Summary

Table of Content

In-flight Internet Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

In-flight Internet Market Size

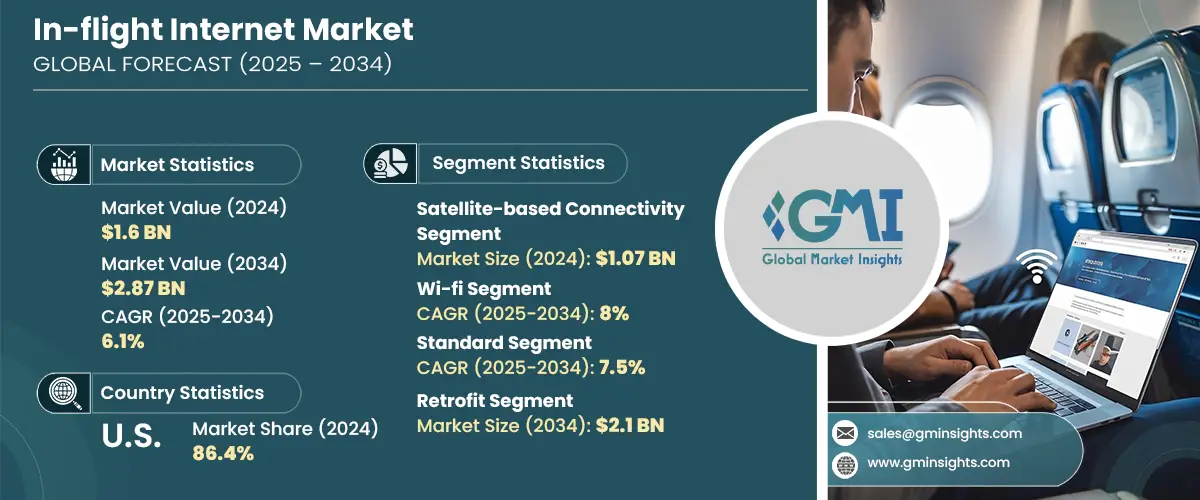

The global in-flight internet market size was valued at USD 1.6 billion in 2024 and is estimated to grow at CAGR of 6.1% to reach USD 2.87 billion by 2034. Rising demand from passengers for in-flight internet connectivity and advancement in satellite technology are the major factors contributing to the growth of the market.

To get key market trends

As the passenger travel demand has reached its pre-covid levels, there has been rise in demand for internet connectivity services during flights from passengers travelling. For instance, according to Viasat’s Passenger Experience Survey which was conducted in 2024 with a sample size of 11,000 respondents it was revealed that 75% of respondents would prefer those airline who provided quality Wi-fi services during flights. Moreover, it was further revealed from the survey that 22% of respondents would not consider flying on a long-haul flight without connectivity.

In-flight Internet Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.1% |

| Market Size in 2034 | USD 2.87 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Passengers increasingly demand for internet access during flight for various purpose such as entertainment, connecting with friends and family, and for work. Also, the rising pentation of smartphone, tablets and laptop is fueling the market growth as these devices are carried on-board by traveler who expect them to use them seamlessly even at 30,000 feet. This has led to an added pressure on airlines to meet these expectations to enhance customer satisfaction and remain competitive in the market.

Technological advancement in satellite connectivity and rise in number of satellite launched has significantly boosted the in-flight internet market. For instance, the number of small satellite launched grew from 2402 in 2022 to 2860 in 2023. These satellites are employed to enhance reliability and speed of internet services during flight. These advancements allow for faster data transmission and better coverage, even over oceans and remote areas, compared to older air-to-ground systems.

As the demand for in-flight internet is increasing, wi-fi and internet services during flights are not luxury but have become necessity for airlines operators. Thus, airline operators should partner with internet service provider to integrate these internet services in their flight to outperform their competitors.

