Summary

Table of Content

Industrial Pumps Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial Pumps Market Size

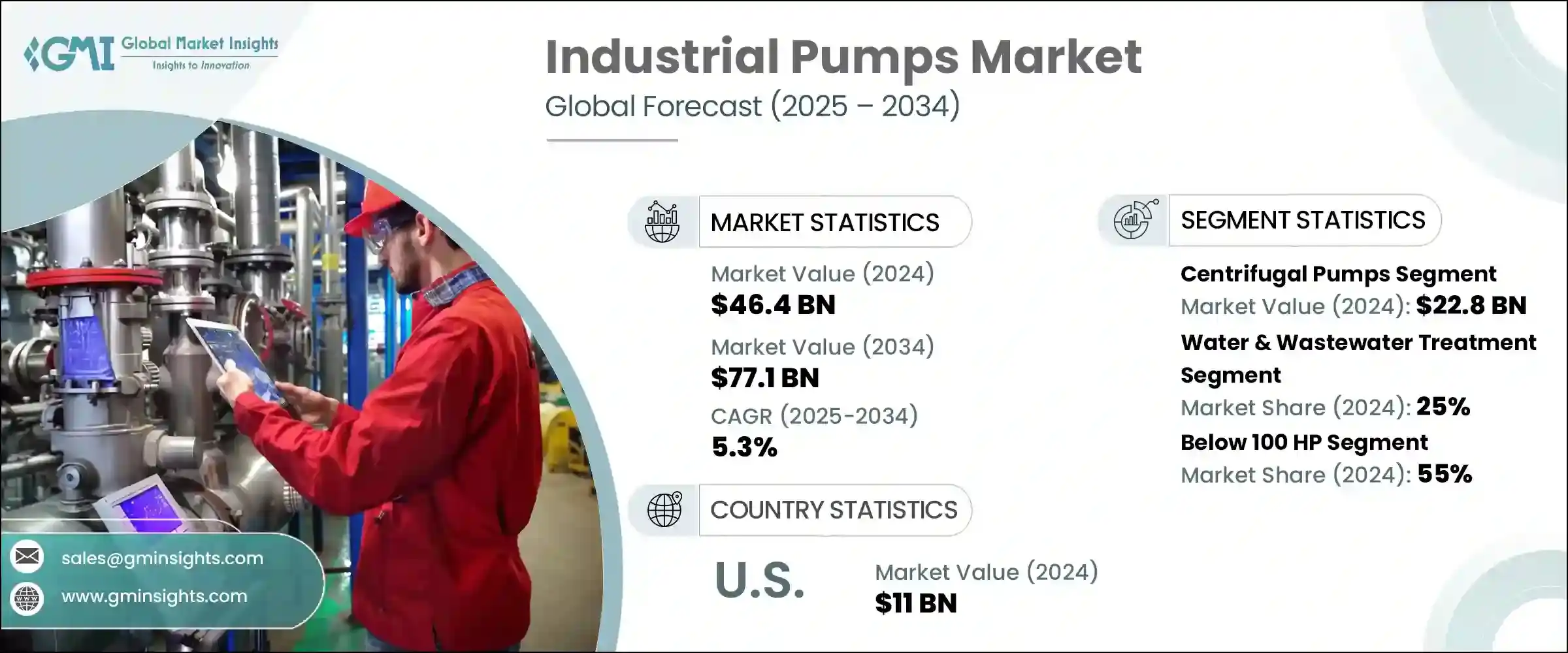

The global industrial pumps market was estimated at USD 46.4 billion in 2024. The market is expected to grow from USD 48.6 billion in 2025 to USD 77.1 billion in 2034, at a CAGR of 5.3%. The market is driven by surging demand from end use industry, advancement in pump technology along with global industrialization and manufacturing expansion.

To get key market trends

Industrial pumps play a key role in the oil and gas sector for the transportation of crude oil, water, and chemicals. While the demand for energy continues to grow globally, this factor also propelling the demand for effective pumping systems in extraction, refining, and transportation activities. As per the National Mining Association in 2023, imports of U.S. minerals totaled almost USD 6 billion, even though there were domestic reserves of USD 6.2 trillion. The mining sector spent USD 11 billion on reclaiming abandoned mines.

