Summary

Table of Content

Lecithin Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Lecithin Market Size

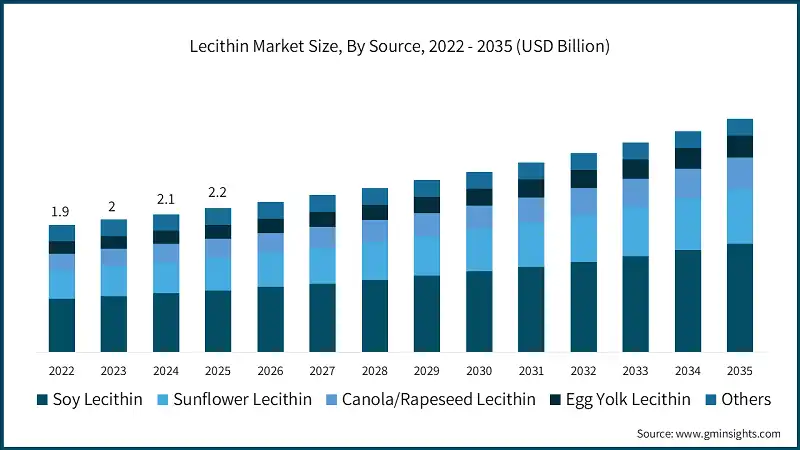

The global lecithin market size was valued at USD 2.2 billion in 2025. The market is projected to reach from USD 2.3 billion in 2026 to USD 3.5 billion by 2035, expanding at a 4.7% CAGR from 2026 to 2035 according to latest report published by Global Market Insights Inc.

To get key market trends

- Demand is broad-based across food, nutraceuticals, pharmaceuticals, personal care, and industrial uses, with the mix steadily shifting toward higher spec grades. Clean label requirements and delivery system advances are moving the center of gravity from commodity fluid lecithin to deoiled, modified, and high-PC fractions. Because lecithin is recovered from oilseed processing, availability and pricing still hinge on oilseed cycles yet value is increasingly set by functionality and documentation.

- Growing use in cosmetics and personal care is driving growth in the market. Lecithin serves as an emulsifier, moisturizer, and penetration enhancer; lecithin emulsions achieved ~1,700 fold curcumin solubility increases and ethosomes boosted transdermal flux 11–13x, while the CIR panel affirmed cosmetic safety without concentration caps.

Lecithin Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.2 Billion |

| Market Size in 2026 | USD 2.3 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.7% |

| Market Size in 2035 | USD 3.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Clean-label and organic demand | Premium pricing and expanded adoption in food & beverage. |

| Bakery/infant nutrition usage & Codex permissibility | Stable regulatory footing under GMP with infant maxima. |

| Pharma/nutra liposomal and PC enriched growth | High PC fractions enable premium applications. |

| Pitfalls & Challenges | Impact |

| Oilseed price and supply volatility | Input cost swings and source substitution. |

| Opportunities: | Impact |

| Organic deoiled capacity build‑out | Tight supply creates room for new certified lines |

| Market Leaders (2025) | |

| Market Leaders |

12.3 % market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging country | U.S., Canada |

| Future outlook |

|

What are the growth opportunities in this market?

Lecithin Market Trends

- Rising demand for plant-based and non-GMO lecithin in food and beverages: Roughly 94% of U.S. soybeans are GMO, pushing identity-preserved non GMO soy and sunflower lecithin for EU and premium channels; the USDA Organic Integrity Database lists 121 certified organic lecithin operations globally, but only three specifically produce organic deoiled lecithin, underscoring tight organic supply.

- Increasing adoption in pharmaceuticals and nutraceuticals: Natural phospholipids—especially 94–98% phosphatidylcholine (PC) fractions—are preferred for liposomes and parenteral emulsions due to quality reproducibility and biocompatibility; EFSA affirms lecithin safety for all animal species with no maximum limits.

- Rising consumer preference for natural and organic ingredients – The USDA National Organic Program permits lecithin when produced without synthetic modifications, supporting organic labelled products and clean label reformulations in key categories.

Lecithin Market Analysis

Learn more about the key segments shaping this market

Based on source the market is segmented as soy lecithin, sunflower lecithin, canola/rapeseed lecithin, egg yolk lecithin, others.

