Summary

Table of Content

Infection Control Supplies Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Infection Control Supplies Market Size

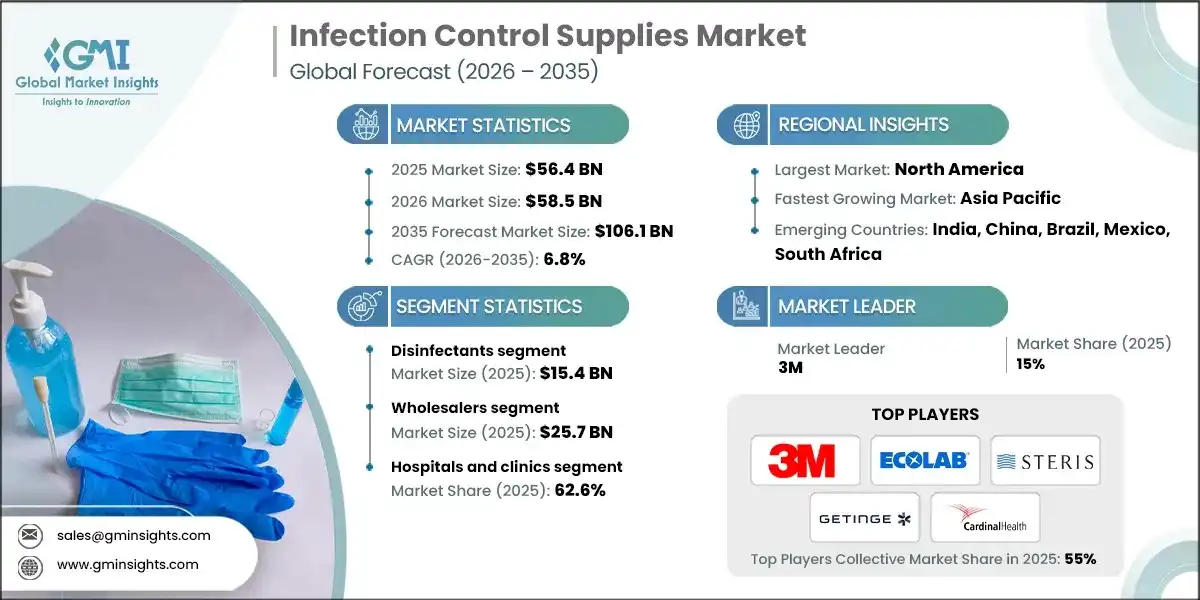

The global infection control supplies market was valued at USD 56.4 billion in 2025 and is projected to grow from USD 58.5 billion in 2026 to USD 106.1 billion by 2035, expanding at a CAGR of 6.8%, according to the latest report published by Global Market Insights Inc. This steady growth is driven by the increasing prevalence of healthcare-associated and infectious diseases, rising infection prevention and control initiatives worldwide, and technological advancements in automated disinfection systems and personal protective equipment.

To get key market trends

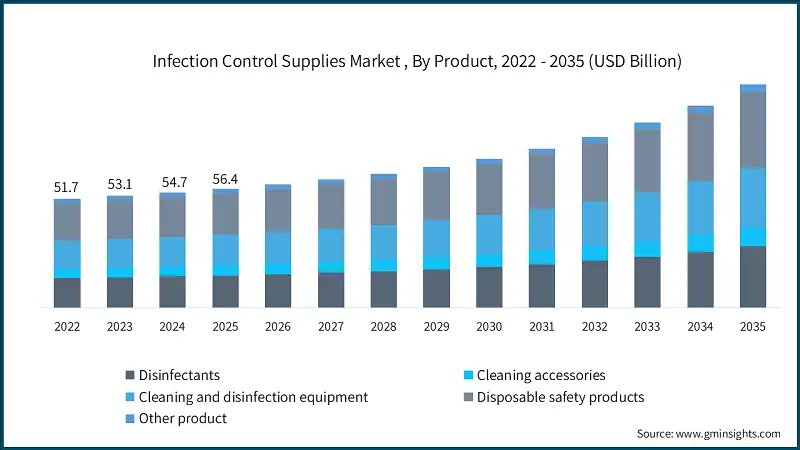

The market increased from USD 51.7 billion in 2022 to USD 54.7 billion in 2024. Growing prevalence of chronic diseases is a major driver for the infection control supplies market. Many chronic conditions like cancers, diabetes, and cardiovascular diseases require regular visits and operations at the hospital, creating a high risk of acquiring HAIs as a result of frequent exposure and contact with the hospital environment. Individuals undergoing or receiving treatments like chemotherapy or dialysis have weak immunity, making it easy for the body to contract infections through contact with infected equipment or healthcare providers. According to the World Health Organization, “At least 43 million deaths were due to noncommunicable diseases (NCDs) in 2021, accounting for 75% of all deaths not attributable to the pandemic.

