Summary

Table of Content

High Temperature Industrial Boiler Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

High Temperature Industrial Boiler Market Size

The global high temperature industrial boiler market was valued at USD 8.9 billion in 2024 and is expected to reach USD 13.8 billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034. The increase in industrial activities combined with the accelerated pace of urbanization in emerging economies will significantly boost the demand for advanced heating technologies. The implementation of government policies aiming at improving energy efficiency, particularly in developing countries, will accelerate the adoption of new boiler technologies. Moreover, the increasing population will also boost the demand for water and space heating systems, leading to business expansion.

To get key market trends

For instance, in 2024, the Canada government proposed new regulations which focus on limiting carbon emissions specifically from oil and gas upstream operations. The framework aims to reduce GHG emissions by 35% relative to the 2019 figures by the year 2030. This plan also includes tax benefits aimed at lowering emissions and a cap-and-trade model to foster emission reduction in the fossil fuel industry.

High Temperature Industrial Boiler Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.5% |

| Market Size in 2034 | USD 13.8 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Increased investment in infrastructure development along with the expansion of renewable energy projects will foster the growth of energy-efficient systems and fuel the transition toward sustainable solutions. Furthermore, the rising focus on reducing industrial emissions will drive the adoption of cleaner technologies and boost the demand for industry landscape.

The expanding utilization of industrial boilers in food processing applications along with the growing need for more efficient integrated boiler systems will further fuel the industry growth. Moreover, international policies focused on green technologies will encourage the adoption of eco-friendly solutions and will expand the product prospects.

To illustrate, in 2024, Canada announced the 2030 Emissions Reductions Plan, the plan aims to decrease emissions by 40% compared to 2005 figures by 2030, with a target of net-zero emissions by the year 2050. This strategy focuses on fostering clean industrial development and providing enduring employment opportunities while addressing climate change.

The imposition of tariffs on imported components by the Trump administration will influence global trade and raise costs in the industrial high-temperature boiler market. The policies will dampen international price competitiveness and prospect growth in domestic manufacturing of these systems. These changes will strengthen the supply chain and foster industrial growth in the long term.

High Temperature Industrial Boiler Market Trends

Stringent government regulations targeting greenhouse gas emissions along with extreme weather conditions are expected to significantly drive growth in the industry. Ongoing investments in economic infrastructure will strengthen industry prospects as companies seek cleaner, more reliable heating solutions to meet evolving environmental and regulatory standards.

The positive outlook toward industrial development coupled with rising demand for advanced heating units will accelerate the business landscape. Growing industrialization and shift toward efficient steam generation technologies will support long-term expansion. These trends position the sector for steady growth owing to rising priority toward performance, sustainability and operational resilience by the industries.

For reference, in 2025, the Federal clean energy incentives announced an investment of USD 235 billion toward the U.S. manufacturing. These initiatives will draw private investment, strengthen energy independence and further develop new technologies. Furthermore, the federal funding will positively impact the job opportunities within the country.

The growing demand for tailored and scalable boiler systems will augment the industry innovation. Ongoing expansion of energy intensive industries including petrochemicals and cement will further accelerate the demand for highly efficient systems. In addition, the increasing demand for power generation to meet the expanding energy needs in the industrial sector will enhance the use of modern industrial boilers.

The rising development of clean fuels including hydrogen along with technological advancements in boiler industry to enhance performance and reduce downtime will significantly contribute to business expansion. Growing expansion of industrial manufacturing across the globe will further contribute to the product penetration.

For reference, in 2025, India launched its first green hydrogen hub in Andhra Pradesh, supported by an investment of 21.6 billion dollars. An investment of 21.6 billion was given to India for this purpose. The NTPC Green Energy Project intends to produce 20 GW of renewable energy, along with 1500 TPD of green hydrogen and 7500 TPD of its by-products which will be primarily positioned for export.

