Home > Chemicals & Materials > Metalworking > Lead Market

Lead Market Analysis

- Report ID: GMI4339

- Published Date: Sep 2019

- Report Format: PDF

Lead Market Analysis

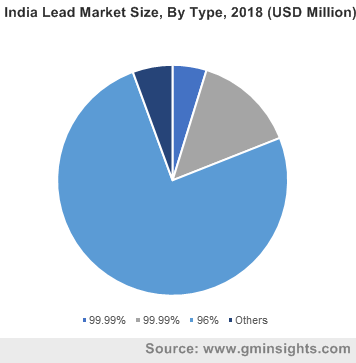

The 99.99% lead grade was valued over 7 billion in 2018. These are widely used across several industries including the manufacturing and construction for roofing & flashing, soundproofing, X ray protection and others. The pure lead ingots are produced from re-melted ingots, raw bullions and lead scraps by pyro metallurgical process. The grade of lead is commonly produced by primary lead companies that hold about 40% of the global lead production.

Ongoing government focus toward improving the respective lead refining capacity and abilities will boost the demand for 96% grade. The key impurities found mixed with the metal include arsenic, selenium, tellurium, bismuth, antimony, silver, copper, nickel, zinc, and tin. In addition, the industry has specified restrictions on elements generating gas from lead-acid batteries. The key difference between the primary and secondary lead is that the recyclers do not remove silver and bismuth impurities during secondary refining process. As over 60% of the world’s lead production come from secondary (recycling) refining resulting in its dominating share over high purity grades.

Ongoing expansion of building infrastructure backed by government investment along with rapid development of commercial facilities across emerging economies will foster the lead demand across construction activities. The metal is used in making thin lead sheets majorly used as a construction material across chemical and other related industries. Other widely used applications include shower pans, building construction for roofing & flashing, gamma-ray & X-ray protection, and soundproofing. In addition, rapidly expanding service sector along with introduction of new manufacturing base across developing nations will further complement the industry outlook.

Plumbing based lead applications exceeded 700 thousand tonnes in 2018. Excellent physical properties including high malleability, resistance to corrosion, and flexibility will instigate the product demand. In addition, stringent government norms pertaining to the replacement and minimizing the use of Pb in pipe manufacturing owing to its dispersion in portable water supplies may impede the business growth. For instance, the U.S. Environmental Protection Agency (EPA) introduced a treatment technique regulation revised in 2007, that directs water authorities to follow lead and copper mandates with respect to the replacement of lead service lines, and regular water sampling.

Extensive secondary lead production across the U.S. and Canada owing to a large number of scrapped batteries along with robust expansion of data centers will propel the growth across North America. For instance in 2018, the NADC reported for about six largest data center leases of the year were signed across North Virginia racking up the records in the industry. The automotive sector is a major consumer of these batteries and directly influences the market dynamics. However, moderate decline in automotive sales coupled with closure of several smelter units over the past decade may have restrained business growth.

The Asia Pacific lead market is anticipated to grow over 2% by 2025. Abundant lead reserves coupled with surging secondary production across the region are the prime factors stimulating the business growth. As per analysis, China is a major driving force across the industry holding over 50% of the global lead consumption, however, stringent smelting restrictions have resulted in a substantial decline in primary production. Furthermore, favorable outlook across India and Australia coupled with presence of leading players of passenger cars, coaches, two-wheelers, and SUVs will augment the lead-based storage industry outlook.