A staggering 18 million people died before the age of 70 years due to an NCD.” This growing global trend underlines the increased risk associated with chronic illnesses and the risk of acquiring infections within the health centers. This has led to a growing demand for the equipment mentioned earlier, which must continuously provide aseptic conditions free from cross-contamination.

Additionally, due to the increase and growth in the surgical and intensive care units across the globe as a result of the increase in chronic illness complications, the utilization of modern transportation systems for infection control, such as automated washer-disinfectors, UV-C technology, and surface-disinfectants. In conclusion, the rising burden of chronic diseases amplifies infection risk in healthcare settings, making infection control supplies an indispensable component of modern patient safety protocols.

Besides that, the increase in the geriatric population base is driving the infection control supplies market. Elderly patients have low immune systems, their hospitalization rates are higher, and chronic conditions are on the rise in the population, which require invasive procedures and increase the risk of HAIs. According to WHO, by 2030, 1 in 6 people in the world will be aged 60 years or over, and the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion. The rise in this trend will increase the demand for infection prevention measures in hospitals, long-term care, and home healthcare greatly.

Older patients have a high chance of infections from contaminated surfaces, instruments, and healthcare workers if they are undergoing surgeries, dialysis treatment, or ICUs. Due to this, there will be a sharp increase in demand for disinfectants, sterilization systems, and PPE in order to keep conditions aseptic and to avoid cross-contamination. Moreover, healthcare systems around the globe are taking several initiatives in providing protective technologies for this increasing segment of patients. Conclusion: Increased geriatric population amplifies the risks of infections, thereby making infection control supplies a required component of effective service delivery.

Infection control supplies are products and equipment designed to prevent, reduce, and eliminate the risk of healthcare-associated infections (HAIs) and cross-contamination in medical and non-medical settings. They work by creating sterile environments, ensuring aseptic handling of instruments, and protecting healthcare personnel and patients from pathogens.

Infection Control Supplies Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 56.4 Billion |

| Market Size in 2026 | USD 58.5 Billion |

| Forecast Period 2026-2035 CAGR | 6.8% |

| Market Size in 2035 | USD 106.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Surge in healthcare-associated infections (HAIs) | Healthcare-associated infections (HAIs) and surgical site infections increase demand for disinfectants, sterilization equipment, and PPE to maintain compliance with CDC and WHO guidelines. |

| Rising geriatric population base | Older adults have weakened immunity and require frequent hospital visits and invasive procedures, increasing infection risk. |

| Growing prevalence of chronic diseases | Chronic conditions such as cancer, diabetes, and cardiovascular diseases lead to higher hospitalization and surgical volumes, amplifying infection risk and boosting demand for disinfectants, PPE, and sterilization systems. |

| Increasing public health awareness | Post-pandemic awareness campaigns and government initiatives promote hygiene compliance, accelerating adoption of hand disinfectants, surface cleaners in healthcare and community settings. |

| Pitfalls & Challenges | Impact |

| Lack of awareness regarding infection control and prevention | In low-resource settings, limited knowledge among healthcare workers and patients reduces adherence to hygiene protocols, hindering market penetration. |

| Insufficient knowledge related to hygienic conditions | Poor training and inadequate monitoring systems in smaller facilities lead to improper use of disinfectants impacting effectiveness and compliance. |

| Opportunities: | Impact |

| Expansion of outpatient and ambulatory care facilities | Rising surgical volumes in ASCs and clinics require cost-effective infection control supplies, opening new revenue streams. |

| Market Leaders (2025) | |

| Market Leaders |

15% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Infection Control Supplies Market Trends

- Technological developments in infection control products are a major driver for the growth of the infection control market. With the advent of faster and more efficient methods for infection control in advanced hospitals, the demand for infection-free practices and products is increasing to ensure the safety of patients. Technological developments in infection control products are helping to change labor-intensive infection control practices into efficient and technological practices.