- Soy lecithin dominates the lecithin market with about 80% share in 2025, reflecting the scale of soybean processing and the recovery of phospholipid gums during oil refining, global soybean output is projected at ~427.14 MMT in 2024/25, led by Brazil at ~175 MMT and the U.S. at ~115.8 MMT. Typical crude soybean oil features 800–1,200 ppm phosphorus, translating to ~2–3% commercial lecithin by weight, while composition centers on PC, PE, and PI alongside neutral oil and minor components that drive emulsification but require antioxidant management.

- Because roughly 94% of U.S. soybeans are GM varieties, identity preserved non GMO soy lecithin commands premia and complex logistics in EU facing programs. Sunflower lecithin holds ~11% share and offers inherent non GMO status, global sunflower seed output dipped to ~51.99 MMT in 2024/25 from ~55.98 MMT in 2023/24, tightening supply amid region specific shortfalls.

Learn more about the key segments shaping this market

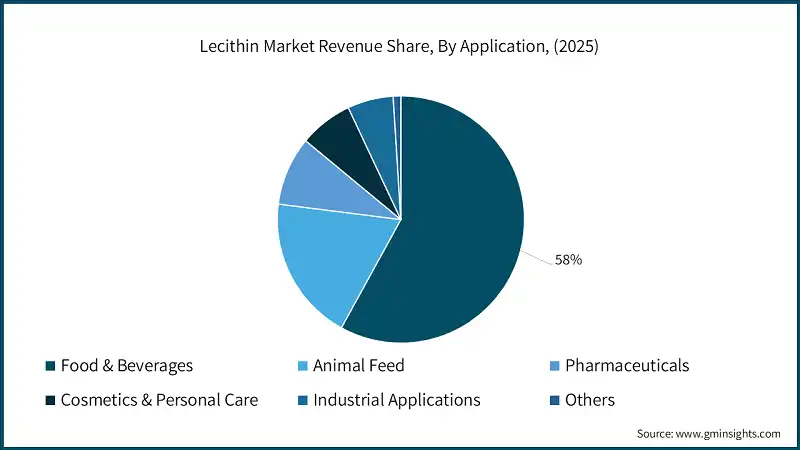

Based on application, the lecithin market is segmented as food & beverages, animal feed, pharmaceuticals, cosmetics & personal care, industrial applications, and others.

- The world's consumption of lecithin is mostly on account of the food & beverage segment, which accounts for 58% of market share in 2025. An increasing number of manufacturers are opting for natural emulsifiers for use in bakery, confectionery, dairy, plant based foods, and clean-label product lines. Lecithin positively influences texture, stabilizes emulsions, and prolongs shelf life; this is in tandem with an increase in demand for processed and convenient foods, particularly among the fast-growing consumer class in the Asia-Pacific.

- The increasing popularity of non-GMO and allergen-free sunflower lecithin thereby creates additional demand, especially in the premium and health-oriented product categories. Beyond food, the pharmaceutical world continues to witness a growing use of lecithin, supported by the increasing global spending on healthcare and nutraceuticals, in delivery systems, capsules, and dietary supplements due to the bioavailability-enhancing properties of lecithin.

Looking for region specific data?

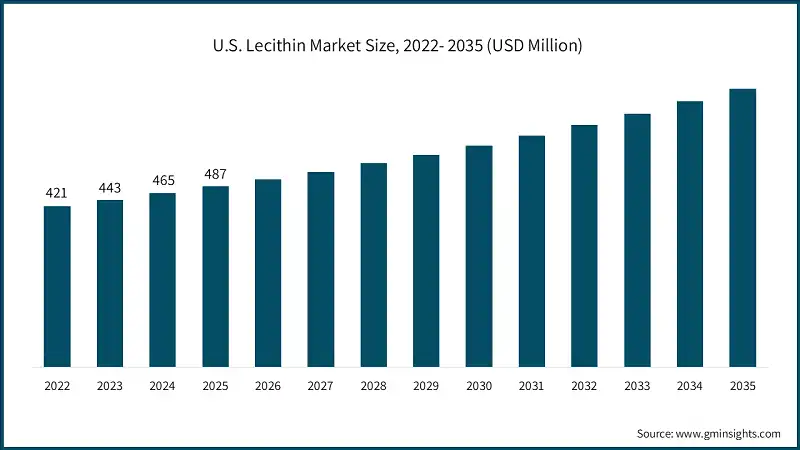

The U.S. Lecithin market valued at USD 487 million in 2025 and estimated to grow to almost USD 773 million by 2035.

