Summary

Table of Content

Hot Melt Adhesive Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Hot Melt Adhesives Market Size

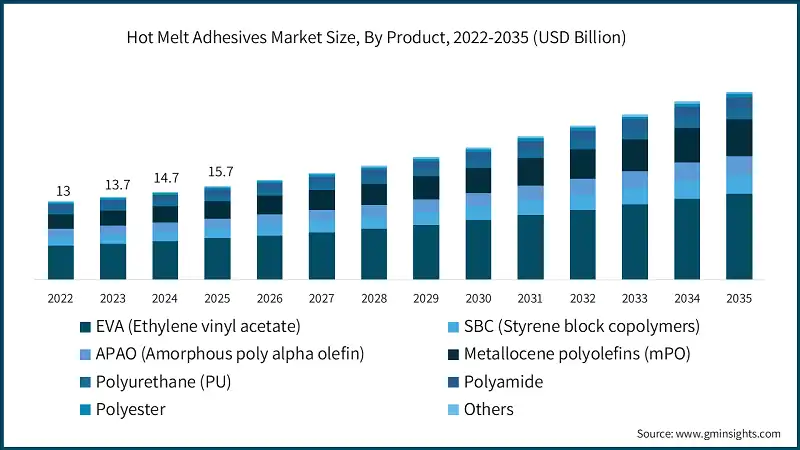

The global hot melt adhesive market was valued at USD 15.7 billion in 2025. The market is expected to grow from USD 16.7 billion in 2026 to USD 31.1 billion in 2035, at a CAGR of 7.1% according to the latest report published by Global Market Insights Inc.

To get key market trends

- Hot melt adhesives (HMAs) refer to thermoplastic materials that are applied in a molten condition, becoming solid upon cooling, thereby forming a strong bond between surfaces. They do not need any drying time, adhesion takes place with the cooling and re-hardening of the adhesive. Due to being instantaneous in nature regarding setting time, being highly versatile, and easy to use, these adhesives find widespread application in packaging, woodworking, textiles, electronics, and various assembly processes.

- The hot melt adhesive industry has seen significant changes over the recent years due to advancements in technology, which improved formulations capable of providing increased resistance to heat, more flexibility, and improved environmental performance.

- The development of products such as reactive hot melts, bio-based HMAs, and low-temperature adhesives has set up conditions where the manufacturers achieve more stringent standards for sustainable production while enhancing production efficiency. Automation-ready application systems and precise dispensing technologies continue to expand the applicability of HMAs even in high-speed manufacturing environments.

- Hot melt adhesives provide benefits like instantaneous bonding, long shelf life, and almost negligible wastage. These adhesives are solvent-free thus they reduce emissions caused by volatile organic compounds (VOCs) and provide adhesion to substrates like plastics, paper, metals, and fabrics, while controlling their performance characteristics for various substrates. Depending on formulation, HMAs can be engineered to provide superior strength, flexibility, or resistance to moisture and temperature fluctuations.

- The market for hot melt adhesives continues to grow in industry for the advantages it provides by making processes faster and more versatile. They serve packaging and labelling requirements, with quick-drying adhesives enhancing productivity when invested in high-volume processes.

- In automotive and electronic design, HMAs enable the creation of lightweight structures and retention of delicate components. As sustainability imperatives continue to grow, industries are leaning towards adhesive solutions with bio-origin and energy-efficient properties, ensuring that hot melt adhesives maintain their relevance in modern manufacturing and product assembly.

Hot Melt Adhesive Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 15.7 Billion |

| Market Size in 2026 | USD 16.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.1% |

| Market Size in 2035 | USD 31.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Shift toward low-temperature hot melt adhesives | Manufacturers are increasingly adopting low-temperature HMAs to reduce energy consumption and improve operator safety. These adhesives also help protect heat-sensitive substrates from thermal damage. |

| Rising demand for reactive and hybrid hot melts | Reactive polyurethane and hybrid formulations are gaining traction for their superior durability and moisture resistance. These advanced HMAs provide stronger long-term performance compared to standard thermoplastic hot melts. |

| Increased customization for niche industries | Industries such as medical devices, filtration, and footwear are demanding highly specialized hot melt formulations. This trend drives manufacturers to create adhesives tailored for specific performance, flexibility, and regulatory needs. |

