Summary

Table of Content

IT Asset Disposition (ITAD) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

IT Asset Disposition Market Size

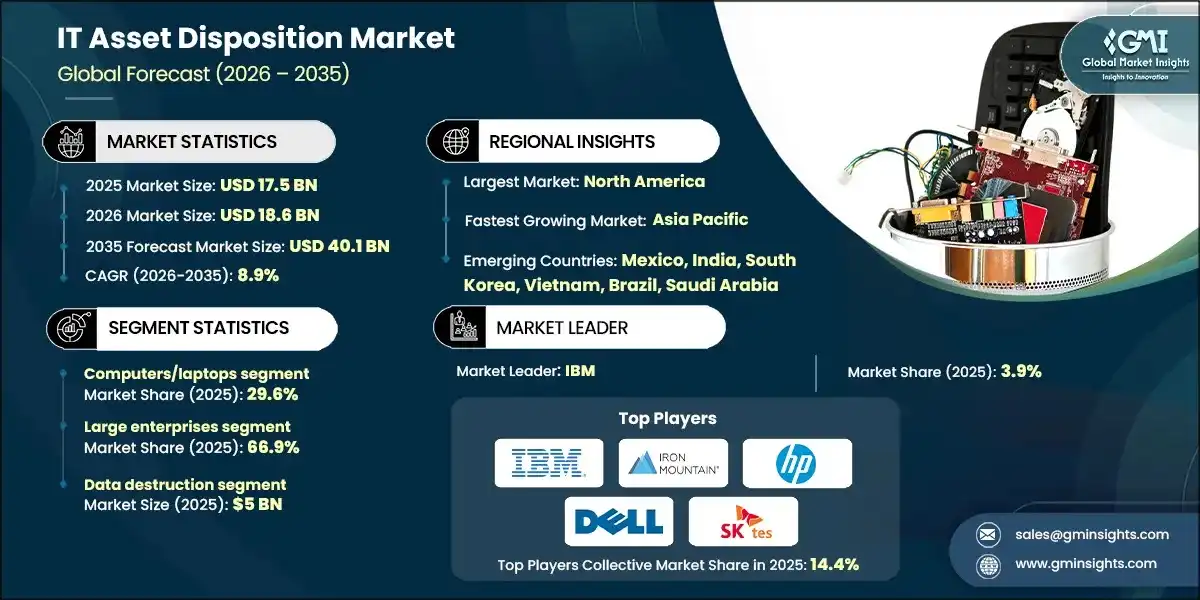

The global IT asset disposition market size was valued at USD 17.5 billion in 2025. The market is expected to grow from USD 18.6 billion in 2026 to USD 40.1 billion in 2035 at a CAGR of 8.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

The main reason that drives the need for services like asset disposition is the increasing amount of e-waste across the world. A decade ago, most of the IT assets were thrown out in garbage, and that amount resulted in an increased amount of e-waste across the globe.

Worldwide, the annual generation of e-waste is rising by 2.6 million tonnes annually, which is expected to surpass 82 million tonnes by 2030. A latest survey estimated that over 62 million tonnes of e-waste were produced in 2022.

Such an increased amount of e-waste turns the world to adopt solutions to decrease the amount of e-waste by utilizing methods such as recycling, reusing and reselling of electronic products, whether these come from IT & telecom industries, banking sectors, manufacturing industries, government or media industries that deploy the majority of the electronics.

For instance, in December 2025, Tech Defenders, certified by R2v3, expanded its IT asset disposition (ITAD) services to Michigan, Northern Indiana, and Northern Ohio. The company helps organizations turn e-waste costs into revenue instead of treating it as an expense.

Such instances clearly indicate the increasing e-waste is now emerging as an opportunity for ITAD players to solve the pain point of industries across the world. Thus, the IT asset disposition market sees strong growth within industries, as they are implementing zero-emission or net zero-emission targets and CSR goals.

