Summary

Table of Content

Marine Propulsion Engine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Marine Propulsion Engine Market Size

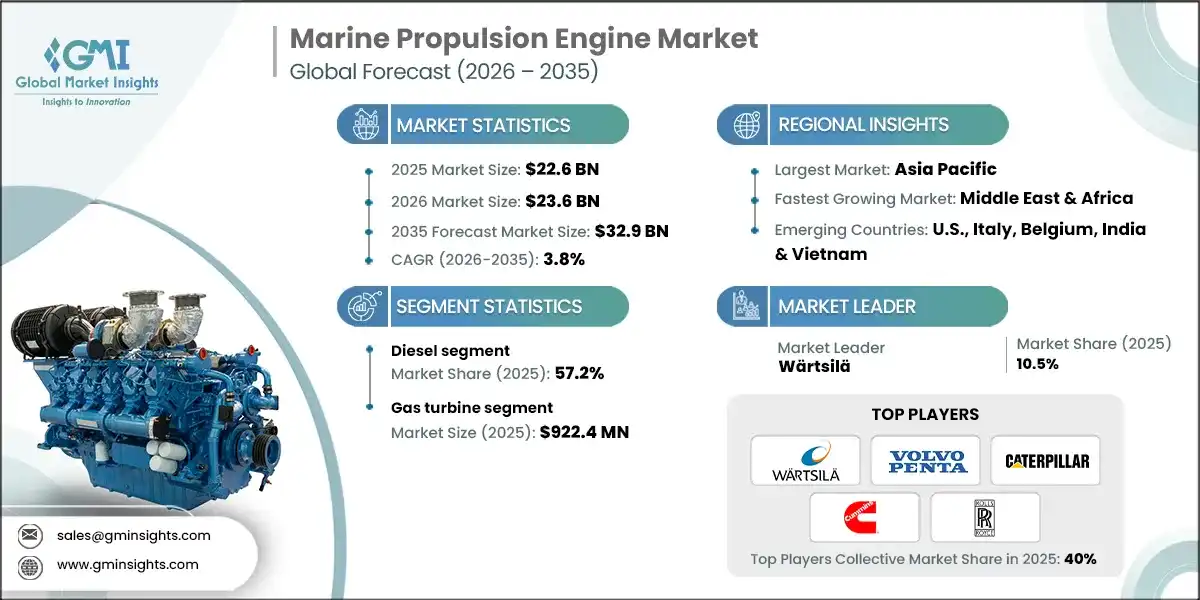

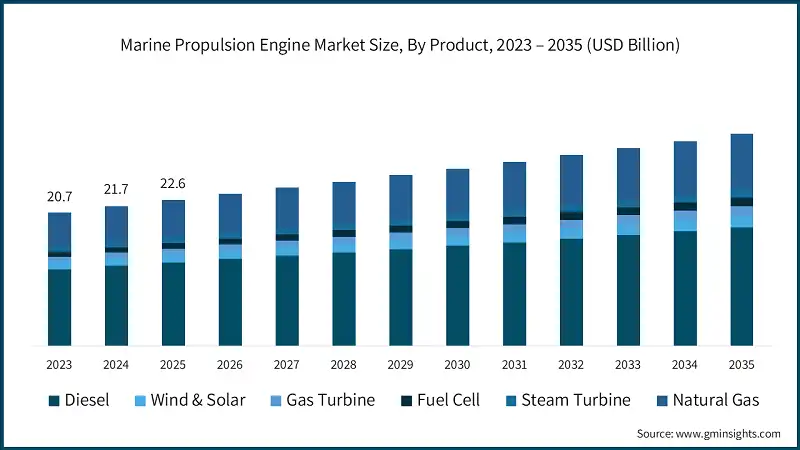

According to a recent study by Global Market Insights Inc., the marine propulsion engine market was estimated at USD 22.6 billion in 2025. The market is expected to grow from USD 23.6 billion in 2026 to USD 32.9 billion by 2035, at a CAGR of 3.8%.

To get key market trends

- Growing pressure to decarbonize global shipping is accelerating the adoption of clean, efficient, and alternative fuel marine propulsion engines across commercial and naval fleets. Increasing development of methanol, LNG, hydrogen, ammonia, and hybrid electric propulsion systems is reshaping the competitive landscape as shipowners plan long term compliance strategies.

