Summary

Table of Content

Marine Radar Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Marine Radar Market Size

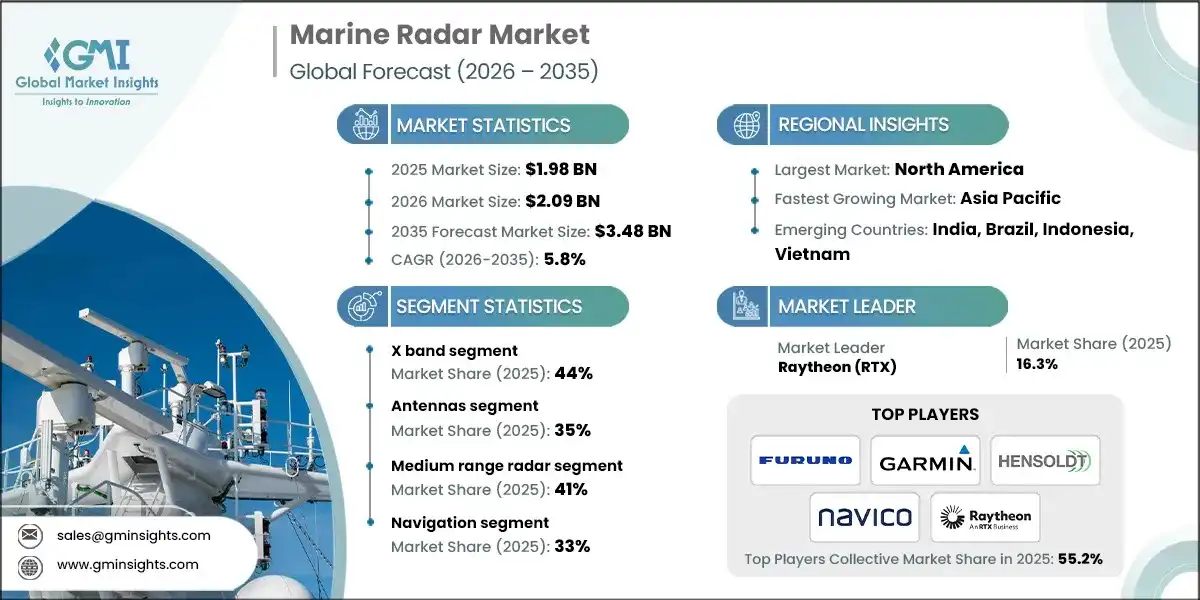

The global marine radar market size was estimated at USD 1.98 billion in 2025. The market is expected to grow from USD 2.09 billion in 2026 to USD 3.48 billion in 2035, at a CAGR of 5.8% according to latest report published by Global Market Insights Inc.

To get key market trends

The increasing global trade through the maritime industry combined with a high density of vessel traffic is resulting in an ever-increasing need for marine radar systems. As per the United Nations Maritime Trade Development Agency (UNCTAD), there were over 11 billion tons of seaborne trade in 2023, leading to an increase in navigation complexity, necessitating an increasing amount of reliable situational awareness solutions for commercial vessels.

A similar trend has continued in maritime safety regulations, creating a further impetus for radar installations across all classes of vessels. The International Maritime Organization reports that there are more than fifty (50) thousand merchant vessels that have been registered globally as of 2024, and that those vessels must comply with the SOLAS requirements regarding navigation and radar installations; this directly supports the baseline demand for both X band and S band radar installations.

Concurrently, the increasing number of incidents or collisions occurring in our most congested waterways is increasing investment into the development of advanced radar technologies. According to the European Maritime Safety Agency, there are more than three (3) thousand marine casualties annually throughout Europe, thus indicating that radar has become a critical resource for maintaining collision-awareness, navigating through restricted visibilities and monitoring traffic flow.

With these technological advancements providing a strong impetus for technological upgrades, the replacement demand for older fleets has also increased. According to Clarkson Research Services, it is estimated that more than forty percent of the global commercial fleet (greater than fifteen years old) will experience a significant number of either retrofits for solid-state radar installations, improved signal processing technology or the digital integration of bridge navigation systems.

