Summary

Table of Content

LNG Terminal Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

LNG Terminal Market Size

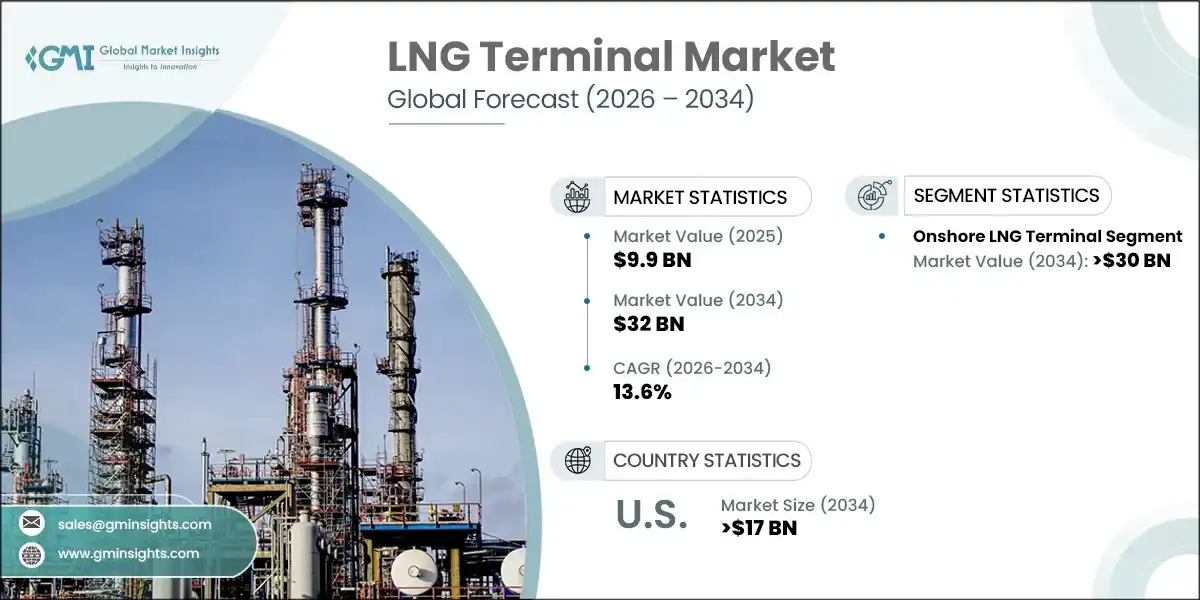

The LNG terminal market was valued at USD 9.9 billion in 2025 and is projected to expand at a CAGR of 13.6% from 2026 to 2034. This strong growth trajectory reflects a structural shift in the global energy mix, as governments and industries accelerate the transition away from coal- and oil-based power generation toward cleaner-burning fuels.

Natural gas has gained prominence as a preferred bridge fuel due to its higher combustion efficiency and significantly lower greenhouse gas emissions compared to conventional fossil fuels. As a result, investments across the liquefied natural gas terminals market are rising to support expanding import, export, storage, and regasification capacity worldwide.

To get key market trends

The global push for decarbonization and stricter emission regulations has led to a steady rise in natural gas consumption across power generation, industrial processing, and transportation. LNG terminals play a critical role in enabling cross-border gas trade, improving energy security, and balancing seasonal supply-demand gaps. This trend is strengthening demand across both the large-scale LNG terminal market and emerging decentralized infrastructure.

At the same time, the small-scale LNG terminal market is gaining momentum, driven by demand from remote power generation, marine bunkering, and regional gas distribution. The growing small-scale LNG market size highlights increasing adoption in areas where pipeline infrastructure is limited or economically unfeasible.

The floating liquefied natural gas terminals market is emerging as a flexible and cost-effective alternative to onshore infrastructure. Floating storage and regasification units (FSRUs) allow faster deployment, reduced upfront investment, and improved adaptability—making them an attractive option for developing economies and fast-growing gas importers.

Growth in LNG usage is also supporting adjacent infrastructure, including the LNG filling station market, particularly for heavy-duty transportation and marine fuel applications. These downstream developments further reinforce the long-term demand outlook for LNG terminals by broadening end-use adoption.