| Pitfalls & Challenges | Impact |

| Competition from advanced adhesive technologies | Reactive and hybrid adhesives sometimes outperform traditional HMAs in demanding conditions. The industry must innovate to stay competitive. |

| Substrate compatibility issues | Not all materials bond well with standard hot melts, especially low-energy plastics. Manufacturers must develop tailored formulations for diverse substrates. |

| Opportunities: | Impact |

| Expansion of bio-based adhesives | The push for sustainability is creating a strong market for bio-based and biodegradable hot melts. These eco-friendly formulations help companies meet regulatory and consumer expectations. |

| Lightweight automotive applications | Automotive manufacturers are shifting to lightweight components, creating new HMA uses. Hot melts help bond plastics and composites while reducing assembly time and weight. |

| Growth in e-commerce packaging | E-commerce relies heavily on durable, tamper-resistant packaging. HMAs provide strong seals that withstand long shipping routes and fluctuating environmental conditions. |

| Market Leaders (2025) | |

| Market Leaders |

24.6% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging country | US, Canada |

| Future outlook |

|

What are the growth opportunities in this market?

Hot Melt Adhesives Market Trends

- The trend of sustainability of hot melt adhesives is changing the market. The manufacturers are trying to come up with bio-based and recyclable HMAs to contribute towards the environment and comply with stricter regulations. These eco-friendly adhesives are now widely accepted in the packaging sector, consumer goods, and disposables.

- The higher adoption is due to the increasing need for low-temperature hot melt adhesives for industrial use. Low-melt HMAs cut down energy consumption during their production and prevent damage of heat-sensitive substrates, such as plastics and coated papers. It also makes for work-friendly conditions by minimizing the risk of burns during application. All these benefits are driving adoption in the packaging, electronics, and textile assembly fields. With efficiency and versatility on more features of low-temperature formulations, those are increasingly preferred by the manufacturers.

- The market is accelerated with the growing demand of reactive and special hot melt adhesives. Reactive HMAs, usually polyurethane based formulation, provide excellent adhesion, heat resistance, and durable solutions. These super-performance adhesives have been gaining from automotive assembly, furniture making, and construction applications.

- Hot melt adhesive properties of bonding difficult substrates and moisture & temperature resistance are opening new industrial applications for them. And with the increase in performance specifications, this segment is speeding up rapidly.

- Increasing adoption powered by automation and precise application of hot melt adhesives is influencing production trends. Modern applications of HMAs consist of automated applicators, sensors, and digital control, which secure consistent flow and minimum waste. Automated hot melt adhesive application is gaining traction in industrialization with increasing production requirements and thus resulting in market growth.

Hot Melt Adhesives Market Analysis

Learn more about the key segments shaping this market

The hot melt adhesive market by product is segmented into EVA (Ethylene vinyl acetate), SBC (Styrene block copolymers), APAO (Amorphous poly alpha olefin), metallocene polyolefins (mPO), polyurethane (PU), polyamide, polyester and others. EVA (Ethylene vinyl acetate) holds the largest market value of USD 6.9 billion in 2025.

- The hot melt adhesive market is witnessing a tremendous growth of diversified polymers to meet specific industrial needs. EVA is still one of the most used types of adhesives, mainly because of its availability at low costs and versatility in applications such as packaging and woodworking. The main beneficiary of rapid growth is the SBC and APAO adhesives due to flexibility and adhesion toward difficult surfaces while providing an opportunity for hygiene and flexible packaging. Metallocene polyolefins (mPO) are gaining acceptance for the high-end packaging application due to good heat resistance and recyclability.

- Polyurethane hot melts are driving the growth of the adhesives market because of their superior bond strength and durability in automotive and construction applications. Polyamide and polyester are demanding high thermal and chemical resistance hot melts such as electronics and industrial laminations. Other adhesives include silicone-based and hybrid formulations which are evolving in the markets due to niche applications such as medical devices and advanced composites.