IT Asset Disposition (ITAD) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 17.5 Billion |

| Market Size in 2026 | USD 18.6 Billion |

| Forecast Period 2026-2035 CAGR | 8.9% |

| Market Size in 2035 | USD 40.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Volume of E-Waste Generation | Forces enterprises to adopt professional ITAD services for compliant disposal, boosting demand for recycling, recovery, and certified data sanitization solutions. |

| Increasing Need for Secure Data Destruction | Rising cybersecurity risks and data privacy regulations push organizations toward certified destruction services, elevating ITAD adoption to prevent breaches. |

| Growth of Cloud Adoption and Data Center Consolidation | Growth of Cloud Adoption and Data Center Consolidation |

| Growing Demand for Value Recovery & Refurbished IT Assets | Accelerating ITAD providers’ revenue opportunities from asset remarketing and circular economy models. |

| Pitfalls & Challenges | Impact |

| Complex Reverse Logistics for Global Enterprises | Managing multi-location asset collection and compliance across borders complicates ITAD execution, that increases operational costs and slows global deployment of standardized programs. |

| Limited Recycling Infrastructure in Developing Regions | Insufficient certified recyclers restrict safe processing of IT waste, creating environmental risks, raising costs, and limiting ITAD footprint in high growth developing markets. |

| Opportunities: | Impact |

| Growing Demand for Sustainable Recycling Solutions | Drive adoption of eco-friendly ITAD services, opening opportunities for green-certified recycling and carbon-efficient value recovery models. |

| Expansion of ITAD Services in Emerging Markets | Create significant demand for secure disposal, enabling ITAD players to build early leadership positions. |

| Rising Opportunities in Data Center Decommissioning | Boosts demand for structured data centre dismantling, creating high-value opportunities for secure asset removal and recycling. |

| Increasing Partnerships with OEMs & Cloud Providers | Enables integrated ITAD offerings, expanding service reach, enhancing credibility, and unlocking recurring enterprise contracts. |

| Market Leaders (2025) | |

| Market Leaders |

3.9% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Mexico, India, South Korea, Vietnam, Brazil, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

IT Asset Disposition Market Trends

CSR is quickly becoming a top priority for most businesses across the globe, as they now see the importance of being responsible stewards of their retired IT assets through the environmentally safe management of those assets.

In addition to managing their IT assets more responsibly, companies are also trying to reduce the overall impact of their operations on the environment by decreasing their carbon footprint and decreasing landfill waste.

As a result of these efforts, businesses are in need of ITAD service providers that can provide certified disposal services. With many companies now reporting publicly on their sustainability efforts and facing increased scrutiny from their investors, customers, and regulators regarding their efforts in this area, the need for ITAD services such as recycling, reusing refurbished assets, and recovering materials is becoming a major CSR initiative for many companies, thus propelling ITAD to the forefront of many companies' corporate sustainability goals.

ITAD companies are also working more with device makers and cloud providers. These partnerships offer complete lifecycle solutions, including deployment, maintenance, and secure disposal. They make services more standardized, improve asset tracking, enhance data security, increase value recovery, helping businesses manage IT assets more easily and cost-effectively.

IT Asset Disposition Market Analysis

Learn more about the key segments shaping this market

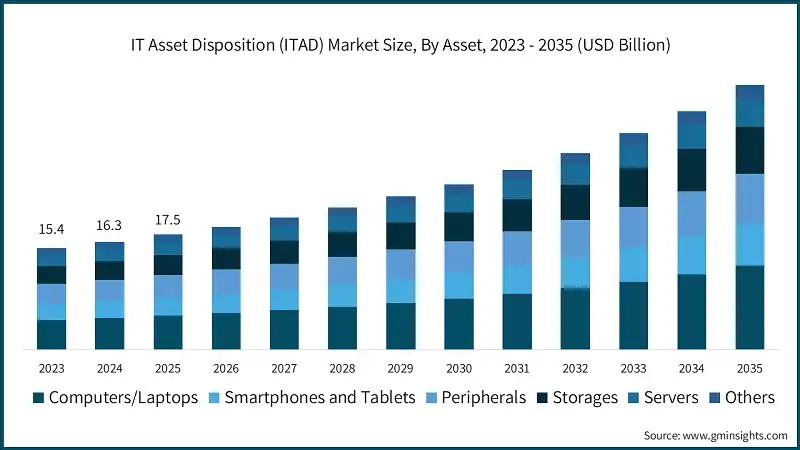

Based on asset, the IT asset disposition market is divided into computers/laptops, smartphones and tablets, peripherals, storages, servers and others. The computers/laptops segment dominated the market with 29.6% share in 2025.

