Summary

Table of Content

Liquid Fertilizer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Liquid Fertilizer Market Size

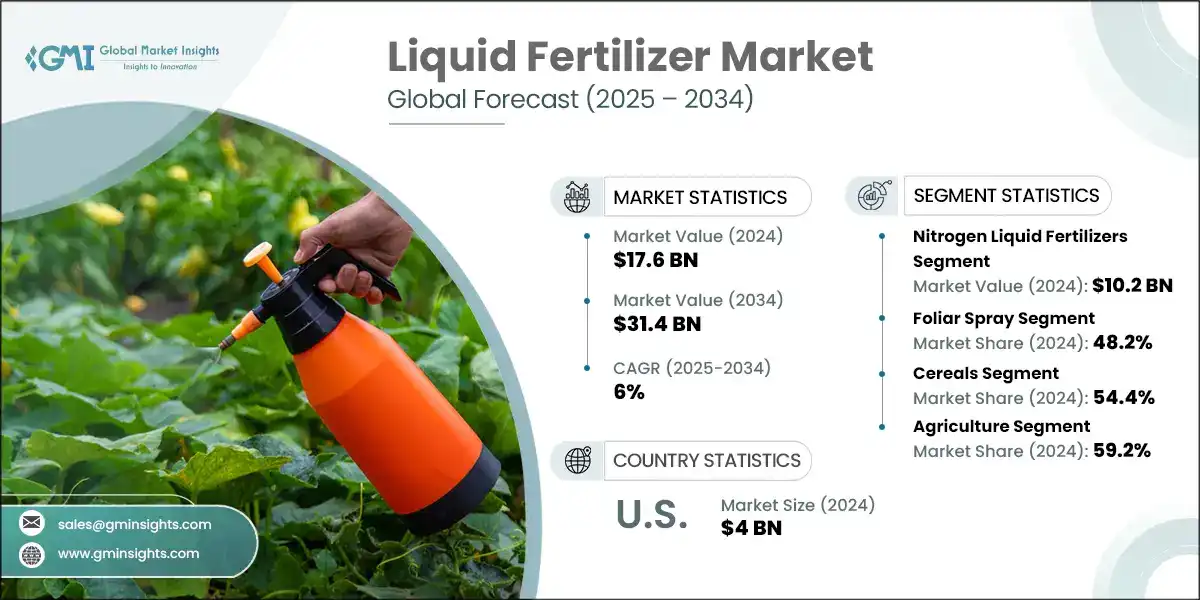

The global liquid fertilizer market was estimated at USD 17.6 billion in 2024. The market is expected to grow from USD 18.6 billion in 2025 to USD 31.4 billion in 2034, at a CAGR of 6%, according to Global Market Insights Inc.

To get key market trends

- Liquid fertilizers are nutrient solutions that are applied onto soil or crops through irrigation and/or spraying for the rapid absorption of nutrients and effective delivery. Liquid forms are more flexible compared to traditional granular fertilizers when it comes to application in modern farming systems, particularly in systems using automation or drip irrigation. Their ease of application and compatibility with precision agriculture are increasingly gaining favor among an array of crops.

- Technology serves as the determining factor for adoption. Drip and sprinkler irrigation systems nowadays have fertigation units attached to mix up fertilizers in irrigation water smoothly. Automation, GPS-based field mapping, and sensor-guided nutrient monitoring will also allow exact cost-effective and environmentally friendly applications. Thus, liquid fertilizer can be used and effective for small-scale and large farms.

- The growing food demand, the scarcity of water, and the need for better nutrient management have compelled farmers toward the use of liquid solutions. These fertilizers offer improved control over application rates, require less nutrients to be lost to the environment, and meet certain environmental standards, particularly in areas facing soil degradation or runoff challenges.

- Different segments propel growth in varied ways. Nitrogen-based liquid fertilizers in demand for cereal crops like corn and wheat act quickly. Organic liquid fertilizers are made using compost extracts, fish emulsions, or seaweed and have a very high growth forecast within the organic farming sectors. These are areas where the natural input prevails. In horticulture, foliar spray application now becomes customary because application is for crop health improvements at critical growth stages.