- Robust, high-efficiency devices that reduce the potential for error, improve compliance, and facilitate the integration of data in real time are essential in hospitals, ambulatory surgery centers, and long-term care institutions. With the increased threat of infection due to the volume of procedures and the prevalence of older patients, the demand for sophisticated technology that offers greater effectiveness and efficiency has also increased.

- Further, innovations related to sustainability are on the rise. The industry is seeing the production of biodegradable gloves, gowns, and packaging made from plant-based polymers such as cornstarch, sugarcane, and other materials.

- Environmentally responsible materials promote sustainability and safety. These materials are well aligned with the goal of making the healthcare environment more sustainable. This shift is also opening new market development prospects for suppliers.

- For instance, UV-C disinfection systems from leading players such as Tru-D Smart UVC demonstrate advanced automation and efficacy. These systems deliver rapid, no-touch disinfection cycles, reducing manual labor and improving turnaround times in operating rooms and isolation wards.

- As a result, technological advancements are transforming infection control supplies from basic consumables into integrated, smart solutions. These innovations improve safety, speed, and sustainability. The future of infection control lies in combining advanced disinfection technologies, eco-friendly materials, and intelligent monitoring systems to create safer healthcare environments worldwide.

Infection Control Supplies Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is segmented into disinfectants, cleaning accessories, cleaning and disinfection equipment, disposable safety products and other products. The disinfectants segment was valued at USD 15.4 billion in 2025 and held a significant market share of 27.2%. The disinfectants segment was further segmented into product type, formulation and EPA classification.

- The growing prevalence of infectious diseases such as tuberculosis, influenza, and COVID-19 has significantly increased the need for effective disinfectants worldwide. For instance, according to WHO, a total of 1.23 million people died from tuberculosis in 2024, including 150,000 among people with HIV. Globally, TB remains the leading cause of death from a single infectious agent and ranks among the top 10 causes of death.

- Such alarming statistics underscore the critical need for stringent infection prevention measures, driving demand for disinfectants across hospitals, clinics, and outpatient facilities. Rising awareness about personal hygiene and regulatory guidelines from agencies such as the EPA, CDC, and WHO further reinforce this trend.

- Industry players are innovating with accelerated hydrogen peroxide formulations, sporicidal wipes, and eco-friendly disinfectants to meet evolving regulatory standards and sustainability goals. Additionally, smart dispensing systems and compliance monitoring technologies are also being integrated.

- In conclusion, disinfectants remain the first line of defense against pathogens, and their demand will continue to rise with increasing infection risks, surgical volumes, and global health awareness. This segment’s growth is further supported by technological advancements and regulatory mandates aimed at improving patient safety.

Based on distribution channels, the infection control supplies market is segmented into wholesalers, retailers, pharmacies, e-commerce and other distribution channels. The wholesalers segment was valued at USD 25.7 billion in 2025.

- Wholesalers act as the primary link between manufacturers and institutional buyers, ensuring uninterrupted availability of essential supplies such as disinfectants, cleaning accessories, sterilization equipment, and personal protective equipment (PPE). Their ability to offer bulk purchasing options, competitive pricing, and efficient logistics makes them the preferred channel for large healthcare facilities that require consistent stock for infection prevention programs.

- The dominance of wholesalers is further supported by group purchasing organizations (GPOs) and centralized procurement systems in hospitals, which rely on wholesale distributors for cost optimization and compliance with regulatory standards. Leading players in this segment often provide value-added services such as inventory management, automated replenishment, and digital ordering platforms, enhancing operational efficiency for healthcare providers.

- Additionally, wholesalers are expanding their capabilities by integrating cold chain logistics for temperature-sensitive products, offering customized delivery schedules, and adopting digital procurement solutions to streamline transactions. These advancements position wholesalers as indispensable partners in infection control supply chains, especially in regions with large hospital networks and high surgical volumes.