Industrial Pumps Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 46.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.3% |

| Market Size in 2034 | USD 77.1 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

According to the U.S. Geological Survey, in 2022, U.S. mines produced nonfuel mineral commodities valued at USD 98.2 billion, and industrial minerals contributed 65% of this value. Crushed stone was the leading nonfuel mineral commodity, accounting for 21% of overall production value. Additionally, the EU mining and quarrying industry's net turnover rose 40% to USD 120 billion in 2021.

The demand for water treatment is growing significantly owing to the rising demand for effective water treatment solutions from various end users. According to the U.S. Environmental Protection Agency (EPA), the average American family of four uses 400 gallons of water per day on average, and approximately 70% of that water is used indoors. According to the Aquasana, a water system company discovered that 77% of Americans filtered their home drinking water in 2022, a consistent risen from 74% in 2021.

Therefore, the management and protection of water resources, fresh & saltwater ecosystems, and the water used for drinking and bathing are one of the cornerstones of environmental protection. For instance, as per the statistical office of the EU, in 2023 Croatia recorded the highest renewable freshwater resources (with a long-term average of 30,000 m³ per inhabitant), followed by Finland (19,900 m³), Latvia (19,400 m³), and Sweden (18,900 m³).

Expanding industrialization within emerging markets like China, India, and Southeast Asia fuels the demand for pumps in manufacturing processes, power stations, and many industrial applications.

Industrial Pumps Market Trends

- Digitization of pumps is one of the most important trends in the industrial pump industry of the future. The Internet of Things (IoT) has enabled pumps to be fitted with sensors and connectivity features, making them capable of collecting and sharing valuable information.

- The application of variable-speed flow controllers is also becoming increasingly popular in different industries. Variable speed flow controllers allow pumps to adjust their speed based on the required flow rate, which results in significant energy savings.

- Grundfos launch of its new generation of large CR pumps in India. Designed with high class efficiency upgrades to provide customers with improved flow performance and pump pressure, the range of CR 185, 215 and 255 caters to a wide range of applications water supply, water treatment and almost all industrial solutions including those for high-pressure, hot, dangerous, flammable, and aggressive liquids.

Industrial Pumps Market Analysis

Learn more about the key segments shaping this market

The industrial pumps market by pump type is segmented into centrifugal pumps, positive displacement pumps, diaphragm pumps, gear pumps, screw pumps and others. In 2024, the centrifugal pumps segment dominates the market generating revenue of USD 22.8 billion and positive displacement pumps segment is expected to grow at CAGR of around 5.3% during the forecast period 2025 to 2034.

- Countries like the United States and Canada have made it a priority to invest in hydraulic fracturing for the oil and gas sector. To achieve their future targets, these countries will require advanced pumps that they can rely on. There is also an increasing necessity to replace the old infrastructure in both countries that will fuel the demand of industrial pumps such as the centrifugal pump.

- Key players are adopting latest techniques and introducing advanced pumps for mining applications to cater to the rising demand. Pumps with variable frequency drives (VFDs) are being launched by manufacturers, enabling mines to adjust pump speed based on demand, lowering energy use and operating costs.

- Miniaturization is the most significant trend in medical technology also for diaphragm pumps. As medical devices trend towards portability and miniaturization, diaphragm pumps are being designed to be implemented in smaller form factors without a loss of their high performance. This is particularly critical for wearables, such as portable insulin pumps, ambulatory oxygen concentrators, and even small infusion pumps for domestic use.

Learn more about the key segments shaping this market

According to the end use industry, the industrial pumps market is segmented into water & wastewater treatment, chemicals and petrochemicals, mining, food and beverages, construction, oil & gas, pharmaceutical, marine, pulp & paper and others. Water & wastewater treatment made up 25% of the market in 2024, due to increasing urbanization and rising need for sustainable water management.

- Population growth and urbanization, particularly in developing countries, are fueling the need for clean water and wastewater treatment. Industrialization and growing water usage in manufacturing processes necessitate more sophisticated water treatment technologies.

- Dewatering pumps also play an important role in mining operations. This type of pump is utilized in mining operations to remove unwanted water from mines to avoid flooding, promote safe mine conditions, and sustain operational effectiveness.

