Summary

Table of Content

Management System Certification Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Management System Certification Market Size

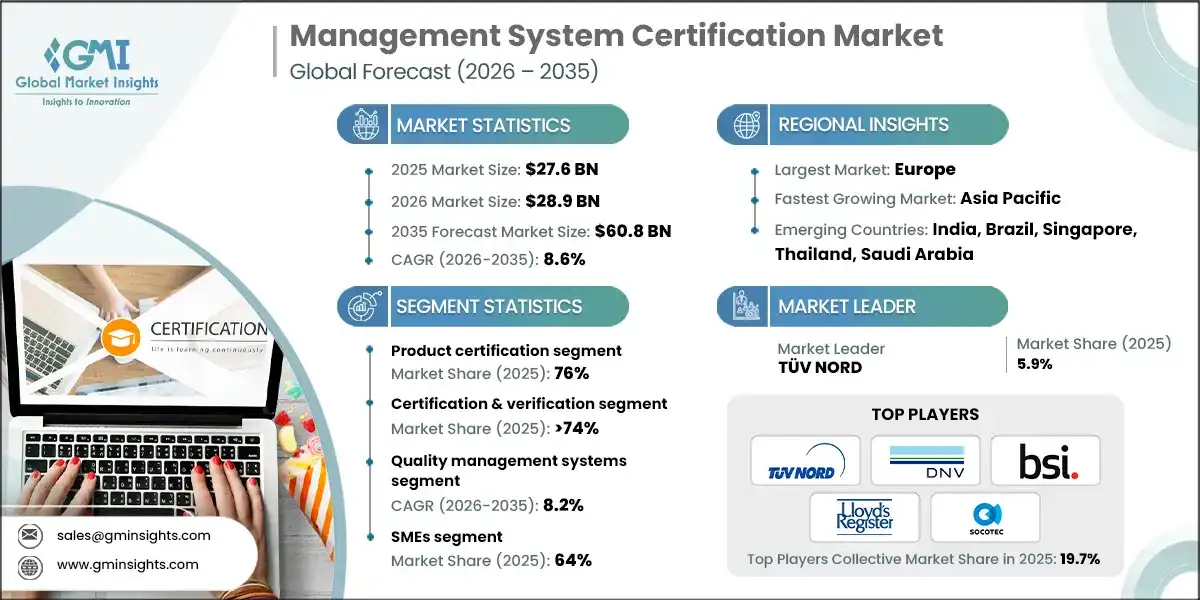

The global management system certification market was estimated at USD 27.6 billion in 2025. The market is expected to grow from USD 28.9 billion in 2026 to USD 60.8 billion in 2035, at a CAGR of 8.6% according to latest report published by Global Market Insights Inc.

To get key market trends

The management system certification market is driven by increasing regulatory requirements, heightened awareness of quality & sustainability, and globalization. Businesses seek certification to comply with regulations, enhance credibility, and facilitate international trade. Certification provides a competitive edge and aids in risk management.

Governments and industry regulators increasingly mandate compliance with international management system standards. Certification helps organizations demonstrate conformity, reduce legal and operational risks, ensure workplace safety, protect data, and maintain market access across regulated domestic and cross-border environments.

Global supply chains and large buyers increasingly require certified management systems from suppliers. Certification enhances credibility, assures consistent quality and safety, supports supplier qualification, and strengthens customer confidence, particularly in manufacturing, healthcare, food, and technology-driven industries.

Rapid digital transformation, cloud adoption, and rising cyber threats are driving demand for information security and cybersecurity certifications. Organizations pursue certification to safeguard data, ensure business continuity, meet data protection regulations, and reassure stakeholders of robust security governance.

DNV launched a blockchain-based platform for managing certification data. The platform stores & updates management systems, products, and supply chain certificates in a secure private blockchain, enabling instant confirmation of their validity. As organizations prioritize excellence and compliance, the market continues to expand, fueled by the need for standardized frameworks and assurance mechanisms.

Globalization fuels the management system certification market as businesses seek to demonstrate compliance with international standards for quality, safety, and sustainability. Certification enables access to global markets by establishing credibility and trust with customers worldwide, driving the demand for certification services across diverse industries and geographical regions.

