Summary

Table of Content

Industrial 3D Printer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial 3D Printer Market Size

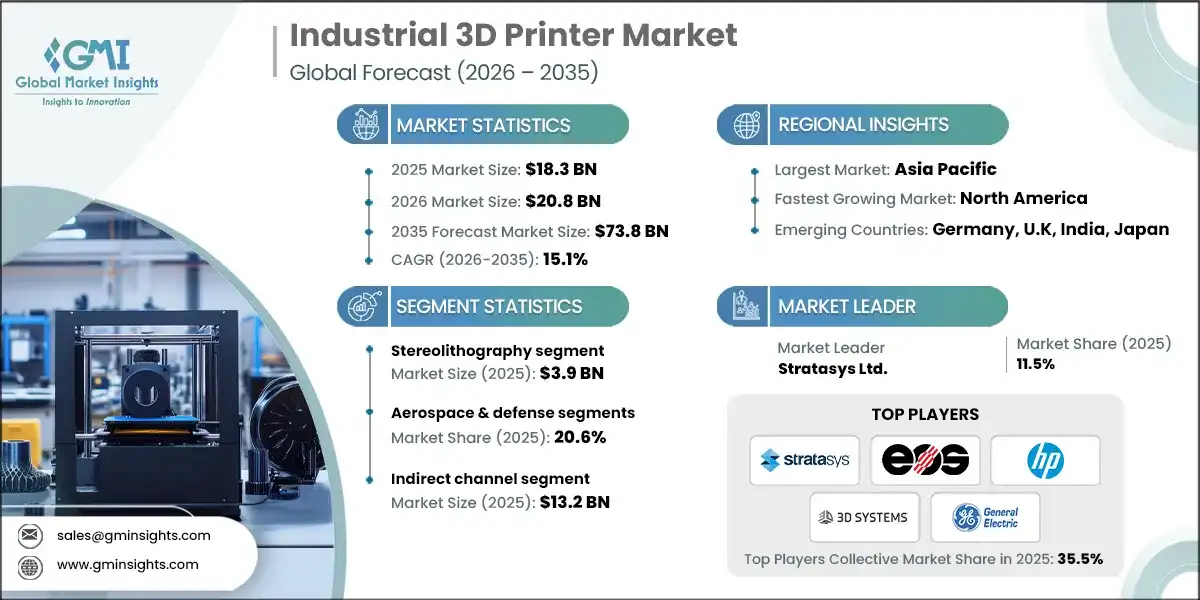

The industrial 3D printer market was valued at USD 18.3 billion in 2025. The market is expected to grow from USD 20.8 billion in 2026 to USD 73.8 billion in 2035, at a CAGR of 15.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

Cost efficiency continues to be a primary driver for the industrial 3D printing market according to Protolabs' highlights, with manufacturers reducing tool costs by as low as 80-90%, yielding over USD 100,000 per part in savings for some applications with annual production runs of only a few thousand parts. For example, Boeing is leveraging 3D printing to manufacture aircraft components that are not only lightweight but create cost reductions along with fuel efficiencies. The German government is also promoting increased use of cost-efficient tools, offering handler subsidies for 3D printing related activities to help scale up broader market uptake.

Cost efficiency can be found in not only the cost of the tooling, but also faster turnaround times; manufacturers highlighted reduced lead times with manufacturing capabilities up to 8 times faster than traditional manufacturing methods. For example, Ford Motor Company uses 3D printing for rapid prototyping, with the objective of shortening the design validation lead time, on prototype parts. On a similar note, the United States Department of Defense plans to use 3D printing for aerospace prototyping to again achieve shorter lead times.

The market is further due to the enhanced ability of the 3D printers in manufacturing highly customized, complex geometric products. In the health-sector, companies such as Stryker, manufacture and deliver custom implants for over 100,000 patients annually, yielding a 30% improved recovery outcome. Further, the European Union is funding 3D printing projects focusing on the ideals of custom healthcare, and design complexity.

Also, material efficiency and sustainability are critical factors influencing 3D printing adoption, depending on the application, material waste reductions range from 30% to 95%. General Electric’s aviation division uses 3D printing to manufacture fuel nozzles with 95% material efficiency, significantly reducing waste. These practices align with increasing regulatory and stakeholder pressure for environmentally friendly solutions.

