Home > Healthcare > Pharmaceuticals > Disease Specific Drugs > Infertility Drugs Market

Infertility Drugs Market Analysis

- Report ID: GMI5892

- Published Date: May 2023

- Report Format: PDF

Infertility Drugs Market Analysis

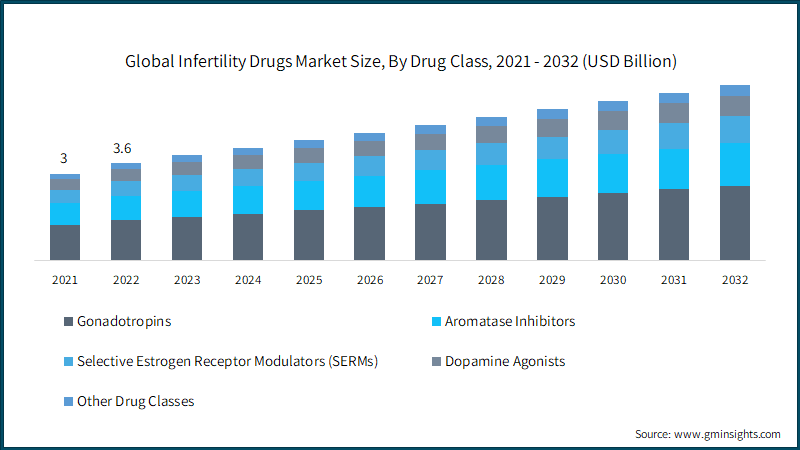

By drug class, the infertility drugs market is classified into gonadotropins, aromatase inhibitors, selective estrogen receptor modulators (serms), dopamine agonists, and other drug classes. The gonadotropins segment accounted for 41.5% of the market share in 2022 and is projected to witness robust growth over the analysis timeframe. Growing demand for assisted reproductive technologies (ART) such as in-vitro fertilization (IVF) services and intrauterine insemination (IUI), where gonadotrophins play a crucial role will supplement the segment share. Moreover, advancements in technology and research are leading to the development of more refined and targeted gonadotrophin formulations.

Based on route of administration, the infertility drugs market is segmented into parenteral, oral, and topical. The parenteral route of administration is expected to register around USD 3.6 billion by 2032. The parenteral route includes injections and intravenous infusion, which offers direct and rapid delivery of infertility drugs into the bloodstream. This ensures more efficient and predictable absorption of the drugs, resulting in faster onset of action and improved treatment outcomes. Therefore, healthcare professionals and patients are increasingly opting for parenteral administration for infertility drugs, thereby propelling market trends. Moreover, the parenteral route of administration allows for precise dosing and individualized treatment regimens, thereby augmenting the market size.

By gender, the infertility drugs market is segmented into female and male. The female segment accounted for significant market revenue in 2022 and is expected to grow at 6.1% during the forecast period. One of the key drivers for the market is the rise in female infertility occurrences. For instance, according to the Centers for Disease Control and Prevention (CDC), in the U.S., among married women aged 15 to 49 years with no prior births, about 1 in 5 (19%) are unable to get pregnant after one year of infertility. Also, about 1 in 4 (26%) women in this group have difficulty getting pregnant or carrying a pregnancy to term (impaired fecundity). Thus, increasing female infertility will accelerate the segmental growth. Moreover, increasing prevalence of Polycystic Ovary Syndrome (PCOS) among women are also anticipated to boost the segment growth.

The distribution channel in infertility drugs market is divided into hospital pharmacies, specialty & retail pharmacies, and online pharmacies. Hospital pharmacies accounted for USD 2 billion market revenue in 2022. Increasing prevalence of infertility coupled with rising healthcare awareness will fuel the demand for specialized medications. Hospital pharmacies, with their comprehensive range of infertility drugs, are well-positioned to meet this demand and ensure their availability within the hospital setting, thereby boosting the segment trends. Additionally, the advanced pharmaceutical infrastructure and expertise of hospital pharmacies, including compounding capabilities, allow for personalized and tailored treatments, further contributing to their growth in this segment.

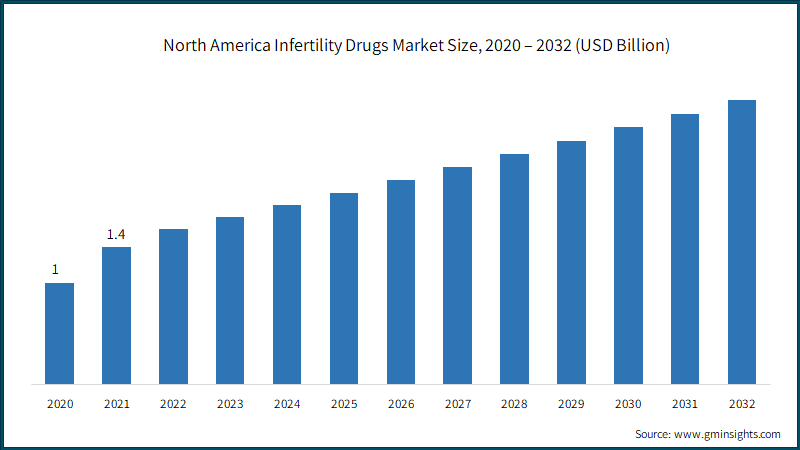

North America infertility drugs market accounted for 43% business share in 2022 and is anticipated to grow at considerable growth rate during the forecast timeframe. Increasing adoption of a sedentary lifestyle by both women and men will accelerate the market expansion. For instance, as per CDC report, in 2021, nearly 12 of every 100 U.S. adults aged 18 years or older (11.5%), accounting 28.3 million adults currently smoke cigarettes. The report also stated that, one of the main causes of hormonal imbalance, polycystic ovarian disease, and weight problems, which have an immediate influence on the embryo and result in infertility concerns, is a sedentary lifestyle.

Therefore, growing adoption of sedentary lifestyle will foster the market outlook. Further, the market for infertility drugs in the region is expanding because of several factors including a high concentration of market players, mergers and collaborations among significant players, and an increase in the number of infertility and PCOS cases.