Summary

Table of Content

Hysteroscopy Instruments Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Hysteroscopy Instruments Market Size

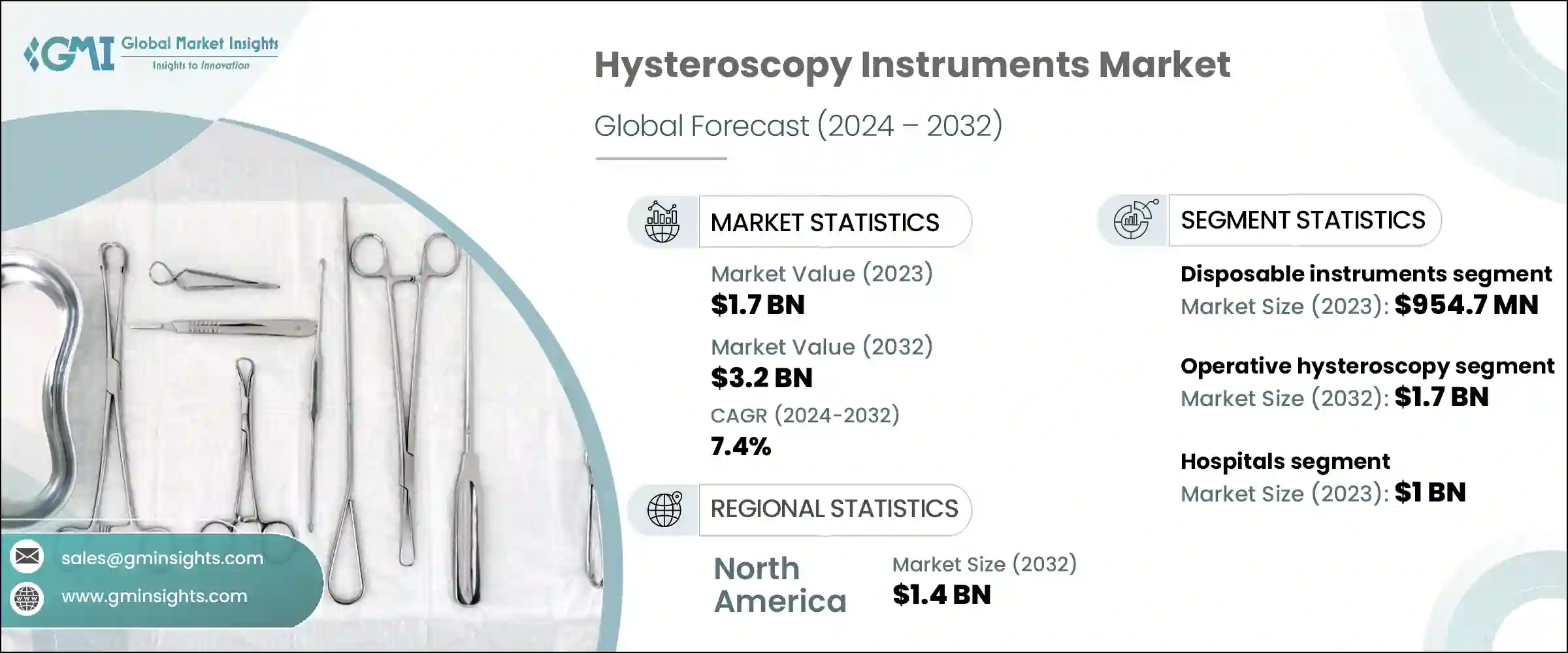

Hysteroscopy Instruments Market size was valued at around USD 1.7 billion in 2023 and is estimated to grow at 7.4% CAGR from 2024 to 2032. Hysteroscopy instruments are specialized medical devices used for performing hysteroscopy, a diagnostic and therapeutic procedure that allows healthcare professionals to view and treat conditions within the uterine cavity. These instruments are essential for evaluating and managing various gynecological conditions through a minimally invasive approach.

