Summary

Table of Content

Global Hydrogen Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Hydrogen Market Size

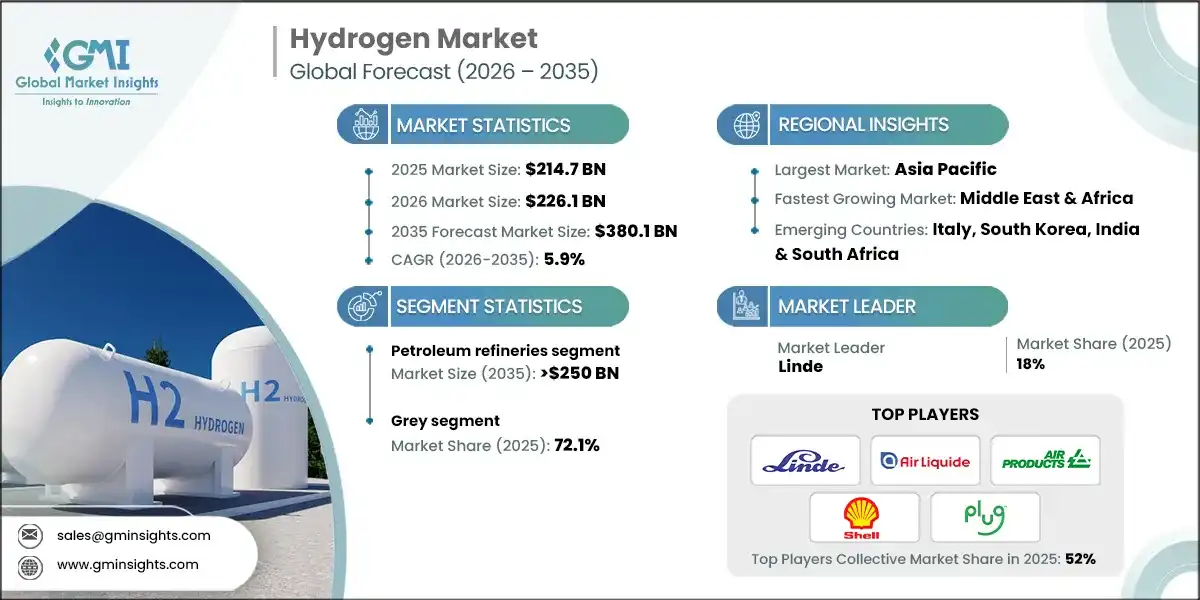

The global hydrogen market was estimated at USD 214.7 billion in 2025. The market is expected to grow from USD 226.1 billion in 2026 to USD 380.1 billion in 2035, at a CAGR of 5.9% according to Global Market Insights Inc.

To get key market trends

- The transition of the hydrogen economy from predominantly fossil-fuel-based production toward low-emissions pathways driven by climate commitments, technological maturation, and evolving policy frameworks is set to drive the market outlook.

- The increasing push to decarbonize energy-intensive industries through the adoption of low-carbon hydrogen pathways, along with the growing use of hydrogen in manufacturing ammonia, methanol, and other chemical products, is anticipated to accelerate the market landscape. A rising number of companies are prioritizing blue hydrogen solutions that rely on natural gas integrated with carbon capture and storage (CCS) technologies to curb emissions, thereby strengthening the overall industry ecosystem.

- The global shift toward cleaner energy systems is increasing the focus on high-efficiency fuel alternatives, creating attractive opportunities for hydrogen to replace traditional fossil-based fuels. Supportive policy frameworks, clean energy goals, and government-led incentives and mandates that promote low-emission solutions are expected to further accelerate hydrogen demand.

- For instance, in September 2024, 58 governments plus the European Union and ECOWAS had adopted national hydrogen strategies, with aggregate deployment targets for low-emissions hydrogen reaching 35-43 million tonnes by 2030, representing 55-65% of the Net Zero Emissions scenario requirements.

