Summary

Table of Content

High Performance Computing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

High Performance Computing Market Size

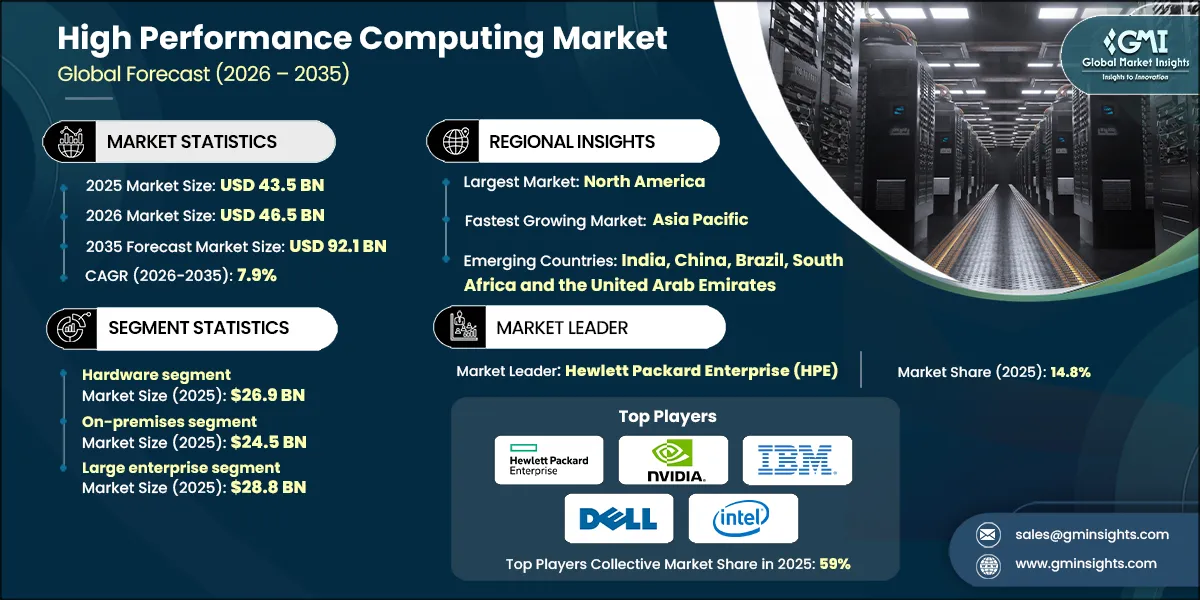

The global high performance computing market was valued at USD 43.5 billion in 2025. The market is expected to grow from USD 46.5 billion in 2026 to USD 66.1 billion in 2031 and USD 92.1 billion in 2035, at a CAGR of 7.9% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The market for high performance computing is expanding, owing to increasing demand for advanced computational power, growing adoption of AI and machine learning, expansion of cloud-based HPC solutions, advancements in processor and interconnect technologies, and increased government and corporate investments.

High-performance computing is being combined with AI and machine learning to speed up discovery and innovation in government science agendas. Public research institutions employ the convergence of HPC and AI to develop complex models for simulating climate science, energy, and security. Governments are leveraging high-performance computing and AI platforms with the aim of enhancing productivity in scientific experimentation, either in high-performance computing or AI-native applications. For instance, in October 2025, the U.S. Department of Energy (DOE) partnered with NVIDIA and Oracle to construct its most powerful AI supercomputer at Argonne National Laboratory.

The union aims to accelerate scientific discoveries and AI research. They aim to deliver a powerful high-performance computing system to support its AI system for scientific applications. This new system is expected to offer better performance for high code and memory bandwidths. In addition, this system will offer parallel processing and high-speed network connections.