Technological advancements are also expanding the industrial 3D printing market; innovations such as multi-material printing and metal additive manufacturing have broadened application possibilities. The World Economic Forum recognizes 3D printing as a transformative technology for Industry 4.0. Additionally, governments in the Asia-Pacific region are heavily investing in research and development to enhance 3D printing capabilities and maintain global competitiveness. For example, HP’s Multi Jet Fusion technology enables faster and more precise production of complex parts.

Industrial 3D Printer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 18.3 Billion |

| Market Size in 2026 | USD 20.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 15.1 % |

| Market Size in 2035 | USD 73.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Wide use of rapid prototyping | Rapid prototyping reduces design cycles and accelerates product development, making 3D printers indispensable in automotive, aerospace, and consumer goods sectors. This drives consistent demand for industrial-grade printers. |

| Improvements in product development and supply chains | Additive manufacturing enables decentralized production and on-demand parts, reducing inventory costs and improving supply chain resilience. This trend boosts adoption in industries seeking agility. |

| Government investments in 3D printing projects | Public funding for defence, healthcare, and industrial innovation accelerates technology development and infrastructure, creating strong growth opportunities for industrial 3D printer manufacturers. |

| Pitfalls & Challenges | Impact |

| Material limitations and quality control | Limited availability of advanced materials and difficulty in ensuring consistent part quality restrict adoption in critical sectors like aerospace and medical, slowing market penetration. |

| Ease of replicating designs with 3D printing technology | IP protection remains a major concern as digital files can be easily copied, discouraging some manufacturers from fully integrating additive manufacturing into production workflows. |

| Opportunities: | Impact |

| Expansion into healthcare and bioprinting | Growing demand for patient-specific implants and surgical models creates a lucrative segment for industrial 3D printers, especially those supporting certified medical-grade materials. |

| Sustainability and regulatory compliance solutions | Eco-friendly materials and energy-efficient printers align with global sustainability goals, while compliance-ready systems for aerospace and healthcare provide a competitive edge for manufacturers. |

| Market Leaders (2025) | |

| Market Leaders |

11.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | Germany, U.K, India, Japan |

| Future outlook |

|

What are the growth opportunities in this market?

Industrial 3D Printer Market Trends

Changing innovation and technology transformation are important for the growth of the industrial 3D printer industry.

- The demand for metal additive manufacturing is becoming one of the leading growth sectors in the industrial 3D printing space. For example, GE Additive leverages this technology to develop lightweight components for next-generation jet engines, significantly reducing both raw material waste and time to manufacture. There is also substantial government funding in European nations around advanced R&D projects that expand the capabilities of metal additive manufacturing, further driving the market growth.

- The use of 3D printing with principles and technologies associated with Industry 4.0 are creating a transformation in the production of manufacturing output. The World Economic Forum refers to 3D printing as being a critical type of enablement for smart manufacturing outcomes, and businesses therefore automatically receive improvement in automated processes, the weight of the items and efficiency overall. Siemens incorporates the use of 3D printing alongside IoT capabilities and AI, to leverage production workflows across its plants and factories.

- Multimaterials 3D printing continues to drive new frontiers in many different industrial applications using HP Multijet Fusion Technology and other methods that enable manufacturers to produce components with multiple material properties in a single print process, 3D printing of multiple materials allows for reduced assembly and assembly costs and increases the functionality of the final product. This is being explored in government-funded research projects by the US and European Countries as well as various industries, such as automotive and healthcare, where the use of 3D printing with multiple materials is providing additional value accrued through collaboration, particularly where the products have complex geometric shapes or functional characteristics.

- Sustainability is also a major trend in industrial 3D printing impacting its growth, with regulatory and environmental issues and the effort in material waste reduction measures- up to 95% of material can be eliminated using 3D printing, as has been shown by General Electric’s Aviation Division. The United Nations is supporting sustainable manufacturing and encouraging the use of 3D printing as part of a circular economy.