- Efforts to reduce carbon emissions across industrial sectors are driving the shift toward low-emission hydrogen production routes, alongside increased use of hydrogen in the synthesis of ammonia, methanol, and other chemical intermediates. For instance, in January 2025, the United States finalized Section 45V Clean Hydrogen Production Tax Credit rules, providing up to USD 3/kg production credits over 10 years.

- Growing focus on clean energy and decarbonization pathways has elevated hydrogen's strategic importance for hard-to-abate sectors. The International Energy Agency projects that achieving Net Zero Emissions by 2050 will require hydrogen demand to reach approximately 150 million tonnes by 2030, with more than one-third coming from new applications including 100% hydrogen-based direct reduced iron (DRI) for steel production, high-temperature industrial heat, transport, and power generation.

- Ongoing technological progress is steadily reducing the cost differential between traditional hydrogen production and low-carbon alternatives. China has established a leading position in both electrolyzer deployment and manufacturing, representing nearly two-thirds of global installed capacity and around 60% of worldwide production capability. The country’s domestic manufacturing capacity, which exceeds 20 GW annually, currently surpasses overall global demand.

- The expansion of hydrogen applications beyond traditional industrial uses into transport and emerging sectors will complement the business landscape. The maritime sector is witnessing accelerating momentum. For instance, as of December 2024, 4 ammonia-fueled vessels and 26 ammonia-ready vessels are operational, and 129 ammonia-fueled plus 193 ammonia-ready vessels are on order.

- Ongoing scaling up of electrolyzer development and manufacturing capacity to meet the projected demand will augment the industry landscape. The International Energy Agency assesses that 65-70 GW of electrolyzer capacity has strong potential to be operational by 2030. Major technology providers are transitioning from prototypes to commercial-scale production.

- For instance, in March 2025, Bosch commercially launched its Hybrion PEM stack at Hannover Messe with approximately 100 MW in pre-orders and commissioned a 2.5 MW in-house electrolyzer at its Bamberg facility producing over 1 metric tonne per day of green hydrogen.

Global Hydrogen Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 214.7 Billion |

| Market Size in 2026 | USD 226.1 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.9% |

| Market Size in 2035 | USD 380.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Favorable government regulations and policy frameworks | Supportive regulatory environments are a key driver of the global hydrogen market, as governments increasingly recognize hydrogens role in achieving energy security and emissions reduction goals. National hydrogen strategies, clear certification frameworks, subsidies, tax credits, and funding for pilot and large-scale projects are reducing investment risk and accelerating commercialization. In addition, mandates for low-carbon fuels in industry, transport, and power generation, along with public procurement and infrastructure support, are creating stable demand signals that encourage private-sector participation across the hydrogen value chain. |

| Increasing focus on clean energy and decarbonization | The growing emphasis on clean energy and deep decarbonization across hard-to-abate sectors is significantly boosting hydrogen adoption worldwide. Industries such as chemicals, refining, steel, and heavy transport are turning to low-carbon hydrogen as a viable alternative to fossil-based fuels and feedstocks. As countries commit to net-zero targets and tighter emissions standards, hydrogen is increasingly viewed as a critical enabler for reducing carbon footprints where direct electrification is not feasible, thereby strengthening long-term market demand. |

| Modern technological advancements | Advancements in hydrogen production, storage, transport, and end-use technologies are improving efficiency while steadily lowering costs, making hydrogen more commercially attractive. Innovations in electrolyzer design, scaling of manufacturing, improvements in carbon capture integration, and digital optimization of hydrogen systems are narrowing the cost gap between conventional and low-emission hydrogen. These technological improvements are also enhancing system reliability and scalability, enabling wider deployment across industrial, mobility, and energy applications and supporting sustained market growth. |

| Pitfalls & Challenges | Impact |

| High safety concerns | High safety concerns associated with hydrogens physical properties including its wide flammability range, low ignition energy, and propensity for embrittlement of certain materials necessitate stringent handling, storage, and transport protocols that increase infrastructure costs and complexity. |

| Lack of dedicated infrastructure | Existing hydrogen pipeline infrastructure totals only approximately 5,000 kilometers globally, concentrated in industrial clusters. More than 90 hydrogen hubs are under development across 36 countries, with projected investment in infrastructure to store, transport, and export hydrogen reaching up to $5 trillion by 2050, but coordination challenges, permitting delays, and financing gaps are slowing deployment. |