- For instance, according to the ECPA (European Crop Protection Association), greenhouse vegetable and fruit growers in Europe apply liquid fertilizers aided by technologically advanced fertigation systems in order to meet stringent environmental and quality standards-with an emphasis on efficiency.

Liquid Fertilizer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 17.6 Billion |

| Forecast Period 2025 – 2034 CAGR | 6% |

| Market Size in 2034 | USD 31.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Advancements in fertigation technology | Automated fertigation systems combined with smart irrigation enable seamless mixing and delivery of liquid fertilizers. Innovations such as IoT-enabled controllers enhance efficiency and ease of use, promoting adoption among both large commercial farms and smaller operations. |

| Precision Agriculture Integration | The rise of sensor technologies and GPS-guided equipment enables precise nutrient application via liquid fertilizers. This tech-driven approach minimizes waste and optimizes crop health, making liquid solutions a preferred choice for data-informed farming systems. |

| Shift Toward Sustainable Farming | Farmers increasingly prioritize eco-friendly practices, driving demand for organic and bio-based liquid fertilizers. This shift responds to stricter environmental regulations and consumer demand for sustainably grown produce, encouraging wider adoption of natural nutrient sources. |

| Growth in High-Value Crop Cultivation | Expansion of fruits, vegetables, and specialty crops boosts liquid fertilizer use, as these crops require tailored nutrient management. The ability of liquid fertilizers to deliver micronutrients quickly supports higher yields and better quality, fueling market growth. |

| Pitfalls & Challenges | Impact |

| Lack of awareness about the optimum usage of fertilizers | Despite advances, many farmers still struggle with applying liquid fertilizers optimally due to gaps in training and extension services. This causes nutrient mismanagement, impacting crop yields and slowing broader adoption as users remain cautious about inconsistent outcomes. |

| Increasing uncertainties and significant policy focus toward the environment | The growing emphasis on sustainability has led to tighter environmental regulations worldwide, but frequent policy changes and varied regional standards create uncertainty. This challenges manufacturers and farmers alike, as adapting to evolving rules can increase costs and delay market growth. |

| Opportunities: | Impact |

| Rising Demand for Organic Farming | The global shift toward organic and sustainable agriculture rises demand for bio-based liquid fertilizers. These products meet consumer preferences and regulatory trends, encouraging farmers to transition from synthetic inputs. |

| Integration with Smart Farming Technologies | The growth of IoT, AI, and data analytics in agriculture creates chances to develop advanced liquid fertilizer delivery systems. Smart fertigation can optimize nutrient use, reduce costs, and improve yields, appealing to tech-savvy growers. |

| Expansion in Emerging Markets | Rising agricultural modernization in regions like Africa, Southeast Asia, and Latin America presents vast opportunities. As farmers adopt more efficient irrigation and fertilization methods, liquid fertilizers can fill gaps in productivity and sustainability. |

| Market Leaders (2024) | |

| Market Leaders |

18% market share |

| Top Players |

Collective market share in 2024 is Collective Market Share is 56% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | China, India, Japan, Australia, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Liquid Fertilizer Market Trends

- Liquid fertilizer marketplace growth is steady as farmers search for better means to feed their crops with less water and fertilizer. Fertigation technologies have been modernized to enable ease of application of nutrients at exactly the time and place required by the plants. Thus, for instance, farmers in drier areas like some parts of Australia have adopted drip fertigation to save water and sustain healthier crops. This practical improvement assists farmers to become more familiar with liquid fertilizers, hence boosting the market.

- Precision agriculture plays a major role in this advancement with the help of sensor and GPS technologies, which allow farmers to closely monitor the actual conditions in their soils and crops. This data-driven approach allows for accurate prescriptions in applying liquid fertilizers so that excess application can be avoided while crops could increase, all stimulating further use of these inputs.

