Summary

Table of Content

MEA Utility Terrain Vehicles Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MEA Utility Terrain Vehicles Market Size

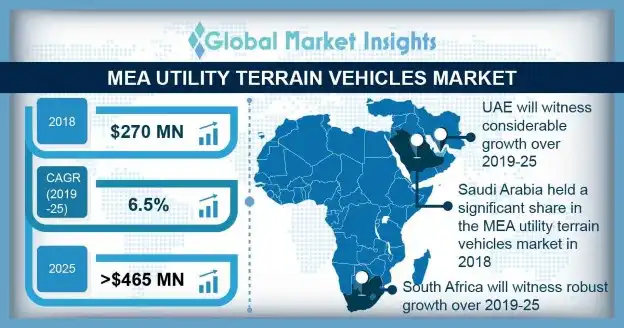

MEA Utility Terrain Vehicles Market size valued at around USD 270 million in 2018 and is estimated to exhibit over 6.5% CAGR from 2019 to 2025.

To get key market trends

To get key market trends

Increasing preferences of infrastructure contractors and planners for deploying easily operable vehicles on construction sites will propel the MEA utility terrain vehicles (UTV) market size over the study timeframe. Rising investments for infrastructure development and modernization of agricultural transportation are prominently supporting the industry share. For instance, in 2016, Egypt implemented investments in construction and building sector rose to USD 1.4 billion with an increase of over 3% as compared with 2015.

MEA Utility Terrain Vehicles Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 270 Million (USD) |

| Forecast Period 2019 - 2025 CAGR | 6.5% |

| Market Size in 2025 | 465 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Rising demand for innovative green buildings and modern amenities will support the infrastructure expansion till 2025. Increasing adoption of green revolution technologies is prominently contributing towards developing agricultural sector, further supporting the MEA utility terrain vehicles market share. Significant growth in the agriculture productivity is attributed to increasing utilization of modernized farming equipment and transportation vehicles. For instance, in 2017, Saudi Arabia agricultural output rose to USD 17.5 billion with an increase of over 1.05% as compared with 2016.

Growing demand for utilizing advanced side by side vehicles equipped with comfortable seating arrangements and improved passenger capacities are significantly expanding the MEA utility terrain vehicles market size. Incorporation of advanced interior cockpits and air conditioning systems are primarily improving the passenger comfort and vehicle handling efficiency. Side by side vehicles offering enhanced durability and safety are gaining a higher visibility in construction sector.

Increasing disposable income along with proliferating economic conditions are providing potential opportunities for recreation activities, further strengthening the market size. For instance, in 2017, disposable income in UAE rose to 329.14 billion with an increase of over 7.8% as compared with 2016. Moreover, rising recreational spending is significantly inducing the increased youth participation in outdoor leisure activities.

Provision of finance assistance policies and promotional deals offered will escalate the product penetration over the study timeframe. Rising tourism industry is positively impacting the GDP, further enhancing the MEA utility terrain vehicles market size. For instance, in 2018, travel industry in UAE rose to USD 44.8 billion with an increase of over 2.4% as compared with 2017.

MEA Utility Terrain Vehicles Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

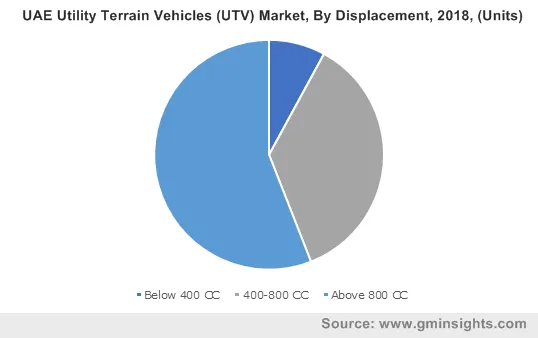

Increasing requirement for higher torque and stability for sports activities will escalate the adoption of 400-800 engine displacement utility terrain vehicles. Desert racing comprising of uneven terrains are inducing the demand for increased power. Rising number of UTVs offering multiple seating configuration and larger storage space will further escalate the UTV market demand over the forecast timeframe.

Utilization of lower displacement engines for recreational activities providing comfortable riding experience and reduced carbon emissions. Increasing preference of youth population for indulging in various recreational and leisure activities will accelerate the adoption of below 400 cc side by side vehicles. Additionally, lower vibration levels and reduced fuel consumption offered by these engines are showcasing potential growth prospects for MEA utility terrain vehicles market size over the study timeframe.

