Home > Media & Technology > Security and Surveillance > IT Security > Intrusion Detection System / Intrusion Prevention System (IDS / IPS) Market

Intrusion Detection System / Intrusion Prevention System (IDS / IPS) Market Size

- Report ID: GMI3178

- Published Date: Mar 2019

- Report Format: PDF

Intrusion Detection System / Intrusion Prevention System Market Size

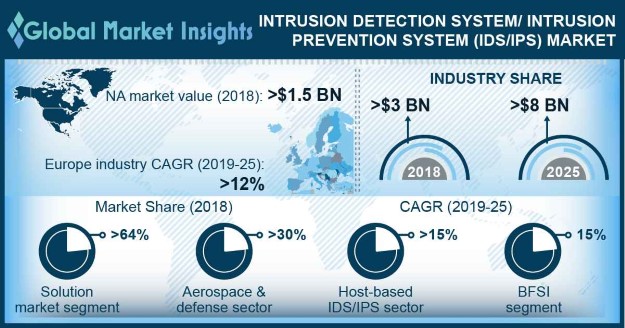

Intrusion Detection System / Intrusion Prevention System (IDS / IPS) Market size estimated at USD 3 billion in 2018 and is growing at a CAGR of over 12% between 2019 and 2025.

The rising security threats, fear of data breaches and consistently changing regulatory landscape have resulted into the rapid development of IDS / IPS. The growing number of cyberattacks in enterprises such as malware, ransomware, and Denial of Service (DoS) have the ability to compromise the existing security systems in an enterprise. These security breaches have long-lasting and damaging effects in the enterprise in terms of regaining customer trust and rebuilding relationships. Hence, organizations worldwide have adopted improved security systems driving the demand for intrusion detection system / intrusion prevention system market.

Companies are adopting IDS / IPS devices to monitor their system and user activities, analyze system configurations and vulnerabilities, assess file and system integrity and track user policy violations. These companies are investing in R&D to enhance the efficiency of these systems for transforming their businesses and mitigating cyber threats. Various financial institutions, government agencies, healthcare and IT & telecom are the major industries investing in the intrusion detection system / intrusion prevention system applications with the cybersecurity expenditure expected to exceed USD 1 trillion between 2017 to 2021.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Intrusion Detection / Prevention System Market Size in 2018: | 3 Billion (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 12% |

| 2025 Value Projection: | 8 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 379 |

| Segments covered: | Component, Type, Deployment Model, Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The rising penetration of smart phones and tablets and growing demand for employee mobility software and mobility service management are also driving the demand for IDS / IPS solutions. Companies encouraging BYOD are implementing security policies to strengthen their BYOD network components by enforcing granular access policies across tablets, laptops, and other mobile devices driving the intrusion detection system / intrusion prevention system market demand. For instance, by adopting intrusion detection system such as Snort the user gets an alert in case of an unauthorized access or suspicious activity at the workplace in real-time.