Summary

Table of Content

Material Handling Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Material Handling Equipment Market Size

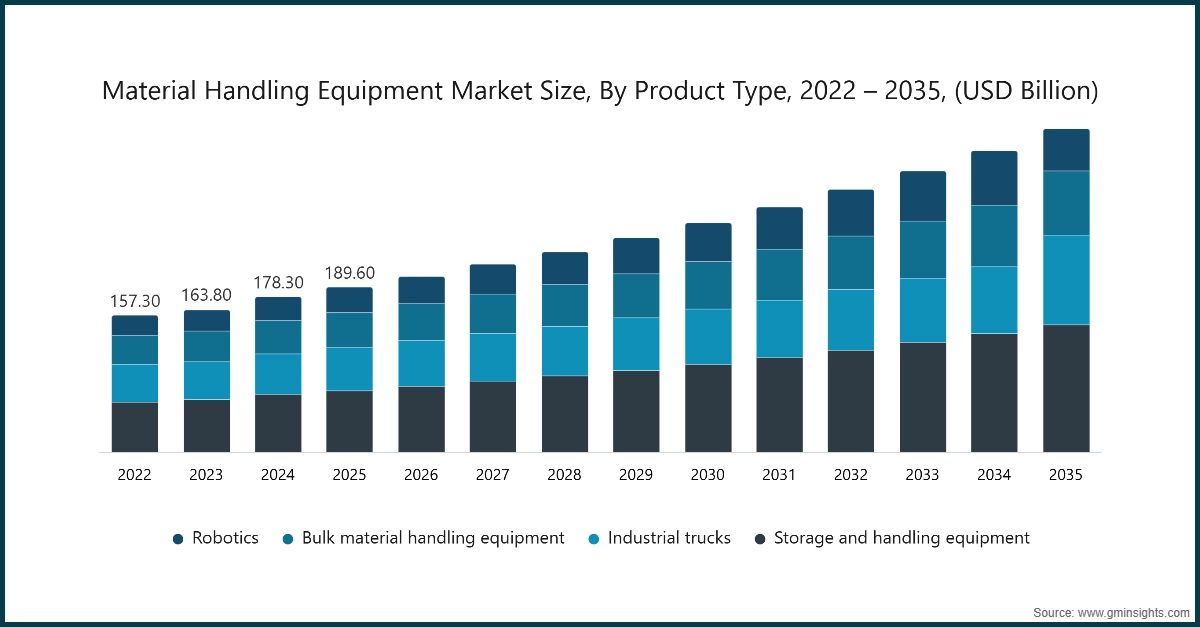

The material handling equipment market was estimated at USD 189.6 billion in 2025. The market is expected to grow from USD 202.3 billion in 2026 to USD 372.6 billion in 2035, at a CAGR of 7% according to latest report published by Global Market Insights Inc.

To get key market trends

- The rapid growth of e-commerce is creating a transformation in how we experience retail. More businesses are creating systems to automate their warehouses and create more advanced systems for handling material-related tasks to meet the increasing consumer demand for convenience through offers of more products to choose from, faster shipping options, and better product selections through online shopping. Companies need to develop efficient logistical & supply chain systems if they wish to meet this growing consumer demand for convenience through online shopping.

- When companies automate their warehouses, they create the ability for them to create a system that can handle larger volume orders with fewer errors and maximized costs, speed and accuracy in order fulfillment. the technological advancements of industry 4.0 will change many areas of manufacturing, logistics, and supply chain practices due to the ability for companies in all industries to use multiple technologies (robotics, IoT, and AI) together to create environments that improve productivity, increase operational efficiency, and improve the speed and quality of decision making.

- The use of automation is one of the most important aspects of the recent advancements in factories and manufacturing processes. Automation allows companies to automate tasks rather than rely on human labor. Robotics, for instance, are being used extensively in warehouse and manufacturing operations to increase speed and decrease human error. Manufacturing companies also use robotics to improve workflow by decreasing the amount of time spent transferring product from one location to another and increasing the time spent actually producing goods. Additionally, automation provides safer working environments for employees and creates efficiencies in production.