- A marine propulsion engine is the primary power system used to drive a ship or vessel through water by converting fuel or electrical energy into mechanical thrust. It can operate on diesel, gas, steam, electricity, or hybrid combinations depending on vessel type and efficiency needs. These engines work together with propellers, thrusters, or waterjets to enable controlled movement and navigation.

- For instance, in August 2024, Brunvoll has been selected to deliver azimuth propulsion thrusters along with the associated control systems for four new hybrid ferries commissioned by Norled. These vessels will operate on the routes connecting Stokkvågen, Lovund, and Træna in Norway.

- Replacement of aging propulsion systems in merchants, offshore, and government vessels is stimulating investments in fuel-efficient, digitally enabled propulsion solutions. Expanding global maritime trade is increasing the need for engines that deliver higher power density, longer operational range, and improved fuel economy for long-haul routes.

- Integration of smart monitoring technologies, including AI-driven predictive maintenance, is influencing the design of propulsion engines focused on operational intelligence and real-time diagnostics. Vessel operators are prioritizing multifuel engines that can transition between marine diesel and alternative fuels without compromising output or durability.

- For illustration, in March 2024, Nordic Investment Bank agreed to provide a seven year loan to support Norled AS in expanding its fleet of zero and low emission vessels, along with the necessary shore-based infrastructure, for the period 2024–2030. The loan amounts to USD 49.7 million and will contribute to Norled’s ongoing shift toward cleaner maritime operations. This initiative represents NIB’s first InvestEU supported loan in Norway.

- Modernization of global ports is enabling better support infrastructure for alternative fuels and charging systems, accelerating adoption of marine engines. Advancements in turbochargers, fuel injection systems, and exhaust aftertreatment technologies are contributing to improved performance and reduced emissions across engine classes.

- Naval programs worldwide are investing in propulsion engines that offer enhanced endurance, stealthier acoustic signatures, and reliable performance in multi-mission environments. Inland waterway transport growth is driving demand for compact, quieter, and more efficient propulsion engines designed for barge operations and regional shipping routes.

- For citation, in May 2025, Asyad Group has unveiled the new large scale cargo vessel “Sohar Max,” designed with integrated wind propulsion technology to enhance environmental performance. This initiative highlights the company’s forward leaning approach to adopting sustainable solutions within maritime transport.

- The marine propulsion engine market was valued at USD 18.5 billion in 2022 and grew at a CAGR of approximately 3.0% through 2025. Engine manufacturers are investing heavily in R&D to improve combustion efficiency, thermal management, and overall sustainability across propulsion platforms.

- Noise and vibration reduction is becoming a critical design priority for passenger vessels, research ships, and naval units requiring acoustic performance improvements. Retrofitting older vessels with cleaner propulsion alternatives is expanding, driven by cost-saving goals and the need to meet new emissions regulations without purchasing new vessels.

Marine Propulsion Engine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 22.6 Billion |

| Market Size in 2026 | USD 23.6 Billion |

| Forecast Period 2026 - 2035 CAGR | 3.8% |

| Market Size in 2035 | USD 32.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion in seaborne trade | Rising global cargo movement and fleet utilization will elevate demand for efficient and compliant marine propulsion systems. |

| Ongoing technological advancement in marine engines | Continuous improvements in hybrid, digital, and fuel-flexible propulsion technologies will accelerate engine upgrades and newbuild adoption. |

| Rapid industrialization and economic liberalization | Expanding manufacturing hubs, growing port activity, and supportive trade policies will reinforce vessel additions and propulsion modernization. |

| Pitfalls & Challenges | Impact |

| Stringent government regulations against emissions | Tightening global and regional emission standards will increase compliance costs, complicate fuel transitions, and pressure operators to rapidly adopt cleaner propulsion technologies. |

| Opportunities: | Impact |

| Rising adoption of hybrid and electric propulsion | Growing interest in battery‑assisted and fully electric systems will open new avenues for advanced energy‑efficient marine power solutions. |

| Expansion of LNG, methanol, and alternative‑fuel infrastructure | Increasing availability of cleaner marine fuels will accelerate deployment of dual‑fuel and future‑fuel‑ready propulsion engines. |

| Growth in offshore wind and support vessel demand | Expanding offshore energy projects will create strong opportunities for dynamic‑positioning‑ready and high‑performance propulsion systems. |

| Modernization of aging global fleets | Replacement of outdated engines with efficient, low‑emission propulsion technologies will boost retrofit and upgrade markets worldwide. |

| Market Leaders (2025) | |

| Market Leaders |

10.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Country | U.S., Italy, Belgium, India & Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Marine Propulsion Engine Market Trends