Marine Radar Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.98 Billion |

| Market Size in 2026 | USD 2.09 Billion |

| Forecast Period 2026-2035 CAGR | 5.8% |

| Market Size in 2035 | USD 3.48 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growth in global seaborne trade | Rising vessel movements increase demand for navigation, collision avoidance, and traffic monitoring radar systems across commercial fleets. |

| Stricter maritime safety regulations | SOLAS and national maritime safety norms mandate radar installation, sustaining consistent demand across vessel categories. |

| Increasing traffic congestion in coastal and port waters | Dense shipping lanes and port approaches require advanced radar for situational awareness and vessel traffic management. |

| Technology upgrades and digital integration | Transition toward solid state radar and integrated bridge systems drives replacement demand. |

| Pitfalls & Challenges | Impact |

| High installation and maintenance costs | Advanced radar systems increase capital expenditure, limiting adoption among small vessel operators. |

| Signal interference and clutter in congested waters | High traffic density and environmental factors can affect radar performance and accuracy. |

| Opportunities: | Impact |

| Retrofit demand from aging global fleets | Older vessels upgrading navigation systems create sustained aftermarket opportunities. |

| Expansion of offshore wind and offshore energy projects | Growth in offshore assets increases demand for navigation and surveillance radar. |

| Adoption of solid state and digital radar | Improved reliability and lower maintenance costs support long term adoption. |

| Market Leaders (2025) | |

| Market Leaders |

16.3% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Brazil, Indonesia, Vietnam |

| Future Outlook |

|

What are the growth opportunities in this market?

Marine Radar Market Trends

Solid state radar is rapidly becoming the standard in most commercial and defense fleets because of its reliability and low-maintenance requirements. An estimated 60% of new commercial orders will feature solid-state radar systems as a part of standard bridge equipment by 2024, according to Information Management Organization (IMO).

Marine radar is being integrated with Electronic Chart Systems (ECS) and Automatic Identification Systems (AIS) into a new way of tracking vessel positions. According to International Maritime Organisation (IMO) reports, over 80% of SOLAS class vessels are employing Integrated Bridge Systems In order to enhance Situational Awareness and Decrease the Operator’s Load while navigating in congested waters.

The growth of Vessel Traffic Services (VTS) is driving the increased demand for shore radar stations. European Maritime Safety Agency (EMSA) reports (2024) that there are more than 1,000 VTS stations operating worldwide, which support port traffic management and Coastal Monitoring and Incident Prevention along high-density shipping lanes.

Increased attention to navigation safety in reduced visibility situations has created an increase in the performance of radar equipment. A recent report from the United Kingdom Marine Accident Investigation Branch (MAIB) has stated that reduced visibility accounts for approximately 30% of all vessel collisions, generating increased demand for advanced clutter suppression and Improved target tracking capabilities.

Radar Replacements are increasing in demand because of the Age of the Global Fleet. Research by Clarksons shows that over 40% of the merchant fleet is over 15 years old, thus resulting in increased Retrofit Cycles for installation of the new digital radar systems.

Marine Radar Market Analysis

Learn more about the key segments shaping this market

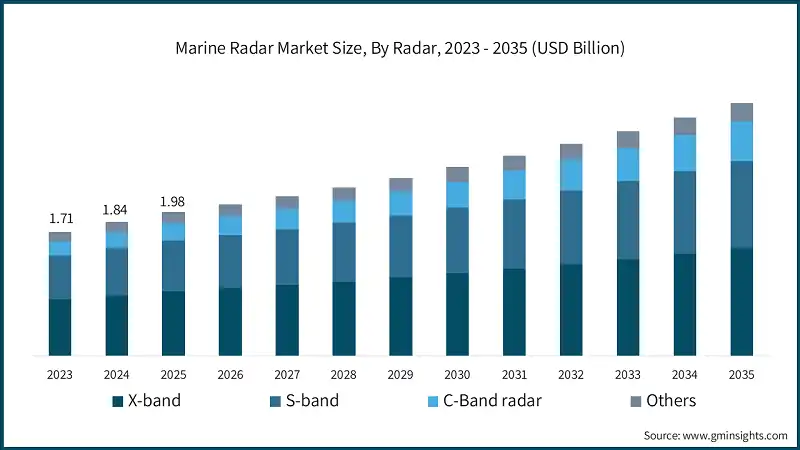

Based on radar, marine radar market is segmented into X band, S band, C band radar, and others. The X band segment dominates the market with 44% share in 2025, and the segment is expected to grow at a CAGR of 5.3% from 2026 to 2035.