High Temperature Industrial Boiler Market Analysis

Learn more about the key segments shaping this market

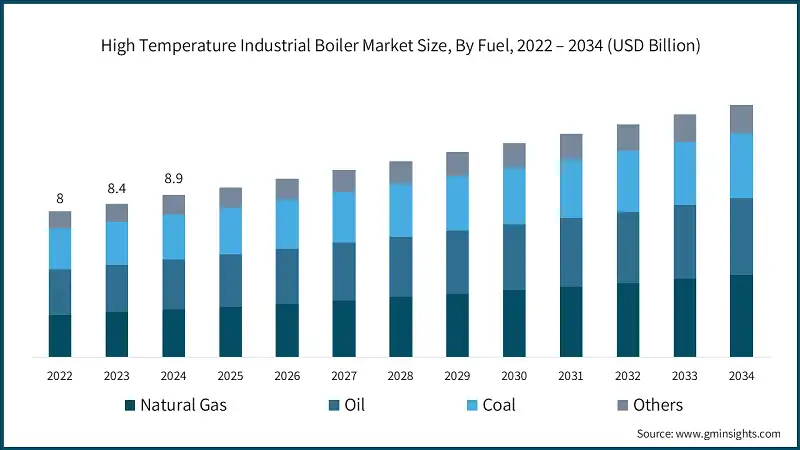

- The global market for high temperature industrial boiler was valued at USD 8, 8.4 & 8.9 billion in 2022, 2023 and 2024 respectively. Based on fuel, the market is segmented into natural gas, oil, coal and others. The increasing strictness and efficiency of policies relating to carbon emission controls is escalating the use of these systems, which in turn is increasing the demand for those products.

- The natural gas high temperature industrial boiler market will grow at a CAGR of over 5.5% by 2034. The growing concerns toward energy security and expansion of gas infrastructure across the globe will propel the adoption of these boilers. Growing requirement of high-temperature steam in industries including food, beverage, and pharmaceutical will further propel the business landscape.

- The market for oil high temperature industrial boilers was valued at over USD 2.5 billion in 2024. The lack of gas infrastructure in remote areas will drive the adoption of these high-temperature boilers for industrial use. Moreover, these boilers are known for their reliability in cold climatic conditions and widespread availability of oil will further strengthen industry demand.

- For instance, in 2024, Canada increased its investment to more than USD 350 million to upgrade its natural gas infrastructure. This investment is expected to attract an additional USD 4.5 billion that will help strengthen the country’s energy security and address the increasing demand owing to population growth and industrial advancement.

- The coal fueled high temperature industrial boiler market is expected to reach over USD 3.5 billion by 2034. These boilers provide substantial thermal output making them suitable for energy-intensive industries including cement, steel, and chemicals. Their low fuel costs, particularly in regions with local resources or subsidies, encourage broad adoption across industrial sectors.

- Based on application, the market is segmented into food processing, pulp & paper, chemical, refinery, primary metal and others. The food processing high temperature industrial boiler market was accounted for over USD 1 billion in 2024. Economic development with high standards and changing lifestyles in different geographies have significantly increased the income levels of households that have positively impacted the food and beverage sector.

- The pulp & paper high temperature industrial boiler market will grow at a CAGR of over 4% till 2034. Ongoing advancement in combustion and heat recovery technologies coupled with rising global demand for paper and packaging mills will boost the deployment of these industrial boilers.

- For reference, in 2024, Canada committed over USD 8 million to support Kruger Wayagamack Pulp and Paper Mill’s groundbreaking carbon capture initiative. This project will pioneer the world’s first demonstration-scale carbon capture system in the pulp and paper industry, aiming to cut CO2 emissions by 1,800 tonnes annually.

- The chemical high temperature industrial boiler market was valued at over USD 2 billion in 2024. The rising need for process steam in chemical manufacturing, coupled with expanding production capacities, will accelerate boiler deployment. The integration of high-temperature boilers within CHP systems will optimize energy use and enhance operational efficiency across chemical facilities.

