Home > Chemicals & Materials > Polymers > Medical Polymers > Medical Styrenic Polymers Market

Medical Styrenic Polymers Market Analysis

- Report ID: GMI1821

- Published Date: Jul 2020

- Report Format: PDF

Medical Styrenic Polymers Market Analysis

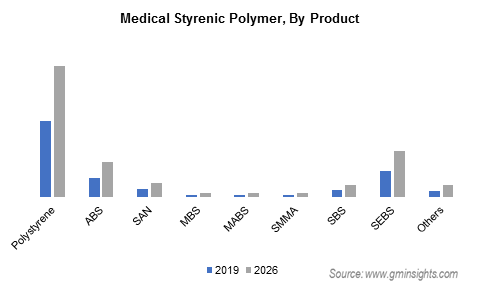

Polystyrene will constitute approximately 50% of the total industry share in 2026. It is the most widely applicable styrenic polymer in the medical industry. It provides several desirable attributes such as excellent flow consistency and color stability, good resistance to ethylene oxide sterilization process, UV light sterilization process as well as to gamma and electron beams.

ABS and SEBS are other major segments in the overall market. Acrylonitrile butadiene styrene held a market share of over 12% in terms of revenue in 2019 and is projected to grow at a CAGR of over 6% during the review period. The other medical styrenic polymers market segment include Acrylonitrile Styrene Acrylate (ASA), Styrene Isoprene Butadiene Styrene (SIBS), Unsaturated Polyester Resin (UPR), etc. ASA exhibits similar properties to ABS such as high gloss, good chemical and heat resistance and high impact strength at low temperatures hence are widely used in medical devices across the globe.

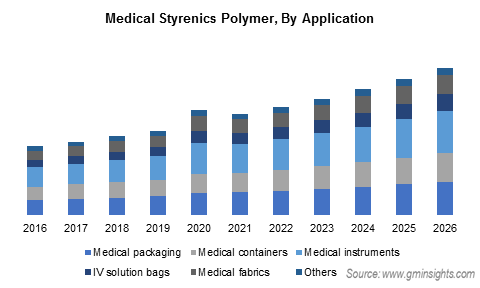

Medical instrument was the largest segment in 2019 and is projected to exhibit a CARG of 6.8% throughout the forecast period. Medical instruments segment includes medical drip chambers, dry powder inhaler, diagnostic instruments, disposable laboratory ware, petri dishes, tissue culture components, flasks, pipettes, etc. The growing demand for styrenic polymers in these applications shall substantially contribute to the growth of the medical styrenic polymers market segment during the assessment period.

Moreover, the ongoing pandemic across the globe has further propelled the demand for medical instruments in turn boosting the demand for medical styrenic polymers. The aforementioned trends along with stringent regulations against using harmful polymer materials has triggered demand for styrene-based polymers in medical instruments which shall further generate substantial gain for the medical styrenic polymers market.

Medical packaging was another major segment in 2019 and held a market share of over 22% in terms of revenue. Stringent regulations imposed by regional regulatory bodies to reduce impact of harmful and toxic materials release in the environment is a key factor which is replacing conventional polymers such as polycarbonate, polyvinyl chloride, etc. with styrene-based polymers as packaging material in the medical industry. Styrenic polymers are plasticizer free and impose no or minimum harm on the environment. For instance, polystyrene which is the most common styrenic polymer as packaging materials owing to its excellent environmental qualities.

The other application segment held a market share of over 5% in 2019. The other application segment for medical styrenic polymer market includes hemodialyzer housing, medical tubing, IV connectors, valves, multi flow devices, etc. which are formed from ABS, SAN, MBS, Polystyrene, etc.

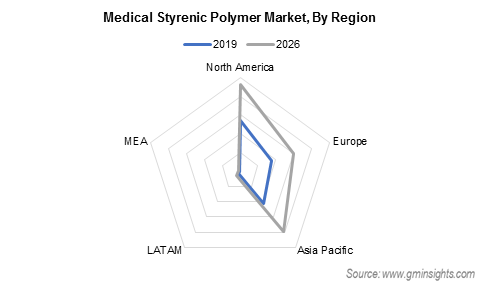

North America held the largest share of over 38% of the total market size in 2019. This can be attributed to growing healthcare spending in the North American region. Moreover, the presence of strict healthcare standards and regulations has resulted in the substitution of conventional metallic devices to thermoplastic elastomer owing to their easy processability and their compliance with the environmental regulations. North American market was closely followed by the European market and shall exhibit similar growth trends throughout the giver period 2020-2026