Summary

Table of Content

Liquid Packaging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Liquid Packaging Market Size

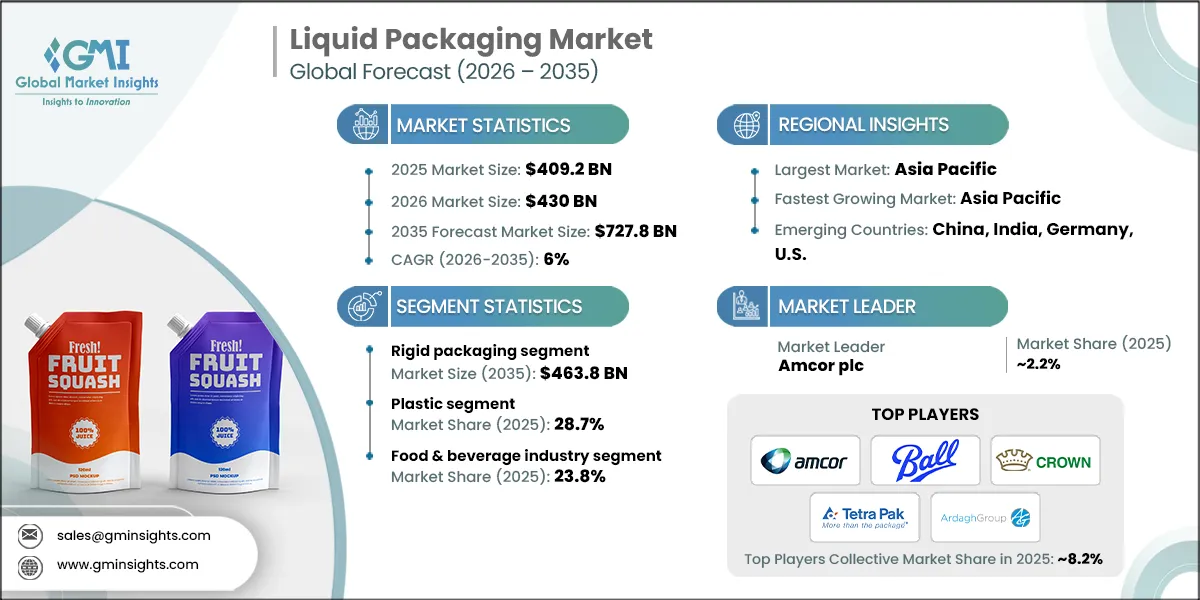

The global liquid Packaging market was estimated at USD 409.2 billion in 2025. The market is expected to grow from USD 430 billion in 2026 to USD 551.9 billion in 2031 and USD 727.8 billion in 2035, at a CAGR of 6% according to latest report published by Global Market Insights Inc. The market is growing due to rising demand for convenient, safe, and sustainable packaging in food, beverage, and pharmaceutical sectors. Sustainability regulations, innovation in eco-friendly materials, and expanding consumption of packaged liquids, especially in emerging markets have further fueled this upward trend.

To get key market trends

The dynamics of market are changing at a fast pace, the main reason behind it is the growing preference for safe, lightweight and sustainable packaging around the world in beverage, pharmaceuticals, and consumer goods sectors. The following synthesis reflects the requested style and considers the latest market insights from diverse sources.

The global liquid packaging market is growing as companies use lighter, recyclable materials and more cost-effective packaging. This growth is driven by higher consumption of beverages, the rise of e-commerce, and the need for packaging that protects products during transportation. For instance, In March 2023, the UK-based grocery retailer Sainsbury's unveiled environmentally friendly packaging for its proprietary liquid laundry detergent. These new cartons, weighing 35% less than their predecessors, have been designed to exhibit a 50% lower carbon footprint.