- In addition to robotics, the IoT provides businesses with the opportunity for real-time visibility and two-way communication between all points within their supply chain, including their customers. This capability has been transformative in allowing companies to accurately predict when products will be in demand and at what volume, thus providing a better understanding of the resources required for production and minimization of periods of downtime during manufacturing. As businesses look to continue to be more cost-effective and expand into new markets, companies will continue to invest in the automation of their operations through Industry 4.0 technology such as robotics and IoT-enabled devices.

- With the continued increase in complexity of the global supply chain due to globalization, the advancement of just-in-time inventory practices, and ever-changing consumer demands, there will also be a continued increase in the need for more advanced material handling products to move product throughout the global marketplace accurately, quickly, and efficiently.

Material Handling Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 189.6 Billion |

| Market Size in 2026 | USD 202.3 Billion |

| Forecast Period 2026-2035 CAGR | 7% |

| Market Size in 2035 | USD 372.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| E-commerce expansion | Rapid growth in online shopping drives demand for automated warehouses and efficient material handling systems to manage high-volume order fulfilment |

| Industry 4.0 & automation | Integration of robotics, IoT, and AI in manufacturing and logistics boosts productivity and reduces labor dependency, fueling adoption of advanced equipment |

| Global supply chain complexity | Increasing globalization and just-in-time inventory practices require sophisticated handling solutions for faster, accurate movement of goods |

| Pitfalls & Challenges | Impact |

| High initial investment | Automated systems and robotics involve significant upfront costs, which can deter small and medium enterprises from adoption |

| Workforce skill gap | Transition to automated and smart systems demands skilled operators and technicians, creating training and recruitment challenges |

| Opportunities: | Impact |

| Green & energy-efficient solutions | Rising sustainability goals open opportunities for electric-powered and eco-friendly material handling equipment |

| Emerging markets growth | Rapid industrialization and infrastructure development in Asia-Pacific and Africa present untapped potential for equipment manufacturers. |

| Market Leaders (2025) | |

| Market Leader |

Market share of ~ 9% |

| Top Players |

Collective market share of ~25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | China, India, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Material Handling Equipment Market Trends

- Automation and robotics are revolutionizing the industry. Companies are increasingly deploying automated guided vehicles (AGVs), robotic arms, and artificial intelligence (AI)-driven systems to enhance operational efficiency and reduce dependency on manual labor. These technologies streamline processes such as material transport, sorting, and inventory management, enabling businesses to achieve higher productivity and cost savings. The integration of robotics also addresses labor shortages and ensures consistent performance, making it a critical investment for modern warehouses and manufacturing facilities.

- The exponential growth of e-commerce continues to reshape the market. Online retail platforms are pushing warehouses and distribution centers to adopt advanced material handling solutions to meet the demands of faster order fulfillment and improved inventory accuracy. Automated storage and retrieval systems (AS/RS), conveyor systems, and high-speed sortation equipment are becoming essential for handling the surge in order volumes. As consumer expectations for quick delivery rise, the need for efficient and scalable material handling systems is expected to grow further.

- The integration of the IoT and predictive analytics is transforming how material handling equipment operates. IoT-enabled devices equipped with smart sensors provide real-time data on equipment performance, usage patterns, and maintenance needs. Predictive analytics leverages this data to forecast potential issues, enabling proactive maintenance and reducing downtime.

- Environmental sustainability is becoming a top priority for manufacturers and end-users in industry. Companies are increasingly adopting electric-powered forklifts, energy-efficient conveyor systems, and eco-friendly designs to align with global sustainability goals and reduce carbon emissions.

- Additionally, the use of renewable energy sources and recyclable materials in equipment manufacturing is gaining traction. These initiatives not only help businesses meet regulatory requirements but also appeal to environmentally conscious consumers and stakeholders.

