Summary

Table of Content

MEA Ferric Chloride Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MEA Ferric Chloride Market Size

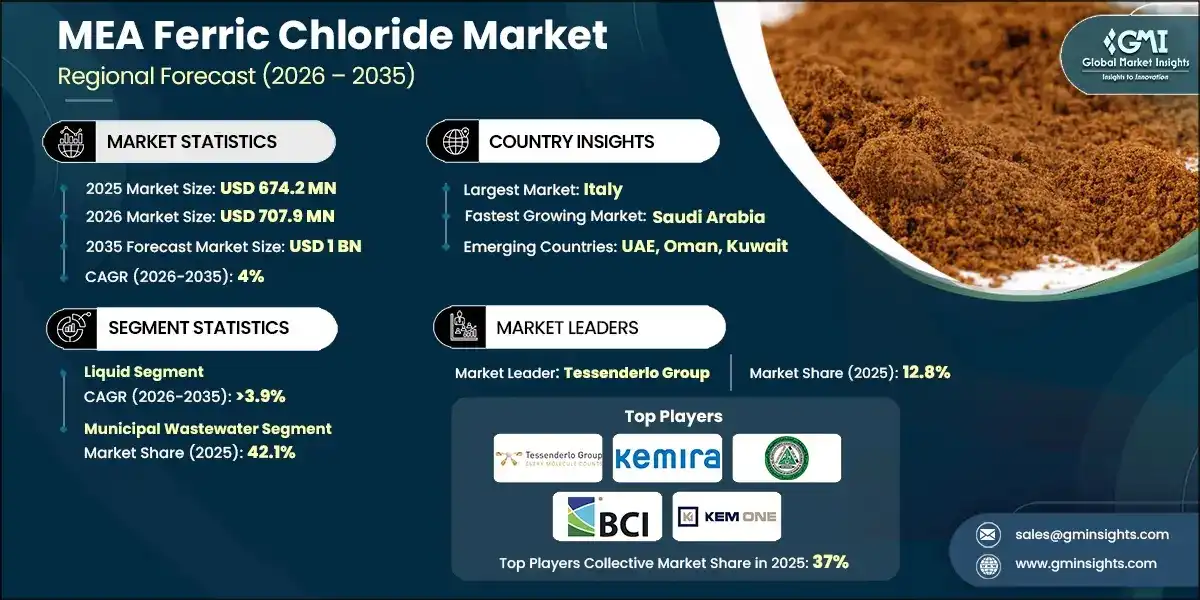

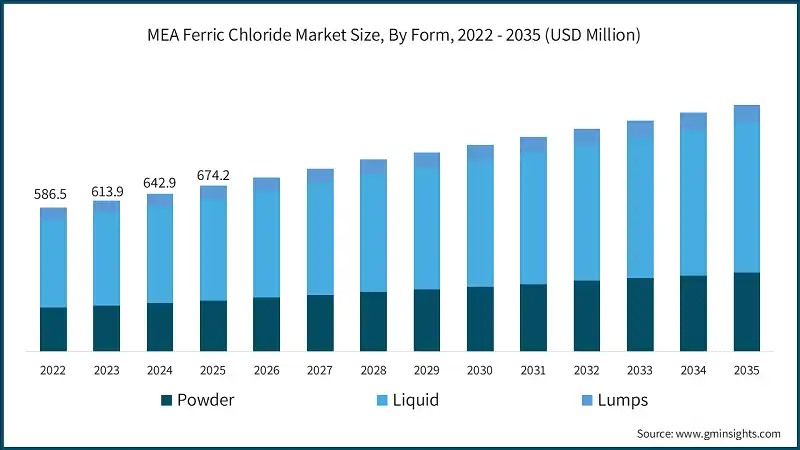

The MEA ferric chloride market was valued at USD 674.2 million in 2025 and is poised to expand from USD 707.9 million in 2026 to USD 1 billion by 2035, reflecting a 4% CAGR over 2026 to 2035 according to the latest report published by Global Market Insights Inc.

