Summary

Table of Content

Industrial Aerators Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial Aerators Market Size

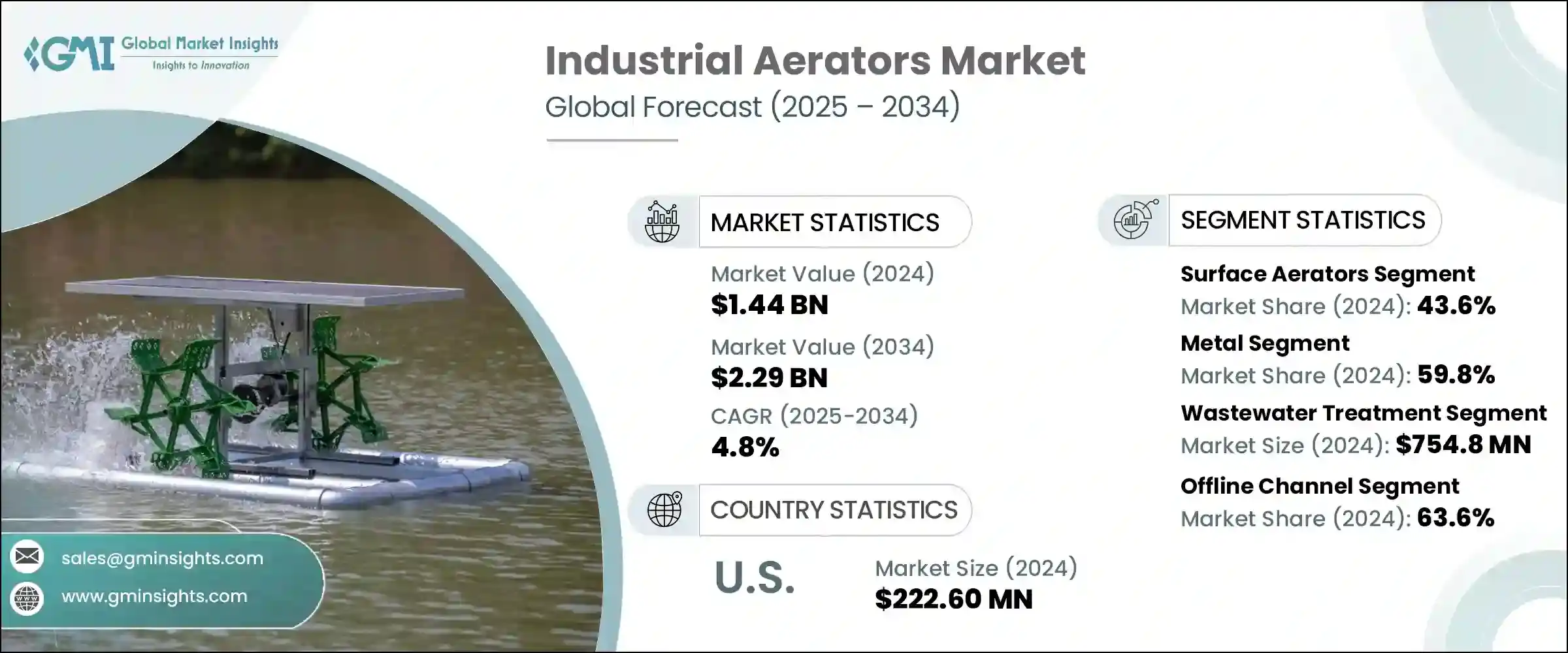

The global industrial aerators market was estimated at USD 1.44 billion in 2024 and projection to grow with CAGR of 4.8% from 2025 to 2034. The global market is growing rapidly with increasing emphasis on wastewater treatment, rising environmental regulations, and expanding industrialization across different economies. Important industries like food & beverage, chemical processing and pharmaceuticals are now using advanced aeration systems to both improve oxygen transfer and make sure their wastewater follows rules.