Learn more about the key segments shaping this market

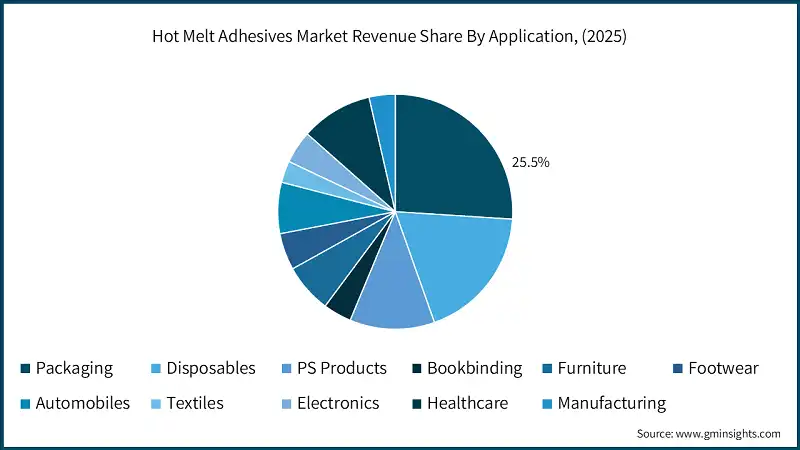

The hot melt adhesive market by application is segmented into packaging, disposables, PS products, bookbinding, furniture, footwear, automobiles, textiles, electronics, healthcare, manufacturing and others. Packaging holds the largest market share of 27.2% in 2025.

- The demand for hot melt adhesives is increasing across diverse industries due to its wide properties and applications used as adhesives. Packaging uses hot melt adhesives on a large scale for sealing of carton, labelling, and packing of sachet. Fast setting and strong bond being the important parameters for high-speed packing results in market growth. Disposable products such as diapers and sanitary goods are glued with hot melt adhesives to their soft substrates in a secure way while allowing comfort and flexibility. Hot melt adhesives are used in PS products like tapes and labels due to value for money with quick setting and good adhesion properties.

- Textile and Footwear are shifting toward flexible, breathable, and seam-free bonding solutions. Bookbinding and graphic arts are still adopting adhesives for enhancing page durability, increasing coating compatibility and improving processing efficiency. In the automotive industry, these adhesives are used on interior bonding jobs such as attaching door panels and dashboard components, where structural strength and lightweight are the factors of consideration. In electronics hot melt adhesives is used for semiconductor assembling, display assembly, and battery packing due to their affinity for making quick, strong bonds without added curing temperature. Similarly, hot melt adhesives are used in wound care products, surgical tapes, and the assembling of medical devices and ensure reliability and safety in the health sector. Manufacturing too utilizes hot melt adhesives in many of its processes like assembling products, packaging, or even bonding materials.

Looking for region specific data?

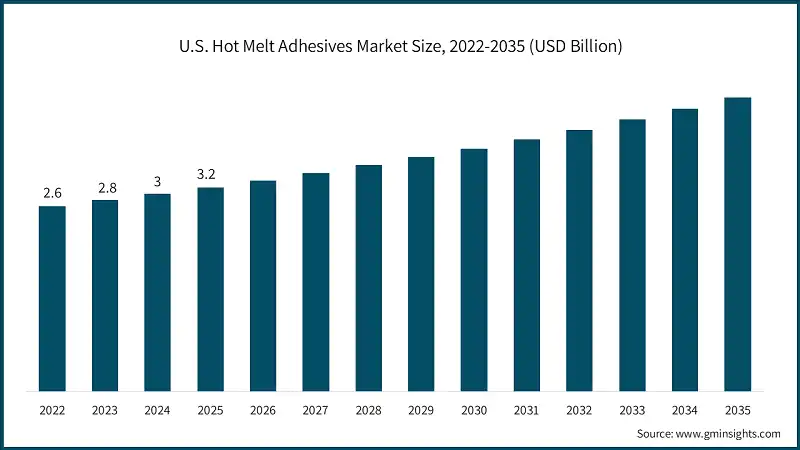

The market in the North America is expected to experience significant and promising growth from USD 4.5 billion in 2025 to USD 8.8 billion in 2035. The U.S. hot melt adhesive market accounted for USD 3.3 billion in 2025.

