Summary

Table of Content

Medical Drone Delivery Services Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Medical Drone Delivery Services Market Size

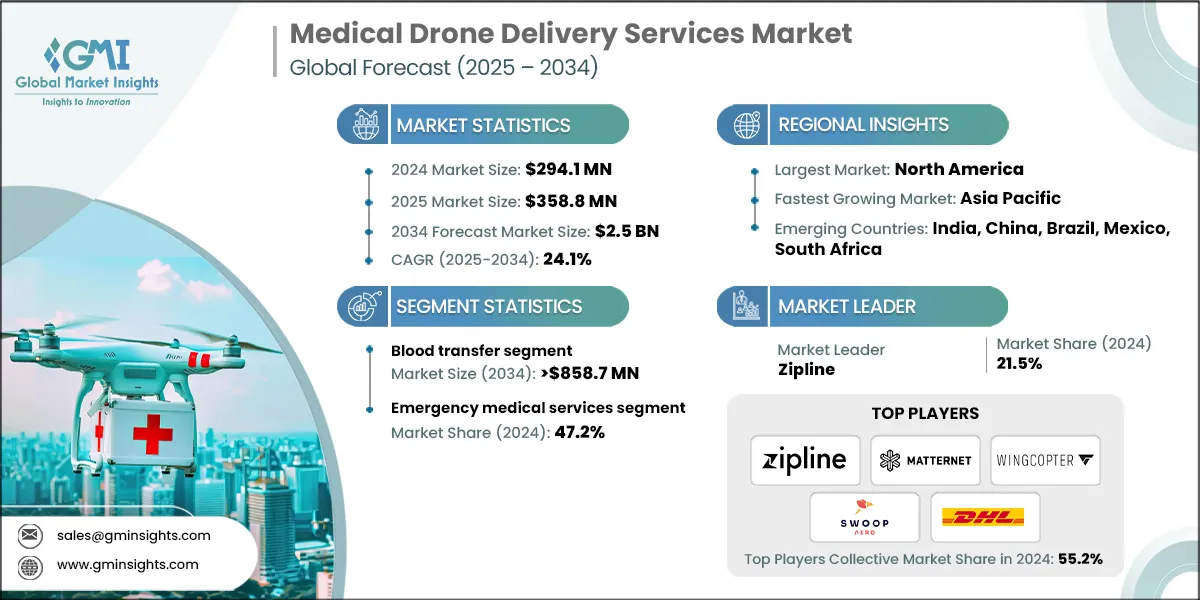

The global medical drone delivery services market size was valued at USD 294.1 million in 2024. The market is expected to reach from USD 358.8 million in 2025 to USD 2.5 billion in 2034, growing at a CAGR of 24.1% during the forecast period, according to the latest report published by Global Market Insights Inc. Increasing need for fast medical deliveries, government policies, advances in technology, and increasing use of drones in healthcare fuel the growth of the market.

To get key market trends

The medical drone delivery service market provides cutting-edge logistics solutions to hospitals, blood banks, pharmaceutical firms, and health technology providers, enhancing delivery speed, operational efficiency, and patient outcomes. Solutions range from autonomous drones and hybrid VTOL aircraft to integrated delivery platforms for blood, vaccines, laboratory samples, and pharmaceuticals. Major players like Zipline, Matternet, Wingcopter, Swoop Aero, and DHL achieve a competitive edge by constantly developing their drone motor technologies, increasing global presence, establishing strategic alliances, and investing heavily in research and development to address mounting healthcare delivery needs and increase their market presence.

Medical Drone Delivery Services Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 294.1 Million |

| Market Size in 2025 | USD 358.8 Million |

| Forecast Period 2025 - 2034 CAGR | 24.1% |

| Market Size in 2034 | USD 2.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing application of medical drone in the healthcare industry | Accelerates rapid delivery of blood, vaccines, lab samples, and pharmaceuticals, enhancing operational efficiency, emergency response, and overall patient care outcomes globally. |

| Rising number of government initiatives | Innovations in autonomous navigation, hybrid VTOL drones, payload capacity, and cold-chain integration improve reliability, efficiency, and safety, driving large-scale adoption across hospitals and healthcare providers. |

| Growing public acceptance | Increased trust and awareness of drone-based medical logistics fosters broader implementation, encouraging hospitals, blood banks, and pharmaceutical companies to integrate drone services efficiently. |

| Pitfalls & Challenges | Impact |

| Complications associated with medical drone | Technical failures, regulatory restrictions, and safety concerns may delay deliveries, limit adoption, and increase operational risks, potentially affecting emergency medical services and patient outcomes. |

| Opportunities: | Impact |

| Expansion in remote and rural healthcare access | Deploying drones in underserved regions ensures timely delivery of critical medical supplies, improves accessibility, and strengthens emergency response in geographically challenging areas. |

| Integration with smart healthcare infrastructure | Linking drones with IoT, AI, and digital health platforms enhances monitoring, route optimization, supply tracking, and predictive logistics, enabling smarter, faster, and more efficient medical delivery systems. |

| Market Leaders (2024) | |

| Market Leaders |

21.5% Market Share |

| Top Players |

Collective market share in 2024 is 55.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