- Rising global merchandise trade volumes and containerized cargo flows will intensify fleet utilization, prompting newbuild orders and propulsion upgrades. Growth in dry bulk (grain, coal, ores) and liquid bulk (crude, LNG, chemicals) shipments will broaden engine demand across vessel classes.

- Consolidation of shipping alliances and optimized route planning will prioritize fuel efficient propulsion to compress costs and enhance turnaround. Port capacity expansions, deeper drafts, and logistics digitization will support larger vessels requiring higher-output, compliant engines.

- For instance, in May 2025, Wattlab brought its SolarDeck solution to the deep-sea shipping market. The system consists of modular, deck-mounted solar panels designed to lower fuel use and cut CO2 emissions by supplying renewable energy directly to onboard electrical loads.

- Rapid progress in dual-fuel engines (LNG, methanol, LPG, ammonia-ready) will enhance fuel flexibility, mitigating decarbonization and supply risks. Hybrid propulsion combining mechanical drive with battery systems will improve transient response, auxiliary load management, and port-side emissions.

- High-efficiency turbocharging, Miller/Atkinson cycle strategies, and advanced injection will raise brake thermal efficiency and cut fuel burn. Digital twins, predictive analytics, and condition-based maintenance will lower lifecycle costs and extend time-on-wing for critical components.

- For illustration, in August 2025, the U.S. Naval Research Laboratory developed a prototype called the Hydrogen Small Unit Power (H SUP) system, designed to support Marine Corps units during expeditionary missions. This hydrogen-based power solution aims to lower the likelihood of detection while strengthening operational readiness in the field.

- Expansion of export-oriented manufacturing hubs will raise shipping throughput, driving demand for cargo vessels and corresponding propulsion engines. Liberalized trade regimes, tariff rationalization, and investment-friendly policies will stimulate shipbuilding orders and fleet growth.

- Development of special economic zones and coastal industrial corridors will catalyze port centric logistics, reinforcing engine procurement cycles. Public-private investment in maritime infrastructure (dry docks, repair yards, bunkering) will shorten overhaul times and support modernization.

Marine Propulsion Engine Market Analysis

Learn more about the key segments shaping this market

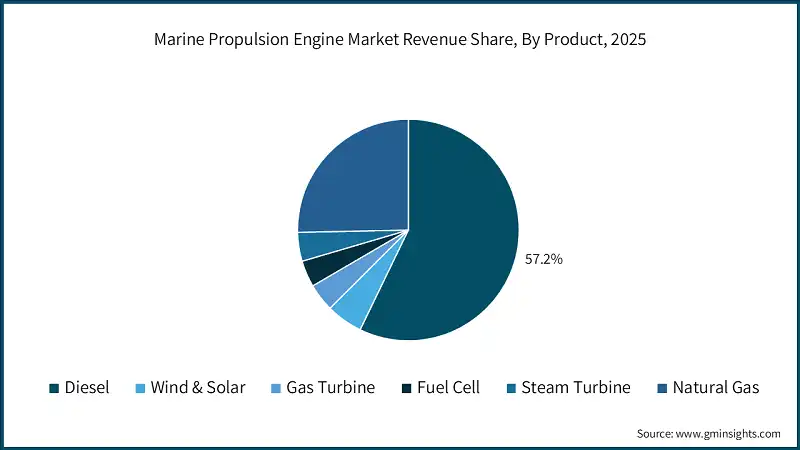

- Based on product, the industry is segmented into diesel, wind & solar, gas turbine, fuel cell, steam turbine, and natural gas. The diesel marine propulsion engine market holds a share of 57.2% in 2025. Persistent dominance in deep-sea and workboat segments will sustain demand for high-torque, long-range diesel propulsion supporting heavy duty cycles and global bunkering availability.