- Automation and sustainability initiatives are propelling the North American market forward together with strong demand from packaging and automotive industries. Particularly in the United States, the adoption of energy-efficient and low-emission adhesive technologies finds momentum as manufacturers upgrade their production lines. It is the growth of e-commerce and industrial assembly that propels the demand for reliable, fast-setting bonding solutions. Across the region, companies are also investing in smart manufacturing systems to ensure quality and reduce material waste further.

The market in the Europe is expected to experience significant and promising growth from USD 3.8 billion in 2025 to USD 7.3 billion in 2035.

- Europe is catered by stringent environmental regulations and a strong movement toward recyclable, low-VOC adhesive solutions. In Germany growth of hot melt adhesives market is due to the automotive and engineering sectors that have developed demand for high-performance, durable hot melt technologies. At the same time, sustainability regulations and circular-economy objectives all over the region encourage the use of bio-based and cleaner formulations. Growing adoption in hygiene, packaging, and electronics applications further buttresses the market progression.

The hot melt adhesive market in Asia Pacific is expected to experience increasing growth from USD 5.8 billion in 2025 to USD 12 billion in 2035 with a CAGR of 7.5%.

- Asia-Pacific continues to be propelled by manufacturing, electronics, and consumer goods production. China being the largest contributor within the region, with major investments in automated packaging lines and high-volume industrial assembly stimulating adhesive demand. Growth in construction and infrastructure development is also creating a demand for durable hot melt solutions. Preference for cost-efficient and scalable technologies in the region further compliments the rapid adoption of modern adhesive systems.

Middle East & Africa hot melt adhesive market is expected to experience significant and promising growth from USD 488 million in 2025 to USD 873 million in 2035.

- The Middle East and Africa region experiences gradual, steady growth in the construction, packaging, and consumer goods sectors. The investment in active infrastructure projects and industrial diversification in the United Arab Emirates is stimulating interest in durable and temperature-resistant adhesive solutions. Application of modern manufacturing practices in the region vastly enhances the demand for hot melt systems. Increased awareness in sustainability and improvements that would enhance automation will, in time, influence adhesive selection trends.

Latin America is expected to experience significant and increasing growth from USD 1.1 billion in 2025 to USD 2.1 billion in 2035.

- The Latin American hot melt adhesive market is influenced by raising demands from the packaging, hygiene, and construction sectors. Brazil emerges a key player due to expanding consumer markets and consistent growth of local manufacturing. Diversifications in production through environmental concerns have led the industries in the region to adopt more efficient, cleaner, and safer adhesive technologies. Sustainability and improvements in production standards are a major force creating the long-term evolution of the market.

Hot Melt Adhesive Market Share

- Hot Melt Adhesive markets are moderately consolidated with players like Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Sika AG, Arkema S.A. holding 52% market share and Henkel AG & Co. KGaA being the market leader holding the market share of 24.6 % in 2025.

- Companies are investing hugely in innovative products, especially in adhesives with higher efficiency in performance, sustainability, and application. They are also developing low-VOC, bio-based, and recyclable-friendly formulations, which means they must comply with the environment-changing regulations and customer expectations. Through continuous R&D initiatives, manufacturers also improve heat resistance, open time control, and bond strength for challenging industrial applications.

- Customizations include changes in adhesive chemistry and give formulation options for specific applications, while consulting on design, training, and helping all strengthen customer relationships and ensure the long-term loyalty of customers.

- Companies working toward sustainable solutions and meeting regulatory compliance aim to follow the increasing environmental standards and the demand from customers for environment-friendly solutions. Such advertisement in low VOCs, water-based, and bio-based adhesives, sticking to safety and environmental regulations, increases brand image and provides a competitive edge for the companies in the global market.

- Another major strategy is to expand and optimize the global supply chain is that companies invest in regional facilities, distribution, and logistics to ensure seamless availability and timely delivery in high-growth markets such as Asia-Pacific, MEA, and Latin America, thus ensuring operational efficiency and reliability.