- The average lifespan of a computer ranges from 3 to 8 years, depending on usage, maintenance, and specific needs. Which means after this period there will be a need for a new system. This particular asset type shows the potential need for asset disposition services. Thus, the revenue from the asset was valued at USD 5.2 billion in 2025.

- Meanwhile, peripherals, including printers, mice, keyboards, speakers, network devices, and cameras, among others, are showing the need for such services, as the wear and tear losses are more with these assets.

- Similarly, rising cloud dependence and data center growth also will result in a higher volume of assets recovered, recycled or reused, which will significantly raise the need for asset deposition service providers, most of which are having their near presence or domestic presence.

- Moreover, other assets like smartphones and tablets are gaining momentum across the industries, as these assets have their own usage. For example, smartphones & tablets are being used because these are compact and easy to carry as compared to a computer or laptop. Thus, services specifically designed for these assets will acquire the early customers from industries.

Learn more about the key segments shaping this market

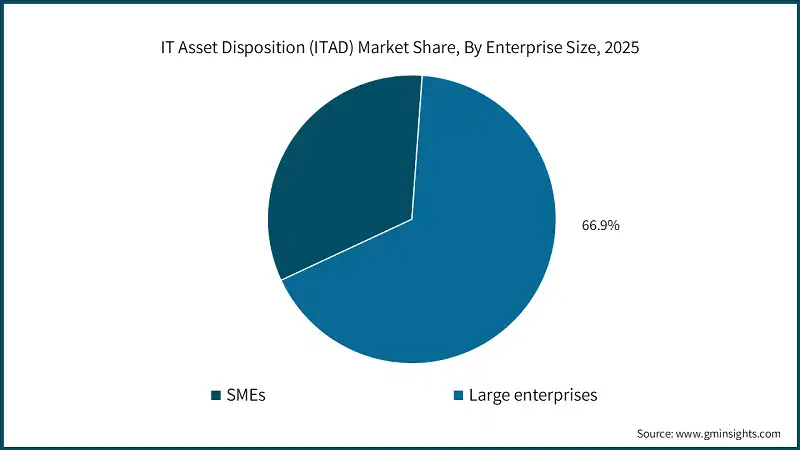

Based on enterprise size, the IT asset disposition market is divided into SMEs and large enterprises. The large enterprises segment dominated the market with 66.9% share in 2025.

- Large companies lead the ITAD market because they manage many IT devices across different locations. Frequent hardware upgrades, driven by new technologies like AI and cloud computing, create a large number of devices that need proper disposal every year. Thus, they contribute the major part of the market's revenue, which was estimated at USD 11.7 billion in 2025.

- These companies rely on specialized ITAD services to handle this efficiently. Operating in multiple countries adds challenges, as they must follow different regulations. Certified processes help them avoid penalties.

- Laws like GDPR, HIPAA, and new ESG standards require secure data destruction and eco-friendly recycling. Large companies invest in professional ITAD services to reduce risks like data breaches and fines for improper e-waste disposal.

- In contrast, small and medium-sized businesses (SMEs) have smaller and scattered inventories. They often cannot afford advanced ITAD services and use basic recycling for disposal. As a result, SMEs have a smaller share of the ITAD market. However, as digitalization grows and regulations become stricter, SMEs may start using ITAD services more, especially with affordable bundled options becoming available.

Based on services, the IT asset disposition market is divided into data destruction, reverse logistics, remarketing, value recovery, de-manufacturing, recycling, logistics management and others. In 2025, the data destruction segment led the IT asset disposition market, reaching a market value of USD 5 billion.

- Behind the dominance of the data destruction segment are regulatory pressures and compliances. The increased burden of regulatory pressures and compliance requirements have increased the amount of data that needs to be destroyed which is due in part to Data Destruction Standards established by regions around the world.

- The Data Destruction standards include legislation such as GDPR, HIPAA & CCPA, which require all organizations to have a secure and permanent method of deleting each piece of sensitive data once it has been determined that it is no longer needed and must be protected from unauthorized access to sensitive data they hold.

