Summary

Table of Content

Lead Acid Battery Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Lead Acid Battery Market Size

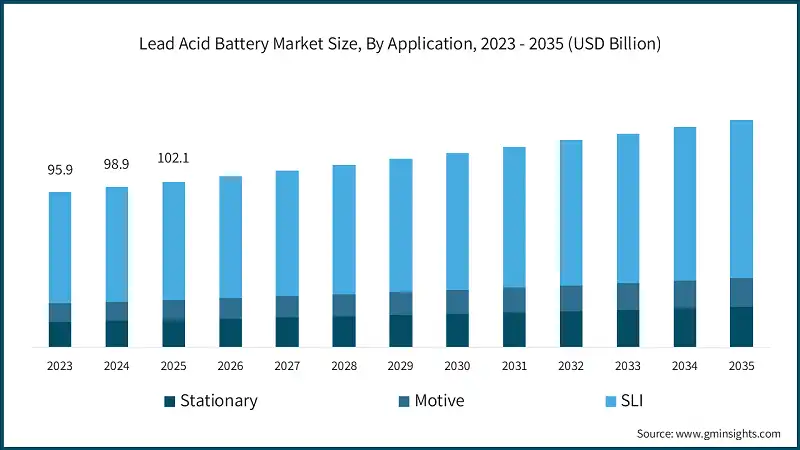

According to a recent study by Global Market Insights Inc., the lead acid battery market was estimated at USD 102.1 billion in 2025. The market is expected to grow from USD 105.5 billion in 2026 to USD 140.6 billion by 2035, at a CAGR of 3.2%.

To get key market trends

- Ongoing technological advancements in flooded batteries and absorbent glass mat batteries are improving their performance for auxiliary applications such as start-stop systems and other functional requirements, thereby strengthening the overall business outlook. Innovations in electrode design & materials, including calcium alloy grids and carbon additives, have enhanced conductivity, discharge capability and cycle life, accelerating the business potential.

- A lead-acid battery is a rechargeable energy storage system that uses sponge lead as the negative plate, sulfuric acid as the electrolyte and lead dioxide as the positive plate. It delivers and stores electricity through reversible chemical reactions, offering reliable and cost-effective power.

- For illustration, in 2024, the U.S. Department of Energy granted USD 150 million to Clarios and USD 198 million to EnerSys to modernize lead-recycling furnaces under a USD 3 billion battery materials initiative focused on enhancing grid stability and power system resilience. These upgraded facilities feature advanced emissions controls surpassing regulatory standards and higher lead recovery efficiency.

- The high recyclability and reusability of materials used in batteries coupled with their positive contribution to environmental sustainability, will support a favorable industry outlook. Rising automobile production and sales across major emerging economies will propel demand for these batteries.

- The lead acid battery market was valued at USD 88.9 billion in 2022 and grew at a CAGR of approximately 2% through 2025. These batteries are extensively used across automotive, industrial, and stationary energy storage applications. In automotive sectors, they support starting, lighting, and ignition systems.

- The industry remains a vital component of the energy storage landscape, supported by its reliability, recyclability, and cost-effectiveness. Despite growing competition from lithium-ion technologies, lead acid batteries continue to dominate applications requiring dependable power, high surge currents and proven performance.

- For instance, the European Union’s Battery Regulation sets minimum recycled content standards for lead batteries, requiring 85% recycled lead by August 2028, in line with European Commission sustainability directives. These regulations encourage ongoing investment in recycling infrastructure and promote long-term environmental sustainability and circular economy practices within the lead-acid battery industry.

- The rapid integration of these batteries with renewable energy systems for storing excess power during peak generation and supplying energy during low-production periods is creating a favorable business environment. Moreover, this combination significantly strengthens energy storage solutions in remote and off-grid areas due to its reliability, cost-effectiveness, and operational efficiency.

- In addition, their cost-effective stationary characteristics and reliable operation across extreme temperature conditions make them well-suited for telecommunications, backup power, and industrial applications, further driving industry growth. Rising investments in capital infrastructure for battery manufacturing are set to strengthen the product penetration.