- Sustainability in farming is another trend with more and more consumers creating concerns regarding issues of the environment and pressure from regulations. As a result, farmers are shifting toward organic and bio-based liquid fertilizers, which are less harmful to the environment, to meet the consumer demand for sustainable agriculture.

- Increased cultivation of fruits and vegetables as high-value crops also fuels the demand for to have their nutrient management customized. The use of liquid fertilizer is preferred in such crops primarily because it allows fast and precise award of nutrients that promotes better growth and productivity.

Liquid Fertilizer Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is divided into NPK liquid fertilizers and nitrogen liquid fertilizers market. The nitrogen liquid fertilizers market, accounting for USD 10.2 Billion in 2024 and is expected to grow at a CAGR of over 5.7% through 2034.

- The nitrogen liquid fertilizer segment is larger than NPK Liquid Fertilizer. Growth in the nitrogen sector is because nitrogen is one of the key nutrients responsible for fast plant growth and finds extensive use across cereal and leafy vegetable crops that require large nitrogen input for maximizing yield. Liquid fertilizer fertilizers are suited to application through modern irrigation and fertigation systems so that fertilizer can be applied in precise quantities, thus reducing wastage and impacts on the environment, thereby promoting greater adoption.

- NPK Liquid Fertilizers are still expanding and gaining popularity, due to their balanced nutrient profile, providing all three major macronutrients—nitrogen, phosphorus, and potassium in one formulation. This balance is crucial for the well-being of crops, root development, and fruit quality, thereby making it widely accepted among diversified cropping systems. The growth is attributed to changing preferences toward tailored nutrient management solutions that optimize yield and quality.

- Nitrogen liquid fertilizer market accounts for about 57.9% of the market share in 2024 followed by 42.1% for NPK liquid fertilizers.

Learn more about the key segments shaping this market

Based on applications, the liquid fertilizer market is segmented into foliar spray, fertigation (irrigation), soil drenching, and seed treatment. Foliar spray has been dominant in the liquid fertilizer segment for 2024, comprising 48.2% of the market.

- The foliar spray segment dominates the market in 2024 because the nutrients applied directly to plant leaves get absorbed and utilized very quickly-as quickly as seven to thirty minutes after application. Foliar sprays are particularly effective in correcting micronutrient deficiencies at critical growth stages and are popular with farmers growing high-value fruits, vegetables, and flower crops. Apart from being cost-effective, they are easy to apply and least interfere with soil economically in open-field and controlled environments.

- Meanwhile, fertigation (irrigation) accounts for 36% market share in 2024 and is rapidly increasing due to its high efficiency in nutrient delivery and water conservation. Another support for the rise of fertigation is that the introduction of both drip and sprinkler irrigation systems in the Middle East, India, and some regions of Latin America is keeping pace with the trend. Since this method of nutrient application is done together with the routine irrigation cycles, it helped save labor and made sure that the nutrients are well available during root uptake. Because of the expanding precision agriculture, fertigation is expected to show enormous growth, especially in the large-scale, high-tech farming environments.

Based on crop type, the market is segmented into cereals, oilseeds, fruits and vegetables, horticultural plants (flowers, ornamental plants, etc.), others. The cereal segment dominates the market.

- The largest share in crop-based segmentation of the liquid fertilizer market is held by cereals, accounting for 54.4% in 2024. These crops require high nutrient input to sustain their yield potential, and liquid fertilizers are a faster and more targeted method of supplying these essential macro-nutrients.

- Fruits and vegetables followed, with a 16% share in 2024, because of growing demand in global markets for quality-residue-free produce. Liquid fertilizers have found wide applications in this segment as they enhance color, texture, and nutrient content.

- Oilseeds account for 13.5% in 2024 and continued to witness rising application of liquid nutrient solutions mainly for yield enhancement, while horticultural plants hold for 11.3% in 2024, which include flowers and ornamentals, are also encouraged to use liquid nutrients for aesthetic purposes. The ‘Others’ category contribute about 4.9% in 2024, which mainly comprises niche or specialty crops, adding modestly yet steadily to the growth of the market, with diversified farming and export-oriented horticulture acting as drivers.