Learn more about the key segments shaping this market

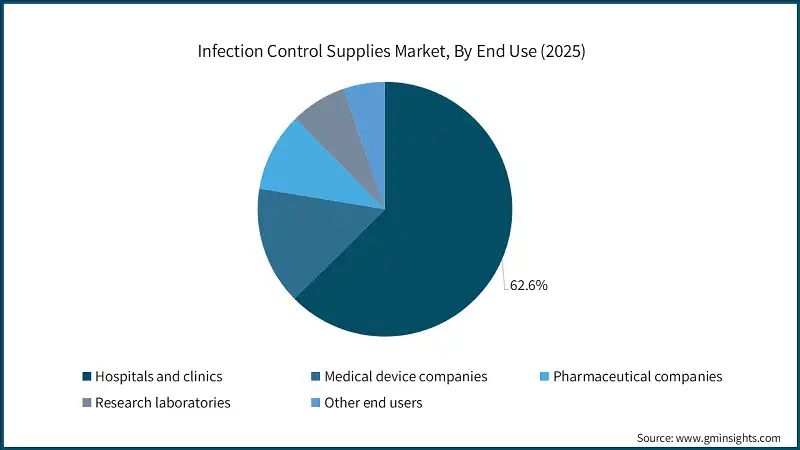

Based on end use, the infection control supplies market is segmented into hospitals and clinics, medical device companies, pharmaceutical companies, research laboratories and other end users. The hospitals and clinics segment held a significant market share of 62.6% in 2024.

- This dominance is driven by high patient volumes, frequent surgical procedures, and the need to prevent healthcare-associated infections (HAIs) such as surgical site infections, catheter-associated urinary tract infections, and ventilator-associated pneumonia.

- Stringent regulatory requirements and accreditation standards have amplified the demand for infection control products in hospital settings. Compliance with guidelines from organizations such as the Centers for Disease Control and Prevention (CDC), Occupational Safety and Health Administration (OSHA), and The Joint Commission necessitates the use of sterilization wraps, disinfectants, PPE, and advanced hand hygiene solutions.

- The growing complexity of care delivery and the rise in immuno-compromised patient populations have increased reliance on advanced infection prevention technologies. Hospitals are adopting automated disinfection systems, antimicrobial coatings, and single-use surgical instruments to minimize cross-contamination risks.

- As surgical volumes and critical care admissions continue to rise globally, hospitals and clinics will remain the primary consumers of infection control supplies. Investments in infection prevention infrastructure and technology integration will further strengthen this segment’s leadership in the market.

Looking for region specific data?

North America Infection Control Supplies Market

- The North America region accounted for 42.5% of the market in 2024. North America continues to dominate the market, supported by its advanced healthcare infrastructure, high awareness levels, and stringent regulatory frameworks.

- A major growth driver is the increasing prevalence of healthcare-associated infections (HAIs) and the rising number of surgical procedures across the region.

- For example, the Centers for Disease Control and Prevention (CDC) estimates that HAIs affect approximately 1 in 31 hospitalized patients in the U.S., underscoring the critical need for effective infection prevention measures in hospitals and clinics.

- Additionally, strong regulatory oversight by agencies such as the CDC, OSHA, and FDA, combined with favorable reimbursement policies, is driving consistent demand for infection control products. Government initiatives promoting infection prevention programs further strengthen market growth.

- With continuous innovation, robust clinical standards, and expanding healthcare infrastructure, North America is expected to maintain its leading position in the market throughout the forecast period.

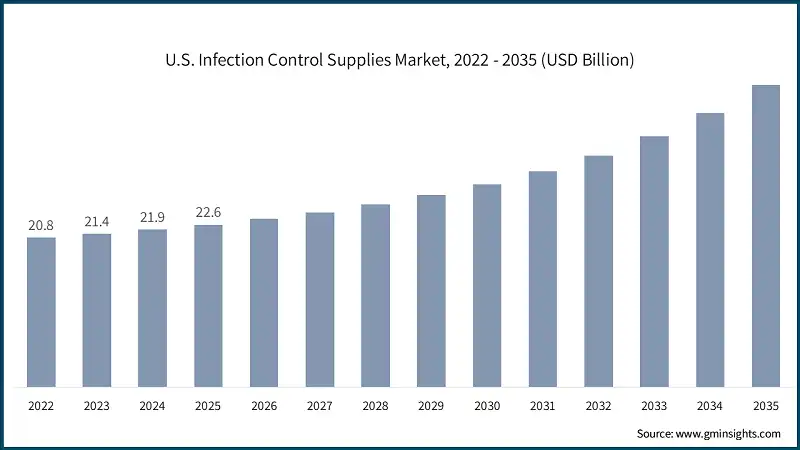

The U.S. infection control supplies market was valued at USD 20.8 billion and USD 21.4 billion in 2022 and 2023, respectively. The market size reached USD 22.6 billion in 2025, growing from USD 21.9 billion in 2024.