To get key market trends

Water conservation and circular use are encouraging the use of high-efficiency surface and diffused aerators. Design solutions such as those using less energy, smart electronics and rust proof materials are now used to achieve sustainability objectives. Besides, the combination of the Internet of Things (IoT) and automation in aeration systems helps monitor systems remotely and perform predictive maintenance according to Industry 4.0 standards. Stronger rules for discharge and higher ESG attention are expected to steer the market towards using more environmentally friendly and energy-efficient aeration technologies.

Industrial Aerators Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.44 Billion |

| Forecast Period 2025 – 2034 CAGR | 4.8% |

| Market Size in 2034 | USD 2.29 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The global market for aerators is further boosted by growing applications in both industrial and municipal settings, for example, at sewage and effluent treatment plants, aquaculture operations and during fermentation processes. Increasingly, food processing, pharmaceuticals and petrochemical industries rely on aerators to improve the quality of their discharged water and lower the organic waste within it. For fish to be healthy in aquaculture, enough oxygen must be delivered, so more advanced aerators above and below the water are needed.

Seven out of ten chemicals in the U.S. water treatment market are used by wastewater treatment due to the growing urban population and strict rules for clean water from authorities. The use of energy- and space-saving aerators is on the rise among small and midsize businesses and municipalities, but larger plants still choose high-capacity aerators. Policies by governments in Asia-Pacific that encourage green infrastructure and sustainability are creating fresh chances to expand in the market. Consistent and lasting growth in the world’s aerator market is coming about due to frequent design improvements, linking aerators with digital control and benefits from smart technology.

Industrial Aerators Market Trends

The growing demand for effective, lasting and green water and wastewater treatment is spurring advancements in the world of aerators. To raise oxygen transfer and cut energy use, manufacturers are using variable speed drives, smart sensors and technologies linked to the Internet of Things (IoT) in their systems. Stricter water discharge regulations and the increasing demand for quick monitoring mean aerators are now necessary in municipal wastewater treatment, the food industry, aquaculture, and chemical manufacturing. Taking shape are global goals for sustainability and government-approved Industry 4.0 actions that focus on automating, connecting, and saving energy for factories.

As decentralized treatment is expanding in areas that lack services, more small- and medium-sized businesses and local governments need compact, modular aerators that are convenient to set up and maintain. Leading players in the sector are putting significant money into research and development to improve the design of impellers, make them more resistant to corrosion, and improve their control interfaces. Innovations aimed at users such as automating cleaning, warning of needed maintenance and monitoring issues from a distance, are improving both reliability and efficiency. For example, Xylem and EDI (Environmental Dynamics International) provide intelligent aeration systems, controlled through advanced panels, which use energy efficiently and scale up treatment plant performance.

Industrial Aerators Market Analysis

Learn more about the key segments shaping this market

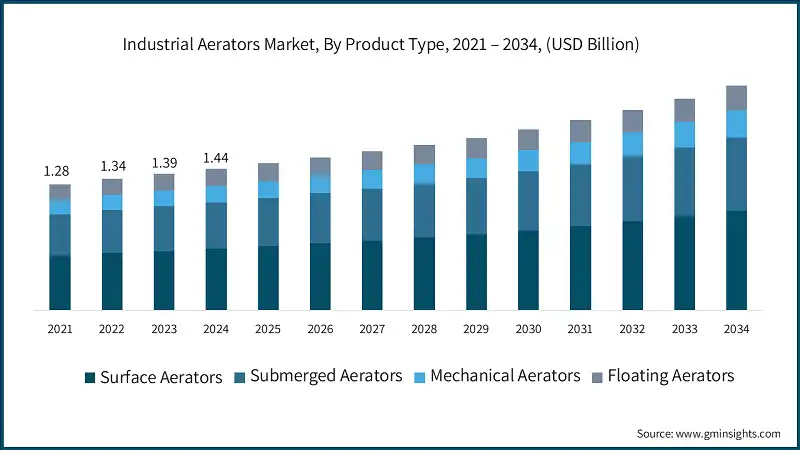

Based on product type, the market is divided into surface aerators, submerged aerators, mechanical aerators, and floating aerators. In 2024, the surface aerators segment dominated the global market, accounting for 43.6% share and expected to grow at a CAGR of 5% during the forecast period.