The market has increased from USD 163.9 million in 2021 and reached USD 241.4 million in 2023. The market is witnessing rapid growth, driven by multiple interrelated factors that collectively enhance the adoption of drone technology in healthcare logistics. One of the primary drivers is the rising demand for rapid and efficient medical deliveries, particularly in remote, rural, and hard-to-reach areas where traditional transport systems are slow or inadequate.

Drones facilitate quick transportation of blood, vaccines, lab samples, and pharmaceuticals, reducing delivery times and improving patient outcomes. Government initiatives and supportive regulatory frameworks further accelerate market growth, as several countries are implementing pilot programs, funding drone-based healthcare delivery projects, and streamlining airspace regulations to enable commercial medical drone operations.

Technological advancements in drone design, including autonomous navigation, hybrid VTOL (vertical take-off and landing) capabilities, enhanced payload capacity, and cold-chain integration, are enabling drones to handle sensitive medical supplies safely and efficiently. Additionally, the growing acceptance of drones within healthcare institutions, pharmaceutical companies, and emergency medical supplies is fostering wider adoption, as stakeholders recognize the potential for improved operational efficiency, reduced logistics costs, and faster emergency response.

Strategic initiatives by key players, including partnerships with hospitals and government agencies, pilot programs, and continuous innovation in drone platforms, reinforce market momentum. Furthermore, the integration of digital tracking, AI-based route optimization, and IoT-enabled payload monitoring enhances the reliability, safety, and traceability of deliveries, making drone logistics increasingly viable for large-scale healthcare operations.

Medical drone delivery services refer to the use of unmanned aerial vehicles (drones) to transport medical supplies, including blood, vaccines, lab samples, and pharmaceuticals, quickly and efficiently. These services enhance healthcare logistics, improve patient outcomes, reduce delivery times, and support hospitals, blood banks, pharmaceutical companies, and emergency medical operations.

Medical Drone Delivery Services Market Trends

The increased use of medical drones in the healthcare sector has come out as a key driver of the market. Healthcare institutions, blood banks, hospitals, and drug manufacturing firms are widely deploying drone technology to ensure secure, efficient, and fast transportation of vital medical materials such as vaccines, blood, lab samples, and critical drugs.

- This trend is driven by the imperative to shorten delivery times, particularly in distant, rural, and hard-to-reach locations where traditional transport tends to be slow, unreliable, or nonexistent. The inclusion of medical drones not only increases operational effectiveness but also improves patient outcomes by enabling timely access to life-preserving medicines and treatments.

- Technological advancements play a key role in expanding drone applications within healthcare. Innovations such as autonomous navigation systems, hybrid vertical take-off and landing (VTOL) capabilities, payload optimization, cold-chain logistics integration, and real-time tracking enable drones to handle sensitive medical products safely and efficiently. AI-powered route planning and IoT-enabled monitoring further enhance reliability, predictability, and operational transparency, making drone delivery systems a viable alternative to traditional logistics.

- Microeconomic factors, such as cost efficiency, reduced transportation expenses, and improved delivery speed, encourage healthcare providers and pharmaceutical companies to adopt drones as part of their supply chain strategies. On a macroeconomic level, rising government investments, supportive regulations, and public-private partnerships facilitate infrastructure development and nationwide deployment of medical drone services. Additionally, increasing public awareness and trust in drone technology further encourages adoption.

- Overall, the growing application of medical drones is transforming healthcare logistics by bridging critical gaps in supply chains, enhancing emergency medical services, and supporting large-scale vaccination or pharmaceutical programs.