Liquid Packaging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 409.2 Billion |

| Market Size in 2026 | USD 430 Billion |

| Forecast Period 2026 - 2035 CAGR | 6% |

| Market Size in 2035 | USD 727.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Adoption of Sustainable Barrier Coatings | Drives ~22% growth by enabling eco-friendly, recyclable, and biodegradable liquid packaging solutions, reducing environmental footprint, and meeting rising regulatory and consumer sustainability demands across food, beverage, and personal care segments. |

| Growing Consumer Preference for Smaller Pack Sizes | Fuels ~20% growth by increasing demand for convenient, single-serve, and on-the-go liquid packaging formats, encouraging manufacturers to innovate compact designs that optimize shelf space and reduce product wastage. |

| E-Commerce Expansion Is Driving Demand for Advanced Liquid Packaging Solutions | Boosts ~15% growth by promoting smart, sensor-enabled packaging that enables real-time monitoring of temperature, humidity, and transit conditions, improving supply chain efficiency, reducing spoilage, and supporting traceability compliance. |

| Customer Experience Enhancement Driving Adoption of User-Friendly Liquid Packaging | Supports ~17% growth by encouraging ergonomic, easy-to-use, and aesthetically appealing packaging that enhances usability, strengthens brand loyalty, and meets evolving consumer expectations in both retail and home consumption. |

| Pitfalls & Challenges | Impact |

| Rising Costs of Key Raw Materials Impacting the Liquid Packaging Market | Restrains ~18% market growth due to escalating prices of plastics, paperboard, aluminium, and glass, which increase production costs, squeeze profit margins, and slow the adoption of advanced liquid packaging solutions across food, beverage, and personal care sectors. |

| Limited Recycling Infrastructure Hindering Growth of the market | Restrains ~15% market growth by limiting the adoption of sustainable and recyclable liquid packaging formats, especially in emerging markets, and creating challenges for compliance with environmental regulations and consumer expectations for eco-friendly packaging. |

| Opportunities: | Impact |

| Leveraging Real-Time Supply-Chain Insights and Data-Driven Predictive Planning to Enhance Distribution and Efficiency | The growing demand for agility and resilience in supply chains is fueling the adoption of real-time monitoring and predictive analytics, allowing companies to optimize distribution, reduce operational bottlenecks, and improve overall efficiency. |

| Smart Warehousing and Robotics as a Strategic Opportunity to Optimize Safety and Efficiency in Liquid Packaging | The increasing emphasis on workplace safety and operational precision accelerates the adoption of smart warehousing and robotic solutions, allowing liquid packaging companies to minimize accidents, streamline processes, and enhance overall productivity. |

| Market Leaders (2025) | |

| Market Leaders |

Market Share of ~2.2% in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Germany, US |

| Future outlook |

|

What are the growth opportunities in this market?

The companies in the liquid packaging market are steadily making their shift towards smart packaging. This has enabled consumers to monitor their products, check their authenticity, and get to know the sustainability of the packaging, which in turn, has become a major driving factor for market growth all over the world.

One of the major contributors to the rapid growth of online shopping market is the demand for packaging that possess the characteristics of being durable, leak-proof, and which are capable of enduring long-distance transportation. Furthermore, stronger packaging is a basic requirement to minimize incidences of product damage and returns, thus acting as a significant growth driver for the market. For instance, in 2024, Amazon used leak-proof Tetra Pak cartons for its direct-to-consumer milk deliveries, leading to a 40% reduction in damage-related returns.

The global market is expected to witness significant growth due to the increasing consumption of beverages and liquid products with eco-friendly packaging. At the same time, distribution sustainability initiatives are provoking brands to go for smart packaging technologies along with dependable and cost-effective packaging solutions.

Liquid Packaging Market Trends

- A major trend in the liquid packaging industry is the shift toward eco-friendly barrier coatings in liquid paperboard applications, which is driving the need to reduce environmental impact and reliance on traditional fossil-based materials. At the same time, rising raw material prices for glass and aluminum are creating pressure across both liquid packaging boards and multi-layer flexible pouches.

- Furthermore, there is rising competition faced by liquid packaging board from newly introduced clear, recyclable plastic cans. While these alternatives have less effect on traditional paperboard, they pose a significant challenge to retort cartons, a segment with strong growth potential.