- X-band radar is typically used by vessels for navigation, collision avoidance, and port operations at short/medium distances. As per the IMO carriage requirements, vessels with a gross tonnage of more than 300 GT must have some form of radar.

- S-band radar, on the other hand, is widely used in large commercial and naval ships during heavy rain and for longer-distance navigation. Clarksons data indicates that greater than 70% of container ships over 8000 TEU incorporate both X- and S-band radar systems.

- Adoption of C-band radar is relatively low and restricted to a limited number of coastal surveillance/legacy defense capabilities. Because of the higher costs and lower resolution compared to modern shipborne X-band systems, C-band accounts for a small percentage of all worldwide installations.

- "Others" encompasses primarily shore-based radars and specialized surveillance systems. Port Authorities and Coastal Agencies utilize these systems, and according to European Maritime Safety Agency (EMSA), there are approximately 1,000 active vessel traffic service centers in operation worldwide sustaining constant growth in demand for non-shipborne radars.

Learn more about the key segments shaping this market

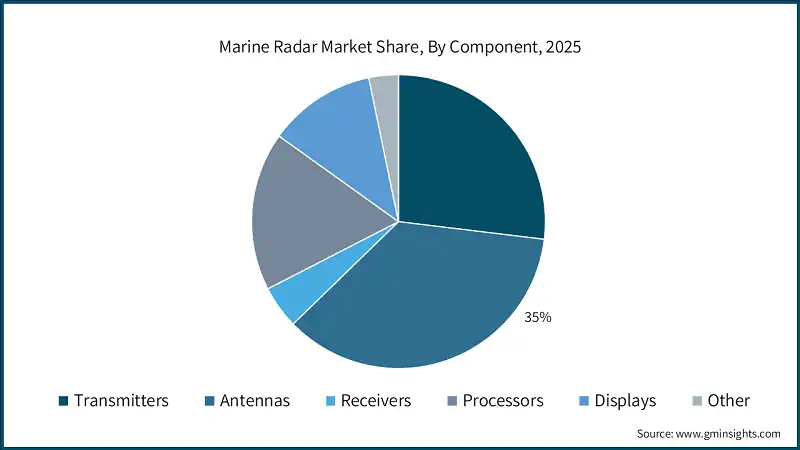

Based on component, the marine radar market is divided into transmitters, antennas, receivers, processors, displays, and others. The antennas segment dominates with 35% market share in 2025 and is growing at a CAGR of 5.3% from 2026 to 2035.

- With more than half of marine radar maintenance being spent on replacing, upgrading, and calibrating antennas across commercial and fishing fleets, antennas are the largest contributor to the detection range and resolution of targets for Marine Radar.

- The second largest contributor to the marine radar market is transmitters and receivers due to the shift towards solid-state radar systems. The latest IMO Newbuild statistics show that over fifty percent of radar systems purchased for vessels delivered after 2023 are equipped with solid-state transmitter/receiver modules that consume less power.

- Processes are becoming more relevant in the marine radar industry given the increasing need for advanced electronic signal processing and to remove false alarms due to noise and clutter. Integrated bridges containing radars have now surpassed eighty percent among SOLAS vessels which drives even more need for processors to process and deliver real-time target tracking information merged with navigation systems.

- The demand for displays will continue to be high as more fleets retrofit and upgrade their bridges. The newest multi-functional displays have replaced the traditional radar screens and greatly improve usability and regulatory compliance, while also having the power supply and housing to enhance long-term reliability of the complete system.

Based on range, the marine radar market is segmented into short range radar, medium range radar, and long range radar. The medium range radar segment dominates with 41% market share in 2025.

- Small and mid-sized vessels equipped with short-range radar systems are more frequently found in congested waterways than large ships or offshore installations. According to the International Maritime Organization (IMO), nearly 60% of the world's registered vessels operate within 20 nautical miles of land; therefore, they have many short-range radar systems installed.

- The medium-range radar systems are typically used by commercial vessels traversing through regional sea lanes as well as offshore/disturbance areas. Clarksons Research says that roughly 30% of global merchant vessels likely travel through 50 miles from the nearest coastline. This supports continued need for medium-range radar systems that can deliver a combination of good target detection and resolution performance.

