Summary

Table of Content

Laboratory Developed Tests Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Laboratory Developed Tests Market Size

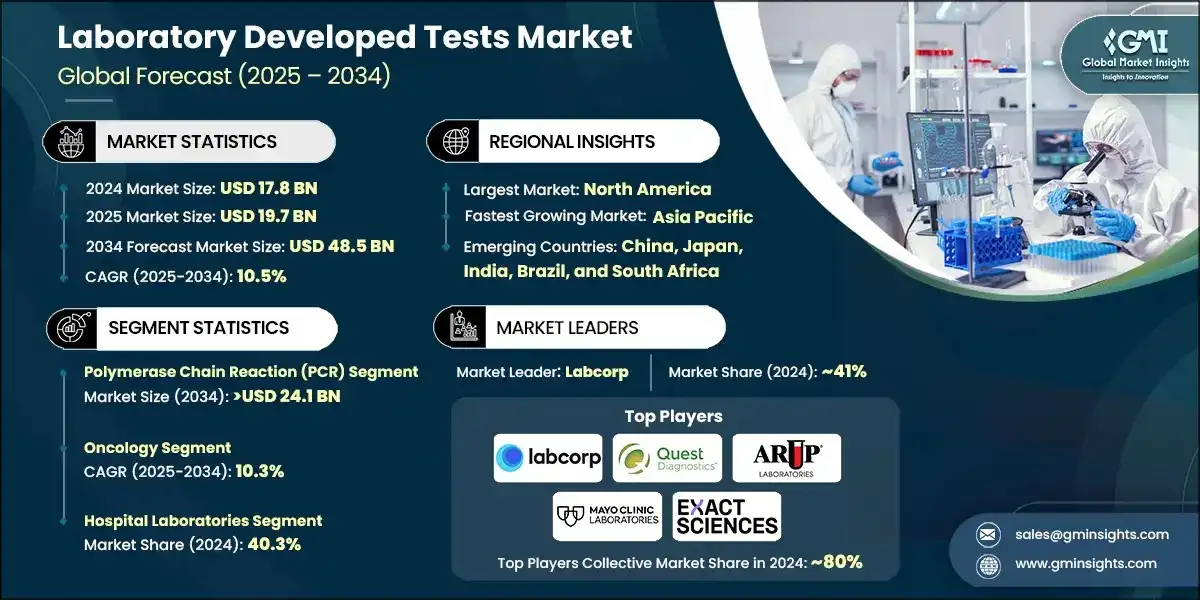

The global laboratory developed tests market was valued at USD 17.8 billion in 2024. The market is expected to grow from USD 19.7 billion in 2025 to USD 48.5 billion in 2034, at a CAGR of 10.5% during the forecast period, according to the latest report published by Global Market Insights Inc. The high market growth is attributed to the increasing awareness and attention towards disease detection early, the emergence of infectious and chronic diseases, and a growing incidence of cancer and genetic disorders, among others.

To get key market trends

Laboratory-developed tests (LDTs) are diagnostic tests that are reshaping personalized medicine, disease management, and clinical decision-making. LDTs are developed, produced, and utilized in a single laboratory, enabling accelerated innovation and customization to address particular patient requirements.

The most prominent developers of LDTs, like Labcorp, Quest Diagnostics, MAYO CLINIC LABORATORIES, and ARUP Laboratories, provide a comprehensive range of LDT from next-generation sequencing (NGS) panels to intricate molecular diagnostics and biomarker-based assays. These tests leverage cutting-edge technologies, including high-throughput genomics, machine learning algorithms, bioinformatics platforms, and cloud-based data integration.

The market has increased from USD 13.2 billion in 2021 and reached USD 16 billion in 2023, with a historic growth rate of 10.3%. This expansion has been driven by the rising prevalence of cancer, genetic, and infectious diseases, growing demand for personalized medicine, and the increasing need for rapid, accurate, and customizable diagnostic solutions. The integration of advanced technologies such as next-generation sequencing (NGS), AI-powered analytics, and cloud-based data platforms has further accelerated innovation and adoption across clinical laboratories worldwide.

The global rise in cancer prevalence is a significant public health concern, influencing the demand for advanced diagnostic solutions. For instance, according to an article published by the Renal and Urology News in 2023, there were approximately 18.5 million new cancer cases worldwide, contributing to over 10.4 million deaths and 271 million disability-adjusted life years globally. This surge is driven by aging populations, lifestyle changes, environmental exposures, and improved detection methods.