In-flight Internet Market Trends

- Integration of LEO satellite systems for the application of in-flight internet services is gaining traction in the market. Airlines are increasingly using LEO based satellites systems to provide internet services during flight as they offer reduce latency and increase speed in comparison to GEO and other higher orbit satellites systems. For instance, according to SpaceX, the Starlink constellation has 2,330 satellites in LEO orbit which provide internet services to 400,000 consumers and enterprises in 32 countries.

- The integration of 5G technology is enhancing the technological landscape of in-flight internet connectivity by providing higher data rates and lower latency. For instance, Gogo’s 5G network is set to launch in 2025 that will enable businesses jets to connect directly to ground stations reducing latency and improve speed. 5G in-flight connectivity will not only enhance passenger experience but it will also help in improving operational efficiency as airlines will be able to accesses critical data such as weather information, air traffic control updates, and maintenance alerts in real time.

- There is growing trend between airline for deployment of hybrid network systems for providing in-flight internet connectivity. By integrating the features of both satellite and ground-based systems these hybrid network systems provide enhance network reliability and speed. The major advantage of these hybrid systems is that it can leverage real-time. This system can dynamically select for best connection based of various factors such as signal strength and latency. For instance, when flying over oceanic regions, satellite connectivity may be optimal, while during urban approaches, ground-based towers could provide superior service.

In-flight Internet Market Analysis

Learn more about the key segments shaping this market

Based on connectivity type, the market is bifurcated into satellite-based connectivity, air-to-ground connectivity, hybrid.

- The satellite-based connectivity market held the largest share and was valued at USD 1.07 billion in 2024. The growth in number of satellite launches coupled with the advancement in satellite connectivity technology is fueling the market growth. Moreover, most the plane fly’s over remote areas such as ocean where internet connectivity can only be provided through the help of satellite. For instance, in February 2025 united Airline announced that it will begin Starlink satellite internet system for in-flight connectivity. The airline plans to introduce the service on commercial flights operated by its Embraer E-175 aircraft by spring 2025.

- The air-to-ground connectivity segment is growing at a decent rate of 4.6% for the period 2025-2034. The air-to-ground connectivity features such as low latency and low-cost compared to satellite-based connectivity is driving the market.

Learn more about the key segments shaping this market

Based on technology, the in-flight internet market is divided into Wi-Fi, 4G/LTE, 5G, and satellite broadband.

- The wi-fi segment is growing at the fastest CAGR of 8% for the forecast period. The growing demand for continuous connectivity from the passenger during flight is expected to drive the market. For instance, according Visat 2024 passenger experience survey it was revealed that 62% of passengers uses Wi-Fi to access entertainment, meanwhile 60% would rather stay connected than sleep or have a drink during their flight. Moreover, 75% of travellers are more likely to book a flight if high-quality in-flight Wi-Fi is available.

- The satellite broadband segment held the largest market share and is expected to reach market size of USD 1.92 billion in 2034. The global connectivity coverage including over oceanic & remote areas provided by satellite systems is contributing to the growth of this market segment. Moreover, growing partnerships & collaboration between satellite operators and airline to provide internet services is also expected to boost the market. For instance, in May 2024 SES, a leading satellite operator is launching Open Orbits, an open architecture network to pool capacity from regional satellite operators for a worldwide in-flight connectivity (IFC) service for airlines.

Based on connectivity speed, the in-flight internet market is divided into high speed, standard, and low bandwidth.

- The standard segment is growing at the fastest CAGR of 7.5% for the forecast period. The growing demand form the passenger for the basic connectivity need is driving the segment growth. As many passengers require in-flight connectivity for essential task such as checking e-mails, texting and browsing news, which can be adequately done with the standard internet speed which is driving the market.

- The low bandwidth segment is held the largest market share and was valued at USD 536.1 million for the year 2024. The growth in low-cost passenger travel and budget airlines in emerging markets such as India, increasing domestic travel is contributing to the growth of this market segment. For instance, in 2024 domestic airlines in India carried 16.13 million passengers, which was higher than 15.2 million ferried during the same period in 2023.

Based on installation type, the in-flight internet market is divided into retrofit and line-fit.

