Summary

Table of Content

Household Refrigerators and Freezers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Household Refrigerators and Freezers Market Size

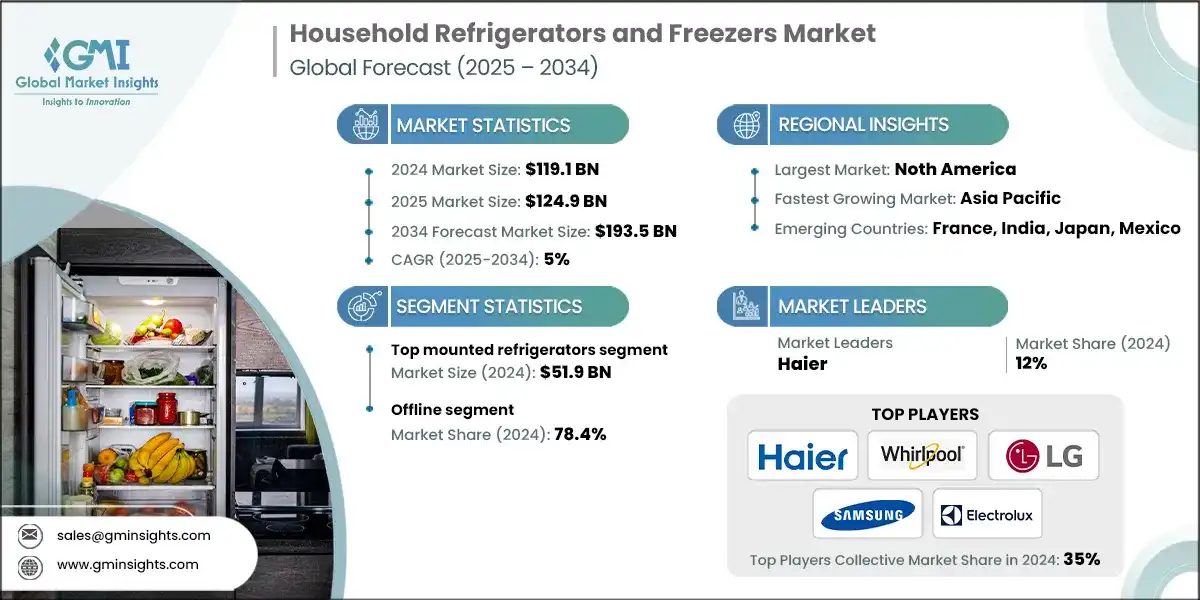

The global household refrigerators and freezers market size was valued at USD 119.1 billion in 2024. The market is expected to grow from USD 124.9 billion in 2025 to USD 193.5 billion in 2034, at a CAGR of 5%, according to the latest report published by Global Market Insights Inc. With increasing preference for energy efficient appliances, which lowers electricity cost as well as reduces carbon footprint and an increasing environment awareness the requirement for energy efficient systems is on the rise. According to the U.S. Department of Energy, ENERGY STAR-certified refrigerators use 15% less energy than non-certified models.

To get key market trends

Manufacturers like Samsung, Haier, LG are responding by introducing advanced technologies like automatic defrost and temperature control, aligning with government incentives promoting sustainable appliances. The adoption of smart technologies in household appliances is redefining consumer expectations. For instance, a 2023 report by the Association of Home Appliance Manufacturers (AHAM) highlights a 20% increase in demand for smart refrigerators with features like Wi-Fi connectivity and virtual assistant compatibility. These innovations enable remote monitoring, real-time inventory updates, and recipe access, enhancing convenience and user experience. LG and Samsung have already showcased their AI-integrated smart refrigerators that reflect a futuristic driven innovation.

Asia Pacific is the fastest growing region of the market, due to the increasing disposable income due to urbanization, especially within the middle class, contributing to the increasing purchase of refrigeration and freezing systems. The World Bank reports that urban populations in these regions are growing at an annual rate of 4%, fueling demand for modern appliances. Urban consumers prioritize refrigerators and freezers with advanced features that align with their fast-paced lifestyles and rising living standards. The expansion of residential properties in urban areas further boosts demand for household appliances. According to the National Association of Realtors, urban housing developments in 2023 increased by 8%, creating opportunities for appliance manufacturers. Consumers in these areas seek energy-efficient and feature-rich refrigerators and freezers to complement their modern homes.