To get key market trends

- Ferric chloride (FeCl3) is a chemical compound extensively employed as a coagulant in water and wastewater treatment processes to eliminate impurities and purify water. It finds applications in etching copper for printed circuit boards, as a catalyst in chemical reactions, and in the manufacturing of pigments and dyes. The ferric chloride market is expanding due to increasing urbanization and industrialization, which drive the demand for clean water and efficient wastewater treatment. According to the United Nations Economic Commission for Africa, the urban population in Africa is expected to nearly triple by 2050, reaching 1.34 billion. This rapid urbanization is likely to increase the demand for water treatment solutions. The World Bank reports that only 28% of Sub-Saharan Africa's population has access to safely managed drinking water.

- In the Middle East, the World Health Organization estimates that 87% of the population uses at least basic drinking water services. These statistics highlight the potential for growth in the ferric chloride market as countries in these regions invest in improving water infrastructure and treatment facilities. Growth opportunities also arise from wider adoption across industries, environmental regulations promoting wastewater management, and advancements in water treatment technologies, particularly in developing regions.

MEA Ferric Chloride Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 674.2 Million |

| Market Size in 2026 | USD 707.9 Million |

| Forecast Period 2026-2035 CAGR | 4% |

| Market Size in 2035 | USD 1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Water scarcity and demand for water treatment | Increasing water stress in MEA is boosting investments in municipal and industrial water treatment, where ferric chloride is a key coagulant for removing impurities |

| Expansion of industries such as petrochemicals, mining, and manufacturing | Growth in these sectors generates large volumes of wastewater, creating strong demand for ferric chloride in effluent treatment and sludge conditioning |

| Innovations in water treatment technologies | Advancements in treatment processes, such as high-efficiency coagulation and integrated systems, are enhancing ferric chloride’s adoption for better performance and cost-effectiveness |

| Pitfalls & Challenges | Impact |

| Fluctuating raw material prices | Variability in iron ore and hydrochloric acid costs impacts ferric chloride production economics, leading to price instability for end-users |

| Competition from alternative chemicals | Substitutes like aluminum-based coagulants and polyaluminum chloride pose competitive pressure, especially in regions prioritizing cost or specific performance attributes |

| Opportunities: | Impact |

| Infrastructure Development & Construction | Large-scale infrastructure projects in MEA require effective water treatment systems, creating indirect demand for ferric chloride in construction-related water management. |

| Market Leaders (2025) | |

| Market Leaders |

12.8 % market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Country | Italy |

| Fastest growing country | Saudi Arabia |

| Emerging country | UAE, Oman, Kuwait |

| Future outlook |

|

What are the growth opportunities in this market?

MEA Ferric Chloride Market Trends

- The Middle East and Africa ferric chloride market is experiencing growth driven by increasing demand for water and wastewater treatment. According to the World Bank, the Middle East and North Africa regions are home to 6% of the world's population but only 1% of its freshwater resources, highlighting the critical need for water treatment solutions. The United Nations Economic Commission for Africa reports that only 28% of the population in sub-Saharan Africa has access to safely managed drinking water services, underscoring the potential for market expansion.

- In Saudi Arabia, the Ministry of Environment, Water and Agriculture has allocated $80 billion for water projects over the next decade, which is likely to boost ferric chloride demand. The growth of the oil and gas industry, particularly in Gulf Cooperation Council countries, further supports market development. However, challenges such as volatile raw material prices and limited local manufacturing capabilities may impact market growth. Environmental regulations promoting sustainable wastewater management and advancements in chemical production are also shaping market trends in the region.

- The MEA ferric chloride market is experiencing steady growth due to increasing investments in water treatment infrastructure and the expanding industrial sector, particularly in oil and gas, petrochemicals, and metal processing. Urbanization and population growth are driving demand for clean water and effective wastewater management. Key markets include Saudi Arabia, the UAE, and South Africa, where government regulations on water treatment are stringent. However, market growth is challenged by the region’s dependence on imports, limited local production, and fluctuating prices of raw materials. Technological advancements and environmental sustainability initiatives present opportunities for market expansion.

MEA Ferric Chloride Market Analysis

Learn more about the key segments shaping this market

Based on form the market is segmented as powder, liquid, and lumps.

- The liquid segment held over USD 414.2 million in 2024, growing at a CAGR of over 3.9% during the forecast period. The liquid segment of the ferric chloride market holds significant potential, driven by its ease of handling, faster solubility, and higher efficiency in water and wastewater treatment applications. Liquid ferric chloride is preferred in municipal water treatment plants, industrial effluent treatment, and sewage treatment due to its effective coagulation properties. Its use is also prominent in etching processes and in various chemical manufacturing industries. As global water treatment needs grow, particularly in regions facing water scarcity, the liquid segment's demand is expected to rise. However, challenges like storage, transportation, and corrosive nature may impact growth but innovations in packaging and handling are mitigating these concerns.

