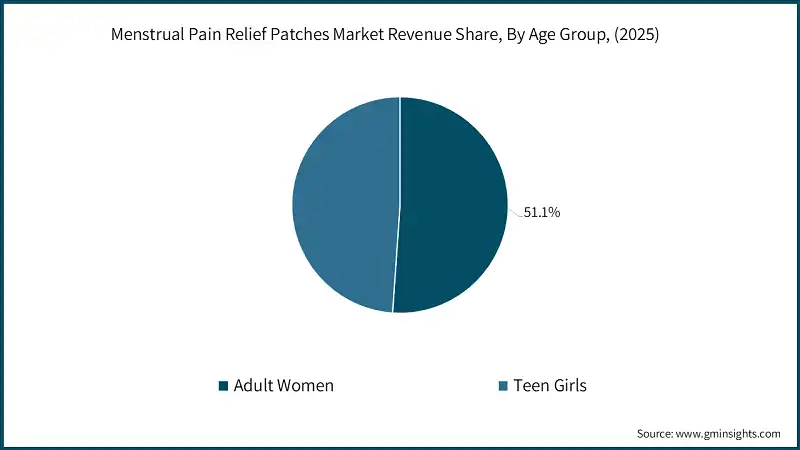

Based on age group, the menstrual pain relief patches market is segmented into adult women and teen girls. The adult women segment held the largest share, accounting for 51.1% of the market in 2025.

- Adult Women are typically considered a broad and diverse demographic group and often represent a variety of life stages, responsibilities and health issues. As a group, they commonly juggle multiple roles personal, professional, and family and this assortment of various roles impacts their preferences regarding wellness, lifestyle, and other consumer product categories. The majority of adult women's purchases are based on a desire to purchase reliable and convenient solutions that can help them with their day-to-day comfort and productivity.

- Health and wellness have become extremely important to most adults in this demographic group. In fact, many are now putting an increased emphasis on buying products that help improve their physical comfort, emotional balance, and overall self-care. These products can take the form of solutions that provide practical, discreet and effective options for menstrual health, stress management, and mobility. As awareness continues to increase about the need for preventive wellness care, more adult women are seeking products that provide long-term benefits rather than short-term fixes.

- When adult females have products that meet their expectations, they are likely to be brand loyal. Therefore, they prefer products that contain a combination of function, quality, and user-centered design. Brands that solve their daily challenges through empathy, convenience and clarity provide engaging experiences, which is why they are seen as a key growth segment in the many types of products sold in the categories of personal care, wellness, hygiene and lifestyle.

Based on distribution channel, the menstrual pain relief patches market is segmented into online and offline. In 2025, online segment held a major market share, generating a revenue of USD 902.7 million.

- Online distribution channels enable consumers to shop from home via web, mobile app, or digital platforms; they can view, compare and buy products from their devices of choice. Since they can view all available products in one location, it makes it easy for consumers to find the product that meets their needs by checking out different options, reading reviews, and determining which option best meets their needs. For this reason, shopping online has become very popular among consumers.

- Additionally, the convenience of product delivery and returns is a big advantage of using the online channel. After the purchase has been made, the item(s) will be delivered directly to the customer and may also include a tracking option so that the customer is aware of when their package will arrive. In addition, many online retailers have easy return policies that give customers peace of mind to purchase items sight unseen. As a result, the online distribution channel has created a convenient and flexible shopping process that fits into the busy lifestyles of today’s consumers.

Looking for region specific data?

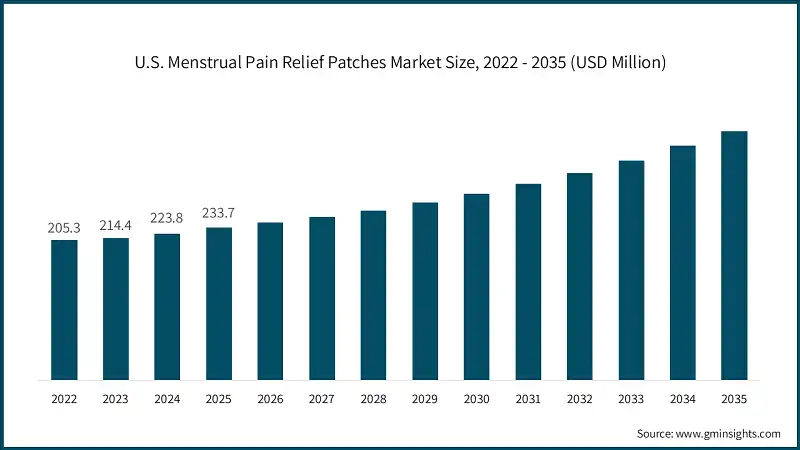

North America Menstrual Pain Relief Patches Market

In 2025, the U.S dominated the North America market, accounting for around 62% and generating around USD 233.7 million revenue in the same year.