To get key market trends

The rising incidence of gynecological conditions, such as abnormal uterine bleeding, polyps, fibroids, and endometrial cancer, is a significant driver of market growth. As the prevalence of these disorders increases, there is a greater demand for effective diagnostic and therapeutic solutions, propelling the adoption of hysteroscopy instruments. Additionally, innovations in hysteroscopy technologies, including the development of high-definition video systems, miniaturized instruments, and advanced electrosurgical tools, are enhancing the efficacy and safety of hysteroscopic procedures. These advancements are expanding the range of indications for hysteroscopy and driving market growth.

Furthermore, there is a growing preference among patients and healthcare providers for minimally invasive surgical instruments and procedures that offer faster recovery times, reduced postoperative pain, and shorter hospital stays. Hysteroscopy, as a minimally invasive diagnostic and therapeutic technique, is increasingly favored for its benefits over traditional surgical methods.

Moreover, the expansion of ambulatory surgery centers (ASCs) that offer outpatient hysteroscopic procedures is driving market growth. ASCs provide cost-effective, efficient care for patients undergoing hysteroscopy, contributing to the increased demand for hysteroscopy instruments.

Hysteroscopy Instruments Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 1.7 billion |

| Forecast Period 2024 to 2032 CAGR | 7.4% |

| Market Size in 2032 | USD 3.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Hysteroscopy Instruments Market Trends

- Hysteroscopy procedures are becoming more popular due to their minimally invasive nature, which offers benefits such as reduced recovery times, less postoperative pain, and shorter hospital stays compared to traditional surgical methods.

- Additionally, the introduction of high-definition imaging systems, state-of-the-art hysteroscopes with enhanced maneuverability, and integrated surgical tools is elevating the precision and effectiveness of hysteroscopy procedures. These technological advancements are fueling market growth by broadening the scope of hysteroscopy applications and delivering improved patient outcomes.

- Furthermore, increased awareness and early diagnosis of gynecological conditions are also contributing to market growth. As awareness of women's health issues grows, more women are seeking diagnostic and therapeutic solutions for conditions such as abnormal bleeding, fibroids, and polyps, which are commonly treated with hysteroscopy.

Hysteroscopy Instruments Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into hysteroscopes, resectoscopes, fluid management systems, handheld instruments, hysterosheaths, and hysteroscopic tissue removal systems. The hysteroscopes segment is further sub-segmented into rigid and flexible hysteroscopes. Additionally, the resectoscopes segment is further sub-segmented into bipolar and unipolar resectoscopes. The handheld instruments segment is further sub-segmented into forceps, scissors, dilators, and other handheld instruments.

The hysteroscopes segment dominated the market with the largest revenue of USD 687.6 million in 2023.

- The rising incidence of gynecological disorders, such as abnormal uterine bleeding, endometrial polyps, and fibroids, is a major driver for the hysteroscopes market. As awareness of these conditions grows and diagnostic procedures become more prevalent, there is a greater demand for hysteroscopy as a minimally invasive diagnostic and therapeutic tool.

- Moreover, increasing healthcare expenditure and favorable government initiatives aimed at improving women's health infrastructure in developing regions are also propelling the adoption of hysteroscopy instruments.

Learn more about the key segments shaping this market

Based on usability, the hysteroscopy instruments market is bifurcated into disposable instruments and reusable instruments. The disposable instruments segment dominated the market and was valued at USD 954.7 million in 2023.

- Minimally invasive procedures are favored for their benefits, including shorter recovery times, reduced postoperative pain, and lower risk of complications. Disposable hysteroscopes align with this trend by providing a convenient and effective option for performing minimally invasive gynecological procedures.

- Furthermore, cost-effectiveness is another major factor driving the adoption of disposable hysteroscopy instruments. While the upfront cost of disposable instruments may be higher compared to reusable ones, they offer significant savings in the long run by eliminating the need for cleaning, sterilization, and maintenance. Additionally, the reduced risk of infection and complications associated with disposable instruments can lead to lower overall healthcare costs.

Based on application, the hysteroscopy instruments market is bifurcated into diagnostics hysteroscopy and operative hysteroscopy. The operative hysteroscopy segment is further sub-segmented into myomectomy, polypectomy, endometrial ablation, and tubal sterilization. The operative hysteroscopy segment is expected to reach USD 1.7 billion by 2032, growing at a CAGR of 7.5% during the forecast period.

