Summary

Table of Content

Intracranial Aneurysm Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Intracranial Aneurysm Market Size

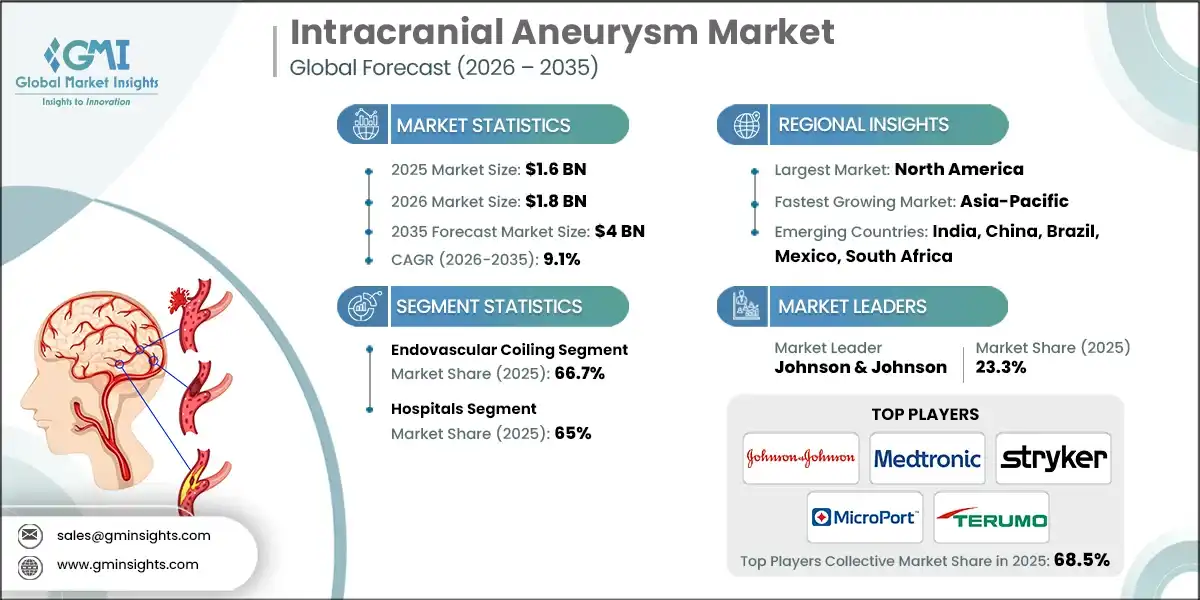

The global intracranial aneurysm market was valued at USD 1.6 billion in 2025. The market is expected to reach from USD 1.8 billion in 2026 to USD 4 billion in 2035, growing at a CAGR of 9.1% during the forecast period, according to the latest report published by Global Market Insights Inc. The high market growth is attributed to the technological advancements in minimally invasive neurovascular devices, increasing adoption of endovascular treatment over surgical clipping, and rising prevalence of intracranial aneurysms and associated risk factors, among other contributing factors.

To get key market trends

An intracranial aneurysm is a confined, abnormal expansion or ballooning of a blood vessel in the brain caused by the thinning of the arterial wall. Such an aneurysm can grow gradually and is associated with the risk of its rupture, which may cause a bleeding situation in the area surrounding the brain that can be fatal. Typically, these aneurysms occur at branching points of major cerebral arteries.

The major players in the global intracranial aneurysm market are Johnson & Johnson, Medtronic, Stryker, MicroPort, and TERUMO. These firms keep their competitive position through continuous product innovation, worldwide market presence, and hefty investment in research and development.

The market has increased from USD 1.2 billion in 2022 and reached USD 1.5 billion in 2024, with the historic growth rate of 12.3%. The market growth was driven by technological advancements in endovascular devices, increasing awareness and early diagnosis of intracranial aneurysms, and the growing number of trained neurointerventional specialists performing minimally invasive procedures.

Moreover, the burden of intracranial aneurysms is rising globally, driven by factors such as hypertension, smoking, alcohol consumption, genetic predisposition, and an ageing population. For instance, according to the World Health Organization (WHO), approximately 1 in 4 adults worldwide had hypertension in 2021, a key risk factor for aneurysms.

The Centers for Disease Control and Prevention (CDC) also reported in 2022 that nearly 12.5% of U.S. adults were current smokers, further contributing to disease risk. As aneurysm incidence increases with age, the expanding elderly population intensifies the global case load; for example, the United Nations estimated in 2023 that the population aged 65 and above reached 761 million. Growing awareness among clinicians and patients has additionally accelerated diagnoses. Together, these trends have increased demand for screening, monitoring, and treatment solutions.