LNG Terminal Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 9.9 Billion |

| Forecast Period 2026-2034 CAGR | 13.6% |

| Market Size in 2034 | USD 32 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

LNG Terminal Market Trends

Expansion of Small-Scale and Modular LNG Facilities

Advancements in LNG production technological trends in 2025 have made it economically viable to deploy compact, modular LNG terminals. These facilities are designed to serve local and regional markets, enabling access to LNG in areas that were previously dependent on large, export-oriented infrastructure. As a result, the small-scale LNG market is gaining momentum, particularly in regions seeking flexible energy solutions without the capital intensity of traditional mega-terminals.

This shift reduces reliance on centralized export hubs and strengthens supply diversity across both onshore LNG and offshore ecosystems. It also supports energy-hungry industrial clusters, utilities, and transportation sectors that require consistent, scalable LNG supply closer to consumption points.

Role of Onshore, Planned, and Floating LNG Terminals

From a market structure perspective, the planned LNG market reflects growing investments in modular and phased-capacity terminals. Developers are increasingly opting for designs that allow incremental expansion, aligning capital deployment with demand visibility.

At the same time, the floating LNG terminals market is expanding as an agile alternative to traditional onshore assets. Floating storage and regasification units (FSRUs) and floating LNG (FLNG) facilities offer faster deployment timelines and lower upfront costs, making them especially attractive for emerging LNG-importing countries.

Together, onshore LNG, planned LNG projects, and floating LNG terminals are creating a more distributed, resilient global LNG infrastructure.

Strengthening Energy Security and Emissions Management

Beyond infrastructure diversification, this paradigm shift is directly linked to improved energy security and system resilience. Distributed LNG production and import infrastructure reduces supply disruption risks and enhances regional self-sufficiency.

Equally important, the industry’s renewed emphasis on environmental performance is reinforcing LNG’s role as a transition fuel. Across the LNG value chain—from production and liquefaction to transport and consumption—operators are prioritizing the reduction of methane emissions. Continuous improvements in monitoring, detection, and mitigation of unplanned emissions are now embedded into project development strategies.

LNG’s Position as a Lower-Carbon Energy Solution

These combined developments position LNG as a comparatively lower-carbon energy solution, especially when supported by advanced emissions management technologies. As LNG market trends in 2025 continue to favor flexibility, sustainability, and modular deployment, the LNG terminal market is expected to remain a critical enabler of the global energy transition.

For decision-makers at the managerial and leadership level, understanding these interconnected trends—spanning small-scale LNG market growth, onshore LNG investments, planned LNG capacity additions, and floating LNG terminals—is essential for aligning long-term energy strategy with evolving market realities.

LNG Terminal Market Analysis

The onshore LNG terminal segment is projected to surpass USD 30 billion by 2034, supported by sustained investments in operational efficiency and cost reduction. Technological advancements—such as improved liquefaction processes, next-generation cryogenic storage systems, and optimized regasification technologies—are helping terminal operators lower the overall cost of LNG terminals while improving throughput and reliability.

A key demand driver is the expansion of small-scale LNG terminals, which are increasingly designed to address localized energy requirements. These facilities play a strategic role in:

- Supplying LNG to industrial end users

- Powering remote and off-grid regions

- Supporting the marine sector through LNG bunker fuel

From a market perspective, this trend directly influences small-scale LNG liquefaction capacity and capital expenditure market dynamics, as modular and scalable terminal designs reduce upfront investment and deployment timelines.

In parallel, onshore facilities remain central to the LNG regasification terminal market, enabling importing countries to strengthen energy security while transitioning toward lower-carbon fuels. As cleaner energy policies gain momentum, onshore LNG terminals are becoming critical infrastructure for ensuring consistent gas supply while supporting long-term sustainability objectives.

The floating LNG terminal market is experiencing robust growth as energy companies seek flexible, faster-to-market, and more cost-efficient alternatives to traditional onshore infrastructure. Floating terminals—covering both liquefaction and regasification applications—allow LNG production, storage, and offloading in offshore or remote locations without the need for large-scale land acquisition or extensive pipeline networks.

This infrastructure model significantly improves project economics, making it attractive within the LNG liquefaction terminal market and the broader LNG regasification industry capacity and capex market. Floating solutions also support phased capacity additions, helping developers manage capital expenditure more effectively.

Technological innovation remains a key growth enabler. Advancements in floating designs are improving liquefaction efficiency, reducing energy consumption, and enhancing safety performance. Additionally, environmental upgrades—such as methane leakage reduction systems and emission control technologies—are reshaping the LNG liquefaction equipment market, aligning floating terminals with stricter environmental standards and corporate ESG strategies.