As cancer becomes increasingly prevalent, the need for early, accurate, and personalized diagnostics has never been more critical. LDTs play a pivotal role in this landscape, enabling rapid identification of genetic mutations, biomarkers, and disease subtypes, which are essential for tailoring targeted therapies and improving patient outcomes.

Laboratory developed tests (LDTs) are diagnostic tests that are designed, manufactured, and used within a single clinical laboratory. They are used to detect or monitor diseases and are not distributed commercially.

Laboratory Developed Tests Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 17.8 Billion |

| Market Size in 2025 | USD 19.7 Billion |

| Forecast Period 2025 – 2034 CAGR | 10.5% |

| Market Size in 2034 | USD 48.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing incidence of cancer and genetic disorders | Drives the demand for advanced diagnostic tests. |

| Rising prevalence of infectious and chronic diseases | Boosts the need for rapid, reliable, and scalable testing solutions |

| Growing awareness and focus on early disease detection | Encourages adoption of preventive diagnostics and screening programs. |

| Technological advancements | Enable more accurate, automated, and high-throughput testing capabilities. |

| Pitfalls & Challenges | Impact |

| Availability of alternative testing methods | May limit adoption of newer tests due to competition or cost-effectiveness. |

| Opportunities: | Impact |

| Integration of automation & digital pathology | Enhances efficiency, accuracy, and scalability of diagnostic workflows. |

| Market Leaders (2024) | |

| Market Leaders |

41% |

| Top Players |

Collective market share in 2024 is 80% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, India, Brazil, and South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Laboratory Developed Tests Market Trends

The field of laboratory developed testing is experiencing significant growth, driven by a series of technological advancements.

- Innovations in next generation sequencing (NGS), mass spectrometry, and microfluidics have enabled laboratories to develop highly sensitive and specific tests tailored to complex conditions like cancer, rare genetic disorders, and infectious diseases. These technologies allow for deeper molecular insights, faster turnaround times, and the ability to detect multiple biomarkers simultaneously, enhancing clinical decision-making.

- Moreover, the integration of artificial intelligence (AI) and machine learning into diagnostic workflows is transforming LDTs into intelligent systems capable of predictive analytics and personalized risk assessment. AI-powered algorithms can analyze vast datasets from genomic, proteomic, and metabolomic sources, helping labs refine test accuracy and uncover novel diagnostic patterns. This is especially impactful in areas like oncology and neurology, where early detection and precision are critical.

- Additionally, automation and robotics are streamlining laboratory workflows, reducing human error, and increasing throughput for high-demand tests. Advanced liquid handling systems, robotic sample processors, and automated data interpretation tools are enabling labs to handle complex assays with greater efficiency and consistency. These improvements not only enhance operational scalability but also support the rapid development and deployment of new LDTs in response to emerging health threats and evolving clinical needs.

Laboratory Developed Tests Market Analysis

Learn more about the key segments shaping this market

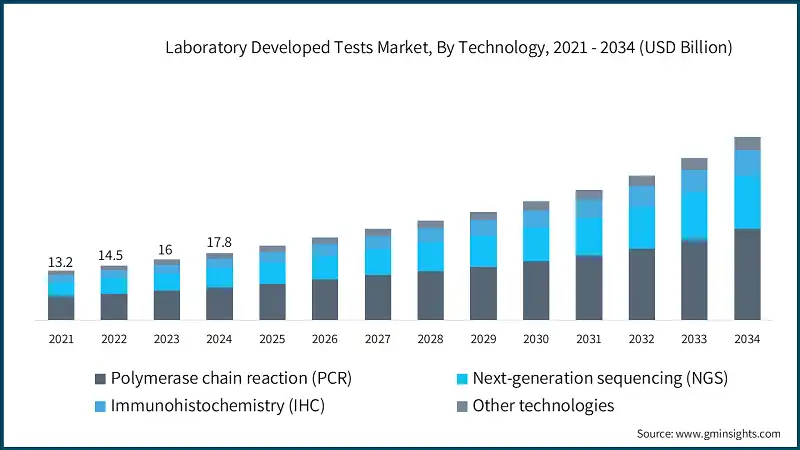

Based on technology, the laboratory developed tests market is segmented into polymerase chain reaction (PCR), next-generation sequencing (NGS), immunohistochemistry (IHC), and other technologies. The polymerase chain reaction (PCR) segment accounted for 49% of the market in 2024 due to its unmatched sensitivity, rapid turnaround time, and versatility in detecting infectious agents, genetic mutations, and cancer biomarkers, making it a cornerstone technology in molecular diagnostics. The segment is expected to exceed USD 24.1 billion by 2034, growing at a CAGR of 10.7% during the forecast period.