- The surface aerator segment is growing rapidly as it is straightforward to install, reasonable in terms of cost and works well for treating municipal and industrial wastewater. The low-cost operation of these aerators in shallow tanks and lagoons makes them useful for rural and decentralized facilities. Because they are easy to look after and reach for fixing problems, they are sought after by small to mid-sized treatment plants. Because of tougher water quality rules in several regions, these systems are being applied at a quicker rate. Proper mixing is necessary to help break down waste in the quickest way, so the mixing process from surface aerators is key. That is why these methods provide a stable and growing solution worldwide for treating wastewater.

- Food processing, beverages and dairy make effective use of aerobic digestion and need better odor control. The use of surface aerators in these industries is increasing significantly. Since they can be set up on either fixed or floating platforms, pumps are well suited to tanks with different structures. Changes in both impeller design and the use of energy-saving motors help improve their function and lower operational costs. Demand for inexpensive and durable surface aerators is growing in developing countries because of government programs for clean water and good sanitation. Being controlled remotely and alerted to faults by automation adds an even greater appeal to UAVs. The drive for sustainability and reusing water is making surface aerators preferred options for their reliability, efficiency, and low cost.

Learn more about the key segments shaping this market

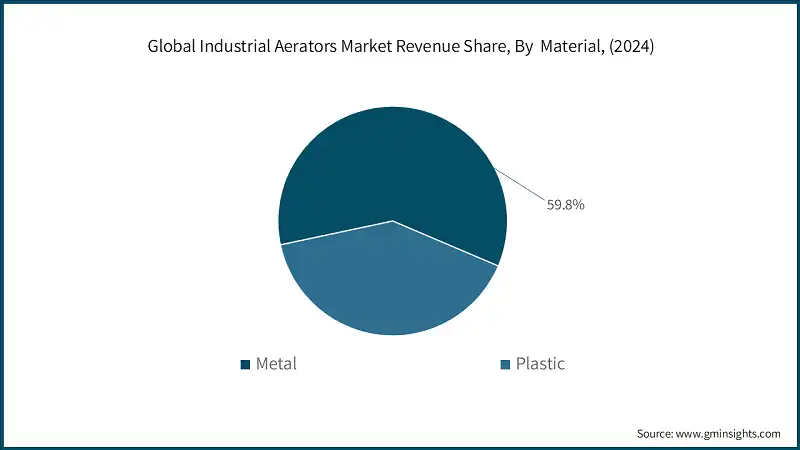

Based on material, the industrial aerators market is segmented into metal and plastic. In 2024, the metal segment comprised 59.8% and is expected to grow at a CAGR of 5% during the forecast period 2034.

- The requirement for metal is driven by the need for it to operate safely and last long in tough industrial and municipal wastewater conditions. Frequently, stainless steel and aluminum are used for their ability to withstand tough chemicals and strong weather in aerator parts. Having a robust design, metal aerators are better suited for numerous operations in large treatment plants. Continuous use means metals, so petrochemical and pharmaceutical firms often turn to metal-built aerators. Metal aerators are favored by many because they cost less overtime because of their stronger construction.

- With energy efficiency and reliable performance matter, manufacturers are developing metal aerators with improved impeller and shaft structures to satisfy increased oxygen transfer. With tighter rules for wastewater discharge by the government, strong mechanical aerators are being demanded increasingly. It is much easier to tie metal aerators into automation systems since their part Precision engineering allows for it. Better coatings and lighter alloys are increasing the suitability of metals. All these reasons are why metal is still preferred in the aerator industry.

Based on applications, the industrial aerators market is segmented as wastewater treatment, aquaculture, water treatment, food and beverage industry, mining industry, pulp and paper manufacturing, oil and gas and others. In 2024, the wastewater treatment segment generated a revenue of USD 754.8 million and is expected to grow at a CAGR of 4.9% during the forecast period.