| Opportunities: | Impact |

| Expansion of hydrogen-based energy storage and clean mobility | Hydrogen enables large-scale, long-duration energy storage, supporting the integration of variable renewable energy sources such as wind and solar into power systems. In parallel, hydrogen and fuel cell technologies are gaining traction in trucks, buses, trains, shipping, and potentially aviation, where battery solutions face limitations related to weight and range. Growing investments in refueling infrastructure and fuel cell technologies are expected to unlock new commercial opportunities across the mobility and energy sectors. |

| Decarbonization of hard-to-abate industrial sectors | Low-carbon hydrogen offers a practical pathway to reduce emissions by replacing coal- and gas-based inputs in processes such as direct reduced iron (DRI) steelmaking and ammonia and methanol production. As regulatory pressure intensifies and carbon pricing mechanisms expand, industrial players are increasingly investing in hydrogen-based solutions, creating substantial long-term demand. |

| Market Leaders (2025) | |

| Market Leaders |

18% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Countries | Italy, South Korea, India & South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Hydrogen Market Trends

- Rising interest in hydrogen fuel cell vehicles (FCVs) for commercial and industrial use, together with increasing deployment of hydrogen-powered buses and trains particularly across Europe and Asia is anticipated to drive product demand. Companies such as Australian startup H2X are advancing FCV designs that offer rapid refueling times and extended driving ranges compared with battery-electric alternatives.

- In parallel, hydrogen-powered trains are gaining traction as viable alternatives to diesel locomotives, especially in European regions where full rail electrification is costly or impractical, supporting broader market expansion. For example, in December 2024, Air Liquide secured USD 114 million in funding from the European Innovation Fund to support its ENHANCE project at the Port of Antwerp-Bruges in Belgium, highlighting growing institutional backing for hydrogen-based transport solutions.

- Public funding initiatives and supportive policy measures are accelerating hydrogen market development, as many countries have introduced or are in the process of formulating national hydrogen strategies aimed at decarbonization and strengthening energy security. For instance, in May 2022, the European Commission launched two reviews related to delegated acts that clarify the European Union’s approach to renewable hydrogen under the Renewable Energy Directive adopted in 2018.

- Evolving policy frameworks across regions are enabling financial support mechanisms such as grants, tax credits, and other incentives for the development of hydrogen production facilities, refueling infrastructure, and storage assets. These measures also encourage greater private-sector participation, while providing industries with economic incentives to adopt emissions-reduction technologies, thereby contributing to broader economic growth.

Hydrogen Market Analysis

Learn more about the key segments shaping this market

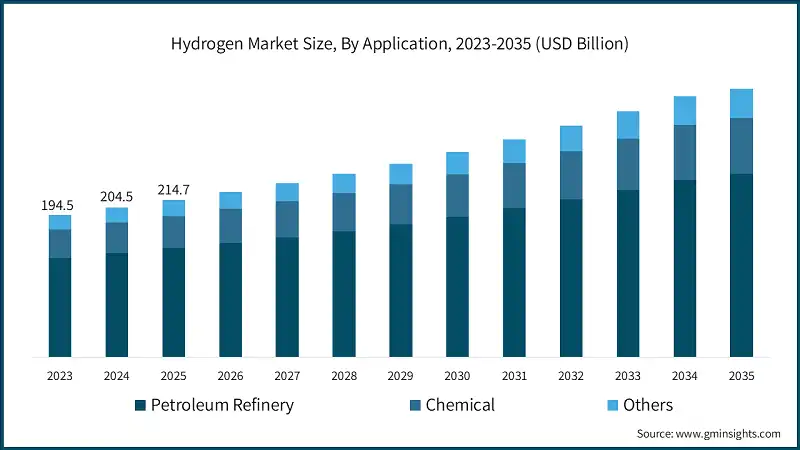

- Based on application, the market is segmented into petroleum refinery, chemical and others. The market for petroleum refineries is expected to reach USD 250 billion by 2035.