- The development of the Extra High Head (XH) pump is addressing the needs of the mining industry. The Sykes XH250 pump is a major development in dewatering technology. Extra High Head (XH) pump successfully enhanced flow capability and pushed head capabilities, enabling pumps to attain total dynamic heads of up to 220 meters.

According to the power, the industrial pumps market is segmented into below 100 HP, 100 - 500 HP and above 500 HP. Below 100 HP made up 55% of the market in 2024.

- Industrial pumps with power range below 100 HP are often employed in small-scale industrial operations or for particular applications within major industrial operations. Pumps below 100 HP are frequently applied in the processes of dewatering, water transfer, or small-scale slurry management activities across industries.

- Low-capacity power pumps like 100 HP pumps are needed since they provide both a balance in energy usage and output, ensuring they are effective in medium-level industrial operations or activities that only require low volume pumps for their work.

- Pumps between 100-500 HP are utilized for medium to major industrial operations. High power pumps are generally implemented for heavy-duty applications such as slurry pumping and dewatering at large operations.

- Cosmos Pumps introduce newest high-technology Giant Dewatering Pump. It boasts a deep power of 650 HP and a high towering head of 130 meters. The Giant Pump even boasts a high dewatering capacity of 10,00,000 liters per hour. The pump is sure to revolutionize the mining sector at an international level.

Looking for region specific data?

With about 80% of the North American industrial pumps market share and estimated USD 11 billion in revenue, the United States led the market in 2024. The expansion of the U.S. market is primarily driven by advancement in pump technology, surging industrial activities and demand for sustainable water management across the nation.

- The U.S. oil and gas sector, particularly in shale oil extraction, remains a major force behind industrial pump demand. Pumps are employed in oil and natural gas extraction, refining, and transportation, as well as in water management and chemical injection operations.

- The mining sector are central to the U.S. economy, making significant contributions to country GDP, employment, and the manufacture of goods that are essential to a range of industries, such as construction, automotive, aerospace, and technology.

- The U.S. mining industry is one of the largest across the globe, producing a wide range of minerals and metals used both domestically and for export. The sector is engaged in extracting more than 80 different kinds of minerals, ranging from coal to iron ore, copper, gold, and rare earth elements.

- In 2023, the U.S. mining industry added about $85 billion to the country's GDP and directly employed about 400,000 individuals, with far more indirectly supported.

- America is a major producer of major metals such as about 1.2 million metric tons of copper, 5 million ounces of gold, and 38 million metric tons of iron ore on an annual basis.

Europe: Surging end use industry such as water and waste management, chemical and petrochemical along with technological advancement and innovation in pump have contributed to the European industrial pumps market's robust growth. The mining and quarrying sector in the EU generated $182.5 billion of net turnover in 2022, an increase of around 70% compared with the year 2021. There were around 17 000 enterprises operating with mining and quarrying as their main activity in the EU in 2022.

Compared with 2021, the value added generated by mining and quarrying has increased by 71.2%, while in terms of net turnover, the increase was 70.5%, up to $182.5 billion. In 2023, the turnover of the EU's mining and quarrying sector is estimated to be $136.9 billion, i.e. 27.1% below the 2022 value but still 24.3% above the value of 2021 ($120.3 billion).

Industrial Pumps Market Share

- The top five companies in Atlas Copco, Ebara, Gardner Denver, Wilo, Xylem and they collectively hold a share of 20%-25% in the market.

- These companies continue to acquire and merge with others, expand facilities, and make various collaborations to increase their product offerings, access customer bases, and secure their market positions.

- Ingersoll Rand has acquired Air Power Systems Co., LLC, Blutek s.r.l., and UT Pumps & Systems Private Limited for a combined purchase price of approximately $135 million. These acquisitions add more than $50 million in revenue cumulatively acquired at a high-single digit multiple of 2024 estimated Adjusted EBITDA.

- Kracht GmbH, the German manufacturer of external gear pumps, fluid measurement, valves, hydraulic drives and dosing systems, acquired by Atlas Copco Group. The business has become part of Atlas Copco’s Power and Flow Division within the Power Technique business area.