Household Refrigerators and Freezers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 119.1 Billion |

| Market Size in 2025 | USD 124.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 5% |

| Market Size in 2034 | USD 193.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for energy-efficient appliances | Consumers are prioritizing energy-efficient refrigerators and freezers to save on costs and support sustainability. |

| Technological advancements and smart features | Smart technologies like AI-driven cooling and advanced sensors are redefining refrigerators as central home devices. |

| Increasing urbanization and disposable income | Growing urban populations and higher disposable incomes are boosting demand for premium, feature-rich refrigeration appliances. |

| Pitfalls & Challenges | Impact |

| Extended replacement cycles | Extended replacement cycles are affecting the home refrigerator and fridge market by delaying consumer purchases. This reduces the frequency of product developments, impacting overall market growth. |

| Price sensitivity among consumers | Buyers increasingly focus on cost-effective options; this behavior limits the demand for premium or high-end refrigerator models. |

| Opportunities: | Impact |

| Expansion in emerging market | Rising middle-class populations in Asia and Africa are fueling demand for affordable and efficient refrigeration solutions. |

| Growth of smart home ecosystems | Integration with IoT platforms is boosting demand for connected refrigerators with remote monitoring and automation features. |

| Market Leaders (2024) | |

| Market Leaders |

12% market share |

| Top Players |

The collective market share in 2024 is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | France, India, Japan, Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

Household Refrigerators and Freezers Market Trends

- Modern refrigerators now incorporate advanced smart features such as Wi-Fi connectivity, touchscreens, and virtual assistant integration. These technologies enable users to remotely manage their appliances, receive real-time updates on food inventory, and access recipes directly from the refrigerator. This trend, gaining momentum since 2020, aligns with the growing adoption of smart home ecosystems, driven by consumer demand for convenience and connectivity.

- Environmental awareness has led consumers to prioritize energy-efficient appliances to reduce electricity consumption and minimize their carbon footprint. According to the U.S. Department of Energy, energy-efficient appliances can save households up to 25% on utility bills annually. In response, manufacturers like LG Electronics, Samsung, and Whirlpool are introducing refrigerators with features such as automatic defrost and precise temperature control to meet these demands.

- Government regulations and incentives are further accelerating the shift toward sustainable appliances. For instance, the U.S. Environmental Protection Agency’s ENERGY STAR program has been promoting energy-efficient products, while similar initiatives in the European Union encourage eco-friendly manufacturing. These policies have motivated manufacturers to innovate and comply with stringent energy efficiency standards.

- Since 2021, the market has seen a steady rise in eco-friendly and smart refrigerators, reflecting a broader shift in consumer preferences. Companies like Haier and Bosch are actively investing in research and development to integrate advanced technologies while adhering to sustainability goals. This dual focus on innovation and environmental responsibility is shaping the future of the refrigerator market.

Household Refrigerators and Freezers Market Analysis

Learn more about the key segments shaping this market

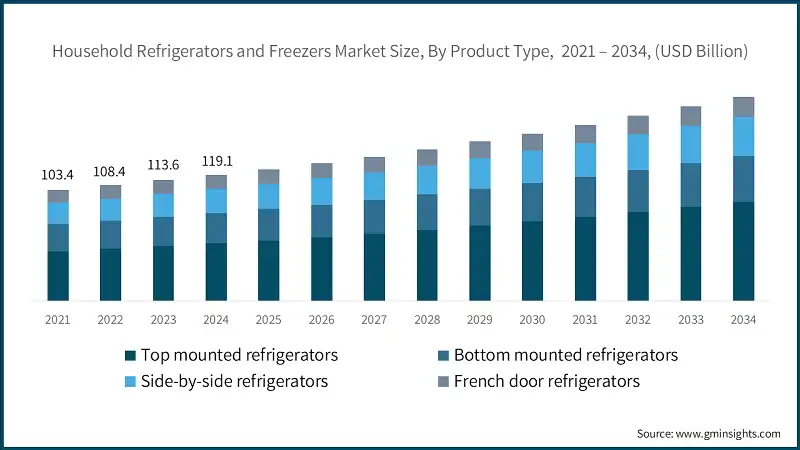

Based on type segment, the market is segmented into top mounted refrigerators, bottom mounted refrigerators, side-by-side refrigerators, and french door refrigerators. The top mounted refrigerators segment held the maximum share in the market, generating a revenue of USD 51.9 billion in 2024.