- According to the Centers for Disease Control and Prevention (CDC), each day approximately 1 in 43 nursing home residents’ contracts at least one infection associated with their healthcare. This alarming statistic underscores the urgent need for robust infection prevention measures and improvements in patient care practices across U.S. healthcare facilities.

- The growing prevalence of healthcare-associated infections (HAIs), coupled with high surgical volumes and an aging population, has significantly increased the demand for advanced infection control solutions in the U.S. Hospitals, clinics, and long-term care facilities rely on sterilization products, disinfectants, and hand hygiene systems to ensure compliance with stringent safety standards and reduce infection risks.

- The U.S. leads in both usage and development of infection control technologies due to its advanced healthcare infrastructure, high patient volumes, and continuous investment in hospital safety and automation.

- As healthcare systems prioritize infection prevention and regulatory compliance, the adoption of advanced infection control supplies continues to accelerate, driving market growth. With strong clinical expertise, robust regulatory frameworks, and ongoing technological innovation, the U.S. is expected to maintain its dominant position in the market throughout the forecast period.

Europe Infection Control Supplies Market

Europe market accounted for USD 15.2 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- According to the European Centre for Disease Prevention and Control (ECDC), more than 3.5 million cases of healthcare-associated infections (HAIs) occur annually in the European Union and European Economic Area (EU/EEA). This alarming figure underscores the critical need for robust infection prevention measures across hospitals, clinics, and long-term care facilities.

- The growing burden of HAIs, combined with high surgical volumes and aging populations, has significantly increased demand for advanced infection control solutions in Europe. Healthcare providers rely on sterilization products, disinfectants, and hand hygiene systems to comply with stringent EU regulatory standards and improve patient safety.

- Government-backed initiatives and strong regulatory frameworks further support market growth by promoting infection prevention programs and mandating compliance with strict hygiene protocols. Investments in healthcare infrastructure and infection control technologies continue to rise across major European countries.

- With continuous innovation, regulatory emphasis, and increasing healthcare investments, Europe is expected to maintain a significant share in the global market throughout the forecast period.

Germany's infection control supplies market is projected to experience steady growth between 2026 and 2035.

- Germany’s population aged 65 and older is projected to grow by 41% to reach 24 million by 2050, accounting for nearly one-third of the total population. This demographic shift significantly increases the demand for infection prevention measures, as older adults are more vulnerable to healthcare-associated infections (HAIs) and require frequent medical interventions.

- The growing aging population, combined with high surgical volumes and chronic disease prevalence, is driving the adoption of advanced infection control solutions in Germany. Hospitals, clinics, and long-term care facilities rely on sterilization products, disinfectants, and hand hygiene systems to maintain compliance with strict hygiene standards and protect high-risk patients.

- With an aging population, stringent regulations, and continuous technological advancements, Germany is expected to remain a key contributor to the European market throughout the forecast period.

Asia Pacific Infection Control Supplies Market

The Asia Pacific region is projected to show a lucrative growth of about 7.5% during the forecast period.

- Population ageing is advancing rapidly across the WHO South-East Asia Region, where the proportion of older people aged 60 years and above is expected to increase from 12.2% in 2024 to 22.9% by 2050. In 2016, approximately 12.4% of the population in the region was 60 years or older, but this is projected to rise to more than a quarter or 1.3 billion people by 2050. This demographic shift significantly increases vulnerability to infections and drives demand for robust infection prevention measures in healthcare settings.

- The growing aging population, combined with rising surgical volumes and chronic disease prevalence, is accelerating the adoption of advanced infection control solutions across Asia Pacific. Hospitals, clinics, and long-term care facilities are investing in sterilization products, disinfectants, PPE, and hand hygiene systems to reduce healthcare-associated infections (HAIs) and comply with international safety standards

- With a rapidly aging population, expanding healthcare infrastructure, and continuous technological advancements, Asia Pacific is expected to emerge as one of the fastest-growing regions in the market throughout the forecast period.

China infection control supplies market is poised to witness lucrative growth between 2026 - 2035.

- China’s aging population is expanding at an unprecedented rate, with people aged 60 and above projected to account for 28% of the population by 2040. By 2019, there were already 254 million older adults, and this figure is expected to reach 402 million by 2040. This demographic trend is creating significant pressure on healthcare systems to strengthen infection prevention measures, particularly in hospitals and eldercare facilities.

- The surge in long-term care facilities and nursing homes across China is driving demand for infection control supplies. These settings face heightened risks of cross-contamination and outbreaks, making sterilization products, advanced disinfectants, and protective equipment indispensable.