- Tiered emission compliance will catalyze adoption of advanced injections, optimized combustion, and aftertreatment, improving specific fuel consumption without compromising reliability. Lifecycle cost optimization through condition-based maintenance, lube management, and component standardization will reinforce diesel’s operational resilience.

- For instance, in December 2025, ABB has received a contract from Washington State Ferries to deliver and integrate hybrid-electric propulsion systems for two 160 vehicle ferries. These vessels form the first phase of WSF’s broader System Electrification Program.

- The wind & solar marine propulsion engine market is set to exceed USD 1.5 billion by 2035. Hybrid energy management systems will orchestrate renewable inputs with batteries and propulsion controls, stabilizing loads and trimming emissions in low-speed operations. Route optimization aligned with meteorological models will maximize wind assist efficacy, supporting measurable bunker savings over seasonal cycles.

- Compliance pressures around port air quality and ECA operations will drive renewable supported hoteling and maneuvering strategies. Digital dashboards quantifying renewable contribution and payback will inform charterer contracts and performance guarantees. Crew training and maintenance protocols for moving appendages and PV systems will mature, lowering operational risks.

- For reference, in July 2024, NYK Bulkship equipped the bulk carrier NBA Magritte with two wind assisted propulsion systems while the vessel was docked in Rotterdam. This marked the first installation of this type of wind-propulsion unit on an NYK Group vessel, representing a notable step in the company’s efforts to integrate energy saving technologies into its fleet.

Learn more about the key segments shaping this market

- The gas turbine marine propulsion engine market was valued at USD 922.4 million in 2025. Demand for lightweight, high power density propulsion will favor gas turbines in fast ferries, naval platforms, and high-speed logistics. Combined cycle and cogeneration architectures with waste-heat recovery will elevate total vessel energy efficiency and reduce emissions intensity.

- Fuel flexibility improvements and modular combustors will support transitions toward cleaner fuels and stricter NOx profiles. Rapid start capability and superior transient response will benefit dynamic operations requiring frequent speed changes. Noise and signature management advancements will enhance suitability for passenger and defense applications.

- For instance, in September 2025, Kospo announced that it had entered into a long-term natural gas supply agreement with Korea Gas Corporation. Under this contract, Kospo will receive 4.4 million tonnes of natural gas over a 10 year period beginning in 2027.

- The fuel cell marine propulsion engine holds a share of 3.9% in 2025. Zero-emission propulsion targets will accelerate pilot deployments of PEM and SOFC systems in short sea, harbor craft, and passenger segments. Modular stacks and scalable power electronics will enable phased capacity additions and redundancy tailored to mission profiles.

- Hydrogen, ammonia, and methanol pathways will shape fuel cell readiness, storage solutions, and safety protocols onboard. Silent operation and low vibration will enhance passenger comfort and niche defense applications requiring acoustic stealth. Hybrid configurations pairing fuel cells with batteries will support peak shaving and hotel loads, reducing conventional engine usage.

- The steam turbine marine propulsion market is set to exceed USD 1 billion by 2035. Integration with waste heat recovery from prime movers will enable auxiliary power generation, improving overall energy economics. Advances in sealing, materials, and blade design will lift efficiency and reduce maintenance intervals under marine duty profiles.

- Simplified drive trains for constant speed applications will support continuous process reliability where torque transients are minimal. Steam cycle optimization tied to cargo handling will reinforce system synergy and operational value. Moreover, automation of condensate management and water chemistry will cut downtime and enhance predictability.

- For illustration, in December 2025, ESVAGT strengthened its expansion strategy through the acquisition of two Service Operation Vessels (SOVs) previously owned by Edda Wind. The move is backed by existing clients, Vestas and Ocean Breeze, who have transferred their long term charter agreements to ESVAGT as part of the transition.

- The natural gas marine propulsion engine market will witness a CAGR of over 3.5% by 2035. Expansion of dual fuel engines capable of operating on natural gas and marine distillates will lower emissions while preserving operational flexibility. Methane slip mitigation through advanced combustion, oxidation catalysts, and controls will improve environmental performance.