- Top-mounted refrigerators, featuring the freezer compartment above the main section, continue to hold a significant share in the global market. According to the U.S. Department of Energy, these models are among the most energy-efficient, helping households reduce electricity consumption. Their affordability and practicality make them a preferred choice for a wide range of consumers.

- These refrigerators are generally more cost-effective compared to other designs, appealing to budget-conscious buyers. Manufacturers like Whirlpool focus on producing durable and affordable models, while LG Electronics emphasizes energy-efficient features to cater to environmentally aware consumers. This segment remains particularly strong in both developed and emerging markets.

- The freezer's top placement in these models enhances cooling efficiency, reducing energy usage. As per the International Energy Agency (IEA), such designs align with global energy efficiency standards, supporting sustainability goals. This has encouraged manufacturers to adopt eco-friendly refrigerants and improve insulation technologies to meet regulatory requirements.

- Leading players like Samsung and Haier are driving innovation in this segment by integrating smart technology, such as IoT-enabled features, and using sustainable materials. These advancements ensure top-mounted refrigerators remain competitive, addressing evolving consumer preferences and adhering to stricter environmental regulations.

Learn more about the key segments shaping this market

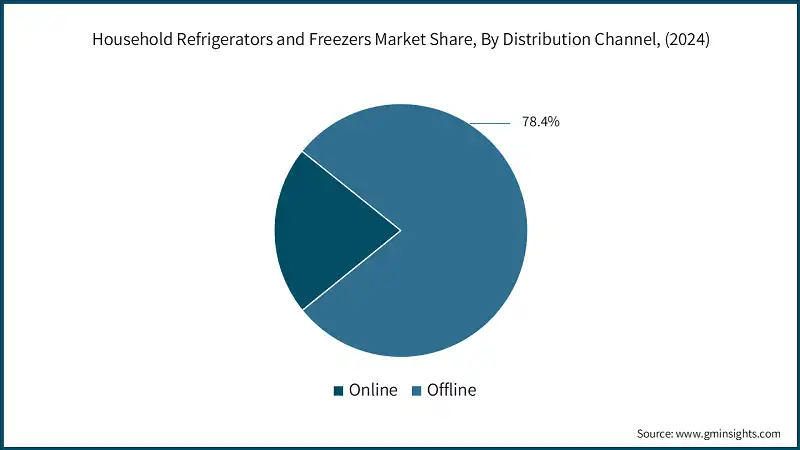

Based on the distribution channel of the household refrigerators and freezers market, it is bifurcated into online and offline. The offline segment held the largest share, accounting for 78.4 % of the global household market share.

- The offline segment remains a significant part of the market due to its ability to provide hands-on shopping experience. Consumers often prefer to physically inspect high-value appliances like refrigerators to ensure they meet quality and functionality expectations. This tactile experience builds trust and confidence in their purchasing decisions.

- Offline stores also offer personalized customer service, with trained staff providing expert advice and immediate assistance. Additionally, services such as installation and maintenance enhance the overall customer experience, making offline channels a preferred choice for many buyers.

- In contrast, the online segment faces slower growth due to certain limitations. Many consumers are hesitant to purchase large appliances online without physically inspecting them, and concerns about delivery logistics and after-sales services further hinder the adoption of online channels for such products.

- Leading companies like Whirlpool Corporation, LG Electronics, Samsung Electronics, and Haier Group actively operate in the offline market. They partner with retail chains to enhance product visibility and offer exclusive promotions, ensuring a strong foothold in this segment despite the growing competition from online platforms.

Looking for region specific data?

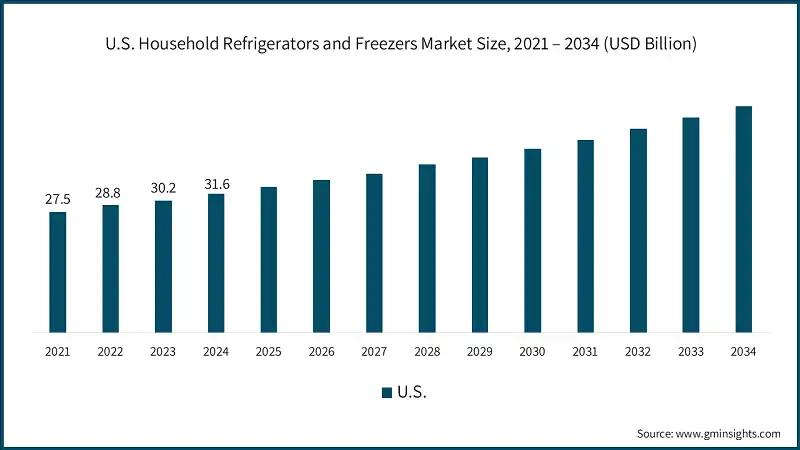

In 2024, the U.S. dominated the household refrigerators and freezers market growth in North America, accounting for 74.9% share in the region.