- China’s healthcare modernization initiatives, including the expansion of tertiary hospitals and specialized surgical centers, are accelerating the adoption of high-performance infection control technologies. This includes advanced sterilization units, disposable surgical instruments, and integrated hygiene monitoring systems.

- Government policies such as the “Healthy China 2030” plan emphasize infection prevention and hospital safety as national priorities. These initiatives are backed by increased healthcare spending and stricter compliance requirements, creating strong growth opportunities for infection control product manufacturers.

Latin America Infection Control Supplies Market

Brazil is experiencing significant growth in the market

- The growth of Brazil’s market is strongly driven by demographic shifts, particularly the rapid aging of its population, alongside rising healthcare demand and modernization of medical infrastructure.

- Brazil only became an “aging” society in 2012, but the share of its population aged 65 and older is projected to triple by 2050, significantly increasing vulnerability to healthcare-associated infections and chronic conditions.

- Hospitals and long-term care facilities are expanding infection prevention protocols to protect older adults, who are more susceptible to complications from infectious diseases. This trend is fuelling demand for advanced sterilization products, disinfectants, and protective equipment.

- With the integration of smart infection control systems and cloud-based compliance tracking, Brazil is strengthening its healthcare resilience and supporting patient safety, ensuring sustained market growth.

Middle East and Africa Infection Control Supplies Market

- Saudi Arabia is steadily increasing its healthcare investments, driven by Vision 2030 initiatives that prioritize modernizing hospitals, laboratories, and infection prevention infrastructure. The government is allocating significant resources to improve patient safety and reduce healthcare-associated infections (HAIs) across public and private facilities.

- These initiatives create a strong foundation for adopting advanced infection control solutions, including sterilization products, disinfectants, and personal protective equipment (PPE). Hospitals and diagnostic laboratories are implementing stringent infection prevention protocols to comply with international standards such as WHO and GCC guidelines.

- Higher healthcare spending accelerates the adoption of innovative technologies, such as automated sterilization systems, antimicrobial coatings, and smart monitoring tools. These advancements support infection control in critical areas such as surgical suites, intensive care units, and high-volume diagnostic centers, ensuring better patient outcomes and reducing cross-contamination risks.

Infection Control Supplies Market Share

- Leading companies in the market are actively strengthening their global footprint through strategic initiatives such as acquisitions, partnerships, and technology-driven collaborations. These efforts aim to secure long-term growth and address the rising demand for infection prevention solutions across healthcare settings. Top 5 players, 3M, Ecolab, Steris, Getinge, and Cardinal Health collectively hold a market share of approximately 55% in the global market.

- Their product portfolios encompass a wide range of advanced infection prevention solutions, including sterilization systems, surgical drapes and gowns, disinfectants, and personal protective equipment (PPE). By integrating automation, sustainability, and compliance features, these companies are enabling hospitals and laboratories to achieve higher standards of hygiene, reduce healthcare-associated infections (HAIs), and streamline sterile processing workflows.

- Close collaboration with hospitals, surgical centers, and regulatory authorities remains central to their strategy, ensuring adherence to stringent infection control protocols and global quality standards. At the same time, these players are expanding their reach in emerging markets and supporting healthcare infrastructure modernization, making infection prevention solutions more accessible worldwide.

- Through continuous innovation, these companies are redefining infection control practices, enhancing patient safety, reducing operational risks, and improving efficiency in healthcare environments. Their commitment to reliability, scalability, and evidence-based practices is shaping modern infection prevention protocols and supporting sustainable healthcare ecosystems globally.

Infection Control Supplies Market Companies

Few of the prominent players operating in the infection control supplies industry include:

- 3M

- Advanced Sterilization Products (ASP)

- Belimed Deutschland GmbH (Metal Zug Group)

- Cardinal Health

- Cantel Medical

- Dentsply Sirona

- Ecolab

- Envista Holdings Corporation

- Getinge

- Henry Schein

- Kimberly-Clark Corporation

- Matachana Group

- Reckitt

- Steelco

- Steris

- Getinge

The company emphasizes workflow optimization and automation, enabling hospitals to achieve high standards of hygiene and patient safety. Getinge’s strong focus on compliance with international regulations and its investment in advanced sterilization technologies position it as a trusted partner for infection prevention in surgical and critical care environments.