Lead Acid Battery Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 102.1 Billion |

| Market Size in 2026 | USD 105.5 Billion |

| Forecast Period 2026-2035 CAGR | 3.2% |

| Market Size in 2035 | USD 140.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Robust expansion of data centers | Rapid growth of data centers globally increases demand for reliable backup power solutions, driving lead-acid battery adoption due to their cost-effectiveness and proven performance in energy storage. |

| Increasing demand for uninterrupted power supply | Rising need for continuous, reliable electricity in residential, commercial, and industrial sectors boosts lead-acid battery usage, ensuring stable power during outages and supporting critical infrastructure. |

| Burgeoning expansion in the automotive industry | Growing automotive production, especially in emerging markets, fuels demand lead-acid batteries for starting, lighting, and ignition systems, making them essential for conventional and hybrid vehicles. |

| Pitfalls & Challenges | Impact |

| Strict government regulations | Stringent environmental and safety regulations on battery manufacturing, disposal, and recycling limit lead-acid battery production and increase compliance costs, restraining the industry growth. |

| Opportunities: | Impact |

| Renewable energy integration | Lead-acid batteries can store solar and wind energy efficiently, supporting growing renewable installations and off-grid power solutions worldwide. |

| Emerging electric vehicle adoption | Rising EV and hybrid vehicle demand in developing markets creates opportunities for lead-acid batteries in auxiliary and starter applications. |

| Energy storage for telecom infrastructure | Expanding telecom networks require reliable backup power, boosting lead-acid battery deployment for uninterrupted operations in base stations and data centers. |

| Technological advancements in battery design | The advancements including increase efficiency, lifespan, and performance, opening new market segments across wide multitude of application areas. |

| Market Leaders (2025) | |

| Market Leaders |

10.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Country | U.S., China, Japan, India & Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Lead Acid Battery Market Trends

- The industry is witnessing rapid growth driven by the rising adoption of these solutions across applications such as telecommunications, UPS systems, and forklift trucks. Sustained economic expansion alongside accelerating urbanization has heightened the need for reliable power backup solutions, thereby strengthening lead acid battery market dynamics.

- Moreover, expanding telecommunications networks and the rapid growth of data centers have increased the demand for dependable backup power infrastructure. Within UPS applications, VRLA lead-acid batteries are widely used to ensure uninterrupted power supply during outages, with their high reliability, low maintenance requirements, and cost efficiency making them a preferred choice.

- Continuous advancements in smart battery technologies and their growing integration with IoT applications are expected to boost product demand. These smart batteries are equipped with monitoring and sensing capabilities that enable real-time tracking of key battery parameters, improving charge cycles, enhancing overall performance, and further strengthening lead acid battery market penetration.

- For citation, in April 2025, the American Clean Power Association (ACP) stated that the U.S. energy storage industry intends to invest nearly USD 100 billion in grid-scale battery deployment and domestic manufacturing capacity. This commitment spans multiple battery technologies, including lead-acid systems for grid support and backup power, highlighting sustained confidence in long-term energy storage market expansion.

- The affordability and reliability of these batteries in everyday operations are encouraging greater adoption by automakers, especially across developing regions. Additionally, the growing penetration of micro-hybrid and stop-start vehicles, which rely on these batteries for enhanced deep-cycle performance, is set to further foster the lead acid battery market landscape.

- The industry is set to witness steady growth, supported by automotive electrification trends, industrial backup needs, and infrastructure expansion. While lithium-ion batteries gain share in advanced applications, continuous innovations in lead acid technology will sustain its relevance in cost-sensitive and reliability-focused markets.

- Automotive demand continues to drive the market, particularly with the proliferation of start-stop systems in passenger and commercial vehicles. Enhanced flooded batteries and AGM batteries are increasingly adopted to meet higher cycling requirements, fuel efficiency standards, and emissions regulations across developed and emerging economies.

- For illustration, In February 2025, EnerSys unveiled new concepts and product updates related to its Synova Sync charger and NexSys BESS energy storage system. These announcements will be made at the ProMat and LogiMAT trade shows, underscoring the company’s emphasis on innovation in charging technologies and large-scale energy storage solutions.

Lead Acid Battery Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

- Based on application, the industry is segmented into stationary, motive and SLI. The SLI application market holds a share of about 65% in 2025 and is projected to grow at a growth rate of over 2.5% through 2035.