- This can include methods of data destruction, such as the use of certified software for wiping data, as well as physical shredding and providing documentation of certification (Certificates of Destruction) of how, when and where the destruction has occurred for compliance and for auditing purposes.

- Between 2026 and 2035, the remarketing segment is expected to show the highest demand, reflecting the fastest-growing CAGR of 10.5%. Devices will continue to be removed from service within large and medium enterprises for upgrades for current hardware, replacement of certain items with damages and old/obsolete equipment and therefore will be in need of remarketing.

Looking for region specific data?

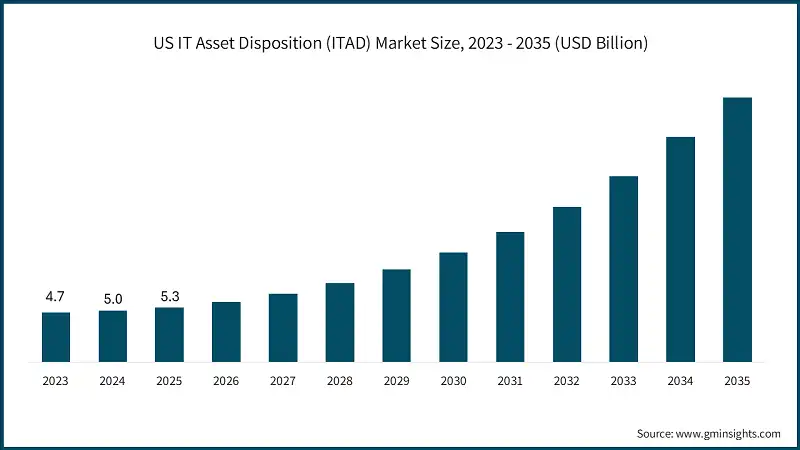

The US IT asset disposition market reached USD 5.3 billion in 2025, growing from USD 5 billion in 2024.

- The advancement of technology within the US has contributed to the growth of the IT asset disposal (ITAD) market, as many large companies are based there, and they have extensive technological needs due to their frequent upgrades.

- As these companies upgrade their data centers and migrate to the cloud, they are left with a lot of old equipment that must be disposed of securely or through certified data destruction so they can comply with current laws regarding HIPAA and CCPA.

- In addition to being able to comply with these laws, the U.S. government's ongoing support for corporate social responsibility (CSR) is an important factor in encouraging companies in the U.S. to adopt sustainable practices and move toward a greener future through responsible recycling and reclamation of value from retired assets.

- ITAD companies in the U.S. grow by using innovation hubs in areas like the Northeast and West Coast, where tech clusters adopt AI, IoT, and blockchain for better asset management. With supportive policies for green information technology and incentives provided for sustainable disposal, it has become easier for new companies to begin operations in this segment and to grow their operations or expand into other areas.

The North America region is valued at USD 6.4 billion in 2025 and expected to grow at the CAGR of 8.4% between 2026 and 2035.

- North America is at the forefront of the IT asset disposal market which is projected to reach USD 14.1 billion by 2035. The main reason behind this is the rapid technological adoption in the region along with frequent hardware upgrades. The U.S. is the central part of the region contributing a lot with its large IT investments and the world-famous tech hub of Silicon Valley which attracts the best companies.

- Moreover, the U.S. has a great number of accelerators and organizations that support the development of startups in every state of the country. Over 90% of North American startups come from United States. Hence, these factors create very favorable conditions for both the newcomers and the established players in the North American market.

- Although Canada is a small country by share in the North American ITAD market, it is gradually becoming influential. This increase is mainly attributed to the significant digitization, the enactment of severe data privacy laws, and the emphasis on environmental sustainability.

The Europe IT asset disposition market accounted for USD 4.5 billion in 2025 and is anticipated to grow at the CAGR of 9.3% between 2026 and 2035.

- There is a strong shift in Europe toward sustainable IT asset disposal practices and new technologies. The circular economy model is receiving much attention to encourage reusing, refurbishing and recovering parts from e-waste in an effort to reduce e-waste.

