Summary

Table of Content

Logistics Robots Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Logistics Robots Market Size

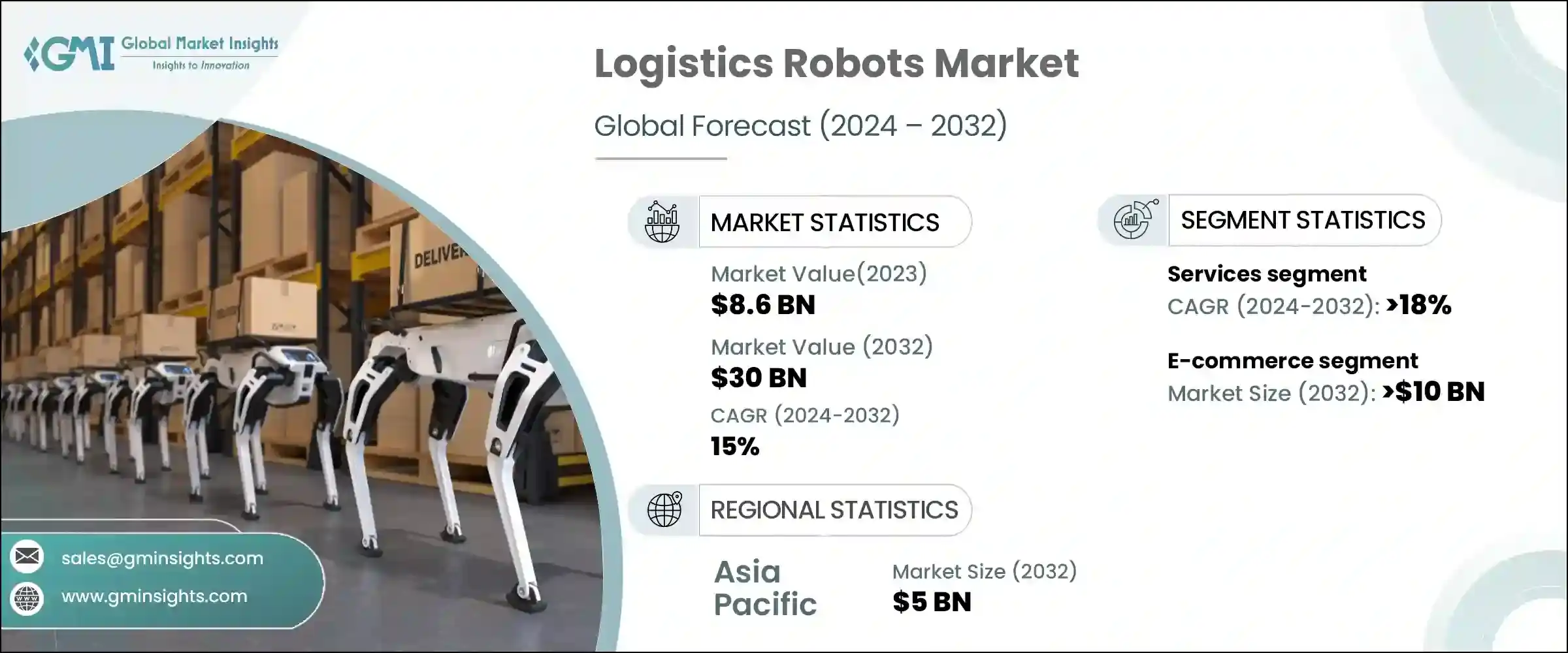

The global logistics robots market was valued at USD 15 billion in 2024. The market is expected to grow from USD 17.2 billion in 2025 to USD 72.6 billion in 2034, at a CAGR of 17.3%, according to latest report published by Global Market Insights Inc.

To get key market trends

The logistics robots market is expected to evolve significantly by 2025 as artificial intelligence, workforce, and sustainability continue to reshape supply chain functions. The blending of generative AI and large behavioral models is a key inflection point for the industry, with examples such as Covariant's robotics foundation models and Toyota's behavioral models demonstrating abilities to learn and generalize complex skills across a variety of logistics settings, including manipulation, navigation, and decision-making.