- The industry focuses on batteries used for starting, lighting, and ignition in internal combustion engine vehicles. Growth is driven by the expanding global vehicle fleet, frequent replacement demand, and cost efficiency. These batteries deliver high cranking power, robust reliability, and remain indispensable despite gradual electrification trends.

- For instance, in September 2024, VARTA Automotive, in collaboration with its parent company Clarios, will present an updated battery product portfolio at Automechanika 2024. The revised lineup is designed to streamline battery selection and better address evolving demand across emerging vehicle segments with changing performance requirements.

- The stationary lead acid battery market is set to exceed USD 22 billion by 2035. These systems serve backup and standby power needs across telecom, data centers, utilities, and industrial facilities. Demand is supported by grid reliability concerns and infrastructure expansion. These batteries are deployed for their proven performance, long service life, recyclability, and cost-effective deployment in critical power applications.

- The motive lead acid battery industry was valued at USD 12.3 billion in 2025. The market caters to electric-powered industrial vehicles such as forklifts, pallet trucks, and automated guided vehicles. Growth is driven by warehouse automation, logistics expansion, and manufacturing activities. These batteries are known for high load-bearing capacity, durability, ease of recycling, and cost-effective energy storage solutions.

Learn more about the key segments shaping this market

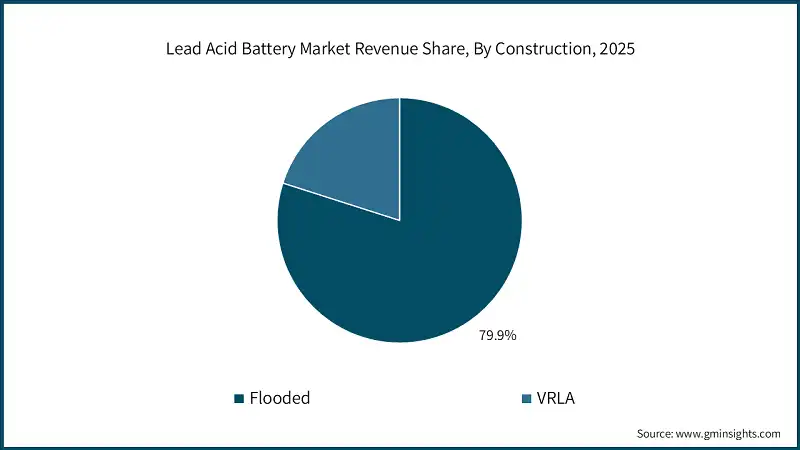

- Based on construction, the industry is divided into flooded and VRLA. The flooded lead acid battery market holds a share of 79.9% in 2025 and is set to reach over USD 105 billion by 2035.

- The industry includes conventional batteries widely used in automotive, industrial, and stationary applications. Demand is supported by low manufacturing costs, proven technology, and high reliability. Although maintenance is required, these batteries are more effective in cost-sensitive and high-capacity installations due to easy availability and strong recycling infrastructure.

- VRLA battery industry was estimated at USD 20.5 billion in 2025. The market comprises of sealed batteries, including AGM and gel types, offering maintenance-free operation. Widely used in telecom, UPS, renewable energy, and industrial sectors, VRLA batteries deliver reliable, long-lasting power, high safety, and consistent performance, making them a favored choice for critical and confined-space applications.

- For instance, large-scale data centers increasingly rely on AGM-based VRLA batteries for backup power, benefiting from their sealed construction, minimal maintenance needs, and enhanced safety in confined indoor spaces. This practical application underscores the broad adoption of VRLA batteries in critical infrastructure, where reliable, maintenance-free, and safe energy storage solutions are essential for uninterrupted operations.

- Based on sales channel, the industry is bifurcated into OEM and aftermarket. The OEM industry will witness a CAGR of 3.5% from 2026 to 2035. The demand is driven by vehicle production, machinery deployment, and infrastructure projects. OEM batteries ensure high quality, compatibility, and warranty-backed performance, reinforcing brand reliability and supporting long-term relationships between manufacturers and end-users worldwide.