- The retrofit segment is expected to reach a market size of USD 2.1 billion in 2034. The growing modernization of the aircraft fleet to integrated advanced connectivity solution is the main factor contributing to the growth of the segment in the market. Retrofit installation upgrades the existing aircraft with an advanced connectivity solution without the need of purchasing new aircraft.

- The line-fit segment is growing at a significant rate of 4.2% for the period 2025-2034. Due to the advancement in new connectivity technology, aircraft built with line-fit systems are often more adaptable to upgrades and modifications. By incorporating advancements directly into the production process, aircraft manufacturers can provide a future-proof solution that is scalable as passenger demands increase.

Based on service model, the in-flight internet market is divided into free Wi-fi, paid Wi-fi, and freemium.

- The free wi-fi segment held the largest market share of 58.1% in 2024 and is expected to continue its domination till the forecast period. The free wi-fi segment is growing due to the increased passenger demand for seamless internet connectivity during flight is driving the market. Moreover, major airlines are offering free wi-fi connectivity to gain a competitive edge from other competitors which is expected to drive the market growth.

- The paid wi-fi segment is growing at the fastest CAGR of 8% for the forecast period. The segment is growing due to the increasing demand high-speed reliable internet access among business travellers and premium passengers.

Based on aircraft type, the in-flight internet market is divided into narrow-body aircraft and wide-body aircraft.

- The narrow-body aircraft segment is expected to grow at the highest CAGR of 6.8% for the forecast period. These types of aircraft hold a significant proportion of global air travel as they are largely in demand for short- to medium-haul flights which is driving the market growth in this segment.

- The wide-body aircraft segment held a 34.2% share in 2024. These types of aircraft are generally used for long-haul flights on international routes and are experiencing a strong push toward in-flight internet adoption due to rising passenger expectations for seamless connectivity during extended travel durations which is expected to drive the market growth.

Based on end-user, the in-flight internet market is divided into commercial and military & defense.

- The commercial segment held the largest market share of 84.6% in 2024. The market in this segment is growing due to the increasing demand for enhanced passenger experiences and the growing importance of connectivity as a competitive differentiator among airlines.

- The military & defense segment is expected to reach a market size of USD 325.4 million in 2034. The rising need for reliable, secure, and resilient communications for military & defense applications is driving the market growth.

Looking for region specific data?

- The U.S. in-flight internet market held the highest share of 86.4% in 2024 in North America and is expected to continue its dominance till the forecast period. The market in this country is growing due to the presence of a large number of internet service providers and satellite manufacturers. Moreover, the country has one of the largest aviation markets with the presence of major players like United & Delta Airlines, which offer in-flight wi-fi connectivity to gain a competitive edge which is driving the market forward.

- The Germany in-flight internet market was valued at 60.3 million in 2024. The market in the country is growing due to the government initiative & regulation for in-flight connectivity services. For instance, the European Union’s approval for 5G connectivity above 3,000 meters by 2025 is expected to accelerate investments in hybrid satellite-air-to-ground systems which will further drive the market forward.

- The China in-flight internet market held the largest market share of 40% in 2024 in Asia Pacific region. The market in the country is growing due to the increased demand for in-flight connectivity services from the passenger travelling in the country.

- The India in-flight internet market is growing at a significant rate and is expected to reach a market size of USD 142.5 million in 2034. The growth in low-cost domestic airlines such as Indigo and Air Asia and rising demand for internet services from passenger traveling is the main factor contributing to the growth of the market. For instance, in 2025 Air India announced that it will offer wi-fi connectivity on domestic flights from 1st January 2025. The services will be available on A350, B787-9, and selected A321neo aircraft. The Wi-Fi service is available free of cost on Wi-Fi-enabled devices such as laptops, tablets, and smartphones with iOS or Android systems, allowing passengers to use multiple devices simultaneously.