- Efforts to expand the use of hydrogen within refineries are strengthening the overall market outlook. Hydrogen plays a critical role in refinery desulfurization processes, helping reduce sulfur levels in diesel and gasoline produced from crude oil. An increasing number of refineries worldwide are adopting green hydrogen to support net-zero emission objectives. For instance, in February 2023, Indian Oil Corporation (IOC), one of India’s largest oil companies, announced plans to install green hydrogen facilities across all its refineries by 2047.

- Rising global agricultural output, which is increasing demand for ammonia, along with the expanding use of methanol in industrial operations, is expected to support market growth. For instance, the MadoquaPower2X Project, initiated in mid-2022, aims to generate renewable hydrogen and ammonia using 1.1 GW of wind and solar capacity to supply a 500 MW electrolyzer system.

- Hydrogen presents opportunities across multiple sectors, including steelmaking, transportation, power generation and grid balancing, and the buildings sector. Efforts to optimize the existing industrial processes to lower emissions, combined with the continued rollout of cost-competitive renewable hydrogen, are likely to drive wider adoption of this clean energy carrier in additional applications. For instance, in December 2024, India’s Ministry of Steel approved two pilot projects for producing Direct Reduced Iron using vertically integrated shaft furnaces powered entirely by hydrogen.

Learn more about the key segments shaping this market

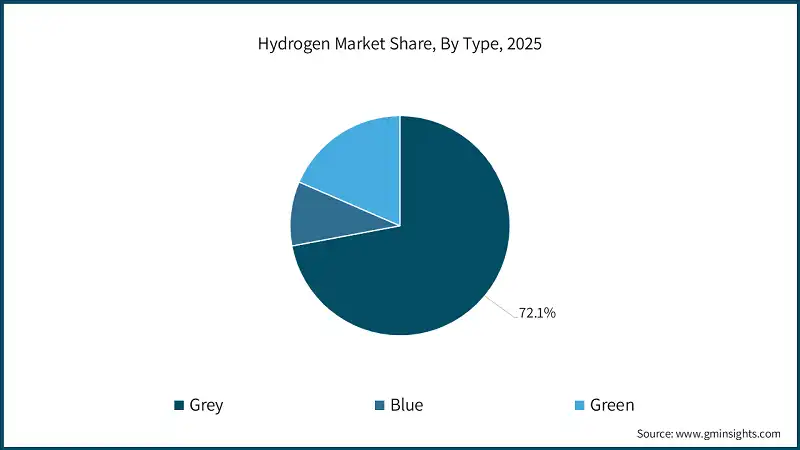

- Based on type, the hydrogen market is bifurcated into grey, blue and green. The grey hydrogen contributed 72.1% of the overall market share in 2025 owing to the existing efforts to modernize the refining capacity and increased consumption of crude oil.

- The high carbon intensity associated with grey hydrogen production through steam methane reforming has accelerated the push toward green hydrogen alternatives. At the same time, heightened efforts to curb greenhouse gas emissions and increasing pressure on industries to transition away from emission-heavy processes are expected to strengthen the overall market landscape.

- Blue hydrogen market is anticipated to grow over 9% CAGR by 2035 on account of continuous technological advancements to develop hydrogen infrastructure. Ongoing introduction of several norms across the government authorities have shifted the interest toward the production of hydrogen using CCS technologies which will further accelerate the business outlook. In March 2024, ExxonMobil, announced a revised version of its flagship blue hydrogen initiative in Texas. The company intends to export approximately 500,000 tonnes of blue ammonia to Japan.

- The green hydrogen market is expected to reach more than USD 103 billion by 2035 as global attention increasingly shifts toward clean energy sources and heightened awareness of carbon emissions continues to grow. The emergence of international trade in green hydrogen, supported by substantial investments across the hydrogen value chain including liquefied hydrogen transport infrastructure is likely to further accelerate market development. For example, in 2024, ABB entered into an agreement with Green Hydrogen International to support the production of approximately 280,000 tons of green hydrogen annually in Texas, U.S.

Looking for region specific data?