Learn more about the key segments shaping this market

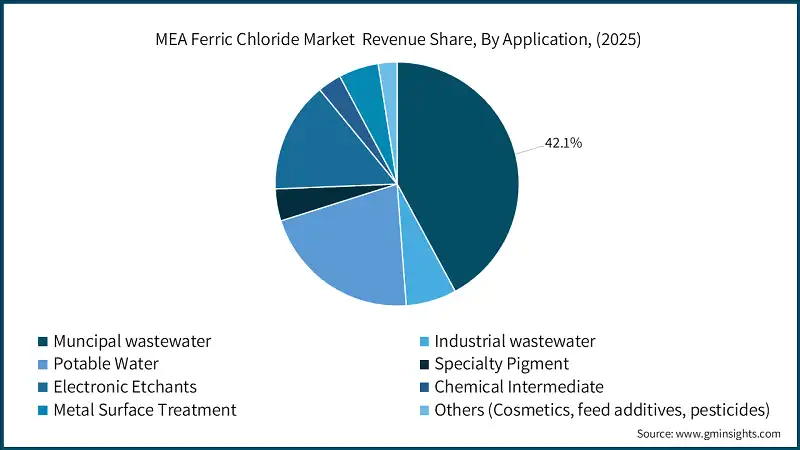

Based on application the MEA ferric chloride market is segmented as Potable Water, Industrial wastewater, Municipal wastewater, Specialty Pigment, Electronic Etchants, Chemical Intermediate, Metal Surface Treatment, Others (Cosmetics, feed additives, pesticides).

- The municipal wastewater segment accounted for 42.1% share in 2025. Ferric chloride is widely used in municipal wastewater treatment as a coagulant to remove suspended solids, organic matter, and phosphorus. It helps in flocculation, where contaminants aggregate and settle, improving water clarity and quality. Additionally, ferric chloride plays a crucial role in reducing odor by controlling hydrogen sulfide. Its effectiveness in phosphorus removal helps municipalities meet stringent environmental regulations for wastewater discharge, preventing eutrophication in water bodies. In the Middle East and Africa, its application is increasingly essential due to water scarcity and growing urbanization. Governments are investing in wastewater treatment facilities to conserve water, driving demand for ferric chloride in the region.

- The wastewater treatment segment from MEA ferric chloride market was valued at USD 445.7 million in 2024 and garner a 3.9% CAGR through 2026-2035. Ferric chloride is extensively utilized in wastewater treatment as a coagulant to eliminate suspended particles, organic matter, and phosphates from water. It interacts with impurities, forming flocs that are easily removed through sedimentation or filtration, thereby enhancing water clarity and reducing pollutants. Its efficacy in odor reduction and sludge control makes it an essential chemical in both municipal and industrial wastewater management. In the Middle East and Africa, where water scarcity and industrial expansion are significant concerns, ferric chloride plays a vital role in wastewater treatment projects. It aids in industries in complying with environmental regulations and promotes sustainable water reuse practices.

Looking for region specific data?

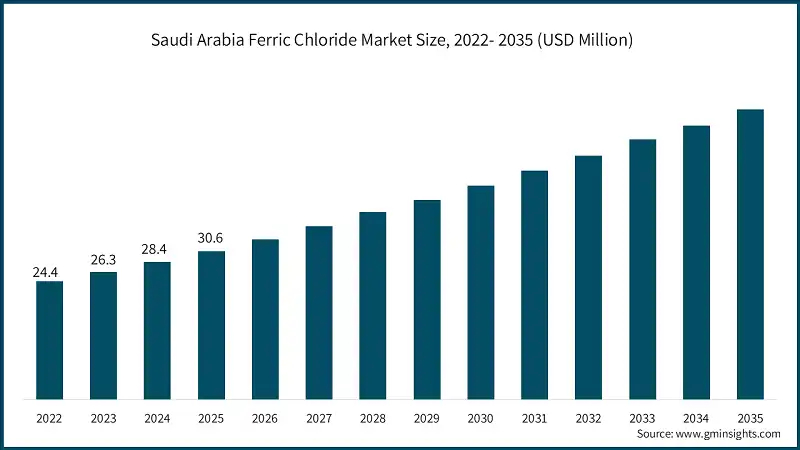

The Saudi Arabia ferric chloride market valued at USD 30.6 million in 2025 and estimated to grow to almost USD 59.8 million by 2035.