Material Handling Equipment Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is categorized into storage and handling equipment, industrial trucks, bulk material handling equipment and robotics. The storage and handling equipment segment accounted for revenue of around USD 70.5 billion in 2025 and is anticipated to grow at a CAGR of 7.6% from 2026 to 2035.

- Storage and handling equipment plays a critical role in material handling operations, forming the backbone of the market due to its extensive applicability across various industries. Warehouses, manufacturing facilities, and distribution centers heavily depend on racking systems, shelving units, and pallets to maximize space utilization and ensure seamless inventory management. These systems are integral to maintaining operational efficiency, particularly in industries where space optimization and inventory accuracy are paramount.

- The dominance of storage and handling equipment is further bolstered by the rapid expansion of the e-commerce and retail sectors. As these industries continue to grow, the demand for efficient storage solutions has surged. E-commerce companies, in particular, require advanced storage systems to manage high volumes of inventory and facilitate quick order fulfillment.

- Similarly, retail businesses rely on these systems to streamline their supply chains and enhance customer satisfaction. The increasing focus on warehouse automation and smart storage solutions is expected to further solidify the position of storage and handling equipment in the market.

Learn more about the key segments shaping this market

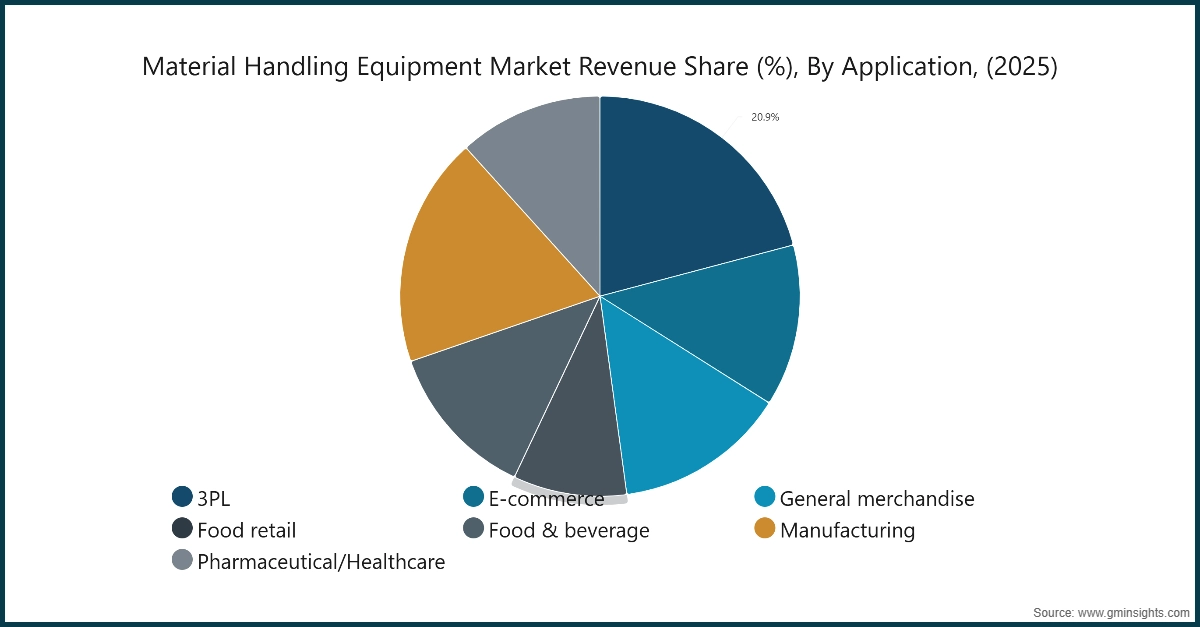

Based on application, the market consists of 3PL, e-commerce, general merchandise, food retail, food & beverage, manufacturing and pharmaceutical/healthcare. The 3PL segment emerged as leader and held 20.8% of the total market share in 2025 and is anticipated to grow at a CAGR of 7.2% from 2026 to 2035.