Medical Drone Delivery Services Market Analysis

Learn more about the key segments shaping this market

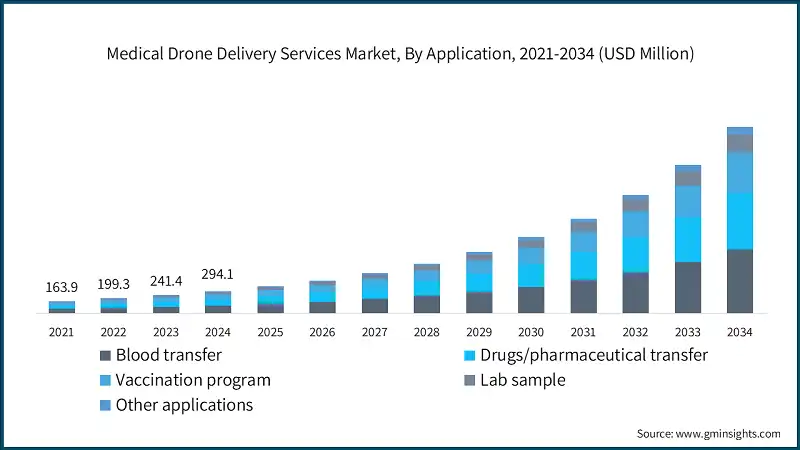

The global market was valued at USD 163.9 million in 2021. The market size reached USD 241.4 million in 2023, from USD 199.3 million in 2022.

Based on the application, the market is segmented into blood transfer, drugs/pharmaceutical transfer, vaccination programs, lab samples, and other applications. The blood transfer segment has asserted its dominance in the market by securing a significant market share of 35.9% in 2024, driven by rising demand for rapid blood delivery in emergencies and remote areas, driving adoption, improving patient outcomes, and increasing healthcare efficiency. The segment is expected to exceed USD 858.7 million by 2034, growing at a CAGR of 23.5% during the forecast period.

On the other hand, the drugs/pharmaceutical transfer segment is expected to grow with a CAGR of 24.8%. The growth of this segment can be attributed to the need for timely, secure medication distribution in hospitals and pharmacies, fuels drone adoption, reducing delays and operational costs.

- The blood transfer segment dominates due to the critical need for rapid and reliable transportation of blood between hospitals, blood banks, and emergency medical centers. Timely delivery is essential for surgeries, trauma care, and emergency transfusions, where even minimal delays can have life-threatening consequences.

- Drones shorten transit time dramatically, especially in far-away, rural, or traffic-jammed urban areas, with the added benefit of quicker response and better patient outcome. Advances in technology, including autonomous navigation, real-time monitoring, and cold-chain-capable payloads, make blood transport safer and more reliable.

- Additionally, government initiatives and partnerships between healthcare providers and drone service companies are expanding the adoption of blood delivery drones. Increasing awareness among hospitals and healthcare organizations regarding the cost-effectiveness, operational efficiency, and potential to save lives further drives the segment’s growth.

- The drugs and pharmaceutical transfer segment held a revenue of USD 83.9 million in 2024, with projections indicating a steady expansion at 24.8% CAGR from 2025 to 2034. The segment is propelled by the need for efficient, reliable, and timely distribution of essential medicines, vaccines, and specialty drugs. Pharmaceutical companies and hospitals are increasingly leveraging drones to overcome logistical challenges in transporting temperature-sensitive or time-critical medications.

- Technological innovations such as cold-chain integration, hybrid VTOL drones, and autonomous navigation enable secure delivery while maintaining drug efficacy.

- Microeconomic factors, including cost reduction in last-mile delivery and faster fulfillment times, encourage adoption, while macroeconomic drivers like government support for innovative healthcare logistics facilitate broader deployment.

- The vaccination program segment held a revenue of USD 62.8 million in 2024, with projections indicating a steady expansion at 24.3% CAGR from 2025 to 2034. The vaccination program segment is gaining momentum as drones provide rapid, scalable, and safe delivery of vaccines to urban and hard-to-reach rural regions.

- Immunization campaigns, particularly for COVID-19, polio, and seasonal influenza, require timely distribution under stringent temperature-controlled conditions, which drones can efficiently manage.

- Technological advancements, such as IoT-enabled cold-chain monitoring, GPS-guided navigation, and autonomous delivery systems, ensure vaccine integrity, accurate delivery, and reduced wastage.