The logistics robot’s ecosystem is a complex, fast-changing network that is characterized by significant consolidation, geographical concentration, and emerging business model innovation. The total value of each ecosystem is close to $39.55 billion by 2033 and demonstrates strong vertical integration trends by leading players and specialized supplier relationships for technologies needed.

COVID-19 became a major driving factor for global adoption of logistics robots. The logistics robotics ecosystem has undergone historic transformation since 2020, pushed by converging forces of supply chain disruptions, structural labor market changes, and precipitated technology adoption. Noteworthy events of consolidation have occurred, notably Rockwell Automation's acquisition of Clearpath Robotics for $600M, Zebra Technologies’ acquisition of Fetch Robotics for $290M, and OMRON's acquisition of Adept Technology for 200M, these are key signals of a fundamentally new approach to integrated automation platforms.

North America represents the largest available growth rate with the lowest current adoption rates. The region holds the highest CAGR in material handling and automation technologies. The U.S. Department of Energy's Technology Integration group has undertaken extensive studies on delivery drones, sidewalk delivery robots, and automated ground delivery systems, which includes over 200 drone flights and 50 test robots for package delivery applications, in addition to developing energy-use models, route planning algorithms, and urban infrastructure integration strategies that would support commercial use.

The logistics robotics market does display regional differences for expansion as Asia Pacific is the dominant growth market driven primarily by growth in China and government influence for automation technologies. According to Asian Robotics Review, Asia's e-commerce growth is approximately 30% annually putting pressure on the logistics infrastructure and creating significant demand for modernizing warehouse robotics systems.

Regional agencies are challenged by logistics while governments, and their support, present specific drivers for robotics to be adopted which are markedly different across Asia Pacific markets, each with different opportunities and requirements.

Logistics Robots Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 15 Billion |

| Market Size in 2025 | USD 17.2 Billion |

| Forecast Period 2025 – 2034 CAGR | 17.3% |

| Market Size in 2034 | USD 72.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Developments in e-commerce sector for picking applications | Accelerates demand for robotics solutions that enhance order fulfillment speed, accuracy, and scalability. |

| Advancements in robotics technology | Improves efficiency, flexibility, and cost-effectiveness of robots in logistics, driving wider adoption across warehouses. |

| Increasing popularity of autonomous warehouses | Boosts market growth by creating high demand for fully automated material handling and navigation solutions. |

| Growing awareness towards sustainability practices in logistic handling | Encourages deployment of energy-efficient and eco-friendly robotic systems, aligning logistics operations with environmental goals. |

| Pitfalls & Challenges | Impact |

| High cost of purchasing and implementing logistics robots | Limits adoption, particularly among small and mid-sized warehouses, slowing overall market growth. |

| Lack of employee skills to operate and maintain advanced robotic systems | Hinders effective utilization and increases dependency on specialized training or external support, restraining market expansion. |

| Opportunities: | Impact |

| Integration of AI and IoT in logistics robots | Enables smarter, data-driven warehouse operations, improving efficiency and predictive maintenance. |

| Adoption of collaborative robots | Opens opportunities for safer human-robot collaboration, increasing flexibility in warehouse operations. |

| Market Leaders (2024) | |

| Market Leaders |

15% market share |

| Top Players |

Collective market share in 2024 is 42% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Singapore, UAE, Indonesia |

| Future outlook |

|

What are the growth opportunities in this market?

Logistics Robots Market Trends

The advancement of technology is significantly enhancing the economics of robotics logistics via large-scale deployments that have been accomplished throughout the world. For example, DHL Life Sciences yielded impressive results from deploying Locus Robotics in one of their facilities, expanding from 6 robots operational at 18,000 sq ft., to deploying 56 LocusBots in a facility that is 99,000 square feet total, and processing >20,000 units/day. With this deployment productivity increased 200% for workers, along with a 50% reduction in order cycle time, and a reduction in training time of 80%.