- The refinery high temperature industrial boiler market will grow at a CAGR of over 4.5% through 2034. The adoption of high-temperature industrial boilers will be driven by increasing focus on energy efficiency, emissions reduction and expansion of refinery activities.

- For instance, in 2024 the Utilities for Net Zero Alliance (UNEZA) committed to funding over USD 116 billion annually for the establishment of power generation facilities and grid infrastructure development across the world. This funding will further the efforts to modern and integrate the grid while aiding the cleaner resource development goals of decarbonization by 2030.

- The primary metal high temperature industrial boiler market was valued at over USD 1.5 billion in 2024. The primary metal industry, especially steel and aluminum production, relies on high-temperature steam for processes including smelting and refining. These boilers are essential to meet the energy-intensive needs of these operations.

Learn more about the key segments shaping this market

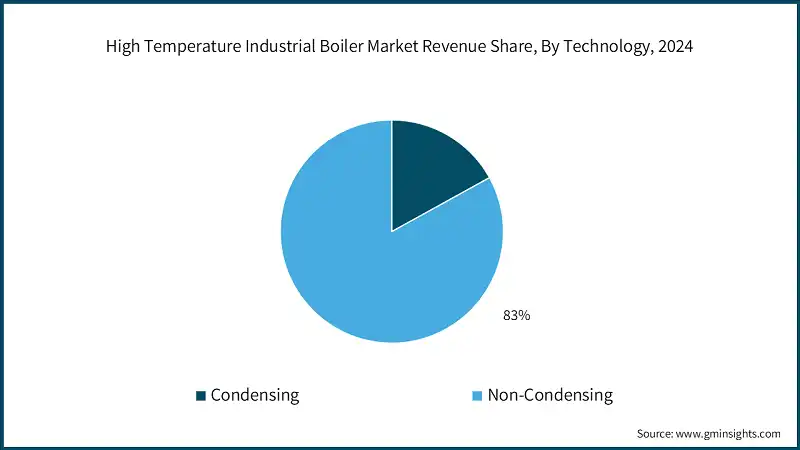

- Based on technology, the market is segmented into non-condensing and condensing. The non-condensing high temperature industrial boiler market holds a share of over 83% in 2024. The strategic collaboration between private companies and government bodies in developing and expanding industrial infrastructure is set to create a dynamic and promising business environment.

- For reference, in 2024 the Ministry of Economic Affairs and Employment of Finland allocated approximately USD 77 million to 13 clean energy ventures. This includes USD 47 million disbursed under the ‘Recovery and Resilience Plan’ as well as around USD 30 million for the grand demonstration project of next generation energy technologies by Nordic Ren-Gas Oy.

- The market for condensing high temperature industrial boilers is expected to grow at a CAGR of over 4.5% till 2034. Surging industrialization and increasing investments toward the expansion of manufacturing facilities will drive the business outlook.

Looking for region specific data?

- U.S. high temperature industrial boiler market was estimated at USD 1.2, 1.3 & 1.4 billion in 2022, 2023 and 2024 respectively. The adoption of high temperature boilers will increase owing to the ongoing replacement of traditional boiler systems along with the introduction of new policies on energy efficiency and emission control limits.

- For instance, foreign countries increased their investment obligations commensurately with the size of the U.S. economy. The UAE promised USD 1.4 trillion, Japan pledged USD 1 trillion, and Saudi Arabia has announced USD 600 billion into investments, while Taiwan promised to increase its contributions showing hiring faith in the rejuvenated American industry and technology.

- The North America high temperature industrial boiler market will witness at a CAGR of over 4% till 2034. The continuous integration of new technologies within the processes of renewables will improve the environmental and ecological sustainability of industries in the region. Additionally, the increasing productivity of the manufacturing industry will further the need for efficiency and propel the efficiency of the industry.