- Third-party logistics (3PL) providers have emerged as significant contributors to the growth of the material handling equipment market. These providers play a pivotal role in managing complex supply chains for multiple clients, offering specialized services that enhance operational efficiency. As businesses increasingly outsource their logistics operations to focus on core competencies, 3PL companies have become indispensable partners in the supply chain ecosystem.

- To meet the growing demand for speed, accuracy, and cost efficiency, 3PL providers are investing heavily in advanced material handling systems. These investments include automated storage and retrieval systems (AS/RS), conveyor systems, and robotic solutions designed to optimize warehouse operations.

- The ability of 3PL companies to offer scalable and flexible solutions without requiring businesses to invest in their own infrastructure has made them a preferred choice across industries. As the global supply chain landscape becomes more complex, the dominance of 3PL providers in driving demand for material handling equipment is expected to strengthen further.

Based on automation level, the market consists of manual, semi-automatic, automatic. The semi-automatic segment emerged as leader and held 37.7% of the total market share in 2025.

- Semi-automatic equipment occupies a unique position in the material handling equipment market, offering a cost-effective alternative to fully automated systems. By combining manual control with mechanized assistance, semi-automatic solutions provide enhanced productivity while minimizing the capital investment required for complete automation. This hybrid approach is particularly appealing to small and medium-sized enterprises (SMEs) and businesses in emerging markets, where budget constraints and gradual adoption of automation technologies are common.

- The popularity of semi-automatic equipment is driven by its ability to deliver operational efficiency without the complexity and high costs associated with full automation. For instance, semi-automatic palletizers, conveyors, and sorting systems enable businesses to improve throughput and reduce labor-intensive tasks while maintaining a level of human oversight. This balance between automation and manual intervention makes semi-automatic equipment an ideal choice for businesses seeking to modernize their operations incrementally.

- In emerging markets, where the adoption of advanced technologies is often gradual, semi-automatic equipment serves as a stepping stone toward full automation. It allows businesses to adapt to changing market demands and improve operational efficiency without overextending their financial resources.

Looking for region specific data?