Government initiatives increasingly utilize cloud-based high-performance computing (HPC) to provide more users with advanced computing capabilities. The hybrid cloud model allows federal agencies and research institutions to perform advanced computing tasks using public cloud resources while keeping their proprietary systems. This public sector and research partnership model lowers the public research institutions' computing resources access barriers and allows advanced computing capabilities to be used outside the traditional supercomputing centers. Cloud-based HPC can also be used for high stake and secure workloads across all data classifications, allowing federal agencies to apply artificial intelligence (AI) and high-performance computing (HPC) resources while maintaining data sovereignty.

Such initiatives are expanding the available public cloud resources for high-performance computing (HPC) and aligning with the national goals to foster innovation and competitiveness. For example, in November 2025, AWS stated that Amazon Web Services would allocate USD 50 billion to enhance artificial intelligence (AI) and high-performance computing (HPC) resources for clients from the U.S. government, increasing secure cloud environments' computation capabilities.

The high performance computing (HPC) market comprises advanced computing systems, software, and services designed to perform extremely complex calculations at high speed. It serves industries, research institutions, and governments for scientific simulations, data analytics, AI/ML workloads, and modeling. HPC combines cutting-edge processors, memory, interconnects, and storage to deliver scalable, parallel computing capabilities for data-intensive and mission-critical applications worldwide.

High Performance Computing Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 43.5 Billion |

| Market Size in 2026 | USD 46.5 Billion |

| Forecast Period 2026-2035 CAGR | 7.9% |

| Market Size in 2035 | USD 92.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing adoption of AI and machine learning | Contributes 26% market impact by increasing demand for high-throughput, parallel processing systems required for AI model training, deep learning, and large-scale inference across healthcare, finance, defense, and scientific research. |

| Expansion of cloud-based HPC solutions | Adds 22% market impact as cloud-based HPC lowers entry barriers, enables elastic scaling, and supports hybrid workloads, encouraging adoption among SMEs, startups, and research organizations lacking on-premises infrastructure. |

| Advancements in processor and interconnect technologies | Provides 21% market impact through performance gains from GPUs, accelerators, high-bandwidth memory, and low-latency interconnects, enabling faster computations and improved efficiency for complex parallel workloads. |

| Increased government and corporate investments | Accounts for 24% market impact as national supercomputing missions, defense programs, and enterprise R&D investments expand HPC capacity to support strategic innovation, scientific leadership, and digital transformation initiatives. |

| Increasing demand for advanced computational power | Drives 28% market impact as governments, research institutions, and enterprises increasingly rely on large-scale simulations, modeling, and data-intensive workloads that exceed conventional computing capabilities, accelerating adoption of HPC infrastructure. |

| Pitfalls & Challenges | Impact |

| High costs and resource demands | Restrains 31% market adoption due to high capital expenditure, energy consumption, cooling requirements, and operational costs associated with deploying and maintaining large-scale HPC systems. |

| Complexity of Software & Integration | Limits 23% adoption as managing heterogeneous architectures, optimizing parallel software, and integrating HPC with AI, cloud, and legacy systems requires specialized expertise and increases deployment complexity. |

| Opportunities: | Impact |

| Integration of HPC with Advanced Analytics and Digital Twins | Will generate 21% future market impact by enabling real-time simulation, predictive modeling, and scenario analysis across manufacturing, energy, aerospace, and smart infrastructure applications. |

| Expansion of Cloud-Native and AI-Optimized HPC Platforms | Will create 25% future market impact by enabling scalable, cost-efficient, and on-demand access to HPC resources, supporting AI-driven workloads and accelerating adoption among enterprises and research institutions. |

| Market Leaders (2025) | |

| Market Leader |

14.8% market share |

| Top Players |

Collective market share in 2025 is 59% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, South Africa, and the United Arab Emirates |

| Future outlook |

|

What are the growth opportunities in this market?

High Performance Computing Market Trends

- The high-performance computing market is experiencing strong growth, due to the rising requirement for complex data processing. The adoption of high-performance computing in artificial intelligence and machine learning is increasing at a pronounced rate. These technologies require a huge amount of processing to train a complex model and analyze large amounts of data.