On the other hand, the next-generation sequencing (NGS) segment held a significant market share of 28.1% in 2024, and its growth can be attributed to its unparalleled ability to deliver high-throughput, precise, and cost-effective genomic insights, which are essential for personalized medicine, rare disease diagnostics, and oncology applications.

- In addition to its diagnostic versatility, PCR technology continues to evolve with innovations such as digital PCR and multiplex assays, which allow for even greater precision and the simultaneous detection of multiple targets in a single test. These advancements have expanded PCR’s utility beyond infectious disease testing into areas like liquid biopsy, pharmacogenomics, and environmental monitoring, reinforcing its dominance in the LDTs landscape and ensuring its relevance in both routine and specialized clinical applications.

- The immunohistochemistry (IHC) segment is expected to grow with a 9.9% CAGR during the analysis period. This growth is primarily driven by the rising global incidence of cancer, which has increased the demand for precise and tissue-specific diagnostic tools. IHC plays a critical role in identifying tumor markers, guiding treatment decisions, and enabling personalized medicine approaches, making it indispensable in oncology diagnostics.

Based on application, the laboratory developed tests market is segmented into oncology, infectious diseases, genetic & rare disorders, cardiology, autoimmune & inflammatory conditions, and other applications. The oncology segment dominated the market in 2024 and is growing with a CAGR of 10.3% during the forecast period.

- The growth of this segment is driven by the rising global burden of cancer and the increasing demand for precision diagnostics and personalized treatment strategies. laboratory developed tests (LDTs) play a crucial role in identifying genetic mutations, tumor markers, and therapy response indicators, making them indispensable in modern oncology workflows.

- The infectious diseases segment is expected to grow with a CAGR of 11% during the analysis period. This growth is primarily driven by the rising global prevalence of viral and bacterial infections, which has intensified the need for rapid, accurate, and scalable diagnostic solutions. Laboratory developed tests (LDTs) offer flexibility and speed in responding to emerging pathogens, making them essential tools for outbreak control and routine infectious disease management.

- The market for the genetic & rare disorders segment is expected to expand rapidly, driven primarily by the increasing prevalence of inherited conditions, advancements in next-generation sequencing (NGS), and the growing demand for precision medicine. As over 80% of rare diseases have a genetic origin, LDTs play a vital role in enabling early and accurate diagnosis, which is critical for timely intervention and treatment planning.

- The cardiology segment is expected to grow with a 10.1% CAGR during the analysis period. This growth is driven by the rising global prevalence of cardiovascular diseases, an aging population, and the increasing demand for early and precise diagnostics. LDTs are playing a critical role in identifying genetic predispositions, monitoring cardiac biomarkers, and guiding personalized treatment strategies for conditions such as coronary artery disease, arrhythmias, and heart failure.

- The autoimmune & inflammatory conditions segment accounted for a 7% share in 2024. The growth is driven due to the rising global prevalence of autoimmune diseases such as rheumatoid arthritis, lupus, and inflammatory bowel disease, which require precise and early diagnostic tools. LDTs offer flexibility in developing customized assays that can detect specific autoantibodies and inflammatory markers, making them essential for accurate diagnosis and disease monitoring.

- On the other hand, the other applications segment held a significant market share of 4.6% in 2024, and its growth can be attributed to the increasing use of LDTs in emerging areas such as prenatal & reproductive health, pharmacogenomics, and transplant medicine, where standardized commercial tests are often unavailable or insufficient. These niche applications benefit from the flexibility and customization that LDTs offer, allowing laboratories to tailor diagnostics to specific clinical needs.