Based on end use, the liquid fertilizer market is segmented into agriculture, horticulture (greenhouses, nurseries), turf and lawn care, and others. Agriculture segment dominated the market.

- The largest segment of the end use market is agriculture, which has a share of 59.2% in 2024. This is primarily because they are compatible with mechanized application systems They are the best suited for yield improvement and quality enhancement of cereals, oilseeds, and pulses. Food security demand increases and thus precision in agriculture becomes more prominent.

- The horticulture segment accounts for 23% market share in 2024, and it is rapidly gaining momentum as the cultivation of fruits, vegetables, and ornamental plants is increasing tremendously under controlled environments such as greenhouses and nurseries. Liquid fertilizers are the best fertilizers to use for such crops as these ones that are high-value, input-sensitive crops as they are precise and efficient.

- Turf and lawn care holds 12.2% market share in 2024 and are growing with continuous expansion because of landscaping introduced into residential, sport, and commercial spaces. The 'Others' segment accounts for 5.6% in 2024 comprises niche applications like hydroponics and specialty crop cultivation, which are relatively small in terms of market share but go a long way to add diversity and innovation in nutrient delivery systems to the overall market.

Looking for region specific data?

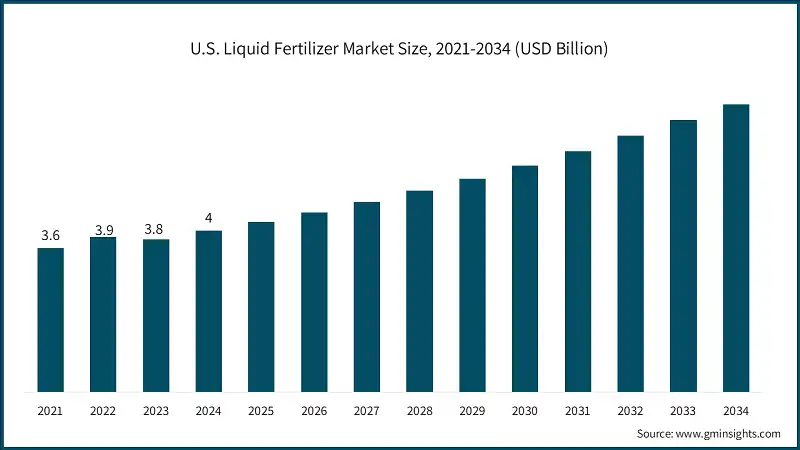

U.S. dominated the liquid fertilizer market in North America with around 87% share and generated USD 4 billion in revenue in 2024.

- The North American liquid fertilizer industry is projected to maintain a steady growth until 2034, propelled by modernization in precision farming and shifting trends toward sustainable farming. Therefore, efficiency in fertilizer usage tends to enhance variable-rate application technologies and nutrient management systems within agriculture and is expected to reduce environmental degradation. Government interventions, like the U.S. Department of Agriculture's (USDA) include conservation practices and nutrient management education in promoting best practices among farmers. There is also a growing push to lower greenhouse gas emissions and to enable better water quality by the increased use of efficient and environmentally friendly fertilizer products.

- In Canada, similar trends are largely observed, emphasizing sustainable agriculture and environmental management. The increase in the liquid fertilizer market is comprising several federal and provincial programs promoting nutrient management planning, along with introducing and use of precision agriculture tools for betterment. Digitalization of farm operation is also facilitating a more precise application of fertilizers leading to an increased crop yield and less loss to the environment.

The liquid fertilizer market in the Germany is expected to experience significant and promising growth from 2025 to 2034.