Furthermore, innovations such as flow-diverter stents, intrasaccular devices, advanced detachable coils, and next-generation microcatheters are transforming aneurysm management. These devices reduce procedure time, improve occlusion rates, and minimize complications. The shift toward minimally invasive neurointerventional procedures is expanding adoption worldwide. Continuous R&D by key players, significantly enhances clinical outcomes and market growth.

Intracranial Aneurysm Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.6 Billion |

| Market Size in 2026 | USD 1.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 9.1% |

| Market Size in 2035 | USD 4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising incidence of hypertension and lifestyle-related diseases | Growing cases of hypertension, smoking, and alcohol use are expanding the at-risk population, directly increasing demand for screening and treatment of intracranial aneurysms. |

| Growth in neurointerventional procedures and trained specialists | The availability of skilled neurointerventionalists and wider adoption of minimally invasive techniques are accelerating procedure volumes and boosting market utilization. |

| Technological advances in endovascular devices | Innovations such as next-generation flow diverters, coils, and stents are improving safety and clinical outcomes, driving faster adoption across hospitals and specialty centers. |

| Increasing awareness about intracranial aneurysms | Greater clinician and patient awareness, along with expanded imaging practices, is leading to earlier detection and increasing the treated patient pool. |

| Pitfalls & Challenges | Impact |

| High cost of devices and procedures | Premium pricing of advanced endovascular systems limits affordability and restricts adoption in cost-sensitive settings, especially across emerging markets. |

| Risk of peri- and post-procedural complications and morbidity | Concerns over potential complications continue to influence treatment decisions, slowing uptake in borderline or asymptomatic cases and impacting overall procedure volumes. |

| Opportunities: | Impact |

| Expansion into emerging markets with growing healthcare infrastructure | Strengthening hospital networks, rising neurovascular specialty centers, and improved imaging access in emerging regions will significantly broaden the treated patient base and accelerate global market penetration. |

| Surging need for personalized implants, 3D-printed devices, and patient-specific planning | Adoption of precision-designed implants and advanced pre-operative planning tools will enhance procedural safety and outcomes, creating new premium product segments and boosting long-term market growth. |

| Market Leaders (2025) | |

| Market Leaders |

23.3% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Intracranial Aneurysm Market Trends

The market is growing considerably with the rapid shift toward intrasaccular and flow-diverter technologies, increasing adoption of AI and advanced imaging for early detection, growing use of minimally invasive endovascular procedures, among other factors collectively driving industry growth.

- Flow-diversion devices and intrasaccular implants such as WEB and Contour are becoming more preferred than conventional coiling. These devices provide improved aneurysm occlusion, less retreatment, and better results in wide-neck or complex aneurysms. The transition is becoming faster due to a strong clinical evidence and more regulatory approvals.

- Endovascular procedures continue to replace surgical clipping as the standard of care. Technological improvements in coils, stents, and microcatheters are enabling treatment of previously inoperable aneurysms. Patient and clinician preference for lower-risk, faster-recovery procedures is driving this trend globally.

- Furthermore, major players such as Medtronic, Stryker, and TERUMO are speeding up clinical research to confirm the effectiveness of next-generation aneurysm devices. The number of trials focusing on long-term occlusion, safety, and treatment durability is increasing rapidly. The large R&D budget is the main reason for the continuous innovation and portfolio diversification by which the market growth is being sustained.