- The United States dominates the North American market, driven by strong economic conditions and evolving consumer preferences. High disposable incomes enable American consumers to invest in premium appliances, often featuring energy-efficient designs and advanced technologies. The growing adoption of smart home ecosystems further boosts demand for refrigerators with Wi-Fi connectivity, touchscreens, and app integration.

- Many leading companies in the market are based in the U.S., contributing to its market leadership. Companies such as Whirlpool Corporation, Sub-Zero Group etc., drive innovation and set industry standards with their extensive product portfolios and technological advancements. Their strong presence ensures a competitive edge for the U.S. in this market.

Asia Pacific household refrigerators and freezers market is the fastest growing region and is expected to grow at 5.4% during the forecast period.

- The Asia Pacific household refrigerator and freezer market is growing rapidly, driven by urbanization and a rising middle class. Higher disposable incomes are enabling consumers to adopt modern appliances, while awareness of food preservation is boosting demand. Advancements in energy-efficient technologies and government support for sustainable appliances further accelerate market growth.

Europe household refrigerators and freezers industry is expected to grow at 5.1% during the forecast period.

- The European market in household refrigerator and freezer is growing as consumers increasingly prioritize energy-efficient and sustainable appliances. Greater awareness of food waste reduction is driving demand for advanced refrigeration solutions. Government incentives and strict energy regulations are further encouraging the adoption of eco-friendly products.

Household Refrigerators and Freezers Market Share

- The top companies in the laboratory equipment market include Haier, Whirlpool, LG, Samsung, and Electrolux and collectively hold a share of 35% in the market. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Haier secures its position in the household refrigerator market by focusing on energy-efficient and innovative solutions. The company integrates smart technology and user-centric designs to meet evolving consumer needs. Significant investments in IoT-enabled appliances enhance connectivity and real-time control. Haier’s minimalist aesthetics and modular designs appeal to modern urban households.

- Whirlpool sustains its leadership in the household refrigerator market with a diverse product portfolio and strong brand reputation. The company prioritizes energy efficiency, durability, and advanced features to address varied customer demands. By using recyclable materials and low-GWP refrigerants, Whirlpool reinforces its commitment to sustainability and responsible practices.

- LG Electronics strengthens its leadership in the household refrigerator segment through advanced technology and premium aesthetics. The company focuses on smart appliances and eco-friendly innovations to align with global sustainability goals. LG’s ThinQ platform, powered by AI, enhances convenience and connectivity for modern households. Its linear inverter compressor technology ensures quiet operation and long-term energy efficiency.

Household Refrigerators and Freezers Market Companies

Major players operating in the global household refrigerators and freezers industry are:

- Arcelik

- BSH

- Electrolux

- Gree

- Haier

- Hisense

- Hitachi

- LG

- Liebherr

- Midea

- Panasonic

- Samsung

- Sharp

- Toshiba

- Whirlpool

Samsung is a prominent player in the household refrigerator market, known for its innovative and energy-efficient solutions. The company offers a wide range of products, such as the Family Hub refrigerator featuring advanced cooling technologies, smart functionalities, and modern designs. Samsung refrigerators are valued for their durability, performance, and user-friendly features, making them a preferred choice for households worldwide.

Electrolux is another leading household refrigerator market known for its high-quality and sustainable appliances. The company focuses on delivering energy-efficient products such as Electrolux French Door Refrigerator series with sleek designs and reliable cooling performance. Electrolux refrigerators cater to diverse consumer needs, offering innovative features with emphasis on sustainability strengthening their market position.