- Long-range radar systems are predominantly installed on large commercial ships (i.e., cargo and duty) and naval vessels, along with smaller ships (i.e., patrol boats and fishing vessels). The Stockholm Institute for Peace Research's (SIPRI) report shows that naval fleets and container ships make up less than 15% of the total number of registered vessels, thereby inhibiting growth potential.

- Improvements being made in digital signal processing are allowing for improved long-range radar performance. New technologies including solid-state radar and digital beam sharpening yield improved target detection performance, resulting in increased rate of acceptance of long-range radar systems and replacement demand for existing short- to medium-range radar systems on the large number of aging airplanes and vessels in use throughout the world.

Based on application, the marine radar market is divided into navigation, collision avoidance, surveillance and security, fishing operations, monitoring coastal traffic, weather monitoring, and others. Navigation segment dominate with 33% market share in 2025.

- The International Maritime Organization (IMO) indicates that over 60% of merchant and fishing vessel rely solely on radar as their primary method of navigation and as such, provide an ever-increasing demand for installation and replacement of radar systems around the world. The increase in the use of such equipment relates to the fact that the vast majority of vessels being used to move cargo through our oceans (over 75% of the volume) are using some form of radars to assist them safely with navigation.

- Radar is increasingly becoming an integral part of the marine industry's ability to avoid collisions between vessels in congested ports and busy shipping lanes. According to the European Maritime Safety Agency (EMSA), nearly 30% of the marine accidents that occurred in 2023 were due to close quarter situations, indicating that radar has played an important role in helping prevent accidents.

- The use of radar for surveillance and security purposes is being driven by the naval and offshore industries. The Stockholm International Peace Research Institute (SIPRI) reports that, as of 2021, there are more than 100 countries that have active naval fleets, with over 1,500 active surface vessels capable of being used for various military and commercial purposes. Many of these surface vessels are equipped with radars that can help detect and monitor threats within a certain perimeter.

- Fishing fleets routinely use radar to locate schools of fish, as well as to navigate through shallow waters and hazardous areas. According to the Food and Agriculture Organization (FAO) of the United Nations, there are estimated to be more than 4 million commercial and recreational fishing vessels operating throughout the world, with the highest rates of radar adoption being found among commercial trawlers (both draggers and bottom trawlers) and purse seiners.

- There is a growing trend in the use of radars for monitoring coastal traffic and weather. The number of vessel traffic service (VTS) centres located worldwide has increased to over 1,000, with many VTS centres using radar for the purpose of providing real-time traffic monitoring. In addition, many meteorological agencies have begun to incorporate radar into their (storm) tracking and early warning systems.

Looking for region specific data?

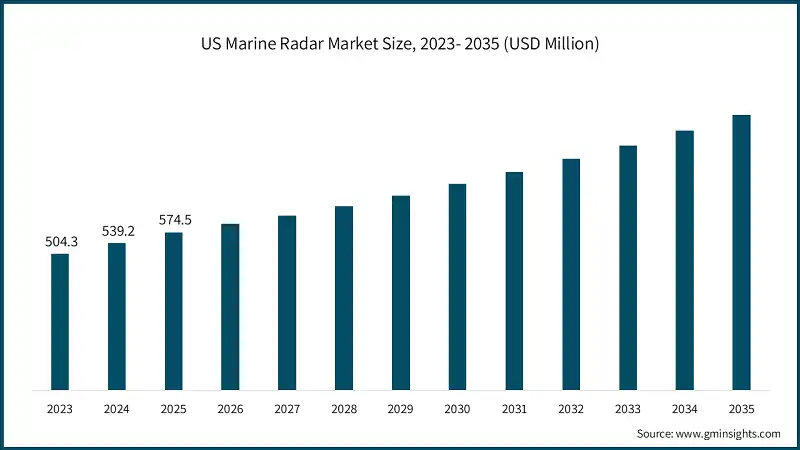

US dominates the North America marine radar market, accounting for 88% share and generating USD 574.5 million revenue in 2025.

- The US market has reached a level of technological maturity with widespread penetration into commercial shipping, naval fleets, and recreational vessels. The presence of stringent maritime regulations and safety compliance requirements, coupled with the amount of coastal and port traffic generated through shipping activities, continue to create ongoing demand for up-to-date radar technology.