- The demand for HPC solutions that can enhance areas such as the medical industry, the financial sector, as well as autonomous vehicles, which rely on AI and ML, is rising rapidly. For example, in August 2023, Citadel Securities, in partnership with Google Cloud, announced a collaboration with Harvard University for the advancement of cardiac diseases through the use of High-Performance Computing in the public cloud. This is because the project seeks to simulate the effectiveness of magnetically controlled artificial bacterial flagella in unclogging arteries. The use of cloud computing in HPC, in this case, facilitates faster medical research at lower costs.

High Performance Computing Market Analysis

Learn more about the key segments shaping this market

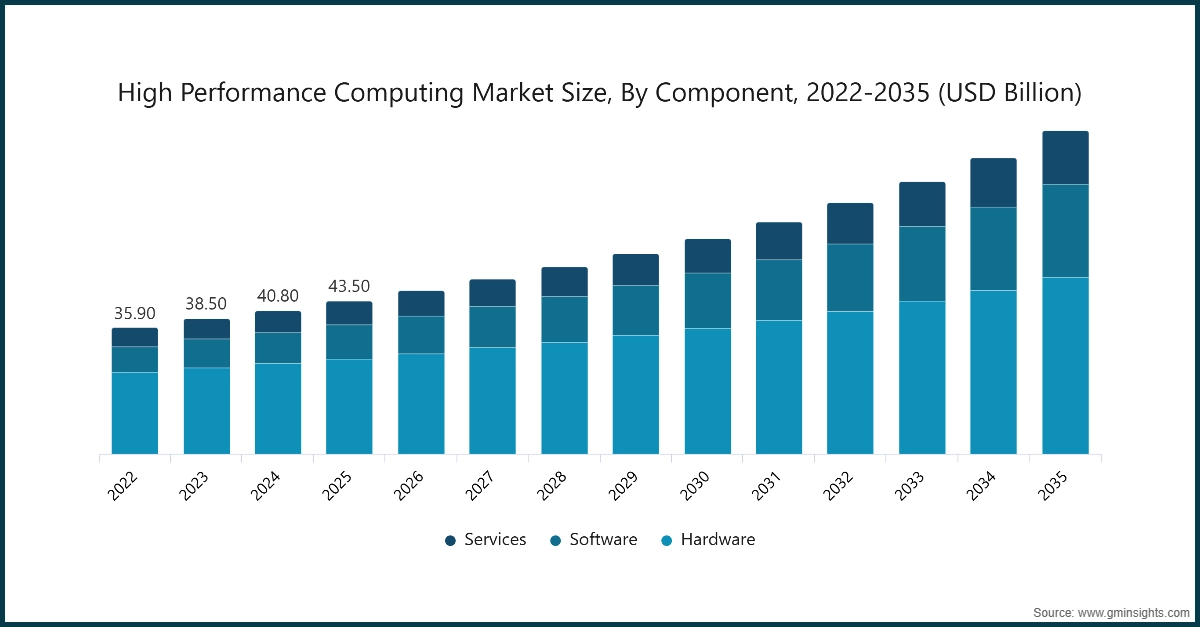

On the basis of components, the high performance computing market is divided into hardware, solutions, and services.

- The hardware segment accounted for the largest market and was valued at USD 26.9 billion in 2025. Increasing deployment of advanced HPC hardware, like high?performance CPUs, GPUs, and interconnects, enhances computational throughput for science, defense, and research institutions.

- The expansion of next-generation infrastructures that accommodate large datasets and simulations consolidates demand for advanced hardware for both public and private HPC systems.

- For example, in October 2025, the U.S. Department of Energy and National Nuclear Security Administration stated that two next-generation HPE Cray supercomputers will increase the capacity of HPC for scientific research and national security missions. This exemplifies government funding for supercomputers and the continuing innovation of hardware.

