Home > Semiconductors & Electronics > Sensors > Hydrogen Fluoride Gas Detection Market

Hydrogen Fluoride Gas Detection Market Analysis

- Report ID: GMI7102

- Published Date: Oct 2023

- Report Format: PDF

Hydrogen Fluoride Gas Detection Market Analysis

Based on system type, the market is segmented into fixed devices and portable devices. The fixed devices segment dominated the global market with a share of over 50% in 2022.

- In industries with large, open areas or expansive facilities, fixed devices are necessary to provide comprehensive coverage. Portable detectors may not be practical for monitoring extensive spaces. Strategically placed fixed systems cover large areas effectively, ensuring that HF gas leaks are detected regardless of the location within the facility.

- Fixed HF gas detection systems often come equipped with data logging capabilities. They record gas concentration levels over time, enabling a detailed analysis of historical data. This data can be valuable for identifying trends, conducting root cause analyses, and optimizing safety protocols. The ability to analyze historical data helps industries enhance their safety strategies and prevent future incidents.

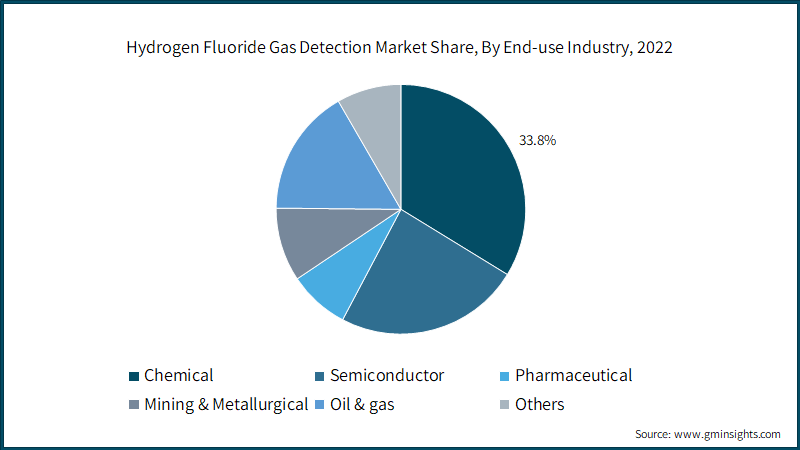

Based on the end-use industry, the market is divided into chemical, semiconductor, pharmaceutical, mining & metallurgical, oil & gas, and others. The chemical segment is anticipated to register a CAGR of over 5% through 2032.

- Ensuring worker safety is the top priority in the chemical industry. HF gas exposure can cause severe health issues, including skin burns, respiratory problems, and even death at higher concentrations. To protect workers and provide a safe working environment, chemical companies invest in state-of-the-art HF gas detection systems. These systems enable early detection of leaks, allowing for timely evacuation and minimizing potential health risks.

- HF gas detection systems are crucial for preventive maintenance in chemical plants. Regular monitoring and early detection of HF gas leaks allow for prompt maintenance and repairs. Preventive maintenance ensures the reliability of equipment and prevents costly downtimes. Chemical companies invest in HF gas detection systems as part of their preventive maintenance strategies, ensuring the uninterrupted operation of their facilities.

Asia Pacific hydrogen fluoride gas detection market is expected to grow at a CAGR of over 5% between 2023 and 2032. The region is home to many innovative technology companies that focus on developing advanced sensors and detection technologies. These advancements lead to the production of more efficient, sensitive, and reliable HF gas detection systems, encouraging industries in the region to adopt the latest technologies for enhanced safety. Countries in Asia Pacific, particularly Taiwan, South Korea, China, and Japan, are the major hubs for semiconductor & electronics manufacturing. HF gas is used in semiconductor etching processes. With the growing demand for electronic components globally, there will be an increased demand for HF gas detection systems subsequently in these manufacturing facilities to protect both workers and the sensitive electronic equipment.