- Over the last few years, there has been increasing popularity among American women for menstrual relief dresser because they are searching for comfortable and easy options for dealing with menstrual cramps. As such, most women have expressed an interest in trying out these types of products since they are convenient, easy to carry around, and non-irritating to the skin. Due to the high level of availability of these products, both retail and online, many more women can learn about these products and incorporate them into their personal care regimen.

- North America, contraceptive patch usage for menstrual-related discomfort has become commonplace as many individuals seek a non-medicated and gentle method of alleviating discomforts that accompany the menstrual cycle. Patches provide an alternative to over-the-counter medications; patches can be easily integrated into busy schedules whether working, attending school, or spending time with family while travelling. As consumer awareness increases regarding the advantages of choosing a patch or similar products that relieve menstrual-related discomfort, the demand for these types of products will continue to rise as new types of patches enter into the marketplace.

Europe Menstrual Pain Relief Patches Market

Europe market held 22.2% share in 2025 and is expected to grow at 4.5% during the forecast period.

- The trend toward using patches to relieve period pain in Europe is on the rise as more people are beginning to seek out more gentle, non-medicated methods for relieving their discomfort. The convenience of wearing them during work, business trips or while going about one's day has made the option of using a patch much more appealing. Since the majority of patches can be worn under clothing, many people find they are a great option for those with busy schedules and prefer products that are easy to use.

- Due to increased awareness of menstrual health, patches, which can be found at pharmacies, supermarkets and through online retailers, are becoming increasingly available in all European countries. Many people are now looking forward to the opportunity of trying newer comfort-oriented products, such as period patches, and the consistent growth in interest for patches will continue to provide women with more options besides traditional methods of alleviating period cramping, such as hot water bottles or over-the-counter medications.

Asia Pacific Menstrual Pain Relief Patches Market

The Asia Pacific leads the market with a share of around 33.2% in 2025 and is anticipated to grow with a CAGR of around 5.9% from 2026 to 2035.

- The Asia Pacific Region has become the dominant region within the Menstrual Pain Relief Patch Market. There are many countries in this region where people's active lifestyles have increased the need for women's practical, portable alternatives for relieving menstrual discomforts. Patches are an ideal solution for women who lead busy lives with shorter schedules due to long workdays and constant travel. Patches offer women the ability to discreetly wear menstrual pads while they are commuting to work at their desks working, or studying at school, making them a convenient solution. In addition, patches are lightweight and are not medicated; therefore, they provide a similar level of comfort to the consumer who prefers non-invasive and daily solutions for comfort and support.

- The Asia-Pacific region has also experienced significant exposure to a wide variety of self-care formats, including both conventional and contemporary self-care items. With growing awareness about menstruation and the importance of physiological comfort during menstruation, patches fill a unique gap in the category and provide an additional opportunity for women to access an ongoing source of relief from their period pain. As more people become familiar with patches through both brick-and-mortar and online stores, patches will undoubtedly become more ingrained in everyday self-care practices throughout the Asia-Pacific region.

Latin America Menstrual Pain Relief Patches Market

Latin America market is growing at a CAGR of 3.4% during the forecast period.

- Countries in Latin America are beginning to recognize the benefits of menstrual pain relief patching as more people are looking for affordable options that can help keep them comfortable during their menstrual cycles. Many women are balancing busy work schedules and family responsibilities and need to find a way to relieve discomfort without having to stop everything. These patches provide an easy way to continue with one's daily life and are appealing due to their portability and ease of use for those seeking a quick and gentle method of obtaining relief.

- As more products related to menstrual comfort are being introduced into the marketplace, more women are learning about different patch formats available to them. As the number of retailers carrying these products expands and as more women gain access to patches via online shopping, there is an increasing number of options available to women who are looking for products that fit their individual needs and schedules. The trend of women incorporating patches into their self-care routines is growing steadily, because of the increased familiarity with these products.

Menstrual Pain Relief Patches Market Share

Rael is leading with 3% market share. Rael, BeYou, The Good Patch, Sirona Hygiene and Nua Lagom Labs collectively hold around 15%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Sirona is a modern health and wellness company that addresses common everyday ailments with easy-to-use, intuitive products. Sirona’s menstrual pain relief patches provide fast relief from menstrual cramps and have a mild ingredient formulation that allows them to be easily incorporated into a busy lifestyle. They believe it is important to provide people with the comfort and accessibility of being able to use their products anywhere and anytime, whether you are at work, on vacation or at home. Sirona provides users with easy-to-use, mess-free solutions that are the perfect support for a healthy menstrual cycle.

Nua's brands have developed an identity that revolves around providing easy-to-use menstrual care solutions that are comfortable, clean, and thoughtfully designed to be integrated into our daily lives. The Pain Relief Patch is similar in design philosophy, providing users with support through skin-friendly materials and calming ingredients, allowing them to utilize these patches during their everyday routines to reduce the discomfort of period pain. The focus on simplicity and user-centered design appeals to consumers who want non-medicated options, are value oriented, and are seeking ways to remain active during their menstrual cycles.