North America Material Handling Equipment Market

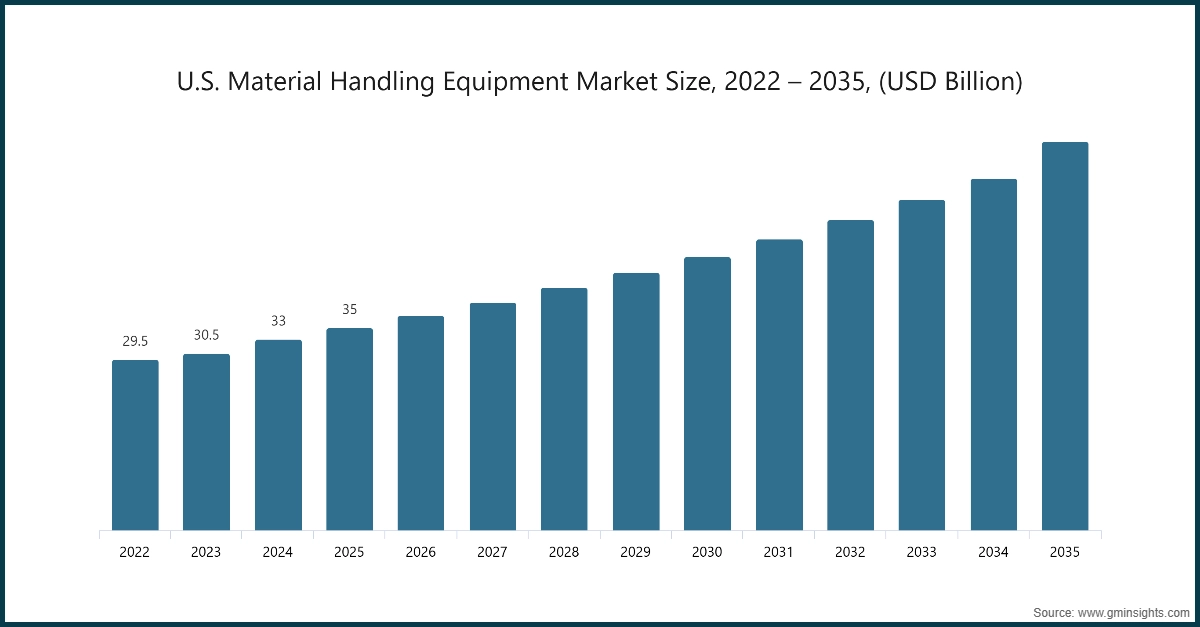

The U.S. dominates an overall North America market with USD 35 billion in 2025 and is estimated to grow at a CAGR of 6.4% from 2026 to 2035.

- The U.S. dominates the material handling equipment industry due to its advanced logistics infrastructure and high adoption of automation technologies. The presence of major e-commerce players and large-scale distribution centers drives continuous investment in automated storage systems, AGVs, and robotics.

- Additionally, strong demand from manufacturing and retail sectors, coupled with Industry 4.0 initiatives, ensures the U.S. remains a leader in innovation and technology integration. Government support for smart warehousing and sustainability further strengthens its competitive position.

Europe Material Handling Equipment Market

In the European market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- Germany holds a leading position in Europe, driven by its robust manufacturing base and automotive industry. The country’s emphasis on precision engineering and automation has resulted in widespread adoption of advanced material handling solutions, including conveyor systems and robotic handling.

- Germany’s commitment to sustainability and energy-efficient technologies also influences equipment design and procurement. Its strong export-oriented economy ensures continuous modernization of logistics and warehousing systems.

Asia Pacific Material Handling Equipment Market

In the Asia Pacific market, the China held 34.3% market share in 2025 and is anticipated to grow at a CAGR of 7.9% from 2026 to 2035.

- China dominates the Asia-Pacific market, fueled by rapid industrialization and the explosive growth of e-commerce. Massive investments in smart warehouses and automated handling systems are transforming supply chains to meet rising consumer demand.

- Government initiatives like “Made in China 2025” and infrastructure development projects further accelerate adoption of advanced material handling technologies. China’s scale and cost advantages make it a global hub for both production and consumption of these systems.

Middle East and Africa Material Handling Equipment market

In the Middle East and Africa market, Saudi Arabia held 21.2% market share in 2025 promising growth from 2026 to 2035.

- Saudi Arabia’s dominance in the Middle East market is linked to its large-scale infrastructure projects and growing logistics sector. The country is investing heavily in modern warehousing and material handling systems to support Vision 2030 goals and diversify its economy beyond oil.

- The rise of retail, e-commerce, and industrial sectors is creating demand for semi-automated and automated solutions. Strategic location as a regional trade hub further strengthens Saudi Arabia’s role in driving material handling equipment adoption.

Material Handling Equipment Market Share

In 2025, the prominent manufacturers in market are collectively held the market share of ~25%.

Toyota’s edge lies in its reputation for reliability and innovation in forklifts and automated solutions. Its strong focus on energy-efficient electric models and advanced safety systems makes it a preferred choice for businesses seeking sustainability and operational excellence.

KION dominates through its comprehensive intralogistics portfolio, including brands like Linde and STILL. Its strength is in automation and warehouse integration, offering end-to-end solutions that combine material handling equipment with advanced software for smart logistics.

Jungheinrich stands out for its leadership in electric-powered equipment and lithium-ion technology. Its commitment to sustainability and cutting-edge automation systems positions it as a go-to provider for eco-friendly and high-performance warehouse solutions.

Material Handling Equipment Market Companies

Major players operating in the market include:

- BEUMER Group

- Columbus McKinnon Corporation

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- Dematic (KION Group)

- Fives Group

- Honeywell Intelligrated

- Hyster-Yale Materials Handling

- Jungheinrich AG

- KION Group

- Komatsu Ltd.