- North America’s lecithin market holds around 27% share, powered by the U.S. soybean production at ~115.8 MMT in FY 2024/25 and Canada’s rapeseed leadership at ~18.8 MMT. Clean label and organic preferences are sharpening demand for non GMO and certified grades, with 56 U.S. operations listed among 121 global organic lecithin certifications.

- Regulatory clarity under the National Bioengineered Food Disclosure Standard hinges on detectability of modified genetic material, which affects documentation and processing choices for soy lecithin. The U.S. lecithin market also benefits from pharmaceutical adoption and a robust cosmetics sector, supported by CIR’s safety assessment for cosmetic use with no concentration limits.

Asia Pacific is currently the largest regional market on the back of China’s major role in market.

- Asia Pacific leads the lecithin market at 30% share, reflecting China’s 21 MMT soybeans and 15.8 MMT rapeseed alongside India’s 10 MMT soybeans and 11.6 MMT rapeseed in 2024. China’s food processing, pharma, and cosmetics sectors anchor demand, while the region’s dominant aquaculture base accelerates feed usage where phospholipid requirements are highest at early life stages. Organic certifications are building in China and India, signalling future availability of certified grades for regional and export markets. Japan skews to high purity lecithin for pharma, and Australia’s rapeseed production supports supply balance.

Europe’s lecithin market accounts for ~26% share and is shaped by stringent GMO and allergen labelling rules that encourage non GMO soy and sunflower sourcing.

- The EU produced ~17.24 MMT rapeseed in 2024 and ~9.5 MMT sunflower seed, providing meaningful feedstock diversity even as weather related declines tightened sunflower supply. EFSA’s favorable opinion on lecithins for all animal species supports growing feed inclusion, while the E number (E322) spans standard and enzymatically hydrolyzed forms with detailed specs. Pharmaceutical grade phospholipids are a European strength, with suppliers specializing in high-PC fractions for liposomal drugs and parenteral systems.

Lecithin Market Share

The lecithin industry shows moderate concentration, the top five players ADM, Cargill, IFF, Bunge, and Wilmar International hold about 49.7% of global share in 2025, leaving a long tail of regional processors and specialty players. The result is two speed competitive field scale processors that can guarantee volumes, segregation, and documentation, and specialists that win on custom specs and speed.

- ADM

- ADM integrates lecithin production across soybean, sunflower, and rapeseed platforms, with assets in the U.S., Brazil, and Europe. Its portfolio spans standard fluid, deoiled powder/granular, and specialty fractions for pharma/nutra. The company emphasizes identity preserved non GMO and organic programs supported by segregated logistics and certification audits. R&D targets enzymatic modification for functionality gains and hydrogenation for stability in sensitive systems.

- ADM integrates lecithin production across soybean, sunflower, and rapeseed platforms, with assets in the U.S., Brazil, and Europe. Its portfolio spans standard fluid, deoiled powder/granular, and specialty fractions for pharma/nutra. The company emphasizes identity preserved non GMO and organic programs supported by segregated logistics and certification audits. R&D targets enzymatic modification for functionality gains and hydrogenation for stability in sensitive systems.

- Cargill

- Cargill operates a broad lecithin platform underpinned by crushing capacity across the Americas, Europe, and Asia. GRAS Notice 682 details canola lecithin manufacturing for foods including non exempt infant formula, covering specifications and safety data for fluid and deoiled forms—evidence of regulatory and process rigor. Technical services support application development in bakery, instantized beverages, confectionery, and infant nutrition, with a growing focus on traceability and sustainable sourcing.

- Cargill operates a broad lecithin platform underpinned by crushing capacity across the Americas, Europe, and Asia. GRAS Notice 682 details canola lecithin manufacturing for foods including non exempt infant formula, covering specifications and safety data for fluid and deoiled forms—evidence of regulatory and process rigor. Technical services support application development in bakery, instantized beverages, confectionery, and infant nutrition, with a growing focus on traceability and sustainable sourcing.

- IFF

- IFF delivers high-purity phospholipids and modified lecithins targeting premium applications. Capabilities include alcohol fractionation and chromatographic enrichment for 70–98% PC grades, hydrogenated lecithins for oxidative stability, and platform technologies for liposomes and microemulsions serving oral, transdermal, and parenteral routes. Co development with pharma and beauty brands differentiates IFF in documentation and design for performance.