Menstrual Pain Relief Patches Market Companies

Major players operating in the menstrual pain relief patches industry are:

- BeBodywise

- BeYou

- Care Me

- Cora Life

- Indocoar Pharma

- La Mend

- Lilas Wellness

- Medi Heally Philippines

- Nua Lagom Labs

- P&G

- Popband

- Rael

- Sirona Hygiene

- Sparsha Pharma

- The Good Patch

- Unexo Life Sciences

BeBodywise, it creates product lines with a wellness-driven philosophy. The company offers products formulated thoughtfully crafted to deliver comfort and address women's overall health needs with all natural calming ingredients. One main product in our line is the beBodywise menstrual pain relief patch. The patch has a thin and breathable design that allows you to wear it comfortably and discreetly underneath everyday clothing. The ease of use and body-friendly materials make our menstrual pain relief patch an ideal alternative to medications. It creates an easy way for individuals to manage cramps comfortably, always, while still being able to move freely throughout their days.

Cora Life promotes a clean and body-conscious menstrual care philosophy, putting comfort and experience at the forefront of its products. Cora Life’s menstrual relief patches utilize natural heat sources to deliver a continual warmth supply and relieve cramping by relaxing the body's muscle tissues and lowering tension associated with muscle spasms. Cora Life's menstrual relief patches are soft, flexible, easy to wear, and great options for those seeking soothing comfort but do not want to turn to medication. The way in which Cora Life’s menstrual relief patches provide warmth and comfort is intended to fit easily into daily self-care practices.

Menstrual Pain Relief Patches Industry News

- In March 2025, Rael has expanded its US retail footprint by launching its cramp/pain relief products, including its menstrual heating pad, into mass retailers, part of its national growth plan. Rael's expansion includes launches in Walmart, Ulta Beauty, and Walgreens; online and in-store. Rael will launch its organic period care line into Walmart beginning in May and its pain-relief products will be available in even more locations shortly thereafter. By expanding to 50,000 retail doors, Rael's goal is to provide access to their clean, cycle-care and pain relief products powered by Korean technology.

- In August 2024, Cora released advanced heat relief patches to offer continuous warmth of up to eight hours via naturally activated carbon. The patches also combine the soothing properties of herbal ingredients, including raspberry leaves, dandelion roots, and cramp bark, to help relieve menstrual cramps.

- In 2024, Cora has expanded its range of menstrual comfort products to include a series of advanced heat relief patches that may reach up to 145 degrees F. These patches dispense heat using activated carbon while using a combination of raspberry leaf, dandelion root, comfrey root, cramp bark and nettle leaf to maintain prolonged heat relief during activities.

- In 2024, BeYou improved upon the natural cooling menstrual pain relief patches by optimizing the slow-release matrix of their ingredients (menthol and eucalyptus oil), which gave longer-lasting soothing sensations (up to 12 hours), and redesigned the ultra-thin, biodegradable patch making it easy to wear under clothing throughout the day.

The menstrual pain relief patches market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) & volume (Million units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Heat patch

- Cool patch

Market, By Warming Comfort

- 8 hours

- 9 to 10 hours

- 11 to 12 hours

Market, By Price

- Low

- Medium

- High

Market, By Age Group

- Adult women

- Teen girls

Market, By Distribution Channel

- Online

- E-commerce

- Company website

- Offline

- Specialty store

- Mega Retail stores

- Others (Individual Stores, Departmental Stores, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the menstrual pain relief patches market?

Key players include BeBodywise, BeYou, Care Me, Cora Life, Indocoar Pharma, La Mend, Lilas Wellness, Medi Heally Philippines, Nua Lagom Labs, and P&G.

What are the key trends in the menstrual pain relief patches industry?

Key trends include a growing preference for natural and chemical-free products, the use of biodegradable materials, and increasing consumer demand for sustainable and personalized solutions.

Which region led the menstrual pain relief patches market in 2025?

The U.S. dominated the North America market in 2025, accounting for approximately 62% of the regional market and generating USD 233.7 million in revenue.

What was the revenue generated by the heat patch segment in 2025?

The heat patch segment generated USD 986 million in 2025, holding the largest share in the product type category.

What was the market share of the adult women segment in 2025?

The adult women segment accounted for 51.1% of the market in 2025, leading the age group segmentation.

How much revenue did the online distribution channel generate in 2025?

The online distribution channel generated USD 902.7 million in 2025, dominating the distribution channel segment.

What was the market size of the menstrual pain relief patches market in 2025?

The market size was USD 1.33 billion in 2025, with a CAGR of 5.1% expected through 2035, driven by increasing demand for non-invasive and convenient period pain relief solutions.

What is the projected value of the menstrual pain relief patches market by 2035?

The market is expected to reach USD 2.15 billion by 2035, fueled by rising consumer preference for natural formulations, sustainability, and personalized care products.

Menstrual Pain Relief Patches Market Scope

Related Reports