- The software segment was the fastest growing market during the forecast period, growing at a CAGR of 10.5% during the forecast period. Advancements in high-performance computing (HPC) software such as optimized job schedulers, parallel libraries, and AI-friendly frameworks increase performance on complex workloads. Robust and secure HPC software has become a necessity for national research infrastructures from governments, which drives the adoption of such software.

- In December 2025, for example, India initiated the NSM 2.0 program, which strategically incorporates HPC, AI, and quantum pathways to enhance software innovation and collaboratively develop HPC laboratories with various higher education institutions.

- HPC software providers are encouraged to develop AI/ML-compatible frameworks, parallel libraries, and schedulers, in alignment with government supercomputing initiatives and research institutions in need of secure and optimized software.

Learn more about the key segments shaping this market

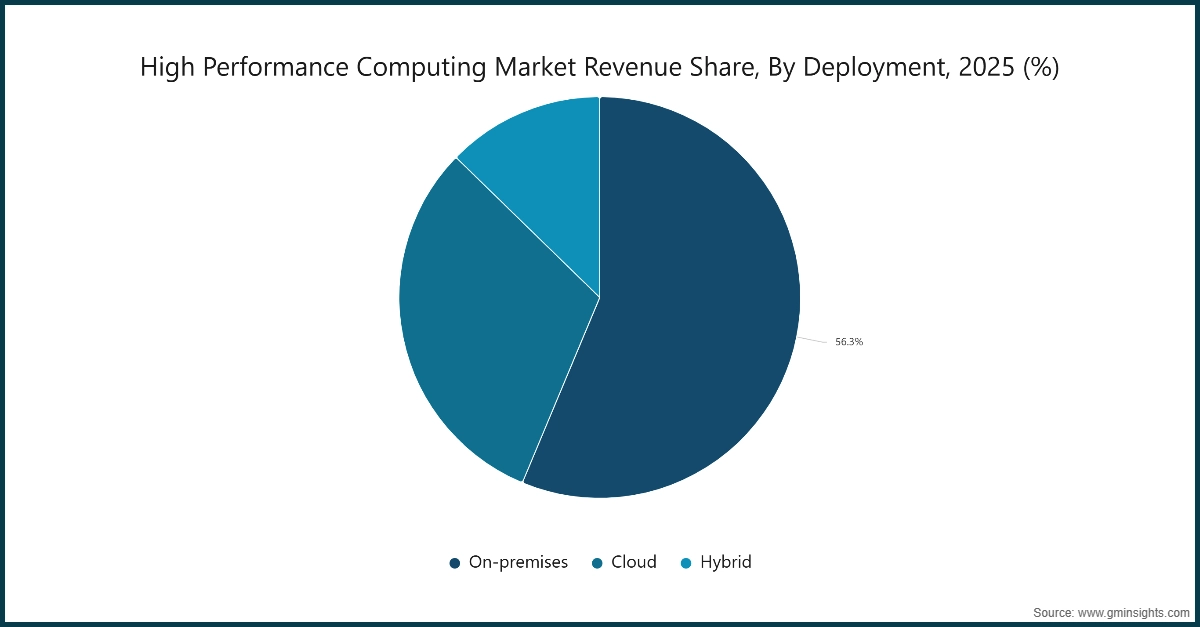

Based on deployment, the high performance computing market is divided into cloud, on-premises, and hybrid.

- The on-premises segment accounted for the largest market and was valued at USD 24.5 billion in 2025. Large institutions and government labs invest in on?premises HPC deployments to maximize control, security, and performance for sensitive computing workloads. Dedicated infrastructure supports mission?critical research and reduces dependency on external networks.

- For instance, in July 2025, the U.S. Department of Defense’s HPC Modernization Program added two supercomputers, increasing on?premises computing capacity above 100 petaflops for defense science and engineering.

- Manufacturers and integrators should focus on delivering secure, high-density on-premises HPC systems for government labs, defense, and research institutions requiring data sovereignty and peak performance.