Learn more about the key segments shaping this market

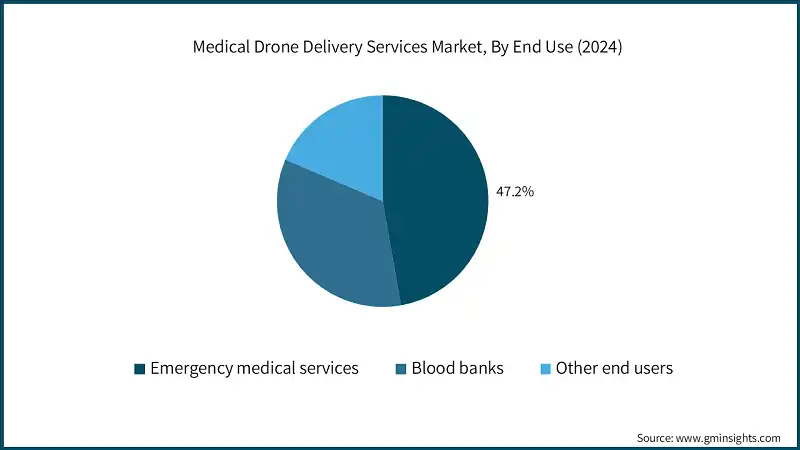

Based on end use, the medical drone delivery services market is classified into emergency medical services, blood banks, and other end users. The emergency medical services segment dominated the market with a revenue share of 47.2% in 2024 and is expected to reach USD 1.2 billion within the forecast period.

- The two largest segments accounted for over 81.4% of the total market value. The market is led by the emergency medical services segment based on the exigent demand for the fast transportation of life-saving medical supplies. Drones are a fast and reliable method for the delivery of blood, vaccines, lab specimens, and critical medications to emergency response teams, trauma centers, and hospitals, with drastically lowered response times in comparison to traditional road transport.

- Advances in technology such as autonomous driving, real-time monitoring, and AI-based route optimization facilitate accurate, secure, and effective deliveries, even to crowded urban centers or far-flung areas.

- Government initiatives and public-private partnerships further encourage EMS adoption by providing funding, regulatory support, and pilot programs for drone integration.

- The blood banks segment held a revenue of USD 100.5 million in 2024, with projections indicating a steady expansion at 23.4% CAGR from 2025 to 2034. The blood banks segment is driven by the need for timely and secure transport of blood and blood products to hospitals and clinics, ensuring patient safety and operational efficiency.

- Medical drones offer a transformative solution by enabling rapid delivery between blood banks, donation centers, and healthcare facilities, minimizing delays in transfusions during emergencies or routine operations.

- Technological innovations such as cold-chain integration, autonomous navigation, and IoT-enabled monitoring allow sensitive blood products to be transported safely while maintaining quality and compliance with regulatory standards.

- Rising government support, regulatory facilitation, and partnerships with healthcare organizations encourage the adoption of drones in blood logistics.

Looking for region specific data?