- For illustration, global automotive manufacturers such as Toyota Motor Corporation and Volkswagen Group source OEM lead-acid batteries directly from approved battery suppliers for factory-fitted vehicles. These OEM-supplied batteries meet precise performance specifications, carry warranty assurance, and strengthen long-term supplier partnerships, validating OEM demand driven by vehicle production, equipment manufacturing, and large-scale infrastructure development.

- The aftermarket lead acid battery market caters to replacement and upgrade demands in automotive, industrial, and stationary applications. Driven by aging fleets, frequent battery wear, and cost-conscious consumers, these batteries offer reliable performance, easy availability, and compatibility with existing systems, making them a crucial segment alongside OEM-supplied units.

Looking for region specific data?

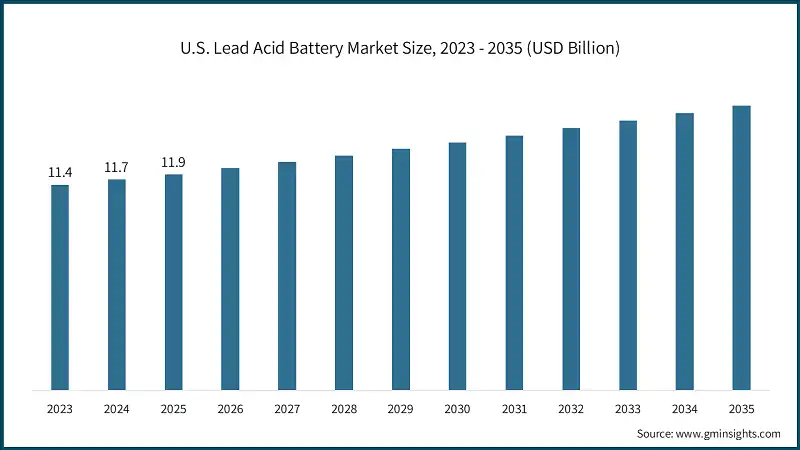

- The U.S. dominated the lead acid battery market in North America with around 85% share in 2025 and generated USD 11.9 billion in revenue. Strong replacement demand, infrastructure growth, and backup power requirements support market stability. Technological advancements in AGM and enhanced flooded batteries improve performance and reliability, while established recycling networks and cost-effectiveness maintain these systems as a preferred energy solution.

- The North America lead acid battery market is projected to hit USD 15 billion by 2035. The industry is driven by automotive demand, industrial applications, and stationary energy storage needs. The growth is supported by fleet replacement cycles, telecom expansion, and reliable backup power requirements. Advancements in AGM and enhanced flooded batteries along with robust recycling infrastructure, sustain market adoption and long-term stability.

- For instance, the U.S. Environmental Protection Agency (EPA) revised the National Emission Standards for Hazardous Air Pollutants (NESHAP) and New Source Performance Standards (NSPS) for lead-acid battery manufacturing facilities. These updated rules impose stricter limits on lead emissions from grid casting, paste mixing, and lead reclamation operations.

- The Europe lead acid battery market was evaluated at USD 16.3 billion in 2025. The industry is shaped by automotive, industrial, and stationary energy storage applications. Rising demand for maintenance-free AGM and gel batteries, coupled with stringent environmental regulations and strong recycling infrastructure, supports sustainable growth. These batteries are opted for their reliability, cost-effectiveness, and proven performance across critical sectors.

- The Asia Pacific lead acid battery industry is set to grow at a rate of over 3% by 2035. The industry will gain an appreciable momentum on account of rapid industrialization and expanding telecom infrastructure. High demand for SLI, motive, and stationary batteries supports lead acid battery market growth.

- For illustration, in March 2025, the Indian Battery Manufacturers Association (IBMA) highlighted the need to strengthen battery technology. The focus is on improving energy density, durability, and faster charging capabilities, particularly to meet growing performance requirements in two-wheeler and three-wheeler vehicle segments.

- The Middle East & Africa market is driven by growing industrialization, infrastructure development and energy backup requirements. These systems are chosen for their cost-effectiveness, durability, and recyclability, while expanding construction and energy projects continue to fuel the business growth.