- The Asia Pacific high temperature industrial boiler market is set to reach over USD 7 billion by 2034. Ongoing industrialization and urban development in the region will drive demand for these boilers. In addition, growing electricity requirements and rural electrification programs will enhance the deployment of these systems in the industrial application.

- For instance, in 2024, Australia initiated the project, “A Future Made in Australia,” aimed at Australia’s resource utilization and rejuvenating its leadership position in clean energy manufacturing. The strategy focuses on public expenditure, innovative activity, environmental sustainability, and increasing international market competition in the developing energy industry.

- The Europe high temperature industrial boiler market is poised to grow at a CAGR of over 3.5% through 2034. Strict regulations regarding environmental policies and emissions will compel industries to integrate high-efficiency cleaner boiler technologies. The growth of industrial activities as well as the growth in energy requirements will boost the industry penetration.

- For reference, in 2025 the European Commission started the Clean Industrial Deal which sought to enhance the competitiveness of industries and at the same time encourage decarbonization.

- The Middle East & Africa high temperature industrial boiler has a market share of over 4.5% in 2024. The evolving technological innovations in automatic controls for modern boilers will further shape the industry trajectory. These advancements in technology are fueling the need for systems optimization across industries.

- The Latin America high temperature industrial boiler market is poised to grow at a CAGR of over 3.5% till 2034. The growth for the new emerging markets is driven by the increasing development and the expansion of chemical and petrochemical industries in the region.

- For instance, in 2024, Braskem invested USD 100 million to increase polyethylene and PVC’s production capabilities in Bahia, Rio Grande do Sul, and Alagoas. This investment stems from the country’s strategy to bolster domestic production and the growth of the petrochemical industry.

High Temperature Industrial Boiler Market Share

- The top 5 players including Miura America, Mitsubishi Heavy Industries, Babcock & Wilcox, IHI Corporation, and Bosch Industriekessel together hold a share of about 45% in the high temperature industrial boiler industry. GE Vernova is a key prominent foothold in the industry driven by its robust corporate partnerships and joint ventures in key global economies.

- Babcock & Wilcox Enterprises has been a foremost industry participant for decades, specializing in steam generation. The firm offers complete services for industrial and utility boilers, aiding clients in improving reliability and performance, reducing expenditures, increasing asset lifespan, and optimizing value across multiple energy uses.

- Robert Bosch provides high temperature industrial boilers with services like maintenance, optimization, and advanced diagnostics for peak performance. Bosch’s proprietary technologies and global capabilities aid industrial and utility clients in improving the efficiency and productivity of their energy systems while lowering emissions and extending the lifespan of their boilers across diverse applications.

High Temperature Industrial Boiler Market Companies

- Revenue for Thermax exceeded USD 870 million for the first three quarters of 2024. The company’s industrial products division alone contributed over USD 350 million, showcasing the firm’s dominance in the market and continuous growth.

- Babcock & Wilcox Enterprises recorded a revenue of USD 717.3 million during 2024, Q4 contributing USD 200.8 million which was a 15% increase compared to the previous year. Full year bookings increased by 39% to USD 889.6 million and the backlog increased by 47% to USD 540.1 million, which indicates strong demand and business growth across critical areas.

- GE Vernova recorded revenue of USD 34.9 billion in 2024 which is an increase of 5% compared to the previous year. Strong business operations and growth strategies directly contributed to the increase. Net income also saw an increase of 1.6 billion, which represents an increase of 4.5% in profit margin. Adjusted EBITDA was registered at USD 2.0 billion.