- The major influencers on trends in the market are the operations of both the US Navy and Coast Guard. As these entities upgrade their radar systems to new products/technologies (solid state radars, integrated systems) for the purposes of improving maritime security, the majority of commercial shipping fleets are investing in radar for the purposes of navigational safety (collision avoidance) in crowded waters and for efficient planning of shipping routes.

- In addition to the commercial shipping sector, the recreational and fishing sectors represent other segments of the market that contribute to continued demand. As yachting, sport fishing, and small vessel navigation become more popular, so does the growing reliance on compact, dependable radars that are able to provide reliable high-resolution images integrated with electronic charting systems.

- Port Authorities and Vessel Traffic Services around the country that provide and promote the installation of radar systems to monitor coastal traffic, the US government continues to invest in advanced surveillance systems to help improve safety and efficiency, expanding port operations, and increasing situational awareness in busy waters.

- All of these technological developments in the US marine radar market are enabling operators to pay more attention to the digital integration of automated target tracking with the use of multifunction displays; in addition, the retrofitting of older age fleets continues to be a strong stimulus for continued growth within the market.

Germany dominates Europe market growing with a CAGR of 5.8% from 2026 to 2035.

- Germany has a large marine radar market, driven primarily by an extensive commercial shipping sector, extensive port operation and development and sophisticated naval operation. The marine safety regulations and the Safety of Life at Sea (SOLAS) Convention create strong demand across all sectors of the commercial shipping industry (cargo, container and passenger).

- Germany’s shipbuilding and maritime technology sectors are continuing to grow, contributing positively to the market for advanced radar systems, including systems that utilize Electronic Chart Systems (ECS), Automatic Identification Systems (AIS) and automated navigation systems to improve safety and efficiency for all types of vessels (commercial and defense).

- The fishing industry and recreational boating industry are also growing in terms of the number of units sold. Compact, high-resolution radar systems are growing in popularity for navigation, collision avoidance and coastal monitoring. Therefore, they are commonly utilized by many small commercial vessels and by recreational boaters.

- In addition to commercial shipping operations, a large number of port authorities and vessel traffic service centres are taking advantage of the capabilities of radar-based surveillance for managing vessel traffic and maintaining a safer coastal environment. Major German ports, such as Hamburg and Bremen, are key contributing factors for radar systems installed at ports, integrated with other port operations to improve the speed and efficiency of the major shipping routes in Germany and Europe.

China dominates the Asia Pacific market, showcasing strong growth potential, with a CAGR of 6% from 2026 to 2035.

- China marine radar marketplace is growing rapidly owing to the combination of an expanding commercial shipping fleet increasing port activities and governmental military modernization plans. The high volume of marine travel off the coasts as well as throughout the inland waterways has been creating the need for a large number of radar units among both commercial and recreational fisherman.

- Government and maritime safety regulations require the installation of radars on larger vessels, thus ensuring a steady amount of installations occurring as well as for both new as well as retrofitted vessels.

- The increase in commercial and professional fishermen operating in congested areas is driving the demand for radar by commercial fishermen in China. The Commercial and Artisanal Fleet together will continue to create a very strong market for medium to long-range radar used in the fishing industry.

- Vessel traffic management agencies and Port Authorities across China are utilizing radar systems as a key component to monitor and manage traffic. The most populous ports of Shanghai, Ningbo, and Shenzhen utilize some of the most advanced maritime radar systems to improve safety for navigation, improve traffic management, and provide better coastal enforcement capabilities.

Brazil leads the Latin American marine radar market, exhibiting remarkable growth of 4.8% during the forecast period of 2026 to 2035.

- Growing commercial shipping, offshore oil and gas operations and a robustly active fishing sector result in the ongoing growth of Brazil’s market as it is supporting the need for navigation & collision avoidance radar systems, resulting in continuous demand for maritime transportation.

- Radar carriage is a requirement in maritime safety regulations for larger sized vessels, therefore there will be many opportunities to add new radar installations and retrofit existing vessels with radar technology.

- The fishing sector provides a high-level of radar adoption since most of Brazil's artisanal and commercial fishing fleets utilize radar systems for the purpose of finding shoals of fish, safely navigating through shallow waters and improving operational efficiency.