- For instance, ITAD EUROPE, the largest event devoted to IT asset disposition, mobile device lifecycle management and reverse logistics will be held on June 17-18, 2026. This event will focus on topics such as data security, globalization and eco-friendly methods of recycling.

- Strict regulations are a key factor in the ITAD market. The Waste Electrical & Electronic Equipment (WEEE) Directive governs the handling of electronic waste while the GDPR holds companies liable for proving that they have erased customer data to prevent violations of privacy.

Germany's IT asset disposition market is expected to grow at a strong CAGR of 8.8% between 2026 and 2035. The market was valued at USD 1.1 billion in 2025.

- Germany leads the world in ICT (information communication technology) and has set a high standard for demand for IT asset Disposition. All ICT companies require electronic and physical assets such as computers, laptops, networks, peripherals, storage, and servers. For instance, Germany is the largest single software market in Europe, comprising approximately 100,000 IT companies and over 1.19 million employees.

- In 2025, the German ICT market generated sales of approximately USD 252 billion, representing the most significant position among countries in Europe.

- Moreover, the United States is one of the most important non-European foreign direct investors (FDI) in Germany. Therefore, the United States invested USD 8.71 billion into Germany’s ICT Industry as of 2022.

- Such instances suggest Germany is poised to be the primary supplier of IT asset disposal services in the near future.

The Asia Pacific IT asset disposition market is estimated to reach USD 10.1 billion by 2035, by growing at a CAGR of 9.9% during the analysis timeframe.

- The Asia Pacific region is an emerging market for IT asset disposition because of the region’s expanding data centers in countries like China, India, and Japan, and a shift to formal services to address issues with informal recycling.

- Companies that are based in the region are spending more on cloud services to support AI but are cutting back on managed services. This has led to faster hardware upgrades and more e-waste, creating a need for secure disposal.

- These factors have led the region to account for the highest growth rate of 9.9% during the projected period between 2026 and 2035.

China is estimated to grow with a CAGR of 10.3% in the projected period between 2026 and 2035, in the Asia Pacific IT asset disposition market.

- China’s strongest CAGR among other countries in the region reflects its continued demand for services like asset disposition. As China’s view on IT sectors is the most, there will be a higher demand for asset recycling services, remarketing, value recovery and data destruction.

- On the other hand, China's growth in cloud computing and upgrades in digital infrastructure, especially in Tier-1 cities, create opportunities. With increasing concerns about data security, companies are using certified data sanitization methods. They are adding advanced processes to meet privacy rules.

- Government efforts to promote a circular economy are encouraging responsible IT asset management. This benefits providers that focus on sustainability and reducing waste instead of informal e-waste handling.

- The Basel Convention's prohibition on the importation of hazardous e-waste, coupled with these regulations, has forced companies to adopt ITAD practices, which in turn has resulted in a more professional market.

Latin America IT asset disposition market is estimated to reach USD 1.7 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- LATAM companies in industries like banking and telecommunications are looking for certified ways to dispose of old hardware as they upgrade devices and move to the cloud. ITAD providers are offering on-site data wiping that meets NIST standards and reselling assets to recover value.

- The approach of sustainability makes the companies look at ITAD as the one supporting compliance since it is focused on recycling and refurbishing.

- The Brazilian National Policy on Solid Waste and the General Data Protection Law (LGPD) impose the disposal of e-waste and secure data deleting.

- The Mexican General Law for Waste Prevention is in favor of a paperless society through eco-friendly disposal among other things. Countries including Chile, Costa Rica, Ecuador, and Peru have also introduced e-waste regulations that impose Extended Producer Responsibility systems.

Brazil is estimated to grow with a CAGR of 8.3% between 2026 and 2035, in the Latin America IT asset disposition market.

- The nation reveals its bigger investments in the expansion of IT infrastructure, such as the installation of data centers and AI. This development accelerates the process of upgrading hardware and the growth of old gadgets that need safe disposal.

- Businesses are going green and they are including ITAD in their ESG strategies. They are putting a lot of emphasis on certified data wiping and material recovery as these are the ways to achieve their circular economy goals.