Management System Certification Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 27.6 Billion |

| Market Size in 2026 | USD 28.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 8.6% |

| Market Size in 2035 | USD 60.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Regulatory compliance requirements | Drives consistent demand for certification services as organizations must comply with evolving national, regional, and international regulations. |

| Supply chain qualification pressure | Increases certification adoption as suppliers seek approval from global buyers requiring certified management systems. |

| Rising cybersecurity and data protection risks | Accelerates demand for information security and cybersecurity certifications to mitigate operational, financial, and reputational risks. |

| Focus on operational efficiency and risk management | Encourages organizations to adopt certified management systems to standardize processes, reduce failures, and improve governance. |

| Growing emphasis on ESG and sustainability | Boosts environmental and energy management certifications supporting sustainability goals, regulatory reporting, and stakeholder expectations. |

| Pitfalls & Challenges | Impact |

| High certification and audit costs | Limits adoption among SMEs due to financial constraints and perceived low short-term return on investment. |

| Complexity of certification processes | Discourages organizations lacking internal expertise, resources, or management commitment to sustain certification requirements. |

| Opportunities: | Impact |

| Expansion of SME-focused certification solutions | Creates opportunities for simplified, modular, and cost-effective certification offerings targeting small and mid-sized enterprises. |

| Growth of integrated management system certifications | Enables certification bodies to increase revenue through bundled audits across multiple management system standards. |

| Rising demand in emerging economies | Presents growth opportunities as industrialization, exports, and regulatory maturity drive certification adoption. |

| Digital and remote auditing models | Improves scalability, reduces costs, and expands reach through technology-enabled audits and assurance services. |

| Market Leaders (2025) | |

| Market Leaders |

held 5.9% Market Share in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Singapore, Thailand, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Management System Certification Market Trends

In the management system certification industry, a notable trend is the increasing integration of digital technologies to streamline certification processes. Automation, data analytics, and cloud-based platforms are being leveraged to improve the efficiency of audits, reduce paperwork & enhance communication between certification bodies and clients.

In accordance with ISO 14064-3, the global standard for GHG claim verification, UL Solutions introduced the Climate Neutral Product Certification program, which provides independent verification of business and product greenhouse gas assertions.

An emerging trend in this market is the rising demand for sector-specific certifications tailored to the unique requirements of different industries. While traditional management system standards such as ISO 9001 and ISO 14001 remain essential, there is growing interest in specialized certifications addressing niche areas such as cybersecurity, supply chain resilience, and social responsibility. These sector-specific certifications provide organizations with targeted guidance and validation, helping them in addressing industry-specific challenges and demonstrating compliance with sector-specific regulations & best practices.

Organizations are combining multiple standards into integrated certifications to reduce audit costs, streamline compliance, improve operational efficiency, and manage quality, safety, environmental, and information security requirements through unified management frameworks.

In February 2024, TÜV Rheinland formed a strategic supplier partnership with Pantone for a top-tier color validation program. Pantone chose TÜV Rheinland as its first lab partner in Asia to execute Pantone Validated measurements as part of this relationship. This collaboration also seeks to assure color accuracy and uniformity across the manufacturing & production processes.

Escalating cyber threats, data breaches, and stricter data protection regulations are driving organizations to adopt information security and cybersecurity management system certifications to strengthen governance, protect digital assets, and ensure business continuity.

Heightened focus on sustainability, carbon reduction, and environmental responsibility is increasing adoption of environmental and energy management system certifications, supporting regulatory compliance, ESG reporting, and long-term operational resilience across industries.