- As water pollution is a worldwide issue, wastewater treatment is the most important application in aerator systems. Many industries and municipalities buy aeration systems to remove harmful organic substances and make their water quality better. Because of tight rules, like those of the EPA and the EU Water Framework Directive, more facilities are chosen to install these systems. Treatment plants depend on aerators to perform properly in activated sludge processes. This need is standard for these products, which means aerators continue to be in high demand.

- Increasing numbers of consumers living in cities and increasing populations are causing great strain on current wastewater systems, mostly in Asia-Pacific and Africa. To solve sanitation problems and protect the environment, governments are constructing and repairing treatment centers. Many farmers prefer aerators because they effectively reduce BOD and COD. In India, Namami Gange is one of the key programs encouraging the growth of the market, alongside modern city projects globally. Surface and diffused aerators are favored by many because of the minimal maintenance and high efficiency count.

- In industrial zones, companies that process medicines, chemicals, food and textiles create a lot of wastewaters that must be managed on-site before release. Because water reuse and zero-liquid discharge are becoming more popular, aeration systems are needed that perform better. Improvements in accuracy and energy saving are made possible by advanced devices such as IoT aerators and automated oxygen regulators. Awareness among companies of sustainable actions has added to the call for improved energy management. Consequently, most of the market applications for aerators are based in the field of wastewater treatment.

Based on distribution channel, the industrial aerators market is segmented as online and offline. The offline channel segment is expected to hold a major share of 63.6% in 2024.

- The offline distribution channel dominates the aerator market as the product is complex and customers often want on-sites demonstrations, modifications and assistance, the offline distribution channel is the main one in the aerator market. Many buyers, particularly those working in municipal and industrial fields, want to speak with staff face to face for detailed information and instruction. By partnering with regional dealers, users get easier access to needed parts and fast maintenance services. Managing large contract orders is made simpler when companies collaborate directly with the vendors. Consumers stick with in-person shopping because they believe and trust the service.

- Online shopping is not fully developed in many parts of the world, having a presence on the ground helps manufacturers grow their market. Because B2B buyers can bulk, change agreements and get fast technical support, offline channels are preferred. By having an offline presence, a business can follow government tender rules, as they tend to prefer certified vendors. Besides, the complexity of some products and the need for site-specific steps require an inspector which websites do not offer. As a result, globally, aerators are distributed through these types of channels.

Looking for region specific data?

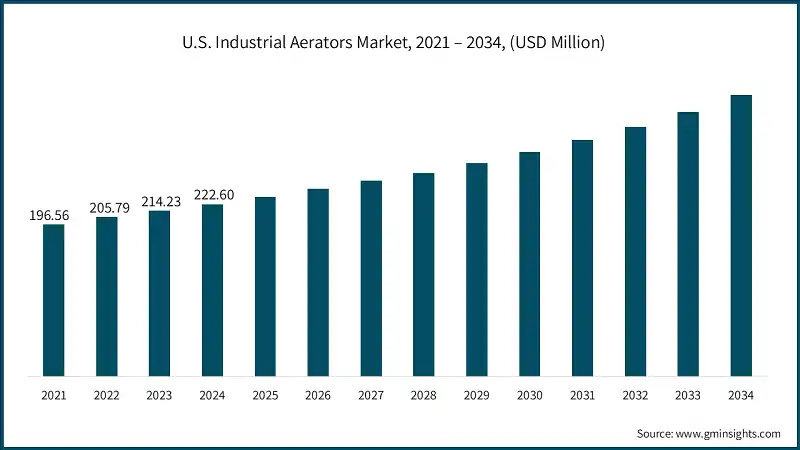

In 2024, North America, United States is dominating the industrial aerators market by 72% and generated USD 222.60 million in revenue in the same year.

- North America is leading the market due to its strong infrastructure in wastewater treatment and industrial process management. many municipal and industrial wastewater treatment plants in the region need to use advanced aeration equipment all the time. Water discharge standards set by the U.S. Environmental Protection Agency (EPA) require both public and private companies to move toward efficient aeration. Because more attention is given to environmental issues, aerators are being adopted more widely. The continued improvement of old water systems is contributing to industry’s growth.