Learn more about the key segments shaping this market

The U.S. LNG terminal market is expected to exceed USD 17 billion by 2034, driven by strong domestic consumption and sustained international demand for LNG exports. Ongoing investments in new terminals and the expansion of existing facilities are increasing both liquefaction and regasification capacity, strengthening the country’s position in the global LNG value chain.

The adoption of advanced liquefaction, storage, and regasification technologies is enhancing operational performance while lowering lifecycle costs—an important factor in LNG plant competitive analysis for global buyers. At the same time, market participants are prioritizing sustainability by integrating low-emission designs, energy-efficient equipment, and methane mitigation initiatives.

This strategic shift toward cleaner operations is shaping future investment decisions across U.S. projects, reinforcing positive LNG growth forecasts over the next decade while supporting global energy transition goals.

Learn more about the key segments shaping this market

LNG Terminal Market Share

Looking for region specific data?

Key players in the LNG industry including BP, Chevron, ExxonMobil, Petronas, Qatar Energy, and Shell, among many others account for a significant position across the value chain. The market is experiencing dynamic shifts in market share, driven by evolving energy demand, technological advancements, and growing energy consumption. As global demand for cleaner energy sources rises, major key players are expanding their capabilities, particularly across the geographies with rapidly rising energy needs.

LNG Terminal Market Companies

Major players operating across the industry include:

- ADNOC

- AES

- BP

- Chevron

- CNPC

- Engas

- Engie

- Eni

- Equinor

- ExxonMobil

- Gazprom

- KNPC

- Pertamina

- Petronas

- Petronet

- Qatar Energy

- Repsol

- Shell

- Total

- Vopak

LNG Terminal Industry News

- In December 2024, Chevron confirmed to initiate a contract to provide about 3.4 billion cubic meter (bcm) or 130 petajoules (PJ) gas from the company’s LNG projects in Pilbara region, Australia to the U.S. based alumina refineries owned by Alcoa group located in western Washington. The agreement binding the purchase and sale of gas is scheduled to continue for 10 years starting from 2028 and is projected to be sourced from Chevron’s LNG ventures called Gorgon, North West Shelf (NWS), and Wheatstone.

- In December 2024, Qatar Energy obtained an LNG supply order to deliver 12 cargoes per annum to the India based gas distribution company called Gail. The five-year contract is set to commence from April 2025 until March 2030 engaging the tentative delivery volume of about 3.6 million tonnes by 2030.

This LNG terminal market research report includes in-depth coverage of the industry with estimates & forecast in terms of “MTPA” and “USD Million” from 2021 to 2034, for the

Market, By Terminal

- Onshore

- Floating

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- France

- Netherlands

- Spain

- Poland

- Russia

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Malaysia

- Indonesia

- Middle East & Africa

- UAE

- Qatar

- Oman

- Algeria

- Egypt

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the LNG terminal market?

Key players include BP, Chevron, ExxonMobil, Petronas, Qatar Energy, Shell, ADNOC, AES, CNPC, Engas, Engie, Eni, Equinor, Gazprom, KNPC, Pertamina, Petronet, Repsol, Total, and Vopak.

What are the upcoming trends in the LNG terminal market?

Key trends include expansion of small-scale modular facilities, adoption of floating storage units (FSRUs), and integration of methane emission reduction systems.

Which region leads the LNG terminal market?

The U.S. LNG terminal market is expected to exceed USD 17 billion by 2034, driven by strong domestic consumption, sustained international demand for LNG exports, and ongoing investments in new terminals and expansion of existing facilities.

What are the key growth drivers in the LNG terminal market?

Key drivers include investments in gas-based infrastructure, transition toward clean energy, and rapid urbanization and industrialization.

What is the market size of the LNG terminal in 2025?

The market was valued at USD 9.9 billion in 2025, with a CAGR of 13.6% expected through 2034 driven by the global shift towards sustainable energy sources.

What is the projected value of the U.S. LNG terminal market by 2034?

The U.S. market is expected to exceed USD 17 billion by 2034.

Which terminal type is experiencing robust growth as a flexible alternative?

The floating LNG terminal market is experiencing robust growth as a flexible, cost-efficient alternative to onshore infrastructure.

What is the growth outlook for the onshore LNG terminal segment by 2034?

The onshore segment is projected to surpass USD 30 billion by 2034.

What is the projected value of the LNG terminal market by 2034?

The market is expected to reach USD 32 billion by 2034, propelled by investments in gas-based infrastructure

LNG Terminal Market Scope

Related Reports