Management System Certification Market Analysis

Learn more about the key segments shaping this market

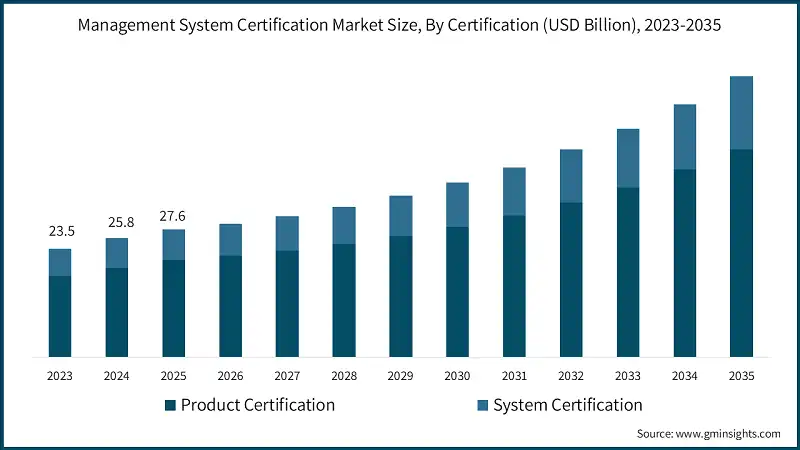

Based on certification, the market is segmented as product certification and system certification. The product certification segment dominated in 2025 with a market share of 76% and is expected to grow at a CAGR of 8.3% during 2026 to 2035.

- Product-based certifications are increasingly aligned with performance benchmarking, digital compliance tools, and sustainability metrics, enabling organizations to differentiate offerings while demonstrating measurable value beyond basic regulatory conformance.

- Demand is rising for product certifications linked to lifecycle impact, traceability, and customer safety, particularly in regulated and export-oriented markets seeking transparency and competitive positioning.

- System certifications are evolving toward integrated, enterprise-wide frameworks that combine quality, safety, environmental, and information security management, reducing duplication and improving governance efficiency.

- Risk-based and outcome-oriented system certification approaches are gaining traction, helping organizations align management systems with strategic objectives, regulatory expectations, and long-term resilience planning.

Learn more about the key segments shaping this market

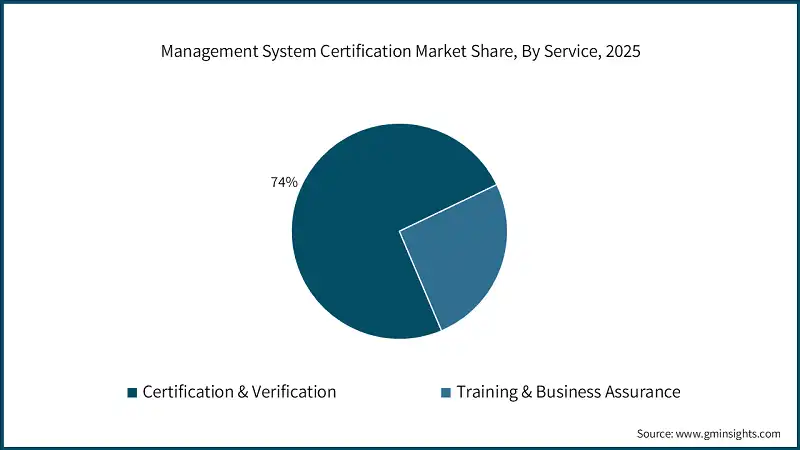

Based on service, the management system certification market is segmented into certification & verification and training & business assurance. In 2025, the certification & verification segment held a market share of over 74% and was valued at around USD 20.5 billion.

- Certification and verification services continue dominating revenue as organizations prioritize third-party assurance to meet regulatory, customer, and supply chain qualification requirements across global operations.

- Technology-enabled audits, including remote and hybrid models, are improving efficiency, scalability, and consistency of verification services while maintaining compliance rigor and audit credibility.

- Training and business assurance services are expanding as organizations invest in workforce capability, internal auditor development, and sustained certification performance amid evolving standards.

- Integrated assurance offerings combining training, gap assessments, and continuous improvement support are gaining adoption, enabling clients to strengthen compliance, reduce audit findings, and manage emerging risks effectively.

Based on application, the management system certification market is segmented as quality management systems, occupational health and safety, cyber security, information security, food safety, environmental management and others. The quality management systems segment led the market in 2025 and is expected to grow at a CAGR of 8.2% during the forecast period from 2026 to 2035.

- Quality management system certifications remain foundational, increasingly linked to operational excellence, customer satisfaction metrics, supplier performance, and continuous improvement initiatives supporting competitiveness across manufacturing, services, and digitally enabled industries.