ROI timelines for robotic solutions have decreased drastically, with some reporting a payback period and quantifiable financial gain from a variety of implementations. For example, a MiR deployment by Honeywell Safety & Productivity Solutions was reported to pay back within 2 years, which paid back the equipment purchase that had freed up the work of six full-time staff from earlier pushing carts to fill orders and removing human error for deliveries through RFID verification. The solution allowed Honeywell to run a continuous out-of-hour operation and motivated the deployment of MiR at four additional sites in the UK.

The RaaS market demonstrates transformational capability through successful implementations in the real world, solving capital issues, and demonstrating results. Mi Rancho represents an example of success using RaaS nee robotic systems without any capital investment, rolling out 6 Formic robotic palletizers across four lines of tortillas, and paying just low hourly/usage rates to use the equipment, along with 24 hours-per-day and support. In addition, there was no responsibility for maintenance or upgrades, as everything was 100% covered by Formic as part of their service agreement.

The integration of AI offers observable possibilities for autonomous workflow automation, evidenced by complex and impactful deployment resulting in operational improvement. Amazon's robotic system, named Robin, exemplifies the extent of AI advancement and sophistication, having sorted greater than 1 billion packages by employing learned metrics of pick success from greater than 394,000 real-production picks. Robin simulates up to 5 million packages per day and manipulates around 200 million packages during evaluation periods. The learnings used in the pick-quality ranking measure were found to be better than human/manual/heuristic methods.

Logistics Robots Market Analysis

Learn more about the key segments shaping this market

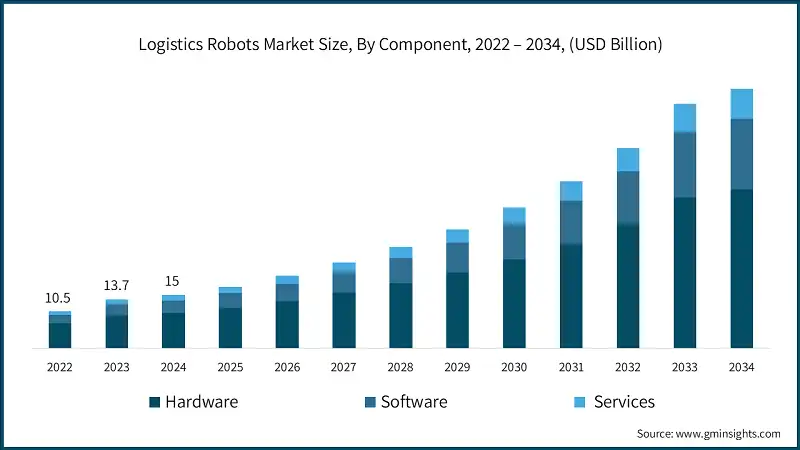

Based on component, the market is divided into hardware, software, and services. The hardware segment accounted for around 66% share in 2024 and is expected to grow at a CAGR of 16.4% from 2025 to 2034.

- In the Hardware segment, robotic platforms and chassis are the fundamental hardware component of logistics robotics systems, covering the mechanical structure, mobility systems, and methods of integration of the base providing a capability for robots to operate in warehouse and distribution environments.

- Research was conducted by the U.S. Department of Energy's Technology integration program into energy systems for logistics robotics, including developing energy use models for delivery drones and ground robots, and indicated current economics are dominated by the regulatory mandate for human operators, e.g., up to 95% of operating costs were directly related to a human operator.

- In the Software subsegment, Robot Operating Systems (ROS) and related software platform systems provide the base software architecture, enabling the systems within warehouse and distribution environments to be coordinated and controlled and integrated into a logistics robotics system.

- According to the survey, the primary investment drive for robotics companies is that software would create the highest profit margins, over 15%, compared to hardware or services. It is evidence throughout the report that ROS and the movement toward standardized and interoperable systems are the next maturity phase of the industry and capable of scalable deployment in a variety of logistics environments.