Learn more about the key segments shaping this market

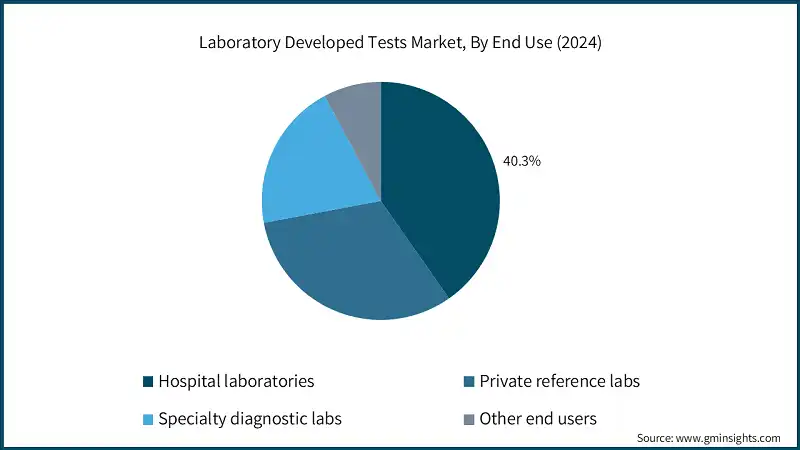

Based on end use, the laboratory developed tests market is segmented into hospital laboratories, private reference labs, specialty diagnostic labs, and other end users. The hospital laboratories segment held a market share of 40.3% in 2024 and is expected to reach USD 19 billion within the forecast period.

- This significant market share is primarily driven by their ability to rapidly develop and validate LDTs tailored to specific clinical needs. These labs benefit from direct access to patient samples, advanced infrastructure, and skilled personnel, allowing for faster turnaround times and integration with hospital workflows. The growing demand for personalized diagnostics, especially in oncology, infectious diseases, and genetic testing, continues to reinforce hospital labs as a central pillar in the LDTs ecosystem.

- The private reference labs segment accounted for a 31.8% share in 2024 and is expected to grow at a 10.8% CAGR. This growth is primarily driven by their ability to scale high-complexity testing, offer specialized LDTs, and maintain rapid turnaround times across a wide geographic footprint. These labs often invest heavily in cutting-edge technologies like next-generation sequencing (NGS), automated platforms, and AI-driven analytics, enabling them to deliver advanced diagnostics at scale.

- The specialty diagnostic labs segment accounted for a 20.1% share in 2024. The growth is driven by their expertise in high-complexity testing, focus on niche and rare conditions, and ability to rapidly develop and validate customized LDTs.

- The other end users segment is expected to grow with a 9.8% CAGR during the analysis period. This growth is primarily driven by the rising adoption of laboratory developed tests in non-traditional settings such as academic research labs, sports medicine centers, and military rehabilitation programs, where advanced therapy technologies are being used to accelerate recovery and enhance performance.

Looking for region specific data?

North America Laboratory Developed Tests Market

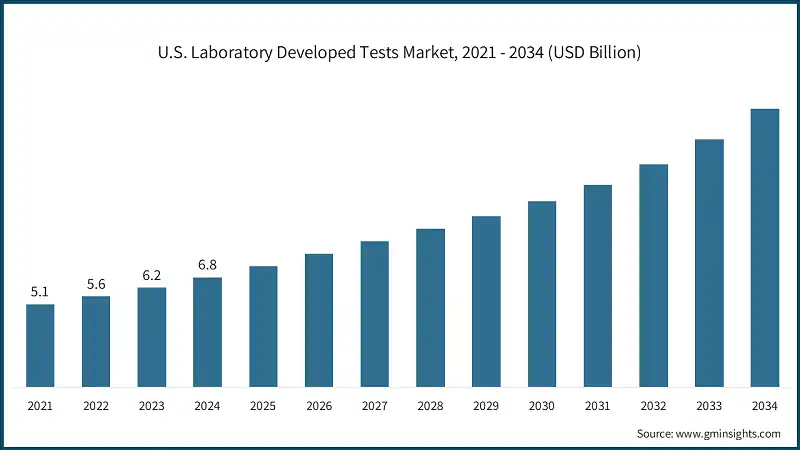

North America dominated the market with the highest market share of 40.9% in 2024.

- The U.S. market was valued at USD 5.1 billion and USD 5.6 billion in 2021 and 2022, respectively. The market size reached USD 6.8 billion in 2024, growing from USD 6.2 billion in 2023, and is anticipated to grow at a CAGR of 9.7% between 2025 and 2034.

- The region benefits from a well-established network of hospitals and reference laboratories that are equipped to develop and validate high-complexity tests, particularly in oncology, infectious diseases, and genetic disorders.