- Occupational health and safety certifications are evolving toward proactive risk management, mental health inclusion, and contractor safety assurance, driven by stricter regulations, workforce well-being priorities, and heightened accountability across construction, manufacturing, and energy sectors.

- Cyber security certifications are experiencing accelerated growth as organizations respond to rising cyber threats, regulatory mandates, and digital transformation, focusing on governance, incident readiness, and secure operations across cloud, industrial, and connected environments.

- Information security management certifications are expanding beyond IT functions to enterprise-wide governance, addressing data privacy, third-party risk, and business continuity as organizations strengthen trust, compliance, and resilience in increasingly digital ecosystems.

- Food safety certifications are evolving with stronger traceability, supplier oversight, and regulatory alignment, driven by globalization of food supply chains, consumer safety expectations, and growing emphasis on transparency, hygiene, and risk-based food management systems.

- Environmental management certifications are increasingly linked to sustainability strategies, carbon reduction goals, regulatory compliance, and ESG reporting, supporting organizations in managing environmental risks while demonstrating accountability to investors, regulators, and customers.

Based on organization size, the management system certification market is divided into SMEs and large enterprises. The SMEs segment held a major market share of 64% in 2025.

- SMEs are increasingly adopting certifications driven by supply chain requirements, export opportunities, and regulatory compliance, supported by simplified standards, digital audits, and cost-effective certification models improving accessibility and adoption rates.

- SMEs are adopting modular and phased certification approaches, supported by digital tools and remote audits, enabling cost-effective compliance while meeting supply chain, regulatory, and customer requirements without significant operational disruption.

- Large enterprises continue leading certification adoption through integrated, multi-site, and global certification programs, leveraging management systems to strengthen governance, risk management, sustainability reporting, and operational consistency across diverse business units.

Looking for region specific data?

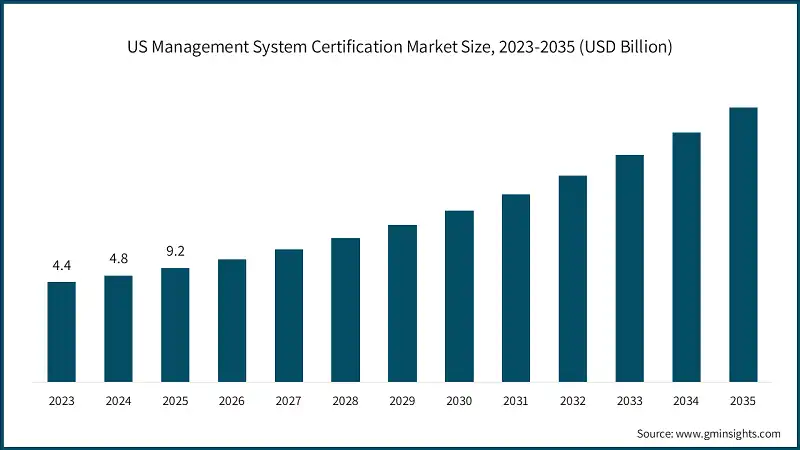

The U.S. management system certification market was valued at USD 9.2 billion in 2025 and is expected to experience significant and promising growth from 2026 to 2035.

- Management system certifications in the US are increasingly driven by regulatory scrutiny, cybersecurity risks, and ESG accountability, with strong adoption across healthcare, technology, defense, and critical infrastructure sectors requiring third-party assurance and compliance validation.

- Information security and cybersecurity certifications are witnessing accelerated growth as organizations address federal regulations, data privacy laws, and rising cyber threats across cloud, defense, and enterprise digital ecosystems.

- Integrated management system certifications are gaining traction among large enterprises seeking operational efficiency, reduced audit duplication, and alignment of quality, safety, and environmental systems with enterprise risk management frameworks.

- Demand for remote and hybrid audits continues to rise, driven by cost optimization, geographically dispersed operations, and acceptance of digital audit technologies by regulators and accreditation bodies.

North America management system certification market held a market revenue USD 9.9 billion in 2025 and is anticipated to grow at a CAGR of 7.9% between 2026 to 2035.