Industrial Pumps Market Companies

Major players operating in the industrial pumps industry are:

- Atlas Copco

- Ebara

- Flowserve

- Gardner Denver

- Gorman-Rupp

- Grundfos

- ITT

- Kirloskar

- KSB

- SPX Flow

- Sulzer

- Tsurumi

- Weir

- Wilo

- Xylem

To improve the services and market share key players are constantly investing in technological activities and are also entering into partnerships to provide improved and better solutions for the customers. These investments are benefiting both companies and customers as they help develop and offer solutions as per the changing technological trends and thus the customer requirements.

Wilo UK has purchased Arfon Rewinds Limited in a deal that expands the business's service capacity in major water management activities such as installation, repair, condition monitoring, and general pump maintenance. Arfon operates two workshops, one for dirty water pumps located in Bromborough and the other for clean water pumps located in Caernarfon.

Grundfos to purchase Culligan's Commercial & Industrial business. The Commercial & Industrial business of Culligan purchased is renowned for their high-quality products, service offerings, innovation and customer orientation. Combined with Grundfos existing water treatment business seeks to form a powerful European water treatment market leader.

Industrial Pumps Industry News

- In March 2025, Flowserve Corporation launched the Innomag TB-MAG Dual Drive Pump, the world’s first seal less pump to eliminate leaks, setting a new standard for safety and environmental protection. The Innomag TB-MAG Dual Drive also has an additional layer of corrosion resistance for handling chemicals due to a non-metallic liner which coats the pump internally.

- In March 2024, Sulzer officially opened an advanced test and assembly facility built alongside its current pump manufacturing facility in Mexico City. The new facility features a 10-meter-deep hydraulics test bed for big pumps, a computerized monitoring system and a dedicated packaging area. Sulzer Mexico's pump plant enhances production capacity for its range of large pumps in order to respond more adequately to growing demand for infrastructure in the Americas.

- In May 2023, Xylem Inc. acquired Evoqua Water Technologies Corp., a move aimed at strengthening its position in the market. The strategic acquisition is critical for Xylem, combining its water technology expertise with Evoqua's cutting-edge water and wastewater treatment technologies. With the acquisition of Evoqua, Xylem considerably strengthens its capacity to deliver upgraded solutions in the water industry.

- In February 2023, Atlas Copco created a new range of multi-purpose electric surface self-priming dewatering pumps with a vast range of applications. The E-Pump series is available in various models with a canopy and open set layout. This multi-purpose solution is perfectly adaptable for most applications such as sewage diversion, in municipality division and building construction sites with access to power supply.

This industrial pump market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Pump Type

- Centrifugal pumps

- Positive displacement pumps

- Diaphragm pumps

- Gear pumps

- Screw pumps

- Others (piston pumps, progressive cavity pumps, etc.)

Market, By Power Source

- Electric & solar pumps

- Diesel pumps

- Others (gasoline solar etc.)

Market, By Flow Rate

- Below 100 m³/h

- 100 - 500 m³/h

- Above 500 m³/h

Market, By Power

- Below 100 HP

- 100 - 500 HP

- Above 500 HP

Market, By Technology

- Conventional

- Smart

Market, By End Use Industry

- Water & wastewater treatment

- Chemicals and petrochemicals

- Mining

- Food and beverages

- Construction

- Oil & gas

- Pharmaceutical

- Marine

- Pulp & paper

- Others (agricultural, textile etc.)

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How much is the U.S. industrial pumps market worth in 2024?

The U.S. market of industrial pumps was worth over USD 11 billion in 2024.

Who are the key players in industrial pumps industry?

Some of the major players in the industry include Atlas Copco, Ebara, Flowserve, Gardner Denver, Gorman-Rupp, Grundfos, ITT, Kirloskar, KSB, SPX Flow, Sulzer, Tsurumi, Weir, Wilo, and Xylem.

What is the size of centrifugal pumps segment in the industrial pumps industry?

The centrifugal pumps segment generated over USD 22.8 billion in 2024.

How big is the industrial pumps market?

The market size of industrial pumps was valued at USD 46.4 billion in 2024 and is expected to reach around USD 77.1 billion by 2034, growing at 5.3% CAGR through 2034.

Industrial Pumps Market Scope

Related Reports