- Recent advancements, such as the introduction of high-definition imaging systems, sophisticated resection tools, and miniaturized instruments for enhanced maneuverability, are significantly expanding the capabilities of operative hysteroscopy. These state-of-the-art technologies are enhancing procedural precision and outcomes, solidifying operative hysteroscopy as a preferred solution for a range of gynecological conditions.

- Additionally, supportive reimbursement policies from insurance providers and government healthcare programs are another key driver of the operative market. Reimbursement for hysteroscopic procedures is increasingly being covered, making these procedures more accessible and affordable for patients. This financial support encourages the adoption of advanced hysteroscopy technologies and drives market growth.

Based on end-user, the hysteroscopy instruments market is segmented into hospitals, ambulatory surgery centers, and other end-users. The hospitals segment held the largest revenue of USD 1 billion in 2023.

- The rising incidence of uterine disorders is a significant driver for the demand for hysteroscopy instruments in the hospital settings. Uterine disorders are common among women of reproductive age and often require detailed examination and intervention, which hysteroscopy can provide.

- the availability of skilled healthcare professionals and the presence of advanced medical equipment in hospitals enhance the efficacy and safety of hysteroscopic interventions. Moreover, rising healthcare expenditure and government initiatives to improve women's health further propel the demand for hysteroscopy instruments in hospitals, ensuring sustained market growth.

Looking for region specific data?

The North America hysteroscopy instruments market is forecasted to reach USD 1.4 billion by 2032, propelled by rapidly aging population, technological advancements, heightened public awareness, and the rising prevalence of gynecological disorders. U.S. dominated the North America market with the largest revenue of USD 694.7 million in 2023.

- As the number of women affected by gynecological conditions grows, there is a higher demand for diagnostic and therapeutic hysteroscopy procedures. The increasing incidence of these disorders, along with greater awareness and early diagnosis, is driving the need for advanced hysteroscopy instruments. For instance, according to the American College of Obstetricians and Gynecologists, approximately 70% of women will have uterine fibroids by age 50, driving demand for effective diagnostic tools.

- Additionally, technological advancements are a major market driver in North America. Recent innovations in high-definition imaging systems and miniaturized instruments have significantly improved the precision and effectiveness of hysteroscopy procedures. These technological improvements are expanding the capabilities of hysteroscopy, making it a preferred method for gynecological diagnostics and treatments.

The hysteroscopy instruments market in UK is expected to experience significant and promising growth from 2024 to 2032.

- In UK, the NHS focuses towards improving patient outcomes and increasing the availability of advanced diagnostic and therapeutic tools, that further supports the adoption of new hysteroscopy technologies. NHS initiatives to enhance gynecological care and streamline access to advanced procedures are contributing to the market’s growth.

- Additionally, growing patient awareness about gynecological health and the importance of early diagnosis is driving demand for hysteroscopy instruments in the UK. Awareness campaigns and educational initiatives are encouraging women to seek regular check-ups and diagnostic evaluations, leading to increased use of hysteroscopy for the early detection and treatment of gynecological conditions.

Japan hysteroscopy instruments market is anticipated to witness lucrative growth between 2024 – 2032.

- Japanese patients and healthcare providers increasingly favor minimally invasive techniques due to their benefits, including shorter recovery times, reduced postoperative pain, and lower risk of complications. The country's aging population also contributes to the rising demand for hysteroscopy instruments, as older women are more likely to require gynecological care. Technological advancements in hysteroscopic equipment, coupled with a well-established healthcare infrastructure, further boost market growth.

- Moreover, the Japanese government and regulatory agencies, such as the Pharmaceuticals and Medical Devices Agency (PMDA), maintain a regulatory framework that facilitates the approval and adoption of new medical technologies. This supportive environment encourages innovation and the introduction of advanced hysteroscopy instruments into the Japanese market.

The hysteroscopy instruments market in Saudi Arabia is expected to experience significant and promising growth from 2024 to 2032.

- The Saudi government is heavily investing in healthcare facilities, including the establishment of new hospitals and specialized clinics. This expansion is creating more opportunities for the adoption of advanced hysteroscopy technologies. For instance, The Saudi Vision 2030 initiative includes significant investments in healthcare infrastructure, with plans to increase the number of medical facilities across the country.