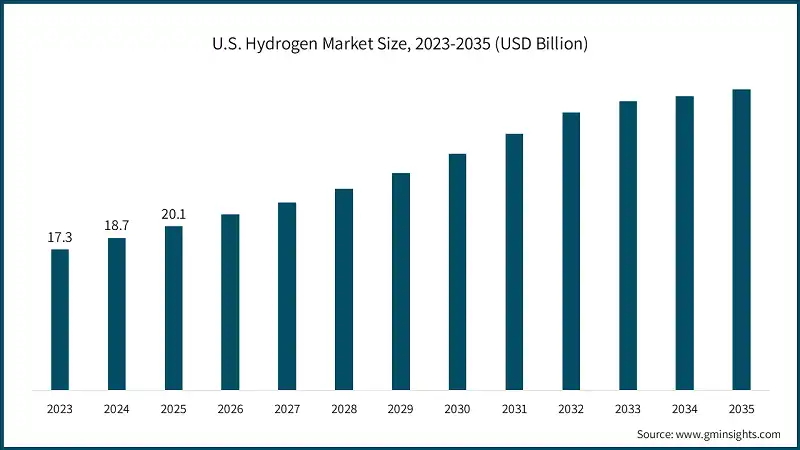

- The U.S. hydrogen market amounted to USD 17.3 billion, USD 18.7 billion and USD 20.1 billion by 2023, 2024 and 2025 respectively. North America accounts for nearly 12.1% of the overall market share in 2025 on account of significant efforts by various government agencies.

- Regions including the California are at the forefront of hydrogen fuel cell vehicle deployment and related infrastructure buildout, while Canada is positioning itself as a strategic exporter of clean hydrogen to Asian markets, supporting global market growth. Moreover, strong commitments to decarbonization, the energy transition, and ongoing technological innovation are expected to create additional opportunities across the hydrogen ecosystem.

- Europe hydrogen market will amount to more than USD 62 billion owing to rising hydrogen demand across industrial, transport, and energy applications is driving market expansion. Collaborative initiatives, including partnerships and joint ventures, are likely to strengthen hydrogen’s integration into the region’s clean energy value chain. For example, in July 2024, Messer Group announced plans for a new green hydrogen production facility in Düren, Germany, designed to support Germany’s clean energy transition.

- The Asia Pacific hydrogen market is expected to grow over 6% CAGR due to the rollout of supportive policy measures aimed at attracting investment into hydrogen initiatives. Ongoing research, pilot, and demonstration programs largely centered on hydrogen production along with country-specific hydrogen roadmaps and continued technological progress in clean energy development are likely to accelerate the adoption of low- and carbon-negative energy solutions across the region. For instance, under China’s Hydrogen Industry Development Plan (2021–2035), the country targets hydrogen production of nearly 200,000 tonnes per year by 2025.

- The Middle East and Africa holds 8.4% market share, with Saudi Arabia's NEOM green hydrogen project representing the largest single investment. The project, developed by NEOM Green Hydrogen Company features 2.2 GW of electrolyzer capacity powered by 4 GW of renewable energy to produce 200,000 tonnes per year of green hydrogen along with a 30-year ammonia offtake agreement with Air Products and project capital expenditure of USD 8.4 billion .

- Latin America hydrogen market is set to grow more than USD 16 billion by 2035 driven by exceptional renewable energy resources and export-oriented strategies. For instance, in July 2025, the World Bank approved a USD 134 million financing package to support the green hydrogen strategy of Brazil's Ceará state, including a USD 90 million IBRD loan, USD 9 million grant from the Livable Planet Fund, and USD 35 million from the Climate Investment Funds to enable clean hydrogen production at the Pecém Complex.

Hydrogen Market Share

- Top 5 players operating in the industry include Air Products & Chemicals, Air Liquide, Linde, Shell and Plug Power accounting for 52% market share. The hydrogen industry competition comprises a variety of regular energy firms, dedicated hydrogen manufacturers, and technology companies.