Learn more about the key segments shaping this market

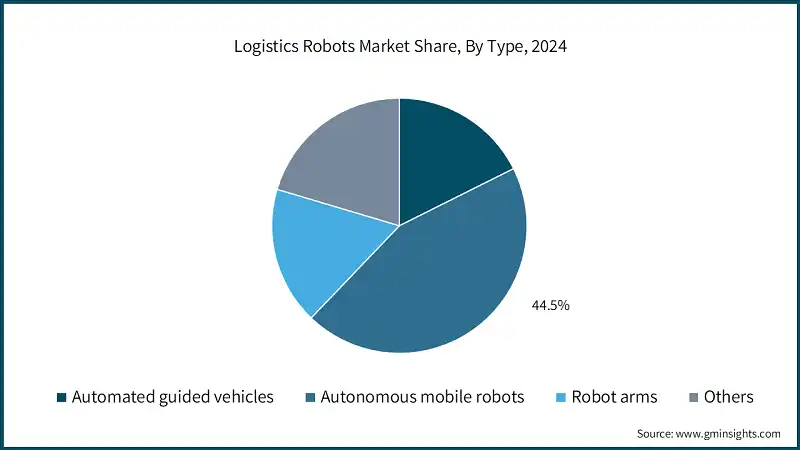

Based on type, the logistics robots market is categorized into automated guided vehicles, autonomous mobile robots, robot arms, and others. The autonomous mobile robots segment dominates the market with 44.5% share in 2024 and is expected to grow at a CAGR of 17.9% between 2025 and 2034.

- Autonomous Mobile Robots (AMRs) are the leading component of logistics robotics, providing significant efficiency and operational improvements compared to AGVs specifically due to their vision systems, AI algorithms, and visual SLAM technology which allows them to operate autonomously in changing environments. The commercialization of AMRs has evolved from pilot testing to full-scale deployment.

- As an example, as of May 2023, The Locus Origin AMRs will be fully deployed in several of DHL Supply Chain’s 1,500 warehouses and distribution centers. The logistics provider has transitioned to deploying 3,000 AMRs globally and over 2,000 in North America according to Sally Miller, global digital transformation officer at DHL Supply Chain. This single case is illustrative of exciting growth in the segment.

- Robot arms form a high-growth niche focused on complex handling and manipulation tasks. DHL’s reports show robotic picking systems hitting over 99 percent accuracy while robot cells can reach around 600 picks per hour, due to computer vision systems that are tightly integrated.

- The National Institute of Standards and Technology forecast the market to grow from $236 million in 2022 to roughly $6.8 billion by 2030, mainly fueled by e-commerce growth and rising micro-fulfilment center adoption. These robotic arms often outperform human pickers in speed and consistency, though deployment require careful planning and calibration.

Based on applications, the market is divided into palletizing & de-palletizing, pick & place, transportation, and others. Transportation segment dominates the market and was valued at USD 4.6 billion in 2024.

- Intra-facility transportation remains a critical focus for autonomous mobile robots (AMRs) and automated guided vehicles (AGVs). The International Federation of Robotics states that improvements in sensors, vision systems, and gripping enable navigation without external infrastructure, use real-time path planning for autonomous mobile robots or AMRs rather than programmed automated guided vehicles or AGVs, and retrofitting for pre-existing vehicles such as forklifts.

- The pick & place application is growing very fast in this market. Robots utilize AI and computer vision, which enable them to pick items that are different in shape, size, and weight, making them useful in heavy traffic warehouses with changing inventories environment.

- Micro-fulfillment centers and e-commerce growth are pushing demand, with estimates going from $236 million in 2022 to nearly $6.8 billion by 2030, showing how much money is in this sector. NIST reports robotic picking is one of the highest-growth areas, because automation lets operators focus on exceptions rather than routine tasks.

Based on end use, the market is divided into e-commerce, healthcare, retail, food & beverages, automotive, and others. The E-commerce drive segment dominates the market and was valued at USD 5.7 billion in 2024.

- The e-commerce segment remains the largest in the logistics robots market, showing rapid adoption globally. Growth rates are so high they push traditional manual warehouse processes beyond their limits. Amazon’s acquisition of Kiva Robotics shows the transformation clearly, click-to-ship times dropped from 60–75 minutes down to around 15, which nobody expected. Warehouses with robots now move products faster, workers can focus more on exceptions, but not every site has the same results yet.