Cardinal Health is a major player in infection prevention, offering a broad portfolio of surgical drapes, gowns, surgical gloves, and PPE designed for clinical and surgical settings. The company prioritizes reliability and scalability, supporting high-volume healthcare environments with cost-effective solutions. Cardinal Health’s commitment to quality and supply chain efficiency strengthens its role in reducing healthcare-associated infections (HAIs) and improving patient safety globally.

3M is recognized worldwide for its leadership in personal protective equipment and sterilization assurance products. The company focuses on innovation in respiratory protection, barrier materials, and sterilization monitoring, ensuring compliance with global safety standards. By integrating advanced material science and ergonomic design, 3M delivers solutions that enhance comfort and protection for healthcare professionals, making it a preferred choice for infection control in hospitals and laboratories.

Infection Control Supplies Market News:

- In March 2023, Getinge announced the acquisition of 100% of the shares of Ultra Clean Systems Inc., a leading U.S. manufacturer of ultrasonic cleaning technologies. Ultra Clean Systems specializes in advanced ultrasonic cleaning systems used in hospitals and surgery centers to decontaminate surgical instruments, ensuring high standards of infection prevention and patient safety. This acquisition strengthens Getinge’s infection control portfolio by integrating cutting-edge ultrasonic cleaning solutions, enhancing its ability to deliver comprehensive sterile processing workflows for healthcare facilities worldwide.

- In September 2021, Sodexo announced an expanded partnership with Ecolab Inc., the global leader in water, hygiene, and infection prevention solutions, to deliver a new infection prevention offering for hospitals and healthcare facilities across the U.S. The collaboration introduced Sodexo’s Protecta Plus program, which integrates Ecolab’s Bioquell hydrogen peroxide vapor technology to provide an additional layer of protection against healthcare-associated infections (HAIs). This strategic partnership strengthens Sodexo’s infection prevention capabilities and enhances Ecolab’s reach in delivering advanced decontamination solutions to healthcare environments.

The infection control supplies market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Disinfectants

- Product type

- Hand disinfectants

- Surface disinfectants

- Skin disinfectants

- Instrument disinfectants

- Formulation

- Disinfectant wipes

- Liquid disinfectants

- Disinfectant sprays

- EPA classification

- Low-level disinfectants

- Intermediate-level disinfectants

- High-level disinfectants

- Product type

- Cleaning accessories

- Cleaning and disinfection equipment

- Ultrasonic cleaners

- Flusher disinfectors

- UV-ray disinfectors

- Washer disinfectors

- Disposable safety products

- Surgical drapes and gowns

- Face masks

- Goggles

- Gloves

- Covers and closures

- Others disposable safety products

- Other products

Market, By Distribution Channel

- Wholesalers

- Retailers

- Pharmacies

- E-commerce

- Other distribution channels

Market, By End Use

- Hospitals and clinics

- Medical device companies

- Pharmaceutical companies

- Research laboratories

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

How much revenue did the wholesalers segment generate in 2025?

The wholesalers segment generated USD 25.7 billion in 2025, leading among distribution channels.

What was the market share of the hospitals and clinics segment in 2024?

The hospitals and clinics segment held a dominant market share of 62.6% in 2024.

Which region leads the infection control supplies market?

North America led the market with a 42.5% share in 2024, supported by advanced healthcare infrastructure, high awareness levels, and stringent regulatory frameworks.

Who are the key players in the infection control supplies market?

Key players include 3M, Advanced Sterilization Products (ASP), Belimed Deutschland GmbH (Metal Zug Group), Cardinal Health, Cantel Medical, Dentsply Sirona, Ecolab, Envista Holdings Corporation, Getinge, Henry Schein, Kimberly-Clark Corporation, and Matachana Group.

What are the upcoming trends in the infection control supplies industry?

Key trends include technological advancements in infection control products, the adoption of high-efficiency devices, and the integration of real-time data for improved compliance and effectiveness.

What is the market size of the infection control supplies market in 2025?

The market size was USD 56.4 billion in 2025, driven by the increasing prevalence of healthcare-associated infections, infection prevention initiatives, and advancements in disinfection technologies.

What was the valuation of the disinfectants segment in 2025?

The disinfectants segment was valued at USD 15.4 billion in 2025, holding a significant market share of 27.2%.

What is the projected value of the infection control supplies market by 2035?

The market is expected to reach USD 106.1 billion by 2035, growing at a CAGR of 6.8% during the forecast period.

Infection Control Supplies Market Scope

Related Reports