- The industry is characterized by vertically integrated industrial gas majors, emerging electrolyzer technology providers, and diversifying energy companies positioning for the low-emissions hydrogen transition. This market structure is evolving rapidly as traditional industrial gas suppliers face competition from renewable energy developers, technology startups scaling electrolyzer manufacturing, and oil and gas companies pivoting toward hydrogen as part of broader decarbonization strategies.

- Competitive dynamics in the market differ across regions, reflecting variations in policy environments, decarbonization priorities, and the speed of technological advancement. An increasing number of private-sector players are moving into the hydrogen ecosystem, drawn by its potential to support emissions reduction. Further, venture capital and private equity investors are channeling funds into both hydrogen production activities and downstream segments such as fuel cells, transportation, and mobility solutions.

Hydrogen Market Companies

Eminent players operating in the hydrogen industry are:

- Air Liquide

- Air Products & Chemicals

- Ally Hi Tech

- Ballard Power Systems

- Caloric

- Claind

- Cummins

- ENGIE

- HyGear

- Infinite Green Energy

- Iwatani Corporation

- Linde

- Mahler AGS

- Mcphy Energy

- Messer

- Nel ASA

- Nuvera Fuel Cells

- Plug Power

- Resonac Holdings Corporation

- Taiyo Nippo Sanso Corporation

- Teledyne Technologies Incorporated

- Xebec Adsorption

- Linde plc maintains market leadership through its extensive global industrial gas operations, hydrogen production facilities, distribution infrastructure including pipeline networks and liquid hydrogen capabilities, and strategic positioning in both conventional and low-emissions hydrogen markets. The company operates the world's largest liquid hydrogen production facility in Leuna, Germany, and has announced multiple clean hydrogen projects including participation in the European Hydrogen Backbone infrastructure development. The company's 2024 annual revenue exceeded USD 31 billion, with hydrogen representing a significant and growing component of its industrial gases portfolio.

- Air Liquide holds a strong competitive position through similar vertically integrated capabilities, operating over 100 hydrogen production units globally and supplying approximately 2 million tonnes of hydrogen annually to industrial customers. The company is advancing major low-carbon hydrogen projects including its partnership with ExxonMobil on the Baytown, Texas facility the world's largest low-carbon hydrogen project designed to produce over 1 billion cubic feet per day of low-carbon hydrogen and more than 1 million tonnes per year of ammonia while capturing over 98% of associated CO2 emissions.

- Air Products & Chemicals differentiates through its focus on large-scale industrial projects and hydrogen liquefaction capabilities, operates the world's largest hydrogen production facility in La Porte, Texas, and advancing multiple blue and green hydrogen megaprojects. The company's Louisiana Clean Energy Complex will produce over 750 million standard cubic feet per day of blue hydrogen, capturing over 5 million metric tonnes of CO2 per year in what is claimed as the largest carbon capture for sequestration facility in the world.

- Shell plc is leveraging its global energy infrastructure, customer relationships, and capital resources to establish a significant position in low-emissions hydrogen production and distribution. The company reached final investment decision on Refhyne II and Holland Hydrogen I, with the latter featuring Gasunie-built pipeline infrastructure with Shell as anchor customer. The company's 2024 revenue exceeded USD 300 billion across all business segments, with hydrogen representing a strategic growth area within its energy transition portfolio.

- Plug Power Inc. has emerged as a leading pure-play hydrogen company, differentiating through its focus on green hydrogen production via proton exchange membrane electrolysis, fuel cell manufacturing, and end-to-end hydrogen solutions for material handling and emerging applications. The company delivered the first of ten 10-megawatt electrolyzer modules to Galp's 100-megawatt green hydrogen project at Sines Refinery in Portugal in October 2025 , and secured its first NASA liquid hydrogen supply contract in December 2025 valued at up to USD 2.8 million for up to 218,000 kilograms of liquid hydrogen. The company's 2024 revenue exceeded USD 750 million, with strategic focus on scaling electrolyzer manufacturing and green hydrogen production to achieve profitability.