- The German market is predicted to grow substantially till 2034 underlining the increasing adoption of precision agriculture and other sustainable nutrient management programs. Farmers are increasingly adopting use of liquid fertilizers because of their enhanced nutrient delivery efficiency, especially in high-value crop production and greenhouse farming. These technologies will lead to increased crop yields and improved environmental benefits due to reduced fertilizer waste and improved nutrient uptake.

- The liquid fertilizer markets in Europe are said to grow upon the sustenance of sustainable agriculture and circular economy principles. For instance, Farm to Fork Strategy of the European Union aims to reduce the environmental footprint of farming while putting emphasis on organic fertilizers and nutrient recycling.

- Countries such as the Netherlands have an active program of manure processing to produce high-quality liquid fertilizers, thereby ensuring a lower dependency on synthetic alternatives. In Eastern Europe, liquid fertilizers have proven useful for improving soil health and productivity, with an increasing demand now supported by government incentives focusing on the reduction of nitrogen emissions.

The liquid fertilizer market in China is expected to experience significant and promising growth from 2025 to 2034.

- Asia Pacific accounted for over 45% of the global liquid fertilizer industry in 2024 and is the fastest-growing region with a CAGR of around 6.2%. Liquid fertilizers market will experience excellent growth due to the increased consumption of food in this region and improvement in modern farming techniques. Farmers have shifted to adopting liquid fertilizers mainly for their efficiency, ease of application, and ability to sustainably increase crop yields. Rapid urbanization and government regulations to improve agricultural productivity further promote the wide range of liquid fertilizer use in different cropping systems, thus favoring the even more prolonged growth of the market.

- Liquid fertilizers have emerged in both China and India as the agriculture sector's largest economies in Asia as major input tools in increasing productivity and addressing environmental concerns. China invests a lot in precision agriculture and nutrient management towards sustainable quality crop production systems through reduced chemical runoff. On the other hand, liquid fertilizers are gaining ground in India with farmer education and improved supply chains to deliver inputs to smallholder farmers for better nutrient use efficiency and yield gains.

The liquid fertilizer market in UAE is expected to experience significant and promising growth from 2025 to 2034.

- The market in the Middle East and Africa will witness rapid growth, starting from 2025 and extending to 2034. This is largely because countries in this region will be struggling with the urgent needs of enhancing agricultural productivity growth for arid to semiarid climates. Several countries also have adopted efficient nutrient management practices in the region, which will increase crop yields while preserving valuable water resources.

- The market for liquid fertilizers in the UAE is expected to grow considerably within the next decade because of the increased emphasis of the country on developing a sustainable agriculture system that fits the water-scarce environment. Containing the integration of fertigation systems with advanced irrigation techniques will establish an optimum condition for nutrient and water use that is a must for desert farming conditions. Expansion of such initiatives for greenhouse cultivation and smart farming additionally straddles the demand for liquid fertilizers that advance productivity but with minimized environmental impact, making UAE one of the hottest growth markets in the region.

The liquid fertilizer market in Brazil is expected to experience significant and promising growth from 2025 to 2034.

- Liquid fertilizer is expected to grow steadily through 2034 within the regions of Latin America regarding agricultural strength and the rising demand for better methods of application. Farmers from Argentina, Colombia, and Chile, among other countries, are beginning to turn more to liquid fertilizers in improving their yields with a more sustainable large-scale cultivation practice. The shift towards precision agriculture further pushes developing exports of cash crops, such as soybeans, coffee, and corn.

- Strong growth exists for the liquid fertilizer market in Latin America within the next decade. Brazil, the agricultural giant in Latin America, possesses vast arable land and practices year-round agriculture cycles. In this case, technology to improve nutrient efficiency and boost productivity is prioritizing the Brazilian agribusiness sector. Hence, with the rising fertigation systems applied to crops such as sugarcane, soybeans, and fruits, rising soil health concerns along with environmental sustainability are driving the adoption of liquid fertilizers.