Hot Melt Adhesive Market Companies Major players operating in the hot melt adhesive industry are: Henkel AG & Co. KGaA manufactures a wide variety of adhesives for automotive, aerospace, electronics, and industrial manufacturing applications. Henkel products include adhesives for metals, composites, plastics, and combinations of materials, as well as for low VOC and bio-based formulations. Henkel operates internationally, with manufacturing, R&D, and distribution networks able to support both mature and developing markets. H.B. Fuller Company develops structural adhesives for use in industry, construction, and consumer applications. Their portfolio includes solvent-free, water-based, and high-performance adhesives for automotive, electronics, packaging, and manufacturing. H.B. Fuller focuses upon product customization, technical support, and regional manufacturing to best serve local market needs. 3M produces hot melt adhesives name for automotive, electronics, aerospace, and general industrial applications. Its adhesives focus on durability, lightweight bonding, and compatibility with difficult substrates. In addition to these services, 3M also provides regional technical support and individualized solutions for industrial and manufacturing applications. Sika AG manufactures adhesives for construction, industrial, and automotive applications, including infrastructure works, commercial buildings, and bonding of composites. It produces high-performance structural adhesives, sealants, and bonding solutions that are compliant with environmental and regulatory demands. Sika works across different areas, including in the MEA and Latin America, with local production and support. Arkema S.A. is a specialty materials company that caters mainly to hospitals and which by means of its Bostik adhesive brand provides high-performance and sustainable solutions. Its business focuses on the innovation of adhesives for packaging, industrial bonding, and flexible laminating applications. The company aims to grow through technological development and selective acquisitions, seeking to strengthen its market position and expand capabilities. Arkema's priority areas relate to sustainability, advanced material science, and specialized solutions to address changing customer needs across a variety of industries.Hot Melt Adhesive Industry News

The hot melt adhesive market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of kilo tons from 2022–2035 for the following segments:

Market, By Product

- EVA (Ethylene vinyl acetate)

- SBC (Styrene block copolymers)

- APAO (Amorphous poly alpha olefin)

- Metallocene polyolefins (mPO)

- Polyurethane (PU)

- Polyamide

- Polyester

- Others

Market, By Application

- Packaging

- Disposables

- PS Products

- Bookbinding

- Furniture

- Footwear

- Automobiles

- Textiles

- Electronics

- Healthcare

- Manufacturing

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What is the projected value of the hot melt adhesive market by 2035?

The market size for hot melt adhesives is expected to reach USD 31.1 billion by 2035, growing at a CAGR of 7.1% from 2026 to 2035. Growth is fueled by rising demand for reactive and hybrid hot melts, sustainability initiatives, and low-temperature adhesive technologies.

Who are the key players in the hot melt adhesive market?

Key players include Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Sika AG, and Arkema S.A. These companies focus on innovation, sustainability, and advanced adhesive technologies to strengthen their market position.

How much revenue did the EVA (ethylene vinyl acetate) segment generate in 2025?

The EVA segment generated USD 6.9 billion in revenue in 2025, making it the largest product category. Its dominance is supported by cost-effectiveness, versatility, and widespread use in packaging and woodworking applications.

What are the upcoming trends in the hot melt adhesive industry?

Key trends include increased adoption of low-temperature and bio-based hot melt adhesives, growth of reactive and hybrid formulations, automation-ready dispensing systems, and rising demand for sustainable, low-VOC adhesive solutions.

What is the hot melt adhesive market size in 2025?

The global market size for hot melt adhesive is valued at USD 15.7 billion in 2025. Market growth is driven by rising demand from packaging, automotive, electronics, and woodworking industries due to fast bonding, solvent-free composition, and high processing efficiency.

What was the market share of the packaging application segment in 2025?

The packaging segment accounted for 27.2% of the market share in 2025, making it the leading application. Strong demand from food packaging, e-commerce, labeling, and carton sealing applications supports segment leadership.

What is the growth outlook for the North America hot melt adhesive market?

The North America market is expected to grow from USD 4.5 billion in 2025 to USD 8.8 billion by 2035, driven by rising automation, strong demand from packaging and automotive industries, and increasing adoption of sustainable adhesive technologies.

What is the market size of the hot melt adhesive industry in 2026?

The hot melt adhesive market reached USD 16.7 billion in 2026, reflecting steady expansion supported by increasing automation, e-commerce packaging growth, and adoption of advanced adhesive formulations.

Hot Melt Adhesive Market Scope

Related Reports