- North American industries are growing driven by its advancements in treatment processes and their focus on adopting technology-automation linked aeration systems controlled remotely. Paying high energy bills is motivating the use of surface and diffused aerators in the region. Because of major aerator brands and extensive distribution, services and products are always available onto the market. In addition, grants and incentives from the government are encouraging more consumers to adopt these practices. As a result of these characteristics, North America dominates in the worldwide aerator market.

In Asia – pacific (APAC) region China is leading the industrial aerators market growth with the CAGR 4.9% in the forecast year of 2025 -2034.

- China is leading the Asia – pacific region in the market due to it’s their fast industrial development and substantial number of wastewater treatment sites. Because of serious water pollution problems, cities in the country rely on modern aeration devices. Growing numbers of consumers living in cities has triggered widespread infrastructure building for wastewater disposal. Since China’s five-year plans stress environmental protection and the use of recycled water, the demand for efficient aerators is rising. Because of this, China is a main center of regional aerator demand.

- Programs initiated by the government promote the use of automated and energy-saving technologies in water treatment plants. Jiangsu and Shandong provinces’ assembly of industries make aerators in regular demand by the government and private companies. The progress made with green technology and clean water by China under the "Beautiful China" program drives new innovations. As smart city ideas develop, many buildings are now requiring digitally integrated aeration systems. The use of technology drives growth in the market over the years.

- The textiles, chemicals and food industries are growing, and exports are booming, and the industrial wastewater treatment industry is quickly expanding. This means even more pressure on reliable and scalable aerators. Because China’s logistic hubs and manufacturing parks handle elaborate recycling, there is a greater need for water reuse. Zero Liquid Discharge (ZLD) objectives in different industries depend heavily on aerators. R&D and manufacture of aeration equipment at local factories keeps financial expenditure low and supports agility in production.

- A growing middle class and a rising Technology led consumers to support installing new clean technology infrastructure, like modern water treatment systems. Because the government has strict rules about discharging waste from factories and cities, aerators are being installed more broadly. As they can find what they need and produce in high volumes, Chinese firms are able to grow quickly and create new things at a reasonable cost. This means China is at the top of the region and is helping to point the way for the global aerator market.

Europe is growing rapidly in the industrial aerators market with CAGR 4.5% in the forecast year of 2025 -2034.

- Germany, Europe is leading the market driven by advanced industrial assets and tough environmental rules focused on wastewater treatment and sustainability. By using engineering and automation well, the country acquires and uses energy-saving systems in wastewater facilities. Prioritizing environmental protection, Germany spends much on ways to ensure clean water. Following EU directives for water treatment and discharge depends on industry-wide aerators. Because of strict regulations and new innovations, there is strong demand for aerators.

- With many mid-sized businesses and large industries concentrated in chemicals, automotive and pharmaceuticals, Germany relies on effective aeration for wastewater. The government is helping to introduce circular economy practices which lead to more water being recycled by advanced aeration. Because manufacturing customized and effective aerator systems is a focus, Germany has become the top exporter of aeration equipment in Europe. The fast-growing nature of the country’s sustainable sector helps it remain at the forefront of aerators.

Industrial Aerators Market Share

- Xylem Inc., Pentair plc, Sulzer Ltd., Evoqua Water Technologies, Aeration Industries International are the major players accounting for market share. The market for industrial aerators is quite competitive as different manufacturers provide similar products intended for wastewater treatment, surface water management and process aeration in many industries. While other markets specialize in one area, this one is very separated, as firms work on surface aerators, diffused aerators and tools for aquaculture and rehabilitating soil.

- With innovation in the industry, customers now care about energy efficiency, lower maintenance, easy setup and being able to meet new environmental laws. Firms that comply with strong emission and sustainability requirements or fit their new models with smart monitoring technologies, have higher chances of doing better than their competitors.

Industrial Aerators Market Companies

Major players operating in the industrial aerators industry:

- Aeration Industries International

- Airmax Inc.

- AquaMaster Fountains and Aerators

- Evoqua Water Technologies

- Evers Agro B.V.

- Fluence Corporation

- Kasco Marine

- Koenders Water Solutions Inc.