- Legislations like the National Solid Waste Policy (PNRS - Law 12.305/2010) compel the manufacturers, consumers and others in the supply chain to take care of the e-waste in the right way. This entails the processes of reverse logistics and recycling.

The Middle East and Africa accounted for 5% share in 2025 and is anticipated to show lucrative growth over the forecast period.

- There is a growing demand for secure data sanitization due to the digital transformation in the Gulf Cooperation Council (GCC) countries such as the United Arab Emirates and Saudi Arabia. The issuance of smart city projects and cloud computing adoption is accelerating the process of updating IT hardware.

- Moreover, government policies in the region, like e-waste management rules and incentives for proper disposal, are contributing to the growth of the ITAD market. These policies come with the requirement of adherence to data privacy and environmental standards. National visions such as Saudi Vision 2030 and UAE digital initiatives are facilitating the infrastructure investments.

- Though the problem of low awareness in less developed markets persists, the MEA market is still growing gradually because of the influx of investments in infrastructure and the introduction of new services.

UAE experiences substantial growth in the Middle East and Africa IT asset disposition market in 2025.

- The UAE has become one of the biggest data center locations in the Middle East with future plans for even more growth. It is estimated that up to USD 1 billion will be invested by 2026. This expansion results in gradual obsolescence of IT hardware, which in turn increases the need for secure disposal services as the risk from cyber-attacks increases.

- The major trends that are shaping the industry include certified data destruction according to NIST 800-88 standards, AI-powered asset tracking providing real-time updates, and incorporating remarketing and refurbishment into the circular economy to prolong the life of hardware.

- The limitation on e-waste and data privacy has also been responsible for this growth. Among the major regulations are Federal Law No. 24 of 1999 concerning environmental protection and Federal Decree-Law No. 45 of 2021 regulating personal data protection. It is the responsibility of the Dubai Municipality to ensure proper collection and disposal of e-waste.

IT Asset Disposition Market Share

- The top 7 companies in the IT asset disposition industry are IBM, Iron Mountain, HP, Dell, SK Tes, Sims Lifecycle and Park Place Technologies, contributing 16.2% of the market in 2025.

- IBM provides IT asset disposition services through Global Asset Recovery Services. These include recycling products and batteries, buying back assets, disposal, remanufacturing, and scrapping in different regions.

- Iron Mountain offers Secure IT Asset Disposition as part of its IT Asset Lifecycle Management. Their services include destroying data, remarketing assets, recycling e-waste, decommissioning, logistics, and compliance reporting with chain-of-custody tracking.

- HP provides services that focus on secure data sanitization, reusing assets, recycling, and sustainability. These services follow certified processes that meet industry standards.

- Dell includes ITAD services in its circular economy approach. These services cover secure recycling, remarketing, data destruction, decommissioning, and ESG reporting for managing hardware lifecycles.

- SK Tes offers global asset disposition services, including data destruction, value recovery, recycling, refurbishment, logistics, and carbon reporting. They operate in over 40 facilities worldwide.

- Sims Lifecycle provides ITAD services like secure data erasure, asset recovery, recycling, resale, decommissioning, and transportation. They ensure environmental compliance and maintain full audit trails.

- Park Place Technologies delivers services such as data sanitization, asset disposition, recycling, remarketing, logistics management, and reporting for IT equipment at the end of its life.

IT Asset Disposition Market Companies

Major players operating in the IT asset disposition industry are:

- IBM

- Iron Mountain

- HP

- Dell

- SK Tes

- Sims Lifecycle

- Park Place Technologies

- LifeSpan

- Technimove

- Apto Solutions

- IBM uses its global network to focus on data security and compliance in IT asset disposition through partnerships. It leads the enterprise market by combining asset recovery with IT services and expanding through acquisitions in North America.

- Iron Mountain uses its experience in archiving to provide secure destruction and logistics in ITAD, along with records management. Its strategy includes federal partnerships and acquisitions like Regency Technologies to grow in North America. It has a strong position in data center disposition.

- HP includes ITAD in its hardware sales, offering data sanitization and recycling that follow industry standards. Its advantage comes from partnerships with OEMs, helping recover value. HP focuses on sustainability in enterprise hardware upgrades across regions.