- The cloud segment was the fastest growing market during the forecast period, growing at a CAGR of 10.3% during the forecast period. Cloud?based HPC expands access to elastic computing resources, allowing agencies and organizations of all sizes to scale computing on demand. Government cloud initiatives are accelerating secure HPC adoption with compliant services.

- For instance, in December 2025, Amazon Web Services announced a USD 50 billion investment to build AI and HPC infrastructure for U.S. government cloud customers, expanding secure cloud HPC capacity for federal missions.

- Cloud providers must invest in scalable HPC infrastructures for government agencies, offering elastic compute resources, AI-enabled platforms, and compliance with national security and regulatory standards.

On the basis of organization size, the high performance computing market is divided into large enterprises and SMEs.

- The large enterprise segment accounted for the largest market and was valued at USD 28.8 billion in 2025. Large enterprises invest in High-Performance Computing (HPC) to reduce time spent on R&D, competitive innovation, and complex simulations. Government and industry partnerships improve the accessibility of advanced computing to large-scale corporate research and the competitiveness of nations.

- Large-scale enterprises’ demand for next-generation digital transformation initiatives will be driven by the integration of HPC with AI and machine learning (ML) workflows, as it will enable them to process and analyze large volumes of data more quickly.

- Manufacturers need to collaborate with government initiatives on AI, simulations, and research-driven innovation to provide large enterprises with highly customizable, high-performing HPC clusters and sophisticated software.

- The SMEs segment was the fastest growing market during the forecast period, growing at a CAGR of 10.5% during the forecast period. HPC cloud services enable lower barriers of entry because they provide cost-effective, scalable computing without a large upfront hardware investment. Government-enabled access to cloud HPC opens up more pathways for innovators with fewer resources.

- Providers should offer cloud-based HPC and subscription models for SMEs, allowing affordable access to government-supported supercomputing resources and advanced software without major upfront investment.

Looking for region specific data?

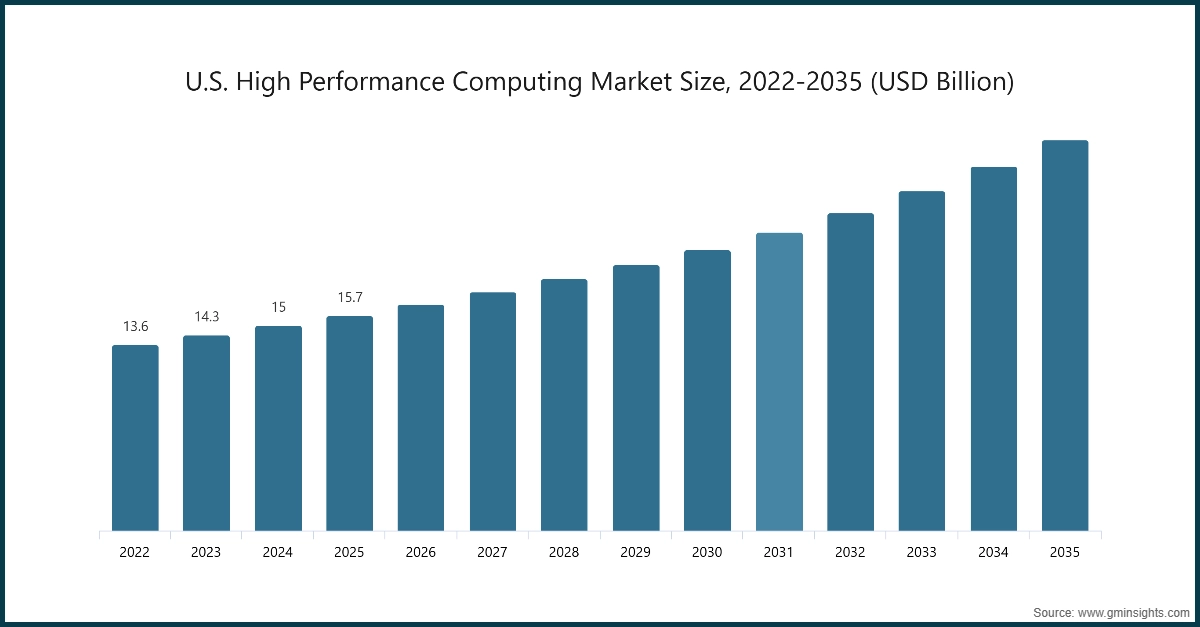

North America High Performance Computing Market

North America dominated the market and held a market share of 43.8% in 2025 of the global market.