- The ferric chloride market in Saudi Arabia is growing steadily, driven by the country's expanding industrial base and stringent water treatment regulations. Saudi Arabia's rapid urbanization, coupled with increasing industrial activities in sectors like petrochemicals, oil and gas, and desalination, has heightened the demand for effective wastewater treatment solutions. Ferric chloride is widely used in both municipal and industrial water treatment facilities to meet regulatory standards for clean water. Government initiatives, such as Vision 2030, emphasize environmental sustainability and infrastructure development, further fueling demand. However, challenges like raw material price fluctuations and reliance on imports may impact market dynamics.

MEA Ferric Chloride Market Share

The market is moderately concentrated, with the top five players holding 37% combined share in 2025 and a long tail of specialized producers, research spin?outs, and regional entrants. Tessenderlo Group leads with 12.8% of the market. Market players in the Middle East and Africa ferric chloride market are adopting several strategies to capitalize on growing demand for water and wastewater treatment. Key strategies include expanding production capacities and establishing local manufacturing facilities to reduce dependency on imports and stabilize supply chains. Companies are also forming strategic partnerships with regional governments and industries to secure long-term contracts in municipal and industrial water treatment projects. Innovation in packaging and transportation mitigates the corrosive nature of ferric chloride is another focus. Additionally, firms are investing in research and development to enhance product quality and explore eco-friendly formulations in line with environmental regulations.

- Tessenderlo Group

- Tessenderlo Group is a Brussels-based diversified chemicals company and a leading producer of ferric chloride for water and wastewater treatment, metal processing, and electronics applications. With integrated facilities across Europe and North America, the company emphasizes sustainability and circular economy principles, offering customized solutions for heavy-metal removal and industrial processes. Tessenderlo is recognized as one of the top global players in ferric chloride, competing in both commodity and specialty segments.

- Tessenderlo Group is a Brussels-based diversified chemicals company and a leading producer of ferric chloride for water and wastewater treatment, metal processing, and electronics applications. With integrated facilities across Europe and North America, the company emphasizes sustainability and circular economy principles, offering customized solutions for heavy-metal removal and industrial processes. Tessenderlo is recognized as one of the top global players in ferric chloride, competing in both commodity and specialty segments.

- Kemira

- Kemira, headquartered in Helsinki, is a global leader in water-treatment chemicals and a major supplier of ferric chloride, primarily for phosphorus removal and biogas applications. The company recently announced a significant expansion at its Tarragona, Spain site to increase ferric chloride capacity by 2026. Kemira’s ferric chloride products support efficient coagulation, reduced sludge volumes, and nutrient optimization, aligning with its sustainability and decarbonization goals. Strong R&D capabilities and tailored solutions reinforce its position as a top-tier supplier for municipalities and industries.

- Kemira, headquartered in Helsinki, is a global leader in water-treatment chemicals and a major supplier of ferric chloride, primarily for phosphorus removal and biogas applications. The company recently announced a significant expansion at its Tarragona, Spain site to increase ferric chloride capacity by 2026. Kemira’s ferric chloride products support efficient coagulation, reduced sludge volumes, and nutrient optimization, aligning with its sustainability and decarbonization goals. Strong R&D capabilities and tailored solutions reinforce its position as a top-tier supplier for municipalities and industries.

- Basic Chemical Industries

- Basic Chemical Industries (BCI), based in Dammam, Saudi Arabia, is a key regional manufacturer of industrial chemicals, including ferric chloride, hydrochloric acid, caustic soda, and sulfuric acid. Its ferric chloride products serve water and wastewater treatment needs across the Middle East, supported by robust manufacturing and distribution infrastructure.

- Basic Chemical Industries (BCI), based in Dammam, Saudi Arabia, is a key regional manufacturer of industrial chemicals, including ferric chloride, hydrochloric acid, caustic soda, and sulfuric acid. Its ferric chloride products serve water and wastewater treatment needs across the Middle East, supported by robust manufacturing and distribution infrastructure.