Major players operating in the high temperature industrial boiler industry are:

- Babcock and Wilcox Enterprises

- Bharat Heavy Electricals

- Clayton Industries

- Cleaver-Brooks

- Cochran

- Doosan Heavy Industries & Construction

- FERROLI

- Fonderie Sime

- FONDITAL

- Forbes Marshall

- GE Vernova

- Groupe Atlantic

- Hoval

- Hurst Boiler and Welding

- IHI Corporation

- John Cockerill

- John Wood Group

- Mitsubishi Heavy Industries

- Miura America

- Rentech Boilers

- Robert Bosch

- Siemens

- Sofinter

- The Fulton Companies

- Thermax

- Victory Energy Operations

- Viessmann

- Walchandnagar Industries

High Temperature Industrial Boiler Industry News

- In February 2025, construction works of supercritical steam boiler island package of Raghunathpur will be handled by Bharat Heavy Electricals under the contract with DVC. This contract further involves secondary services auxiliary to the construction of the thermal power plant high efficiency boiler including the fabrication and erection of the boiler.

- In March 2024, Babcock & Wilcox received contracts of USD 24 million for the supply of three industrial boilers to petrochemical facilities in the Middle East and Central Asia. These contracts underscore B&W's emphasis on expansion in these areas. These boilers enable flexible use of fuels and aid in the diversification of industrial infrastructure.

- In May 2024, Cleaver-Brooks was acquired by Miura Co., Ltd., incorporating them into their global network of boiler manufacturers. The goal of the partnership is to enhance customer service and sustainable boiler solutions at Cleaver-Brooks and expand Miura's access to industrial heating markets around the world, leveraging both companies’ cutting-edge thermal technology.

- In May 2024, Miura increased their boiler manufacturing network by acquiring Cleaver-Brooks. This acquisition aims at advancing customer service and sustainable boiler offerings at Cleaver-Brooks while broadening Miura’s access to industrial heating markets globally, using the two firms advanced thermal technologies.

The high temperature industrial boiler market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume revenue (USD Million), capacity (MMBTU/hr) & volume (Units) from 2021 to 2034, for the following segments:

Market, By Temperature

- 180°F - 200°F

- > 200°F - 220°F

- > 220°F - 240°F

- > 240°F

Market, By Product

- Fire-tube

- Water-tube

Market, By Capacity

- < 10 MMBTU/hr

- 10 - 25 MMBTU/hr

- 25 - 50 MMBTU/hr

- 50 - 75 MMBTU/hr

- 75 - 100 MMBTU/hr

- 100 - 175 MMBTU/hr

- 175 - 250 MMBTU/hr

- > 250 MMBTU/hr

Market, By Fuel

- Natural gas

- Oil

- Coal

- Others

Market, By Technology

- Condensing

- Non-Condensing

Market, By Application

- Food processing

- Pulp & paper

- Chemical

- Refinery

- Primary metal

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Poland

- Italy

- Spain

- Austria

- Germany

- Sweden

- Russia

- Asia Pacific

- China

- India

- Philippines

- Japan

- South Korea

- Australia

- Indonesia

- Middle East & Africa

- Saudi Arabia

- Iran

- UAE

- Nigeria

- South Africa

- Latin America

- Argentina

- Chile

- Brazil

Frequently Asked Question(FAQ) :

Who are the key players in high temperature industrial boiler market?

Some of the major players in the high temperature industrial boiler industry include Bharat Heavy Electricals, Clayton Industries, Cleaver-Brooks, Cochran, Doosan Heavy Industries & Construction, FERROLI, Fonderie Sime, FONDITAL, Forbes Marshall, GE Vernova, Groupe Atlantic.

How big is the high temperature industrial boiler market?

The high temperature industrial boiler market was valued at USD 8.9 billion in 2024 and is expected to reach around USD 13.8 billion by 2034, growing at 4.5% CAGR through 2034.

How much is the U.S. high temperature industrial boiler market worth in 2024?

The U.S. high temperature industrial boiler market was worth over USD 1.4 billion in 2024.

What is the size of food processing segment in the high temperature industrial boiler industry?

The food processing segment generated over USD 1 billion in 2024.

High Temperature Industrial Boiler Market Scope

Related Reports