- Moreover, consumer preferences in the Beverage Sector are constantly changing; there is more demand for smaller pack sizes, for example, a 500ml carton of juice, convenient ready-to-drink packaging formats, and On-the-Go Packages due to the rise of "Time-Starved Consumers." These trends will ultimately increase the amount of Liquid Paperboard consumed by each unit produced and will offer manufacturers greater value through greater demand for related materials and supplies.

- For instance, in June 2025, Tropicana launched a new line of 500 ml cartons with Orange Juice that will be available in the UK; they are switching from larger formats to more immediate single-serving formats to attract consumers who are budget-conscious and to provide consumers with less waste and more uses of Liquid Paperboard.

Liquid Packaging Market Analysis

Learn more about the key segments shaping this market

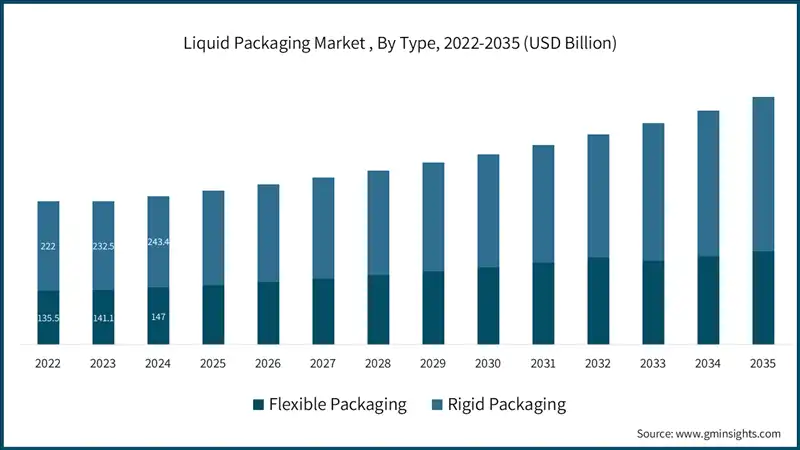

Based on type, the global market is segmented into flexible and rigid packaging.

- The rigid packaging segment market is anticipated to reach USD 463.8 billion by 2035. Rigid formats such as PET bottles, HDPE containers, and paperboard cartons continue to dominate the market, due to their excellent barrier properties, durability, and appeal to premium consumers. These formats benefit from advanced material formulations that allow for lighter weight without compromising structural integrity, making them ideal for high-speed filling operations and efficient logistics. The combination of toughness, convenience, and premium perception has enabled them to hold strong market position.

- The liquid packaging market uses AI and Digital Technologies to improve its production process. Companies such as Tetra Pak, SIG Combibloc, and Elopak are leading the Liquid Packaging Industry by implementing AI platforms to detect defects in real time on Aseptic Filling Lines; manufacturers can reduce waste, improve quality assurance, and improve operational efficiencies. Manufacturers are not just using these systems for defect detection; they are also using them for predictive maintenance, energy optimization and supply chain analytics, which highlights a larger trend within the Liquid Packaging Industry of Smart Manufacturing.

- Hence, rigid packaging is expected to stay the leading category as companies innovate with lighter, recyclable materials and adopt digital technologies to boost efficiency and cut costs. This creates strong growth opportunities for packaging manufacturers and tech providers due to the segment’s durability, value, and ongoing modernization.