- Cryogenic storage innovations and compact tank arrangements will broaden LNG adoption across mid size vessels. Improved bunkering logistics and standardized interfaces will reduce turnaround times and support predictable voyage planning. Digital monitoring of gas quality, pressure, and safety interlocks will raise reliability and compliance confidence.

Looking for region specific data?

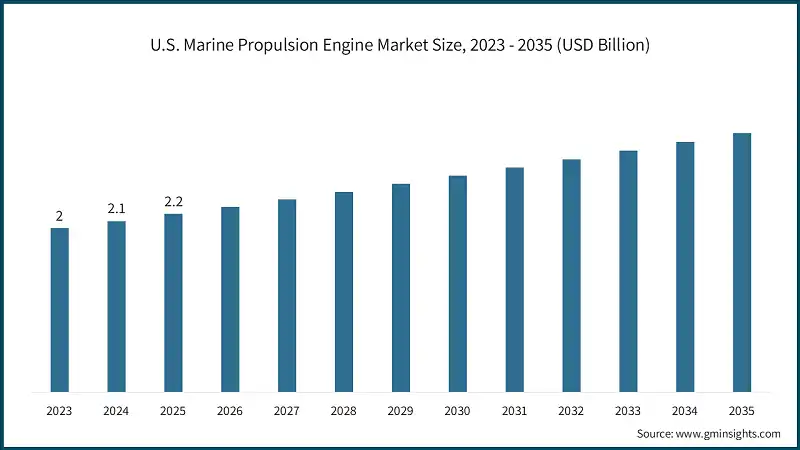

- The U.S. dominated the marine propulsion engine market in North America with around 68.6% share in 2025 and generated USD 2.2 billion in revenue. Growth in coastal shipping, Jones Act shipbuilding, and modernization of inland towboat fleets will drive adoption of efficient, compliance ready propulsion engines tailored to domestic operating profiles.

- The North America marine propulsion engine market is projected to surge over USD 4.5 billion by 2035. Canadian Arctic and Great Lakes operations will emphasize cold start reliability, ice class requirements, and fuel economy under extended duty cycles. LNG adoption in select routes will leverage cryogenic storage innovations and standardized bunkering interfaces to ensure voyage predictability.

- For reference, in December 2025, Master Boat Builders has unveiled plans to develop a new USD 60 million, 150,000 square foot production facility dedicated to supporting government and defense vessel construction.

- The Europe marine propulsion engine market is set to grow at a rate of over 3% by 2035. Stringent emission zones and green corridor policies will accelerate hybrid, dual fuel, and battery assisted propulsion across ferries, short sea, and inland fleets. Methanol and LNG pathways, plus ammonia ready designs, will shape procurement preferences for future fuel capable engines.

- The Asia Pacific marine propulsion engine market holds a share of 58.3% in 2025. Rapid shipbuilding activity and diversified cargo flows will sustain demand for high output propulsion engines across container, bulk, tanker, and Ro-Ro segments. Adoption of dual fuel platforms will expand, driven by fuel availability and regulatory trajectories in key maritime nations.

- For citation, in May 2025, Mitsubishi Heavy Industries Marine Machinery & Equipment started demonstration trials of a new methane oxidation catalyst designed for LNG powered vessels. The system was jointly developed with Daihatsu Infinearth Mfg, which contributed its engine optimization expertise.

- The Middle East & Africa marine propulsion engine market is set to grow at a rate of over 4% by 2035. Energy exports and bulk commodity flows will drive propulsion engines optimized for long routes, high load factors, and durability under harsh conditions. Port expansions and free zone logistics will stimulate engine demand with emphasis on fuel efficiency and predictable maintenance cycles.

- The Latin America marine propulsion engine market will exceed USD 800 million by 2035. Growth in agricultural exports and mineral shipments will sustain demand for efficient propulsion engines across bulk and container fleets. Riverine and coastal logistics will favor engines with high reliability, shallow draft compatibility, and simplified maintenance regimes.

Marine Propulsion Engine Market Share

- The top 5 players in marine propulsion engine industry are Wärtsilä, AB Volvo Penta, Caterpillar, Cummins & Rolls-Royce contribute around 40% of the market share in 2025. The market is shaped by global manufacturers offering diesel, dual fuel, hybrid, electric, and high performance engine solutions tailored to commercial, naval, and offshore fleets.