Liquid Fertilizer Market Share

- The top 5 companies in the liquid fertilizer industry are Nutrien Ltd., Yara International ASA, ICL (Israel Chemicals Ltd.), IFFCO (Indian Farmers Fertilizer Cooperative Ltd.), K+S Aktiengesellschaft. contributing around 56% of the market in 2024.

- The liquid fertilizer market is highly competitive, with key players fiercely investing in long-term R&D to develop innovative and energy-efficient nutrient formulations. This focus addresses the growing global demand for sustainable agricultural practices and adapts to shifting environmental regulations at both regional and international levels. Through these advancements, companies continuously enhance fertilizer efficiency and nutrient delivery while minimizing environmental emissions, meeting the strict standards of modern farming and allied sectors.

- The market is also witnessing growing interest in multifunctional liquid fertilizers that offer benefits such as improved nutrient uptake, water retention, and resistance to environmental stresses. These advanced formulations support the increasing need for sustainable crop management and help farmers reduce input costs by enhancing fertilizer effectiveness. Such innovations pave the way for broader adoption of liquid fertilizers, especially in high-value crops and precision agriculture systems.

- Leading manufacturers leverage their expansive global distribution networks to ensure reliable availability of their liquid fertilizer products across diverse agricultural regions. Their strong commitment to eco-friendly and sustainable nutrient solutions gives them a competitive edge amid stricter government regulations and rising consumer awareness about sustainable farming practices. This focus helps build trust and loyalty among farmers, agribusinesses, and other stakeholders.

- These market players are also consistently investing heavily in product innovation and region-wise market development, especially in some of the fastest growing regions, namely APAC and North America. The demand of advanced liquid fertilizers in these regions is mainly due to rapidly changing urban patterns, changing food habits, and advancement in agricultural technologies such as precision application methods and fertigation systems. These companies stay ahead of competition and set benchmarks for the future's growth and sustainability of the global market by providing region specific formulations and tailored applicability solutions.

Liquid Fertilizer Market Companies

Major players operating in the liquid fertilizer industry are:

- Nutri-Tech Solutions Pty Ltd

- FoxFarm Soil & Fertilizer Co

- CSBP

- ICL

- Compo Expert

- Nutrien Ltd.

- BMS Micro-Nutrients NV

- EuroChem Group

- IFFCO

- K+S Aktiengesellschaft

- Yara International ASA

- AgroLiquid

- Nutrien Ltd.: It is a crop nutrient leader that provides a wide range of liquid fertilizers containing nutrients to support nutrient utilization and crop productivity. These include very specific crop nutrient blends customized for precision farming and sustainable farming. Their massive reach with distribution networks offering their products to the farmers across the USA creates branding for the company.

- Yara International ASA: It is a major global producer of liquid nitrogen solutions and specialty liquid fertilizers, which includes advanced NPK formulations. The company is focused on developing energy-efficient, environmentally friendly liquid fertilizers that improve nutrient uptake and cause a lesser impact on the environment. As of now, the advancements in liquid fertilizer sold are supporting sustainable agriculture through Europe and in the emerging markets.

- Israel Chemicals Ltd (ICL): It is a leading global producer of liquid fertilizers, concentrating on premium minerals, specialty nutrients and micronutrient products. Creating liquid fertilizers aimed at precision farming ensures improved crop health, yield, and balanced nutrient delivery. The company’s primary focus on R&D encourages innovation in sustainable liquid fertilizers to serve a global agricultural company.

- IFFCO (Indian Farmers Fertiliser Cooperative Ltd.): India's major fertilizer cooperative, IFFCO occupies a significant market position in liquid fertilizers with a range of liquid-blended fertilizers that are rich in nutrients and are designed to meet various crop requirements. Deliverables from their line of liquid fertilizers encourage the land to make better use of nutrients while improving soil health for suitable sustainable initiatives. IFFCO's wide network of cooperatives ensures multilocational distribution directly to the farmers around India.