Learn more about the key segments shaping this market

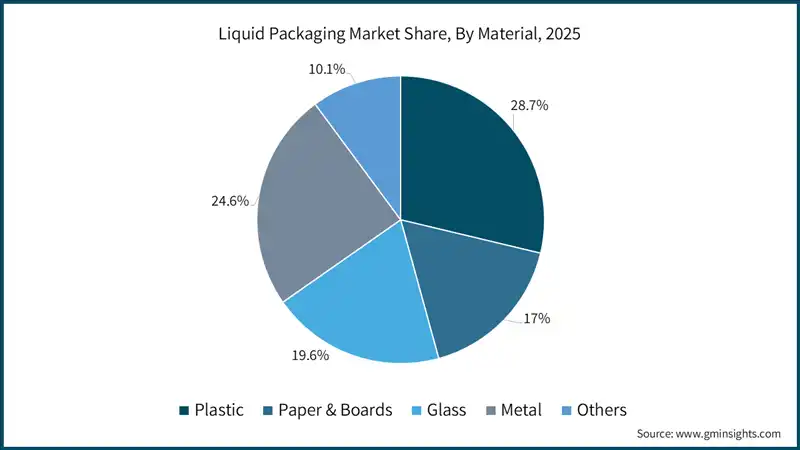

Based on material type, the global liquid packaging market is segmented into plastic, paper & paperboard, glass, metal, and other materials.

- The plastic remains the dominant material segment, accounting for an estimated 28.7% market share in 2025. It is also the fastest-growing segment, expanding at a CAGR of 6.5% during the forecast period.

- Plastic continues to be widely preferred in liquid packaging due to its comparatively low material costs and excellent performance on high-speed filling and packaging lines. These advantages help manufacturers improve operational efficiency while reducing overall production and ownership costs. As a result, plastic packaging is widely used across a diverse range of liquid products, including beverages, dairy products, personal care liquids, and household chemicals.

- In addition, the plastic packaging segment is undergoing a notable transformation driven by sustainability initiatives, such as the growing shift toward the use of recycled plastics and mono-material packaging solutions, which allow companies to extend product life cycles while reducing environmental impact. This trend aligns with increasing regulatory pressure and rising consumer demand for sustainable packaging solutions. For instance, in July 2025, India’s Food Safety and Standards Authority approved six additional manufacturing units for food-grade recycled PET (rPET). This approval significantly strengthened the country’s ability to supply recycled plastic materials for food and beverage packaging, supporting compliance with sustainability regulations and circular economy goals.

- The rapid growth of the plastic segment is further supported by well-established manufacturing scalability and robust global resin supply chains. Continuous innovation in recycled-content formulations, including rPET and bio-based polymers, is enabling major global brands to increasingly incorporate sustainable materials into their packaging portfolios. These developments are reinforcing plastics’ position as a highly adaptable and future-ready packaging material.

- While alternative materials such as paperboard and glass offer environmental benefits and are gaining attention in specific applications, plastics continue to dominate the liquid packaging market due to their unmatched versatility. Plastic packaging is widely used across multiple formats, including bottles, pouches, and cartons, and can be easily tailored to meet regulatory standards across different regions. Strong consumer demand for lightweight, convenient, and resealable packaging further contributes to the sustained demand for plastic-based solutions. These factors continue to drive innovation and reinforce plastics’ leadership position within the global liquid packaging industry.

- Major global brands are also supporting this shift through strong sustainability commitments. In 2025, companies such as Coca-Cola, Danone, and Unilever announced further initiatives to increase the use of recycled plastic content in their packaging. These efforts are aimed at meeting ESG targets, reducing carbon footprints, and aligning with growing consumer expectations for environmentally responsible products.

- The metal packaging segment is also experiencing steady and accelerated growth, registering a CAGR of 6.2% and projected to reach a market value of USD 181.9 billion by 2035. Growth in this segment is primarily driven by the superior barrier properties of metal packaging, which offer strong protection against light, oxygen, and external contaminants. As a result, metal materials such as aluminum cans and steel drums are widely used for carbonated beverages, juices, and industrial liquids that require extended shelf life and consistent product quality.

- Moreover, advancements in high-speed canning technologies and energy-efficient production processes have improved manufacturing efficiency, making metal packaging more cost-effective for large-scale producers. Leading beverage companies, including Coca-Cola and major energy drink brands, continue to rely heavily on lightweight aluminum packaging. Lightweight aluminum not only supports high recyclability rates but also helps reduce transportation and freight costs by up to 30%. These combined benefits enhance both the economic and environmental appeal of metal packaging, strengthening its position as a reliable and high-performance solution within the global market.

Based on end use industries, the global liquid packaging market is categorized into food & beverage, personal care, pharmaceutical, household care, industrial, and other applications.