- The regulatory environment in North America, especially in the U.S., has historically supported innovation in LDTs, allowing laboratories to respond swiftly to emerging health needs. Increasing integration of AI, automation, and next-generation sequencing technologies continues to drive growth, making the region a hub for cutting-edge diagnostic development.

Europe Laboratory developed tests Market

Europe market accounted for USD 4.2 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- Europe’s LDTs market is shaped by strong public healthcare systems, growing investment in molecular diagnostics, and a rising focus on early disease detection. Countries like Germany, France, and the UK are at the forefront of adopting personalized medicine, with hospital and academic labs playing a key role in developing specialized tests.

- Collaborations between research institutions and diagnostic companies are fostering innovation, particularly in oncology and rare disease diagnostics. Regulatory harmonization across the EU is also improving the standardization and quality of LDTs, supporting broader adoption across clinical settings.

Asia Pacific Laboratory developed tests Market

The Asia Pacific market is anticipated to grow at a CAGR of 12% during the analysis timeframe.

- Asia Pacific is experiencing rapid growth in the LDTs market, driven by increasing healthcare access, rising disease burden, and expanding investments in diagnostic infrastructure. Countries such as China, Japan, and India are embracing advanced technologies like NGS and PCR to meet the growing demand for accurate and timely diagnostics.

- The region’s evolving regulatory frameworks and emphasis on healthcare modernization are enabling faster development and deployment of LDTs. Additionally, the growing focus on personalized medicine and preventive care is encouraging innovation in genetic, oncology, and infectious disease testing.

Latin America Laboratory Developed Tests Market

The Latin America market is experiencing robust growth over the analysis timeframe.

- Latin America is emerging as a promising market for LDTs, supported by rising awareness of chronic and infectious diseases and improving healthcare infrastructure. Brazil is leading the way in adopting molecular diagnostics, particularly in hospital and reference lab settings.

- The region’s focus on public health and outbreak preparedness has accelerated the adoption of LDTs for infectious disease detection. Increasing collaborations with global diagnostic firms and investments in laboratory automation are further enhancing the capabilities of local labs to develop and deliver specialized tests.

Middle East & Africa Laboratory Developed Tests Market

The Middle East & Africa (market is experiencing notable growth over the analysis timeframe.

- The MEA region is witnessing steady growth in the LDTs market, driven by rising demand for personalized diagnostics and expanding healthcare investments. Countries in the region are modernizing their healthcare systems and adopting advanced diagnostic technologies to improve patient outcomes.

- Despite regulatory and infrastructure challenges, the region is making progress in standardizing laboratory practices and expanding access to high-quality diagnostics. Strategic partnerships, training programs, and technology transfers are helping build local capacity for LDT development, especially in oncology, infectious diseases, and genetic testing.

Laboratory Developed Tests Market Share

Leading industry players such as Labcorp, Quest Diagnostics, ARUP Laboratories, MAYO CLINIC LABORATORIES, and EXACT SCIENCES collectively hold a market share of around 80% in the competitive LDTs market. These companies maintain their leadership through extensive test portfolios, nationwide lab networks, and deep expertise in molecular diagnostics, oncology, and genetic testing. Their strategic focus on clinical validation and rapid test development capabilities enables them to meet evolving clinical demands and regulatory standards efficiently.

Other notable contributors to the LDT market include prognomiQ, Quest Diagnostics, SONIC HEALTHCARE USA, and veracyte. These companies are actively innovating in niche areas such as liquid biopsy, hereditary cancer screening, and non-invasive prenatal testing. Their focus on next-generation sequencing (NGS), AI-powered interpretation tools, and patient-centric testing models is expanding the scope of LDTs beyond traditional hospital settings.

Laboratory Developed Tests Market Companies

A few of the prominent players operating in the laboratory developed tests industry include:

- ARUP Laboratories

- BioReference

- EXACT SCIENCES

- Freenome

- GeneDx

- GUARDANT

- HealthBio

- IgX

- Labcorp

- MAYO CLINIC LABORATORIES

- MicroGenDX

- prognomiQ

- Quest Diagnostics

- SONIC HEALTHCARE USA

- veracyte

- Labcorp

Labcorp stands out with its integrated diagnostics and drug development model, offering a vast test portfolio backed by deep clinical data and nationwide lab infrastructure, making it a leader in precision medicine and oncology diagnostics.

