Summary

Table of Content

Linear Low-Density Polyethylene (LLDPE) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Linear Low-Density Polyethylene Market Size

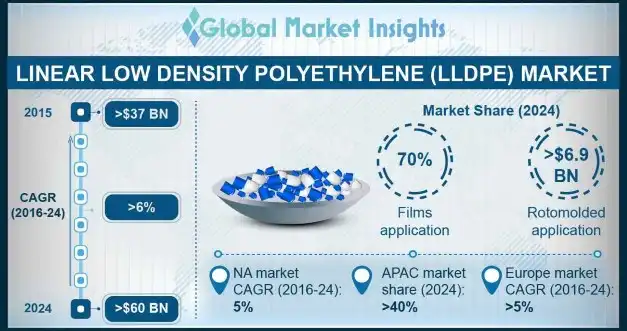

Linear Low-Density Polyethylene Market size was above USD 37 billion in 2015 with gains at over 6% between 2016 and 2024. It has applications in various industries such as household products, packaging, automotive, and agriculture. Linear low-density polyethylene offers a wide spectrum of advantages than other polyethylene derivatives.

To get key market trends

Linear low-density polyethylene is extensively used as films owing to its superior tensile properties. These films are used where elongation and flexibility are vital factors such as packaging industry, canal linings, miming, hazardous waste liners, and geo-membrane liners. LLDPE films are consumed widely in the food packaging sector as they are impact resistant and possess high tensile strength. Packed food & beverage consumption is increasing due to improved living standards of youth. Moreover, escalating adoption of ready-to-mix and ready-to-eat food packets has increased the linear low-density polyethylene market in the food packaging industry.

Linear Low-Density Polyethylene Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 37 Billion (USD) |

| Forecast Period 2016 - 2024 CAGR | 6% |

| Market Size in 2024 | 60 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Linear Low-Density Polyethylene Market Analysis

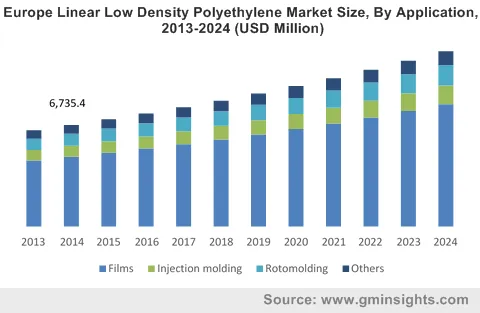

Linear low-density polyethylene films segment accounted for more than 70% of market share in 2015 and is anticipated to have a significant share during the forecast period. Increasing protective films demand in agriculture for UV ray’s protection and reducing soil erosion shall give a positive outlook to linear low-density polyethylene market growth. LLDPE films are also used as a moisture barrier in the construction sector under concrete structure. Further, increased usage of films in the food packaging industry has also contributed to the market.

Injection molding is another crucial application of linear low-density polyethylene, contributing nearly 2,500 kilo tons in 2015. Injection molding is a part manufacturing technology and is used to manufacture plastic products such as pocket combs, automotive dashboards, bottle caps, and wire spools. Advantages of injection molding are better-finished parts, minimal scrap losses, low labor cost, repeatable high tolerances, and high production rates. Thus, increasing application of injection molding augments the linear low-density polyethylene market value.

Learn more about the key segments shaping this market

Another upcoming linear low density polyethylene application is rotomolding, it had a market size of more than USD 4.4 billion in 2015. Rotomolding process is used to manufacture hollow plastic articles without any pressure involved in its manufacturing. This technology is more economical than injection or blow molding as the molds do not have to sustain any pressure.

Rotomolding has a wide range of applications in construction, furniture, agriculture, automotive, water treatment, and packaging industries. Substantial growth in all these industries has led to increasing the linear low-density polyethylene market consumption in rotomolding applications.

Asia Pacific had registered a significant share of nearly 45% in 2015. Emerging economies’ construction spending is rising in this region. China and India had witnessed construction spending of around USD 1.75 trillion and USD 420 billion respectively in 2015, which is likely to boost the linear low-density polyethylene market revenue over the forecast period. Moreover, the growing packed food adoption in this region due to its ease of consumption has bolstered the product demand.

North America has an established packed food & beverage business, especially in the U.S. Also, it has a considerable potential for infrastructural development owing to the ever-increasing living standards of their population. North America contributes significantly to the automobile industry with automobile manufacturers such as “General Motors”. North America had a market size of above USD 7 billion in 2015 in linear low-density polyethylene market.

Europe had witnessed an increasing adoption of rotomolding technology owing to its developing telecommunication, electronics, and automobile industries. This industry flourishment has resulted in infrastructure growth in Spain, Italy, and Germany. Moreover, Germany is an automobile hub with automotive giants including “Volkswagen AG” and “ŠKODA AUTO a.s.”

Linear Low-Density Polyethylene Market Share

Some of the major manufacturers in the linear low density polyethylene industry are:

- Nova Chemicals Corporation

- Reliance Industries

- LyondeBassells Industries N.V

- Saudi Basic Industries Corporation (SABIC)

- CNPC

- China Petroleum & Chemical Corporation (Sinopec Corporation)

- Exxon Mobil Corporation

- Borealis AG

- Mitsui and Westlake

- Sasol Limited

- Chevron Phillips Chemical Company LLC

- Mitsubishi Chemicals

- Braskem S.A

- The Dow Chemical Company

- Basell

- INEOS Group AG

Linear low-density polyethylene market report includes an in-depth coverage of the industry with estimates & forecast in terms of volume in kilotons & revenue in USD million from 2016 to 2024, for the following segments:

By Application

- Films

- Injection molding

- Rotomolding

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Who are the key global manufacturers and suppliers of LLDPE?

Companies like Nova Chemicals Corp., LyondeBassells Industries N.V., Reliance Industries, SABIC, CNPC, Exxon Mobil Corp., and Chevron Phillips Chemical Co. are some of the key manufacturers and suppliers of LLDPE.

What is the anticipated worth of the linear low density polyethylene market by the year 2024?

The forecast worth of linear low density polyethylene market is predicted to exceed 60 Billion (USD) by 2024.

How will the worldwide linear low density polyethylene industry grow during the forecast duration?

According to credible reports, linear low density polyethylene market would record a crcr of 6% over the anticipated time span.

What is the use of line low density polyethylene (LLDPE) in the packaging sector?

Linear low density polyethylene is used for making films for industries like the packaging sector where parameters like elongation and flexibility are of high significance.

How will North America LLDPE market accrue revenue over the coming years?

Notable growth in the packed food & beverage sector of the U.S. and changing standard of living will fuel new growth proceeds in North America LLDPE market.

Which factors have led to the adoption of LLDPE films in the food packaging sector?

Robust increase in the consumption of packed food & beverage products and escalating adoption of ready-to-eat food packets have driven the demand for LLDPE films in the food packaging industry.

Linear Low-Density Polyethylene Market Scope

Related Reports