- The food & beverage industry holds a dominant position and is expected to account for approximately 23.8% of the total market share in 2025, making it the largest contributor to overall demand.

- The food and beverage sector continues to generate significant demand for liquid packaging solutions, supported by the high consumption of beverages, dairy products, sauces, condiments, and other liquid food products. These applications require packaging that can accommodate large production volumes while maintaining stringent standards for safety, durability, and performance. As global consumption continues to increase, packaging manufacturers are focusing on delivering scalable, efficient, and reliable solutions tailored to the operational requirements of this sector.

- To address rising demand, food and beverage manufacturers are prioritizing packaging solutions with strong barrier properties against moisture, oxygen, and external contaminants. Compatibility with automated and high-speed filling lines has become a critical requirement, enabling efficient large-scale production and cost optimization. In addition, packaging solutions must support liquids of varying viscosities while ensuring extended shelf life, product integrity, and compliance with food safety regulations.

- Sustainability and innovation are increasingly influencing the development of food and beverage liquid packaging. In 2025, leading brands and packaging suppliers expanded collaborations to advance environmentally responsible packaging solutions. These initiatives include the growing use of food-grade recycled PET (rPET) in beverage bottles and the development of recyclable and mono-material pouches that comply with strict food safety standards. For instance, in May 2025, PepsiCo increased the use of rPET in its beverage packaging and partnered with packaging manufacturers to develop recyclable mono-material pouches for sauces and liquid food products, aiming to improve recyclability without compromising performance.

- Similar sustainability-driven initiatives are evident in emerging markets. In February 2025, Tetra Pak India began incorporating ISCC PLUS-certified recycled polymers into its liquid packaging materials to align with evolving national plastic waste management regulations. Additionally, in June 2025, UFlex Ltd. launched an FSSAI-compliant single-pellet recycled PET solution for food and beverage packaging, which simplifies manufacturing processes, enhances recyclability, and supports the growing demand for sustainable packaging solutions.

Looking for region specific data?

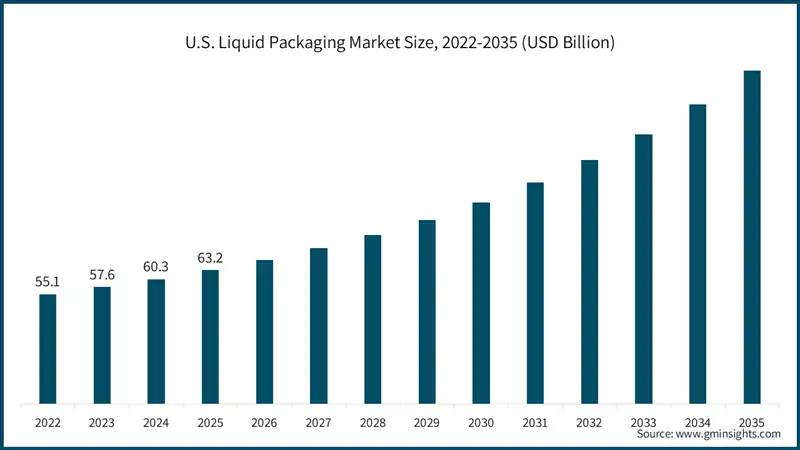

The North American global liquid packaging market was valued at USD 88.1 billion in 2025 and is expected to exhibit lucrative growth over the forecast period.

- North America represents a significant share of the global market, supported by a well-established consumer base, continuous innovation in packaging technologies, and substantial investments in advanced manufacturing capabilities. The region benefits from a strong ecosystem of packaging converters, raw material suppliers, and leading consumer goods companies, all of which are actively engaged in the development of sustainable packaging formats, advanced barrier technologies, and high-speed, efficient filling solutions.

- In addition, the presence of leading research institutions and a diverse range of end-use industries such as beverages, dairy products, food, and personal care has accelerated the commercialization of new packaging materials and formats. This strong innovation pipeline continues to support steady market expansion across the region. The United States remains the largest market not only in North America but globally, driven by high consumption of packaged liquid products, rapid adoption of sustainable packaging solutions, and ongoing technological advancements, positioning the market for sustained long-term growth.