- North America’s certification market is shaped by harmonized standards adoption, cross-border trade requirements, and strong participation from manufacturing, energy, healthcare, and technology sectors emphasizing quality, safety, and data protection.

- Sustainability and environmental management certifications are expanding as organizations respond to climate commitments, investor pressure, and evolving regulatory expectations related to emissions, energy efficiency, and ESG reporting.

- SMEs across North America are increasingly adopting certifications to meet supplier qualification demands from large corporations, supported by simplified standards, digital audits, and training-focused assurance models.

- Certification bodies are expanding value-added services, including training, advisory, and continuous assurance, to address complex compliance landscapes and enhance long-term client engagement.

Europe management system certification market accounted for USD 7.9 billion in 2025 and is anticipated to show growth of 8.9% over the forecast period from 2026 to 2035.

- The European certification market is strongly driven by regulatory compliance, sustainability mandates, and harmonized EU standards, particularly across manufacturing, automotive, chemicals, and consumer goods industries.

- Environmental, energy, and sustainability-related management system certifications are experiencing robust growth due to EU climate policies, carbon reduction targets, and mandatory ESG disclosures.

- Integrated and multi-site certifications are increasingly adopted by multinational organizations operating across EU member states to ensure consistent compliance and reduce audit complexity.

- Digitalization of audit processes and conformity assessments is accelerating, supported by EU acceptance of remote auditing and technology-enabled compliance verification frameworks.

Germany dominates the Europe management system certification market, showcasing strong growth potential, and held a market share of 28% in 2025.

- Germany’s certification market is driven by its strong industrial base, export orientation, and strict regulatory environment, with sustained demand for quality, safety, and environmental management system certifications.

- Automotive, manufacturing, and engineering sectors continue leading certification adoption, emphasizing supplier qualification, process excellence, and compliance with international standards to maintain global competitiveness.

- Sustainability, energy efficiency, and carbon management certifications are gaining prominence as German organizations align with national energy transition goals and EU climate regulations.

- High emphasis on technical rigor and audit credibility sustains demand for well-established certification bodies with deep engineering expertise and sector-specific capabilities.

Asia Pacific region leads the management system certification market, exhibiting remarkable growth with a CAGR of 10.6% during the forecast period of 2026 to 2035.

- APAC represents the fastest-growing certification market, driven by rapid industrialization, expanding exports, regulatory development, and increasing participation of SMEs across manufacturing and services sectors.

- Quality and environmental management certifications dominate adoption, supported by supply chain requirements from multinational buyers and growing awareness of international compliance standards.

- Food safety and occupational health certifications are expanding rapidly due to population growth, urbanization, and stricter regulatory oversight across food processing, construction, and industrial sectors.

- Certification bodies are investing in local partnerships, digital audits, and scalable service models to address diverse regulatory environments and high-volume demand across APAC markets.

China to experience substantial growth in the Asia Pacific management system certification market in 2025. The market in China is expected to reach USD 8.5 billion by 2035.

- China’s certification market is driven by export compliance, government regulation, and manufacturing scale, with strong demand for quality, environmental, and occupational health management system certifications.

- Environmental and energy management certifications are gaining importance as organizations align with national carbon neutrality goals and stricter environmental enforcement policies.

- Information security and cybersecurity certifications are expanding as digitalization, data localization laws, and technology adoption increase across enterprises and public-sector organizations.

- Domestic certification bodies are strengthening competitiveness through cost efficiency, government alignment, and localized service delivery while international players focus on export-oriented clients.

Latin America management system certification market was valued at USD 1.7 billion in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- The LATAM certification market is experiencing steady growth as regulatory frameworks mature and export-oriented industries increasingly adopt international management system standards to improve compliance, competitiveness, and market access across manufacturing, agriculture, mining, and energy sectors.

- Quality management and food safety certifications dominate demand in Latin America, driven by stringent export requirements and deeper integration into global supply chains serving North American and European buyers prioritizing standardized quality, safety, and traceability assurance.

- Small and medium enterprises represent a rapidly expanding customer base, adopting certifications to strengthen market credibility, qualify as suppliers for multinational corporations, access export markets, and meet buyer-driven compliance and governance expectations.