Industrial 3D Printer Market Analysis

Learn more about the key segments shaping this market

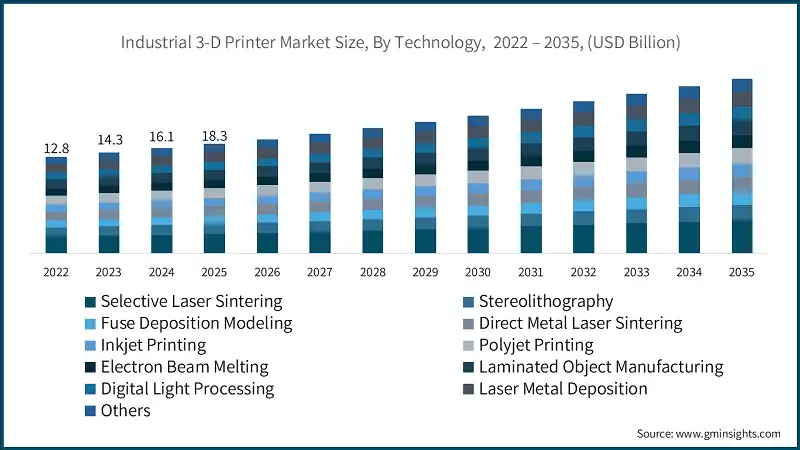

Based on technology segment, the market is segmented into selective laser sintering, stereolithography, fuse deposition modeling, direct metal laser sintering, inkjet printing, polyjet printing, electron beam melting, laminated object manufacturing, digital light processing, laser metal deposition, and others. The stereolithography category generated revenue of USD 3.9 billion in 2025.

- Stereolithography (SLA) leads the industrial area as it allows to produce highly complex prototypes and functional parts with precision. As such, SLA is commonly found in developed industries with intricate geometric designs, including automotive and healthcare. For example, Formlabs uses SLA to manufacture dental aligners as well as medical devices with extreme accuracy.

- The acceptance of SLA technology in industrial applications is being encouraged by government efforts and funding programs. The European Union has financed SLA-based R&D by offering funding through Horizon Europe and similar programs and consequently has sparked innovation surrounding SLA resins as well as targeted applications in healthcare. In North America, regional governmental funding agencies are stimulating SLA adoption by providing grants and/or tax incentives for new manufacturers to put float SLA in their production processes.

- Development of advanced photopolymer resins for SLA has improved flexibility and mechanical properties of SLA printing. These acquired properties have also resulted in heat resistant, water resistant, and biocompatibility for various applications. Manufacturers of advanced photopolymer resins have suggested we will see a CAGR of more than 20% growth in SLA-compatible resins during the forecast period. 3D Systems offers a variety of SLA materials for aerospace and consumer goods industries.

- Leading producers are adopting SLA technology to achieve astonishing results in diverse applications. For example, BMW utilizes SLA to generate prototypes of parts for vehicles while effectively lowering development time and costs at the same time. In a similar way, Align Technology uses SLA to manufacture millions of custom-made dental aligners per year, demonstrating scalability. These examples demonstrate SLA's ability to meet higher quality demands across multiple markets.

- Sustainability is increasingly a goal of SLA technology, with manufacturers focused on decreased material waste and energy consumption. SLA processes are recognized as material-efficient with low waste due to effective build height and print speed. The United Nations supports sustainable manufacturing and promotes manufacturing with technologies such as SLA. Examples of companies making eco-focused SLA materials include carbon, which develops and offers sustainable materials as part of their mission to promote sustainable practices in manufacturing that are environmentally considerate.

Learn more about the key segments shaping this market

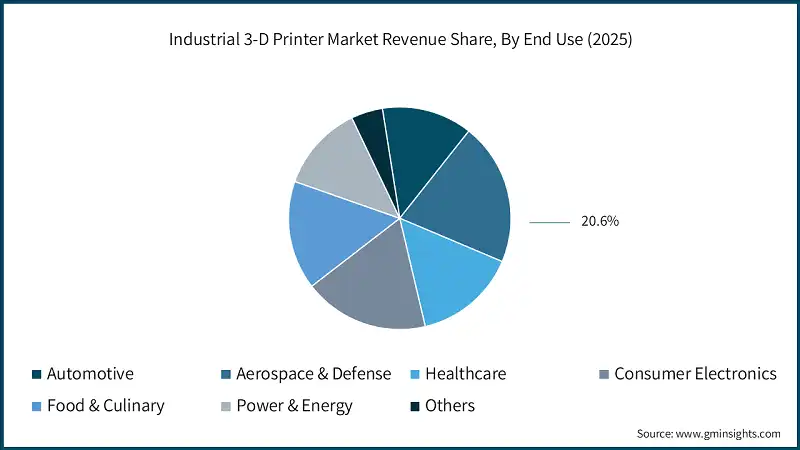

Based on the end use, the industrial 3D printer market is bifurcated into automotive, aerospace & defense, healthcare, consumer electronics, food & culinary, power & energy and others. The aerospace & defense segments held about 20.6% of the market share in 2025.

