Summary

Table of Content

Industrial Sludge Treatment Chemicals Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial Sludge Treatment Chemicals Market Size

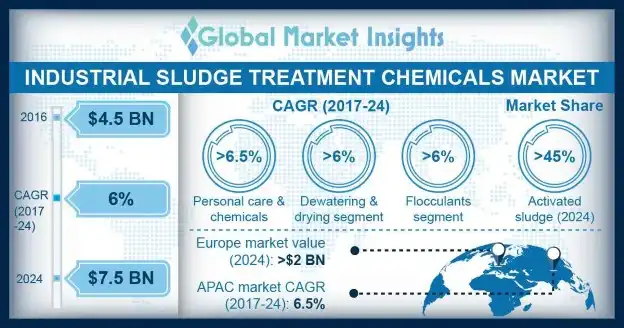

Industrial Sludge Treatment Chemicals Market size was valued at $4.5 billion in 2016 and is expected to reach $7.5 billion by 2024 growing at a CAGR of around 6% from 2017 to 2024. Increasing need for sludge removal will fuel the global market demand in coming years.

To get key market trends

Wastewater treatment process generates huge amounts of industrial sludge. Different industries, especially in the manufacturing sector, release wastewater in large amounts which contain chemical constituents and microorganisms. This water is reduced through various processes to form sludge which further undergoes treatment for volume reduction, stability, and safe disposal. It also helps to minimize the pathogen content in the sludge which renders safe disposal.

Development in new sludge removal technologies such as automated chemostat treatment (ACT), KemiCond process, and extracellular polymers extraction from activated sludge with the help of cation exchange resin will drive the industrial sludge treatment chemicals market share in the forthcoming years. ACT simplifies the process treatment by reducing chemical usage and bio sludge as well as black sludge reduction making it a novel method for sludge treatment.

KemiCond process is further divided into three steps, namely, acidification, oxidation, and flocculation. This enables the dewatering by breaking down the water and retaining structures formed in the sludge. Development of such innovative and cost-effective solutions is likely to propel the industrial sludge treatment chemicals market demand.

Industrial Sludge Treatment Chemicals Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 4.5 Billion (USD) |

| Forecast Period 2017 - 2024 CAGR | 6% |

| Market Size in 2024 | 7.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Increasing development in machinery and other processes for environmental concerns is on a rise owing to government regulations. Improvement and integrated mechanisms in wastewater treatment plants such as uncoupled metabolism, endogenous metabolism, microbial predation, to produce lesser sludge might create hindrance for the industrial sludge treatment chemicals market value in future years.

Industrial Sludge Treatment Chemicals Market Analysis

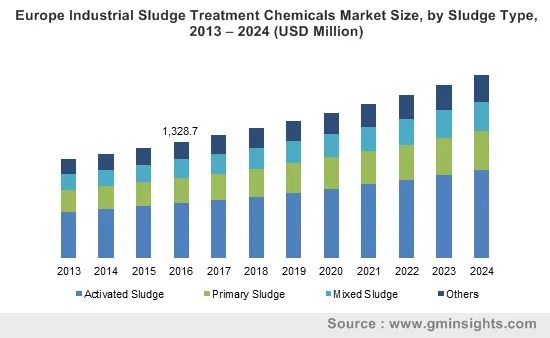

The market is segmented based on sludge type as activated, primary, mixed and other sludges which include tertiary, etc. Activated sludge is nothing but a process of treating waste industrial water by aeration. Activated sludge held a major share in the market and was valued close to $2 billion in 2016.

Unlike activated sludge formed from secondary sewage treatment, primary sludge is formed during the primary sewage treatment and does not require aeration. It is produced through the mechanical wastewater treatment process where the sludge composition depends upon the catchment area. The segment held an industrial sludge treatment chemicals market share of over 20% in 2016 and will grow at a moderate rate.

Based on process treatment, the market has been classified based on process treatment as dewatering & drying, conditioning & stabilization, thickening, and digestion treatments. The dewatering and drying segment will grow at a decent CAGR of over 6% in the coming years.

The conditioning & stabilization process involves long-storage in either specially designed large clarification basins or even process buffer tank depending on the treatment system’s size. The segment, as of 2016, held a major share in the industrial sludge treatment chemicals market and will grow at a significant rate in coming years.

Based on process chemicals, the industrial sludge treatment chemicals market analysis is segmented into four broad categories namely flocculants, coagulants, disinfectants, and others. The others segment includes activated carbon, defoamers, etc. Flocculants are chemicals that help flocculation used in water treatments to improve the filterability or sedimentation of small particles. The segment will hold a major share in future and accounted for close to 35% market share in 2016.

Coagulation is a chemical process that comprises charge neutralization and involves the addition of polymers that cluster the small particles together into larger masses which makes them easily separable from water. The segment was valued at over $1.5 billion and will see exceptional growth in the coming years.

