Summary

Table of Content

Laser Processing Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Laser Processing Equipment Market Size

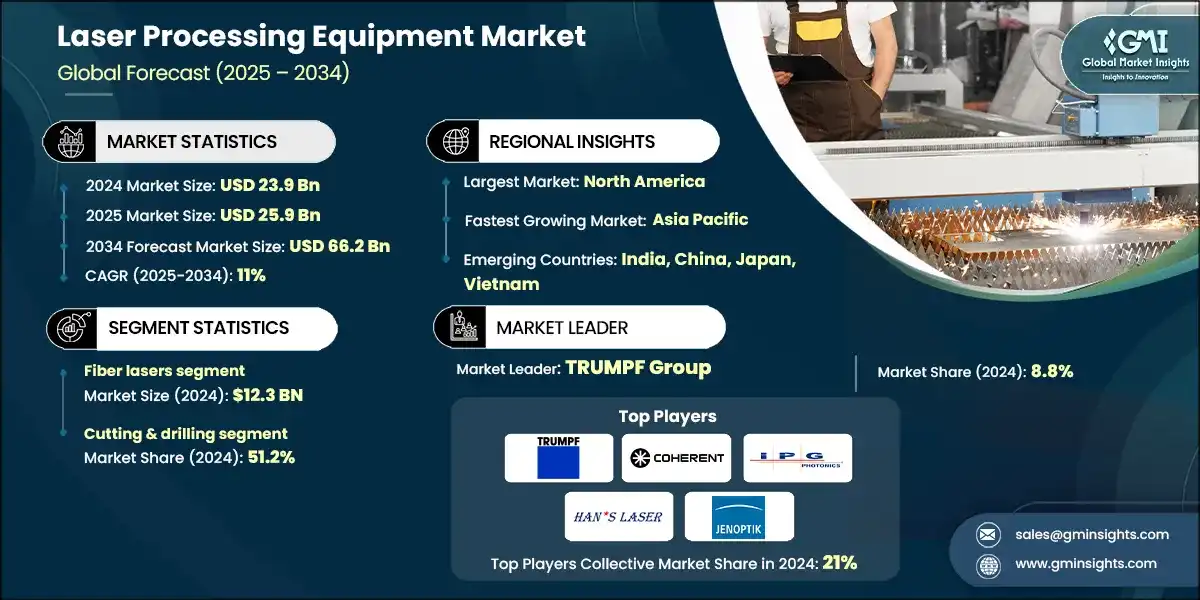

According to a recent study by Global Market Insights Inc., the global laser processing equipment market was estimated at USD 23.9 billion in 2024. The market is expected to grow from USD 25.9 billion in 2025 to USD 66.2 billion in 2034, at a CAGR of 11%.

To get key market trends

The increasing adoption of Industry 4.0 technologies, such as IoT, AI, and automation, is driving the use of advanced laser processing equipment. According to the International Federation of Robotics (IFR), automation in manufacturing has increased by 14% annually, with advancing laser systems offering real-time monitoring, predictive maintenance, and improved productivity. Fiber lasers are required for cutting, welding, marking, and engraving applications due to their efficiency and reliability making them important in, replacing traditional laser technologies.

As electronics and medical devices get smaller every passing year the requirement for laser systems and equipment capable of micro-processing and precision machining is on the rise. As per SEMI (Semiconductor Equipment and Materials International), the global electronics manufacturing sector is projected to grow by 6% in 2024, further requiring the need for high-precision laser systems. These systems are critical for producing components with intricate designs and tight tolerances.

In the medical sector, laser processing equipment is hugely used for their precision and ability to work with a variety of materials such as metals, plastics, and ceramics. The World Health Organization (WHO) reports that the aging population is expected to double by 2050, increasing the demand for medical devices. Further driving its expansion in healthcare applications.

Fiber laser technology is also gaining traction in industrial manufacturing, supported by its energy efficiency and low maintenance costs. According to the Laser Institute of America (LIA), fiber lasers account for over 50% of the global laser market, with their adoption expected to grow further during the forecast period. This growth highlights the increasing reliance on advanced laser systems for precision-driven industrial processes.