- Wärtsilä is a diversified marine power and technology provider with strong positioning across medium speed engines, hybrid/electric integration, and digital optimization. Its portfolio spans dual fuel (LNG/methanol ready) engines, propulsion packages (thrusters, gear), and energy management systems, complemented by shore power and batteries for hybridization.

- AB Volvo Penta focuses on high reliability marine engines and complete propulsion systems with particular strength in diesel for commercial workboats, coastal cargo, patrol, and passenger craft, alongside hybrid and electric solutions for short sea operations. Its differentiator is system integration engines, IPS/inline drivelines, gearboxes, controls, and electronic steering delivering compact layouts, strong load acceptance, and low vibration/noise performance.

- Caterpillar’s marine business and aftertreatment high torque diesel engines for tugs, offshore support, bulk/containers, and specialized workboats, complemented by generator sets, controls, and after treatment. The brand’s competitive advantage is ruggedness, service reach, and parts availability, making it a preferred choice in demanding duty cycles and remote operations.

- Cummins competes with a broad range of diesel marine engines and generator sets tailored to workboats, patrol, passenger ferries, inland/coastal cargo, and select offshore applications, increasingly complemented by hybrid and lower emission solutions. Strengths include reliability, serviceability, and global support, with a focus on compact footprints, ease of installation, and diagnostics that streamline maintenance planning.

- Rolls Royce’s mtu brand (Power Systems) positions strongly in high performance marine propulsion, supplying diesel, gas, and hybrid solutions for naval, fast ferries, yachts, and commercial craft requiring power density, low signature, and dynamic response. Competitive strengths include advanced controls, integration expertise, and hybrid architecture combining engines, batteries, and power electronics to reduce emissions and improve maneuvering efficiency.

Marine Propulsion Engine Market Companies

Major players operating in the marine propulsion engine industry are:

- AB Volvo Penta

- Anglo Belgian Corporation

- Caterpillar

- Cummins

- Deere & Company

- Deutz AG

- HD Hyundai Heavy Industries Engine & Machinery

- Ingeteam

- Isuzu Motors Engine Sales

- Masson Marine

- Mitsubishi Heavy Industries

- Nanni

- Perkins Engines

- Rolls-Royce

- Scania

- Steyr

- Vetus

- Wärtsilä

- Yamaha Motor

- Yanmar Marine International

- Over the first nine months of 2025, Caterpillar generated USD 48.5 billion in revenue. From this total, the company dedicated roughly USD 1.6 billion to research and development activities. Operating profit for the period reached about USD 8.5 billion, which was also reflected in its profit before tax. These results indicate strong operational efficiency combined with a continued focus on innovation.

- During the same nine month period in 2025, Cummins reported revenue of USD 25.1 billion, underscoring solid business performance. The company recorded a gross margin of USD 6.6 billion, supported by consistent demand across its engine and power solutions portfolio. Research and development spending totaled around USD 1 billion, demonstrating sustained investment in new technologies. Cummins also had operating income of USD 3.2 billion, highlighting robust profitability across its core segments.

- During the first half of 2025, Rolls Royce generated approximately USD 11.1 billion in revenue. The company reported a gross profit of USD 3.4 billion and an operating profit of USD 2.4 billion. Its research and development spending for the period amounted to around USD 0.3 billion.

Marine Propulsion Engine Industry News

- In October 2025, Rolls Royce has completed a successful test of the world’s first high speed marine engine designed to run solely on methanol, conducted at its Friedrichshafen test facility. This achievement marks a major step forward for the company and its partners in the meOHmare research initiative as they work toward cleaner, climate neutral propulsion technologies for the maritime sector. The development supports Rolls Royce’s broader strategy to help customers cut CO2 emissions, aligning with the “lower carbon” pillar of its long-term transformation plan. It also reinforces the company’s strategic focus on expanding its marine business within the Power Systems division.