Hydrogen Industry News

- In December 2025, Plug Power announced its first NASA liquid hydrogen supply contract, valued at up to USD 2.8 million for up to 218,000 kilograms of liquid hydrogen to be delivered to Kennedy Space Center and Marshall Space Flight Center over 12 months. This marks Plug Power's entry into the aerospace sector and demonstrates the company's liquid hydrogen production and logistics capabilities, with potential for additional NASA contracts as the space industry expands hydrogen-fueled launch systems.

- In November 2025, Marubeni Corporation announced the successful completion of a green hydrogen demonstration project between Australia and Indonesia, marking the first international shipment of green hydrogen in the Asia-Pacific region. The project demonstrated the technical feasibility of producing green hydrogen in Australia using renewable electricity, converting it to ammonia for shipping, and transporting it to Indonesia for potential use in power generation and industrial applications, validating a potential trade corridor for future commercial-scale operations.

- In October 2025, Plug Power delivered the first of ten 10-megawatt electrolyzer modules for Galp's 100-megawatt green hydrogen project at the Sines Refinery in Portugal. The complete facility is expected to produce 15,000 tonnes per year of renewable hydrogen by early 2026, replacing approximately 20% of the refinery's grey hydrogen demand and reducing Scope 1 and 2 greenhouse gas emissions by 110,000 tonnes CO2-equivalent annually, representing one of Europe's largest operational green hydrogen projects for refinery applications.

- In August 2025, the New York State awarded over USD 11 million to five clean hydrogen research and development and demonstration projects, including National Grid Ventures' USD 2 million project to install the first commercially deployed 100% hydrogen-fueled linear generator at Northport Power Plant for one-year testing of air quality and grid reliability benefits. Additional funded projects include hydrogen storage systems, distribution infrastructure, and hydrogen-powered transport demonstrations, reflecting New York's strategy to advance hydrogen across multiple applications.

The hydrogen market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue and volume in “USD Billion and MT” from 2023 to 2035, for the following segments:

Market, By Type

- Grey

- Blue

- Green

Market, By Application

- Petroleum Refinery

- Chemical

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Netherlands

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Middle East & Africa

- Saudi Arabia

- Iran

- UAE

- South Africa

- Qatar

- Kuwait

- Latin America

- Brazil

- Argentina

- Chile

Frequently Asked Question(FAQ) :

Who are the key players in the global hydrogen market?

Leading companies operating in the hydrogen market include Linde, Air Liquide, Air Products & Chemicals, Shell plc, Plug Power Inc., Nel ASA, Cummins, ENGIE, Messer, and Ballard Power Systems.

What is the projected market value of the petroleum refinery segment by 2035?

The petroleum refinery segment leads the market and is expected to exceed USD 250 billion by 2035, as hydrogen remains essential for desulfurization and cleaner fuel production.

Which region is the largest hydrogen market?

North America accounts for nearly 12.1% of the overall market share in 2025 on account of significant efforts by various government agencies.

What is the growth outlook for green hydrogen market from 2026 to 2035?

The green hydrogen segment is expected to surpass USD 103 billion by 2035, driven by global clean energy targets, falling electrolyzer costs, and rising investments in renewable-powered hydrogen production.

Which type dominated the hydrogen market in 2025?

Grey hydrogen dominated the market with a 72.1% share in 2025, owing to its widespread use in petroleum refining and chemical production.

What is the expected growth rate of the blue hydrogen segment?

The blue hydrogen segment is anticipated to grow at a CAGR of over 9% through 2035, supported by advancements in carbon capture and storage (CCS) technologies and regulatory pressure to reduce emissions.

What is the market size of the global hydrogen market in 2025?

The market size was valued at USD 214.7 billion in 2025, with a CAGR of 5.9% expected through 2035, supported by growing demand for clean energy, favorable government regulations, and rising decarbonization initiatives across industries.

What is the projected value of the hydrogen market by 2035?

The hydrogen market is expected to reach USD 380.1 billion by 2035, due to accelerating adoption of low-emission hydrogen technologies.

What is the estimated hydrogen market size in 2026?

The hydrogen market is projected to grow to USD 226.1 billion in 2026, driven by increased investments in hydrogen production, infrastructure development, and supportive policy frameworks.

Global Hydrogen Market Scope

Related Reports