Laser Processing Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 23.9 Billion |

| Market Size in 2025 | USD 25.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 11% |

| Market Size in 2034 | USD 66.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Advancements in laser technology | Advancements in laser technology are enabling the development of more efficient and precise laser processing equipment, driving market growth. |

| Growing demand for high-quality and precision manufacturing | The demand for high-quality and precision manufacturing is increasing the deployment of laser processing equipment in industries like automotive and electronics. |

| Rising adoption of additive manufacturing (3D printing) | The adoption of additive manufacturing (3D printing) is boosting the use of laser processing equipment for applications such as prototyping and complex part production. |

| Pitfalls & Challenges | Impact |

| High initial investments | The high initial investment required for advanced laboratory equipment creates entry barriers for small and medium-sized facilities, restricting their market participation and slowing their modernization efforts |

| Increased operating costs | Global regulatory standards are becoming more stringent and frequently changing, which necessitates ongoing product validation and documentation. This increases operational complexity and extends the time required to introduce recent technologies to the market. |

| Opportunities: | Impact |

| (EVs) and Battery Manufacturing | The growing adoption of EVs and advancements in battery manufacturing are driving demand for laser processing equipment, particularly for precision welding and cutting applications in battery assembly. |

| Semiconductor and Microelectronics Fabrication | The increasing complexity of semiconductor and microelectronics fabrication processes is boosting the need for laser processing equipment, enabling high-precision material processing and enhanced production efficiency. |

| Market Leaders (2024) | |

| Market Leaders |

8.8% market share |

| Top Players |

The collective market share in 2024 is 21% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Japan, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Laser Processing Equipment Market Trends

Technological advancements are driving the market towards efficiency and precision.

- Laser-based additive manufacturing technologies, such as Selective Laser Melting (SLM) and Stereolithography (SLA) are driven by their ability to enable rapid prototyping and produce intricate components. According to the Additive Manufacturing Association, the adoption of laser-based additive manufacturing has grown steadily, with a compound annual growth rate (CAGR) of over 20% in the last decade. Companies like TRUMPF and IPG Photonics Corporation have been leveraging these technologies to enhance manufacturing precision and efficiency.

- Technological advancements and industry-specific requirements such as ultrafast lasers for medical micro-surgeries, high-power fiber lasers for aerospace propulsion and custom manufacturing are driving the innovation in laser processing equipment. According to the Laser Institute of America, the global laser processing equipment market is projected to grow at a CAGR of 8.5% during the forecast period of 2024-2029, driven by the increasing adoption of Industry 4.0 practices. Companies like Epilog Laser, Newport Corporation, and Eurolaser, are actively collaborating with manufacturers to develop customized solutions that address evolving industry needs.

Laser Processing Equipment Market Analysis

Learn more about the key segments shaping this market

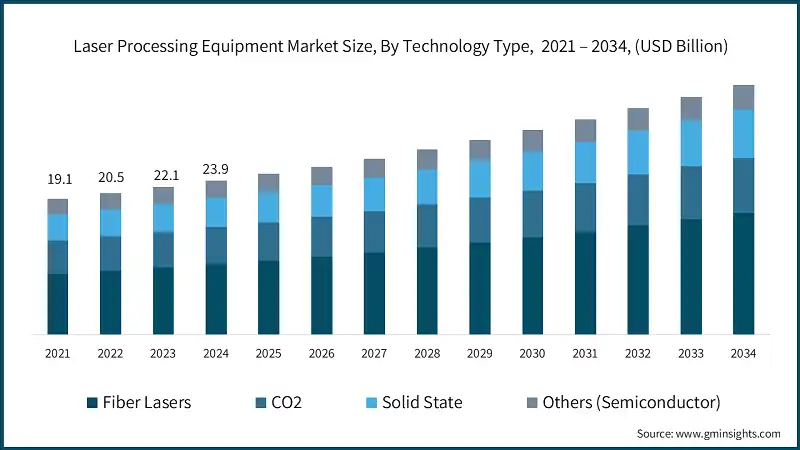

Based on technology type, the laser processing equipment is segmented into fiber lasers, CO2, solid state, and others. The fiber lasers segment generating a revenue of USD 12.3 billion in 2024

Fiber lasers are highly efficient, converting a substantial portion of input energy into usable laser energy. This efficiency significantly reduces power consumption and operating costs, offering businesses a cost-effective solution for various applications.

- According to the U.S. Department of Energy, energy-efficient technologies like fiber lasers can lower operational expenses by up to 30%, enabling companies to allocate resources more effectively. This economic advantage has driven their adoption across industries, particularly in manufacturing and precision engineering.

