Home > Chemicals & Materials > Polymers > Industrial Polymers > MEA Polyurethane Market

MEA Polyurethane Market Size

- Report ID: GMI2522

- Published Date: Apr 2018

- Report Format: PDF

MEA Polyurethane Market Size

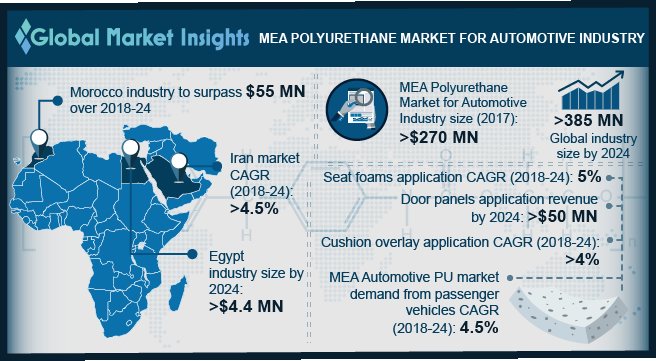

MEA Polyurethane Market for Automotive Industry size was over USD 270 Million in 2017 and industry expects consumption above 91 kilo tons by 2024.

Rising demand for lightweight vehicles, favorable government standards regarding fuel emissions and increasing demand for passenger and commercial vehicles will drive MEA polyurethane market for automotive industry demand. These PU materials are used in vehicle interiors which provides durability and reduces the overall weight of the vehicle, thus reducing the CO2 emissions and enhancing the car longevity. Supporting government norms regarding usage of PU products in vehicles over CO2 emissions along with low cost of product compared to metal counterparts have catalyzed regional industry growth.

Polyurethane materials are manufactured using chemical processes by reacting polyols and diisocyanates in the presence of appropriate additives and catalysts. Increased product usage in seat foams, door panels, steering wheels, dashboard and bumpers have led to reduction in overall weight of the vehicle, thus enhancing growth in automobile sales in MEA. High versatility and easy mold ability of the product enables the automobile manufacturers to produce various shapes and design for the vehicles, thereby promoting MEA polyurethane market for automotive industry growth.

Rising consumer demand for high-end luxury vehicles including BMW, Audi and Mercedes pertaining to better economic conditions and high purchasing power will promote the usage of polyurethane products in Iran, UAE and Saudi Arabia. Additionally, PU products used in the interior of automobiles helps in minimizing production costs of manufacturers along with making the vehicles competitive in the market. Transport sector is one of the major contributor to CO2 emissions in MEA region. CO2 emission from vehicles contributes over 36% of the total emissions in Morocco, 28% in Jordan, 24% in the Saudi Arabia and over 60% in Libya. Excessive GHG emissions and polluting air quality has propagated the countries to adopt measures for controlling the limits of Volatile Organic Compounds (VOC’s) as a result of providing environmental benefits.

| Report Attribute | Details |

|---|---|

| Base Year: | 2017 |

| MEA Polyurethane Market Size in 2017: | 270 Million (USD) |

| Forecast Period: | 2018 to 2024 |

| Forecast Period 2018 to 2024 CAGR: | 5% |

| 2024 Value Projection: | 385 Million (USD) |

| Historical Data for: | 2013 to 2017 |

| No. of Pages: | 295 |

| Tables, Charts & Figures: | 362 |

| Segments covered: | Product, Application, Vehicle Type, End-Use and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Methylene diphenyl diisocyanate(MDI) and toluene diisocyanate (TDI) are reacted with various polyols for manufacturing of flexible and semi-flexible foams which are further utilized in the headrests, armrests, dashboard and seats. Both polyols and diisocyanates are extracted from crude oil or natural oils from renewable resources. The crude oil production in Middle East & Africa accounted for over 33 million barrels of oil per day in 2016, nearly accounting for approximately 30% of the total crude oil production in the world. The development of advanced drilling techniques for crude oil extraction is majorly contributing towards large production of petroleum products. Abundant availability of raw materials along with technological advancements in engineered plastics will drive MEA polyurethane market for automotive industry growth.

Polyurethane materials are flexible, lightweight and durable providing excellent cushioning properties along with complete driving comfort and their insulation properties provides high protection against the noise and heat of engines. Many Middle Eastern countries tend to follow the European fuel emission standards which are considered stringent and are majorly contributing to MEA polyurethane market for automotive industry size.