- For instance, national telecom operators across Saudi Arabia and South Africa widely deploy batteries for telecom tower backup applications. These systems help maintain uninterrupted network operations in regions affected by grid instability, demonstrating a strong preference for energy storage solutions that are cost-effective, durable, highly reliable, and supported by well-established recycling infrastructure.

- The Latin America lead acid battery market is propelled by automotive replacement demand, industrial growth, and expanding energy infrastructure. SLI, motive, and stationary batteries dominate applications due to their reliability, low cost, and recyclability. Increasing investments in telecom, utilities, and transportation sectors further support steady industry landscape.

Lead Acid Battery Market Share

- The top 5 players in lead acid battery industry are Exide Industries, C&D Technologies, EnerSys, Clarios and GS Yuasa International contribute around 35% of the market share in 2025.

- The industry is mature, highly competitive, and characterized by steady demand across various applications. It is price-sensitive, driven by replacement cycles, infrastructure development, and reliability requirements. While facing competition from alternative technologies, its established supply chains, recyclability, and cost-effectiveness sustain long-term stability.

- Exide Industries is one of the prominent players in the battery market, offering a wide range of automotive, industrial, and stationary batteries. Known for innovation, durability, and reliability, the company serves both OEM and aftermarket segments. Its extensive distribution network and strong brand presence make it a market leader in India and abroad.

- C&D Technologies operates in the battery market, offering a range of industrial and reserve power solutions. The company manufactures VRLA, flooded, and specialty batteries for telecom, UPS, and renewable energy applications. Its products emphasize reliability, long service life, and consistent performance, supporting critical power needs across various sectors.

- EnerSys is a global manufacturer in the market, offering a wide range of industrial and reserve power batteries. Its products, including VRLA and flooded types, serve telecom, UPS, and renewable energy sectors. The company focuses on delivering durable, reliable, and high-performance energy solutions for critical applications.

- Clarios provides batteries for automotive, commercial, and energy storage applications. The company focuses on innovative, high-performance solutions, including advanced SLI and VRLA batteries. Its products prioritize reliability, longevity, and environmental sustainability, supporting critical power and mobility requirements worldwide.

- GS Yuasa International is a Japan-based battery manufacturer with a strong presence in the market. The company produces automotive, industrial, and stationary batteries, focusing on high reliability, efficiency, and long operational life. It serves applications such as vehicles, backup power systems, and industrial energy storage.

Lead Acid Battery Market Companies

Major players operating in the lead acid battery industry are:

- Amara Raja Energy & Mobility

- Banner

- Camel Group

- C&D Technologies

- Chaowei Power Holdings

- Clarios

- Crown Equipment Corporation

- CSB Battery

- Concorde Battery Corporation

- East Penn Manufacturing Company

- EnerSys

- EnergoAlliance

- Exide Industries

- First Battery

- Focus Technology

- GS Yuasa International

- HOPPECKE Battery

- Leoch International Technology

- MUTLU

- Narada

- Power-Sonic

- The Furukawa Battery

- Yokohama Batteries

- Zibo Torch Energy

- EnerSys, a U.S. based company, reported fiscal 2025 sales of USD 3.6 billion, largely fueled by its reserve and motive power divisions. Dominated by thin-plate pure lead AGM and flooded lead-acid batteries, these segments accounted for over 80% of revenue. Strong telecom UPS growth and increased electric forklift adoption sustained lead-acid demand despite weaker specialty battery volumes.

- GS Yuasa International reported FY 2025 revenue of USD 3.7 billion, supported by replacement battery pricing and a steady UPS unit backlog. The Automotive Battery and Industrial Battery & Power Supply segments, largely dependent on enhanced flooded and VRLA lead-acid batteries, contributed around 88% of total sales, highlighting the continued significance of lead-acid technology despite expanding lithium initiatives.

- In 2025, India-based Exide Industries achieved revenue of USD 1.8 billion, driven almost entirely by automotive, industrial, and inverter lead-acid battery sales from its eight domestic factories. While OEM demand eased, strong performance in inverter-UPS and two-wheeler replacement segments pushed lead-acid batteries to contribute more than 90% of the company’s total turnover.