- The retail sector is seeing rapid acceleration in the adoption of automation due to omnichannel fulfillment requirements, the complexity of inventory management, and competitive pressures to increase operational efficiencies, while maintaining service levels to customer.

- By the end of 2026, more than 60% of top retailers will invest in AI loss-prevention technology, that directly tapping into RFID, camera, traffic, and inventory data, resulting in demand for robotic mounted computer vision and RFID system for inventory auditing, cycle counting, and theft prevention tasks. This advanced retail industry is more secure and transparent.

Looking for region specific data?

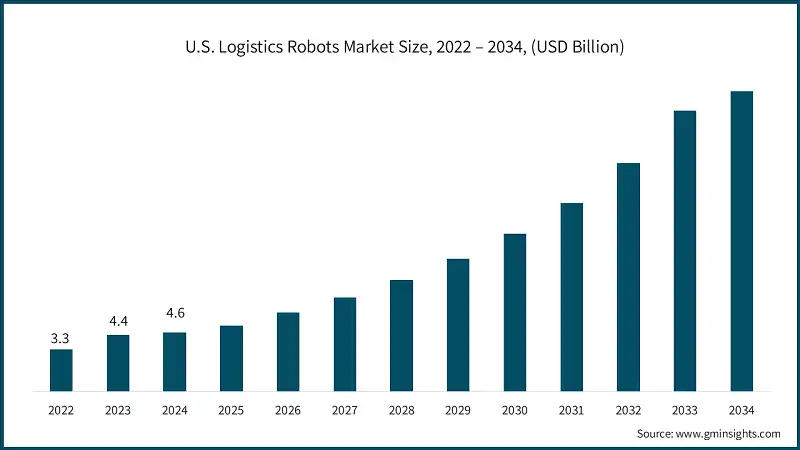

The U.S. dominated the North America logistics robots market with around 65% revenue share with USD 4.6 billion revenue in 2024.

- The United States logistics robotics market demonstrates significant growth potential despite relatively low current adoption rates, with substantial opportunities driven by labor market pressures, technological infrastructure advantages, and supportive government policies. Government support and research infrastructure provide significant competitive advantages for U.S. market development, with extensive federal programs supporting automation technology development and commercial deployment.

- The U.S. Department of Energy's comprehensive Technology Integration program encompasses 46 multi-year projects across alternative fuels, energy-efficient mobility systems, and technology integration, with many projects directly relevant to logistics robotics including automated ground delivery, drone delivery systems, curb management technologies, and electrified depot operations. The National Institute of Standards and Technology's research roadmap identifies critical measurement science needs for manufacturing robotics, including development of datasets, standards, test methods, benchmarks, and evaluation tools that support commercial deployment of logistics robotics systems, with emphasis on addressing integration costs, ROI uncertainty, and technical reliability challenges that currently limit broader adoption across U.S. manufacturing and logistics operations.

- Canada's logistics robotics market benefits from proximity to U.S. technology development, shared regulatory frameworks, and integrated supply chain networks, while facing similar labor market pressures and e-commerce growth drivers that support automation adoption across key industrial sectors. The country grows with substantial CAGR of 15.9% in the region. The National Cooperative Highway Research Program's analysis of connected and automated vehicle technologies includes Canadian perspectives and regulatory considerations, noting the importance of cross-border coordination for automated logistics systems and infrastructure requirements that enable seamless operation across the integrated North American market.

Germany market for logistics robots will grow tremendously between 2025-2034

- Germany holds an 30% share of the Europe logistics robots market in 2024 with a CAGR of 15.3% through 2034. Germany remains one of the leading markets in Europe for logistics robotics, because of advanced manufacturing capabilities and a long industrial automation heritage. Investments in Industry 4.0 initiatives fuel demand for sophisticated automation technologies, though some smaller firms still face integration difficulties.

- The manufacturing sector shows high adoption of automation, technical education supports skilled workforce, and supplier networks provide wide range of robotics and equipment. Government policies encourage technological adoption and industrial competitiveness; at the same time some regulations create added complexity for new deployments.