- North America maintains leadership in HPC infrastructure, driven by federal research, defense simulations, and AI workloads.

- The U.S. and Canada host several fastest systems, and enterprise HPC adoption continues to widen into energy, life sciences, and autonomous systems.

- Collaborative public?private initiatives expand capacity and cloud?based HPC access while workforce development and exascale objectives draw sustained funding across agencies and institutions. This strong ecosystem fuels computational research competitiveness across sectors.

- Regional manufacturers should focus on developing scalable, high?performance processors with integrated AI?HPC hardware that will be better suited for a range of federal and enterprise workloads. This will offer improved system reliability and performance across a range of HPC deployments.

The U.S. high performance computing market was valued at USD 13.6 billion and USD 14.3 billion in 2022 and 2023, respectively. The market size reached USD 15.7 billion in 2025, growing from USD 15 billion in 2024.

- The U.S. HPC landscape shifted with increased federal funding in defense computing, energy innovations, and exascale programs. There is increased investment in the integration of AI, cloud computing, and mission-critical simulations and modeling.

- U.S. suppliers must focus on secure, high?performance hardware and cloud?native HPC solutions, aligning with federal cloud and exascale initiatives to deliver optimized, mission?ready systems for government and commercial use.

Europe High Performance Computing Market

Europe market accounted for USD 12.5 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The EuroHPC Joint Undertaking, along with other public investment initiatives, has facilitated the expansion of the Euro HPC market.

- Euro HPC member states have added supercomputing capacity in the provision of science, industry, and AI, thereby increasing self-sufficient computing and competitive research. This is accompanied by shared access, and training initiatives for SMEs and higher education institutions, aimed at fostering the use of HPC.

- European manufacturers need to focus on energy-efficient hardware and a flexible, integrated, and interoperable software set to address the needs of the pan European supercomputing consortia and industry for scalable deployments of HPC.

Germany dominated the Europe high performance computing market, showcasing strong growth potential.

- Germany enhances its position in high-performance computing by establishing computing infrastructure to support industry, science, and climate research.

- For example, in September 2025, the Jupiter exascale-class supercomputer was launched at Jülich by Friedrich Merz, Chancellor of Germany, placing Germany and Europe at a competitive edge in research with respect to AI and supercomputing

- Cooperation between research institutions and industries enhances the adoption of HPC in vehicle simulation, materials research, and engineering. Skills campaigns, plus applications that cut across sectors, help to entrench HPC innovation in the innovation strategies of Germany.

- OEMs should prioritize cutting?edge node design and low?latency interconnects tailored for exascale systems and industrial HPC workloads.

Asia Pacific High Performance Computing Market

The Asia Pacific market is the fastest growing market and is anticipated to grow at the CAGR of 10.7% during the analysis timeframe.

- Asia Pacific shows the fastest HPC growth globally, with China, Japan, South Korea, and India expanding computing infrastructure to support AI, scientific research, and manufacturing innovation.

- National strategies associate high-performance computing (HPC) with smart manufacturing, advanced materials research, and sovereign computing. The adoption of public cloud HPC and initiatives focused on sovereign cloud computing allow access to HPC services outside of the traditional research centers.

- Regional collaboration and cross-border technology sharing alleviate the skills shortage. At the same time, investments in exascale computing and semiconductor ecosystems continue to drive the expansion of HPC capabilities.