Intracranial Aneurysm Market Analysis

Learn more about the key segments shaping this market

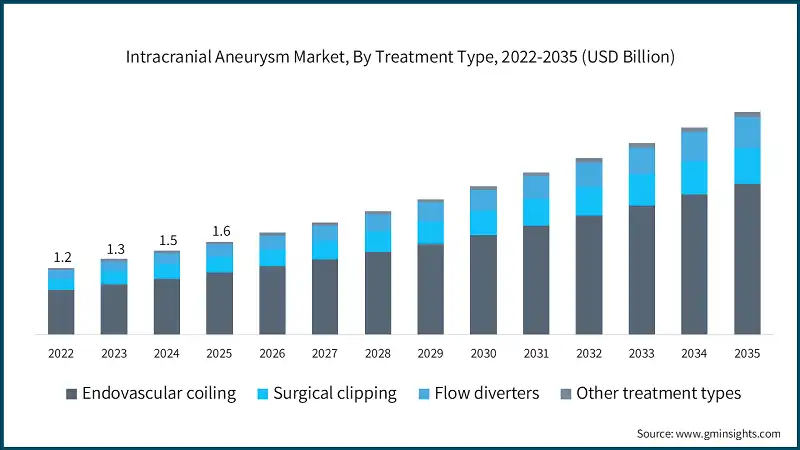

Based on the treatment type, the intracranial aneurysm market is segmented into endovascular coiling, surgical clipping, flow diverters, and other treatment types. The endovascular coiling segment has asserted its dominance in the market by securing a significant market share of 66.7% in 2025 owing to its minimally invasive nature, favourable clinical outcomes, and widespread adoption as the standard of care for both ruptured and unruptured aneurysms. The segment is expected to exceed USD 2.7 billion by 2035, growing at a CAGR of 9.2% during the forecast period.

On the other hand, the flow diverters segment is expected to grow with a CAGR of 9.7%. The growth of this segment is driven by increasing adoption of next-generation devices that offer superior long-term vessel reconstruction, reduced retreatment rates, and expanding use in complex and wide-neck aneurysms.

- The endovascular coiling segment continues to dominate the market. Endovascular coiling is generally preferred over surgical clipping, considering it is a less invasive method, entails a shorter recovery time, and has a lower procedural morbidity. Most notably, for elderly patients and those with a high surgical risk, this trend is very evident. As hospitals are moving towards minimally invasive care pathways, coiling cases keep on increasing.

- Long-term clinical trials provide evidence of fewer disabilities and better results of coiling in most cases as compared to open surgery. Coiling is being extensively recommended for both ruptured and unruptured aneurysms, also those in complicated areas. Procedural demand is getting higher due to updated guidelines and widening treatment indications.

- The surgical clipping segment held a revenue of USD 279.1 million in 2025, with projections indicating a steady expansion at 8.5% CAGR from 2026 to 2035. The segment is driven by its proven long-term durability, especially for aneurysms unsuitable for endovascular repair, and the growing availability of advanced intraoperative imaging and microsurgical tools that improve safety and precision during open procedures.

- The flow diverters segment accounted for significant revenue in 2025 and is anticipated to grow at a CAGR of 9.7% over the forecast period. Flow diverters are gaining momentum as they enable parent vessel reconstruction and effective treatment of large, fusiform, or wide-neck aneurysms, supported by expanding clinical approvals and growing preference for single-device, long-term solutions.

Learn more about the key segments shaping this market

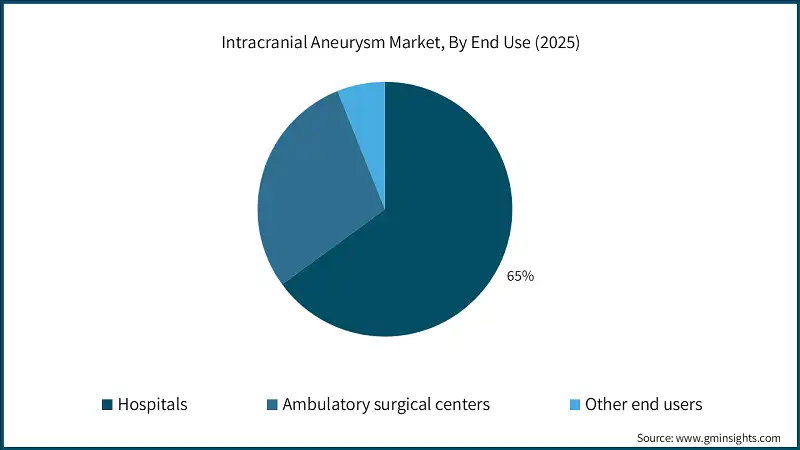

Based on end use, the intracranial aneurysm market is classified into hospitals, ambulatory surgical centers, and other end users. The hospitals segment dominated the market with a revenue share of 65% in 2025 and is expected to reach USD 2.5 billion within the forecast period.

- Hospitals experience high patient inflow due to increasing cases of subarachnoid hemorrhage, ruptured aneurysms, and acute neurovascular emergencies. As the burden of hypertension, smoking, and ageing rises, more patients present with aneurysm-related complications. This drives greater need for hospital-based, immediate intervention capabilities.

- Hospitals offer neurosurgeons, neurointerventionalists, intensivists, and trained imaging specialists under one roof, enabling coordinated management of high-risk aneurysm cases. Their 24/7 emergency and critical care capability makes hospitals the primary site for ruptured aneurysm treatment. This integrated care model strengthens their dominance in the market.