- The use of radar by Port Authorities and Coastal Surveillance Agencies to manage vessel port traffic is an ongoing trend. The Ports of Santos, Rio De Janeiro and Paranaguá are examples of Ports where advanced radar technologies are being used to support safe and efficient vessel movement.

UAE to experience substantial growth in the Middle East and Africa marine radar market in 2025.

- Heavy traffic due to commercial shipping, Oil and Gas support logistics and Navy operations creates a large demand for radar to assist ships in navigating and avoiding collision while in Commercial shipping and Offshore fleets.

- Large vessels are regulated by strict maritime safety and SOLAS regulations to carry radar, and there are large volumes of these vessels being installed due to the high volume of commercial shipping activity in Jebel Ali and Abu Dhabi Ports, this creates an opportunity for Radar manufacturers to continue growing at a steady rate throughout the life of the manufacturer.

- Radar systems are most effective when used in conjunction with AIS and Electronic Chart Systems to provide the best overall navigation efficiency and the highest level of situational awareness in congested waterways.

- The expansive and growing Offshore Oil and Gas Infrastructure will continue to grow, and with it, so will the need for a reliable means of navigating offshore/ocean and safely coordinating operations in both the Energy and Logistics Industries.

- Port authorities and Coastal Surveillance agencies are using Radar technology to manage vessel traffic and provide an early warning capacity in their coastal jurisdictions. Significant investments in advanced radar technology have exceeded the overall efficiency of traffic management while simultaneously providing a means of accident prevention and ensuring secure operations in the Gulf region of the UAE.

Marine Radar Market Share

- The top 7 companies in the marine radar industry are Raytheon RTX, Furuno Electric, Hensoldt, Garmin, Navico, JRC Nisshinbo, and Sperry Marine, contributed around 66% of the market in 2025.

- Raytheon RTX remains an industry leader in delivering advanced Naval Radar Systems and supports air and missile defence with SPY6 Series Systems on naval warships, while also providing SeaVue Surveillance Seawater Radars. These systems incorporate the latest Military-Grade Technology and provide exceptional performance for Maritime Operatives.

- Furuno Electric is one of the world's leading companies in the commercial and fishing vessel segments. Their Solid-State Doppler Radar Series of products feature extensive target analysis, as well as fast tracking capabilities. The various Solid State Doppler Radar family products are available in both X-Band and S-Band configurations, have been extensively distributed around the World, and have established a solid reputation as navigation integration specialists.

- Hensoldt has an excellent reputation within the Tactical Naval Radar Equipment Sector through its SharpEye Solid State Technology and the TRS4D Series of Products, which provide Multifunctional Surveillance for both Defence and Security Vessels, with a particularly strong European presence.

- Garmin has become the leading supplier of Recreational/Small Commercial Boat Radars worldwide. Using Garmin’s xHD and Fantom Series, these radar units incorporate pulse compression and Doppler processing for providing clear target detection, while providing a compact form factor.

- Navico is the industry leader in both the professional and leisure boat radar market categories. This company’s HALO RADAR series of pulse compression open array radars provides exceptionally long-range performance, while meeting all International Maritime Organization (IMO) compliance standards for Commercial Fleets.

- JRC Nisshinbo is an established and reputable manufacturer of Marine Radars. The JMA and JMR series of radars utilize advanced signal processing technologies to benefit both merchant ships and fishing vessels, while taking advantage of the large scale of the manufacturing process, along with the extensive distribution networks that JRC Nisshinbo has in place.

- Sperry Marine is a part of Northrop Grumman and is well positioned to service both commercial and naval customers with their VisionMaster series of radar products.

Marine Radar Market Companies

Major players operating in the marine radar industry are:

- Furuno Electric

- Garmin

- Hensoldt

- JRC Nisshinbo

- Kongsberg Gruppen

- Navico

- Raymarine

- Raytheon RTX

- Sperry Marine

- Terma

- Marine radar systems play an important role in navigation, prevention, surveillance and weather monitoring across commercial shipping, fishing, naval defence, recreational boating and offshore operations. The market offers two types of radars: X band radars offer a high-resolution image of the area, while S band radars have better long-range performance; both types have unique advantages based on environmental conditions in which they are used. The growing demand from both merchants (due to the rise of global trade) and military and recreational use has led to a focus on the merchant marines as the primary application area.