Quest Diagnostics differentiates itself through its strong consumer-facing strategy, advanced data analytics, and scalable testing platforms, enabling broad access to personalized and preventive care solutions.

ARUP Laboratories, affiliated with the University of Utah, excels in research-driven innovation and highly specialized LDTs, particularly in rare diseases and complex genetic conditions, supported by its academic foundation and commitment to quality and regulatory advocacy.

Laboratory Developed Tests Industry News:

- In September 2025, Quest Diagnostics announced its partnership with Epic aimed at transforming the laboratory testing experience for both patients and healthcare providers. Through this integration, physicians using Epic will gain seamless access to Quest’s vast test menu, real-time results, and decision-support tools, all within their existing clinical systems. The initiative is expected to reduce administrative burden, improve turnaround times, and enhance diagnostic accuracy by embedding lab data into the broader care continuum.

- In October 2021, Labcorp announced a strategic partnership with GeneCentric Therapeutics. This collaboration involves ribonucleic acid (RNA)-based diagnostics and companion diagnostics development, combining GeneCentric’s extensive pipeline of predictive response gene signatures with Labcorp’s decades-long leadership in bringing new tests to market. This partnership helped the company gain a competitive edge over its peers.

The laboratory developed tests market research report includes an in-depth coverage of the industry with estimates and forecasts in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Technology

- Polymerase chain reaction (PCR)

- Next-generation sequencing (NGS)

- Immunohistochemistry (IHC)

- Other technologies

Market, By Application

- Oncology

- Infectious diseases

- Genetic & rare disorders

- Cardiology

- Autoimmune & inflammatory conditions

- Other applications

Market, By End Use

- Hospital laboratories

- Private reference labs

- Specialty diagnostic labs

- Other end users

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the laboratory developed tests market?

North America dominated the market with a 40.9% share in 2024. The region's leadership is attributed to advanced healthcare infrastructure and high adoption of innovative diagnostic technologies.

What was the valuation of the hospital laboratories segment?

The hospital laboratories segment held a 40.3% market share in 2024.

What is the projected size of the laboratory developed tests market in 2025?

The market is expected to reach USD 19.7 billion in 2025.

How much revenue did the polymerase chain reaction (PCR) segment generate?

The PCR segment accounting for 49% of the market share, driven by its unmatched sensitivity, rapid turnaround time, and versatility in molecular diagnostics.

What is the projected value of the laboratory developed tests market by 2034?

The market is expected to reach USD 48.5 billion by 2034, fueled by advancements in diagnostic technologies and the integration of artificial intelligence in laboratory workflows.

What are the upcoming trends in the laboratory developed tests market?

Key trends include advancements in next-generation sequencing (NGS), mass spectrometry, and microfluidics, as well as the integration of artificial intelligence and machine learning for predictive analytics and personalized diagnostics.

What is the market size of the laboratory developed tests in 2024?

The market size was USD 17.8 billion in 2024, with a CAGR of 10.5% expected through 2034, driven by increasing awareness of early disease detection, the rise in infectious and chronic diseases, and the growing prevalence of cancer and genetic disorders.

Mention the key players involved in the laboratory developed tests industry?

23andMe, Inc., Abbott, Bio-Rad Laboratories, Inc., Eurofins Scientific, F. Hoffmann-La Roche Ltd., Illumina, Inc., NeoGenomics Laboratories, OPKO Health, Inc., QIAGEN and Quest Diagnostics Incorporated

How big is the North America laboratory developed tests industry?

North America laboratory developed tests market size reached USD 3.7 billion in 2023, favored by growing burden of chronic diseases, such as diabetes, cardiovascular diseases, and cancer.

Why is the use of molecular diagnostics growing in laboratory developed tests?

The molecular diagnostics segment in the laboratory developed tests industry generated USD 2.4 billion in 2023, driven by sensitive and specific methods for detecting pathogens and identifying genetic mutations associated with cancer.

What is the size of laboratory developed tests industry?

Laboratory developed tests market size was valued at USD 8.9 billion in 2023 and is estimated to grow at 6.4% CAGR from 2024 to 2032, owing to increasing incidence of cancer and genetic disorders.

Who are the key players in the laboratory developed tests market?

Key players include ARUP Laboratories, BioReference, EXACT SCIENCES, Freenome, GeneDx, GUARDANT, HealthBio, IgX, and Labcorp.

Laboratory Developed Tests Market Scope

Related Reports