- Otterbine Barebo Inc.

- Pentair plc

- SPX Corporation

- Severn Trent Services

- Sulzer Ltd.

- Triplepoint Environmental

- Xylem Inc.

These are some of the top companies dominating the market providing many different aeration technologies to meet the needs of industries. Xylem Inc., Pentair plc, Sulzer Ltd., Evoqua Water Technologies, and Aeration Industries International are the leading companies in the aerators market. Because of their background, they produce equipment that is trusted, uses less energy and can be easily adjusted. Their skills are highly valued in wastewater treatment, aquaculture, and process water management. Firms in this industry make regular progress in improving their products’ performance, keeping them eco-friendly and connecting them with current monitoring and automation technologies.

Xylem Inc., Pentair plc and Sulzer Ltd. are at the front of changing the aerators industry by making energy-efficient technology available at low prices. Because the pressure to protect water is rising, industries are adopting advanced aeration systems to ensure they meet tough environmental and work requirements. Because of changes after the pandemic, more money is being put into building modern wastewater treatment facilities which require new improvements in aeration technology.

Evoqua Water Technologies, Aeration Industries International and Fluence Corporation are integrating new capabilities such as variable speed drives, advanced monitoring, and remote control into their aerators to increase both their efficiency and sustainability. With more businesses using IoT and automation in industrial sites, these businesses are developing ways to fit well into complicated water systems. It is still a tough market for businesses; everyone works on extending their product range, keeping prices low and making sure they are following the rules.

Industrial Aerator Industry News

- In February 2025, Xylem Inc. introduced a new energy-saving fine bubble aerator help treat wastewater in a more energy-efficient way in municipal plants. It improves how oxygen is added to the water, reduces operating costs and helps the industry move toward environmental sustainability.

- In February 2025, Ingersoll Rand bought Scientific Systems Inc. (SSI), a world leader in wastewater treatment equipment. Ingersoll Rand can now include SSI’s advanced membrane diffusers and aeration systems in its technology, giving customers wider solutions for handling wastewater.

- In April 2025, Wiedenmann presented the Terra Core 8, with a working width of 195 cm and the ability to adjust its working depth from 40 to 100 mm. The machine makes holes evenly and with 270 holes per square meter and the Vibra-Stop system helps minimize vibrations, making things more comfortable for the operator and extending the machine’s useful life.

The industrial aerators market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and Volume in Thousand Units from 2021 to 2034, for the following segments.

Market, By Product Type

- Surface aerators

- Submerged aerators

- Mechanical aerators

- Floating aerators

Market, by Horsepower

- Low horsepower (0.5 to 5HP)

- Medium horsepower (5 to 20HP)

- High horsepower (20+ HP)

Market, By Material

- Metal

- Plastic

Market, By Automation

- Automatic

- Non-automatic

Market, By Application

- Wastewater treatment

- Aquaculture

- Water treatment

- Food and beverage industry

- Mining industry

- Pulp and paper manufacturing

- Oil and gas

- Others

Market, By Distribution Channel

- Online

- E-commerce

- Company websites

- Offline

- Special stores

- Distributors

- Mega retail stores

The above information is provided for the following regions:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are some of the prominent players in the industrial aerators market?

Key players in the sector include Aeration Industries International, Airmax Inc., AquaMaster Fountains and Aerators, Evoqua Water Technologies, Evers Agro B.V., Fluence Corporation, Kasco Marine, Koenders Water Solutions Inc., Otterbine Barebo Inc., Pentair plc, SPX Corporation, Severn Trent Services, Sulzer Ltd., Triplepoint Environmental, and Xylem Inc.

How big is the industrial aerators market?

The global market size for industrial aerators was valued at USD 1.44 billion in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

What is the market share of the surface aerators segment?

The surface aerators segment dominated the market in 2024 with a 43.6% share and is expected to grow at a CAGR of 5% during the forecast period.

How much is the U.S. industrial aerators industry worth?

The U.S. accounted for 72% of the North America market, generating USD 222.60 million in revenue in 2024.

Industrial Aerators Market Scope

Related Reports