- Economic volatility and cost sensitivity across the region are accelerating demand for modular, phased certification and training services that enable organizations to improve risk management, operational resilience, and compliance without significant upfront investment.

MEA management system certification market valued at USD 1.4 billion in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- The MEA certification market is driven by large-scale infrastructure development, energy investments, and regulatory modernization initiatives, particularly in Gulf Cooperation Council countries emphasizing quality, safety, environmental, and asset integrity management systems.

- Occupational health and safety, environmental, and asset management certifications are expanding rapidly across construction, oil and gas, utilities, transportation, and industrial sectors due to high-risk operations and regulatory enforcement.

- Governments and state-owned enterprises play a critical role in driving certification adoption by mandating compliance, enforcing standards, and requiring certified management systems for supplier qualification and project participation.

- African markets are witnessing gradual certification growth supported by industrialization, donor-funded infrastructure projects, and increasing awareness of international standards among exporters, manufacturers, and SMEs seeking global market integration.

Management System Certification Market Share

- The top 7 companies in the management system certification industry are TÜV NORD, DNV, The British Standards Institution, Lloyd's Register Group Services, Holding Socotec, DQS, and RINA contributed around 21.7% of the market in 2025.

- TÜV NORD leverages its position as one of Europe’s largest technical services organizations, offering integrated certification, inspection, testing, and training services, supported by strong automotive and industrial expertise and expanding Asia-Pacific operations through acquisitions and joint ventures.

- DNV differentiates through deep technical expertise in high-risk industries, leadership across core ISO certifications, and its Veracity digital platform delivering analytics, benchmarking, and risk insights that extend value beyond traditional certification and strengthen global client relationships.

- Lloyd's Register Group Services builds on its heritage in safety and technical assurance, delivering integrated management system certifications while advancing digital audit capabilities and expanding certification services aligned with renewable energy, electric vehicles, and global energy transition initiatives.

- The British Standards Institution benefits from its dual role as standards developer and certification provider, enabling early access to emerging standards, strong technical authority, and international growth focused on Asia-Pacific and North American markets while maintaining regulatory relevance.

- Holding Socotec differentiates through integrated certification, inspection, testing, and consulting services, particularly in construction and real estate sectors, supported by strong European presence and growth strategies centered on acquisitions, sustainable building standards, and service diversification.

- DQS positions as a pure-play management system certification specialist, focusing on ISO standards, personalized service for mid-market and SME clients, strong auditor expertise, and digital platforms enhancing certification management and customer experience.

- RINA leverages its engineering and classification heritage to deliver integrated certification and assurance solutions, expanding internationally across energy, infrastructure, aerospace, and transportation sectors while investing in digital audits, analytics, and advanced certification technologies.

Management System Certification Market Companies

Major players operating in the management system certification industry are:

- TÜV NORD

- DNV

- The British Standards Institution

- Lloyd's Register Group Services

- Holding Socotec

- DQS

- RINA

- Drata

- SIS Certifications

- TÜV NORD operates as a comprehensive technical services provider offering certification, inspection, testing, and training, with strong positioning in automotive, industrial, and renewable energy sectors, expanding Asia-Pacific presence, and strategic focus on digital audits, cybersecurity, and information security certifications.

- DNV delivers assurance, risk management, and management system certifications with strong expertise in high-risk industries, differentiating through its Veracity digital platform, data-driven insights, and strategic focus on energy transition, healthcare quality management, and supply chain sustainability verification.

- The British Standards Institution functions as both the UK’s national standards body and a global certification provider, leveraging standards development expertise, early access to emerging requirements, and broad certification, training, and consulting services to drive international growth across Asia-Pacific and North America.

- Lloyd's Register Group Services provides certification, inspection, training, and technical consulting services, emphasizing integrated management systems and leveraging maritime and safety heritage while expanding digital audit capabilities and certification offerings aligned with renewable energy and electric vehicle supply chains.

- Holding Socotec delivers integrated testing, inspection, certification, and consulting services with strong focus on construction and infrastructure sectors, differentiating through regulatory compliance expertise, sustainable building certifications, and growth driven by geographic expansion and acquisitions across Europe and Asia-Pacific.