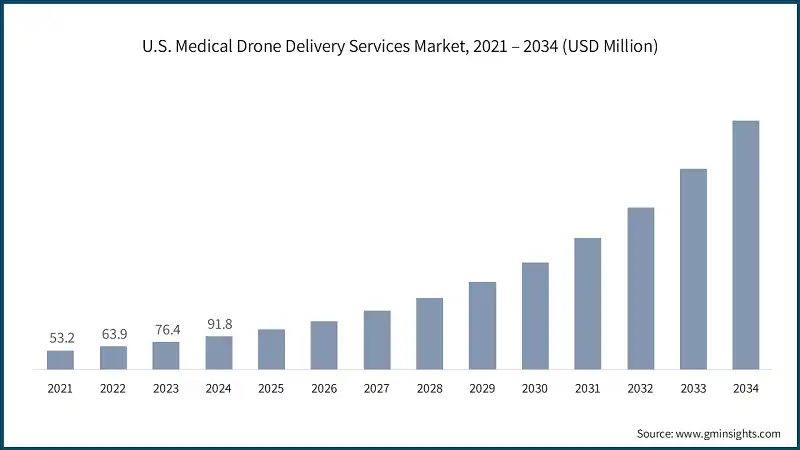

North America Medical Drone Delivery Services Market North America dominated the global market with the highest market share of 33.2% in 2024. The U.S. medical drone delivery services market was valued at USD 53.2 million and USD 63.9 million in 2021 and 2022, respectively. In 2024, the market size grew to USD 91.8 million from USD 76.4 million in 2023. Europe market accounted for USD 87.2 million in 2024 and is anticipated to show lucrative growth over the forecast period. Germany dominates the European medical drone delivery services market, showcasing strong growth potential. The Asia Pacific market is anticipated to grow at the highest CAGR of 26.2% during the analysis timeframe. China medical drone delivery services market is estimated to grow with a significant CAGR in the Asia Pacific market. Brazil leads the Latin America market, exhibiting remarkable growth during the analysis period. The Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa market in 2024. The global market is highly competitive, with leading players focusing on technological innovation, advanced autonomous systems, and strategic partnerships to strengthen their market positions. Rising demand for rapid medical deliveries, increasing healthcare digitization, and the need for efficient logistics in remote and urban regions are driving companies to leverage R&D investments, AI-enabled route optimization, and IoT-based tracking systems to enhance delivery reliability and improve patient outcomes. The growing emphasis on emergency medical services, blood supply logistics, and vaccination programs is encouraging players to develop scalable, cost-effective, and patient-centric solutions while expanding their presence in emerging markets. Key players, including Zipline, Matternet, Wingcopter, Swoop Aero, and DHL, collectively account for 55.2% of the global market. These companies maintain leadership through extensive drone fleets, integrated delivery platforms, strategic collaborations with hospitals, blood banks, and government agencies, and continuous advancements in VTOL and hybrid drones, cold-chain integration, and autonomous navigation. Their dominance is reinforced by pilot programs, global operational expansion, and strong logistics networks to ensure rapid, safe, and reliable medical deliveries. Smaller and niche players are also gaining traction by focusing on specialized medical delivery applications, such as lab samples, remote healthcare, and pharmaceutical transport. Competitive differentiation is increasingly defined by the ability to provide technologically advanced, scalable, and regulatory-compliant solutions. As the market evolves, competition is expected to intensify, with both established leaders and emerging firms pursuing innovation, strategic partnerships, and digital integration to capture greater market share. A few of the prominent players operating in the medical drone delivery services industry include: Zipline leads the market with a share of 21.5% in 2024. Zipline is a global leader in medical drone delivery, renowned for large-scale vaccine, blood, and pharmaceutical distribution. Its autonomous drone fleet, robust logistics network, and strategic government partnerships enable rapid, reliable deliveries, particularly to remote and underserved regions, enhancing healthcare accessibility and emergency response efficiency worldwide. Matternet specializes in hospital-to-hospital medical logistics, offering safe, fast, and autonomous delivery of blood, lab samples, and pharmaceuticals. Its integrated digital platform, regulatory compliance, and strong partnerships with healthcare institutions ensure efficient, trackable, and scalable medical drone operations, improving patient outcomes and streamlining critical supply chain management.Europe Medical Drone Delivery Services Market

Asia Pacific Medical Drone Delivery Services Market

Latin American Medical Drone Delivery Services Market

Middle East and Africa Medical Drone Delivery Services Market

Medical Drone Delivery Services Market Share

Medical Drone Delivery Services Market Companies

Medical Drone Delivery Services Industry News:

The medical drone delivery services market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Application

- Blood transfer

- Drugs/pharmaceutical transfer

- Vaccination program

- Lab sample

- Other applications

Market, By End Use

- Emergency medical services

- Blood banks

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the estimated market size of the global medical drone delivery services market in 2025?

The market is projected to reach USD 358.8 million in 2025, supported by expanding drone pilot programs in healthcare, government funding, and adoption by hospitals and pharmaceutical firms for time-sensitive deliveries.

What is the market size of the global medical drone delivery services market in 2024?

The market size was USD 294.1 million in 2024, driven by the rising demand for rapid healthcare logistics, government-backed pilot programs, and technological advancements in drone navigation, payload handling, and cold-chain delivery.

What is the projected market value of the global medical drone delivery services industry by 2034?

The market is expected to reach USD 2.5 billion by 2034, growing at a CAGR of 24.1%, fueled by regulatory support, growing healthcare digitalization, and increasing use of drones for vaccine, blood, and pharmaceutical transport.

Which application segment dominated the global medical drone delivery services industry in 2024?

The blood transfer segment dominated with a 35.9% share (USD 105.7 million) in 2024, driven by the need for rapid blood transport in trauma and emergency care, particularly across remote and hard-to-reach regions.

Which end-use segment held the largest share in the global market in 2024?

The emergency medical services (EMS) segment led with a 47.2% share (USD 138.8 million) in 2024, driven by the growing deployment of drones for urgent delivery of life-saving medical supplies and support for faster emergency response times.

Which region leads the global medical drone delivery services market?

North America dominated with a 33.2% share (USD 97.8 million) in 2024, driven by strong FAA regulatory support, advanced drone infrastructure, and the presence of leading players such as Zipline and Matternet.

Who are the key players in the global medical drone delivery services market?

Key players include Zipline, Matternet, Wingcopter, Swoop Aero, DHL, Wing (Alphabet), Draganfly, Volansi, MightyFly, Apian, Air Taurus, and Flirtey/SkyDrop.

Medical Drone Delivery Services Market Scope

Related Reports