- Dell connects ITAD to circular economy models, offering recycling and remarketing tied to device lifecycles. It leads the market with global logistics and OEM partnerships, focusing on ESG goals and carbon tracking for large-scale clients.

- SK Tes runs over 40 facilities worldwide, providing ITAD services focused on value recovery and recycling. It leads the market with contracts from hyperscalers and regional expansions, like in Japan, and ensures compliance in over 100 countries.

- Sims Lifecycle works with OEMs to handle data center decommissioning and asset recovery. It targets hyperscalers with circular practices and holds a strong position through environmental compliance and a global resale network.

- Park Place Technologies offers ITAD with maintenance services, focusing on data sanitization and remarketing. It stands out by supporting multi-vendor environments and competes in the mid-market with logistics and reporting for end-of-life equipment.

IT Asset Disposition Industry News

- In December 2025, Tech Defenders expanded its ITAD services to Michigan, Northern Indiana, and Northern Ohio. The company helps organizations turn old technology into a source of income instead of a cost.

- In July 2025, Vyta opened a new ITAD facility in Frankfurt to serve clients in Germany and mainland Europe. The 1,000 m² facility is certified with ISO 9001, 14001, and 45001, as well as R2v3.

- In April 2025, SK Tes announced a new facility in Shannon, Ireland. The 36,000 square foot site is part of the company’s global growth plan and will offer ITAD, data center, and technology lifecycle management services to customers in Ireland.

- In October 2024, Kefron launched IT Asset Disposition (ITAD) services to provide businesses in Ireland and the UK with secure and eco-friendly ways to recycle or dispose of old IT equipment.

- In February 2024, Quantum Lifecycle Partners opened its 10th facility in Canada and its third in Alberta. The company already had a recycling facility in Edmonton, but the new ITAD facility will offer full lifecycle management services for electronics and IT hardware to current and new customers.

The IT asset disposition market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2022 to 2035, for the following segments:

Market, By Asset

- Computers/Laptops

- Smartphones and Tablets

- Peripherals

- Storages

- Servers

- Others

Market, By Enterprise Size

- SMEs

- Large enterprises

Market, By Services

- Data Destruction

- Reverse Logistics

- Remarketing

- Value Recovery

- De-Manufacturing

- Recycling

- Logistics Management

- Others

Market, By Deployment

- Onsite ITAD Services

- Offsite / Facility-Based ITAD

Market, By Channel

- Direct (OEM to Client)

- Third-Party ITAD Providers

Market, By Industry Vertical

- BFSI

- IT & Telecom

- Government

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the IT asset disposition market?

Trends include increased focus on corporate sustainability goals, partnerships with device manufacturers and cloud providers for lifecycle solutions, enhanced data security, and value recovery through certified disposal services.

Who are the key players in the IT asset disposition industry?

Key players include IBM, Iron Mountain, HP, Dell, SK Tes, Sims Lifecycle, Park Place Technologies, LifeSpan, Technimove, and Apto Solutions.

What was the market share of the large enterprises segment in 2025?

The large enterprises segment held a 66.9% market share in 2025. The market is attributed to frequent hardware upgrades and the management of numerous IT devices across multiple locations.

What was the valuation of the US IT asset disposition sector?

The US market was valued at USD 5.3 billion in 2025, led by technological advancements and frequent upgrades by large corporations.

How much revenue did the data destruction segment generate in 2025?

The data destruction segment generated approximately USD 5 billion in 2025, driven by regulatory pressures and compliance requirements.

What was the market share of the computers/laptops segment in 2025?

The computers/laptops segment dominated the market with a 29.6% share in 2025.

What is the expected size of the IT asset disposition industry in 2026?

The market size is projected to reach USD 18.6 billion in 2026.

What was the market size of the IT asset disposition in 2025?

The market size was USD 17.5 billion in 2025, with a CAGR of 8.9% expected through 2035. The increasing global e-waste crisis is driving the market growth.

What is the projected value of the IT asset disposition market by 2035?

The market is poised to reach USD 40.1 billion by 2035, driven by rising demand for certified disposal services, sustainability initiatives, and partnerships with device manufacturers and cloud providers.

IT Asset Disposition (ITAD) Market Scope

Related Reports