- The United Kingdom has a logistics robotics market supported by an advanced financial services industry, strong e-commerce adoption, and the transition to an altered supply chain after Brexit that helps create a supportive investment in automation to support new operational challenges and competitive pressures. Changes to supply chains because of Brexit, and changes in labor markets, create specific drives to robotics in logistics operations in the UK as firms modify their operations to support new trade relationships and regulatory structures.

- The country grows with significant CAGR of 16.3% in the region. Changes in supply chain structure have increased complexity and generally cost pressures, increasing the desirability of automation solutions. Changes in labor market availability to UK firms, primarily due to separation from EU labor markets, has led to increased interest from firms in robotics and automation to address labor and staffing issues, and provide continuity of services.

The logistics robots market in China will experience strong growth during 2025-2034.

- The China dominated the Asia-Pacific market with around 41% share and revenue of USD 2.1 billion in 2024. Asian Robotics Review characterizes the region's warehouses as inefficient and urgently needing automation to meet booming e-commerce demand, with Asia's 3.5 billion population creating massive logistics requirements that traditional manual systems cannot efficiently address.

- China stands out as the largest single market globally for logistics robotics, because of huge e-commerce growth, government backing for automation, and the world’s biggest manufacturing base. JD.com’s automated warehouses, including the “Asia No.1” facility in Shanghai, covers 100,000 square meters and can sort up to 16,000 packages per hour, accuracy near 99.99%. These deployments show scale, sophistication, and operational models that are now being followed elsewhere in the world.

- India grows with significant CAGR of 16.1% in the region. With rapid digitalization, a growing manufacturing industry and government plans to endorse both automation and technology adoption in the key industrial sectors, India's logistics robotics market exhibits a strong potential for growth. Initiatives by the Indian government such as Make in India, Digital India, and other technology promotion mechanisms create a policy environment favorable to logistics robotics adoption. The large information technology industry in India also has technical capabilities for integrating robotics systems and for developing software.

The Logistics robots market in Brazil will experience significant growth between 2025 and 2034.

- Latin America holds a 3.4% market share of the logistics robots in 2024 with a CAGR of 16% through 2034. In Latin America, Brazil represents the largest market for logistics robots with market size USD 0.25 billion in 2024. The country represents the largest Latin American market for logistics robotics, driven by substantial domestic demand, advanced manufacturing capabilities, and strategic position as a regional logistics hub that serves both domestic and international markets.

- Mexico is one of the fastest growing countries in the region with 17.7% CAGR till 2034, this growth is driven by a robust manufacturing base and deeply integrated. Mexico serves as a primary manufacturing location for automotive, electronics, aerospace, and consumer goods, substantially driving demand for advanced solutions to support just-in-time manufacturing, quality management, and exports utilizing components that meet international standards.

- The remaining Latin American markets in countries like Chile, Colombia, Peru, Venezuela, and Central American countries present opportunities for logistics robotics with various economic development, endowment of natural resources, and trade relationships that provide specific automation demands. National economies with strong mining sectors such as Chile and Peru demand technically or specialized logistics for applications such as materials handling, port or border operations, and supply chain management, often due to the elements and environments requiring quality and safety and international standards for mineral exportation.

The Logistics robots market in UAE is expected to experience high growth between 2025 and 2034.

- The Middle East and Africa region demonstrate emerging potential for robotics in logistics, a situation driven by ongoing infrastructure development and various economic diversification programs. Strategic partnerships formed with major logistics providers are creating essential pathways for this technological adoption. In the United Arab Emirates, government initiatives such as the UAE Vision 2071 and numerous smart city programs foster a policy environment that is supportive, aligning the adoption of advanced logistics robotics directly with broader national development goals and creating a fertile ground for implementation.

- Saudi Arabia's logistics robotics market is fueled by Vision 2030 economic diversification initiatives, substantial infrastructure investment programs, and beneficial positioning as a hub for regional logistics and assistance for the Kingdom's efforts to transition from an oil-based economy to an industrialized, diversified economy. These advanced logistics technologies will be used in purpose-built buildings specifically designed to demonstrate / showcase those technologies and serve as exemplary for potential future development.