- The ambulatory surgical centers segment accounted for significant revenue in 2025 and is anticipated to grow at a CAGR of 9.7% over the forecast period. A rising shift toward outpatient neurovascular care, supported by faster patient recovery, lower procedural costs, and improved minimally invasive techniques, is driving greater utilization of ambulatory surgical centers for selected aneurysm cases.

Looking for region specific data?

North America Intracranial Aneurysm Market North America dominated the market with the highest market share of 41.7% in 2025. Europe market accounted for USD 410.8 million in 2025 and is anticipated to show lucrative growth over the forecast period. The Asia Pacific market is anticipated to grow at the highest CAGR of 10.6% during the analysis timeframe. The Latin America market is experiencing robust growth over the analysis timeframe. The Middle East & Africa (MEA) market is experiencing robust growth over the analysis timeframe. The market is competitive, with several global and regional players focusing on product innovation, strategic collaborations, and geographic expansion to strengthen their market positions. Companies are investing heavily in research and development to introduce advanced endovascular devices such as flow-diverter stents, intrasaccular implants, and next-generation coils that offer higher efficacy and improved safety profiles. Key players include Johnson & Johnson, Medtronic, Stryker, MicroPort, and TERUMO, collectively accounting for 68.5% of the total market share. Market players are also adopting strategies such as mergers and acquisitions, partnerships with hospitals, and clinical collaborations to expand their product portfolios and enhance market penetration. The focus on minimally invasive procedures, coupled with increasing adoption of advanced imaging technologies, is driving intense competition among manufacturers. Additionally, emerging players in Asia Pacific and Latin America are leveraging cost-effective innovations to capture regional demand, further intensifying the competitive landscape and fuelling global market growth. A few of the prominent players operating in the intracranial aneurysm industry include: It offers a comprehensive neurovascular portfolio through Cerenovus, including coils, stents, and flow diverters, supported by strong clinical evidence and global physician training programs. Its integrated solutions enhance procedural efficiency and patient outcomes. Leverages a broad global distribution network and advanced neurovascular devices, including flow diverters and intrasaccular systems, backed by continuous R&D and surgeon education. This strengthens adoption across complex aneurysm cases worldwide. Provides innovative surgical and endovascular solutions with a focus on minimally invasive technologies and precision-guided systems. Its emphasis on integrated imaging and procedural support enhances safety and efficacy in aneurysm interventions.Europe Intracranial Aneurysm Market

Asia Pacific Intracranial Aneurysm Market

Latin America Intracranial Aneurysm Market

Middle East & Africa Intracranial Aneurysm Market

Intracranial Aneurysm Market Share

Intracranial Aneurysm Market Companies

Intracranial Aneurysm Industry News:

The intracranial aneurysm market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Treatment Type

- Endovascular coiling

- Surgical clipping

- Flow diverters

- Other treatment types

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the intracranial aneurysm market?

Prominent players include B. BRAUN, Balt Group, INTEGRA, Johnson & Johnson, Medtronic, MicroPort, MIZUHO, Penumbra, Peter LAZIC, and phenox.

What was the revenue share of the hospitals segment in 2025?

The hospitals segment dominated the market with a revenue share of 65% in 2025 and is expected to reach USD 2.5 billion during the forecast period.

Which region led the intracranial aneurysm market in 2025?

North America led the market with a 41.7% share in 2025, driven by advanced healthcare infrastructure and high adoption of innovative treatment technologies.

What are the key trends in the intracranial aneurysm industry?

Key trends include the rapid adoption of intrasaccular and flow-diverter technologies, increasing use of AI and advanced imaging for early detection, and the growing preference for minimally invasive endovascular procedures.

What was the market share of the endovascular coiling segment in 2025?

The endovascular coiling segment held a significant market share of 66.7% in 2025, driven by its minimally invasive nature and favorable clinical outcomes. It is projected to exceed USD 2.7 billion by 2035, growing at a CAGR of 9.2%.

What is the projected value of the intracranial aneurysm market by 2035?

The market is expected to reach USD 4 billion by 2035, fueled by technological innovations, rising prevalence of intracranial aneurysms, and growing preference for minimally invasive procedures.

What was the market size of the intracranial aneurysm market in 2025?

The market size was valued at USD 1.6 billion in 2025, with a CAGR of 9.1% expected through 2035, driven by advancements in minimally invasive neurovascular devices and increasing adoption of endovascular treatments.

Intracranial Aneurysm Market Scope

Related Reports