Household Refrigerators and Freezers Industry News

- In May 2025, LG introduced its new Bottom Freezer Refrigerator, designed for easy access and ergonomic convenience. This model places the frequently used refrigerator section at eye level, reducing the need to bend down. It features Smart Inverter Compressor technology, multi-air flow cooling, and moist balance crisper for optimal food preservation. With a sleek design and energy-efficient performance, LG aims to enhance everyday usability while maintaining modern aesthetics.

- In April 2025, Haier India launched the Lumiere Series at HTS India’s Most Stylish 2025 event. This product is India’s only 4-door convertible side-by-side refrigerator. It incorporates advanced features such as Smart Sense AI, Wi-Fi connectivity, and My Zone temperature control, enabling enhanced customization and energy efficiency. Designed with a sleek mirror glass finish and flexible storage options, the Lumiere Series aims to redefine modern Indian kitchens.

- In February 2025 Samsung launched an advanced smart refrigerator- the Bespoke Flex AI series. It features a 32-inch touchscreen, voice recognition, and an auto-open function. This innovative appliance integrates AI technology with smart home connectivity, offering seamless and efficient user experience. Its premium and modern design further establishes it as a standout product in the smart appliance market.

- In July 2024, Whirlpool India introduced the Ice Magic Pro Glass Door Refrigerator range. The range features a premium glass door finish, advanced IntelliSense Inverter Technology, and a Magic Chiller with an Easy Slide mechanism for faster cooling. Combining modern aesthetics with smart functionality, these refrigerators offer energy efficiency and a design tailored to Indian consumer preferences.

The household refrigerators and freezers market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and Volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Product

- Top mounted refrigerators

- Bottom mounted refrigerators

- Side-by-side refrigerators

- French door refrigerators

Market, By Capacity

- Less than 15 cu. Ft.

- 16 cu. Ft to 30 cu. Ft.

- More than 30 cu. Ft.

Market, By Structure

- Built-in

- Freestanding

- Counter-depth

- Compact/Mini

- Side-by-side

- Others (French door, top freezer, bottom freezer etc.)

Market, By Cooling technology

- Direct cool

- Frost-free

- Inverter compressor

- Dual evaporator

- Thermoelectric

Market, By Smart features

- Wi-Fi enabled

- App-controlled

- Voice assistant integration

- Others (touchscreen display, internal camera etc)

Market, By Finish

- Stainless steel

- Matte black

- Glass door

- Others (Retro, custom etc.)

Market, By Price range

- Low

- Medium

- High

Market, By End use

- Residential

- Commercial

Market, By Distribution Channel

- Online

- E-commerce

- Company websites

- Offline

- Departmental stores

- Hypermarkets/supermarkets

- Specialty retailers

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for the Asia Pacific market from 2025 to 2034?

Asia Pacific is projected to be the fastest-growing region, expanding at a CAGR of 5.4% through 2034, fueled by rising disposable incomes, rapid urbanization, and demand for premium, feature-rich appliances.

Which region leads the household refrigerators and freezers market?

North America was the largest regional market in 2024, with the U.S. accounting for 74.9% of the regional share, supported by high disposable incomes and strong adoption of smart and premium appliances.

How much revenue did the top-mounted refrigerators segment generate in 2024?

Top-mounted refrigerators generated USD 51.9 billion in 2024, making it the leading product category due to affordability, energy efficiency, and wide adoption across markets.

What was the valuation of the offline distribution channel segment in 2024?

Offline distribution channels held the largest share at 78.4% of the market in 2024, reflecting consumer preference for in-store inspection and personalized services for high-value appliances.

Who are the key players in the household refrigerators and freezers market?

Key players include Haier, Whirlpool, LG, Samsung, Electrolux, Arcelik, BSH, Hisense, Hitachi, Liebherr, Midea, Panasonic, Sharp, and Toshiba.

What is the estimated market size of the household refrigerators and freezers market in 2025?

The market is expected to reach USD 124.9 billion in 2025, supported by rising consumer preference for smart and sustainable appliances.

What is the projected value of the household refrigerators and freezers industry by 2034?

The market is expected to reach USD 193.5 billion by 2034, growing at a CAGR of 5%, driven by urbanization, higher disposable incomes, and the expansion of smart home ecosystems.

What is the market size of the household refrigerators and freezers market in 2024?

The market size was USD 119.1 billion in 2024, supported by rising demand for energy-efficient appliances and increasing adoption of smart home technologies.

Household Refrigerators and Freezers Market Scope

Related Reports