- The aerospace & defense industry is at the forefront of the industrial 3D printing market with its focus on weight savings and fuel efficiency. For example, with 3D-printed aerospace parts, it is possible to achieve a 55% reduction in weight, which translates to 20% fuel savings. The FAA has documented that lighter aircraft generate the most significant reduction in operational costs. Boeing has incorporated 3D-printed titanium parts into its 787 Dreamliner, proving that 3D printing can efficiently address weight optimization.

- The need for sophisticated geometries and design flexibility allows Aerospace & Defense to hold their mantle as the leader in 3D printing utilization in new industries. Additive manufacturing's ability to manufacture lattice structures, as well as conformal cooling channels, would literally be impossible to manufacture with traditional means. NASA has been able to employ 3D printing for rocket engine parts, such as rocket engine components, such as the RS-25's injector, improved performance while accelerating the process. This property is consistent with the need to design advanced parts in its unique process.

- Aerospace & defense also demonstrates 3D printing's ability to cost-effectively manufacture a low volume of high-cost production. Because there is no tooling cost, additive manufacturing is an efficient method to produce parts in limited quantities. Airbus has also indicated that it incorporated over 1,000 3D-printed components into its A350 XWB aircraft, exemplifying improved cost savings and reduction in lead time from production. The European Space Agency (ESA) has promoted the economic advantages regarding the 3D printing processes, citing the use of additive manufacturing for component production specifically for satellites.

- Regulatory approvals have made advancements that have enabled increased use of 3D printing in aerospace & defense. The FAA and EASA have already approved multiple flight-critical 3D printed parts. The LEAP engine in use by GE Aviation features 3D-printed fuel nozzles which have already achieved regulatory approval and are in a commercial environment. This regulatory instillation puts a foundation in place for another wave of widespread adoption across the field of aerospace and defense through the facilitation of innovation and reliability.

- 3D printing improves supply chain resilience, by allowing production to occur on-demand rather than relying on external suppliers, the chances in the supply chain are minimized. During the COVID-19 period, Lockheed Martin participated in the COVID-19 supply chain disruptions with additive manufacturing for critical component parts of aircraft and was able to promote production under duress of supply chain issues. The department of defense has also put money towards additive manufacturing technology as a means of reducing dependence on supply chains and ensuring strategic independence.

Based on distribution channels, the industrial 3D printer market is segmented into direct and indirect channels. The indirect channel segment generating a revenue of USD 13.2 billion in 2025.

- This distribution channel is enabled by the reach and relationships/distribution networks already established by distributors and resellers allowing manufacturers to reach customers more broadly.

- It is also true that government has recently been working to encourage the indirect channel through explore discussion about programs that support advanced manufacturing technologies. One example of this in the U.S. is the government's "Additive Manufacturing Forward" initiative (AM Forward) to incentivize companies in various industry sectors to utilize 3D printing technologies, ultimately creating demand for industrial 3D printers, thus positively impact the indirect channels role. As well, in the Europe/Australia region, similar programs have seen similar impact for their indirect channel.

- Manufacturers such as Stratasys and 3D Systems have utilized distributors and resellers to scale their businesses and move into new markets. Working together with distributors and resellers that facilitate localized support, training, and after-sales services, manufacturers supported retention and customer satisfaction. This has led to increased ability to drive revenue, as well as extending the market representation of the company.

- Moreover, the indirect channel provides cost advantage for manufacturers by eliminating the need to develop and maintain a direct sales infrastructure. Distributors typically fulfil the logistics, inventory management, and customer service roles for the manufacturers while allowing them to remain focused on innovating and producing. As demand for industrial 3D printers expands in sectors like automotive, aerospace, and healthcare, the indirect channel has established itself clear of the leading distribution channel in the market.

Looking for region specific data?

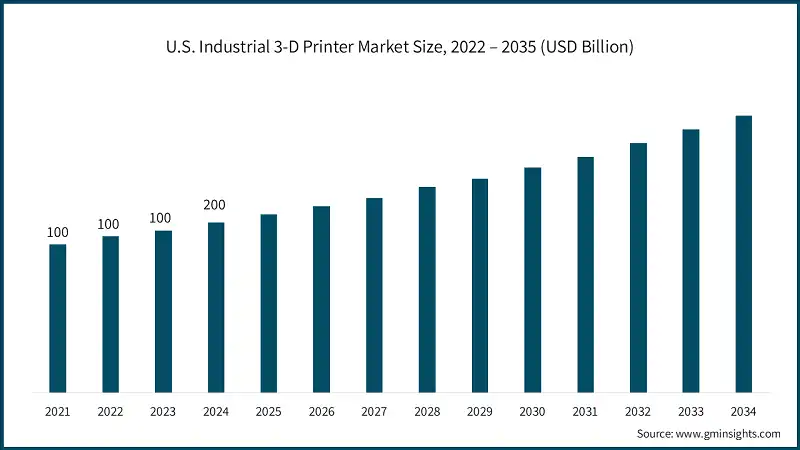

In 2025, the U.S. dominated the industrial 3D printer market growth in North America, accounting for 78.1% of the share in the region.