Management System Certification Industry News

- In January 2025, the International Organization for Standardization published ISO 37301 Compliance Management Systems as a fully certifiable international standard, replacing ISO 19600 guidelines. The standard introduces mandatory requirements for organizational compliance governance, with early adoption across financial services, healthcare, and government sectors.

- In December 2024, DNV announced a strategic partnership with Microsoft Corporation to integrate Azure artificial intelligence technologies into certification audit processes. The collaboration enables AI-driven document analysis, automated risk assessments, and predictive audit planning through DNV’s Veracity platform, enhancing audit efficiency and quality.

- In November 2024, the European Commission released delegated acts under the Corporate Sustainability Reporting Directive defining assurance requirements for sustainability reporting. The regulations mandate limited assurance initially, progressing to reasonable assurance by 2028, creating substantial growth opportunities for certification and sustainability assurance providers.

- In October 2024, TÜV NORD acquired EcoVadis’ certification and rating division, strengthening its sustainability assessment and supply chain verification capabilities. The acquisition expands TÜV NORD’s client base and enables integrated offerings across management system certification, supplier sustainability ratings, and carbon footprint verification.

- In September 2024, the International Accreditation Forum and International Laboratory Accreditation Cooperation adopted permanent remote assessment guidelines. These rules formalize virtual audit methodologies, establish technical and competency requirements, and significantly reduce certification costs while improving access for geographically dispersed organizations.

- In August 2024, the British Standards Institution launched an AI Ethics Certification Scheme based on ISO/IEC 42001. The certification addresses artificial intelligence governance, transparency, and risk management, with early adoption by major technology firms reflecting growing demand for AI accountability frameworks.

The management system certification market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) from 2022 to 2035, for the following segments:

Market, By Certification

- Product Certification

- System Certification

Market, By Service

- Certification & Verification

- Training & Business Assurance

Market, By Organization size

- SMEs

- Large Enterprises

Market, By Application

- Quality Management Systems

- Occupational Health & Safety

- Cyber Security

- Information Security

- Food Safety

- Environmental Management

- Others

Market, By Industry Vertical

- Aerospace & Defense

- Automotive & Transportation

- Construction

- Consumer Goods & Retail

- Energy & Utilities

- Healthcare & Life Sciences

- Information Technology & Telecommunication

- Manufacturing

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Portugal

- Croatia

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

- Turkey

Frequently Asked Question(FAQ) :

Who are the key players in the management system certification market?

Key players include TV NORD, DNV, The British Standards Institution, Lloyds Register Group Services, Holding Socotec, DQS, RINA, Drata, SIS Certifications, ASTM, SGS, Bureau Veritas, Intertek, TUV Rheinland, DEKRA, UL, Applus, IMQ, IRCLASS, LL-C Certification, GCL International, Aurion International, AL BORJ Facility Management, Vanta, Bluestar Management Systems, Finecert.

What is the growth outlook for the Asia Pacific management system certification market from 2026 to 2035?

Asia Pacific leads with the fastest CAGR of 10.6% from 2026 to 2035, fueled by industrialization, exports, and SME adoption in manufacturing and services.

What are the upcoming trends in the management system certification market?

Key trends include digital technologies for audits, integrated multi-standard certifications, sector-specific options like cybersecurity, and sustainability-focused ESG systems.

How much revenue did the product certification segment generate in 2025?

Product certification dominated with 76% market share in 2025, growing at a CAGR of 8.3% through 2035.

What was the valuation of the SMEs segment in 2025?

SMEs held 64% market share in 2025, driven by supply chain demands, export needs, and cost-effective digital audits.

What is the management system certification market size in 2026?

The market size is projected to reach USD 28.9 billion in 2026.

What is the market size of the management system certification in 2025?

The market size reached USD 27.6 billion in 2025, with a CAGR of 8.6% expected from 2026 to 2035 driven by regulatory requirements, quality sustainability awareness, and globalization.

What is the projected value of the management system certification market by 2035?

The market is expected to reach USD 60.8 billion by 2035, propelled by supply chain pressures, cybersecurity risks, and ESG sustainability focus.

Management System Certification Market Scope

Related Reports