Lead Acid Battery Industry News

- In August 2025, Clarios acquired the lead-acid battery recycling facilities of Ecobat located in Germany and Austria, including sites in Freiberg, Braubach, and Arnoldstein. This transaction represents a major consolidation move within Europe’s lead-acid battery recycling landscape, strengthening regional recycling capacity, supply chain integration, and circular economy initiatives.

- In May 2025, GS Yuasa International renewed the ECO.R Revolution series of high-performance automotive batteries. The updated series achieves improved balance between long service life, strong starting power, and enhanced thrust for vehicles equipped with Idling Stop Systems. The company consolidated the ECO.R REVOLUTION branding under the flagship ECO.R series to strengthen product identity and market positioning in the automotive battery division as per company announcement.

- In April 2025, EnerSys announced a strategic realignment that includes closing its flooded lead-acid battery manufacturing facility in Monterrey, Mexico, and transferring production to its Richmond, Kentucky plant. Concurrently, the company committed USD 4.5 million to expand flooded battery production capacity at its Bielsko-Bia?a facility in Poland, enhancing operational efficiency and regional supply capabilities.

- In March 2025, East Penn Manufacturing announced it will showcase its new Deka Ready Power product line at ProMat 2025 in Illinois. The lineup features both lithium and gel battery technologies, delivering high performance, long-term value, and low total cost of ownership, specifically designed to meet rising demand for maintenance-free motive energy solutions.

The lead acid battery market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Million Units) from 2022 to 2035, for the following segments:

Market, By Application

- Stationary

- Telecommunications

- UPS

- Control & switchgear

- Others

- Motive

- SLI

- Automobiles

- Motorcycles

Market, By Construction

- Flooded

- VRLA

- AGM

- GEL

Market, By Sales Channel

- OEM

- Aftermarket

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Austria

- Netherlands

- Sweden

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Thailand

- Philippines

- Vietnam

- Singapore

- Middle East & Africa

- Saudi Arabia

- UAE

- Iran

- Egypt

- Turkey

- Morocco

- South Africa

- Nigeria

- Algeria

- Latin America

- Brazil

- Argentina

- Mexico

- Chile

Frequently Asked Question(FAQ) :

What are the upcoming trends in the lead acid battery market?

What are the upcoming trends in the lead acid battery market?

Who are the key players in the lead acid battery market?

Key players include EnerSys, Exide Industries, C&D Technologies, Clarios, GS Yuasa International, Amara Raja Energy & Mobility, Banner, Camel Group, Chaowei Power Holdings, Crown Equipment Corporation, CSB Battery, Concorde Battery Corporation, East Penn Manufacturing Company, First Battery, HOPPECKE Battery, Leoch International Technology, MUTLU, Narada, Power-Sonic, The Furukawa Battery, Yokohama Batteries, and Zibo Torch Energy.

Which region leads the lead acid battery market?

U.S. held 85% share with USD 11.9 billion in 2024, supported by strong replacement demand, infrastructure expansion, and growing backup power requirements.

What is the growth outlook for the OEM sales channel from 2026 to 2035?

OEM sales channel is projected to grow at a 3.5% CAGR till 2035, driven by vehicle production, machinery deployment, and infrastructure projects ensuring quality and warranty-backed performance.

What was the valuation of the flooded lead acid battery segment in 2025?

Flooded lead acid batteries held 79.9% market share in 2025 and are set to reach over USD 105 billion by 2035, driven by low manufacturing costs and proven technology.

How much revenue did the SLI application segment generate in 2025?

SLI applications held approximately 65% market share in 2025, leading the market due to expanding global vehicle fleet and high cranking power requirements for starting, lighting, and ignition systems.

What is the current lead acid battery market size in 2026?

The market size is projected to reach USD 105.5 billion in 2026.

What is the market size of the lead acid battery in 2025?

The market size was USD 102.1 billion in 2025, with a CAGR of 3.2% expected through 2035 driven by global data center expansion, automotive demand, and cost-effective backup power solutions.

What is the projected value of the lead acid battery market by 2035?

The lead acid battery market is expected to reach USD 140.6 billion by 2035, propelled by renewable energy integration, telecom infrastructure expansion, and technological advancements in battery design.

Lead Acid Battery Market Scope

Related Reports