- The growth is mainly due to the economic strength of the U.S. manufacturing industry and the growing adoption of advanced technologies. The U.S. Census Bureau determined that, in 2023, the manufacturing industry contributed almost USD 2.3 trillion to GDP. This economic measure reflects the strength of manufacturing in the U.S., as well as its ability to adapt and innovate, such as in the case of 3D printing.

- Leading manufacturers such as Stratasys and 3D Systems are instrumental in this growth. Stratasys, for instance, has experienced growth by developing its portfolios to meet the needs of higher-precision industries, such as aerospace and healthcare. 3D Systems enable growth by working with large automotive companies to develop lines of 3D print production. Building 3D printing businesses aids the U.S. 3D printing sector in further solidifying its growing marketplace.

Asia Pacific industrial 3D printer market is the fastest growing region and is expected to grow at 14.8% CAGR during the forecast period.

- The Asia Pacific market growth is primarily driven by the increasing adoption of 3D printing in industries such as automotive, aerospace, and healthcare, where demand for rapid prototyping and customized manufacturing is rising.

- Government initiatives are playing a significant role in driving this growth. For instance, China's "Made in China 2025" policy promotes the adoption of advanced manufacturing technologies, including 3D printing, to enhance industrial competitiveness.

Europe industrial 3D printer market is expected to grow at 14.2% CAGR during the forecast period.

- The Europe market is driven by increasing adoption across various industries, government initiatives supporting advanced manufacturing technologies further bolster market growth. Leading manufacturers are also contributing to market expansion. French company Prodways Group has been actively developing innovative 3D printing solutions for industrial applications. For instance, the European Union's Horizon Europe program allocates significant funding for research and innovation in 3D printing technologies. Additionally, France's "Industrie du Futur" initiative promotes the adoption of industrial 3D printing among manufacturers.

Middle East and Africa industrial 3D printer market is expected to grow at 13.6% CAGR during the forecast period

- This growth is primarily driven by the increasing demand for advanced manufacturing technologies and the ability of 3D printing to reduce production costs and improve efficiency is a key factor fueling its adoption.

- Saudi Arabia’s Vision 2030 emphasizes industrial diversification and the adoption of advanced technologies, including 3D printing. Regional manufacturers are also contributing to the market's expansion. Immensa Technology Labs, based in the UAE, has been actively providing 3D printing solutions for construction and industrial applications.

Industrial 3D Printer Market Share

The top companies in the industrial 3D printer industry include Stratasys Ltd., EOS GmbH, HP Inc., 3D Systems, Inc. and General Electric and collectively hold a share of 35.5% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Stratasys delivers industrial 3D printing solutions through its FDM and PolyJet technologies, enabling high-precision prototyping and production. Its systems support certified materials for aerospace, automotive, and healthcare applications. The company offers complete solutions including printers, software, and material packages, along with post-processing systems for dimensional accuracy and surface finish.

- EOS specializes in metal and polymer additive manufacturing systems using laser sintering technology. Its printers comply with international standards and support validated materials for regulated industries like aerospace and medical. EOS provides integrated process monitoring and powder handling systems, ensuring repeatability and quality assurance across production runs.

- HP offers industrial-grade 3D printing solutions based on Multi Jet Fusion (MJF) technology for high-speed, cost-efficient production. These systems are designed for scalability and sustainability, supporting certified materials for automotive and consumer goods. HP provides complete workflows including printers, build units, and processing stations, integrated with advanced software for quality control.

Industrial 3D Printer Market Companies

Major players operating in the industrial 3D printer industry are:

- 3D Systems

- Desktop Metal

- EOS

- Formlabs

- General Electric

- HP

- Markforged

- Materialise

- Nano Dimension

- Prodways

- Renishaw

- SLM Solutions

- Stratasys

- Ultimaker

- Velo3D

3D Systems provides a broad portfolio of industrial 3D printers, including SLA, SLS, and metal additive systems, tailored for aerospace, healthcare, and industrial manufacturing. Its solutions meet stringent regulatory requirements and support validated materials. The company offers complete ecosystems with printers, software, and post-processing tools to ensure seamless production and quality consistency.