Introduction of advanced UTV’s offering improved suspensions, hydrostatic transmission and power steering systems are supporting the operations on construction worksites. Growing inclination of farmers and ranchers for utilizing modern farming methods and technologies are positively influencing the MEA utility terrain vehicles market share over the study timeframe. Moreover, integration of advanced driver assistance technologies such as GPS systems and digital display dashboards are further augmenting the product penetration.

Increasing ultra-light mobility requirements for various tactical and combat operations will positively influence the military side by side vehicles over the study timeframe. Growing inclination of defence authorities for deploying innovative military UTVs offering improved transportability and multi mission capabilities will augment the industry share. Moreover, increasing military expenditure will provide potential opportunities for enhancing the industry size. For instance, in 2017, military spending in South Africa rose to USD 4.1 billion with an increase of over 12% as compared with 2016.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

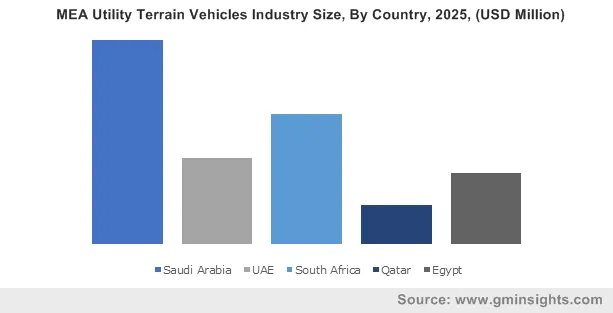

Saudi Arabia holds significant share in the MEA utility terrain vehicles market size owing to rising infrastructure development coupled with proliferating foreign investments. Several championships and racing events organized in Saudi Arabia under the direction of the Saudi Entertainment Authority (GEA) are attracting the sports enthusiasts. Further, increasing government funding and supportive initiatives targeted towards enhancement of recreational infrastructure will support the market size over the study timeframe.

UAE will exhibit significant growth owing to increasing recreational spending and economic growth. For instance, in 2015, annual GDP rose to USD 358.13 billion with an increase of over 5.1% as compared with 2014. Rising championship events along with increasing recreational spending will support market growth. The industry participants are organizing several events in the country to promote the youth participation. Moreover, easy availability of side by side vehicles through effective chain of distributors and dealers will significantly contribute towards augmenting the MEA utility vehicles market size.

MEA Utility Terrain Vehicles Market Share

Major participants in UTV market include

- Polaris Industries Inc

- Kubota Corporation

- Yamaha Motor

- John Deere

- Kawasaki Motors

- Honda Motors

- Bombardier Recreational Products

Industry players are striving to provide high quality products at cost effective prices through advanced manufacturing techniques. They are focusing to serve large customer base by expanding the distribution networks. Diversification of product portfolio and expansion of business operations are significantly contributing towards increasing revenue generation capabilities, driving the market size.

Industry Background

Increasing population in conjunction with proliferating economic conditions are positively influencing the adoption of side by side vehicles thereby escalating the MEA utility market size. Regulatory authorities including Roads and Transport Authority (RTA), Egyptian Environmental Affairs Agency (EEAA) are providing technical requirements and safety standards for reducing the environmental impacts by side by side vehicles.

Frequently Asked Question(FAQ) :

How are UTV manufacturers expanding their business reach in MEA?

Companies such as Yamaha Motor, John Deere, Polaris Industries Inc, Kubota Corporation, and Bombardier Recreational Products are delivering superior quality UTVs in MEA at cost-effective price through innovative manufacturing techniques.

Which aspects are propelling UAE utility terrain vehicles industry size?

Robust economic growth and surging spending on recreational activities are driving UAE industry size.

Why are UTVs gaining traction in the defense sector?

The defense sector of MEA is significantly leveraging UTVs to offer better transportability and multi-mission capabilities across rough terrains.

What are the key factors accelerating 400cc-800cc utility terrain vehicles demand?

Need for vehicular features like improved stability and high torque as well as surging demand for UTVs offering larger storage and multiple seating configurations are supporting the demand for 400cc-800cc UTVs.

What was the size of the global MEA utility terrain vehicles market in 2018?

The market size of MEA utility terrain vehicles was valued at over USD 870 million in 2018.

What is the expected growth rate for MEA utility terrain vehicles industry share during the forecast timespan?

The industry share of MEA utility terrain vehicles is estimated to exhibit around 6.5% CAGR from 2019 to 2025.

MEA Utility Terrain Vehicles Market Scope

Related Reports