- Several of the leading players in the marine radar market include Raytheon RTX, Furuno Electric, Hensoldt AG, Garmin, Navico, JRC Nisshinbo, Sperry Marine, Raymarine, Kongsberg Gruppen and Terma AS. These companies have found success through innovations surrounding solid-state technology, Doppler processing and integrated multifunction displays. The marine radar industry has gained momentum from the International Maritime Organization’s (IMO) safety regulations, increasing maritime traffic, and investments being made into autonomous vessels.

Marine Radar Industry News

- In September 2025, Raymarine released the Pathfinder Radar range which is covered by IMO Type approval on CAT-1 products (conforming to international convention) and Black Box Radar (CHIRP Pulse Compression) for Commercial and Inland vessels.

- In October 2025, Raytheon produced the first production run of the SharpSight Multi-Domain Surveillance Radar that integrates HISAR and SeaVue technologies for Manned and Unmanned systems.

- In October 2025, the German Government selected Raytheon to supply SPY-6(V)1 radar for placement on Eight F127 Frigates through a Foreign Military Sales contract.

- In October 2025, Furuno products have been given multiple awards in the Categories of New Usage and Specialty Products at the NMEA Product of Excellence Awards for the Radar Systems DRS4D-NXT Solid-State Doppler Radar & FAR-2228-NXT-BB X-Band Solid-State Radars that are IMO approved.

- In August 2025, Raytheon performed a successful demonstration of advanced tracking capability for the AN/SPY-6(V)4 Radar. This was done during the first live maritime test in collaboration with US Navy.

- In July 2025, Simrad introduced AutoTrack, a new feature in both HALO 2000 and HALO 3000 Radars that provides Automatic Target Tracking.

- In July 2025, Terma entered into a cooperative agreement with Sperry Marine to provide SCANTER 4603 and SCANTER 6002 Naval Surveillance Radars for both Canadian Coast Guard Multi-Purpose Vessels and Polar Icebreaker Programs.

The marine radar market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) and volume (Units) from 2022 to 2035, for the following segments:

Market, By Radar

- X-band

- S-band

- C-Band radar

- Others

Market, By Component

- Transmitters

- Antennas

- Receivers

- Processors

- Displays

- Other

Market, By Range

- Short-range radar (1-20 NM)

- Medium-range radar (20-50 NM)

- Long-range radar (50-100 NM and above)

Market, By Application

- Navigation

- Collision Avoidance

- Surveillance & Security

- Fishing Operations

- Monitoring Coastal Traffic

- Weather Monitoring

- Others

Market, By End Use

- Commercial vessels

- Naval & Defense / Military Naval

- Recreational Boats / Yachts

- Private boat owners

- Fishing vessels

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Turkey

Frequently Asked Question(FAQ) :

What are the upcoming trends in the marine radar market?

Adoption of solid-state radar, integration with ECS and AIS, expansion of VTS, improved low-visibility navigation performance, and increased retrofitting of aging fleets.

Who are the key players in the marine radar industry?

Key players include Furuno Electric, Garmin, Hensoldt, JRC Nisshinbo, Kongsberg Gruppen, Navico, Raymarine, Raytheon RTX, Sperry Marine, and Terma.

What is the growth outlook for the antennas segment from 2026 to 2035?

The antennas segment is set to expand at a CAGR of 5.3% through 2035, maintaining its dominance with a 35% market share in 2025.

Which region leads the marine radar sector?

North America leads the market, with the US contributing 88% of the regional revenue in 2025. This dominance is led by technological maturity, stringent maritime regulations, and high coastal and port traffic.

What is the expected size of the marine radar industry in 2026?

The market size is projected to reach USD 2.09 billion in 2026.

What was the market share of the X band segment in 2025?

The X band segment dominated the market with a 44% share in 2025 and is expected to grow at a CAGR of 5.3% till 2035.

What is the market size of the marine radar in 2025?

The market size was USD 1.98 billion in 2025, with a CAGR of 5.8% expected through 2035. The growth is driven by increasing global trade, dense vessel traffic, and the need for advanced situational awareness solutions.

What is the projected value of the marine radar market by 2035?

The market is poised to reach USD 3.48 billion by 2035, fueled by advancements in radar technology, integration with navigation systems, and rising retrofit cycles for aging fleets.

Marine Radar Market Scope

Related Reports