- Mitsubishi Logisnext

- Murata Machinery

- SSI SCHAEFER

- Toyota Material Handling

Crown’s competitive advantage is its ergonomic design and operator-focused innovations. Its advanced fleet management systems and durable equipment help businesses optimize productivity while reducing maintenance costs.

Hyster-Yale excels in heavy-duty material handling solutions, offering robust forklifts and specialized equipment for demanding environments. Its global presence and focus on fuel-efficient and electric models strengthen its position in diverse industrial sectors.

Material Handling Equipment Industry News

- In April 2025, Toyota Material Handling North America integrated The Raymond Corporation under one leadership structure forming a unified organization promoting operational efficiency and innovation.

- In January 2025, Toyota expanded its product lineup with new electric pneumatic forklifts (8,000–17,500 lb capacity) and core electric series featuring lithium-ion batteries, enhancing performance and sustainability.

- In February 2024, Mitsubishi Logisnext introduced Jungheinrich-branded AGVs, Rocrich AMRs, and telematics solutions at MODEX 2024.

The material handling equipment market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Product type

- Storage and handling equipment

- Racks

- Stacking frames

- Shelves, bins and drawers

- Mezzanines

- Industrial trucks

- Automated guided vehicles (AGV)

- Hand, platform and pallet trucks

- Order jackers

- Pallet jacks

- Side loaders

- Walkie Stackers

- Bulk material handling equipment

- Conveyor belts

- Case conveyors

- Pallet conveyors

- Stackers

- Reclaimers

- Elevators

- Others

- Robotics

- Autonomous mobile robots

- Corobots

- Scara robots

- Industrial robots

- Others

- AS/RS

- Unit-load AS/RS

- Mini-load AS/RS

Market, By Automation

- Manual

- Semi-automatic

- Fully automatic

Market, By Application

- 3PL

- E-commerce

- General merchandise

- Food retail

- Food & beverage

- Manufacturing

- Pharmaceutical/Healthcare

Market, By Distribution channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- Europe

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the material handling equipment market?

Key trends include deployment of automated guided vehicles (AGVs) and robotic arms, IoT integration for real-time monitoring, predictive analytics for maintenance, and adoption of electric-powered and eco-friendly equipment for sustainability.

Who are the key players in the material handling equipment market?

Key players include Toyota Material Handling, KION Group, Jungheinrich AG, Crown Equipment Corporation, Hyster-Yale Materials Handling, Daifuku Co. Ltd., Dematic (KION Group), Mitsubishi Logisnext, SSI SCHAEFER, Columbus McKinnon Corporation, BEUMER Group, Honeywell Intelligrated, Komatsu Ltd., Murata Machinery, and Fives Group.

What was the market share of the 3PL application segment in 2025?

The 3PL (third-party logistics) segment held 20.8% of the total market share in 2025, emerging as a leader driven by businesses outsourcing logistics operations.

What is the growth outlook for China material handling equipment market from 2026 to 2035?

China is anticipated to grow at a CAGR of 7.9% till 2035, fueled by rapid industrialization, explosive e-commerce growth, and government initiatives like

How much revenue did the storage and handling equipment segment generate in 2025?

Storage and handling equipment generated USD 70.5 billion in 2025, forming the backbone of the market due to extensive applicability across warehouses and distribution centers.

Which region leads the material handling equipment market?

The U.S. dominates an overall North America market and valued at USD 35 billion in 2025 and is estimated to grow at a CAGR of 6.4% from 2026 to 2035.

What is the market size of the material handling equipment in 2025?

The market size was USD 189.6 billion in 2025, with a CAGR of 7% expected through 2035 driven by e-commerce expansion, Industry 4.0 adoption, and increasing global supply chain complexity.

What is the current material handling equipment market size in 2026?

The market size is projected to reach USD 202.3 billion in 2026.

What is the projected value of the material handling equipment market by 2035?

The global market for material handling equipment is expected to reach USD 372.6 billion by 2035, propelled by automation, robotics integration, and the growth of advanced warehouse management systems.

Material Handling Equipment Market Scope

Related Reports