- K+S Aktiengesellschaft: It is a globally recognized supplier of exclusive liquid fertilizers and water-soluble nutrients, and it has a big footprint in Europe. Embodying the concept of 'liquid solutions' melded with global popular research where liquid fertilization epitomizes enhancement of nutrient efficiency and support to crop resilience. The company's primary concerns are the environmental factors that might protect the indigenous sacrosanct environmental assets in its basic level, strengthening them with all stringent regulations, thus supporting most up-to-date farming practices.

Liquid Fertilizer Industry News

- On May 6, 2025, Liquiadubos just announced the inauguration of its new liquid fertilizer plant in Ferreira do Alentejo, Portugal. It will be creating cutting-edge NPK-supported liquid fertilizers that aim to support olive and almond crops. The company will be investing heavily in environmental sustainability as well as focusing on reducing the import dependency. It will supply the Portuguese market with advanced fertilizers manufactured locally.

- In May 2024, AgroChem Solutions launches smart liquid fertilizer system, integrating soil sensors and GPS for precision applications. Early trials show 20% reduction in fertilizer use with maintained yields.

The liquid fertilizer market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo tons) from 2021 to 2034, for the following segments:

Market, By Product

- NPK liquid fertilizers

- NP 10:34 liquid fertilizers

- NP 10:37 liquid fertilizers

- NPK 20:20:20

- NPK 15:15:15

- NPK 12:12:17

- NPK 18:9:18

- NPK 8:16:24

- NPK 14:14:14

- NPK 6:12:18

- NPK 10:10:10

- Other NPK formulations

- Nitrogen liquid fertilizers

- UAN (Urea-ammonium nitrate) liquid fertilizers

- Ammonium nitrate-based liquid fertilizers

- Ammonium sulfate-based liquid fertilizers

- Calcium nitrate-based liquid fertilizers

- Ammonium chloride-based liquid fertilizers

- Sodium nitrate-based liquid fertilizers

- Urea-ammonium sulfate (UAS) liquid fertilizers

- Other nitrogen formulations

Market, By Application

- Foliar spray

- Fertigation (irrigation)

- Soil drench

- Seed treatment

Market, By Crop Type

- Cereals

- Oilseeds

- Fruits and vegetables

- Horticultural plants (flowers, ornamental plants, etc.)

- Others

Market, By End Use

- Agriculture

- Horticulture (greenhouses, nurseries)

- Turf and lawn care

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Frequently Asked Question(FAQ) :

What is the market size of the liquid fertilizer in 2024?

The global market size for liquid fertilizer was valued at USD 17.6 billion in 2024, with a CAGR of 6% expected through 2034 driven by advancements in fertigation technology.

What is the projected value of the liquid fertilizer market by 2034?

The market size for liquid fertilizer is expected to reach USD 31.4 billion by 2034, fueled by smart irrigation adoption, sustainable farming practices, and growing demand for high-value crops.

How much revenue did the nitrogen liquid fertilizer segment generate in 2024?

Nitrogen liquid fertilizers generated USD 10.2 billion in 2024, holding 57.9% of the total market share.

What was the valuation of the foliar spray application segment in 2024?

The foliar spray segment dominated with 48.2% market share in 2024.

Which crop segment leads the liquid fertilizer market?

Cereals led the market with 54.4% share in 2024, supported by high nutrient requirements for wheat, corn, and rice cultivation.

Who are the key players in the liquid fertilizer market?

Key players include Nutrien Ltd., Yara International ASA, ICL, IFFCO, K+S Aktiengesellschaft, EuroChem Group, AgroLiquid, Compo Expert, BMS Micro-Nutrients NV, and FoxFarm Soil & Fertilizer Co.

What are the upcoming trends in the liquid fertilizer industry?

Key trends include adoption of smart fertigation systems, shift toward organic and bio-based fertilizers, and integration with precision farming technologies.

What was the valuation of the U.S. liquid fertilizer market in 2024?

The U.S. market generated USD 4 billion in 2024. Strong adoption of precision farming, sustainable practices, and government-backed nutrient management programs drive market growth.

Liquid Fertilizer Market Scope

Related Reports