- IFF delivers high-purity phospholipids and modified lecithins targeting premium applications. Capabilities include alcohol fractionation and chromatographic enrichment for 70–98% PC grades, hydrogenated lecithins for oxidative stability, and platform technologies for liposomes and microemulsions serving oral, transdermal, and parenteral routes. Co development with pharma and beauty brands differentiates IFF in documentation and design for performance.

- Bunge

- Bunge Limited leverages specialty fats business to link lecithin chemistry with fat systems, accelerating formulation wins in instant powders, chocolate, confectionery, and infant formula. Collaborative research with university college cork maps composition to rheology and end-use performance, giving customers data driven selection pathways. Sustainability programs address deforestation free soy and supply chain emissions.

- Bunge Limited leverages specialty fats business to link lecithin chemistry with fat systems, accelerating formulation wins in instant powders, chocolate, confectionery, and infant formula. Collaborative research with university college cork maps composition to rheology and end-use performance, giving customers data driven selection pathways. Sustainability programs address deforestation free soy and supply chain emissions.

Lecithin Market Companies

Major players operating in the lecithin industry are:

- Archer Daniels Midland

- Cargill

- International Flavors & Fragrances

- Bunge Limited

- GIIAVA

- Ruchi Soya

- Wilmar International

- Lipoid GmbH

- American Lecithin Company

- Thew Arnott

- Sternchemie

- Sodrugestvo

- LEKITHOS

- LECICO

- SOYA International

Lecithin Industry News

- In March 2025, Louis Dreyfus Company launched new product line in China addressing growing demand for plant based ingredients. This includes lecithin product line which includes wide variety of types including powdered lecithin from non-GMO soy, sunflower and rapeseed.

- In August 2024, Bunge expanded its lecithin portfolio in North America which will include deoiled soybean lecithin, which complements product portfolio of the company.

The lecithin market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Source

- Soy lecithin

- GMO soy lecithin

- Non-GMO soy lecithin

- Sunflower lecithin

- Canola/rapeseed lecithin

- Egg yolk lecithin

- Others

Market, By Form

- Fluid/liquid lecithin

- Deoiled powder lecithin

- Granular lecithin

Market, By Application

- Food & beverages

- Bakery products

- Confectionery & chocolate

- Infant formula & baby foods

- Dairy & dairy alternatives

- Others

- Animal feed

- Poultry feed applications

- Aquaculture feed applications

- Livestock feed applications

- Pharmaceuticals

- Solid & liquid dosage forms

- Transdermal delivery systems

- Others

- Cosmetics & personal care

- Skin care formulations

- Hair care products

- Industrial applications

- Plastics & coatings

- Lubricants & release agents

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What was the valuation of the U.S. lecithin sector?

The U.S. market was valued at USD 487 million in 2025, with an estimated growth to nearly USD 773 million by 2035.

What are the key trends driving the lecithin market?

Key trends include rising demand for plant-based and non-GMO lecithin, increased use in pharmaceuticals and nutraceuticals, growing preference for natural and organic ingredients, and advances in clean-label formulations.

What was the market share of soy lecithin in 2025?

Soy lecithin dominated the market with approximately 80% share in 2025, reflecting the scale of soybean processing and the recovery of phospholipid gums during oil refining.

Who are the key players in the lecithin industry?

Key players in the lecithin market include Archer Daniels Midland, Cargill, Bunge Limited, GIIAVA, Ruchi Soya, Wilmar International, Lipoid GmbH, American Lecithin Company, Thew Arnott, and Sternchemie.

What is the expected size of the lecithin industry in 2026?

The market size is projected to reach USD 2.3 billion in 2026.

What was the market size of the lecithin in 2025?

The market size was valued at USD 2.2 billion in 2025, with a CAGR of 4.7% projected from 2026 to 2035. The market growth is driven by increasing demand across food, nutraceuticals, pharmaceuticals, personal care, and industrial applications.

What is the projected value of the lecithin market by 2035?

The market is poised to reach USD 3.5 billion by 2035, fueled by advancements in clean-label requirements, delivery systems, and the shift toward higher-spec grades such as deoiled and modified lecithin.

Lecithin Market Scope

Related Reports