- The exceptional beam quality and stability of fiber lasers allow for precise and accurate results, making them indispensable for applications requiring intricate details or tight tolerances. For instance, in micro-machining and electronics manufacturing, where precision is critical, fiber lasers ensure consistent performance.

- The Laser Institute of America highlights that advancements in laser technology have enhanced production capabilities, enabling manufacturers to meet stringent quality standards while minimizing material waste. This reliability has positioned fiber lasers as a preferred choice in high-precision industries.

- Moreover, the versatility of fiber lasers extends their utility across a wide range of sectors, including automotive, aerospace, and healthcare. Their ability to handle diverse materials, such as metals, plastics, and composites, makes them suitable for cutting, welding, and marking applications.

Learn more about the key segments shaping this market

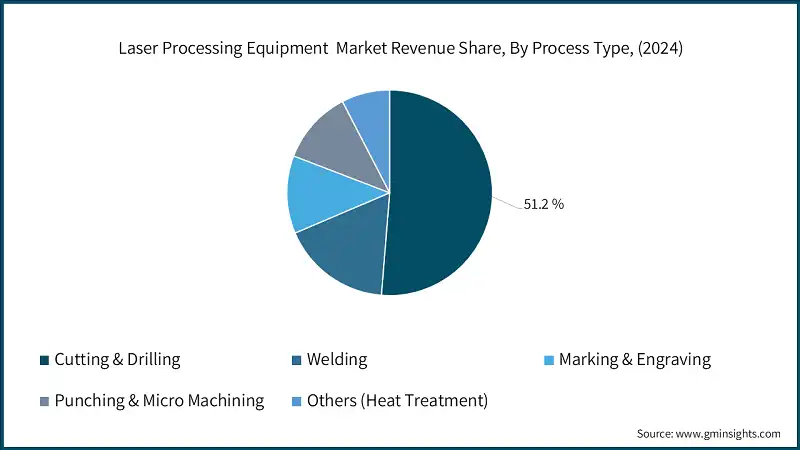

Based on process type, the market is categorized into cutting & drilling, welding, marking & engraving, punching & micromachining, and others. The cutting & drilling segment accounted for about 51.2% of the laser processing equipment market share in 2024.

- Laser cutting and drilling are highly valued for their precision, enabling manufacturers to create intricate designs and achieve fine details with exceptional accuracy. This precision reduces material wastage, lowering production costs and supporting sustainability goals.

- According to the Association for Manufacturing Technology (AMT), precision technologies like laser processing can improve manufacturing efficiency by up to 30%. Companies such as TRUMPF and Coherent are leveraging these technologies to enhance their production capabilities.

- The versatility of laser processing equipment allows it to handle materials such as metals, plastics, ceramics, and composites, making it indispensable across industries like automotive, aerospace, electronics, and medical devices.

- For example, in the automotive sector, laser processing is used to produce lightweight components that align with global trends toward fuel efficiency and reduced emissions. Tesla and General Motors are among the companies utilizing laser technologies to innovate and optimize their manufacturing processes.

Looking for region specific data?