Asia-Pacific region dominated the global liquid packaging market, accounting for approximately 38% of total market share in 2025.

- The expansion of the Asia-Pacific market is primarily driven by favorable regulatory frameworks, increasing financial and investment support, rapid development of advanced manufacturing infrastructure, and robust research and development ecosystem.

- Country such as China and India has emerged as a global hub for liquid packaging research and innovation. The region hosts a large concentration of prominent packaging converters, material innovators, and consumer goods manufacturers that actively collaborate to drive technological advancements and develop next-generation liquid packaging solutions. This integrated ecosystem continues to attract investments, accelerate innovation, and strengthen the region’s market position.

- China continues to exert a strong influence on the global liquid packaging market and remains the largest market worldwide. The Chinese market was valued at USD 60.8 billion in 2022 and USD 64 billion in 2023, before expanding to USD 136.9 billion by 2035.

- Market growth in China is supported by a highly developed manufacturing ecosystem, strong capital investment, and supportive regulatory policies that encourage sustainable and innovative packaging solutions. The country is home to numerous leading packaging converters and consumer goods companies, benefiting from a well-established pipeline of advanced liquid packaging technologies. Moreover, the presence of large-scale, world-class manufacturing facilities enables rapid commercialization and widespread adoption of new packaging formats, reinforcing China’s leadership position in the global market.

The European liquid packaging market is expected to register the highest compound annual growth rate (CAGR) of 6.1% during the forecast period, reflecting strong momentum across the region.

- Growth in Europe is driven by rising investments in sustainability, increasing demand for eco-friendly and recyclable packaging formats, and the widespread availability of advanced packaging technologies. Governments across the region are actively supporting the expansion of the manufacturing base while simultaneously promoting packaging innovation through funding programs, regulatory reforms, and international collaborations.

- In addition, Europe’s large consumer base, high awareness of environmental sustainability, and the growing presence of regional packaging players are collectively driving demand for advanced and high-performance liquid packaging solutions. Within Europe, the German liquid packaging market is projected to grow at a notable CAGR of approximately 7.1% CAGR over the forecast period.

- Germany remains a key hub for liquid packaging innovation in the region, supported by substantial investments in manufacturing research and development, strong government initiatives, and a rapidly advancing industrial automation landscape. Sustainable packaging and advanced manufacturing technologies have been prioritized within national innovation strategies, leading to increased public funding and favorable regulatory changes that encourage the adoption of next-generation liquid packaging solutions.

- Germany’s strong manufacturing capabilities, expanding logistics infrastructure, and rising domestic demand for lightweight and recyclable packaging formats position the country as a leader in liquid packaging development across Europe.

The market in the Middle East and Africa accounted for approximately 6.4% of the market share in 2025. The liquid packaging market in the Middle East and Africa is also experiencing steady growth, with Saudi Arabia emerging as one of the key contributors to regional expansion.

- The Saudi Arabian market is expected to witness substantial growth, supported by the rapid development of manufacturing facilities and increasing demand for sustainable and convenient packaging solutions. The country hosts several large-scale manufacturing plants and is benefiting from growing consumer preference for easy-to-use, environmentally responsible packaging formats.

- Market growth is further supported by increased collaboration with international packaging companies, along with government-led initiatives aimed at strengthening industrial capacity, promoting local manufacturing, and advancing sustainability objectives.

The Latin American liquid packaging market is projected to grow at a CAGR of approximately 4.4% within the global market during the forecast period. The growth is primarily driven by rising demand for eco-friendly packaging materials, steady urbanization, and the continued expansion of the beverage, dairy, and pharmaceutical industries across the region.