GE Additive focuses on metal additive manufacturing technologies such as Direct Metal Laser Melting (DMLM) and Electron Beam Melting (EBM) for aerospace and energy sectors. Its systems meet global compliance standards and use certified metal powders for high-performance applications. GE Additive provides end-to-end solutions including printers, powder handling, and process monitoring for industrial-scale production.

Industrial 3D Printer Industry News

- In November 2025, HP unveiled the HP Industrial Filament 3D Printer 600 High Temperature (HP IF 600HT) at Formnext 2025. The launch includes new material innovations like HP 3D HR PA 11 Gen2 and the HP Additive Manufacturing Network (AMN) to streamline global part production and supply chain efficiency.

- In November 2025 HP partnered with Würth Additive Group to enable digital inventory and localized on-demand production. This collaboration supports industrial customers in reducing supply chain complexity and improving efficiency through additive manufacturing solutions.

- In November 2025, XJet introduced Carmel Pro, a next-generation metal and ceramic 3D printer at Formnext 2025. The system is designed to deliver superior precision and material versatility, targeting advanced industrial applications in aerospace and medical sectors.

- In May 2025, UltiMaker signed an exclusive distribution agreement with Sicnova for Spain and Portugal. This strategic move strengthens UltiMaker’s European presence and expands its industrial and professional 3D printing service network in the Iberian market.

- In November 2024, a consortium formed at Formnext 2024 by Stratasys, EOS, HP, Materialise, Renishaw, Nikon SLM, and TRUMPF aims to accelerate industrial adoption of 3D printing. The initiative focuses on creating common standards and interoperability to overcome integration challenges in manufacturing.

The industrial 3D printer market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Technology

- Selective laser sintering

- Stereolithography

- Fuse deposition modeling

- Direct metal laser sintering

- Inkjet printing

- Polyjet printing

- Electron beam melting

- Laminated object manufacturing

- Digital light processing

- Laser metal deposition

- Others

Market, By End Use

- Automotive

- Aerospace & defense

- Healthcare

- Consumer electronics

- Food & culinary

- Power & energy

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which region leads the industrial 3D printer market?

U.S. led North America’s industrial 3D printer market with a 78.1% share in 2025, driven by a strong manufacturing base and rapid adoption of advanced technologies.

What are the upcoming trends in the industrial 3D printer market?

Key trends include growing demand for metal additive manufacturing, integration of 3D printing with Industry 4.0 principles using IoT and AI, multi-material 3D printing enabling components with multiple material properties, and sustainability focus with material waste reduction up to 95%.

Who are the key players in the industrial 3D printer market?

Key players include Stratasys Ltd., EOS GmbH, HP Inc., 3D Systems Inc., General Electric, Desktop Metal, Formlabs, Markforged, Materialise, Nano Dimension, Prodways, Renishaw, SLM Solutions, Ultimaker, and Velo3D.

What is the growth outlook for the Asia Pacific industrial 3D printer market from 2026 to 2035?

Asia Pacific market is expected to grow at 14.8% CAGR during the forecast period, fueled by increasing adoption in automotive, aerospace, and healthcare industries, plus government initiatives like China's

How much revenue did the stereolithography segment generate in 2025?

The stereolithography category generated revenue of USD 3.9 billion in 2025, As its ability to produce highly complex prototypes and functional parts with precision for automotive and healthcare industries.

What was the market share of the aerospace & defense segment in 2025?

The aerospace & defense segment held about 20.6% of the market share in 2025, supported by focus on weight savings and fuel efficiency, with 3D-printed aerospace parts achieving up to 55% reduction in weight.

What is the current industrial 3D printer market size in 2026?

The market size is projected to reach USD 20.8 billion in 2026.

What is the projected value of the industrial 3D printer market by 2035?

The industrial 3D printer market is expected to reach USD 73.8 billion by 2035, propelled by integration of AI, IoT, and sensor-based technologies, sustainable product designs with recyclable materials, and expansion into healthcare bioprinting and renewable energy sectors.

What is the market size of the industrial 3D printer in 2025?

The market size was USD 18.3 billion in 2025, with a CAGR of 15.1% expected through 2035 driven by rapid prototyping that shortens design cycles and accelerates product development across automotive, aerospace, and consumer goods industries.

Industrial 3D Printer Market Scope

Related Reports