- The Japan in-flight internet market was valued at USD 95.7 million in 2024. The market is growing due to the technological advancement in network connectivity. Moreover, Airlines like ANA and JAL prioritize passenger experience, offering free or subsidized Wi-Fi on both domestic and international routes to differentiate themselves. For instance, in September 2024 Japan Airlines (JAL) announced that it will enhance its inflight Wi-Fi service to provide a more comfortable inflight experience for passengers. Starting October 1, 2024, the inflight Wi-Fi service will be expanded on both international and domestic flights.

In-flight Internet Market Share

The in-flight internet industry is consolidated due to presences of large number of both multinational operators and strong regional players. Viasat, Inc., Deutsche Telekom AG, Lufthansa Technik, Panasonic Avionics Corporation, and Gogo Business Aviation LLC are the top 5 companies accounting for 55%-60% of the market. The players in this market compete with one another through technology advancements, collaboration & partnership and geographical expansion. For instance, in 2024 Azul one of the largest airline operator in Brazil announced its collaboration with Viasat Inc. With this collaboration Viasat will be offering advanced in-flight connectivity to Azul's new Airbus A330-900neo fleet. Azul passengers traveling on the new, line-fit Airbus A330-900neos will be able to enjoy onboard internet from gate to gate. Customers will be able to acquire packages for streaming audio and video, web browsing, and messaging.

Similarly, Lufthansa Technik a significant player in in-flight internet market is collaborating with regional and international airline operator to expand its business operation. For instance, in 2024 SkyFive AG, an inflight connectivity (IFC) technologies company, is partnering with Lufthansa Technik with the goal of scaling-up its delivery capabilities for Air-to-Ground (A2G) inflight broadband services to commercial airlines.

In-flight Internet Market Companies

Some of the eminent market participants operating in the market include:

- Viasat, Inc.

- Deutsche Telekom AG

- Lufthansa Technik

- Panasonic Avionics Corporation

- Gogo Business Aviation LLC.

In-Flight Internet Industry News

- In March 2024, Viasat Inc announced that it has been selected by Korean Air to provide in-flight connectivity to its 40 Boeing 787s aircrafts. By adding connectivity to the cabin across so many aircraft, Korean Air is committing to meeting passenger expectations for increased connectivity while onboard. With the high-speed in-flight Wi-Fi enabled by Viasat, Korean Air passengers will be able to browse the internet, enjoy social media, stream video and audio, shop online, catch-up with work.

- In 2024, Lufthansa Group has selected Viasat and Deutsche Telekom to equip more than 150 aircraft with EAN (European Aviation Network). With this solution, passengers on board Lufthansa, SWISS and Austrian Airlines aircraft can enjoy high-speed Internet.

The In-flight Internet market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Connectivity Type

- Satellite-based connectivity

- Ka-band

- Ku-band

- L-band

- Others

- Air-to-ground connectivity

- Hybrid

Market, Technology

- Wi-Fi

- 4G/LTE

- 5G

- Satellite broadband

Market, By Connectivity Speed

- High speed

- Standard

- Low bandwidth

Market, By Installation Type

- Retrofit

- Line-fit

Market, By Service Model

- Free Wi-fi

- Paid Wi-fi

- Freemium

Market, By Aircraft type

- Narrow-body aircraft

- Wide-body aircraft

Market, By End Use

- Commercial

- Military & Defense

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Australia

- South Korea

- Japan

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

How big is the in-flight internet market?

The market size for in-flight internet was valued at USD 1.6 billion in 2024 and is expected to reach around USD 2.87 billion by 2034, growing at 6.1% CAGR through 2034.

Who are the key players in in-flight internet industry?

Some of the major players in the industry include Viasat, Inc., Deutsche Telekom AG, Lufthansa Technik, Panasonic Avionics Corporation, and Gogo Business Aviation LLC.

What is the size of satellite-based connectivity segment in the in-flight internet industry?

The satellite-based connectivity segment generated over USD 1.07 billion in 2024.

How much in-flight internet market share captured by U.S. in 2024?

The U.S. market held around 86.4% share in 2024.

In-flight Internet Market Scope

Related Reports