MEA Ferric Chloride Market Companies

Major players operating in the MEA ferric chloride industry are:

- Agua Chem Ltd

- Al Kout

- BASF

- BorsodChem

- Chemifloc

- Feracid

- Kemira

- SAT Sulphur Company

- Swedish Jordanian Chemicals

- Tessenderlo Group

MEA Ferric Chloride Industry News

- In February 2025, Nouryon opened an office in Al Dhahran, Saudi Arabia, strengthening its presence in the Middle East. The facility enhances customer engagement and technical support for ferric and other specialty chemicals in MEA

- In April 2024, KERN Strategies & Developments launched modular 40% ferric chloride production plants that convert iron and chlorine (or iron oxides + HCl + Cl?) into ferric chloride on-site. These units offer low CAPEX/OPEX, automatic operation, and eliminate transport/storage hazards—ideal for decentralized MEA deployment.

- In July 2024, Kemira announced a multi-million?Euro expansion of its ferric chloride production at its Tarragona plant in Spain to develop a tailored Biogas Digestion Product (BDP). Although located in Europe, the launch addresses growing demand across regions including MEA, enhancing the company’s product portfolio in ferric chloride-based sustainable solutions.

The MEA ferric chloride market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Form

- Powder

- Liquid

- Lumps

Market, By Application

- Potable Water

- Industrial wastewater

- Municipal wastewater

- Specialty Pigment

- Electronic Etchants

- Chemical Intermediate

- Metal Surface Treatment

- Others (Cosmetics, feed additives, pesticides)

Market, By End Use

- Wastewater Treatment

- Pharmaceuticals

- Chemicals

- Electronics

- Metals & Metallurgy

- Others

The above information is provided for the following regions and countries:

- Saudi Arabia

- UAE

- Oman

- Kuwait

- Qatar

- Mediterranean countries

- Tunisia

- Egypt

- Morocco

- Algeria

- Israel

- Jordan

- Syria

- Turkey

- Greece

- Italy

- France

- Spain

- Africa

- Cameroon

- Republic of Congo

- Equatorial Guinea

- Nigeria

- Senegal

- Angola

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the MEA ferric chloride market?

Key players in the MEA ferric chloride industry include Tessenderlo Group, Kemira, Al Qahtani Chemicals Company, Basic Chemical Industries, Kem One, BASF, and Swedish Jordanian Chemicals.

What is the size of the wastewater treatment segment in the MEA ferric chloride industry?

The wastewater treatment segment was valued at USD 445.7 million in 2024 and is projected to grow at a CAGR of 3.9% through 2035, supported by industrial expansion and water reuse initiatives.

Which country leads the MEA ferric chloride industry?

Saudi Arabia accounted for USD 30.6 million of the MEA ferric chloride market in 2025. Growth is driven by rapid urbanization, industrial wastewater generation, and large-scale water projects aligned with Vision 2030.

What are the upcoming trends in the MEA ferric chloride market?

Key trends include increased adoption in municipal wastewater treatment, expansion of liquid ferric chloride usage, and rising demand from oil & gas, petrochemical, and mining industries.

What was the market share of the municipal wastewater application segment in 2025?

Municipal wastewater treatment accounted for 42.1% share of the MEA ferric chloride market in 2025, driven by increasing urbanization and government-led investments in sewage treatment facilities.

How much revenue did the liquid ferric chloride segment generate in 2024?

The liquid ferric chloride segment generated USD 414.2 million in 2024, leading the market due to its high efficiency, ease of handling, and widespread use in water and wastewater treatment applications.

What is the projected value of the MEA ferric chloride market by 2035?

The market is expected to reach USD 1 billion by 2035, supported by growth in petrochemicals, mining, manufacturing, and stricter wastewater discharge regulations.

What is the current MEA ferric chloride industry size in 2026?

The market is projected to reach USD 707.9 million in 2026 as investments in municipal water infrastructure and industrial effluent treatment continue to increase.

What is the market size of the MEA ferric chloride industry in 2025?

The market size was valued at USD 674.2 million in 2025, with a CAGR of 4% expected through 2035 driven by rising water scarcity and expanding wastewater treatment requirements across the region.

MEA Ferric Chloride Market Scope

Related Reports