- Governments in Latin America are gradually implementing restrictions on single-use plastics, which is accelerating the adoption of recyclable mono-material packaging, bio-based plastics such as polyethylene derived from sugarcane, and paper-based liquid cartons. Sustainability initiatives by leading packaging companies are also supporting market growth. For instance, in 2025, Tetra Pak Brazil utilized sugarcane-based plastic in approximately 13 billion packaging units, enabling major brands such as Coca-Cola and Nestlé to achieve renewability levels of around 82%, thereby reinforcing the region’s shift toward sustainable liquid packaging solutions.

Liquid Packaging Market Share

The global liquid packaging industry is dominated by a group of large, diversified packaging companies that offer integrated packaging solutions across beverages, dairy, food, and personal care applications. The competitive landscape is primarily shaped by Amcor plc, Ball Corporation, Crown Holdings, Inc., Tetra Pak International SA, and Ardagh Group, whose market leadership is supported by their extensive product portfolios, broad geographic presence, and strong manufacturing and distribution capabilities.

- Amcor plc: The company is a leading player in the liquid packaging market, driven by its wide range of packaging solutions, strong sustainability focus, and global manufacturing footprint. The company plays a key role in shaping market dynamics through continuous innovation in lightweight packaging, recyclability, and advanced barrier technologies. Amcor’s solutions are widely adopted across beverage, dairy, food, and personal care applications, where large-scale production and high-performance standards are critical. Its emphasis on material efficiency and circular packaging design directly addresses evolving customer and regulatory requirements.

- Ball Corporation: The company's expertise in aluminum cans and rigid packaging, leveraging its expertise in metal packaging to deliver lightweight, high-barrier, and recyclable solutions. The company continues to introduce advanced can and can-end technologies that enhance product protection and functionality. Supported by a strong global production network, Ball Corporation is well-positioned to meet demand for beverages and specialty liquids across multiple regions, while its sustainability initiatives significantly contribute to improving recycling rates and reducing environmental impact.

- Crown Holdings, Inc.: The company is one of the leading manufacturers of metal and composite packaging, utilizing its global conversion and distribution network to deliver high-quality and functional liquid packaging formats. The company’s focus on advanced barrier performance, venting systems, and energy-efficient manufacturing processes strengthens its position in carbonated soft drinks, juices, and specialty liquid markets. Crown’s ability to combine performance with operational efficiency continues to support its competitive standing.

- Tetra Pak International SA: The company remains a dominant player in aseptic and carton-based liquid packaging, particularly within the beverage and dairy segments. The company operates at a systems level, offering integrated solutions that combine processing, filling, and packaging technologies. Tetra Pak’s end-to-end service model, along with its strong emphasis on food safety, extended shelf life, and product integrity, makes it a preferred partner for liquid products requiring long-lasting freshness and distribution efficiency.

- Ardagh Group: The company is one of the world’s largest suppliers of glass and metal liquid packaging, delivering value through advanced design capabilities, lightweight container options, and a reliable global supply network. The company’s diversified portfolio supports both premium and mass-market liquid packaging formats across a wide range of end-use applications, including beverages, food, and personal care.

Liquid Packaging Market Companies

Major players operating in the global liquid packaging industry are:

- Amcor plc

- Ball Corporation

- Crown Holdings, Inc.

- Tetra Pak International SA

- Ardagh Group

- O-I Glass (Owens-Illinois)

- SIG Combibloc Group AG

- Elopak AS

- Greatview Aseptic Packaging Co.

- Evergreen Packaging Inc.

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Smurfit Kappa Group plc

- WestRock Company

- International Paper Company

- ALPLA Group

- Huhtamäki Oyj

Collectively, Amcor plc, Ball Corporation, and Crown Holdings, Inc. account for more than 5% of the global liquid packaging market. These companies are actively focusing on the use of advanced materials, strategic partnerships, and sustainable packaging solutions to enhance packaging performance, recyclability, and operational efficiency. Their strategies are centered on delivering innovative, end-to-end packaging systems while expanding their global footprint through acquisitions, collaborations, and regional capacity expansions.

Sustainability and lightweight remain central to the competitive strategies of leading market participants. Companies are increasingly investing in recycled content, material reduction, and energy-efficient production processes to meet regulatory requirements and appeal to environmentally conscious consumers. At the same time, manufacturers are strengthening flexible and resilient production capabilities to mitigate supply chain risks and ensure consistent supply during market disruptions.