Hysteroscopy Instruments Market Share

The hysteroscopy instruments sector is competitive in nature, with a mix of major global and smaller to medium-sized companies competing for market share. A pivotal aspect of market strategy involves the continual introduction of innovations such as high-definition imaging systems, 4k ultra high-definition hysteroscopes, miniaturized hysteroscopes, and integrated surgical tools. Notably, prominent industry players command considerable influence in this dynamic landscape, often driving forward advancements through substantial investments in research and development. Additionally, strategic alliances, acquisitions, and mergers are instrumental in fortifying market positions and expanding global footprint amidst evolving regulatory landscapes.

Hysteroscopy Instruments Market Companies

Some of the eminent market participants operating in the hysteroscopy instruments industry include:

- B. Braun Melsungen AG

- Boston Scientific Corporation

- CooperSurgical, Inc.

- EMOS Technology GmbH

- Endoservice GmbH

- Erbe Elektromedizin GmbH

- Hologic, Inc.

- Johnson & Johnson Services, Inc.

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- XION GmbH

Hysteroscopy Instruments Industry News:

- In November 2022, India Medtronic Private Limited, a wholly owned subsidiary of Medtronic plc, announced the launch of the TruClear System, a mechanical hysteroscopic tissue removal system designed for the safe and effective treatment of intrauterine abnormalities (IUA). This innovative system aimed to enhance the precision and efficacy of hysteroscopic procedures. The launch of the TruClear System positioned the company at the forefront of the gynecological solutions market by expanding their product portfolio and meeting the increasing demand for advanced, reliable treatment options for intrauterine conditions.

- In November 2020, Hologic, Inc., a leading medical technology company, introduced the Omni Suite, a comprehensive surgical offering designed to optimize both diagnostic and operative hysteroscopy. The Omni Suite included the Omni 30° and 0° hysteroscopes, the Omni 4K video system, and the Omni Lok cervical seal. This advanced suite enabled customized operative capabilities and provided powerful visualization tools for diagnosing and treating patients. This product launch allowed Hologic to reinforce its position in the market by delivering an innovative solution that enhances both procedural efficiency and patient outcomes, aligning with the growing demand for advanced hysteroscopic technologies.

The hysteroscopy instruments market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Million from 2021 – 2032 for the following segments:

Market, By Type

- Hysteroscopes

- Rigid hysteroscopes

- Flexible hysteroscopes

- Resectoscopes

- Bipolar resectoscopes

- Unipolar resectoscopes

- Fluid management systems

- Handheld instruments

- Forceps

- Scissors

- Dilators

- Other handheld instruments

- Hysterosheaths

- Hysteroscopic tissue removal systems

Market, By Usability

- Reusable instruments

- Disposable instruments

Market, By Application

- Diagnostic hysteroscopy

- Operative hysteroscopy

- Myomectomy

- Polypectomy

- Endometrial ablation

- Tubal sterilization

Market, By End-user

- Hospitals

- Ambulatory surgery centers

- Other end-users

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the major hysteroscopy instruments industry players?

Johnson & Johnson Services, Inc., KARL STORZ SE & Co. KG, Medtronic plc, Olympus Corporation, Richard Wolf GmbH, Smith & Nephew plc, Stryker Corporation, and XION GmbH among others.

Why is the hysteroscopy instruments industry growing in North America?

North America hysteroscopy instruments market is forecasted to reach USD 1.4 billion by 2032, propelled by rapidly aging population, technological advancements and heightened public awareness.

Why is the demand for disposable hysteroscopy instruments rising?

The disposable hysteroscopy instruments market was valued at USD 954.7 million in 2023 and will expand rapidly through 2032, owing to their cost effectiveness.

How much is the hysteroscopy instruments industry worth?

The hysteroscopy instruments market size was valued at USD 1.7 billion in 2023 and is estimated to grow at 7.4% CAGR from 2024 to 2032, driven by the rising incidence of gynecological conditions, such as abnormal uterine bleeding.

Hysteroscopy Instruments Market Scope

Related Reports