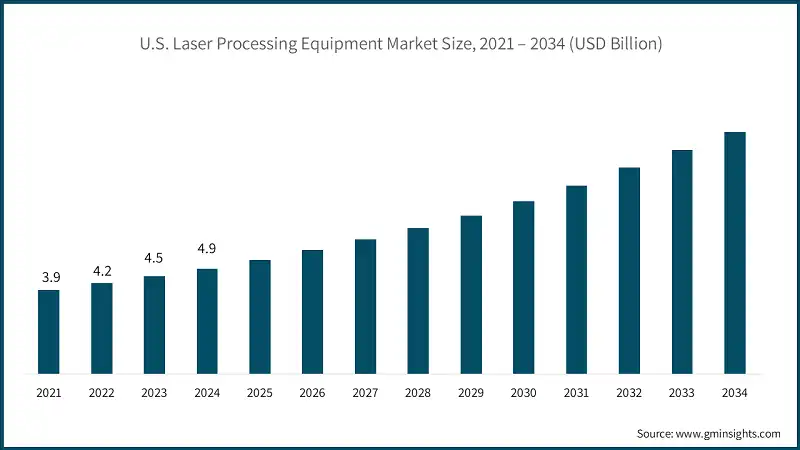

North America Laser Processing Equipment Market Asia Pacific market for laser processing equipment is expected to grow at 11.5% CAGR during 2025 to 2034. Major players operating in the laser processing equipment industry include: Han’s Laser in the laser processing equipment market, offers an extensive portfolio of over 200 models, including laser marking, cutting, welding, and cleaning systems. Serving a wide range of industries, Han’s Laser is recognized for its high-speed, precision laser solutions that are both cost-efficient and scalable for mass production. By incorporating automation and intelligent control systems, the company has established itself as a reliable partner for high-throughput industrial applications, particularly in the evolving field of smart manufacturing. Jenoptik applies its extensive knowledge in photonics and optical technologies to design high-precision laser processing systems tailored for the automotive, semiconductor, and medical technology industries. Its offerings include laser material processing systems, optical metrology solutions, and automation platforms, all designed to ensure reliability and seamless integration. Jenoptik stands out by combining laser precision with real-time quality monitoring and modular system designsAsia Pacific Laser Processing Equipment Market

Europe Laser Processing Equipment Market

Laser Processing Equipment Market Share

Laser Processing Equipment Market Companies

Laser Processing Equipment Industry News

The laser processing equipment market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Technology Type

- Fiber lasers

- CO2

- Solid State

- Others (Semiconductor, etc.)

Market, By Process Type

- Cutting & drilling

- Welding

- Marking & engraving

- Punching & micromachining

- Others (heat treatment., etc.)

Market, By Metal Type

- Steel

- Aluminium

- Copper

- Plastics and polymers

- Ceramics

- Others (Glass, composites, semiconductors etc.)

Market, By Function Type

- Semi-automatic

- Automatic

Market, By Integration Level

- Standalone systems

- Integrated production lines

- Modular systems

- Portable/desktop units

Market, By Laser Source Type

- Diode lasers

- Disk lasers

- Excimer lasers

- Others (Ultrafast lasers, thulium, etc.)

Market, By Cooling Mechanism

- Air-cooled

- Water-cooled

- Hybrid cooling

Market, By End Use

- Automotive

- Metal & fabrication

- Electronics

- Energy & power

- Others (medical, & life sciences, aerospace & defense, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for Asia Pacific region from 2025 to 2034?

Asia Pacific is projected to grow at 11.5% CAGR through 2034, supported by increasing industrial applications, manufacturing technology advancements, and rising demand for precision engineering.

Which region leads the laser processing equipment market?

U.S. held a 65% share of North America’s laser processing equipment market in 2024, fueled by robust R&D ecosystem and diverse industrial base including automotive, aerospace, and electronics.

What are the upcoming trends in the laser processing equipment market?

Key trends include adoption of laser-based additive manufacturing (SLM and SLA), ultrafast lasers for medical applications, high-power fiber lasers for aerospace, and Industry 4.0 integration with IoT and AI technologies.

Who are the key players in the laser processing equipment market?

Key players include TRUMPF Group, Coherent, IPG Photonics, Hans's Laser Technology, Jenoptik AG, Concept Laser, Control Micro Systems, Eurolaser, Hans Group, Hgtech, Laser Systems, Lumibird, Newport, Rofin-Sinar Technologies, Universal Laser Systems, and Vermont.

What was the market share of the cutting & drilling segment in 2024?

Cutting & drilling segment held 51.2% market share in 2024, dominating the process type category due to precision requirements and material waste reduction benefits.

How much revenue did the fiber lasers segment generate in 2024?

Fiber lasers generated USD 12.3 billion in 2024, leading the technology segment due to their high efficiency, exceptional beam quality, and versatility across multiple applications.

What is the market size of the laser processing equipment in 2024?

The market size was USD 23.9 billion in 2024, with a CAGR of 11% expected through 2034 driven by Industry 4.0 adoption, automation advancements, and growing demand for precision manufacturing.

What is the current laser processing equipment market size in 2025?

The market size is projected to reach USD 25.9 billion in 2025.

What is the projected value of the laser processing equipment market by 2034?

The laser processing equipment market is expected to reach USD 66.2 billion by 2034, propelled by fiber laser technology adoption, additive manufacturing growth, and increasing micro-processing requirements.

Laser Processing Equipment Market Scope

Related Reports