Considering end-user industries, the market is segmented as automotive, oil & gas, metal processing, food & beverages, pulp & paper, personal care & chemicals, electronics, and others. The others segment consists of textile industry, paints & coatings industry, etc. Personal care and chemicals industry will grow at a highest CAGR in the of over 6.5% coming years owing to rising usage of grooming products.

Pulp & paper segment will be the second fastest growing segment in the coming years. Rising food processing and packaging industries coupled with increasing processed food demand will lead the food & beverage segment to capture highest share of industrial sludge treatment chemicals market in the coming years. The segment held a share close to 15% in the market as of 2016.Market, By Region

North America held a major chunk of share in the industrial sludge treatment chemicals market owing to the gradual increasing population coupled with various industries and the increasing water & sewage treatment facilities. The segment is said to grow with a significant rate of over 6% in the future years.

Asia Pacific was said to hold second largest share in the market and will continue to grow at the highest CAGR in the coming timespan. Increasing number of industries producing large amounts of sewage will enhance the industrial sludge treatment chemicals market in the years ahead.

Industrial Sludge Treatment Chemicals Market Share

Prominent players operating in the industrial sludge treatment chemicals industry are :

- BASF

- Accepta

- Kemira

- Suez

- Ovivo

- Ecolab

- Kurita Water Industries

- Beckart Environmental

- Amcon

- Hubbard-Hall

- ITS Group

- Ashland

- Veolia

- AkzoNobel

- SAS Environmental Services.

The companies in this industry are adopting key strategies for product launching in order to expand their business operations in different countries across the world. BASF, one of the popular players in the industrial sludge treatment chemicals market, offers a comprehensive range of water and sludge treatment chemicals. The company recently introduced a range of ultra-high molecular weight cationic flocculants and complements.

Industry Background

Industrial sludge treatment chemicals market will witness significant growth in the coming days owing to the increasing number of industrial activities. Rising manufacturing activities leads to the formation of sludge which will further propel the product market demand. Governments in several nations have initiated and prepared certain guidelines for the recycling of industrial sewage and treatment using environment friendly process chemicals. This in turn will drive the global market in future years.

The industrial sludge treatment chemicals market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2013 to 2024, for the following segments:

By Sludge Type

- Activated sludge

- Primary sludge

- Mixed sludge

- Others

By Process Treatment

- Dewatering & drying treatment

- Conditioning & stabilization treatment

- Thickening treatment

- Digestion treatment

Process Chemicals by End-user

- Flocculants

- Automotive

- Oil & gas

- Metal processing

- Food & beverages

- Pulp & paper

- Personal care & chemicals

- Electronics

- Others

- Coagulants

- Automotive

- Oil & gas

- Metal processing

- Food & beverages

- Pulp & paper

- Personal care & chemicals

- Electronics

- Others

- Disinfectants

- Automotive

- Oil & gas

- Metal processing

- Food & beverages

- Pulp & paper

- Personal care & chemicals

- Electronics

- Others

- Others

- Automotive

- Oil & gas

- Metal processing

- Food & beverages

- Pulp & paper

- Personal care & chemicals

- Electronics

- Others

By End-user

- Automotive

- Oil & gas

- Metal processing

- Food & beverages

- Pulp & paper

- Personal care & chemicals

- Electronics

- Others

The above information will be provided for following regions/countries:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Which are the top companies in the industrial sludge treatment chemicals industry?

BASF, Accepta, Kemira Oyj, SUEZ, Ovivo, Ecolab, Kurita Water Industries Ltd., Beckart Environmental, Inc., Amcon Inc., Hubbard-Hall Inc., ITS Group, Ashland, Veolia, AkzoNobel N.V., SAS Environmental Services are some of the top contributors in the industry.

Which sludge type segment is expected to drive the market during the forecast period?

The activated sludge type segment registered a major market share in 2016 and is projected to record a remarkable growth rate throughout the forecast period.

How much size did the global Industrial Sludge Treatment Chemicals Market register in 2016?

Industrial Sludge Treatment Chemicals Market size was valued at $4.5 billion in 2016

What will be the worth of the Industrial Sludge Treatment Chemicals industry by the end of 2024?

Industrial Sludge Treatment Chemicals Market growing at a CAGR of around 6% from 2017 to 2024

What will be the worth of global industrial sludge treatment chemicals market by the end of 2024?

According to the report published by Global Market Insights Inc., the industrial sludge treatment chemicals business is supposed to attain $7.5 billion by 2024.

What are the key factors driving the market?

Increasing need for sludge removal, growing end-user industries, development of new technologies for sludge removal, and application of sludge as a fertilizer are major factors expected to drive the growth of global market.

Industrial Sludge Treatment Chemicals Market Scope

Related Reports