- The remaining Middle East & Africa markets show varied opportunities for logistics robotics guided by the economic development status, natural resource endowment, and positioning in regional and global trade networks, which create specific needs for automation. Countries within the Gulf Cooperation Council such as Qatar, Kuwait, Oman, and Bahrain have potential to deploy logistics robots due to large investments in infrastructure, positioning in global energy markets, and government directed efforts to diversify the economy and technological advancements, which create favorable conditions for automation.

Logistics Robots Market Share

The top 7 companies in the market are Amazon Robotics, Daifuku, KION/Dematic, Honeywell, KUKA/Swisslog, AutoStor, and Toyota/Bastian. These companies hold around 49% of the market share in 2024.

- Amazon is a disruptive force in logistics robotics because they have developed a global fulfillment network utilizing automation technologies throughout their entire systems. Technology examples include Amazon Robotics drive units that deliver inventory pods to human pickers; robotic arms like Sparrow that pick individual items; and an entire suite of software platforms.

- Daifuku is the worldwide leader for material handling systems and logistics automation. They have an extensive portfolio of solutions including automated storage and retrieval systems, conveyor systems, and robotic systems that support all types of industrial sectors. Competitive advantages include novel and proprietary technologies like the Daifuku Distributed Controls (DDC) system that optimizes material flow in real time.

- Dematic a global leader in integrated automated technology, software, and services to optimize supply chain operations and is especially known for intelligent automation solutions combining robotics, software, and data analyses is also a major player in the logistics field. Dematic was purchased by KION Group, which provided for even more global reach and financial resources, and to further emphasize and promote innovation and customer service.

- Honeywell Intelligrated is a significant player in warehouse automation and material handling, using the wider Honeywell corporation's expertise in industrial automation, software and connectivity technologies to provide integrated logistics solutions. Honeywell's competitive strategy is based around reliability, security and total system performance, with extensive service capabilities, and a global support network to provide value for customers over the long term as they optimize their system.

- AutoStore is a first mover and the leader in cube storage automation, with a novel approach to automated storage and retrieval to optimize storage density with minimized facilities footprint and energy consumption. AutoStore's recent IPO and large amount of investment from SoftBank indicated strong market confidence in AutoStore's technology and ability to expand their customer base around the world. Partnerships with leading system integrators also provide deployments and local support.

Logistics Robots Market Companies

Major players operating in the logistics robot industry include:

- ABB

- Amazon Robotics

- AutoStore

- Daifuku

- Honeywell

- KION/Dematic

- KUKA/Swisslog

- Omron

- Toyota/Bastian

- Yaskawa Electric

- The market for logistics robots is rapidly being influenced by the front-running players in the provision of automation technologies and robotics for material handling, picking, sorting, and intralogistics optimization. Deployments of Amazon Robotics and DHL's Locus Robotics exemplify market leaders. These deployments combine AI-enabled navigation along with adaptive learning and scalable fleets of robots to service large warehouse footprints.

- Honeywell Robotics and GreyOrange provide greater capabilities than the construction of robotic fleets alone by connecting the fleets with warehouse execution systems. This combination creates a seamless order-to-delivery creation. Their business model is directed at reducing cycle times, reducing operational costs, and providing another level of safety standards. They are strong suppliers in the market for large third-party logistics providers and retailers.

- Other significant organizations add their unique capabilities specific to their functional area. Geek+ supports the rapid growth of both omni-channel retail and consumer electronics distribution with emphasis on mobile robotics on the goods-to-person applications. Fetch Robotics, who is part of Zebra Technologies, delivers flexible autonomous mobile robots (AMRs) that run in collaborative mode in dynamic workspaces. They gain market share autonomously rendering process utilized in manufacturing logistics and healthcare supply chains.