- Original Equipment Manufacturers (OEMs) are encouraged to focus on heterogeneous node architectures and decentralized accelerator technologies, addressing the varied HPC needs of governments and the private sector.

China high performance computing market is estimated to grow with a CAGR of 11.1% during the forecast period, in the Asia Pacific market.

- China’s HPC Trend focuses on national computational sovereignty and the merging of HPC with AI and big data.

- The Government intends to develop a supercomputing Internet to connect all leading computing facilities and promote the innovation of science and engineering.

- While export controls remain, a shift in domestic procurement of chips favors local processors and AI accelerators, indicating a long-term shift toward self-sustained HPC hardware with domestic end products.

- Enhancing research and the application of industrial AI within regions increases China’s global competitiveness in the HPC field.

Latin American High Performance Computing Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil's HPC market advances with the help of national AI and digital infrastructure plans for high-performance computing resources for research, public services, and business innovation.

- The government strategies encourage HPC investments, and with the AI Brazilian Artificial Intelligence Plan 2024–2028, there is progress on building the processing capacity and training the talent to expand into computational research and AI applications.

- In addition, public and private partnerships are also made to realize international cooperation in HPC and state-of-the-art infrastructural development.

Middle East and Africa High Performance Computing Market

South Africa market to experience substantial growth in the Middle East and Africa market in 2025.

- Regional collaboration and participation in global HPC events raise the profile of HPC's potential to help societal challenges such as natural disaster modeling and large?scale simulations.

- Increased investment in skills and partnerships pursues local HPC capacity and the integration of HPC solutions within the academic and government research agenda.

- Manufacturers targeting South Africa should have their focus on scalable clusters and cost-effective HPC solutions towards academic research and regional research programs.

High Performance Computing Market Share

The market scenario for high performance computing is shaped by rapid technological advancements, AI integration, and collaborations among leading hardware, software, and cloud solution providers. Together, key players in this market, including Hewlett Packard Enterprise (HPE), NVIDIA Corporation, IBM Corporation, Dell Technologies, and Intel Corporation, account for around 59% of market share in 2025.

These companies focus on R&D to enhance processor performance, GPU acceleration, interconnect technologies, and HPC software frameworks. Notably, there are strategic partnerships, joint ventures, and acquisitions to accelerate innovation, improve cloud and on-premises HPC deployments, and expand geographical presence. Additionally, emerging start-ups and niche players are driving affordable HPC solutions and AI-enabled platforms, further promoting innovation and adoption globally.

High Performance Computing Market Companies

Prominent players operating in the high performance computing industry are as mentioned below:

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- IBM Corporation

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD)

- Lenovo Group Limited

- Fujitsu Limited

- Cisco Systems, Inc.

- Oracle Corporation

- Microsoft Corporation (Azure)

- Amazon Web Services (AWS)

- Google LLC (Google Cloud)

- Atos SE

- Inspur Group Co., Ltd.

- Sugon Information Industry Co., Ltd.

- Super Micro Computer, Inc. (Supermicro)

- DataDirect Networks (DDN)

- Rescale, Inc.

- PSSC Labs

· Hewlett Packard Enterprise (HPE) captured 14.8% of the market, due to one of the most complete sets of high-performance servers, supercomputing solutions, and AI-optimized acceleration engines. HPE has built tailored, high-reliability integrated compute clusters and sustained software solutions. HPE's high-performance computing (HPC) analytic and management software, coupled with solid partnerships and investments with government research labs, defense contractors, and enterprise clients, has driven broad adoption of computing solutions to facilitate scientific research, industrial simulations, and enterprise AI.

· NVIDIA Corporation acquired 13.7% of the HPC market share in the year 2025 due to its dominance in GPU computing, AI driven frameworks and high performance interconnects. The company engages in NVIDIA funded national HPC projects to enable fast AI training and large scale simulations. NVIDIA provides integrated hardware, software, and network solutions to high performance computing (HPC), scientific computing, and enterprise systems. He complete solutions offered by the company cover all aspects of Artificial Intelligence (AI), scientific, and enterprise computing workloads.