Liquid Packaging Industry News

- In June 2024, AeroFlexx and Chemipack partnered up to implement sustainable liquid packaging solutions in Europe, which would be a response to the increasing demand for eco-friendly options. AeroFlexx, a leading company in liquid packaging technology, has made its proprietary filling machine operational in Chemipack’s production facility in Poland. This partnership is a combination of Chemipack’s proficiency in blending and filling operations, which can supply more than 100 billion liters per year, and AeroFlexx’s ambition to penetrate the European market.

- In February 2024, Amcor plc, Stonyfield Organic, and Cheer Pack North America jointly introduced the first all-polyethylene (PE) spouted pouch, thus achieving a significant milestone in sustainable packaging. This ingenious development is swapping Stonyfield Organic's earlier multi-laminate surface, used for its YoBaby refrigerated yogurt, with a mono-material PE design, which not only bears the recycled-ready badge but is also friendly to Mother Nature.

The global liquid packaging Market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Bn) from 2022 to 2035, for the following segments:

Market, By Type

- Flexible packaging

- Rigid packaging

Market, By Material

- Plastic

- Paper & boards

- Glass

- Metal

- Others

Market, By End Use Industries

- Food & beverage

- Personal care

- Pharmaceutical

- Household care

- Industrial

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the size of the North American liquid packaging market in 2025?

The North American market was valued at USD 88.1 billion in 2025. Growth is driven by strong demand from food & beverage and personal care sectors, along with increasing adoption of sustainable packaging solutions.

What are the key trends shaping the liquid packaging industry?

Major trends include adoption of sustainable barrier coatings, growth of smart and IoT-enabled packaging, rising demand for smaller pack sizes, expansion of e-commerce-driven packaging solutions, and increased use of recycled and bio-based materials.

Who are the key players in the liquid packaging market?

Key players include Amcor plc, Ball Corporation, Crown Holdings, Inc., Tetra Pak International SA, Ardagh Group, SIG Combibloc Group AG, Elopak AS, and O-I Glass. These companies focus on sustainability, lightweight materials, and advanced packaging technologies.

Which end-use industry leads the liquid packaging market?

The food & beverage industry leads the market, accounting for approximately 23.8% share in 2025. High consumption of beverages, dairy products, sauces, and liquid foods continues to drive demand for efficient and safe packaging solutions.

What is the growth outlook for the metal packaging segment?

The metal packaging segment is expected to grow at a CAGR of 6.2% and reach USD 181.9 billion by 2035. High recyclability, strong barrier protection, and increasing use in beverages and industrial liquids are driving segment growth.

What is the leading material segment in the liquid packaging industry?

Plastic is the leading material segment, accounting for around 28.7% market share in 2025. Its dominance is supported by low material costs, lightweight properties, and growing use of recycled and mono-material plastic solutions.

Which packaging type dominates the liquid packaging industry?

Rigid packaging dominates the market and is projected to reach USD 463.8 billion by 2035. Strong barrier properties, durability, and suitability for high-speed filling operations continue to support its widespread adoption.

What is the projected value of the liquid packaging market by 2035?

The market size for liquid packaging is expected to reach USD 727.8 billion by 2035, growing at a CAGR of 6% from 2026 to 2035. Growth is fueled by eco-friendly barrier coatings, smart packaging adoption, and expanding demand across emerging economies.

What is the market size of the liquid packaging industry in 2026?

The market size for liquid packaging is estimated at USD 430 billion in 2026, reflecting steady expansion driven by increased consumption of packaged liquids and advancements in packaging materials and technologies.

What is the liquid packaging market size in 2025?

The market size for liquid packaging was valued at USD 409.2 billion in 2025. Strong demand from food, beverage, pharmaceutical, and personal care industries, along with rising adoption of sustainable and lightweight packaging solutions, is supporting market growth.

Liquid Packaging Market Scope

Related Reports