- Swisslog, a KUKA company, is recognized for high-throughput automated storage & retrieval systems (AS/RS), often customized to support cold chain tasks or very high-density storage. Seegrid is a company focused almost entirely on vision-guided vehicles intended for heavy-duty pallet movement, designed primarily for automotive and food & beverage warehousing applications.

- These companies are evolving the logistics robot sector, newly entering the market by maintaining a reasonable level of innovation, providing reliable performance, and creating adjustable applications for several industries. With the emergence of robotics as a service model, which lowers the upfront costs of robotics, and AI methods to automate workflows and improve performance.

Logistics Robots Industry News

- In February 2025, Locus Robotics announced a strategic partnership with BITO Lagertechnik, an expert in advanced storage and order-picking technology. This partnership combines BITO's capabilities in high-quality storage and Locus Robotics' AI-based LocusONE orchestration platform along with its autonomous mobile robo fleet into a single offering to create more efficient warehouse and fulfillment operations.

- In December 2024, Dematic showcased its footprint in Asia by opening a new office in Taoyuan City, Taiwan. The office is in the Zhongli District, close to Taoyuan International Airport and the High-Speed Rail Station and is intended to provide closer support to regional customers in retail, food and beverage, pharmaceuticals and third-party logistics.

- In February 2024, Dematic collaborated with Canadian logistics provider Groupe Robert to establish the first automated cold storage facility for third-party logistics in Quebec. The facility includes a large-scale Automated Storage and Retrieval System, supported by cranes that are 130 feet tall and can handle a variety of fresh and frozen goods at high capacities.

- In September 2023, Stow Robotics rebranded the company with Movu Robotics and launched the latest generation of its robotic sorting solution. This advanced system offers upgradation in its working speed, accuracy, and machine learning capabilities leading to a system with greater reliability and performance to capture a wider mix of products.

The logistics robots market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue and volume ($Bn & Units) from 2021 to 2034, for the following segments:

Market, By Component

- Hardware

- Robotic platforms & chassis

- Sensors & perception systems

- Actuators & manipulation systems

- Others

- Software

- Robot operating systems

- Fleet management software

- Warehouse management integration

- Others

- Services

- Professional

- Managed

Market, By Type

- Automated guided vehicles

- Autonomous mobile robots

- Robot arms

- Others

Market, By Application

- Palletizing & de-palletizing

- Pick & place

- Transportation

- Others

Market, By End use

- E-commerce

- Healthcare

- Retail

- Food & beverages

- Automotive

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region led the North American logistics robots market in 2024?

The United States dominated the North American logistics robots market, accounting for 65% of the regional revenue, which amounted to USD 4.6 billion in 2024.

What are the upcoming trends in the logistics robots market?

Key trends include the integration of generative AI with behavioral models, advancements in autonomous systems, and the growing focus on sustainability practices in logistics operations.

Who are the key players in the global logistics robots market?

Major players include ABB, Amazon Robotics, AutoStore, Daifuku, Honeywell, KION/Dematic, KUKA/Swisslog, Omron, Toyota/Bastian, and Yaskawa Electric.

What is the expected market size of logistics robots in 2025?

The market size is projected to grow to USD 17.2 billion in 2025.

What is the growth outlook for the autonomous mobile robots (AMRs) segment from 2025 to 2034?

The autonomous mobile robots segment is expected to grow at a CAGR of 17.9% between 2025 and 2034, fueled by advancements in vision systems, AI algorithms, and visual SLAM technology.

How much revenue did the hardware segment generate in 2024?

The hardware segment accounted for approximately 66% of the market share in 2024.

Which end-use segment held the largest share in the logistics robots market in 2024?

The e-commerce segment was valued at USD 5.7 billion in 2024, due to rapid adoption and efficiency improvements in warehouse operations.

What was the market size of the global logistics robots in 2024?

The global logistics robots market was valued at USD 15 billion in 2024, with a CAGR of 17.3% expected through 2034 driven by AI adoption, workforce transformation, and sustainability in supply chains.

What is the projected value of the logistics robots market by 2034?

The logistics robots market is anticipated to reach USD 72.6 billion by 2034.

Logistics Robots Market Scope

Related Reports