- In May 2025, Volvo Penta has introduced a cutting edge electric version of its IPS marine propulsion system, marking a significant advancement in the company’s sustainability journey. This fully electric propulsion range builds on the well established Volvo Penta IPS platform and represents another key step toward achieving zero emission mobility for both land based and marine applications. Developed initially for commercial marine operations, the new electric IPS lineup consists of five driveline configurations.

- In May 2025, Cummins received AIP from DNV for its methanol ready QSK60 engines, certified for both IMO II & IMO III standards and offered in the 2000–2700 hp (1491–2013 kW) range. Granted in June 2024, this AIP confirms that Cummins’ retrofit compatible methanol dua fuel solution meets rigorous global marine safety and performance requirements. After completing extensive field validation, Cummins aims to introduce the methanol retrofit kits after 2028, aligning the rollout with expected market needs and methanol infrastructure development.

- In May 2024, Caterpillar Marine has announced major progress in its methanol capable dual fuel Cat 3500E marine engines. The update was shared at the 27th International Tug & Salvage Convention, Exhibition & Awards 2024 in Dubai. As part of a new Memorandum of Understanding with Damen Shipyards Group, Caterpillar Marine plans to introduce the first field trial units of the 3500E engines in 2026. The upcoming 3500E series will feature advanced dual fuel technology that builds on Caterpillar’s established diesel platforms and is compatible with low pressure methanol fuel systems operating below 10 bar.

The marine propulsion engine market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Product

- Diesel

- Wind & solar

- Gas turbine

- Fuel cell

- Steam turbine

- Natural gas

The above information has been provided for the following regions & countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- Italy

- France

- Russia

- Denmark

- Netherlands

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Singapore

- Middle East & Africa

- Saudi Arabia

- UAE

- Iran

- Angola

- Egypt

- South Africa

- Latin America

- Brazil

- Argentina

- Mexico

Frequently Asked Question(FAQ) :

What is the growth outlook for the natural gas marine propulsion engine segment from 2026 to 2035?

Natural gas marine propulsion engines are projected to grow at over 3.5% CAGR by 2035, driven by expansion of dual-fuel engines and methane slip mitigation through advanced combustion technologies.

Which region leads the marine propulsion engine market?

The U.S. dominated the marine propulsion engine market in North America with around 68.6% share in 2025 and generated USD 2.2 billion in revenue.

What are the upcoming trends in the marine propulsion engine market?

Key trends include rising adoption of hybrid and electric propulsion, expansion of LNG, methanol, and alternative-fuel infrastructure, growth in offshore wind and support vessel demand, modernization of aging global fleets, and advancements in digital engine management and predictive maintenance.

Who are the key players in the marine propulsion engine market?

Key players include Wärtsilä, AB Volvo Penta, Caterpillar, Cummins, Rolls-Royce, Anglo Belgian Corporation, Deere & Company, Deutz AG, HD Hyundai Heavy Industries Engine & Machinery, Ingeteam, Isuzu Motors Engine Sales, Masson Marine, Mitsubishi Heavy Industries, Nanni, Perkins Engines, Scania, Steyr, Vetus, Yamaha Motor, and Yanmar Marine International.

What was the valuation of the gas turbine marine propulsion engine segment in 2025?

Gas turbine marine propulsion engines were valued at USD 922.4 million in 2025, favored for lightweight, high-power-density applications in fast ferries, naval platforms, and high-speed logistics.

What is the market size of the marine propulsion engine in 2025?

The market size was USD 22.6 billion in 2025, with a CAGR of 3.8% expected through 2035 driven by increasing pressure to decarbonize global shipping and the accelerating adoption of clean, energy-efficient, and alternative-fuel propulsion systems.

What is the projected value of the marine propulsion engine market by 2035?

The marine propulsion engine market is expected to reach USD 32.9 billion by 2035, propelled by expansion in seaborne trade, technological advancements in hybrid and dual-fuel engines, and modernization of aging global fleets.

What is the current marine propulsion engine market size in 2026?

The market size is projected to reach USD 23.6 billion in 2026.

How much revenue did the diesel marine propulsion engine segment generate in 2025?

Diesel marine propulsion engines held 57.2% market share in 2025, driven by persistent dominance in deep-sea and workboat segments supporting heavy duty cycles and global bunkering availability.

Marine Propulsion Engine Market Scope

Related Reports