· IBM Corporation secured 11.3% of the HPC market share and was attributed to its command in HPC servers, AI infrastructure and software stacks. The company provides scalable and high performance to its customers. The federal research institutions, academic consortia and industrial research and development (R&D) partnerships are the ones who high attributed to IBM’s expansion in mission critical and regulated environments.

· Dell Technologies owned 10.4% of the HPC market owing to its balanced compute, storage, and networking solutions that are tailored for HPC and AI workloads. Plus, Dell’s modular, high-density systems allow for versatile deployments at research centers and enterprise HPC. System integration and adoption across various cross sectors are largely driven by collaborations with government agencies, universities, and industrial pioneers.

· Intel Corporation captured 8.8% of the HPC market in 2025 with its state-of-the-art processors, interconnects, and accelerators for the best achievable performance in HPC. Intel also builds high-efficiency hardware and applies AI and parallel computing software to address next-generation HPC solutions. Intel's relationships with government, national labs, and commercial users of supercomputers promote the adoption of Intel's solutions across the scientific, industrial, and enterprise domains of HPC.

High Performance Computing Industry News

- In January 2026, Marvell announced its acquisition of XConn Technologies to integrate high-performance CXL (Compute Express Link) and PCIe switching into its AI and data center connectivity portfolio.

- In January 2026, AMD unveiled the Ryzen AI Max+ series during CES, introducing high-performance "Strix Halo" APUs suited for mobile workstations and heavy AI compute tasks.

- In December 2025, NVIDIA acquired SchedMD, the lead developer of Slurm Workload Manager, a designed job scheduler and resource manager for supercomputing clusters around the globe.

- In October 2025, Qualcomm announced its takeover of Arduino in order to combine high-performance edge computing with open-source hardware development for the industry and robotics sectors.

The high performance computing market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Component

- Hardware

- Software

- Services

Market, By Deployment

- Cloud

- On-premises

- Hybrid

Market, By Organization Size

- Small and Medium-sized enterprise

- Large Enterprise

Market, By End-use

- Government and Defense

- BFSI

- Education and Research

- Manufacturing

- Healthcare and Life Sciences

- Energy and Utilities

- Media and Entertainment

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the high-performance computing industry?

Key players include Hewlett Packard Enterprise (HPE), Dell Technologies, IBM Corporation, NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Lenovo Group Limited, Fujitsu Limited, Cisco Systems, Inc., Oracle Corporation, and Microsoft Corporation (Azure).

What are the upcoming trends in the high-performance computing market?

HPC trends include AI/ML integration, cloud-based solutions for cost efficiency, advanced processors and interconnects, and growing use in healthcare, finance, and autonomous vehicles.

What was the valuation of the on-premises segment in 2025?

The on-premises segment accounted for USD 24.5 billion in 2025, led by investments from large institutions and government labs prioritizing control, security, and performance.

Which region leads the high-performance computing industry?

North America leads the market, holding a 43.8% share in 2025, propelled by federal research, defense simulations, and AI workloads.

What is the expected size of the high-performance computing industry in 2026?

The market size is projected to reach USD 46.5 billion in 2026.

How much revenue did the hardware segment generate in 2025?

The hardware segment generated approximately USD 26.9 billion in 2025, dominating the market due to the deployment of advanced CPUs, GPUs, and interconnects.

What is the projected value of the high-performance computing market by 2035?

The market is poised to reach USD 92.1 billion by 2035, fueled by the expansion of cloud-based HPC solutions, government and corporate investments, and technological advancements.

What was the market size of the high-performance computing in 2025?

The market size was USD 43.5 billion in 2025, with a CAGR of 7.9% expected through 2035. The growth is driven by increasing demand for advanced computational power, AI and machine learning adoption, and advancements in processor technologies.

High Performance Computing Scope

Related Reports